Global Personal Lubricants Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

3.12 Billion

2025

2033

USD

1.70 Billion

USD

3.12 Billion

2025

2033

| 2026 –2033 | |

| USD 1.70 Billion | |

| USD 3.12 Billion | |

|

|

|

|

Personal Lubricants Market Size

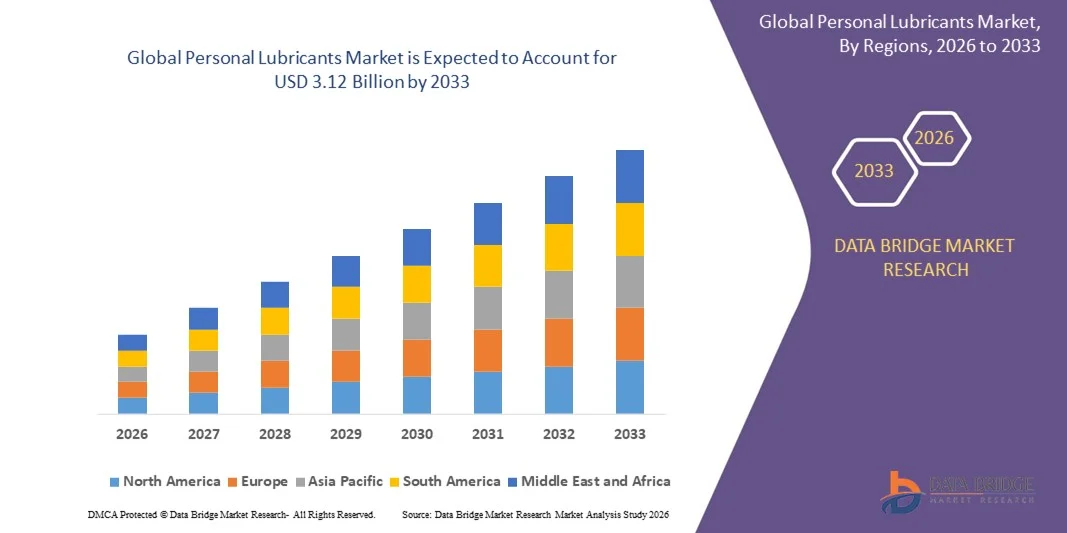

- The global personal lubricants market size was valued at USD 1.70 billion in 2025 and is expected to reach USD 3.12 billion by 2033, at a CAGR of 7.89% during the forecast period

- The market growth is largely fuelled by the increasing awareness of sexual wellness and hygiene, rising prevalence of sexual dysfunction, and growing acceptance of intimate care products across all age groups

- In addition, the expansion of e-commerce channels and discreet availability of products online is driving wider adoption, especially among younger, tech-savvy consumers

Personal Lubricants Market Analysis

- The market is witnessing innovation in product formulations, including water-based, silicone-based, and hybrid lubricants, catering to diverse consumer preferences and needs

- Growing demand for natural and organic lubricants is reshaping the market, as consumers increasingly seek products free from chemicals and parabens while offering enhanced comfort and safety

- North America dominated the personal lubricants market with the largest revenue share of 38.75% in 2025, driven by growing awareness of sexual wellness, increasing adoption of intimate care products, and rising demand for high-quality, safe formulations

- Asia-Pacific region is expected to witness the highest growth rate in the global personal lubricants market, driven by increasing urbanization, rising disposable incomes, growing acceptance of sexual wellness products, and expanding e-commerce and retail channels across countries such as China, Japan, and India

- The Water-Based segment held the largest market revenue share in 2025 driven by its compatibility with condoms and sex toys, ease of cleaning, and low irritation potential, making it a preferred choice among consumers. Water-based lubricants are widely adopted for their versatility and affordability, supporting frequent usage across various applications

Report Scope and Personal Lubricants Market Segmentation

|

Attributes |

Personal Lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Personal Lubricants Market Trends

Rising Demand for Safe and Natural Ingredients

- The growing focus on safe, hypoallergenic, and natural formulations is significantly shaping the personal lubricants market, as consumers increasingly prefer products that are free from harmful chemicals, parabens, and synthetic additives. Personal lubricants are gaining traction due to their ability to enhance comfort, reduce irritation, and improve sexual wellness without compromising safety, encouraging manufacturers to innovate with new formulations that cater to evolving consumer preferences

- Increasing awareness around sexual health, hygiene, and wellness has accelerated the demand for personal lubricants across different age groups. Health-conscious consumers and populations seeking safer intimate care options are actively choosing products with natural or dermatologically tested ingredients, prompting brands to emphasize safety, quality, and skin-friendly formulations

