Market Analysis and Insights Global Pet Treats and Chews Market

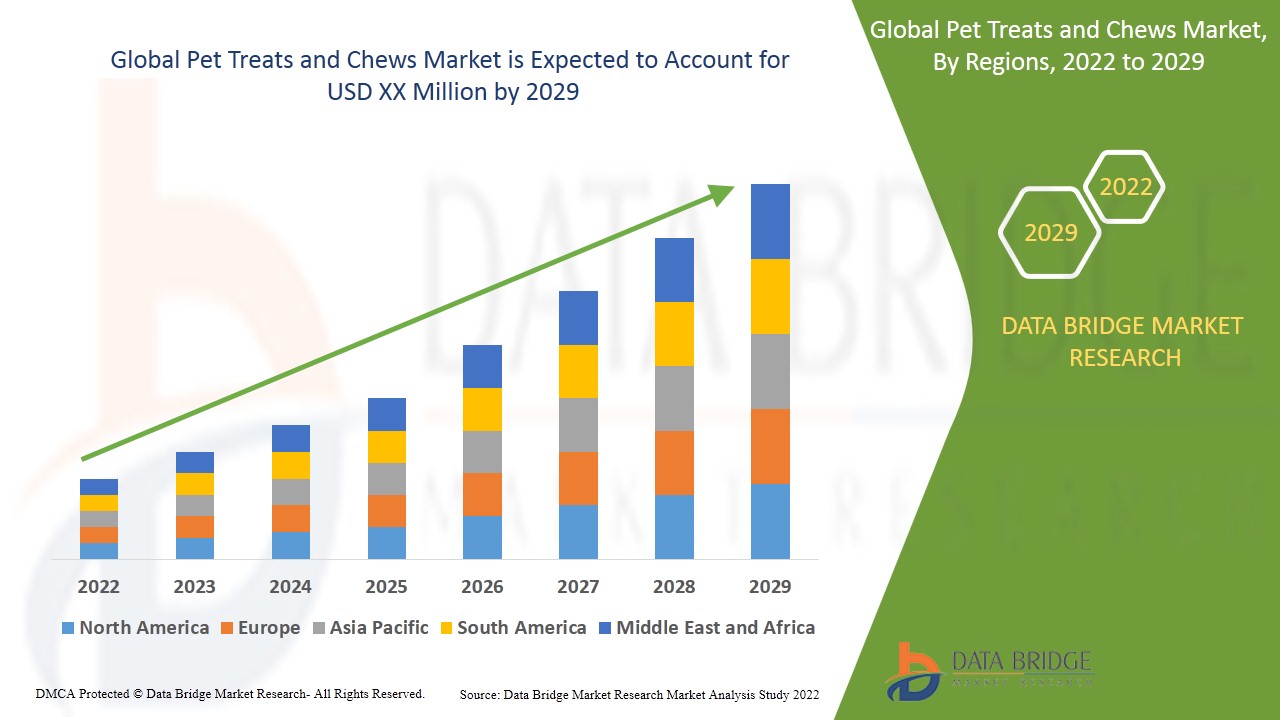

Data Bridge Market Research analyses that the global pet treats and chews market growing at a CAGR of 3.60% in the forecast period of 2022-2029. The rising number of pets and rising health-related concerns among pet owners are driving the growth of the pet treats and chews market from 2022 to 2029.

Pet food is food that has been specially formulated and is intended for consumption by pets. It can be plant-based or animal-based. Treat items are a type of pet food that is not designed to provide balanced and healthy nutrition, but rather to reward animals.

The growing demand for dental treats and chews will have an impact on the growth of the pet treats and chews market. The rising popularity of products with few and simple ingredients is also expected to boost market growth. Growing weight and age-related concerns among pet owners are also expected to drive market growth.

