Global Pesticide Inert Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

57.83 Billion

USD

94.29 Billion

2024

2032

USD

57.83 Billion

USD

94.29 Billion

2024

2032

| 2025 –2032 | |

| USD 57.83 Billion | |

| USD 94.29 Billion | |

|

|

|

|

What is the Global Pesticide Inert Ingredients Market Size and Growth Rate?

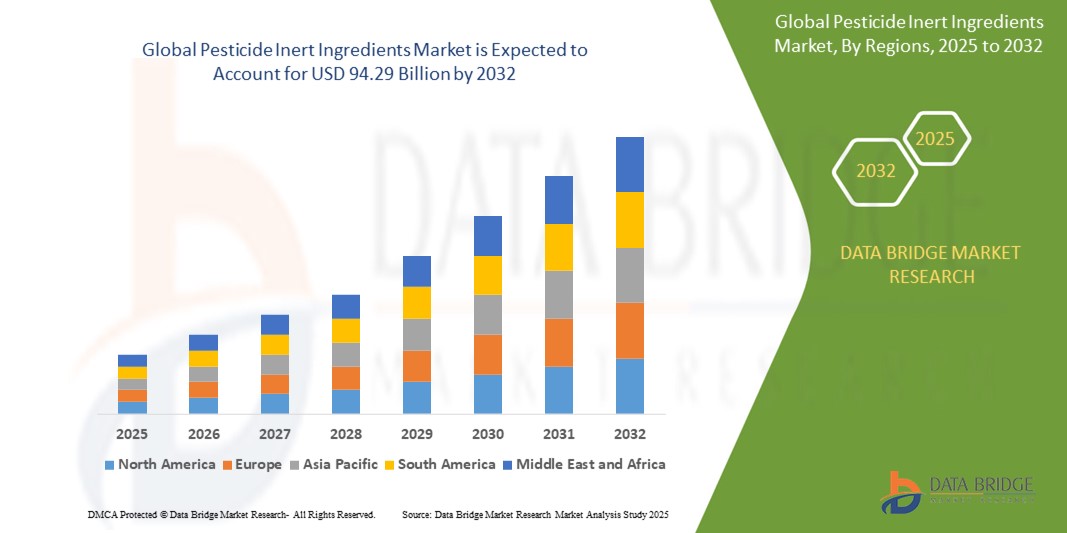

- The global pesticide inert ingredients market size was valued at USD 57.83 billion in 2024 and is expected to reach USD 94.29 billion by 2032, at a CAGR of 6.30% during the forecast period

- Public health vector control involves managing populations of disease-carrying organisms, such as mosquitoes and ticks, to prevent the spread of infectious diseases to humans. The pesticide inert ingredients market plays a crucial role by providing inert ingredients used in pesticide formulations designed for vector control

- These inert ingredients help enhance the effectiveness and safety of pesticides by improving their stability, dispersal, and adhesion properties. Facilitating the development of more efficient and targeted pesticide formulations, inert ingredients contribute to successfully managing vector populations, ultimately safeguarding public health against vector-borne diseases such as malaria, dengue fever, and Lyme disease

What are the Major Takeaways of Pesticide Inert Ingredients Market?

- Technological advancements in the pesticide inert ingredients market, including discovering new and improved inert ingredients with enhanced efficacy, stability, and safety profiles, drive the market's growth

- Ongoing research and development efforts and the increasing demand for sustainable agriculture and biodegradable formulations contribute to the market's expansion. For instance, Clariant invests in technology to provide sustainable, biodegradable inert ingredients.

- Asia-Pacific dominated the pesticide inert ingredients market with the largest revenue share of 42.6% in 2024, driven by increasing agricultural activities, growing demand for high-yield crop production, and the rising adoption of advanced crop protection solutions

- North America pesticide inert ingredients market is poised to grow at the fastest CAGR of 13.1% during the forecast period from 2025 to 2032, fueled by the region’s strong focus on sustainable agriculture, advanced crop protection technologies, and increasing regulatory scrutiny regarding pesticide safety

- The Solvents segment dominated the pesticide inert ingredients market with the largest market revenue share of 39.4% in 2024, driven by their essential role in enhancing the solubility and stability of active ingredients within pesticide formulations

Report Scope and Pesticide Inert Ingredients Market Segmentation

|

Attributes |

Pesticide Inert Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pesticide Inert Ingredients Market?

