Global Pet Cups Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

1.72 Billion

2024

2032

USD

1.07 Billion

USD

1.72 Billion

2024

2032

| 2025 –2032 | |

| USD 1.07 Billion | |

| USD 1.72 Billion | |

|

|

|

|

PET Cups Market Size

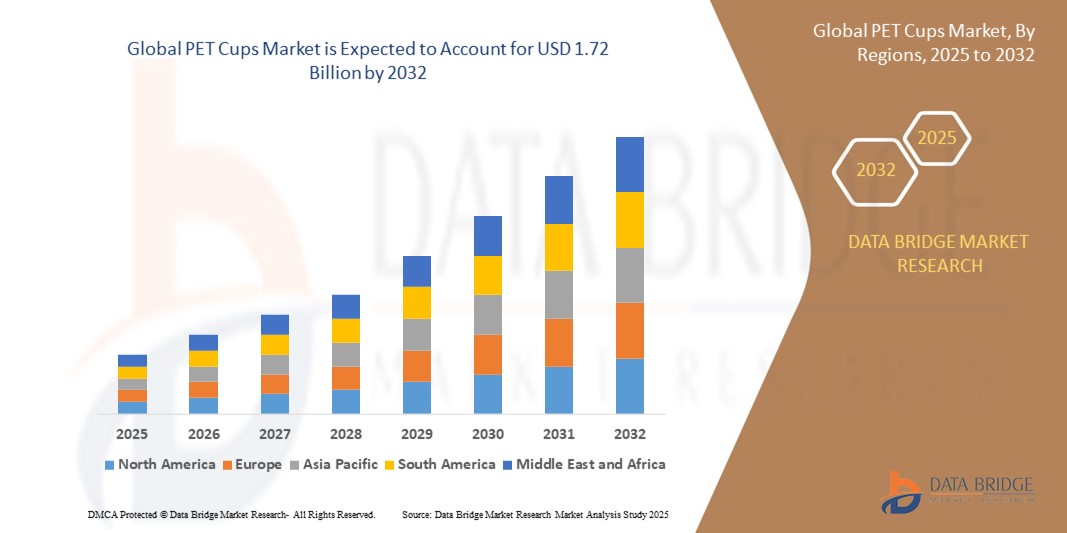

- The global PET cups market size was valued at USD 1.07 billion in 2024 and is expected to reach USD 1.72 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the rising demand for convenient and sustainable packaging solutions across the food and beverage industry

- Increasing adoption of on-the-go lifestyles and the expanding café and quick-service restaurant sector are further boosting the consumption of PET cups

PET Cups Market Analysis

- The PET cups market is witnessing significant growth owing to the increasing shift towards recyclable and lightweight packaging materials in the global foodservice sector

- Manufacturers are focusing on innovation in product designs, such as adding enhanced barrier properties and customization features, to meet evolving consumer preferences

- Asia-Pacific dominated the PET cups market with the largest revenue share of 38.5% in 2024, driven by the rising demand for sustainable beverage packaging, increasing café culture, and rapid urbanization across countries such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global PET cups market, driven by technological advancements in PET manufacturing, strong regulatory support for sustainable packaging, and high adoption of PET cups across commercial and retail sectors

- The Clear PET Cup segment held the largest market revenue share in 2024, driven by its excellent transparency, allowing attractive product display for beverages such as iced coffees, smoothies, and bubble teas. The high clarity also makes clear PET cups the preferred choice for branding and promotional purposes by beverage companies

Report Scope and PET Cups Market Segmentation

|

Attributes |

PET Cups Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Expansion Of Sustainable Packaging Solutions Growing Demand From Foodservice And Beverage Industry |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

