Global Pets Vitamins And Supplements Market

Market Size in USD Billion

CAGR :

%

USD

3.67 Billion

USD

7.48 Billion

2024

2032

USD

3.67 Billion

USD

7.48 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 7.48 Billion | |

|

|

|

|

Pets Vitamins and Supplements Market Size

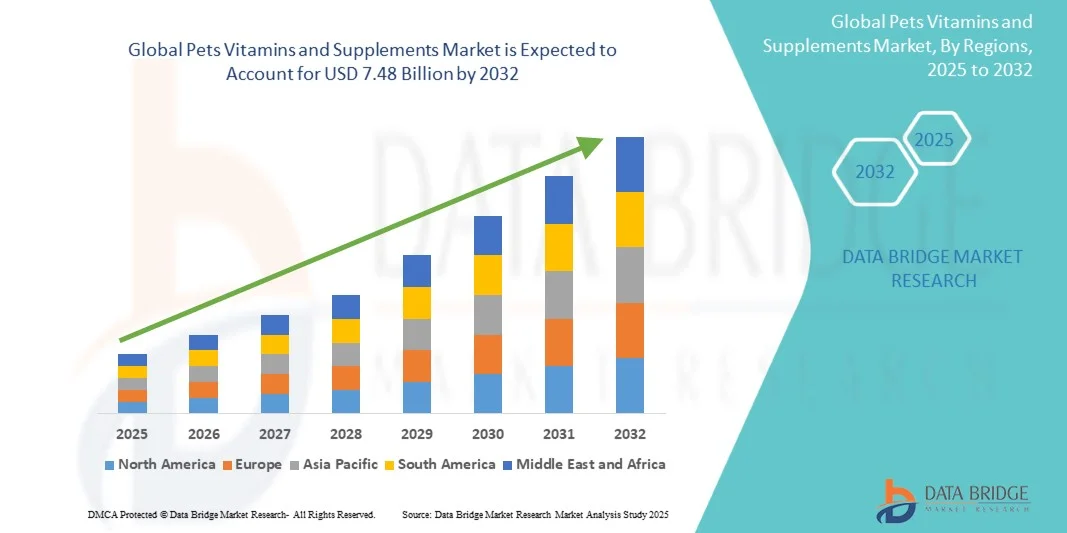

- The global pets vitamins and supplements market size was valued at USD 3.67 billion in 2024 and is expected to reach USD 7.48 billion by 2032, at a CAGR of 9.29% during the forecast period

- The market growth is primarily driven by increasing awareness of pet health and wellness, alongside rising pet ownership and spending on preventive healthcare for pets

- Moreover, the demand for natural, organic, and functional supplements that support immunity, digestion, and overall vitality is shaping consumer preferences, making vitamins and supplements an essential part of pet care routines. These trends are accelerating market adoption, thereby substantially propelling industry growth

Pets Vitamins and Supplements Market Analysis

- Pets vitamins and supplements, including vitamins and functional supplements, are increasingly integral to preventive pet healthcare in dogs, cats, horses, rabbits, and other companion animals, driven by rising awareness of pet wellness and nutrition

- The market growth is primarily fueled by increasing pet ownership, consumer focus on pet health, and preference for natural, fortified, and functional formulations that support immunity, digestion, and overall vitality

- North America dominated the pets vitamins and supplements market with the largest revenue share of 39.5% in 2024, supported by high pet ownership rates, advanced retail infrastructure, and strong adoption of premium and specialized pet supplements, with the U.S. leading in e-commerce sales and innovative product launches across vitamins and probiotics

- Asia-Pacific is expected to be the fastest-growing region in the pets vitamins and supplements market during the forecast period due to rising urbanization, increasing disposable incomes, and growing awareness of preventive pet care

- Probiotics segment dominated the pets vitamins and supplements market with a market share of 42% in 2024, driven by their widespread adoption for improving gut health, immunity, and overall wellness among pets

Report Scope and Pets Vitamins and Supplements Market Segmentation

|

Attributes |

Pets Vitamins and Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pets Vitamins and Supplements Market Trends

“Growing Focus on Functional and Natural Ingredients”

- A significant and accelerating trend in the global pets vitamins and supplements market is the rising consumer preference for functional, natural, and organic ingredients that support immunity, digestion, and overall pet wellness

- For instance, Nutramax Laboratories offers supplements enriched with glucosamine and chondroitin for joint health, appealing to health-conscious pet owners seeking preventive care solutions

- Pet supplements are increasingly being formulated with plant-based, probiotic, and antioxidant-rich ingredients to cater to the growing demand for clean-label and health-promoting products

- Functional supplements are often combined with vitamins such as Vitamin C, Vitamin E, and minerals to provide comprehensive support for pets’ daily nutritional needs

- This trend towards natural, multi-benefit, and scientifically formulated supplements is shaping consumer expectations for preventive pet healthcare

