Global Pet Oral Care Products Market

Market Size in USD Million

CAGR :

%

USD

4,203.54 Million

USD

26,677.03 Million

2022

2030

USD

4,203.54 Million

USD

26,677.03 Million

2022

2030

| 2023 –2030 | |

| USD 4,203.54 Million | |

| USD 26,677.03 Million | |

|

|

|

|

Pet Oral Care Products Market Analysis and Size

The increasing cases of gum diseases among pet animals especially after the age of three, rise in awareness about pet oral health and the popularity of the products due to their ability to improve health care are the major factors driving the pet oral care products market. The incidences of bad breath, broken or loose teeth, discolored teeth, pain and bleeding of teeth, the oral problems among feline and canine such as periodontal disease and the increasing necessities of these oral care products accelerate the pet oral care products market growth. The rise in the number of dental procedures, the increase in the number of regular vet check-ups and the individual veterinarians and organizations encouraging the role of tooth brushing influence the pet oral care products market. The increasing use of these pet oral care products for cleaning the teeth every day, rise to products such as dental treats, water additives, dental wipes and breath fresheners among others and premiumization of pet care market also boost the pet oral care products market. In addition, increase in veterinary health expenditure, rise in pet ownership, growing disposable income and surge in pet insurance positively affect the pet oral care products market. Furthermore, rapid advancements and product launches extend profitable opportunity to the pet oral care products market players in the forecast period.

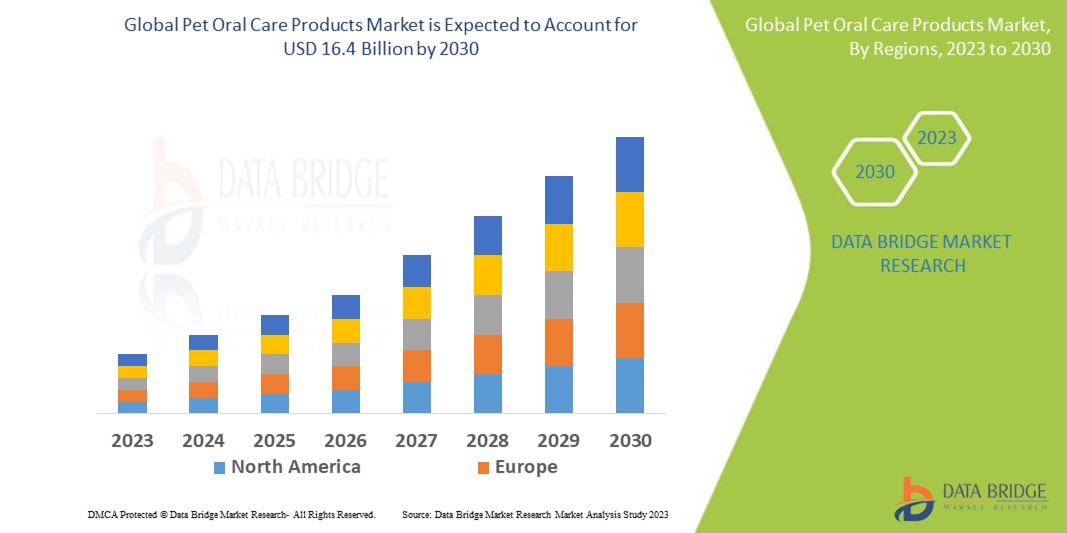

Data Bridge Market Research analyzes that the global pet oral care products market which was USD 9.8 billion in 2022, would rocket up to USD 16.4 billion by 2030, and is expected to undergo a CAGR of 6.4% during the forecast period 2023 to 2030. This indicates the market value. “Mouthwash/Rinse ” dominates the product segment of the global pet oral care products market owing to the surge in the demand of pet care products. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Pet Oral Care Products Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product (Mouthwash/Rinse, Tooth Paste, Tooth Brush, Dental Chews, Other Product Types), Animals (Cats, Dogs, Horses), End-Use (Veterinary Hospitals, Private Clinics, Home Care, Colleges and Universities) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

AllAccem (U.S.), CEVA Logistic (France), Colgate-Palmolive Company (U.S.), Dechra (U.K.), HealthyMouth LLC (U.S.), imrex (Canada), Mars, Incorporated (U.S.), Petzlife Products Inc. (U.S.), TropiClean Pet Products (U.S.), among other. |

|

Market Opportunities |

|

Market Definition

Pet oral care refers to one of the most effective measures taken by pet owners to maintain the overall health of the pets and prevent health related problems of the animals. They assist in protecting the animals from transmission of infectious diseases from other pets and plays an important role in the functioning of hygiene and comfort for the pets. These pet’s oral care is suggested to be checked annually with the use of these pet oral care products. Pet oral care products mean several kinds of appliances, medicines and other chemicals utilized to maintain proper oral hygiene and prevent dental diseases in pets.

