Global Pet Feed Yeast Market

Market Size in USD Million

CAGR :

%

USD

720.51 Million

USD

1,304.27 Million

2025

2033

USD

720.51 Million

USD

1,304.27 Million

2025

2033

| 2026 –2033 | |

| USD 720.51 Million | |

| USD 1,304.27 Million | |

|

|

|

|

What is the Global Pet Feed Yeast Market Size and Growth Rate?

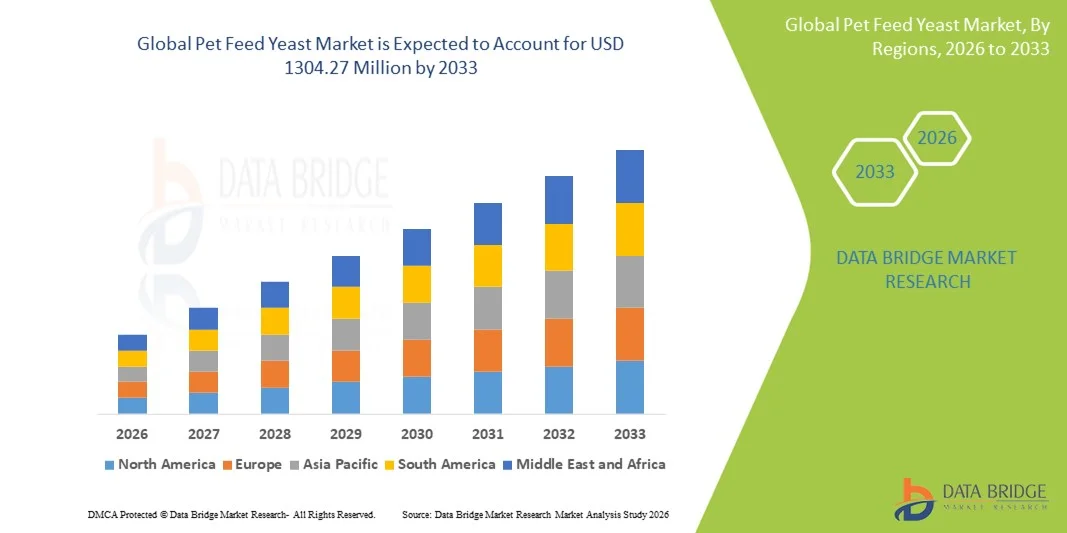

- The global pet feed yeast market size was valued at USD 720.51 million in 2025 and is expected to reach USD 1304.27 million by 2033, at a CAGR of 4.20% during the forecast period

- Increase in the demand from the additives application is the vital factor escalating the market growth, also rising concerns related to animal health, increasing benefits associated with the product and rising consumption of nutritional and dietary supplements all over the globe are the major factors among others driving the growth of pet feed yeast market

What are the Major Takeaways of Pet Feed Yeast Market?

- Rising modernization and rising consumption of dairy products, rising research and development activities in the market, rising innovations in the animal feed industry and rise in demand for pet food nutrition will further create new opportunities for pet feed yeast market

- However, rising competition for necessary raw materials, increasing concerns regarding complications with the health of pets with over-consumption of the product and increasing willingness of livestock growers to use antibiotics for animal feed are the major factors among others acting as restraints

- Asia-Pacific dominated the pet feed yeast market with a 38.9% revenue share in 2025, supported by strong demand for high-quality, nutrient-rich yeast ingredients across China, Japan, India, and South Korea

- North America is projected to register the fastest CAGR of 10.98% from 2026 to 2033, driven by increasing demand for functional, protein-rich, and gut-health-enhancing yeast ingredients in the U.S. and Canada

- The Dry segment dominated the market with a revenue share of 57.8% in 2025, supported by its long shelf life, superior stability, and ease of incorporation into pet food formulations

Report Scope and Pet Feed Yeast Market Segmentation

|

Attributes |

Pet Feed Yeast Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pet Feed Yeast Market?

