Global Pharma E Commerce Market

Market Size in USD Billion

CAGR :

%

USD

14.70 Billion

USD

74.57 Billion

2024

2032

USD

14.70 Billion

USD

74.57 Billion

2024

2032

| 2025 –2032 | |

| USD 14.70 Billion | |

| USD 74.57 Billion | |

|

|

|

|

Pharma E-Commerce Market Size

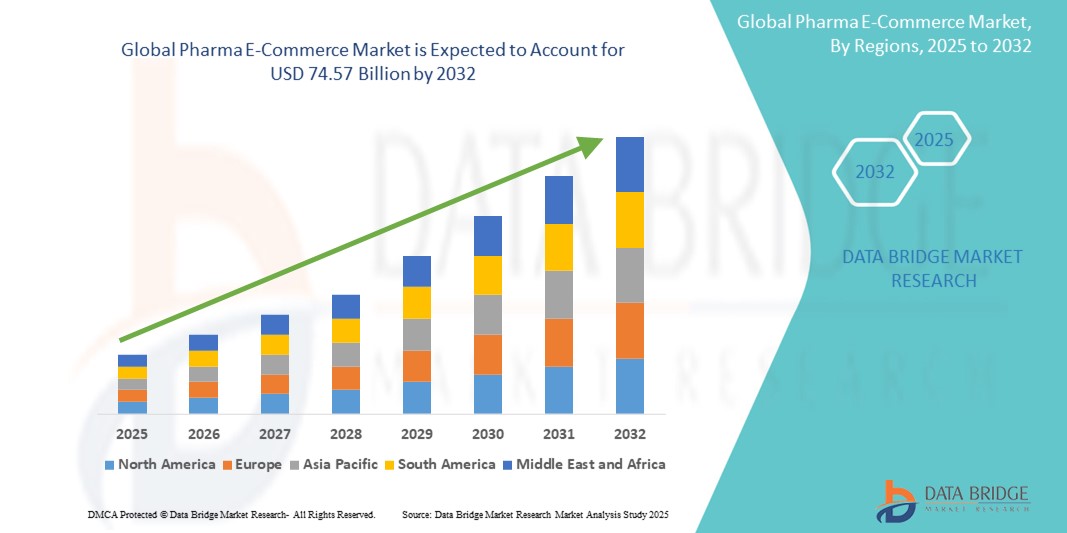

- The global Pharma E-Commerce market was valued at USD 14.70 billion in 2024 and is expected to reach USD 74.57 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 22.50%, primarily driven by the increasing adoption of online pharmaceutical platforms for the Global Pharma E-Commerce Market

- This growth is driven by factors such as the rising consumer preference for online shopping, the increasing penetration of internet access in emerging economies, and the growing demand for home delivery of medicines

Pharma E-Commerce Market Analysis

- There is a noticeable shift towards online pharmacies, with consumers seeking the convenience of home delivery and the ability to compare prices and products easily

- E-commerce platforms are integrating technologies such as artificial intelligence and data analytics to offer personalized recommendations and improve customer experiences

- Despite growth, the market faces challenges related to counterfeit drugs and regulatory compliance, necessitating stringent measures to ensure consumer safety

- For instance, Amazon has ventured into the pharmaceutical e-commerce space, offering prescription medications and health products, thereby expanding its healthcare portfolio

- The pharmaceutical e-commerce market is rapidly evolving, with technological advancements and shifting consumer preferences playing pivotal roles in its expansion

Report Scope and Pharma E-Commerce Market Segmentation

|

Attributes |

Pharma E-Commerce Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pharma E-Commerce Market Trends

“Integration of Telemedicine with Pharmaceutical E-Commerce”

- Pharmaceutical e-commerce platforms are increasingly integrating telemedicine services to offer a comprehensive healthcare experience. This integration allows patients to consult with healthcare providers remotely and receive prescriptions that can be directly fulfilled by online pharmacies

- For instance, Pfizer plans to launch an online direct-to-consumer platform that connects U.S. customers with independent telehealth consultants and drug-dispensing partners, aiming to streamline access to medications such as Paxlovid and Zazpret

- Consumers are seeking more convenient options to engage with their healthcare, driving the demand for platforms that combine telemedicine with pharmaceutical services

- For Instance, Amazon Pharmacy is experiencing rapid growth, partly due to the high demand for anti-obesity drugs, and is exploring advancements such as same-day delivery and potential drone deliveries to enhance customer convenience

- Advancements in technology, such as artificial intelligence and data analytics, are enabling e-commerce platforms to offer personalized healthcare services. These technologies assist in prescribing medications based on individual health profiles and previous purchases, improving the overall patient experience