- Transparency in product ingredients, eco-friendly packaging, and clean-label positioning are influencing purchasing decisions. Manufacturers are leveraging certifications, clear labeling, and educational campaigns to build consumer trust, differentiate products in a competitive market, and drive adoption among conscious buyers

- For instance, in 2024, brands such as KY Jelly in the U.K. and Astroglide in the U.S. expanded their product portfolios by introducing plant-based and organic lubricants. These products were marketed for their safety, skin-friendliness, and environmentally responsible formulations, distributed across retail, specialty, and online channels

- While demand for personal lubricants is growing, sustained market expansion depends on continuous R&D, innovative product development, maintaining functional performance, and improving accessibility. Manufacturers are also focusing on cost-effective production, scalable supply chains, and targeted marketing to increase adoption globally

Personal Lubricants Market Dynamics

Driver

Growing Awareness and Preference for Safe, Natural, and Functional Products

- Rising consumer demand for safe, non-irritating, and natural ingredients is a major driver for the personal lubricants market. Manufacturers are increasingly replacing synthetic or chemical-heavy formulations with natural alternatives to meet consumer expectations, enhance product appeal, and comply with health and safety standards. This trend also encourages innovation in plant-based and hypoallergenic lubricant solutions

- Expanding applications in sexual wellness, healthcare, and intimate care are influencing market growth. Personal lubricants help improve comfort, enhance sexual experience, and support intimate health, enabling manufacturers to meet consumer needs for safe and effective products. The increasing openness toward sexual wellness globally further reinforces this trend

- Brands are actively promoting natural and functional lubricant formulations through marketing campaigns, endorsements by healthcare professionals, and product certifications. These efforts, supported by rising awareness around sexual health, encourage partnerships between manufacturers and retailers to improve market reach and educate consumers

- For instance, in 2023, Pjur in Germany and Sliquid in the U.S. reported increased incorporation of natural and organic ingredients in their lubricant products. This expansion followed higher consumer demand for clean-label, dermatologically tested, and plant-based products, driving repeat purchases and brand differentiation

- Although rising awareness and safety trends support growth, wider adoption depends on affordability, ingredient availability, and scalable production processes. Investment in innovative formulations, supply chain efficiency, and consumer education will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

Higher Cost and Limited Awareness Compared to Conventional Products

- The relatively higher cost of natural or organic lubricants compared to conventional synthetic alternatives remains a key challenge, limiting adoption among price-sensitive consumers. Higher raw material costs and complex production processes contribute to elevated pricing, while limited availability of certified ingredients can affect market penetration

- Consumer awareness remains uneven, particularly in developing markets where sexual wellness education and product knowledge are still emerging. Limited understanding of the benefits of safe and natural lubricants restricts adoption across certain demographics, slowing growth in these regions

- Distribution and supply chain challenges also impact market growth, as natural and organic lubricants often require stringent quality control, proper storage, and certified sourcing. Logistical complexities and shorter shelf life of some products increase operational costs for manufacturers and retailers

- For instance, in 2024, distributors in Southeast Asia supplying brands such as Sliquid and Aloe Cadabra reported slower uptake due to higher prices and limited awareness of functional and natural benefits. These challenges affected product visibility and sales in retail channels

- Overcoming these challenges will require cost-efficient production, wider distribution networks, and focused educational initiatives targeting both consumers and healthcare professionals. Collaboration with retailers, e-commerce platforms, and certification bodies can help unlock long-term growth potential, while marketing strategies emphasizing safety, natural ingredients, and functional benefits will drive widespread adoption

Personal Lubricants Market Scope

The market is segmented on the basis of product type, distribution channel, utility/application, and end-user.

- By Product Type

On the basis of product type, the personal lubricants market is segmented into Water-Based, Silicone-Based, Oil-Based, and Hybrid/Specialty. The Water-Based segment held the largest market revenue share in 2025 driven by its compatibility with condoms and sex toys, ease of cleaning, and low irritation potential, making it a preferred choice among consumers. Water-based lubricants are widely adopted for their versatility and affordability, supporting frequent usage across various applications.

The Silicone-Based segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its long-lasting lubrication, water resistance, and skin-friendly formulation, making it ideal for extended use and specialized sexual wellness needs. Silicone-based lubricants are particularly popular for couples seeking enhanced performance and premium experience, often serving as a preferred option for intimate activities requiring minimal reapplication.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Drug Stores & Pharmacies, E-Commerce, Specialty Sexual-Wellness Stores, and Supermarkets & Hypermarkets. The Drug Stores & Pharmacies segment held the largest market revenue share in 2025 owing to the convenience of over-the-counter availability, consumer trust, and widespread presence in urban and semi-urban regions.

