Global Pharmaceutical Analytical Testing Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

9.51 Billion

USD

17.93 Billion

2025

2033

USD

9.51 Billion

USD

17.93 Billion

2025

2033

| 2026 –2033 | |

| USD 9.51 Billion | |

| USD 17.93 Billion | |

|

|

|

|

Pharmaceutical Analytical Testing Outsourcing Market Size

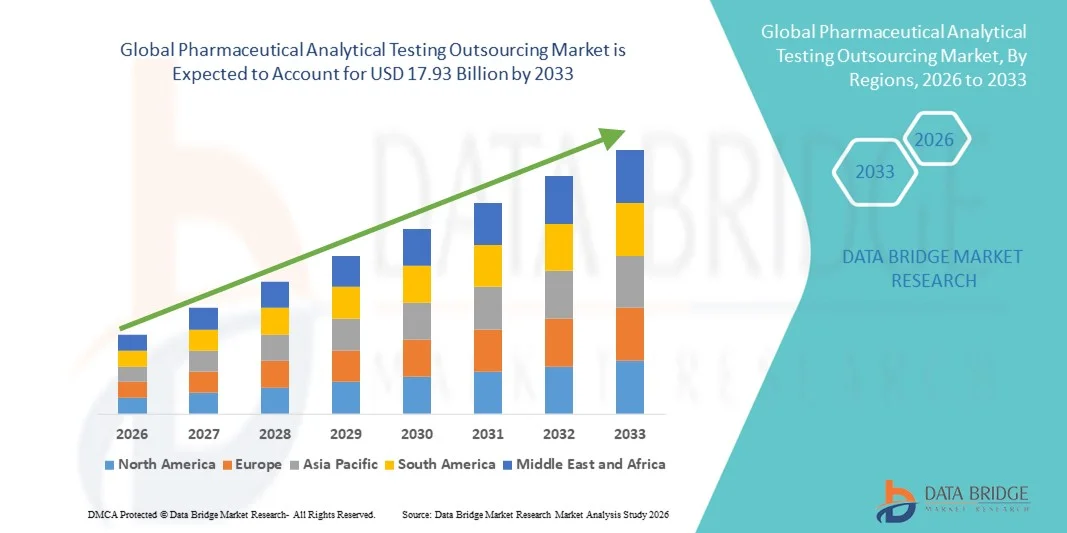

- The global pharmaceutical analytical testing outsourcing market size was valued at USD 9.51 billion in 2025 and is expected to reach USD 17.93 billion by 2033, at a CAGR of 8.25% during the forecast period

- The market growth is largely fueled by the increasing demand for outsourced pharmaceutical analytical testing services, driven by the need for high-quality, cost-efficient, and compliant testing across drug development pipelines. Growing complexity in drug formulations, regulatory requirements, and quality standards is pushing pharmaceutical companies to rely on specialized outsourcing partners for analytical testing, method development, and validation

- Furthermore, rising pressure on pharmaceutical and biotech companies to accelerate time-to-market, reduce operational costs, and maintain regulatory compliance is establishing outsourcing as a preferred model for analytical testing services. These converging factors are accelerating the adoption of Pharmaceutical Analytical Testing Outsourcing solutions, thereby significantly boosting the industry's growth

Pharmaceutical Analytical Testing Outsourcing Market Analysis

- Pharmaceutical analytical testing outsourcing services are increasingly vital for modern drug development and quality assurance across pharmaceutical, biotech, and contract research organizations, owing to their ability to provide accurate, compliant, and timely testing solutions

- The escalating demand for outsourced analytical testing is primarily fueled by the growing complexity of drug formulations, stringent regulatory requirements, and the need for high-throughput, precise, and reproducible testing, enabling pharmaceutical companies to focus on R&D while ensuring quality and compliance

- North America dominated the pharmaceutical analytical testing outsourcing market with the largest revenue share of 40% in 2025, driven by the high prevalence of pharmaceutical R&D activities, strong regulatory frameworks, advanced laboratory infrastructure, and the presence of key outsourcing service providers. The U.S. continues to lead the region due to expanded clinical trial programs, increasing adoption of automated and high-throughput analytical platforms, and integration of advanced testing technologies in hospitals and contract research organizations

- Asia-Pacific is expected to be the fastest-growing region in the pharmaceutical analytical testing outsourcing market during the forecast period, projected to expand at a CAGR supported by increasing healthcare expenditure, rapid urbanization, growing pharmaceutical and biotechnology research in China, India, and Southeast Asia, and rising demand for early-stage drug development and analytical testing services