- Strategic collaborations between pharmaceutical companies and e-commerce platforms are facilitating the integration of telemedicine services. These partnerships aim to provide a seamless healthcare experience by combining medical consultations with convenient access to medications, thereby expanding the reach and effectiveness of healthcare services

Pharma E-Commerce Market Dynamics

Driver

“Increasing Adoption of Online Pharmacies”

- The global trend toward e-commerce has significantly influenced the pharmaceutical sector, with more consumers opting for online pharmacies due to the convenience of home delivery and the ability to compare prices easily

- Pharmaceutical e-commerce platforms are increasingly integrating telemedicine services, allowing patients to consult with healthcare providers remotely and receive prescriptions that can be directly fulfilled by online pharmacies

- The adoption of artificial intelligence and data analytics enables online pharmacies to offer personalized recommendations and improve customer service, enhancing the overall user experience

- Regulatory reforms in various regions are streamlining online prescription processes and ensuring better oversight of digital pharmacies, fostering a conducive environment for the growth of pharmaceutical e-commerce

- The increasing penetration of smartphones and internet access in emerging markets presents significant growth opportunities for online pharmacies to expand their reach and customer base

Opportunity

“Expansion in Emerging Markets”

- The increasing internet penetration in emerging markets provides a vast customer base for online pharmacies to tap into, facilitating market expansion

- Governments in emerging markets are implementing initiatives to promote digital health solutions, creating a favorable environment for the growth of pharmaceutical e-commerce

- Collaborations between online pharmacies and local healthcare providers can enhance service delivery and expand reach across diverse regions in emerging markets

- Tailoring services to meet the specific needs and preferences of consumers in emerging markets can drive customer adoption and loyalty

- Online pharmacies can offer cost-effective solutions for accessing medications, addressing the affordability concerns prevalent in emerging markets

Restraint/Challenge

“Counterfeit Drugs”

- Navigating the complex and varied regulatory requirements across different regions poses significant challenges for online pharmacies seeking to expand globally

- The prevalence of counterfeit medications in the pharmaceutical e-commerce market raises concerns about patient safety and undermines consumer trust

- Ensuring the security of sensitive patient information and complying with data protection regulations are critical challenges for online pharmacies

- Implementing stringent verification processes to confirm the legitimacy of online pharmacies can slow down market expansion and increase operational costs

- Concerns over the authenticity of medications and the reliability of online pharmacies can deter consumers from adopting e-pharmacy services, limiting market growth

Pharma E-Commerce Market Scope

The market is segmented on the basis product and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By End User |

|

Pharma E-Commerce Market Regional Analysis

“North America is the Dominant Region in the Pharma E-Commerce Market”

- U.S. is a key driver, with a large population increasingly turning to online pharmacies for both prescription and over-the-counter medications

- The region benefits from advanced healthcare infrastructure, high internet penetration, and favorable regulatory policies

- The implementation of stringent data privacy regulations, such as HIPAA, has promoted trust in e-commerce platforms, ensuring consumer confidence in purchasing medications online

- The high demand for wellness products, nutraceuticals, and convenience in healthcare services supports sustained growth in this region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Countries such as China, India, and Japan are at the forefront of this expansion, supported by robust infrastructure and government initiatives promoting digital health

- The region's large population, combined with its rising demand for medications, wellness products, and online healthcare services, presents substantial growth opportunities

- Emerging markets, where physical pharmacy access is limited, offer untapped potential for e-commerce platforms

- Regulatory bodies in the region are gradually improving their stance on online pharmaceutical sales, fostering a safer and more structured environment for e-commerce companies

Pharma E-Commerce Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Boehringer Ingelheim International GmbH (Germany)

- AbbVie Inc (U.S.)

- Aurobindo Pharma (India)

- Pfizer Inc. (U.S.)

- Walmart Inc. (U.S.)

- Walgreen Co. (U.S.)

- Express Scripts (U.S.)

- The Kroger Co. (U.S.)

- L Rowland & Co (U.K.)

- DocMorris (Switzerland )

- Giant Eagle, Inc. (U.S.)

- OptumRx, Inc. (U.S.)

- CVS Health (U.S.)

- Merck & Co., Inc. (U.S.)

- Thermo Fisher Scientific (U.S.)