The increased availability of more innovative products in the market will also have an effect on the growth of the pet treats and chews market. Pet treats and chews that are widely available will also contribute to market growth. In the pet food industry, there is a growing emphasis on clean label. To meet customer demands, the clean label pet food trend has prompted innovation. Companies are investing more in research and development to create shelf-stable and safe pet food. The competition is gaining traction as there is a growing demand for highly palatable pet food made from a small number of ingredients in order to achieve the clean label goal.

However, the consumption of preservative-containing foods prevents the market for pet food ingredients from expanding. Furthermore, the increased demand for recent foods as opposed to organic pet foods and pre-packaged foods are different factors that are hinder the expansion of the pet food ingredients market within the forecast period. In the forecast period, non-uniformity in international trade will act as a market restraint for the growth of animal-based pet food ingredients.

This pet treats and chews market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on pet treats and chews market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Pet Treats and Chews Market Scope and Market Size

Pet treats and chews market is segmented of the basis of product type, application, pet and ingredient type. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product type, the pet treats and chews market is segmented into natural and organic treats, humanization, dental treats and chews and functional treats.

- Pet treats and chews market is also segmented on the basis of application into supermarkets, hypermarket, e- commerce and retailers.

- On the basis of pet, the pet treats and chews market is segmented into dogs, cats, birds, fish and others.

- On the basis of ingredient type, the pet treats and chews market is segmented into animal-derived, plant-derived, cereals and cereal derivatives, and other ingredient types.

Pet Treats and Chews Market Country Level Analysis

The pet treats and chews market is analyses and market size, volume information is provided by country, product type, application, and pet and ingredient type as referenced above.

The countries covered in the pet treats and chews market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa(MEA) as a part of Middle East and Africa(MEA).

North America is predicted to dominate the pet treats and chews market because of the increasing pet humanization and pet ownership, the emergence of private label store brands, and growing urbanization accompanied by increased disposable incomes. The market is influenced heavily by human nutrition, which drives research toward better and safer pet food with high nutritional and dietary benefits.

The country section of the pet treats and chews market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Pet Treats and Chews Market Share Analysis

The pet treats and chews market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to pet treats and chews market.

Some of the major operating in the pet treats and chews market are Big Heart Pet Brands, Inc., Allanasons Pvt Ltd, Eurocan Pet Products, The Dog Treat Company, Redbarn Pet Products LLC, MANELI PETS, PORTLAND PET FOOD COMPANY, Cadet Pet, Inc., Presidio Natural Pet Co, Zuke's - Natural Dog Treats, Evanger’s Dog & Cat Food Company, Inc., Mars Incorporated., Nutro Products Inc., The J.M. Smucker Company, Beaphar, Harringtons, PetGuard, SCHELL & KAMPETER, INC., Hill's Pet Nutrition and Lafeber Co. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PET TREATS AND CHEWS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PET TREATS AND CHEWS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PET TREATS AND CHEWS MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 VALUE CHAIN ANALYSIS

5.3 KEY INDUTRY TRENDS AND FUTUTE PRESPECTIVE

5.4 FACTORS INFLUENCING PURCHASING DECISION OF END USER

5.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.6 TECHNOLOGUCAL ADVANCEMENT IN PRODUCTION METHODS

5.7 NEW PRODUCT LAUNCHES OF REGULAR AND PLANT-BASED TREATS AND CHEWS PRODUCTS

6 REGULATORY FRAMEWORK AND GUIDELINES

7 IMPACT ANALYSIS OF COVID-19

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 PRICE IMPACT

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 GLOBAL PET TREATS AND CHEWS MARKET , BY TYPE