- The finished product segment dominated the market with a revenue share of 44.8% in 2025, driven by the increasing need to test and validate final pharmaceutical products for purity, potency, and safety before regulatory submission and commercialization

Report Scope and Pharmaceutical Analytical Testing Outsourcing Market Segmentation

|

Attributes |

Pharmaceutical Analytical Testing Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pharmaceutical Analytical Testing Outsourcing Market Trends

Enhanced Convenience Through Advanced Outsourcing Solutions

- A significant and accelerating trend in the global pharmaceutical analytical testing outsourcing market is the growing adoption of integrated and flexible outsourcing solutions. Pharmaceutical companies are increasingly leveraging external contract research organizations (CROs) and specialized laboratories to enhance efficiency, reduce operational costs, and accelerate time-to-market for drug development

- For instance, leading CROs now offer comprehensive end-to-end analytical testing services, including method development, validation, stability testing, and quality control, allowing pharmaceutical companies to focus on core research and development activities. Similarly, many service providers are adopting modular and scalable service models, providing flexibility to accommodate projects of varying complexity and volume

- The trend toward outsourcing is also supported by regulatory compliance requirements, which demand highly specialized expertise and certified laboratory infrastructure for accurate and reproducible results. Many CROs have expanded their global footprint, providing clients with access to high-quality analytical facilities across multiple geographies

- In addition, the integration of automated laboratory instrumentation and advanced analytics tools within outsourced facilities is streamlining workflows, reducing human error, and enabling faster turnaround times for testing results

- Pharmaceutical companies are increasingly prioritizing outsourcing strategies that provide seamless data management, reporting, and communication, ensuring transparency and real-time access to testing outcomes

- This trend toward more efficient, reliable, and compliant analytical outsourcing services is reshaping the expectations of pharmaceutical organizations. Consequently, companies such as SGS, Eurofins, and Charles River Laboratories are expanding their service portfolios to provide end-to-end solutions tailored to client needs

- The demand for outsourced analytical testing services is growing rapidly across small, mid-sized, and large pharmaceutical firms, as companies increasingly seek to reduce operational complexity while maintaining high standards of quality and compliance

Pharmaceutical Analytical Testing Outsourcing Market Dynamics

Driver

Rising Need for Specialized Expertise and Cost-Efficient Solutions

- The increasing complexity of pharmaceutical compounds, biologics, and generics is driving demand for specialized analytical testing capabilities that many in-house laboratories cannot fully support. Outsourcing these services ensures access to advanced instrumentation, highly skilled personnel, and validated methodologies

- For instance, in March 2023, Eurofins Scientific expanded its analytical testing services for complex biologics in Europe and North America, enhancing capabilities in method development, stability testing, and regulatory reporting. Such initiatives allow pharmaceutical companies to accelerate drug development timelines while maintaining stringent quality standards

- As pharmaceutical R&D continues to grow in complexity and scale, companies are increasingly outsourcing tasks such as impurity profiling, bioanalytical testing, and formulation characterization to reduce operational costs and optimize resources

- Furthermore, the growing regulatory scrutiny across markets such as the U.S., EU, and Japan is increasing the need for fully compliant and validated testing services that are both accurate and efficient

- Outsourcing also allows companies to leverage the latest laboratory technologies, such as high-resolution mass spectrometry, automated sample preparation, and advanced chromatography systems, without incurring capital expenditure

- The ability to rapidly scale testing services based on project demands, coupled with flexible contractual arrangements, is a major factor driving the adoption of outsourced analytical services

- Consequently, the increasing requirement for cost-efficient, high-quality, and timely analytical testing solutions is a primary driver for growth in the Pharmaceutical Analytical Testing Outsourcing market

Restraint/Challenge

Concerns Regarding Data Security, Regulatory Compliance, and High Service Costs

- While outsourcing offers many advantages, concerns regarding the security of sensitive pharmaceutical data and intellectual property remain a significant challenge. Companies must ensure that contract service providers adhere to strict confidentiality protocols and cybersecurity measures

- In addition, navigating complex regulatory environments and ensuring compliance with FDA, EMA, ICH, and local standards can be challenging when relying on external testing providers. Non-compliance or procedural errors by the CRO can have serious implications for drug approval timelines

- High costs associated with premium outsourcing services, particularly for specialized biologics and high-throughput testing, can be a barrier for smaller pharmaceutical companies or startups with limited budgets

- Some organizations are hesitant to fully outsource critical testing functions due to concerns about maintaining control over quality and turnaround times

- Building strong, reliable partnerships with service providers is essential to mitigate risks related to delays, inaccuracies, or non-compliance

- While pricing structures are gradually becoming more flexible and modular, perceived premium costs and dependency on third-party providers can still restrict adoption among price-sensitive clients

- Addressing these challenges through rigorous provider selection, robust data governance, and clear contractual agreements will be vital for sustained growth in the Pharmaceutical Analytical Testing Outsourcing market

Pharmaceutical Analytical Testing Outsourcing Market Scope

The market is segmented on the basis of service type, product type, and end-users.