Latest Developments in Global Pharma E-Commerce Market

- In October 2024, Amazon Pharmacy launched same-day prescription delivery in Los Angeles and New York City, with plans to expand to 12 additional cities by the end of 2024. This service utilizes artificial intelligence and machine learning to expedite prescription fulfillment, enhancing customer convenience

- In March 2024, Eli Lilly partnered with Amazon Pharmacy to deliver the weight loss drug Zepbound and other medicines from its direct-to-consumer website

- In January 2024, Eli Lilly and Company launched LillyDirect for people living with obesity, migraine, and diabetes in the U.S. This platform provides disease management resources and direct home delivery of select Lilly medicines for people in the U.S.

- In December 2024, Canadian FinTech company Nuvei Corporation partnered with Familiprix to launch an e-commerce program allowing associated pharmacists to accept online payments. This initiative aims to improve payment acceptance rates and streamline the checkout process for online shoppers, enabling over 400 independent pharmacies in Quebec and New Brunswick to enter the online marketplace

- In March 2023, Roman Pharma Company declared its intention to launch a direct-to-consumer (D2C) online store as an avenue for sales growth. The platform offers a wide range of nutraceutical items, such as vitamins, minerals, herbal supplements, and other nutritional supplements, providing consumers with a practical means of obtaining premium products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PHARMA E-COMMERCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PHARMA E-COMMERCE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PHARMA E-COMMERCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

5.3 E-COMMERCE STRATEGIES BY PHARMACEUTICAL MANUFACTURERS

5.3.1 US

5.3.1.1. GSK

5.3.1.2. NOVARTIS

5.3.1.3. MERCK

5.3.1.4. PFIZER

5.3.1.5. ASTRAZENECA

5.3.1.6. BMS

5.3.1.7. ABBVIE

5.3.1.8. AMGEN

5.3.1.9. ROCHE

5.3.1.10. NOVONORDISK

5.3.1.11. LILLY

5.3.1.12. VIATRIS

5.3.1.13. ORGANON

5.3.1.14. OTHERS

5.3.2 REST OF THE WORLD

5.3.2.1. GSK

5.3.2.2. NOVARTIS

5.3.2.3. MERCK

5.3.2.4. PFIZER

5.3.2.5. ASTRAZENECA

5.3.2.6. BMS

5.3.2.7. ABBVIE

5.3.2.8. AMGEN

5.3.2.9. ROCHE

5.3.2.10. NOVONORDISK

5.3.2.11. LILLY

5.3.2.12. VIATRIS

5.3.2.13. ORGANON

5.3.2.14. OTHERS

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYSIS AND RECOMMENDATIONS

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNOLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL PHARMA E-COMMERCE MARKET, BY PRODUCT