Rising Demand for Nutrient-Dense, Digestive-Enhancing, and Multi-Functional Pet Feed Yeast Solutions

- The pet feed yeast market is witnessing rapid growth toward nutrient-rich, multifunctional, and clean-label yeast formulations, driven by rising demand for high-quality protein sources, digestive support ingredients, and immune-boosting additives in pet nutrition

- Manufacturers are developing advanced yeast-based functional blends that support gut health, enhance nutrient absorption, improve palatability, and strengthen immunity across dog, cat, poultry, and aquaculture feed products

- Growing consumer preference for natural, non-GMO, and chemical-free nutritional enhancers is reshaping product innovation in the global pet food industry

- For instance, leading companies such as ADM, Cargill, Lesaffre, and AngelYeast are expanding their portfolios with enriched yeast derivatives used in premium pet food, supplements, and performance-enhancing formulations

- Rising awareness regarding pet gut health, joint care, metabolic wellness, and immune resilience continues to drive adoption worldwide

- As pet owners increasingly prioritize balanced, functional, and holistic nutrition, pet feed yeast is becoming a core ingredient in next-generation pet food and supplement innovations

What are the Key Drivers of Pet Feed Yeast Market?

- Increasing demand for high-protein, digestible, and nutrient-enhancing yeast ingredients is driving adoption across commercial pet food, veterinary diets, and specialty nutrition segments

- For instance, in 2025, companies such as ADM, Lallemand, and AngelYeast Co. expanded production of yeast-based β-glucans, nucleotides, and probiotic-rich formulas used in growth diets, immunity-boosting feeds, and performance-focused pet nutrition

- Rising awareness of gut microbiome balance, immunity support, and digestive well-being is accelerating demand across North America, Europe, and Asia-Pacific

- Advances in fermentation technologies, strain optimization, and nutrient enhancement have improved product quality, stability, and application diversity

- Growing trends toward clean-label, natural, vegan, and sustainable pet food ingredients are further boosting industry expansion

- With rising investments in R&D, product diversification, and cross-border partnerships, the Pet Feed Yeast market is projected to sustain strong growth in the global pet nutrition sector

Which Factor is Challenging the Growth of the Pet Feed Yeast Market?

- High production, fermentation, and purification costs associated with premium yeast derivatives, such as yeast β-glucans, probiotics, and nucleotides, limit broader affordability in emerging regions

- For instance, during 2024–2025, fluctuations in molasses availability, fermentation inputs, and energy costs impacted production volumes for several global manufacturers

- Strict regulations relating to feed safety, microbial contamination control, and pet ingredient labeling add to operational complexities

- Limited consumer awareness in developing markets about the health benefits, digestibility improvements, and immunity-boosting properties of yeast ingredients restrains adoption

- Strong competition from soy protein concentrates, fishmeal, probiotics, and synthetic alternatives creates pricing pressure and challenges product differentiation

- To address these barriers, companies are prioritizing cost-efficient production, regulatory compliance, scalable sourcing, and educational market outreach to expand the global footprint of high-quality Pet Feed Yeast solutions

How is the Pet Feed Yeast Market Segmented?

The market is segmented on the basis of product, type, and end-use vertical.

- By Product:

On the basis of product, the pet feed yeast market is segmented into Fresh, Dry, and Instant. The Dry segment dominated the market with a revenue share of 57.8% in 2025, supported by its long shelf life, superior stability, and ease of incorporation into pet food formulations. Dry yeast offers higher nutrient concentration, better digestibility, and extended storage benefits, making it ideal for mass-market kibble, supplements, and functional pet treats. Its compatibility with extrusion processes further boosts industrial adoption.

The Instant segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing usage in premium pet food blends, vet-recommended digestive supplements, and high-performance nutrition products. Instant yeast provides rapid activation, enhanced palatability, and improved nutrient delivery, supporting its rising demand in high-protein, grain-free, and specialized nutrition lines. Growing preference for convenience, rapid solubility, and functional enrichment is accelerating its global adoption.

