Global Pet Food Flavors Market

Market Size in USD Million

CAGR :

%

USD

8.92 Million

USD

16.44 Million

2021

2029

USD

8.92 Million

USD

16.44 Million

2021

2029

| 2022 –2029 | |

| USD 8.92 Million | |

| USD 16.44 Million | |

|

|

|

|

Pet Food Flavors Market Analysis and Size

The consumer preference for pet food flavours has increased over the last five years, manufacturers and suppliers of pet food products must optimise their product offerings to meet consumer demand. Flavour is a high-growth segment in the overall food ingredients market, and consumer preference for pet food flavours, combined with manufacturers' willingness to capitalise on the opportunity in this niche business, translated into increased demand for pet food flavours around the world.

As more and more pet owners want to provide their pets with human-like products or experiences, the term "pet humanization" is becoming a globally accepted term in the pet industry. Pet owners consider their pets to be family members, so they demand pet food that provides nutritional benefits, high ingredient quality, improved digestibility, and animal safety. This trend is boosting demand for high-quality pet food with high nutritional value. The humanization of pets has increased public awareness of healthy eating habits. It has enabled pet owners to spend more on high-quality pet food products, as evidenced by an increase in pet-related spending in recent years.

However, rising pet obesity, regulatory issues, and rising pet allergies will have an impact on the overall growth of the pet food flavours market. Key market players are implementing strategies such as customization and partnerships to counteract the aforementioned threats and maintain growth rates.

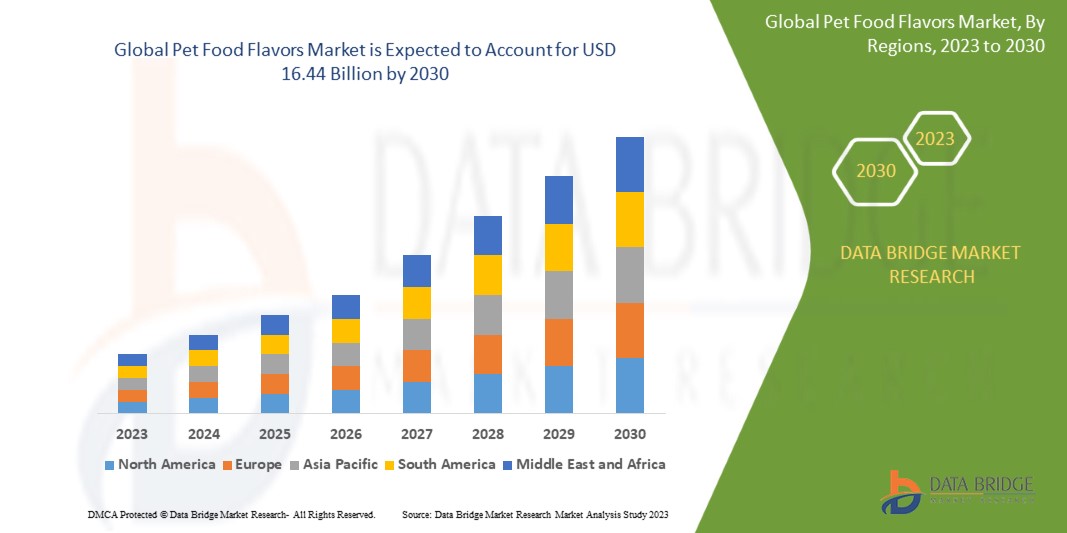

Data Bridge Market Research analyzes that the pet food flavors market which was USD 8.92 billion in 2022, is likely to reach USD 16.44 billion by 2030, and is expected to undergo a CAGR of 8.0% during the forecast period of 2023 to 2030. “Natural Flavors” dominates the type segment of the pet food flavors market due to rising health consciousness, consumer preference for safer options, and adherence to stringent regulatory standards compared to artificial flavors.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

Type (Natural Flavors, Artificial Flavors), Application (Cat Food, Bird Food, Fish Food, Dog Food) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Kerry (Ireland), Givaudan (Switzerland), Firmenich SA (Switzerland), Sensient Technologies Corporation (U.S), Symrise, (U.S), T.HASEGAWA CO., LTD. (Japan), ADM (U.S), Huabao International Holdings Limited. (Hongkong), Takasago International Corporation (Japan) |

|

Market Opportunities |

|

Market Definition

Pet food flavors are additives that enhance taste and aroma in pet food, ensuring palatability and masking undesirable odors. Employed in dog, cat, bird, and fish food, they cater to diverse preferences. These flavors make the food more enticing for pets, promoting better consumption and nutrient intake. They're crucial in diverse formulations of dry kibble, wet food, treats, seeds, pellets, and flakes. Pet food flavors not only improve product attractiveness but also address specific taste preferences of various animals, ultimately supporting the pet food industry by encouraging pet consumption, ensuring adequate nutrition, and meeting the unique dietary needs of different pets.