17.1 OVERVIEW

17.2 PRESCRIPTION PHARMACEUTICALS

17.2.1 ANALGESICS

17.2.1.1. PARACETAMOL

17.2.1.2. FENTANYL

17.2.1.3. TRAMADOL

17.2.1.4. ACETAMINOPHEN

17.2.1.5. OTHERS

17.2.2 IMMUNOSUPPRESSIVES

17.2.2.1. AZATHIOPRINE

17.2.2.2. CICLOSPORIN

17.2.2.3. MYCOPHENOLATE MOFETIL

17.2.2.4. OTHERS

17.2.3 ANTIDEPRESSANT

17.2.3.1. RISPERIDONE

17.2.3.2. OLANZAPINE

17.2.3.3. TRIFLUOPERAZINE

17.2.3.4. CHLORDIAZEPOXIDE

17.2.3.5. OTHERS

17.2.4 ANTI-INFECTIVES

17.2.4.1. ANTIBIOTICS

17.2.4.1.1. AMOXICILLIN

17.2.4.1.2. METRONIDAZOLE

17.2.4.1.3. DOXYCYCLINE

17.2.4.1.4. CIPROFLOXACIN

17.2.4.1.5. LEVOFLOXACIN

17.2.4.1.6. OTHERS

17.2.4.2. ANTIVIRAL

17.2.4.2.1. ACICLOVIR

17.2.4.2.2. ABACAVIR

17.2.4.2.3. LOPINAVIR

17.2.4.2.4. OSELTAMIVIR

17.2.4.2.5. OTHERS

17.2.4.3. ANTIFUNGAL

17.2.4.3.1. CLOTRIMAZOLE

17.2.4.3.2. ITRACONAZOLE

17.2.4.3.3. NYSTATIN

17.2.4.3.4. VORICONAZOLE

17.2.4.3.5. FLUCONAZOLE

17.2.4.3.6. OTHERS

17.2.4.4. OTHERS

17.2.5 ANTI-INFLAMMATORY

17.2.5.1. DICLOFENAC

17.2.5.2. IBUPROFEN

17.2.5.3. NAPROXEN

17.2.5.4. PREDNISOLONE

17.2.5.5. OTHERS

17.2.6 DIURETICS

17.2.6.1. SPIRONOLACTONE

17.2.6.2. HYDROCHLOROTHIAZIDE

17.2.6.3. FUROSEMIDE

17.2.6.4. OTHERS

17.2.7 GASTROINTESTINAL

17.2.7.1. ESOMOPRAZOLE

17.2.7.2. OMEPRAZOLE

17.2.7.3. RANITIDINE

17.2.7.4. LOPERAMIDE

17.2.7.5. OTHERS

17.2.8 CARDIOVASCULAR

17.2.8.1. ATENOLOL

17.2.8.2. MOLSIDOMINE

17.2.8.3. DIGOXIN

17.2.8.4. VERAPAMIL

17.2.8.5. OTHERS

17.3 VACCINES

17.3.1 EBOLA VACCINE

17.3.2 HUMAN PAPILLOMAVIRUS VACCINE

17.3.3 MEASLES, MUMPS, AND RUBELLA VIRUS VACCINE

17.3.4 HAEMOPHILUS B VACCINE

17.3.5 PNEUMOCOCCAL VACCINE

17.3.6 HEPATITIS B VACCINE

17.3.7 ROTAVIRUS VACCINE

17.3.8 HEPATITIS A VACCINE

17.3.9 BCG VACCINE

17.3.10 VARICELLA VIRUS VACCINE

17.3.11 DIPHTHERIA AND TETANUS VACCINES

17.3.12 SHINGLES VACCINES

17.3.13 OTHERS

17.4 SPECIALTY PHARMACEUTICALS

17.4.1 GASTROINTESTINAL

17.4.1.1. AFINITOR

17.4.1.2. AYVAKIT

17.4.1.3. BRAFTOVI

17.4.1.4. CYRAMZA

17.4.1.5. ENHERTU

17.4.1.6. LEUCOVORIN CALCIUM

17.4.1.7. LENVIMA

17.4.1.8. LONSURF

17.4.1.9. LYNPARZA

17.4.1.10. NEXAVAR

17.4.1.11. PEMAZYRE

17.4.1.12. QINLOCK

17.4.1.13. STIVARGA

17.4.1.14. SUTENT

17.4.1.15. TARCEVA

17.4.1.16. TECENTRIQ

17.4.1.17. TIBSOVO

17.4.1.18. WELIREG

17.4.1.19. XELODA

17.4.1.20. XERMELO

17.4.2 BRAIN

17.4.2.1. GLEOSTINE

17.4.2.2. MATULANE

17.4.2.3. TEMODAR

17.4.3 BREAST

17.4.3.1. AFINITOR

17.4.3.2. ANASTROZOLE

17.4.3.3. AROMASIN

17.4.3.4. ENHERTU

17.4.3.5. EVEROLIMUS

17.4.3.6. FEMARA

17.4.3.7. IBRANCE

17.4.3.8. KISQALI

17.4.3.9. LYNPARZA

17.4.3.10. MEGACE

17.4.3.11. METHOTREXATE

17.4.3.12. NERLYNX

17.4.3.13. ORSERDU

17.4.3.14. PIQRAY

17.4.3.15. SOLTAMOX

17.4.3.16. TALZENNA

17.4.3.17. TRODELVY

17.4.3.18. TUKYSA

17.4.3.19. TYKERB