- The demand for high-quality, functional supplements is growing rapidly across both companion animal segments and specialty pets, as owners increasingly prioritize health, longevity, and vitality

Pets Vitamins and Supplements Market Dynamics

Driver

“Rising Pet Ownership and Health Awareness”

- The increasing number of pet owners and heightened awareness of pet health and nutrition are significant drivers for the growing demand for vitamins and supplements

- For instance, Banfield Pet Hospital reported rising spending on preventive pet care, highlighting the willingness of owners to invest in supplements for overall pet wellness

- Consumers are seeking products that offer immunity support, digestive health, and joint care, driving innovation and new product launches in the market

- The growth of premium and specialized pet foods and supplements is encouraging adoption of vitamins, minerals, and probiotics across dogs, cats, and other companion animals

- The rising trend of treating pets as family members and prioritizing preventive healthcare is making vitamins and supplements an essential part of routine pet care

- Easy availability of supplements through veterinary clinics, pet pharmacies, and online platforms further supports market expansion in multiple regions

Restraint/Challenge

“Regulatory Compliance and Product Safety Concerns”

- Regulatory restrictions, quality control issues, and safety concerns pose significant challenges to the pets vitamins and supplements market

- For instance, reports of contamination or mislabeled ingredients have made some pet owners cautious about supplement usage, limiting adoption in certain regions

- Ensuring compliance with FDA, EFSA, and other regional regulations for pet supplements is essential to maintain product safety and consumer trust

- Variability in ingredient standards, dosing recommendations, and labeling requirements across countries complicates manufacturing and distribution for global players

- In addition, the relatively high cost of premium functional supplements can be a barrier for budget-conscious pet owners, slowing market penetration in developing regions

- Overcoming these challenges through rigorous testing, transparent labeling, and regulatory adherence will be crucial for sustained market growth and consumer confidence

Pets Vitamins and Supplements Market Scope

The market is segmented on the basis of pets, vitamins, supplements, end-users, and distribution channels.

- By Pets

On the basis of pets, the pets vitamins and supplements market is segmented into cats, dogs, horses, rabbits, and others. The dog segment dominated the market with the largest revenue share in 2024, driven by the high global dog population and increasing awareness among dog owners regarding preventive healthcare. Dogs are often given supplements for joint health, immunity, digestion, and coat care, making them the primary target for product innovation. Strong marketing campaigns, wide availability across veterinary clinics, and e-commerce platforms further boost adoption. Diverse product formats such as chews, powders, and liquids provide convenience to pet owners. Increasing pet humanization trends strengthen demand for premium dog supplements. Veterinary endorsements and clinical backing also contribute to sustained growth in this segment.

The cat segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising cat ownership, increasing awareness of feline-specific health needs, and the development of tailored vitamins and supplements for digestive health, hairball control, and immune support. Innovative product launches targeting cats, combined with convenient delivery formats such as treats and soft chews, are further boosting adoption. The growing trend of treating cats as family members encourages owners to invest in high-quality supplements. E-commerce availability and subscription models enhance accessibility. Veterinary guidance and education campaigns are driving faster acceptance of cat-focused supplements. Overall, rising consumer interest and urban pet ownership trends support rapid market expansion.

- By Vitamins

On the basis of vitamins, the pets vitamins and supplements market is segmented into Vitamin A, Vitamin B, Vitamin C, Vitamin E, Vitamin K, Choline, and others. The Vitamin E segment dominated the market in 2024, owing to its widespread use in promoting skin, coat, and immune health among pets. Vitamin E is often incorporated into multi-vitamin supplements and functional formulations addressing age-related health concerns. Its antioxidant properties are highly valued among pet owners seeking preventive healthcare solutions. Compatibility with other vitamins and minerals allows manufacturers to create comprehensive blends, enhancing market appeal. Veterinary recommendations and growing consumer awareness about antioxidants drive adoption. Its widespread use across dogs and cats makes it a staple ingredient in premium pet supplements.

The Vitamin C segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of immunity support and preventive health in pets. Vitamin C is frequently combined with probiotics, minerals, and other vitamins to provide holistic health benefits. Convenient delivery formats such as chewables, powders, and fortified treats enhance acceptance among pet owners. Rising focus on preventive care for aging pets drives repeated purchases. Innovative product launches targeting cats and dogs further accelerate growth. Educational campaigns and social media influence boost consumer awareness of Vitamin C benefits for pets.

- By Supplement

On the basis of supplements, the pets vitamins and supplements market is segmented into minerals, antioxidants, probiotics, prebiotics, and others. The probiotics segment dominated the market in 2024 with a market share of 42% due to its critical role in supporting gut health, immunity, and overall wellness in dogs, cats, and other pets. Probiotics are widely recommended by veterinarians and integrated into daily pet nutrition routines. Growing consumer awareness about digestive health and preventive supplementation fuels demand. Probiotics are often combined with vitamins and minerals in multi-benefit formulations. Strong distribution through veterinary clinics and e-commerce supports adoption. Rising trends in natural and functional pet care further strengthen the segment’s market position.