“Rising Focus on Sustainable and Bio-Based Formulations”

- A significant and accelerating trend in the global pesticide inert ingredients market is the growing demand for sustainable, eco-friendly, and bio-based inert ingredients that reduce environmental impact and support regulatory compliance. Manufacturers are increasingly reformulating products to align with stringent environmental standards

- For instance, companies are exploring bio-derived solvents, surfactants, and emulsifiers that maintain product performance while minimizing ecological risks. Innovations in biodegradable adjuvants and inert carriers are helping meet consumer and regulatory expectations for greener agricultural solutions

- The push towards sustainable agriculture is driving research into plant-based, renewable, and low-toxicity inert ingredients, enabling pesticide formulations that are safer for users and non-target organisms. This aligns with broader industry movements towards responsible crop protection and reduced chemical footprints

- Global emphasis on reducing pesticide residues and protecting pollinator health is further accelerating this trend, as inert ingredients play a crucial role in product efficacy and environmental behavior

- For instance, in 2023, Croda International Plc. launched new bio-based adjuvant solutions to support more sustainable pesticide formulations while maintaining high field performance standards

- As sustainability becomes a market differentiator, companies investing in innovative, eco-conscious inert ingredients are expected to capture growing demand, particularly from regions with strict environmental regulations such as Europe and North America

What are the Key Drivers of Pesticide Inert Ingredients Market?

- The rising global demand for enhanced agricultural productivity to support food security, coupled with regulatory pressures for safer pesticide formulations, is a significant driver boosting the Pesticide Inert Ingredients market

- For instance, in September 2024, BASF SE announced the expansion of its agricultural solutions portfolio with a focus on advanced formulation technologies using innovative inert ingredients that improve efficacy and safety profiles

- Modern crop protection requires inert ingredients that optimize pesticide delivery, stability, and environmental behavior, making them essential to meeting regulatory standards and maximizing product performance

- In addition, the shift towards integrated pest management (IPM) practices and precision agriculture is increasing the need for inert ingredients that enable targeted, efficient application of pesticides, reducing wastage and off-target effects

- Growing awareness among farmers about the importance of formulation quality and the role of inert ingredients in improving effectiveness and crop safety is contributing to market expansion, especially in emerging markets across Asia-Pacific and Latin America

- The ongoing development of multi-functional inert ingredients, offering benefits such as improved rainfastness, enhanced bioavailability, and better compatibility with biological pesticides, is further driving adoption across the agricultural sector

Which Factor is challenging the Growth of the Pesticide Inert Ingredients Market?

- Stringent and evolving regulatory frameworks governing pesticide formulations, particularly in regions such as Europe and North America, present significant challenges for the Pesticide Inert Ingredients market. Many traditional inert ingredients face restrictions due to environmental toxicity, human health concerns, or negative impacts on biodiversity

- For instance, in 2023, regulatory agencies such as the European Chemicals Agency (ECHA) imposed stricter reviews on co-formulants, requiring companies to reformulate products or phase out certain inert ingredients, adding complexity and cost to product development

- The high research and development costs associated with identifying, testing, and validating new, compliant inert ingredients can delay time-to-market for innovative pesticide solutions, particularly for smaller manufacturers with limited resources

- In addition, fluctuating raw material availability and pricing for bio-based or specialty inert ingredients can impact production costs, posing affordability challenges, especially in price-sensitive agricultural markets

- Overcoming these obstacles requires continuous innovation, robust testing, and strategic partnerships within the agricultural value chain to develop cost-effective, compliant, and high-performance inert ingredient solutions

How is the Pesticide Inert Ingredients Market Segmented?

The market is segmented on the basis of type, nature, form, and end use.