The E-Commerce segment is expected to witness the fastest growth rate from 2026 to 2033, driven by discreet purchasing options, wider product variety, home delivery, and increasing digital penetration. Online platforms are particularly preferred by younger consumers for convenience and privacy, often serving as the primary channel for experimental and niche product adoption.

- By Utility/Application

On the basis of utility/application, the market is segmented into Sexual Wellness and Other. The Sexual Wellness segment held the largest market revenue share in 2025 driven by rising awareness of sexual health, growing acceptance of intimate wellness products, and increasing efforts to enhance sexual satisfaction.

The Other segment is expected to witness significant growth from 2026 to 2033, driven by rising adoption of lubricants in medical, cosmetic, and personal care applications. These products are particularly preferred in clinical and therapeutic contexts, often serving as complementary solutions to traditional sexual wellness use.

- By End-User

On the basis of end-user, the market is segmented into Female and Other. The Female segment held the largest market revenue share in 2025 owing to increasing focus on women’s sexual health, growing acceptance of female-oriented intimate care products, and targeted marketing initiatives.

The Other segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising male awareness, changing perceptions regarding sexual wellness, and increasing demand for gender-neutral and couple-oriented products. These users are particularly inclined toward products offering enhanced performance, comfort, and convenience.

Personal Lubricants Market Regional Analysis

- North America dominated the personal lubricants market with the largest revenue share of 38.75% in 2025, driven by growing awareness of sexual wellness, increasing adoption of intimate care products, and rising demand for high-quality, safe formulations

- Consumers in the region highly value product safety, ease of use, and compatibility with condoms and sex toys, contributing to the widespread adoption of personal lubricants

- This growth is further supported by high disposable incomes, evolving lifestyle preferences, and the increasing focus on sexual health, establishing personal lubricants as a preferred solution across different age groups and genders

U.S. Personal Lubricants Market Insight

The U.S. personal lubricants market captured the largest revenue share in 2025 within North America, fueled by rising awareness of sexual health, increased acceptance of intimate wellness products, and the trend of preventive self-care. Consumers are increasingly prioritizing comfort, safety, and performance in their choice of lubricants. The growing demand for natural, water-based, and silicone-based formulations, combined with robust e-commerce penetration and product innovation, further propels the market. Moreover, the integration of lubricants in sexual wellness education and healthcare programs is significantly contributing to market expansion.

Europe Personal Lubricants Market Insight

The Europe personal lubricants market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising awareness of sexual wellness, increasing acceptance of intimate care products, and supportive regulatory frameworks. The region is witnessing growing demand for premium and organic formulations, with consumers preferring products that are safe, hypoallergenic, and eco-friendly. Increasing urbanization, evolving lifestyle choices, and growing e-commerce adoption are further fostering market growth across sexual wellness applications.

U.K. Personal Lubricants Market Insight

The U.K. personal lubricants market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising focus on sexual wellness, growing preference for discreet online purchasing, and heightened awareness of safe, high-quality products. Consumers are increasingly inclined toward premium, water-based, and silicone-based lubricants. The U.K.’s strong retail and e-commerce infrastructure, combined with increasing health and wellness initiatives, is expected to continue stimulating market growth.

Germany Personal Lubricants Market Insight

The Germany personal lubricants market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of sexual health, high demand for natural and specialty formulations, and growing acceptance of intimate care products. Germany’s focus on product safety, sustainability, and innovation promotes the adoption of personal lubricants across various demographics. In addition, the integration of sexual wellness education and healthcare programs is driving adoption, particularly in urban regions.

Asia-Pacific Personal Lubricants Market Insight

The Asia-Pacific personal lubricants market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of sexual wellness, increasing disposable incomes, and growing acceptance of intimate care products in countries such as China, Japan, and India. Government initiatives promoting health and wellness, along with expanding e-commerce and retail channels, are accelerating market adoption. The region’s evolving social attitudes and rising interest in premium and innovative lubricant formulations are further supporting growth.

Japan Personal Lubricants Market Insight

The Japan personal lubricants market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s health-conscious culture, urbanization, and growing focus on convenience and safety. Japanese consumers are increasingly adopting water-based, silicone-based, and hybrid lubricants for sexual wellness and personal care. The integration of products in healthcare and wellness programs, coupled with an aging population seeking easy-to-use and safe formulations, is expected to further drive market demand.