PET Cups Market Trends

Growing Demand For Sustainable And Recyclable Beverage Packaging

- The rising shift toward eco-friendly packaging is driving the adoption of PET cups as they are recyclable, lightweight, and cost-effective. With increasing environmental concerns and stricter regulations on single-use plastics, manufacturers are turning to PET as a sustainable alternative for beverage packaging across quick-service restaurants, cafés, and retail chains. The ongoing push for carbon neutrality by global brands is further accelerating PET adoption over non-recyclable alternatives

- Consumer preference for on-the-go beverages such as smoothies, iced coffees, and bubble tea is accelerating the use of PET cups due to their durability and transparency, which enhances product presentation. This trend is further supported by the growing café culture in urban regions worldwide, where premium beverage chains prioritize product visibility and brand aesthetics to attract customers. Social media-driven trends emphasizing visually appealing drinks are also contributing to PET cup demand

- The foodservice industry is rapidly transitioning toward PET-based solutions to meet sustainability targets while maintaining product safety and quality. PET cups offer excellent barrier properties and are compatible with recycling infrastructure, aligning with circular economy initiatives. In addition, advancements in food-grade PET materials have enabled longer shelf-life and improved product hygiene, making them a preferred choice for large-scale beverage packaging

- For instance, in 2023, several global beverage brands introduced PET cups with higher recycled content, significantly reducing their carbon footprint and meeting government-mandated sustainability goals. The shift toward recycled PET (rPET) materials has also opened opportunities for circular supply chain collaborations between packaging producers and waste management companies

- While the adoption of PET cups is rising, continuous innovation in biodegradable coatings and improved recycling technologies is essential to balance performance, cost, and environmental impact. Industry players are also exploring hybrid solutions combining PET with plant-based polymers to meet evolving sustainability benchmarks and consumer expectations

PET Cups Market Dynamics

Driver

Rising Beverage Consumption And Expansion Of Foodservice Industry

- The booming ready-to-drink beverage sector, particularly cold coffees, bubble teas, and juices, is a major growth driver for PET cups. These cups are preferred for their aesthetic appeal, convenience, and compatibility with sealing machinery used by beverage outlets. Customization options such as logo printing and seasonal designs further boost their popularity among beverage brands seeking product differentiation

- Rapid urbanization and the increasing number of quick-service restaurants (QSRs), coffee chains, and bubble tea outlets globally are fueling demand. PET cups have become the standard packaging choice for both dine-in and takeaway beverages, especially in fast-growing Asian and Middle Eastern markets where disposable packaging solutions dominate. Market studies indicate that urban millennials and Gen Z consumers are key drivers of on-the-go beverage culture

- The hospitality sector’s focus on cost efficiency and branding opportunities through custom-printed PET cups is further boosting market penetration. In addition, growing demand from institutional catering services and convenience stores is opening new distribution channels for PET cup manufacturers

- For instance, leading QSR chains in Asia-Pacific reported a surge in PET cup consumption in 2023, driven by rising middle-class incomes and evolving consumer lifestyles. This demand spike has encouraged regional players to expand local PET manufacturing capacities to reduce import dependence and supply chain delays

- While demand continues to rise, ensuring a steady supply of high-quality recycled PET (rPET) material is becoming a strategic priority for manufacturers to meet sustainability goals. Government-led incentives for recycling and collection infrastructure are expected to ease material shortages over the forecast period

Restraint/Challenge

Volatility In Raw Material Prices And Recycling Infrastructure Limitations

- The price fluctuations of PET resin, derived from crude oil, directly affect PET cup production costs. Global supply chain disruptions and rising energy prices have added further pressure on manufacturers, impacting profit margins. This volatility also complicates long-term pricing strategies for beverage brands relying on PET packaging for large-scale operations

- Limited recycling infrastructure in several developing economies poses a major challenge to achieving closed-loop recycling for PET cups. As a result, a significant share of used cups still ends up in landfills despite being recyclable. This problem is worsened by fragmented collection networks and a lack of consumer awareness regarding proper waste segregation practices

