Global Pet Nuclear Medicine Market

Market Size in USD Billion

CAGR :

%

USD

10.35 Billion

USD

31.66 Billion

2024

2032

USD

10.35 Billion

USD

31.66 Billion

2024

2032

| 2025 –2032 | |

| USD 10.35 Billion | |

| USD 31.66 Billion | |

|

|

|

|

PET Nuclear Medicine Market Size

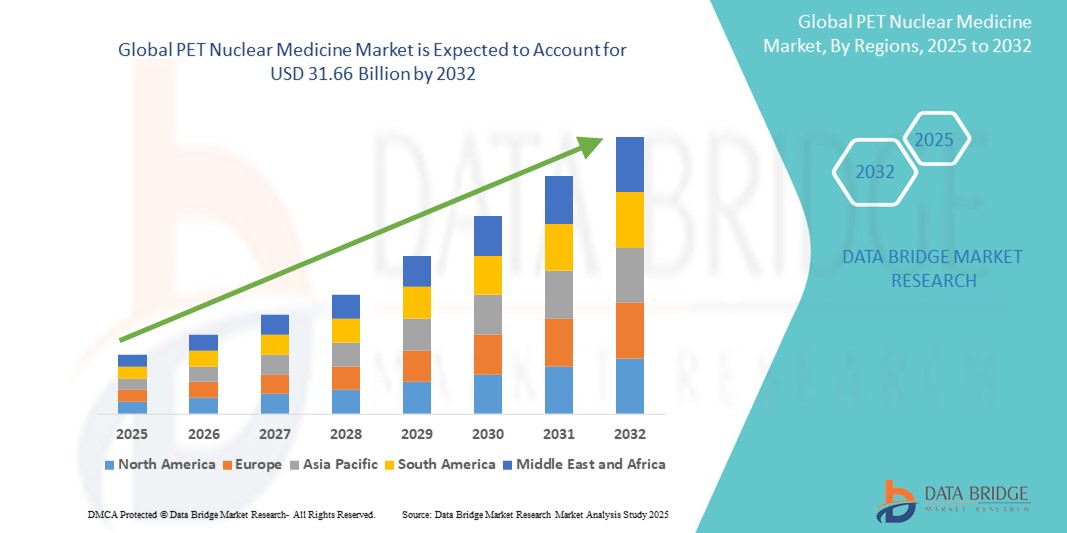

- The global PET nuclear medicine market size was valued at USD 10.35 billion in 2024 and is expected to reach USD 31.66 billion by 2032, at a CAGR of 15.00% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases, especially cancer and cardiovascular disorders, which has heightened the demand for advanced diagnostic imaging technologies such as PET scans

- Moreover, technological advancements in radiotracers, rising adoption of hybrid imaging systems, and the growing awareness about early and accurate disease detection are positioning PET nuclear medicine as a critical tool in precision diagnostics. These factors are contributing to sustained demand and substantial expansion of the market globally

PET Nuclear Medicine Market Analysis

- PET nuclear medicine, utilizing positron-emitting radiotracers for highly sensitive imaging, is becoming a critical component of modern diagnostic and therapeutic strategies in both oncology and cardiology due to its precision, non-invasive nature, and ability to detect disease at the molecular level

- The escalating demand for PET nuclear medicine is primarily fueled by the increasing incidence of chronic conditions such as cancer and neurological disorders, greater awareness about early disease detection, and advancements in radiopharmaceuticals and imaging equipment

- North America dominated the PET nuclear medicine market with the largest revenue share of 40.06% in 2024, attributed to advanced healthcare infrastructure, robust R&D investments, and early adoption of hybrid imaging systems, with the U.S. experiencing substantial growth in PET procedures, driven by supportive reimbursement policies and presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the PET nuclear medicine market during the forecast period due to expanding healthcare access, growing medical tourism, and increasing government focus on early disease diagnosis

- Oncology segment dominated the PET nuclear medicine market with a market share of 43.7% in 2024, driven by the high demand for accurate cancer detection, staging, and monitoring using PET tracers such as FDG for enhanced clinical decision-making