Global Pet Oral Care Products Market Dynamics

Drivers

- Increasing Awareness and Diagnosis

The rising prevalence of gum diseases among pet animals is acting as a significant driver in the global pet oral care products market. The increasing awareness about the importance of oral hygiene in pets and its impact on their overall health has led to a growing demand for specialized oral care products. Pet owners are seeking preventive measures to combat gum diseases, such as periodontitis and gingivitis, in their furry companions. This trend has fueled the market for pet oral care products, including toothpaste, dental chews, mouthwashes, and oral sprays, with manufacturers introducing innovative and effective solutions to address this concern

- Rise in Awareness about Pet Oral Health

The heightened awareness surrounding pet oral health is playing a pivotal role in driving the global pet oral care products market. Pet owners are increasingly recognizing the significance of maintaining good oral hygiene for their beloved companions. The understanding that oral health issues can lead to serious health complications, including periodontal diseases, tooth decay, and systemic infections, has spurred the demand for oral care products. As a result, there is a growing market for pet toothbrushes, dental wipes, water additives, and other specialized products. Manufacturers are capitalizing on this awareness by offering a wide range of effective and convenient solutions, further propelling the growth of the market

Opportunity

- Increase in the Number of Regular Vet Check-Ups

The increase in the number of regular veterinary check-ups presents a significant opportunity in the global pet oral care products market. Pet owners are becoming more proactive in seeking professional veterinary care, including regular dental examinations, for their pets. These check-ups allow veterinarians to identify oral health issues at an early stage and recommend appropriate oral care products. As a result, there is a growing demand for pet toothbrushes, toothpaste, dental treats, and other oral care products that are recommended and endorsed by veterinarians. Manufacturers can leverage this opportunity by developing high-quality, veterinarian-recommended oral care products and forging partnerships with veterinary clinics to promote their usage

Restraint/Challenge

- Lack Of Proper Veterinary Dentistry In Developing Countries

The lack of proper veterinary dentistry in developing countries poses a significant restraint in the global pet oral care products market. Limited access to trained veterinary professionals and specialized dental equipment in these regions hinders the diagnosis and treatment of oral health issues in pets. As a result, pet owners may not prioritize oral care or seek appropriate dental products for their pets. The absence of robust veterinary dental services creates a barrier for manufacturers of pet oral care products to penetrate these markets effectively. Addressing this issue requires investments in veterinary education, infrastructure, and awareness campaigns to promote the importance of oral health and encourage the use of dental products in developing countries

Recent Development

- In September 2021 Royal Canin, a Brand of Mars Inc., launched Health Management, which offered five tailored nutritional ranges designed to support optimal health in cats and dogs: which included oral care products Feline Dental Diet and Canine Dental Diet.

Global Pet Oral Care Products Market Scope

The global pet oral care products market is segmented on the basis of product, animals and end use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Mouthwash/Rinse

- Tooth Paste

- Tooth Brush

- Dental Chews

- Other Product Types

Animals

- Cats

- Horses

- Dogs

End-Use

- Veterinary Hospitals

- Private Clinics

- Home Care

- Colleges and Universities

Global Pet Oral Care Products Market Regional Analysis/Insights

The global pet oral care products market is analyzed and market size insights and trends are provided by country, product, animals and end-use as referenced above.

The countries covered in the global pet oral care products market report are the U.S., Canada, Mexico, Peru, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Hungary, Lithuania, Austria, Ireland, Norway, Poland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Vietnam, Rest of Asia Pacific, South Africa, Saudi Arabia, U.A.E., Kuwait, Israel, Egypt, Rest of Middle East and Africa

North America dominates the global pet oral care products market because of the strong base of healthcare facilities, the strong presence of major players in the market, increasing pet care and rising demand of pet care products.