- By Type

On the basis of type, the pesticide inert ingredients market is segmented into Solvents, Emulsifiers, Surfactants, Propellants, and Others. The Solvents segment dominated the Pesticide Inert Ingredients market with the largest market revenue share of 39.4% in 2024, driven by their essential role in enhancing the solubility and stability of active ingredients within pesticide formulations. Solvents facilitate uniform application and improve product efficacy across diverse agricultural conditions, making them indispensable in herbicides, insecticides, and fungicides. The widespread use of solvents in both conventional and advanced formulations reinforces their market leadership.

The Emulsifiers segment is anticipated to witness the fastest growth rate of 22.5% from 2025 to 2032, fueled by increasing demand for effective dispersion of active ingredients and improved bioavailability. Emulsifiers enable stable mixing of oil and water-based components, enhancing performance and reducing application variability. Growing emphasis on formulation efficiency and environmental safety is further propelling emulsifier adoption across pesticide types.

- By Nature

On the basis of nature, the pesticide inert ingredients market is segmented into Bio-based and Synthetic. The Synthetic segment accounted for the largest market revenue share of 67.8% in 2024, driven by their widespread availability, proven efficacy, and cost-effectiveness in enhancing pesticide formulation performance. Synthetic inert ingredients offer consistent quality and compatibility with a broad range of pesticide actives, making them the preferred choice for large-scale agricultural operations.

The Bio-based segment is expected to witness the fastest CAGR from 2025 to 2032, supported by growing environmental regulations, rising demand for sustainable crop protection solutions, and increasing consumer preference for eco-friendly agricultural inputs. Bio-based inert ingredients, derived from renewable sources, offer reduced toxicity profiles and improved biodegradability, aligning with the industry's sustainability goals.

- By Form

On the basis of form, the pesticide inert ingredients market is segmented into Liquid and Solid. The Liquid segment dominated the market with the largest revenue share of 58.6% in 2024, attributed to the ease of mixing, uniform application, and enhanced solubility of liquid inert ingredients in pesticide formulations. Liquid forms enable efficient spray applications, making them highly preferred for herbicides, insecticides, and fungicides across various crop types.

The Solid segment is projected to register the fastest growth rate from 2025 to 2032, driven by the development of controlled-release and granule-based pesticide formulations. Solid inert ingredients are gaining popularity for their extended shelf-life, reduced application frequency, and minimized environmental drift, especially in soil treatment and seed coating applications.

- By End-Use

On the basis of end-use, the pesticide inert ingredients market is segmented into Herbicides, Insecticides, Fungicides, and Others. The Herbicides segment held the largest market revenue share of 45.1% in 2024, driven by the widespread use of herbicides in both conventional and modern farming to control weed growth and enhance crop yields. Inert ingredients play a vital role in improving herbicide performance, coverage, and environmental safety.

The Insecticides segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising pest management demands in both agricultural and urban settings. Inert ingredients in insecticides enhance product stability, delivery efficiency, and target specificity, contributing to higher crop protection and yield optimization, particularly in regions facing significant pest infestation challenges.

Which Region Holds the Largest Share of the Pesticide Inert Ingredients Maret?

- Asia-Pacific dominated the pesticide inert ingredients market with the largest revenue share of 42.6% in 2024, driven by increasing agricultural activities, growing demand for high-yield crop production, and the rising adoption of advanced crop protection solutions. The region's large population base, coupled with expanding arable land, is accelerating the need for effective pesticide formulations containing high-performance inert ingredients

- Farmers in Asia-Pacific are increasingly adopting pesticide products with enhanced formulation stability, improved bioavailability, and environmental safety offered by modern inert ingredients

- In addition, favorable government initiatives promoting sustainable agriculture, rising awareness about crop health, and significant investment in agricultural R&D are supporting market growth. The strong presence of key pesticide manufacturers and raw material suppliers in countries such as China, India, and Japan further reinforces the region’s dominance

China Pesticide Inert Ingredients Market Insight

The China pesticide inert ingredients market captured the largest revenue share within Asia-Pacific in 2024, driven by rapid growth in the agriculture sector, a rising focus on food security, and strong domestic manufacturing capabilities for both active and inert pesticide components. The increasing emphasis on advanced formulations to enhance pesticide efficacy and minimize environmental impact is propelling demand for high-quality inert ingredients in China.