- In addition, competition from alternative packaging materials such as paper cups with biodegradable linings is growing due to aggressive marketing campaigns highlighting sustainability. The rising consumer sentiment against plastics in some markets has led to policy discussions on PET usage restrictions, creating regulatory uncertainty for manufacturers

- For instance, in 2023, multiple European countries introduced stricter Extended Producer Responsibility (EPR) regulations, imposing recycling and waste management obligations on packaging producers. Similar initiatives are emerging in parts of Asia and Latin America, requiring manufacturers to adopt eco-design principles for PET products

- To address these challenges, the industry is investing in chemical recycling technologies, rPET production facilities, and partnerships with waste management companies to improve collection and processing capabilities. Collaboration between packaging producers, local governments, and NGOs is also seen as critical to building a circular PET economy

PET Cups Market Scope

The market is segmented on the basis of product type, application, end use, capacity, and distribution channel.

- By Product Type

On the basis of product type, the PET cups market is segmented into Clear PET Cup, Opaque PET Cup, and Printed PET Cup. The Clear PET Cup segment held the largest market revenue share in 2024, driven by its excellent transparency, allowing attractive product display for beverages such as iced coffees, smoothies, and bubble teas. The high clarity also makes clear PET cups the preferred choice for branding and promotional purposes by beverage companies.

The Printed PET Cup segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for customized and logo-printed cups among cafés, quick-service restaurants, and beverage chains. These cups offer strong brand visibility and marketing potential, fueling their adoption across global foodservice outlets.

- By Application

On the basis of application, the PET cups market is segmented into Food Packaging, Beverage Packaging, and Others. The Beverage Packaging segment accounted for the largest market share in 2024 due to the booming on-the-go consumption trend and growing popularity of takeaway beverages across urban markets. PET cups are widely used for cold coffees, milkshakes, juices, and specialty drinks, ensuring durability and product safety during transportation.

The Food Packaging segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for ready-to-eat snacks, desserts, and portion-packed meals. The adoption of PET cups for food applications is driven by hygiene concerns and consumer preference for convenient, disposable packaging solutions.

- By End Use

On the basis of end use, the PET cups market is segmented into Food Services, Bars, Restaurants, and Others. The Food Services segment dominated the market in 2024, driven by the expansion of quick-service restaurants, coffee chains, and convenience food outlets globally. These establishments rely heavily on PET cups for cost-effective and efficient packaging solutions.

The Bars segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing consumption of cocktails, mocktails, and other specialty drinks served in customizable and visually appealing PET cups, particularly at outdoor events and festivals.

- By Capacity

On the basis of capacity, the PET cups market is segmented into 0-10 Oz, 10-15 Oz, 16-20 Oz, and 21-25 Oz. The 16-20 Oz segment held the largest market share in 2024, attributed to its widespread use in serving standard beverage portions in cafés, QSR chains, and juice bars. This capacity range balances cost efficiency with consumer convenience, making it the most popular size category.

The 21-25 Oz segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for larger serving sizes in smoothies, iced beverages, and specialty drinks, especially in North America and Asia-Pacific markets.

- By Distribution Channel

On the basis of distribution channel, the PET cups market is segmented into Hypermarket, Supermarket, Departmental Stores, E-commerce, and Direct Sales. The Supermarket segment held the largest revenue share in 2024, supported by high product visibility, bulk purchasing options, and strong retail penetration in both developed and emerging economies.

The E-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rapid expansion of online retail platforms, ease of doorstep delivery, and rising preference for digital procurement by small cafés and local foodservice providers.