- By Type:

On the basis of type, the pet feed yeast market is segmented into Dry and Liquid. The Dry segment dominated the market with a revenue share of 63.5% in 2025, owing to its superior stability, long shelf life, and ease of transportation and storage. Dry yeast is widely preferred in commercial pet food manufacturing due to its consistent quality, cost efficiency, and suitability for powdered supplements, kibble fortification, and digestive-health blends. Its ability to retain nutrients such as proteins, β-glucans, and amino acids supports its extensive use across dogs, cats, and specialty animal diets.

The Liquid segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing use in wet pet foods, liquid nutritional tonics, flavor enhancers, and probiotic-rich formulations. Rising consumer demand for palatable, easily digestible, and ready-to-use nutritional solutions is driving adoption. Growth of online pet nutrition brands and personalized nutrition trends further fuels market traction.

- By End-Use Vertical:

On the basis of end-use vertical, the pet feed yeast market is segmented into Food & Beverages, Pharmaceutical, Breweries, and Nutraceutical Manufacturers. The Food & Beverages segment dominated the market with a revenue share of 52.3% in 2025, driven by large-scale incorporation of yeast into pet snacks, kibble, wet foods, and digestive-health formulations. Growing demand for protein-rich, immunity-boosting, and gut-health-oriented pet diets has increased yeast usage across major brands. Enhanced amino acid content, palatability improvement, and functionality in energy-rich pet meals further support segment leadership.

The Nutraceutical Manufacturers segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for supplements targeting digestion, immunity, skin health, and metabolic support in pets. Increasing premiumization of pet wellness, veterinarian recommendations for functional supplements, and growth of specialty nutraceutical brands are accelerating adoption. Expansion of probiotic-enriched, organic, and fortified yeast formulations continues to strengthen its market growth.

Which Region Holds the Largest Share of the Pet Feed Yeast Market?

- Asia-Pacific dominated the Pet Feed Yeast market with a 38.9% revenue share in 2025, supported by strong demand for high-quality, nutrient-rich yeast ingredients across China, Japan, India, and South Korea. Rapid growth in premium pet food categories, rising adoption of fortified diets, and expanding veterinary awareness strengthen regional leadership. Increasing pet ownership, urbanization, and preference for protein-enhanced, digestive-support pet foods continue to boost market uptake

- Leading regional producers are investing in advanced fermentation, high-purity yeast extraction, and sustainable production systems to meet rising export and domestic demand

- Rapid expansion of organized retail, e-commerce, and premium pet nutrition brands further enhances market penetration across Asia-Pacific

- With strong manufacturing capabilities, cost-efficient production, and growing adoption of natural functional ingredients, Asia-Pacific will continue dominating the global Pet Feed Yeast market

North America Pet Feed Yeast Market Insight

North America is projected to register the fastest CAGR of 10.98% from 2026 to 2033, driven by increasing demand for functional, protein-rich, and gut-health-enhancing yeast ingredients in the U.S. and Canada. Pet owners are shifting toward high-nutrition, clean-label, and specialized diets that incorporate yeast for immunity, digestion, and palatability improvements. Manufacturers are investing in premium-grade yeast supplements, probiotic blends, and natural flavor-enhancement products. Growth of online retail, pet subscription programs, and veterinary-approved functional foods further accelerates consumer adoption. Rising awareness of pet wellness, allergies, and digestive disorders also supports strong yeast ingredient consumption.

China Pet Feed Yeast Market Insight

China is the largest contributor within Asia-Pacific, driven by significant yeast production capacity, mature fermentation technology, and growing demand for nutrient-enriched pet foods. Manufacturers are investing in strain optimization, high-purity yeast extracts, and beta-glucan–rich formulations to support immunity and metabolic health in pets. Rapid growth of premium pet food brands, increasing disposable incomes, and rising adoption of Western-style pet nutrition trends continue to strengthen market leadership. Export-oriented yeast manufacturing and government support for advanced biotechnology further enhance China’s strategic role.