8.1 OVERVIEW

8.2 REGULAR/ANIMAL BASED TREATS AND CHEWS

8.3 PLANT-BASED TREATS AND CHEWS

9 GLOBAL PET TREATS AND CHEWS MARKET , BY PRODUCT TYPE

9.1 OVERVIEW

9.2 NATURAL AND ORGANIC TREATS AND CHEWS

9.3 DENTAL TREATS AND CHEWS

9.4 FUNCTIONAL TREATS AND CHEWS

9.5 OTHERS

10 GLOBAL PET TREATS AND CHEWS MARKET , BY FORM

10.1 OVERVIEW

10.2 DRY

10.3 MOIST/SEMI-MOIST

11 GLOBAL PET TREATS AND CHEWS MARKET, BY TIME OF CONSUMPTION

11.1 OVERVIEW

11.2 TRAINING

11.3 BONDING

11.4 OCCUPYING TIME

11.5 CLEANING TEETH

12 GLOBAL PET TREATS AND CHEWS MARKET , BY TYPE OF PETS

12.1 OVERVIEW

12.2 DOG

12.2.1 PUPPY

12.2.2 ADULT 1+ YEARS

12.2.3 MATURE 7+ YEARS

12.3 CAT

12.3.1 KITTEN

12.3.2 ADULT 1+ YEARS

12.3.3 MATURE 7+ YEARS

12.4 FISH

12.5 HAMSTER

12.6 MOUSE

12.7 PARROT

12.8 OTHERS

13 GLOBAL PET TREATS AND CHEWS MARKET , BY PACKAGING TYPE

13.1 OVERVIEW

13.2 CANS

13.3 POUCHES

13.4 PAPER BAGS

13.5 TRAYS

13.6 OTHERS

14 GLOBAL PET TREATS AND CHEWS MARKET, BY KEY INGREDIENTS

14.1 OVERVIEW

14.2 ANIMAL-BASED INGREDIENT

14.2.1 POULTRY

14.2.2 FISH

14.2.3 BEEF

14.2.4 OTHERS

14.3 PLANT-BASED INGREDIENT

14.3.1 LEAFY GREENS

14.3.2 LENTILS

14.3.3 RICE

14.3.4 SEEDS

14.3.5 BROCCOLI

14.3.6 CARROTS

14.3.7 QUINOA

14.3.8 OATS

14.3.9 BEANS

14.3.10 FRUITS

14.3.11 OTHERS

15 GLOBAL PET TREATS AND CHEWS MARKET , BY END-USER

15.1 OVERVIEW

15.2 HOUSEHOLD

15.3 ANIMAL HOSPITALS AND CLINICS

15.4 PET HOTELS AND RESORTS

15.5 PET DAY CARE CENTRES

15.6 OTHERS

16 GLOBAL PET TREATS AND CHEWS MARKET , BY PRICING

16.1 OVERVIEW

16.2 REGULAR

16.3 PREMIUM PRODUCTS

17 GLOBAL PET TREATS AND CHEWS MARKET , BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 STORE BASED RETAIL

17.2.1 SPECIALITY STORES

17.2.2 CONVENIENCE STORE

17.2.3 PET STORES

17.2.4 VETERINARY CLINICS

17.2.5 GROCERY STORES

17.2.6 SUPERMARKET/HYPERMARKET

17.2.7 OTHERS

17.3 ONLINE BASED RETAIL

18 GLOBAL PET TREATS AND CHEWS MARKET , COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: GLOBAL

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS & PARTNERSHIP

18.8 REGULATORY CHANGES

19 SWOT AND DBMR ANALYSIS, GLOBAL PET TREATS AND CHEWS MARKET

20 GLOBAL PET TREATS AND CHEWS MARKET , BY GEOGRAPHY

20.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

