Global Pet Sitting Market

Market Size in USD Billion

CAGR :

%

USD

4.45 Billion

USD

8.87 Billion

2025

2033

USD

4.45 Billion

USD

8.87 Billion

2025

2033

| 2026 –2033 | |

| USD 4.45 Billion | |

| USD 8.87 Billion | |

|

|

|

|

Pet Sitting Market Size

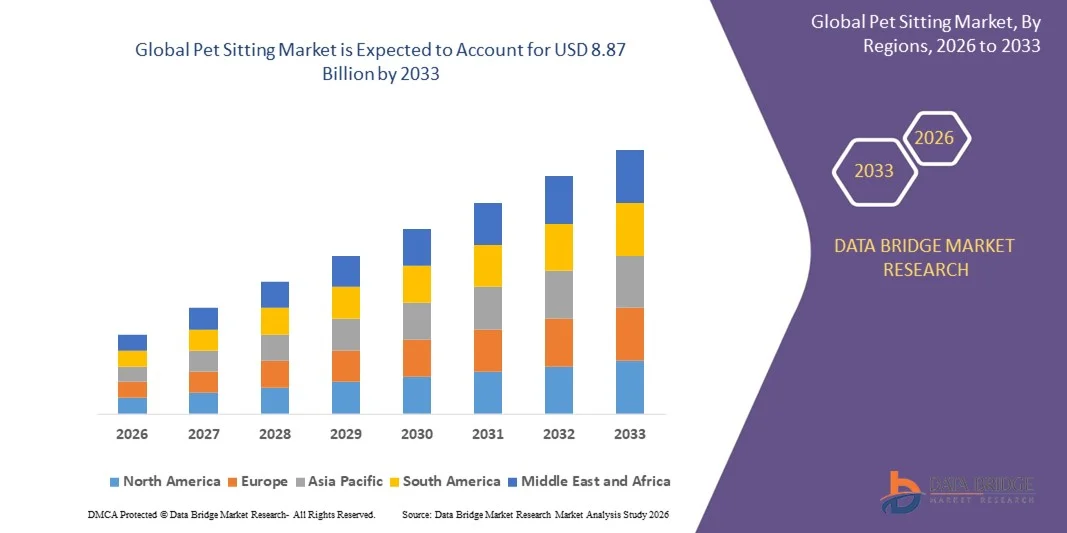

- The global pet sitting market size was valued at USD 4.45 billion in 2025 and is expected to reach USD 8.87 billion by 2033, at a CAGR of 9.00% during the forecast period

- The market growth is largely fuelled by the rising rate of pet ownership and increasing humanisation of pets, with owners prioritising personalised and stress-free care options when away from home

- Growing disposable incomes and changing lifestyles, such as longer working hours and frequent travel, are encouraging pet owners to opt for professional pet sitting services over informal care arrangements

Pet Sitting Market Analysis

- The pet sitting market is witnessing steady growth due to increasing awareness of pet health, safety, and emotional well-being, with pet owners seeking in-home care solutions that maintain pets’ daily routines

- Service providers are focusing on value-added offerings, such as real-time updates, pet activity tracking, and customised care plans, which enhance customer satisfaction and repeat usage

- North America dominated the pet sitting market with the largest revenue share in 2025, driven by high pet ownership rates, strong spending on pet care services, and the growing humanisation of pets

- Asia-Pacific region is expected to witness the highest growth rate in the global pet sitting market, driven by changing lifestyles, expanding middle-class population, and increasing penetration of mobile-based pet care platforms

- The Day Care Visits segment held the largest market revenue share in 2025 driven by the growing preference for in-home pet care that ensures comfort, routine continuity, and reduced stress for pets. Day care visit services typically include feeding, playtime, medication administration, and companionship, making them a widely preferred option among working professionals and frequent travelers seeking reliable and personalized care

Report Scope and Pet Sitting Market Segmentation

|

Attributes |

Pet Sitting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pet Sitting Market Trends

Rising Demand For Personalized And In-Home Pet Care Services

- The increasing focus on pet comfort, emotional well-being, and routine continuity is significantly shaping the global pet sitting market, as pet owners prefer in-home care over traditional boarding facilities. Pet sitting services are gaining traction due to their ability to provide personalized attention, reduced stress for pets, and flexible care schedules, aligning with the growing humanisation of pets

- Growing awareness around pet health, safety, and mental well-being has accelerated the demand for professional pet sitting services among working professionals and frequent travelers. Pet owners are actively seeking trusted caregivers who can offer customized feeding, exercise, and medication routines, encouraging service providers to enhance quality standards and service reliability

- Convenience-driven lifestyles and digital adoption are influencing purchasing decisions, with consumers favoring app-based platforms that offer easy booking, verified sitters, real-time updates, and transparent pricing. These features are helping platforms build trust and long-term customer relationships while differentiating services in a competitive market

- For instance, in 2024, Rover in the U.S. and TrustedHousesitters in the U.K. expanded their service offerings by introducing enhanced in-home pet sitting options with live pet updates and sitter background verification. These initiatives were launched to address rising demand for personalized and stress-free pet care, resulting in higher user engagement and repeat bookings