Report Scope and PET Nuclear Medicine Market Segmentation

|

Attributes |

PET Nuclear Medicine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

PET Nuclear Medicine Market Trends

“Technological Advancements Driving Diagnostic Precision”

- A significant and accelerating trend in the global PET nuclear medicine market is the advancement of next-generation radiotracers and hybrid imaging modalities such as PET/CT and PET/MRI, which are greatly enhancing diagnostic precision and disease monitoring across oncology, cardiology, and neurology

- For instance, radiopharmaceuticals such as Ga-68 and F-18 labeled compounds are gaining prominence due to their improved target specificity, aiding in the early detection and staging of cancers. Companies such as Telix Pharmaceuticals are developing targeted PET tracers for prostate and kidney cancer

- Cutting-edge technologies are enabling shorter scan times, higher image resolution, and improved quantification capabilities. The introduction of digital PET scanners, for example, allows for lower doses of radiation and improved patient comfort while maintaining diagnostic accuracy

- Artificial intelligence is also being integrated into image reconstruction and interpretation, offering tools that assist radiologists in identifying anomalies with greater consistency and speed. GE Healthcare and Siemens Healthineers are incorporating AI-powered analytics into PET workflows for enhanced clinical efficiency

- The increasing focus on personalized medicine is also driving interest in PET imaging, as it allows clinicians to assess treatment efficacy and tailor therapies in real-time based on metabolic activity. This precision-driven approach is especially critical in oncology where response monitoring is essential

- The growing demand for non-invasive and early diagnostic tools, coupled with innovations in radiopharmaceutical production and imaging hardware, is expected to further accelerate the adoption of PET technologies globally in both clinical and research settings

PET Nuclear Medicine Market Dynamics

Driver

“Rising Cancer Burden and Growing Demand for Accurate Diagnostic Tools”

- The increasing global burden of cancer and chronic diseases, along with growing awareness regarding the benefits of early diagnosis, is a major driver for the PET nuclear medicine market

- For instance, according to the WHO, global cancer cases are expected to rise significantly in the coming years, highlighting the urgent need for accurate and non-invasive imaging tools. PET scans, which provide detailed metabolic information, have become essential in detecting, staging, and monitoring various cancers

- Furthermore, the adoption of hybrid imaging technologies such as PET/CT and PET/MRI is expanding due to their ability to provide both anatomical and functional insights in a single session, thereby improving diagnostic confidence and reducing the need for multiple scans

- Increasing investments by governments and private healthcare providers in nuclear medicine infrastructure, along with supportive reimbursement policies in developed markets, are also propelling growth. Leading market players are forming partnerships to expand their tracer manufacturing and cyclotron facilities to meet rising demand

- The shift toward value-based healthcare and personalized treatment approaches is positioning PET imaging as a cornerstone in clinical decision-making across oncology, neurology, and cardiology, further strengthening market momentum

Restraint/Challenge

“High Cost and Regulatory Complexity in Radiotracer Production”

- The high cost associated with PET imaging procedures and radiotracer production poses a significant challenge, particularly in low- and middle-income countries where access to advanced imaging infrastructure is limited

- For instance, the production of short-lived isotopes such as F-18 requires access to cyclotrons and radiopharmacies, which involve substantial capital investment and strict regulatory oversight. This complexity can result in supply chain limitations, especially in geographically dispersed regions

- Regulatory hurdles related to the approval and distribution of new radiopharmaceuticals also act as barriers to market entry. Varying compliance requirements across countries can delay commercialization and limit the availability of novel PET agents

- In addition, PET procedures can be cost-prohibitive for many patients due to limited insurance coverage in certain regions, further restricting utilization despite clinical advantages

- Overcoming these barriers will require expanded investment in radiopharmaceutical infrastructure, public-private partnerships to improve access, and harmonization of regulatory pathways to streamline innovation and ensure wider adoption of PET nuclear medicine technologies across the globe

PET Nuclear Medicine Market Scope

The market is segmented on the basis of type, application, procedure, and end user.