Pet Food Flavors Market Dynamics

Drivers

- Increasing pet humanization

The growing trend of considering pets as family members has significantly impacted the pet food industry. Pet owners increasingly seek high-quality, flavorful, and diverse food options for their pets. As a result, the demand for innovative and appealing pet food flavors has surged, driving the growth of the global pet food flavors market.

- Rising demand for natural ingredients

With a parallel shift in consumer preferences towards natural and organic products, the pet food industry is witnessing a similar trend. Pet owners are more conscious about the ingredients in their pets' food, demanding natural and healthy flavoring options. This demand has led to the development of natural pet food flavors, thereby bolstering market growth.

- Expansion in pet ownership

The continuous growth in pet ownership worldwide, particularly in emerging markets, is a substantial driver for the pet food flavors market. As more households embrace pet ownership, the need for a variety of flavors and options in pet food increases, propelling manufacturers to diversify their product range.

Restraints

- Regulatory hurdles

Compliance with stringent regulations and standards for pet food ingredients and flavors poses a challenge for market players. Meeting these requirements while innovating and meeting consumer demands can be a challenging and time-consuming process.

- Cost and sourcing challenges

Procuring high-quality, natural ingredients for pet food flavors at a reasonable cost can be a constraint. Balancing cost-effectiveness with the demand for natural and healthy ingredients remains a challenge, influencing pricing and profitability for companies in the market.

Opportunities

- Innovation in flavor development

The market offers ample opportunities for innovation in creating novel and unique pet food flavors. Companies have the chance to invest in research and development to introduce new, appealing tastes that cater to diverse pet palates, thereby gaining a competitive edge in the market.

- Health-oriented flavors

The evolving trend toward health and wellness in pet food presents an opportunity for developing flavors that not only taste good but also offer specific health benefits. Manufacturers can explore creating flavors that promote better digestion, boost immunity, or support other health aspects, aligning with the growing focus on pet health.

Challenges

- Competition and differentiation

One of the primary challenges in the pet food flavors market is the increasingly competitive landscape. With more players entering the market, standing out becomes difficult. Companies need to differentiate themselves not only in terms of flavor variety but also in quality, sourcing, and health benefits offered by their products. Creating unique and appealing flavors while maintaining quality and meeting regulatory standards requires substantial investment and innovation.

- Consumer education and perception

Educating consumers about the significance of flavors in pet food and the impact on pets' health and preferences remains a challenge. Often, pet owners might not fully understand the importance of different flavors or the impact of ingredients on their pets. Overcoming misconceptions or lack of awareness surrounding pet food flavors and their significance in a pet's diet can be a hurdle for companies operating in this market. Establishing trust and transparency about the benefits of specific flavors and ingredients is crucial for market growth.

This pet food flavors market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Pet Food Flavors market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Development

- In August 2023, International Flavors & Fragrances Inc. (IFF) expanded its North American Creation and Design Center, introducing a new pet food development lab and enhancing flavor creation facilities. The move integrates flavor, ingredients, and product design expertise, aiming to accelerate product innovation and cater to the projected $58 billion pet food market in 2023. This expansion reflects a strategic response to shorter product development cycles, ensuring nimbleness and expedited solutions across various food categories. With a focus on rapid product creation, IFF aims to enhance consumer experiences by combining expertise in ingredients, flavors, and consumer behavior analysis, strengthening their end-to-end approach for product design in a rapidly growing global pet food flavors market

Global Pet Food Flavors Market Scope

The pet food flavors market is segmented on the basis of type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Natural Flavors

- Artificial Flavors

Application

- Cat Food

- Bird Food

- Fish Food

- Dog Food

Pet Food Flavors Market Regional Analysis/Insights

The pet food flavors market is analysed and market size insights and trends are provided by type, product, and category are referenced above.

The countries covered in the pet food flavors market report are U.S., Canada, and Mexico, Brazil, Argentina, rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, South Africa, Israel, and the rest of the Middle East and Africa.

North America is expected to dominate the market due to the high pet ownership, affluent demographic, emphasis on pet health, and premium pet care preferences historically drove significant demand for pet food flavors in this region during the forecast period.

Asia-Pacific is expected to witness the fastest growth during the forecast period due to the growing middle-class population, urbanization, and evolving pet culture contribute to increasing demand for pet products, potentially impacting the pet food flavors market in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Pet Food Flavors Market Share Analysis

The pet food flavors market competitive landscape provides details by competitors. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the pet food flavors market.

Some of the major players operating in the pet food flavors market are:

- Kerry (Ireland)

- Givaudan (Switzerland)

- Firmenich SA (Switzerland)

- Sensient Technologies Corporation (U.S)

- Symrise, (U.S)

- T.HASEGAWA CO., LTD. (Japan)

- ADM (U.S)

- Huabao International Holdings Limited. (Hongkong)

- Takasago International Corporation (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pet Food Flavors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pet Food Flavors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pet Food Flavors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.