China Personal Lubricants Market Insight

The China personal lubricants market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising disposable incomes, and increasing awareness of sexual health. China represents one of the largest emerging markets for intimate care products, with growing adoption across female and male users. The expansion of e-commerce platforms, affordability of products, and rising domestic manufacturing capacity are key factors propelling market growth.

Personal Lubricants Market Share

The Personal Lubricants industry is primarily led by well-established companies, including:

- Reckitt Benckiser Group plc (U.K.)

- BioFilm, Inc. (U.S.)

- Trigg Laboratories, Inc. (U.S.)

- LifeStyles Healthcare Pte Ltd. (Singapore)

- The Yes Yes Company Ltd. (U.K.)

- Lovehoney Group Ltd. (U.K.)

- Church & Dwight Co., Inc. (U.S.)

- Mayer Laboratories Inc. (U.S.)

- Überlube (U.S.)

- Sliquid, LLC (U.S.)

Latest Developments in Global Personal Lubricants Market

- In August 2025, PH-D Feminine Health introduced Femme Glide, a water-based lubricant infused with organic aloe, vitamin E, and hyaluronic acid. The product is designed to enhance hydration, provide a soothing experience, and maintain intimate comfort. It strengthens PH-D Feminine Health’s position in the feminine wellness segment by catering to consumers seeking natural and gentle formulations. The launch also highlights the growing trend of clean-label and skin-friendly personal lubricants. Femme Glide is expected to drive higher adoption among health-conscious users and promote repeat purchases

- In February 2025, Durex launched the “Afterglow” campaign to promote lubricant use as part of everyday self-care. The campaign emphasizes sexual wellness as an integral part of personal health and lifestyle. It aims to normalize lubricant usage, reducing stigma and encouraging broader acceptance among diverse consumer groups. The initiative supports Durex’s brand positioning as a pioneer in sexual wellness and intimacy solutions. By linking lubricants with routine self-care, the campaign is expected to boost market awareness and stimulate sales growth

- In January 2025, Peptonic Medical debuted VagiVital Active Glide, a medical-grade lubricant praised for its soothing performance and skin-friendly formulation. The product targets consumers with sensitive needs, enhancing trust in professional-grade intimate care solutions. It strengthens Peptonic Medical’s presence in the healthcare-focused segment of the personal lubricants market. VagiVital Active Glide supports safe, reliable use for medical and personal applications, fostering confidence in product efficacy. Its launch also reflects the rising consumer demand for functional, high-quality lubricants

- In January 2025, Americhem unveiled EcoLube MD, a PFAS-free internal lubricating compound for medical-device applications. The product promotes sustainable and safe innovations in healthcare and medical technology. EcoLube MD aligns with the increasing regulatory emphasis on environmentally friendly and non-toxic materials. It enables medical-device manufacturers to meet compliance standards while maintaining performance. The introduction of EcoLube MD is expected to accelerate adoption of eco-conscious lubricants in clinical and industrial applications

- In June 2024, Playground expanded its water-based lubricant range with Pillow Talk, a signature product designed to encourage open discussions about sexual wellness. The launch focuses on promoting cultural acceptance and healthy communication regarding intimacy. Pillow Talk targets consumers looking for safe, effective, and approachable personal lubricants. It strengthens Playground’s portfolio in the lifestyle-driven sexual wellness segment. The product also drives engagement by combining quality formulation with social messaging that resonates with modern users

- In August 2023, Sliquid, LLC launched Sliquid Sparkle, a Pride-edition water-based lubricant with a simple five-ingredient formula. The product appeals to niche and inclusive consumer segments, supporting diversity and representation in sexual wellness. Sparkle is a limited-edition variant of Sliquid H2O, emphasizing clean, non-irritating formulations. Its launch strengthens brand visibility and connects with socially conscious consumers. The product highlights Sliquid’s commitment to inclusivity while maintaining premium quality and ease of use

- In July 2022, JO, a CC Wellness brand, introduced three new flavored water-based lubricants—Mimosa, Cosmopolitan, and Mai Tai. These flavored variants broaden product variety and cater to consumers seeking novel experiences. The launch supports JO’s positioning in the fun and lifestyle-oriented sexual wellness segment. It addresses consumer demand for sensory-enhanced lubricants that combine safety with enjoyment. The addition of these products is expected to boost brand engagement and expand the customer base in both online and offline retail channels

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.