17.4.3.20. VERZENIO

17.4.3.21. XELODA

17.4.3.22. OTHERS

17.4.4 GENITOURINARY

17.4.4.1. AFINITOR

17.4.4.2. BAVENCIO

17.4.4.3. CABOMETYX

17.4.4.4. CASODEX

17.4.4.5. ERLEADA

17.4.4.6. FOTIVDA

17.4.4.7. INLYTA

17.4.4.8. LENVIMA

17.4.4.9. LUPRON

17.4.4.10. LYNPARZA

17.4.4.11. NEXAVAR

17.4.4.12. NILANDRON

17.4.4.13. NUBEQA

17.4.4.14. ORGOVYX

17.4.4.15. RAPAMUNE

17.4.4.16. RUBRACA

17.4.4.17. SUTENT

17.4.4.18. TRODELVY

17.4.4.19. VOTRIENT

17.4.4.20. WELIREG

17.4.4.21. XTANDI

17.4.4.22. YONSA

17.4.4.23. ZYTIGA

17.4.5 GYNECOLOGY

17.4.5.1. HEXALEN

17.4.5.2. HYDREA

17.4.5.3. ELAHERE

17.4.5.4. LENVIMA

17.4.5.5. LYNPARZA

17.4.5.6. RUBRACA

17.4.5.7. ZEJULA

17.4.6 HEAD, NECK & THYROID

17.4.6.1. CAPRELSA

17.4.6.2. GAVRETO

17.4.6.3. HYDREA

17.4.6.4. LENVIMA

17.4.6.5. NEXAVAR

17.4.6.6. RETEVMO

17.4.7 HEMATOLOGIC

17.4.7.1. AGRYLIN

17.4.7.2. ALKERAN

17.4.7.3. BESPONSA

17.4.7.4. BESREMI

17.4.7.5. BOSULIF

17.4.7.6. BRUKINSA

17.4.7.7. CALQUENCE

17.4.7.8. COPIKTRA

17.4.7.9. CYTOXAN

17.4.7.10. DOPTELET

17.4.7.11. GLEEVEC

17.4.7.12. HYDREA

17.4.7.13. IDHIFA

17.4.7.14. IMBRUVICA

17.4.7.15. INQOVI

17.4.7.16. INREBIC

17.4.7.17. JAKAFI

17.4.7.18. JAYPIRCA

17.4.7.19. LEUCOVORIN CALCIUM

17.4.7.20. LEUKERAN

17.4.7.21. METHOTREXATE

17.4.7.22. MONJUVI

17.4.7.23. MYLOTARG

17.4.7.24. NINLARO

17.4.7.25. ONUREG

17.4.7.26. POLIVY

17.4.7.27. POMALYST

17.4.7.28. PROMACTA

17.4.7.29. PURINETHOL

17.4.7.30. REVLIMID

17.4.7.31. REZLIDHIA

17.4.7.32. REZUROCK

17.4.7.33. RYDAPT

17.4.7.34. SARCLISA

17.4.7.35. SCEMBLIX

17.4.7.36. SPRYCEL

17.4.7.37. TARGRETIN

17.4.7.38. TASIGNA

17.4.7.39. TAVALISSE

17.4.7.40. THALOMID

17.4.7.41. TIBSOVO

17.4.7.42. TRETINOIN

17.4.7.43. VENCLEXTA

17.4.7.44. VIDAZA

17.4.7.45. VONJO

17.4.7.46. XOSPATA

17.4.7.47. XPOVIO

17.4.7.48. ZYDELIG

17.4.8 LUNG

17.4.8.1. AFINITOR

17.4.8.2. ALECENSA

17.4.8.3. ALUNBRIG

17.4.8.4. COTELLIC

17.4.8.5. CYRAMZA

17.4.8.6. ERLOTINIB

17.4.8.7. EXKIVITY

17.4.8.8. GAVRETO

17.4.8.9. HYCAMTIN

17.4.8.10. IMFINZI

17.4.8.11. IRESSA

17.4.8.12. KRAZATI

17.4.8.13. LORBRENA

17.4.8.14. LUMAKRAS

17.4.8.15. METHOTREXATE

17.4.8.16. PORTRAZZA

17.4.8.17. RETEVMO

17.4.8.18. ROZLYTREK

17.4.8.19. TABRECTA

17.4.8.20. TAGRISSO

17.4.8.21. TEPMETKO

17.4.8.22. VEPESID

17.4.8.23. VIZIMPRO

17.4.8.24. XALKORI

17.4.9 MELANOMA AND BASAL CELL

17.4.9.1. BAVENCIO

17.4.9.2. BRAFTOVI

17.4.9.3. COTELLIC

17.4.9.4. ERIVEDGE

17.4.9.5. MEKINIST

17.4.9.6. MEKTOVI

17.4.9.7. ODOMZO

17.4.9.8. TAFINLAR

17.4.9.9. ZELBORAF

17.4.10 RARE AND COMPLEX THERAPIES

17.4.10.1. CABLIVI

17.4.10.2. ENSPRYNG

17.4.10.3. FYARRO

17.4.10.4. GAMIFANT

17.4.10.5. KINERET

17.4.10.6. LIVTENCITY

17.4.10.7. LUPKYNIS

17.4.10.8. NULIBRY

17.4.10.9. PYRUKYND

17.4.10.10. SKYCLARYS