Japan Pet Feed Yeast Market Insight

Japan demonstrates stable and steadily rising demand for high-quality, natural yeast ingredients used in functional pet foods, therapeutic diets, and premium supplements. Strong emphasis on pet health, longevity, and digestive efficiency drives adoption of yeast-based formulations. Innovations in postbiotic yeast, purified yeast extracts, and allergen-free protein sources attract health-conscious consumers. Japan’s advanced retail ecosystem, coupled with regulatory support for safe and functional pet nutrition, continues to create consistent market opportunities.

India Pet Feed Yeast Market Insight

India is emerging as one of the fastest-growing markets in Asia-Pacific, driven by expanding pet ownership, rising middle-class incomes, and growing awareness of digestive and immunity-related pet health concerns. Demand for yeast-based supplements, fortified kibble, and protein-enhanced pet foods is increasing across urban regions. Growth of e-commerce platforms, veterinary clinics, and premium pet nutrition brands supports market penetration. Manufacturers are introducing cost-effective, nutrient-rich formulations to meet the needs of price-sensitive consumers while ensuring functional benefits.

South Korea Pet Feed Yeast Market Insight

South Korea contributes significantly to regional growth, supported by rising preference for high-protein, enzyme-rich, and immune-boosting pet foods. The strong influence of wellness trends, premiumization, and functional pet diets promotes widespread adoption of yeast-based ingredients. Pet owners increasingly seek digestive-support formulas, hypoallergenic diets, and natural palatability enhancers featuring yeast extracts. Growing online retail penetration, innovative product launches, and strong traction in premium pet stores further accelerate market expansion.

Which are the Top Companies in Pet Feed Yeast Market?

The pet feed yeast industry is primarily led by well-established companies, including:

- Associated British Foods plc (U.K.)

- Lesaffre (France)

- Leiber GmbH (Germany)

- Cargill, Incorporated (U.S.)

- AngelYeast Co., Ltd. (China)

- Lallemand Inc. (Canada)

- F.L. Emmert (U.S.)

- BIOMIN Holding GmbH (Austria)

- ADM (U.S.)

- DSM (Netherlands)

- Oriental Yeast Co., Ltd. (Japan)

- KothariYeast.in (India)

- Chr. Hansen Holding A/S (Denmark)

- Bruchem Inc. (U.S.)

- Synergy Flavors (U.S.)

- Scandinavian Formulas (U.S.)

What are the Recent Developments in Global Pet Feed Yeast Market?

- In July 2025, Alltech announced a major expansion of its fermentation capacity in Kentucky, integrating advanced CO₂ capture technology to enhance efficiency and sustainability. This strategic move strengthens the company’s production capabilities and supports growth across global feed applications

- In June 2025, Cargill introduced a new whey-based yeast product line designed specifically for Asian aquaculture markets, with initial deployment in Thailand and Vietnam. This expansion enhances regional nutrition solutions and reinforces Cargill’s focus on performance-driven aquafeed innovations

- In June 2024, Evonik Industries received EFSA approval for its proprietary selenium yeast formulation for poultry and swine, enabling broader use across the European livestock sector. This regulatory milestone supports safer, more effective mineral supplementation in animal nutrition

- In November 2023, Lesaffre announced plans to expand its presence in the U.S. through capital investments and acquisitions, extending beyond yeast and bacteria into nutrition, health, and biotechnology. This initiative strengthens the company’s strategic diversification and market positioning

- In June 2022, ADM Animal Nutrition, a division of Archer Daniels Midland Company, broadened its animal feed recall, initially announced in March and April 2024, to include additional products due to elevated mineral levels that could harm farm animals. This action highlights the company’s commitment to product safety and regulatory compliance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.