- While demand for pet sitting services continues to rise, sustained market growth depends on maintaining service quality, sitter availability, and trust-building mechanisms. Companies are focusing on platform security, training programs, and service standardization to ensure consistent customer experience and long-term adoption

Pet Sitting Market Dynamics

Driver

Growing Preference For Personalized And Stress-Free Pet Care

- Rising pet ownership and increasing emotional attachment between pets and owners are key drivers for the global pet sitting market. Pet owners are increasingly choosing personalized, in-home care solutions to ensure pets remain comfortable and safe in familiar environments, supporting steady demand growth

- Expanding participation of dual-income households and frequent travel patterns are contributing to higher reliance on professional pet sitters. These services provide flexibility, reliability, and peace of mind, enabling owners to balance work and lifestyle commitments without compromising pet care

- Digital platforms and mobile applications are actively promoting pet sitting services through user-friendly interfaces, secure payment systems, and verified caregiver networks. In addition, marketing efforts highlighting trust, transparency, and pet well-being are encouraging wider adoption across urban populations

- For instance, in 2023, Wag! in the U.S. and Pawshake in Australia reported increased bookings for in-home pet sitting services driven by busy lifestyles and rising travel frequency. Both platforms emphasized safety checks, sitter ratings, and real-time pet updates to strengthen consumer trust and platform loyalty

- Despite strong demand drivers, continued growth relies on effective sitter onboarding, training, and service consistency. Investment in technology, customer support, and caregiver quality assurance will remain essential to sustain market momentum

Restraint/Challenge

Trust Concerns And Service Cost Sensitivity

- Trust and safety concerns remain a major challenge in the pet sitting market, as pet owners may hesitate to allow unfamiliar caregivers into their homes. Incidents related to inconsistent service quality or lack of sitter accountability can negatively impact customer confidence and limit repeat usage

- Service cost sensitivity also restricts adoption among price-conscious consumers, particularly when compared to informal care arrangements such as family or friends. Premium pricing for experienced or specialized pet sitters may limit market penetration in certain customer segments

- Operational challenges, such as sitter availability during peak travel seasons and maintaining service standards across platforms, further impact market growth. In addition, managing cancellations, emergencies, and liability issues increases complexity for service providers

- For instance, in 2024, pet sitting platforms operating in urban markets such as New York and London reported customer hesitation due to pricing concerns and trust-related issues, particularly among first-time users. These challenges affected booking conversion rates and required additional investment in customer education and platform security

- Addressing these challenges will require stronger verification systems, transparent communication, competitive pricing models, and enhanced customer education. Collaboration with insurers, training providers, and technology partners can help improve trust, reduce risks, and unlock long-term growth opportunities in the global pet sitting market

Pet Sitting Market Scope

The market is segmented on the basis of application and pet type.

- By Application

On the basis of application, the global pet sitting market is segmented into Day Care Visits, Dog Walking, Pet Transportation, and Others. The Day Care Visits segment held the largest market revenue share in 2025 driven by the growing preference for in-home pet care that ensures comfort, routine continuity, and reduced stress for pets. Day care visit services typically include feeding, playtime, medication administration, and companionship, making them a widely preferred option among working professionals and frequent travelers seeking reliable and personalized care.

The Dog Walking segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, busy lifestyles, and rising awareness of pet physical fitness and mental stimulation. Dog walking services are gaining popularity due to their flexibility, affordability, and suitability for daily care needs, particularly among apartment-dwelling pet owners who require regular outdoor activity support for their pets.

- By Pet Type

On the basis of pet type, the global pet sitting market is segmented into Dogs, Cats, Fish, Cage Pets, and Others. The Dogs segment accounted for the largest market share in 2025 owing to higher dog ownership rates and the greater need for regular supervision, exercise, and social interaction. Dog owners are more inclined to seek professional pet sitting services to meet daily care requirements, including walking, feeding, and behavioral monitoring.

The Cats segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising cat adoption and the increasing preference for in-home care that minimizes environmental changes. Cat owners often opt for pet sitting services to ensure feeding, litter maintenance, and companionship without relocating pets, supporting consistent demand across urban and suburban households.

Pet Sitting Market Regional Analysis

- North America dominated the pet sitting market with the largest revenue share in 2025, driven by high pet ownership rates, strong spending on pet care services, and the growing humanisation of pets

- Pet owners in the region place strong emphasis on convenience, reliability, and personalised in-home care, preferring professional pet sitting services over traditional boarding facilities

- This widespread adoption is further supported by busy lifestyles, frequent travel, and the strong presence of app-based platforms offering verified sitters, real-time updates, and flexible service options

U.S. Pet Sitting Market Insight

The U.S. pet sitting market captured the largest revenue share in 2025 within North America, fuelled by increasing pet ownership, high disposable incomes, and a strong culture of premium pet care. Pet owners are increasingly prioritising personalised, stress-free care solutions that allow pets to remain in familiar environments. The widespread adoption of digital platforms, combined with demand for background-verified sitters and mobile app integration, continues to support market expansion. In addition, the rising trend of pet humanisation and frequent domestic travel further strengthens demand for professional pet sitting services.