17.4.10.11. TARPEYO

17.4.10.12. TURALIO

17.4.10.13. VIJOICE

17.4.11 OTHER SPECIALTY PRODUCTS

17.5 OVER THE COUNTER PHARMACEUTICALS

17.5.1 ANTACIDS

17.5.1.1. ALUMINUM CARBONATE ANTACIDS

17.5.1.2. CALCIUM CARBONATE ANTACIDS

17.5.1.3. MAGNESIUM OXIDE ANTACIDS

17.5.1.4. SODIUM BICARBONATE ANTACIDS

17.5.1.5. SODIUM CITRATE ANTACIDS

17.5.1.6. ALUMINUM HYDROXIDE ANTACIDS

17.5.1.7. MAGNESIUM HYDROXIDE ANTACIDS

17.5.1.8. OTHERS

17.5.2 PAIN RELIEF

17.5.2.1. ASPIRIN

17.5.2.2. NAPROXEN

17.5.2.3. IBUPROFEN

17.5.2.4. ACETAMINOPHEN

17.5.2.5. OTHERS

17.5.3 VITAMINS

17.5.3.1. BIOTIN

17.5.3.2. FOLIC ACID

17.5.3.3. THIAMIN

17.5.3.4. RIBOFLAVIN

17.5.3.5. PANTOTHENIC ACID

17.5.3.6. ASCORBIC ACID

17.5.3.7. COBALAMIN

17.5.3.8. PYRIDOXINE

17.5.3.9. NIACIN

17.5.3.10. RETINOIDS AND CAROTENE

17.5.3.11. CHOLINE

17.5.3.12. CALCIFEROL

17.5.3.13. ALPHA-TOCOPHEROL

17.5.3.14. PHYLLOQUINONE

17.5.3.15. MENADIONE

17.5.3.16. OTHERS

17.5.4 MINERALS

17.5.4.1. CALCIUM

17.5.4.2. CHLORIDE

17.5.4.3. CHROMIUM

17.5.4.4. COPPER

17.5.4.5. FLUORIDE

17.5.4.6. IODINE

17.5.4.7. IRON

17.5.4.8. MAGNESIUM

17.5.4.9. MANGANESE

17.5.4.10. MOLYBDENUM

17.5.4.11. PHOSPHORUS

17.5.4.12. POTASSIUM

17.5.4.13. SELENIUM

17.5.4.14. SODIUM

17.5.4.15. SULFUR

17.5.4.16. ZINC

17.5.4.17. OTHERS

17.5.5 DIETARY SUPPLEMENTATION

17.5.5.1. FISH OIL

17.5.5.2. HYDROCIL

17.5.5.3. REGULOID

17.5.5.4. PSYLLIUM

17.5.5.5. METAMUCIL

17.5.5.6. OTHERS

18 GLOBAL PHARMA E-COMMERCE MARKET, BY DRUG TYPE

18.1 OVERVIEW

18.2 BRANDED

18.3 GENERIC

19 GLOBAL PHARMA E-COMMERCE MARKET, BY THERAPEUTICS APPLICATION

19.1 OVERVIEW

19.2 ISCHEMIC HEART DISEASE

19.2.1 PRESCRIPTION MEDICINE

19.2.2 OVER THE COUNTER

19.3 CHRONIC OBSTRUCTIVE PULMONARY DISEASE

19.3.1 PRESCRIPTION MEDICINE

19.3.2 OVER THE COUNTER

19.4 DIARRHEAL DISEASES

19.4.1 PRESCRIPTION MEDICINE

19.4.2 OVER THE COUNTER

19.5 LOWER RESPIRATORY INFECTION

19.5.1 PRESCRIPTION MEDICINE

19.5.2 OVER THE COUNTER

19.6 CEREBROVASCULAR DISEASES

19.6.1 PRESCRIPTION MEDICINE

19.6.2 OVER THE COUNTER

19.7 IRON-DEFICIENCY ANAEMIA

19.7.1 PRESCRIPTION MEDICINE

19.7.2 OVER THE COUNTER

19.8 NEONATAL PRETERM BIRTH

19.8.1 PRESCRIPTION MEDICINE

19.8.2 OVER THE COUNTER

19.9 TUBERCULOSIS

19.9.1 PRESCRIPTION MEDICINE

19.9.2 OVER THE COUNTER

19.1 SENSE ORGAN DISEASES

19.10.1 PRESCRIPTION MEDICINE

19.10.2 OVER THE COUNTER

19.11 CANCER

19.11.1 PRESCRIPTION MEDICINE

19.11.2 OVER THE COUNTER

19.12 INJURIES

19.12.1 PRESCRIPTION MEDICINE

19.12.2 OVER THE COUNTER

19.13 OPHTHALMOLOGY

19.13.1 PRESCRIPTION MEDICINE

19.13.2 OVER THE COUNTER

19.14 DERMATOLOGY

19.14.1 PRESCRIPTION MEDICINE

19.14.2 OVER THE COUNTER

19.15 NEUROLOGY

19.15.1 PRESCRIPTION MEDICINE

19.15.2 OVER THE COUNTER

19.16 ENDOCRINOLOGY