20.2 GLOBAL

20.2.1 U.S.

20.2.2 CANADA

20.2.3 MEXICO

20.3 EUROPE

20.3.1 GERMANY

20.3.2 U.K.

20.3.3 ITALY

20.3.4 FRANCE

20.3.5 SPAIN

20.3.6 SWITZERLAND

20.3.7 NETHERLANDS

20.3.8 BELGIUM

20.3.9 RUSSIA

20.3.10 TURKEY

20.3.11 REST OF EUROPE

20.4 ASIA-PACIFIC

20.4.1 JAPAN

20.4.2 CHINA

20.4.3 SOUTH KOREA

20.4.4 INDIA

20.4.5 AUSTRALIA

20.4.6 SINGAPORE

20.4.7 THAILAND

20.4.8 INDONESIA

20.4.9 MALAYSIA

20.4.10 PHILIPPINES

20.4.11 REST OF ASIA-PACIFIC

20.5 SOUTH AMERICA

20.5.1 BRAZIL

20.5.2 ARGENTINA

20.5.3 REST OF SOUTH AMERICA

20.6 MIDDLE EAST AND AFRICA

20.6.1 SOUTH AFRICA

20.6.2 UAE

20.6.3 SAUDI ARABIA

20.6.4 KUWAIT

20.6.5 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL PET TREATS AND CHEWS MARKET , SWOT & DBMR ANALYSIS

22 GLOBAL PET TREATS AND CHEWS MARKET , COMPANY PROFILE

22.1 THE J.M SMUCKER COMPANY

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHICAL PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 DOG TREAT FACTORY

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 GEOGRAPHICAL PRESENCE

22.2.5 RECENT DEVELOPMENTS

22.3 ALLANASONS PVT LTD

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 GEOGRAPHICAL PRESENCE

22.3.5 RECENT DEVELOPMENTS

22.4 MARS, INCORPORATED

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 GEOGRAPHICAL PRESENCE

22.4.5 RECENT DEVELOPMENTS

22.5 NESTLÉ PURINA PETCARE

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHICAL PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 HILL'S PET NUTRITION, INC.

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHICAL PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT DEVELOPMENTS

22.7 DIAMOND PET FOODS INC

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHICAL PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT DEVELOPMENTS

22.8 GENERAL MILLS

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHICAL PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT DEVELOPMENTS

22.9 WELLPET

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHICAL PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT DEVELOPMENTS

22.1 MERRICK PET CARE

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHICAL PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