The prebiotics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing interest in complementary digestive health solutions. Prebiotics promote the growth of beneficial gut bacteria and are increasingly incorporated into premium and specialty pet supplements. Awareness about the gut–immune health connection supports adoption among pet owners. Innovative formats such as fortified treats and powders improve convenience and compliance. Veterinary guidance and preventive healthcare campaigns further accelerate growth. Expanding pet populations in urban areas create a strong consumer base for prebiotic products.

- By End-Users

On the basis of end-users, the pets vitamins and supplements market is segmented into veterinary hospitals and others. The veterinary hospitals segment dominated the market in 2024, owing to the strong influence of veterinarians in recommending vitamins and supplements for preventive and therapeutic pet care. Veterinary hospitals stock specialized products including joint, digestive, and immunity-focused supplements. Professional guidance and clinical credibility drive higher adoption rates. Integration with wellness programs encourages routine supplementation. Repeat purchases through veterinary channels are common due to trusted advice. Marketing collaborations between manufacturers and veterinary networks further boost sales.

The “others” segment, including pet specialty stores and home users, is expected to witness the fastest growth from 2025 to 2032 due to rising e-commerce adoption and direct-to-consumer sales. Convenience and accessibility are key drivers for this channel. Awareness campaigns targeting pet owners educate about preventive care. Subscription models for supplements further enhance adoption. Product variety and pricing flexibility attract new customers. Urbanization and increased disposable incomes support rapid market expansion.

- By Distribution Channel

On the basis of distribution channel, the pets vitamins and supplements market is segmented into direct tender, veterinary pharmacy, online pharmacy, and others. The veterinary pharmacy segment dominated the market in 2024, as pet owners often rely on professional guidance for purchasing vitamins and supplements. Veterinary pharmacies provide product authenticity, professional advice, and access to specialized formulations. Frequent veterinary visits and follow-up care drive repeat purchases. Partnerships between manufacturers and veterinary clinics ensure product availability. Both prescription-based and over-the-counter supplements are offered. Professional endorsement enhances consumer trust and adoption.

The online pharmacy segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by e-commerce convenience, doorstep delivery, and subscription-based models. Digital marketing and online education about preventive care are accelerating adoption. Consumers can compare products, read reviews, and access niche formulations. Increased smartphone penetration supports online sales. Innovative delivery formats and packaging improve customer experience. Urban and tech-savvy pet owners drive rapid growth in this channel.

Pets Vitamins and Supplements Market Regional Analysis

- North America dominated the pets vitamins and supplements market with the largest revenue share of 39.5% in 2024, supported by high pet ownership rates, advanced retail infrastructure, and strong adoption of premium and specialized pet supplements, with the U.S. leading in e-commerce sales and innovative product launches across vitamins and probiotics

- Pet owners in the region highly value the role of supplements in supporting immunity, digestion, joint health, and overall vitality, with strong demand for natural and functional formulations tailored to different breeds and life stages

- This widespread adoption is further supported by advanced veterinary healthcare infrastructure, high disposable incomes, and the rapid expansion of online and retail distribution channels, establishing North America as the leading hub for both innovative product launches and consistent consumer demand in the global market

U.S. Pets Vitamins and Supplements Market Insight

The U.S. pets vitamins and supplements market captured the largest revenue share of 82% in 2024 within North America, fueled by the country’s high pet ownership rates and the strong trend of treating pets as family members. Consumers are increasingly prioritizing preventive healthcare through vitamins, minerals, probiotics, and functional supplements. The growing popularity of premium and natural formulations, combined with the widespread availability of products through veterinary pharmacies and e-commerce platforms, further propels market growth. Moreover, the rising influence of digital marketing and pet-focused subscription services is significantly contributing to the expansion of the U.S. market.

Europe Pets Vitamins and Supplements Market Insight

The Europe pets vitamins and supplements market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising consumer awareness of preventive pet healthcare and strict regulations ensuring product quality. The increase in urban pet ownership, coupled with the demand for functional and natural supplements, is fostering adoption across the region. European consumers are particularly drawn to clean-label, organic, and scientifically formulated products. The market is experiencing notable growth across veterinary hospitals, online pharmacies, and specialty stores, with supplements being incorporated into both preventive and therapeutic care routines.

U.K. Pets Vitamins and Supplements Market Insight

The U.K. pets vitamins and supplements market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising adoption of pets and the growing culture of premium pet care. Increasing concerns about pet health, nutrition, and longevity are encouraging owners to choose specialized supplements. The U.K.’s robust retail and e-commerce infrastructure, combined with veterinary recommendations, continues to stimulate growth. A strong focus on organic, sustainable, and functional formulations is also shaping market preferences among health-conscious pet owners.