- By Type

On the basis of type, the PET nuclear medicine market is segmented into F-18, Rb-82, and Others. The F-18 segment dominated the market with the largest market revenue share in 2024, owing to its widespread use in oncology for imaging glucose metabolism using 18F-FDG (fluorodeoxyglucose). F-18's favorable half-life and high image resolution make it a preferred choice across various diagnostic applications, especially cancer detection and monitoring.

The Rb-82 segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its growing adoption in cardiac imaging. Rb-82 offers rapid imaging and high-quality myocardial perfusion data, making it an ideal choice for stress testing and cardiovascular diagnostics. The increasing burden of heart diseases globally is further propelling demand for Rb-82-based PET procedures.

- By Application

On the basis of application, the global PET nuclear medicine market is segmented into Oncology, Cardiology, Neurology, and Other PET Applications. The oncology segment dominated the PET nuclear medicine market in 2024, accounting for the highest revenue share of 43.7% due to the high prevalence of cancer and the critical role PET imaging plays in tumor detection, staging, and treatment planning. The use of F-18-FDG and other oncology-targeted tracers contributes to the segment’s strong market position.

The neurology segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising cases of neurological disorders such as Alzheimer’s and Parkinson’s disease. PET imaging is being increasingly adopted for early diagnosis and monitoring of neurological changes, especially with the advent of specialized tracers such as 18F-florbetapir for amyloid plaque detection.

- By Procedure

On On the basis of procedure, the global PET nuclear medicine market is segmented into diagnostic procedures and therapeutic procedures. the diagnostic procedures segment held the largest share of the market in 2024 due to the dominant use of PET imaging in disease diagnosis across oncology, cardiology, and neurology. The non-invasive nature, precision, and ability to detect functional abnormalities before anatomical changes occur make diagnostic PET procedures essential in clinical practice.

The therapeutic procedures segment is anticipated to witness the fastest growth rate from 2025 to 2032, particularly as theranostics (combining diagnostics and therapy) gains traction in personalized medicine. PET imaging is increasingly being used to guide radiopharmaceutical therapies, especially in oncology, where it supports targeted treatment delivery and efficacy assessment.

- By End User

On the basis of end user, the PET nuclear medicine market is segmented into Hospitals and Diagnostic Centers and Research Institutes. The hospitals and diagnostic centers segment dominated the market in 2024, driven by high patient volumes, access to advanced imaging infrastructure, and widespread use of PET scans in clinical diagnostics. Increasing investments in hospital-based nuclear medicine departments and integrated PET/CT systems also support this segment’s dominance.

The research institutes segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by growing R&D activities focused on developing novel PET tracers, exploring new clinical applications, and advancing radiopharmaceutical science. Increased collaboration between academic institutions, healthcare organizations, and biotech firms is fueling innovation in this segment.

PET Nuclear Medicine Market Regional Analysis

- North America dominated the PET nuclear medicine market with the largest revenue share of 40.06% in 2024, attributed to advanced healthcare infrastructure, robust R&D investments, and early adoption of hybrid imaging systems

- Healthcare providers in the region prioritize early and accurate diagnosis, and PET imaging is valued for its high sensitivity, precision, and ability to guide personalized treatment decisions

- This dominance is further supported by significant investments in nuclear medicine research, the presence of leading radiopharmaceutical manufacturers, favorable reimbursement frameworks, and increased awareness among clinicians and patients about the clinical benefits of PET imaging, establishing it as a cornerstone modality in modern diagnostics across the U.S. and Canada

U.S. PET Nuclear Medicine Market Insight

The U.S. PET nuclear medicine market captured the largest revenue share of 81% in 2024 within North America, driven by the country’s advanced healthcare infrastructure, high adoption of innovative diagnostic tools, and increasing prevalence of cancer and neurological disorders. The strong presence of major radiopharmaceutical manufacturers, coupled with supportive reimbursement policies, boosts market penetration. In addition, the rapid integration of AI in imaging diagnostics and growing demand for personalized medicine further contribute to the expanding use of PET technologies across clinical settings.