India Pesticide Inert Ingredients Market Insight

The India pesticide inert ingredients market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the country's growing agricultural sector, a push for higher crop productivity, and an increasing shift towards environmentally friendly pesticide formulations. Government support for modern farming practices, coupled with rising awareness of sustainable crop protection, is expected to drive strong demand for bio-based and high-performance inert ingredients in India.

Japan Pesticide Inert Ingredients Market Insight

The Japan pesticide inert ingredients market is gaining momentum, driven by the country's emphasis on high-efficiency agricultural inputs and technological innovation. Japan's advanced research in crop protection and formulation science is fostering the adoption of inert ingredients that enhance pesticide effectiveness while meeting stringent environmental standards. In addition, the growing focus on eco-friendly solutions and reduced chemical footprints is accelerating the use of bio-based inert ingredients in the Japanese market.

Which Region is the Fastest Growing Region in the Pesticide Inert Ingredients Market?

The North America pesticide inert ingredients market is poised to grow at the fastest CAGR of 13.1% during the forecast period from 2025 to 2032, fueled by the region’s strong focus on sustainable agriculture, advanced crop protection technologies, and increasing regulatory scrutiny regarding pesticide safety. Farmers and agrochemical companies are investing in improved inert ingredients that enhance pesticide stability, application efficiency, and environmental compatibility.

U.S. Pesticide Inert Ingredients Market Insight

The U.S. pesticide inert ingredients market accounted for the largest revenue share within North America in 2024, driven by rising demand for innovative agricultural solutions that optimize crop yields and reduce environmental risks. The push for precision agriculture, coupled with regulatory initiatives promoting safe and effective pesticide use, is accelerating the development and adoption of high-performance inert ingredients in the U.S. market.

Canada Pesticide Inert Ingredients Market Insight

The Canada pesticide inert ingredients market is expected to witness significant growth, supported by an expanding agricultural sector, increasing adoption of integrated pest management practices, and rising awareness of sustainable farming. Canadian farmers are adopting advanced pesticide formulations with inert ingredients that improve performance while aligning with stringent environmental protection standards.

Which are the Top Companies in Pesticide Inert Ingredients Market?

The pesticide inert ingredients industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Clariant (Switzerland)

- Croda International Plc (U.K.)

- DuPont (U.S.)

- Eastman Chemical Company (U.S.)

- Huntsman International LLC. (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Solvay (Belgium)

- Stepan Company (U.S.)

- Evonik (Germany)

- Akzo Nobel N.V. (Netherlands)

- Shell (U.K.)

What are the Recent Developments in Global Pesticide Inert Ingredients Market?

- In March 2024, The Pesticide Inert Ingredients industry witnessed a significant regulatory development as the Environmental Protection Agency (EPA) announced new guidelines for inert ingredients in pesticide formulations. These guidelines aim to enhance transparency and safety standards, requiring manufacturers to disclose more information about the inert ingredients used in their products. This move is expected to foster greater accountability and promote the use of safer inert ingredients in pesticide formulations, aligning with growing consumer and environmental concerns

- In October 2023, BASF SE, a global leader in the chemical industry, announced strategic collaboration with research institutions. It aims to enhance the development of innovative pesticide inert ingredients. Collaborating with top academic and research organizations, BASF accelerates the discovery and implementation of novel inert ingredients with improved safety and efficacy profiles. This initiative underscores BASF's commitment to advancing sustainable solutions in the pesticide sector, addressing regulatory requirements and evolving market demands

- In October 2023, Croda International Plc entered into a strategic partnership with BioAmp Ltd. to jointly develop sustainable, bio-based emulsifiers aimed at enhancing the environmental profile of pesticide formulations. This collaboration underscores Croda’s commitment to advancing eco-friendly agricultural solutions and meeting the growing demand for greener crop protection products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.