22.11 CENTRAL GARDEN & PET COMPANY

22.11.1 COMPANY OVERVIEW

22.11.2 REVENUE ANALYSIS

22.11.3 GEOGRAPHICAL PRESENCE

22.11.4 PRODUCT PORTFOLIO

22.11.5 RECENT DEVELOPMENTS

22.12 SUNSHINE MILLS INC.

22.12.1 COMPANY OVERVIEW

22.12.2 REVENUE ANALYSIS

22.12.3 GEOGRAPHICAL PRESENCE

22.12.4 PRODUCT PORTFOLIO

22.12.5 RECENT DEVELOPMENTS

22.13 ALPHIA

22.13.1 COMPANY OVERVIEW

22.13.2 REVENUE ANALYSIS

22.13.3 GEOGRAPHICAL PRESENCE

22.13.4 PRODUCT PORTFOLIO

22.13.5 RECENT DEVELOPMENTS

22.14 NUTRISOURCE PET FOODS

22.14.1 COMPANY OVERVIEW

22.14.2 REVENUE ANALYSIS

22.14.3 GEOGRAPHICAL PRESENCE

22.14.4 PRODUCT PORTFOLIO

22.14.5 RECENT DEVELOPMENTS

22.15 INSTINCT PETFOOD

22.15.1 COMPANY OVERVIEW

22.15.2 REVENUE ANALYSIS

22.15.3 GEOGRAPHICAL PRESENCE

22.15.4 PRODUCT PORTFOLIO

22.15.5 RECENT DEVELOPMENTS

22.16 BENEVO

22.16.1 COMPANY OVERVIEW

22.16.2 REVENUE ANALYSIS

22.16.3 GEOGRAPHICAL PRESENCE

22.16.4 PRODUCT PORTFOLIO

22.16.5 RECENT DEVELOPMENTS

22.17 AMÌ PET

22.17.1 COMPANY OVERVIEW

22.17.2 REVENUE ANALYSIS

22.17.3 GEOGRAPHICAL PRESENCE

22.17.4 PRODUCT PORTFOLIO

22.17.5 RECENT DEVELOPMENTS

22.18 BENYFIT NATURAL PET

22.18.1 COMPANY OVERVIEW

22.18.2 REVENUE ANALYSIS

22.18.3 GEOGRAPHICAL PRESENCE

22.18.4 PRODUCT PORTFOLIO

22.18.5 RECENT DEVELOPMENTS

22.19 AKELA PET S LTD.

22.19.1 COMPANY OVERVIEW

22.19.2 REVENUE ANALYSIS

22.19.3 GEOGRAPHICAL PRESENCE

22.19.4 PRODUCT PORTFOLIO

22.19.5 RECENT DEVELOPMENTS

22.2 NESTLÉ SA

22.20.1 COMPANY OVERVIEW

22.20.2 REVENUE ANALYSIS

22.20.3 GEOGRAPHICAL PRESENCE

22.20.4 PRODUCT PORTFOLIO

22.20.5 RECENT DEVELOPMENTS

22.21 BEAPHAR UK LTD.

22.21.1 COMPANY OVERVIEW

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 GEOGRAPHICAL PRESENCE

22.21.5 RECENT DEVELOPMENTS

22.22 ARDEN GRANGE

22.22.1 COMPANY OVERVIEW

22.22.2 REVENUE ANALYSIS

22.22.3 GEOGRAPHICAL PRESENCE

22.22.4 PRODUCT PORTFOLIO

22.22.5 RECENT DEVELOPMENTS

22.23 PETS CHOICE LTD

22.23.1 COMPANY OVERVIEW

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 GEOGRAPHICAL PRESENCE

22.23.5 RECENT DEVELOPMENTS

22.24 THE DOG TREAT COMPANY

22.24.1 COMPANY OVERVIEW

22.24.2 REVENUE ANALYSIS

22.24.3 PRODUCT PORTFOLIO

22.24.4 GEOGRAPHICAL PRESENCE

22.24.5 RECENT DEVELOPMENTS

22.25 MARS INCORPORATED

22.25.1 COMPANY OVERVIEW

22.25.2 REVENUE ANALYSIS

22.25.3 PRODUCT PORTFOLIO

22.25.4 GEOGRAPHICAL PRESENCE

22.25.5 RECENT DEVELOPMENTS

22.26 JACK DOGGIES B.V.

22.26.1 COMPANY OVERVIEW

22.26.2 REVENUE ANALYSIS

22.26.3 PRODUCT PORTFOLIO

22.26.4 GEOGRAPHICAL PRESENCE

22.26.5 RECENT DEVELOPMENTS

22.27 SCRUMBLES

22.27.1 COMPANY OVERVIEW

22.27.2 REVENUE ANALYSIS

22.27.3 PRODUCT PORTFOLIO

22.27.4 GEOGRAPHICAL PRESENCE

22.27.5 RECENT DEVELOPMENTS

22.28 NATURAL DOG COMPANY

22.28.1 COMPANY OVERVIEW

22.28.2 REVENUE ANALYSIS

22.28.3 PRODUCT PORTFOLIO

22.28.4 GEOGRAPHICAL PRESENCE

22.28.5 RECENT DEVELOPMENTS

22.29 BERN PET

22.29.1 COMPANY OVERVIEW

22.29.2 REVENUE ANALYSIS

22.29.3 PRODUCT PORTFOLIO

22.29.4 GEOGRAPHICAL PRESENCE

22.29.5 RECENT DEVELOPMENTS

22.3 ANTOS B.V.

22.30.1 COMPANY OVERVIEW

22.30.2 REVENUE ANALYSIS

22.30.3 PRODUCT PORTFOLIO

22.30.4 GEOGRAPHICAL PRESENCE

22.30.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 CONCLUSION

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Global Pet Treats And Chews Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pet Treats And Chews Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pet Treats And Chews Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.