Europe PET Nuclear Medicine Market Insight

The Europe PET nuclear medicine market is projected to expand at a substantial CAGR throughout the forecast period, supported by increasing healthcare expenditure, strong R&D in nuclear imaging, and widespread adoption of hybrid imaging modalities such as PET/CT. Growing public awareness of early disease detection and rising incidences of chronic diseases are fostering market growth. Furthermore, initiatives by the European Medicines Agency (EMA) to streamline radiopharmaceutical approvals are accelerating the adoption of PET technologies across hospitals and diagnostic centers.

U.K. PET Nuclear Medicine Market Insight

The U.K. PET nuclear medicine market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased investments in cancer diagnostics, government support for nuclear medicine infrastructure, and expansion of public-private partnerships in medical imaging. The country’s emphasis on early diagnosis through national screening programs and its well-established NHS framework are key contributors to rising PET scan volumes. Technological advancements and collaborations with research institutions are further supporting the market’s development.

Germany PET Nuclear Medicine Market Insight

The Germany PET nuclear medicine market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare standards, innovation-driven medical research, and growing demand for precise, image-guided diagnostics. Germany’s strong academic and clinical ecosystem, coupled with widespread implementation of PET/CT and PET/MRI scanners in major hospitals, supports high usage rates. The country's emphasis on early cancer detection and expanding applications of PET in neurology and cardiology are also enhancing market growth.

Asia-Pacific PET Nuclear Medicine Market Insight

The Asia-Pacific PET nuclear medicine market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by expanding healthcare infrastructure, rising awareness of early diagnostics, and increasing cancer incidence across emerging economies. Countries such as China, India, and Japan are leading the region’s growth, supported by government initiatives to improve access to nuclear medicine and investments in local radiopharmaceutical production. The affordability of PET procedures and growing medical tourism also contribute to regional market expansion.

Japan PET Nuclear Medicine Market Insight

The Japan PET nuclear medicine market is gaining momentum due to its advanced imaging infrastructure, aging population, and widespread acceptance of precision diagnostics. Japan’s commitment to early detection of age-related diseases, such as cancer and dementia, drives PET adoption across hospitals and specialty clinics. Integration of AI in diagnostic imaging, along with collaborations between academic institutions and biotech firms, supports continuous innovation and sustained market growth.

India PET Nuclear Medicine Market Insight

The India PET nuclear medicine market accounted for the largest market revenue share in Asia Pacific in 2024, driven by increasing healthcare investment, growing cancer burden, and rapid development of diagnostic infrastructure. India’s expanding network of PET centers, government-backed cancer screening programs, and presence of domestic radiopharmaceutical manufacturers are key growth drivers. The adoption of PET technology in tier 2 and tier 3 cities, supported by public-private partnerships, is widening access and stimulating national market expansion.

PET Nuclear Medicine Market Share

The PET nuclear medicine industry is primarily led by well-established companies, including:

- Cardinal Health (U.S.)

- General Electric Company (U.S.)

- Lantheus (U.S.)

- Bayer AG (Germany)

- Bracco (Italy)

- NMR (U.S.)

- Eckert & Ziegler (Germany)

- Jubilant DraxImage, Inc. (Canada)

- PharmaLogic U.S.)

- Institute of Isotopes (Hungary)

- SHINE Technologies, LLC (U.S.)

- Global Medical (China)

- Segami Corporation (U.S.)

- Spectrum Dynamics Medical (Israel)

- CMR Naviscan (U.S.)

- Shanghai United Imaging Healthcare Co., LTD (China)

- Neusoft Corporation (China)

What are the Recent Developments in Global PET Nuclear Medicine Market?