19.16.1 PRESCRIPTION MEDICINE

19.16.2 OVER THE COUNTER

19.17 GASTROINTESTINAL DISORDERS

19.17.1 PRESCRIPTION MEDICINE

19.17.2 OVER THE COUNTER

19.18 AUTOIMMUNE

19.18.1 PRESCRIPTION MEDICINE

19.18.2 OVER THE COUNTER

19.19 OTHERS

20 GLOBAL PHARMA E-COMMERCE MARKET, BY ROUTE OF ADMINISTRATION

20.1 OVERVIEW

20.2 ORAL

20.2.1 TABLETS

20.2.2 CAPSULES

20.2.3 POWDER

20.2.4 PILLS

20.2.5 SYRUPS

20.2.6 OTHERS

20.3 TOPICAL

20.3.1 SOLUTIONS

20.3.2 CREAM

20.3.3 OINTMENT

20.3.4 GELS

20.3.5 LOTIONS

20.3.6 POWDERS

20.3.7 OTHERS

20.4 PARENTERAL

20.5 INTRANASAL

20.5.1 DROPS

20.5.2 SPRAYS

20.5.3 POWDERS

20.5.4 GELS

20.5.5 OTHERS

20.6 OCULAR

20.6.1 EYE DROPS

20.6.2 SPRAYS

20.6.3 OINTMENTS

20.6.4 OTHERS

20.7 OTHERS

21 GLOBAL PHARMA E-COMMERCE MARKET, BY MODEL TYPE

21.1 OVERVIEW

21.2 B2B

21.2.1 B2B2B

21.2.2 B2B2C

21.3 B2C

22 GLOBAL PHARMA E-COMMERCE MARKET, BY PLATFORM TYPE

22.1 OVERVIEW

22.2 MANUFACTURER OWNED DIGITAL COMMERCE

22.3 DISTRIBUTOR/WHOLESALER OWNED DIGITAL COMMERCE

22.4 MANUFACTURER OWNED MARKET PLACE

22.5 3RD PARTY MARKETPLACE

22.6 RETAIL

23 GLOBAL PHARMA E-COMMERCE MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.2 COMPANY SHARE ANALYSIS: EUROPE

23.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.4 MERGERS & ACQUISITIONS

23.5 NEW PRODUCT DEVELOPMENT & APPROVALS

23.6 EXPANSIONS

23.7 REGULATORY CHANGES

23.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL PHARMA E-COMMERCE MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL PHARMA E-COMMERCE MARKET, BY REGION

GLOBAL PHARMA E-COMMERCE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 EUROPE

25.2.1 GERMANY

25.2.2 FRANCE

25.2.3 U.K.

25.2.4 HUNGARY

25.2.5 LITHUANIA

25.2.6 AUSTRIA

25.2.7 IRELAND

25.2.8 NORWAY

25.2.9 POLAND

25.2.10 ITALY

25.2.11 SPAIN

25.2.12 RUSSIA

25.2.13 TURKEY

25.2.14 NETHERLANDS

25.2.15 SWITZERLAND

25.2.16 REST OF EUROPE

25.3 ASIA-PACIFIC

25.3.1 JAPAN

25.3.2 CHINA

25.3.3 SOUTH KOREA

25.3.4 INDIA

25.3.5 AUSTRALIA

25.3.6 SINGAPORE

25.3.7 THAILAND

25.3.8 MALAYSIA

25.3.9 INDONESIA

25.3.10 PHILIPPINES

25.3.11 VIETNAM

25.3.12 REST OF ASIA-PACIFIC

25.4 SOUTH AMERICA

25.4.1 BRAZIL

25.4.2 ARGENTINA

25.4.3 PERU

25.4.4 COLOMBIA

25.4.5 VENEZUELA

25.4.6 REST OF SOUTH AMERICA

25.5 MIDDLE EAST AND AFRICA

25.5.1 SOUTH AFRICA

25.5.2 SAUDI ARABIA

25.5.3 UAE

25.5.4 EGYPT

25.5.5 KUWAIT

25.5.6 ISRAEL

25.5.7 REST OF MIDDLE EAST AND AFRICA

25.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

26 GLOBAL PHARMA E-COMMERCE MARKET, COMPANY PROFILE

26.1 CVS HEALTH

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 ZUR ROSE GROUP AG

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 WALGREENS BOOTS ALLIANCE

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 TRUECOMMERCE INC.