Asia-Pacific is expected to witness significant growth during the forecast period from 2023 to 2030 due to the increase in the government initiatives to promote awareness, growing research activities in the region, availability of massive untapped markets, large population pool, and the growing demand for quality healthcare in the region.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The global pet oral care products market also provides you with detailed market analysis for every country's growth in healthcare expenditure for capital equipment, installed base of different kinds of products for the global pet oral care products market, the impact of technology using lifeline curves and changes in healthcare regulatory scenarios and their impact on the global pet oral care products market. The data is available for the historic period from 2015 to 2020.

Competitive Landscape and Global Pet Oral Care Products Market Share Analysis

The global pet oral care products market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the global pet oral care products market are

- AllAccem (U.S.)

- CEVA Logistic (France)

- Colgate-Palmolive Company (U.S.)

- Dechra (U.K.)

- HealthyMouth LLC (U.S.)

- imrex (Canada)

- Mars, Incorporated (U.S.)

- Petzlife Products Inc. (U.S.)

- TropiClean Pet Products (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PET ORAL CARE PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PET ORAL CARE PRODUCTS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PET ORAL CARE PRODUCTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL PET ORAL CARE PRODUCTS MARKET, BY PRODUCT TYPE

16.1 OVERVIEW

16.2 TOOTHBRUSH

16.2.1 TRADITIONAL TOOTHBRUSH

16.2.1.1. MARKET VALUE (USD MILLION)

16.2.1.2. MARKET VOLUME (UNITS)

16.2.1.3. AVERAGE SELLING PRICE (USD)

16.2.2 FINGERBRUSH

16.2.2.1. MARKET VALUE (USD MILLION)

16.2.2.2. MARKET VOLUME (UNITS)

16.2.2.3. AVERAGE SELLING PRICE (USD)

16.2.3 ULTRASONIC TOOTHBRUSH

16.2.3.1. MARKET VALUE (USD MILLION)

16.2.3.2. MARKET VOLUME (UNITS)

16.2.3.3. AVERAGE SELLING PRICE (USD)

16.2.4 BAMBOO TOOTBRUSH

16.2.4.1. MARKET VALUE (USD MILLION)

16.2.4.2. MARKET VOLUME (UNITS)

16.2.4.3. AVERAGE SELLING PRICE (USD)

16.2.5 OTHERS

16.3 TOOTHPASTE

16.3.1 ANTIBACTERIAL AND ANTI IFLAMMATORY

16.3.1.1. MARKET VALUE (USD MILLION)

16.3.1.2. MARKET VOLUME (UNITS)

16.3.1.3. AVERAGE SELLING PRICE (USD)

16.3.2 ACTIVATED CHARCOAL TOOTPASTE

16.3.2.1. MARKET VALUE (USD MILLION)

16.3.2.2. MARKET VOLUME (UNITS)

16.3.2.3. AVERAGE SELLING PRICE (USD)

16.3.3 FLUORIDE FREE

16.3.3.1. MARKET VALUE (USD MILLION)

16.3.3.2. MARKET VOLUME (UNITS)

16.3.3.3. AVERAGE SELLING PRICE (USD)

16.3.4 OTHERS

16.4 DENTAL CHEWS

16.4.1 SOFT CHEWS

16.4.1.1. MARKET VALUE (USD MILLION)

16.4.1.2. MARKET VOLUME (UNITS)

16.4.1.3. AVERAGE SELLING PRICE (USD)

16.4.2 TEXTURED CHEWS

16.4.2.1. MARKET VALUE (USD MILLION)

16.4.2.2. MARKET VOLUME (UNITS)

16.4.2.3. AVERAGE SELLING PRICE (USD)

16.4.3 ENZYMATIC CHEWS

16.4.3.1. MARKET VALUE (USD MILLION)

16.4.3.2. MARKET VOLUME (UNITS)

16.4.3.3. AVERAGE SELLING PRICE (USD)

16.4.4 TREATED RAWHIDES

16.4.4.1. MARKET VALUE (USD MILLION)

16.4.4.2. MARKET VOLUME (UNITS)

16.4.4.3. AVERAGE SELLING PRICE (USD)

16.5 WATER ADDITIVES

16.5.1.1. MARKET VALUE (USD MILLION)

16.5.1.2. MARKET VOLUME (UNITS)

16.5.1.3. AVERAGE SELLING PRICE (USD)

16.6 BREATH FRESHENER SPRAY

16.6.1 MARKET VALUE (USD MILLION)

16.6.2 MARKET VOLUME (UNITS)

16.6.3 AVERAGE SELLING PRICE (USD)

16.7 DENTAL GELS

16.7.1 MARKET VALUE (USD MILLION)

16.7.2 MARKET VOLUME (UNITS)

16.7.3 AVERAGE SELLING PRICE (USD)

16.8 DENTAL WIPES

16.8.1 MARKET VALUE (USD MILLION)