Germany Pets Vitamins and Supplements Market Insight

The Germany pets vitamins and supplements market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of pet nutrition, sustainability, and preventive care. German consumers show a strong preference for scientifically validated, eco-friendly, and high-quality products. The country’s advanced veterinary infrastructure and emphasis on innovation promote the adoption of supplements for joint, digestive, and immunity health. Increasing demand for premium and organic pet supplements, combined with strong distribution networks, supports rapid market development across residential and veterinary end-users.

Asia-Pacific Pets Vitamins and Supplements Market Insight

The Asia-Pacific pets vitamins and supplements market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing pet ownership, rising disposable incomes, and growing awareness of pet wellness in countries such as China, Japan, and India. The region’s rapid urbanization, supported by government initiatives promoting pet care and digitalization of retail, is driving adoption. Furthermore, as APAC emerges as a cost-effective manufacturing hub for supplements, affordability and accessibility are improving, widening the consumer base for both mass-market and premium products.

Japan Pets Vitamins and Supplements Market Insight

The Japan pets vitamins and supplements market is gaining momentum due to the country’s pet-friendly culture, rapid urbanization, and growing focus on preventive care. Japanese consumers place strong emphasis on functional, scientifically backed products, particularly those targeting immunity, skin, and joint health. The integration of vitamins and supplements with other pet wellness products is fueling growth. Moreover, Japan’s aging population, combined with a growing preference for smaller pets such as cats, is such asly to spur demand for easy-to-use, high-quality supplements across both residential and veterinary channels.

India Pets Vitamins and Supplements Market Insight

The India pets vitamins and supplements market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rising disposable incomes, and high rates of pet adoption. India stands as one of the fastest-growing markets for pet care products, with supplements gaining popularity in both urban and semi-urban regions. The push towards preventive healthcare, supported by increasing veterinary recommendations and strong domestic manufacturing, is fueling demand. The availability of affordable vitamins, probiotics, and mineral supplements, alongside rapid e-commerce growth, continues to propel the market in India.

Pets Vitamins and Supplements Market Share

The Pets Vitamins and Supplements industry is primarily led by well-established companies, including:

- Nutramax Laboratories, Inc. (U.S.)

- Elanco (U.S.)

- Zoetis Services LLC (U.S.)

- Nestlé Purina PetCare (U.S.)

- Mars, Incorporated (U.S.)

- VetriScience Laboratories (U.S.)

- Zesty Paws (U.S.)

- VetriScience. (U.S.)

- Tomlyn (U.S.)

- Virbac (France)

- Royal Canin SAS. (France)

- Hill's Pet Nutrition, Inc. (U.S.)

- Vetoquinol (France)

- PetAg (U.S.)

- NaturVet (U.S.)

- Ark Naturals (U.S.)

- Nordic Naturals (U.S.)

- PetHonesty (U.S.)

- Kemin Industries (U.S.)

- Platinum Performance (U.S.)

What are the Recent Developments in Pets Vitamins and Supplements Market?

- In June 2025, Ultimate Pet Nutrition expanded the availability of its flagship supplement brands Nutra Complete and Nutra Thrive by partnering with Pet Supplies Plus stores across the U.S. Previously sold mainly online, these formulations focus on holistic wellness through balanced nutrition and targeted supplementation

- In May 2025, Royal Canin launched a new range of soft chew supplements and probiotic powders targeting specific health areas such as joint mobility, digestion, skin & coat, and immune function. The company also introduced National Pet Wellness Day on May 8, to raise awareness of proactive pet health management and the role of supplements. This dual initiative highlights Royal Canin’s focus on education alongside innovation, emphasizing the importance of preventive care in pets

- In February 2025, Elanco Animal Health announced the launch of Pet Protect, a comprehensive line of veterinarian-formulated supplements for dogs and cats. The product portfolio includes joint support, multivitamins, Omega-3, digestive health, calming, and immune system supplements, designed to target key wellness areas in companion animals

- In December 2023, EverRoot, powered by Purina, is teaming up with world-class athlete, fitness and wellness advocate, and LailaAliLifestyle.com Brand CEO, Laila Ali, to introduce a new form to its trusted line of dog supplements, EverRoot Dog Supplements Soft Chews. Available across a variety of key health benefit areas, the new soft chew option is designed to help pet parents further personalize their dog's supplement plan to meet their unique needs and preferences

- In September 2022, Opal Pets, a U.S.-based vegan pet nutrition provider, launched Perfect Powder, a plant-based supplement designed to provide essential vitamins, minerals, and amino acids for pets. Targeted at owners seeking sustainable and cruelty-free solutions, the product supports overall health while aligning with vegan dietary practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.