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 PHARMAHOPERS (WEBHOPERS INFOTECH PVT. LTD)

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 CONSULTATION REMEDIES

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 RETAILIO

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 PHARMAFLAIR

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 LINIMENT PHARMA PRIVATE LIMITED

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 ALIBABA GROUP

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 MERCK & CO., INC.

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 AMAZON.COM, INC.

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 APOTEK HJÄRTAT AB. (ICA GRUPPEN AB)

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 THE KROGER CO.

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 GIANT EAGLE, INC.

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 OPTUM, INC. (UNITEDHEALTH GROUP.)

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 REDCARE PHARMACY.

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 WALMART.

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 DOCMORRIS

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 TABLETKI.UA

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 APOLLO PHARMACY (APOLLO HOSPITALS)

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 PHARMEASY

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 RITE AID CORP.

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 ASNA.

26.24.1 COMPANY OVERVIEW

26.24.2 REVENUE ANALYSIS

26.24.3 GEOGRAPHIC PRESENCE

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 MEDPLUSMART.COM.

26.25.1 COMPANY OVERVIEW

26.25.2 REVENUE ANALYSIS

26.25.3 GEOGRAPHIC PRESENCE

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

26.26 FOOD LION LLC

26.26.1 COMPANY OVERVIEW

26.26.2 REVENUE ANALYSIS

26.26.3 GEOGRAPHIC PRESENCE

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPMENTS

26.27 RXSENSE (SINGLECARE)

26.27.1 COMPANY OVERVIEW

26.27.2 REVENUE ANALYSIS

26.27.3 GEOGRAPHIC PRESENCE

26.27.4 PRODUCT PORTFOLIO

26.27.5 RECENT DEVELOPMENTS

26.28 LLC FAMILY PHARMACY APRIL

26.28.1 COMPANY OVERVIEW

26.28.2 REVENUE ANALYSIS

26.28.3 GEOGRAPHIC PRESENCE

26.28.4 PRODUCT PORTFOLIO

26.28.5 RECENT DEVELOPMENTS

26.29 MCKESSON CORPORATION

26.29.1 COMPANY OVERVIEW

26.29.2 REVENUE ANALYSIS

26.29.3 GEOGRAPHIC PRESENCE

26.29.4 PRODUCT PORTFOLIO

26.29.5 RECENT DEVELOPMENTS

26.3 UK MEDS DIRECT LTD

26.30.1 COMPANY OVERVIEW

26.30.2 REVENUE ANALYSIS

26.30.3 GEOGRAPHIC PRESENCE

26.30.4 PRODUCT PORTFOLIO

26.30.5 RECENT DEVELOPMENTS

26.31 DIRK ROSSMANN GMBH

26.31.1 COMPANY OVERVIEW

26.31.2 REVENUE ANALYSIS

26.31.3 GEOGRAPHIC PRESENCE

26.31.4 PRODUCT PORTFOLIO

26.31.5 RECENT DEVELOPMENTS

26.32 AMERISOURCEBERGEN CORPORATION.

26.32.1 COMPANY OVERVIEW

26.32.2 REVENUE ANALYSIS

26.32.3 GEOGRAPHIC PRESENCE

26.32.4 PRODUCT PORTFOLIO

26.32.5 RECENT DEVELOPMENTS

26.33 STOLICHKI

26.33.1 COMPANY OVERVIEW

26.33.2 REVENUE ANALYSIS

26.33.3 GEOGRAPHIC PRESENCE

26.33.4 PRODUCT PORTFOLIO

26.33.5 RECENT DEVELOPMENTS

26.34 RAIA DROGA

26.34.1 COMPANY OVERVIEW

26.34.2 REVENUE ANALYSIS

26.34.3 GEOGRAPHIC PRESENCE

26.34.4 PRODUCT PORTFOLIO

26.34.5 RECENT DEVELOPMENTS

26.35 APTEKA.RU

26.35.1 COMPANY OVERVIEW

26.35.2 REVENUE ANALYSIS

26.35.3 GEOGRAPHIC PRESENCE

26.35.4 PRODUCT PORTFOLIO

26.35.5 RECENT DEVELOPMENTS

26.36 GOODRX

26.36.1 COMPANY OVERVIEW

26.36.2 REVENUE ANALYSIS

26.36.3 GEOGRAPHIC PRESENCE

26.36.4 PRODUCT PORTFOLIO

26.36.5 RECENT DEVELOPMENTS

26.37 CARDINAL HEALTH

26.37.1 COMPANY OVERVIEW

26.37.2 REVENUE ANALYSIS

26.37.3 GEOGRAPHIC PRESENCE

26.37.4 PRODUCT PORTFOLIO

26.37.5 RECENT DEVELOPMENTS

26.37.6

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.