Europe Pet Sitting Market Insight

The Europe pet sitting market is expected to witness steady growth from 2026 to 2033, primarily driven by increasing awareness of pet well-being and changing lifestyles across urban populations. The growing number of single-person households and working professionals is supporting demand for reliable pet care services. European consumers are drawn to structured, regulated, and trust-based service models, encouraging the adoption of professional pet sitting platforms across residential settings.

U.K. Pet Sitting Market Insight

The U.K. pet sitting market is expected to witness notable growth from 2026 to 2033, driven by rising pet adoption and increasing preference for in-home pet care services. Concerns related to pet anxiety, safety, and routine disruption are encouraging owners to choose pet sitters over kennels. The country’s strong digital infrastructure and high usage of online booking platforms further contribute to market growth.

Germany Pet Sitting Market Insight

The Germany pet sitting market is expected to witness the fastest growth rate from 2026 to 2033, supported by a strong focus on animal welfare, structured pet care practices, and growing urbanisation. German pet owners show a preference for organised and trustworthy care solutions, driving demand for certified and trained pet sitters. The increasing participation of working professionals and frequent travel patterns also supports consistent market demand.

Asia-Pacific Pet Sitting Market Insight

The Asia-Pacific pet sitting market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising pet ownership, increasing disposable incomes, and rapid urbanisation in countries such as China, Japan, and India. Changing lifestyles and growing awareness of professional pet care services are encouraging adoption. In addition, the expansion of mobile-based service platforms and social media-driven awareness is improving market accessibility across the region.

Japan Pet Sitting Market Insight

The Japan pet sitting market is expected to witness steady growth from 2026 to 2033 due to high urban density, smaller living spaces, and an aging population. Pet owners increasingly seek convenient and reliable care solutions that minimise disruption to pets’ routines. The strong emphasis on hygiene, safety, and technology integration is driving demand for professional pet sitting services, particularly in urban residential areas.

China Pet Sitting Market Insight

The China pet sitting market accounted for a significant market share in Asia Pacific in 2025, attributed to rapid urbanisation, rising middle-class income levels, and increasing pet ownership. The growing popularity of companion animals and the expansion of digital service platforms are making pet sitting services more accessible. In addition, the rising number of young professionals and frequent travel patterns are driving demand for flexible and reliable pet care solutions across major cities.

Pet Sitting Market Share

The Pet Sitting industry is primarily led by well-established companies, including:

• A Place for Rover, Inc. (U.S.)

• DogVacay (U.S.)

• Holidog, Inc. (France)

• Care.com, Inc. (U.S.)

• Fetch! Pet Care (U.S.)

• Swifto Inc. (U.S.)

• Chicago Dog Walkers (U.S.)

• Best Friends Pet Care (U.S.)

• Camp Bow Wow (U.S.)

• PetSmart LLC (U.S.)

• Ancol Pet Products Limited (U.K.)

• Blue Buffalo Co., Ltd. (U.S.)

• Champion Petfoods (Canada)

• Colgate-Palmolive Company (U.S.)

• Heristo Aktiengesellschaft (Germany)

• Mars, Incorporated (U.S.)

• Nestlé (Switzerland)

• Doskocil Manufacturing Company, Inc. (U.S.)

• Petco Animal Supplies, Inc. (U.S.)

• PetSmart Inc. (U.S.)

Latest Developments in Global Pet Sitting Market

- In November 2023, Rover Group, Inc. entered into a definitive acquisition agreement with Blackstone, marking a strategic consolidation move aimed at strengthening financial stability and accelerating platform expansion. The all-cash deal valued at approximately USD 2.3 billion is expected to support long-term investments in technology, service quality, and global reach, reinforcing Rover’s leadership position in the pet sitting market

- •In September 2023, Wag! partnered with a pet health technology company to integrate health monitoring features into its mobile application. This development enhances user experience by offering real-time pet health insights, aligning with the growing focus on preventive pet care and supporting increased market penetration among health-conscious pet owners

- In August 2023, Rover announced the launch of a subscription-based service providing exclusive discounts and priority access to pet sitters. This initiative was intended to improve customer retention, generate recurring revenue, and differentiate Rover through value-added benefits, positively impacting competitive positioning in the pet care sector

- In July 2023, PetBacker expanded its service portfolio to include pet grooming and training services in Singapore. This diversification strategy aimed to address evolving consumer needs, position the company as a comprehensive pet care provider, and strengthen its competitive presence in the Southeast Asian pet services market

- In September 2022, PetSmart introduced a new range of pet furniture, including couches, beds, and stands, developed in collaboration with interior designers Nate Berkus and Jeremiah Brent. This product launch was designed to enhance pet comfort while appealing to pet owners’ home aesthetics, enabling PetSmart to expand its lifestyle-oriented offerings and strengthen customer engagement

- In May 2022, Kimpton Hotels & Restaurants partnered with Wag! to offer on-property and at-home pet walking and drop-in services for hotel guests across the U.S. This partnership aimed to enhance the pet-friendly hospitality experience, increase service accessibility, and drive cross-industry demand for professional pet care solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.