- In April 2023, Telix Pharmaceuticals Limited, a global leader in radiopharmaceutical development, received regulatory approval in the United States for Illuccix, its prostate cancer imaging agent based on Ga-68-PSMA. This milestone underscores Telix’s commitment to advancing targeted diagnostics and improving patient outcomes through precision nuclear medicine. The approval enhances access to state-of-the-art PET imaging tools and strengthens the company's presence in the competitive oncology imaging market

- In March 2023, Siemens Healthineers launched its next-generation Biograph Vision Quadra, a long axial field-of-view PET/CT scanner, designed to improve image resolution and speed. Tailored for both clinical and research applications, this innovation enables whole-body dynamic imaging and higher throughput. The development represents Siemens’ ongoing efforts to enhance PET/CT technology for early and accurate disease detection, supporting broader adoption across high-volume diagnostic centers

- In February 2023, GE HealthCare announced a strategic collaboration with Spectrum Dynamics Medical to integrate its AI-powered molecular imaging solutions into next-generation SPECT and PET systems. This partnership aims to deliver enhanced image quality and automated workflows, accelerating diagnostic processes and improving operational efficiency. The initiative demonstrates GE HealthCare's strategic focus on digital innovation and AI integration in nuclear medicine

- In January 2023, Curium, a leading provider of nuclear medicine solutions, expanded its production capacity for F-18 radiopharmaceuticals in Europe with the inauguration of a new facility in France. This move addresses the growing demand for PET imaging agents and strengthens Curium’s supply chain resilience across the continent. The expansion highlights the company’s commitment to supporting the increasing clinical need for high-quality diagnostic tracers in oncology and neurology

- In January 2023, Bayer AG announced new investments in its theranostics pipeline, emphasizing its focus on combining targeted radiopharmaceutical therapy with diagnostic imaging using PET. The company’s expanding oncology portfolio now includes novel compounds aimed at treating prostate and other solid tumors. This strategic development reflects Bayer’s intent to become a leader in precision oncology through the convergence of therapeutic and diagnostic nuclear medicine technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PET NUCLEAR MEDICINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PET NUCLEAR MEDICINE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PET NUCLEAR MEDICINE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR PET NUCLEAR MEDICINE MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR PET NUCLEAR MEDICINE MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE PET NUCLEAR MEDICINE MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR PET NUCLEAR MEDICINE MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR PET NUCLEAR MEDICINE MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 OPPUTUNITY MAP ANALYSIS