PET Cups Market Regional Analysis

• Asia-Pacific dominated the PET cups market with the largest revenue share of 38.5% in 2024, driven by the rising demand for sustainable beverage packaging, increasing café culture, and rapid urbanization across countries such as China, India, and Japan

• Consumers in the region highly value the convenience, durability, and transparency of PET cups, which enhance product presentation and support on-the-go consumption of beverages such as iced coffees, smoothies, and bubble tea

• This widespread adoption is further supported by growing disposable incomes, a rising number of quick-service restaurants, and government initiatives promoting eco-friendly and recyclable packaging solutions

China PET Cups Market Insight

The China PET cups market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, expanding middle-class population, and high rates of technological adoption in foodservice operations. The country’s strong manufacturing capabilities and focus on sustainable packaging solutions are boosting the production and availability of PET cups. Moreover, government policies encouraging recycling and reduction of single-use plastics are accelerating the adoption of PET cups across commercial and retail segments.

Japan PET Cups Market Insight

The Japan PET cups market is expected to witness the fastest growth rate from 2025 to 2032 due to high consumer demand for on-the-go beverages and a strong café culture. The adoption of PET cups is further supported by government policies promoting recyclable packaging and initiatives encouraging the use of sustainable materials. Japan’s emphasis on convenience, hygiene, and product presentation is also accelerating PET cup usage across foodservice and retail segments.

North America PET Cups Market Insight

The North America PET cups market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for eco-friendly and recyclable beverage packaging across the U.S. and Canada. Consumers increasingly prefer PET cups for their convenience, durability, and transparency, especially in coffee chains, quick-service restaurants, and retail outlets. The growth is further supported by government initiatives promoting sustainable packaging, corporate sustainability commitments, and a strong focus on reducing single-use plastics. Moreover, the adoption of custom-printed PET cups for branding and marketing purposes is fueling market expansion in both foodservice and retail sectors.

U.S. PET Cups Market Insight

The U.S. PET cups market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for convenient, on-the-go beverage packaging and growing awareness of sustainable packaging solutions. The rise of coffee chains, bubble tea outlets, and QSRs is further fueling demand. In addition, consumer preference for transparent and recyclable packaging aligns with environmental initiatives, supporting market growth.

Europe PET Cups Market Insight

The Europe PET cups market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent regulations on single-use plastics and increasing adoption of recyclable packaging materials. Countries such as Germany, France, and the U.K. are witnessing strong growth in cafés, juice bars, and foodservice establishments using PET cups. The demand is further supported by rising consumer awareness regarding sustainability and government initiatives promoting circular economy practices in packaging.

U.K. PET Cups Market Insight

The U.K. PET cups market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing trend of takeaway beverages and the expansion of coffee shops and quick-service outlets. Consumers are increasingly adopting PET cups for convenience, product safety, and environmental sustainability. In addition, retailers and foodservice providers are investing in customized, printed PET cups for branding purposes, further driving market growth.

Germany PET Cups Market Insight

The Germany PET cups market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing environmental awareness and strict compliance with European Union packaging directives. The country is witnessing rising adoption of PET cups in cafés, juice bars, and fast-food chains. Integration of recycled PET (rPET) and biodegradable coatings in cup production is further contributing to market growth while supporting sustainability objectives.

PET Cups Market Share

The PET Cups industry is primarily led by well-established companies, including:

- Dart Container Corporation (U.S.)

- Solo Cup Company (U.S.)

- WinCup (United States), CKF Inc (Canada)

- Anchor Packaging Inc, (U.S.)

- Ningbo Yi Sheng Plastic Co., (China)

- Huhtamaki Oyi, (Finland)

- NNZ Group (Netherlands)

- Macpac (U.K.)

- Sonoco products Company (U.S.)

- Temma shiki Co., Ltd (Japan)

Latest Developments in Global PET Cups Market

- In 2024, Greiner Packaging took a close look at the background of the new legal requirements, such as the ban on single-use plastics. Recycled polyethylene terephthalate (r-PET) is ideal for a dedicated recycling stream, accommodating environmental, economic, and social considerations. Mechanical recycling of r-PET works well and is extremely efficient. In addition, we can expect chemical r-PET recycling to be possible starting

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pet Cups Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pet Cups Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pet Cups Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.