16.8.2 MARKET VOLUME (UNITS)

16.8.3 AVERAGE SELLING PRICE (USD)

16.9 ANTI-PLAQUE PENS

16.9.1 MARKET VALUE (USD MILLION)

16.9.2 MARKET VOLUME (UNITS)

16.9.3 AVERAGE SELLING PRICE (USD)

16.1 DENTAL POWDER

16.10.1 MARKET VALUE (USD MILLION)

16.10.2 MARKET VOLUME (UNITS)

16.10.3 AVERAGE SELLING PRICE (USD)

16.11 OTHERS

16.11.1 MOUTHWASH/RINSE

16.11.2 TONGUE CLEANER

16.11.3 ORAL CARE FOOD ADDITIVES

16.11.4 OTHER ORAL CARE PRODUCTS

17 GLOBAL PET ORAL CARE PRODUCTS MARKET, BY ANIMAL TYPE

17.1 OVERVIEW

17.2 DOGS

17.2.1 LARGE

17.2.2 MEDIUM

17.2.3 SMALL

17.3 CATS

17.3.1 LARGE

17.3.2 MEDIUM

17.3.3 SMALL

17.4 HORSES

17.4.1 LARGE

17.4.2 MEDIUM

17.4.3 SMALL

17.5 OTHERS

18 GLOBAL PET ORAL CARE PRODUCTS MARKET, BY PRICE RANGE

18.1 OVERVIEW

18.2 LOW

18.3 MEDIUM

18.4 HIGH

19 GLOBAL PET ORAL CARE PRODUCTS MARKET, BY END USER

19.1 OVERVIEW

19.2 VETERINARY HOSPITALS

19.3 VETERINARY CLINICS

19.4 HOME CARE SETTINGS

19.5 OTHERS

20 GLOBAL PET ORAL CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 OFFLINE

20.2.1 SUPERMARKETS/ HYPERMARKETS

20.2.2 SPECIALIZED PET SHOPS

20.2.3 OTHERS

20.3 ONLINE

20.3.1 COMPANY OWNED WEBSITES

20.3.2 E-COMMERCE WEBSITES

20.3.3 OTHERS

21 GLOBAL PET ORAL CARE PRODUCTS MARKET, SWOT AND DBMR ANALYSIS

22 GLOBAL PET ORAL CARE PRODUCTS MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL PET ORAL CARE PRODUCTS MARKET, BY REGION

Global Pet oral care products market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 U.K.

23.2.3 ITALY

23.2.4 FRANCE

23.2.5 SPAIN

23.2.6 RUSSIA

23.2.7 SWITZERLAND

23.2.8 TURKEY

23.2.9 BELGIUM

23.2.10 NETHERLANDS

23.2.11 DENMARK

23.2.12 SWEDEN

23.2.13 POLAND

23.2.14 NORWAY

23.2.15 FINLAND

23.2.16 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 SINGAPORE

23.3.6 THAILAND

23.3.7 INDONESIA

23.3.8 MALAYSIA

23.3.9 PHILIPPINES

23.3.10 AUSTRALIA

23.3.11 NEW ZEALAND

23.3.12 VIETNAM

23.3.13 TAIWAN

23.3.14 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 EGYPT

23.5.3 BAHRAIN

23.5.4 UNITED ARAB EMIRATES

23.5.5 KUWAIT

23.5.6 OMAN

23.5.7 QATAR

23.5.8 SAUDI ARABIA

23.5.9 REST OF MEA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL PET ORAL CARE PRODUCTS MARKET, COMPANY PROFILE

24.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 HEALTHYMOUTH LLC

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 VIRBAC

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 DECHRA PHARMACEUTICALS

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 PETZLIFE

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 ALLACCEM

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 VETOQUINOL

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 MARS INCORPORATED

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 IMREX INC

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 CEVA

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 ARM & HAMMER

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 TROPICLEAN

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 NYLABONE

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 ALL4PETS

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 BEAPHAR

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 VET'S BEST

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 PETOSAN

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 COLGATE-PALMOLIVE

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 DR. BRITE

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.19.6

24.19.7

24.2 VETOQUINOL

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 PURINA PET CARE (NESTLE)

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHIC PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.