16 VALUE CHAIN ANALYSIS

17 HEALTHCARE ECONOMY

17.1 HEALTHCARE EXPENDITURE

17.2 CAPITAL EXPENDITURE

17.3 CAPEX TRENDS

17.4 CAPEX ALLOCATION

17.5 FUNDING SOURCES

17.6 INDUSTRY BENCHMARKS

17.7 GDP RATION IN OVERALL GDP

17.8 HEALTHCARE SYSTEM STRUCTURE

17.9 GOVERNMENT POLICIES

17.1 ECONOMIC DEVELOPMENT

18 GLOBAL PET NUCLEAR MEDICINE MARKET, BY TYPE

18.1 OVERVIEW

18.2 DIAGNOSTIC RADIOPHARMACEUTICALS

18.2.1 PET ISOTOPES

18.2.1.1. FLUORINE-18 (F-18)

18.2.1.2. CARBON-11 (C-11)

18.2.1.3. NITROGEN-13 (N-13)

18.2.1.4. OXYGEN-15 (O-15)

18.2.1.5. GALLIUM-68 (GA-68)

18.2.2 THERAPEUTIC RADIOPHARMACEUTICALS

18.2.2.1. BETA EMITTERS

18.2.2.1.1. LUTETIUM-177 (LU-177)

18.2.2.1.2. IODINE-131 (I-131)

18.2.2.2. ALPHA EMITTERS

18.2.2.3. BRACHYTHERAPY ISOTOPES

19 GLOBAL PET NUCLEAR MEDICINE MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 ONCOLOGY

19.2.1 BRAIN CANCER

19.2.2 LUNG CANCER

19.2.3 BREAST CANCER

19.2.4 PROSTATE CANCER

19.2.5 COLORECTAL CANCER

19.2.6 THYROID CANCER

19.3 CARDIOLOGY

19.3.1 CORONARY ARTERY DISEASE (CAD)

19.3.2 CARDIOMYOPATHY

19.3.3 CONGENITAL HEART DISEASE

19.4 NEUROLOGY

19.4.1 ALZHEIMER'S DISEASE

19.4.2 PARKINSON'S DISEASE

19.4.3 EPILEPSY

19.4.4 MULTIPLE SCLEROSIS

19.5 OTHERS

20 GLOBAL PET NUCLEAR MEDICINE MARKET, BY PROCEDURES

20.1 OVERVIEW

20.2 DIAGNOSTIC

20.3 THERAPEUTIC

21 GLOBAL PET NUCLEAR MEDICINE MARKET, BY ROUTE OF ADMINISTRATION

21.1 OVERVIEW

21.2 ORAL

21.3 INTRAVENOUS

21.4 INHALATION

21.5 OTHERS

22 GLOBAL PET NUCLEAR MEDICINE MARKET, BY END-USER

22.1 OVERVIEW

22.2 HOSPITALS

22.3 DIAGNOSTIC IMAGING CENTERS

22.4 RESEARCH INSTITUTES

22.5 OTHERS

23 GLOBAL PET NUCLEAR MEDICINE MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 NEW PRODUCT DEVELOPMENT & APPROVALS

23.7 EXPANSIONS

23.8 REGULATORY CHANGES

23.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL PET NUCLEAR MEDICINE MARKET, BY GEOGRAPHY

24.1 GLOBAL PET NUCLEAR MEDICINE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 NORTH AMERICA

24.1.1.1. U.S.

24.1.1.2. CANADA

24.1.1.3. MEXICO

24.1.2 EUROPE

24.1.2.1. GERMANY

24.1.2.2. FRANCE

24.1.2.3. U.K.

24.1.2.4. HUNGARY

24.1.2.5. LITHUANIA

24.1.2.6. AUSTRIA

24.1.2.7. IRELAND

24.1.2.8. NORWAY

24.1.2.9. POLAND

24.1.2.10. ITALY

24.1.2.11. SPAIN

24.1.2.12. RUSSIA

24.1.2.13. TURKEY

24.1.2.14. NETHERLANDS

24.1.2.15. SWITZERLAND

24.1.2.16. REST OF EUROPE

24.1.3 ASIA-PACIFIC

24.1.3.1. JAPAN

24.1.3.2. CHINA

24.1.3.3. SOUTH KOREA

24.1.3.4. INDIA

24.1.3.5. AUSTRALIA

24.1.3.6. SINGAPORE

24.1.3.7. THAILAND

24.1.3.8. MALAYSIA

24.1.3.9. INDONESIA

24.1.3.10. PHILIPPINES

24.1.3.11. VIETNAM

24.1.3.12. REST OF ASIA-PACIFIC

24.1.4 SOUTH AMERICA

24.1.4.1. BRAZIL

24.1.4.2. ARGENTINA

24.1.4.3. PERU

24.1.4.4. REST OF SOUTH AMERICA

24.1.5 MIDDLE EAST AND AFRICA

24.1.5.1. SOUTH AFRICA

24.1.5.2. SAUDI ARABIA

24.1.5.3. UAE

24.1.5.4. EGYPT

24.1.5.5. KUWAIT

24.1.5.6. ISRAEL

24.1.5.7. REST OF MIDDLE EAST AND AFRICA

24.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL PET NUCLEAR MEDICINE MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL PET NUCLEAR MEDICINE MARKET, COMPANY PROFILE

26.1 CARDINAL HEALTH

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 GENERAL ELECTRIC

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 LANTHEUS

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 BAYER AG

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 BRACCO

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 ECKERT & ZIEGLER

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 JUBILANT DRAXIMAGE, INC.

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 PHARMALOGIC

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 SPECTRUM DYNAMICS MEDICAL

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 CMR NAVISCAN

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 NEUSOFT CORPORATION

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 SIEMENS HEALTHINEERS

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 PHILIPS HEALTHCARE

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 CANON MEDICAL SYSTEMS CORPORATION

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 ELI LILLY AND COMPANY

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 IBA MOLECULAR

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 ADVANCED ACCELERATOR APPLICATIONS (AAA)

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 SOFIE BIOSCIENCES

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 TRASIS

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 MOLECULAR IMAGING, INC.

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.