- By Service Type

On the basis of service type, the Pharmaceutical Analytical Testing Outsourcing market is segmented into bioanalytical testing, method development & validation, stability testing, and others. The bioanalytical testing segment dominated the largest market revenue share of 41.5% in 2025, driven by the growing complexity of biologics, biosimilars, and novel drug formulations requiring high-precision analysis. Pharmaceutical companies increasingly rely on external CROs for bioanalytical testing to ensure accuracy, compliance with regulatory standards, and faster turnaround times. The segment’s dominance is supported by the rising prevalence of clinical trials and the need for validated assays for pharmacokinetic and toxicology studies. In addition, bioanalytical testing services often provide specialized capabilities such as mass spectrometry, high-performance liquid chromatography (HPLC), and immunoassay testing, which many in-house laboratories may not possess. The growing adoption of biologics, personalized medicines, and advanced therapeutics has further strengthened the segment. CROs offering bioanalytical testing are expanding their global footprint, providing pharmaceutical companies with access to multiple testing facilities across North America, Europe, and Asia-Pacific. High regulatory scrutiny and quality compliance drive companies to prefer outsourcing over in-house analysis. Increasing demand for contract research services from both small and mid-sized pharmaceutical companies also contributes to the segment’s dominance.

The method development & validation segment is expected to witness the fastest growth during the forecast period with a CAGR of 22.3% from 2026 to 2033, fueled by the rising complexity of new drug molecules and formulations. The segment is driven by the need for robust, validated analytical methods to meet regulatory submission requirements across global markets. Pharmaceutical companies are increasingly outsourcing method development and validation to access specialized expertise, advanced instrumentation, and faster delivery timelines. The increasing focus on novel therapies such as gene therapies, peptide-based drugs, and complex biologics is generating strong demand. CROs offering flexible, scalable method development solutions are preferred for their ability to adapt to changing regulatory guidelines. Method development services also enable clients to optimize assay sensitivity, specificity, and reproducibility, ensuring consistent quality. The segment benefits from the growth of clinical trial activities globally, especially in emerging markets where outsourcing reduces time and capital investment. The integration of automated analytical systems and high-throughput platforms in outsourced laboratories is accelerating method development workflows. Companies are also offering modular service models, allowing clients to choose specific phases of method development and validation. Overall, rising R&D complexity and regulatory pressure make method development & validation a high-growth segment.

- By Product Type

On the basis of product type, the Pharmaceutical Analytical Testing Outsourcing market is segmented into raw materials, finished products, and active pharmaceutical ingredients (APIs). The finished product segment dominated the market with a revenue share of 44.8% in 2025, driven by the increasing need to test and validate final pharmaceutical products for purity, potency, and safety before regulatory submission and commercialization. Outsourced testing ensures comprehensive quality assessment, including stability, content uniformity, and impurity profiling. The finished product segment also benefits from the rise in complex formulations, combination products, and generic drug approvals worldwide. CROs provide specialized testing platforms for large-scale finished product analysis, supporting both batch release and regulatory compliance. High demand from contract manufacturing organizations (CMOs) and pharmaceutical companies for third-party testing enhances the segment’s revenue share. In addition, rigorous global quality standards necessitate outsourcing to certified laboratories for unbiased assessment.

The API segment is projected to witness the fastest growth with a CAGR of 21.9% from 2026 to 2033, as pharmaceutical companies increasingly outsource analytical testing of active ingredients to meet stringent regulatory and quality standards. Growth is driven by the rising production of complex APIs and biologics, along with increased outsourcing in emerging markets where local analytical facilities may lack advanced instrumentation. CROs offering API testing provide robust characterization, impurity profiling, and stability assessment services. Increasing contract manufacturing of APIs globally is also propelling segment growth. The need for rapid method development and validation for new APIs contributes to outsourcing adoption. The API segment benefits from global pharmaceutical expansion, rising generic production, and increasing regulatory scrutiny.

- By End-User

On the basis of end-users, the Pharmaceutical Analytical Testing Outsourcing market is segmented into pharmaceutical & biopharmaceutical companies and the biotechnology industry. Pharmaceutical & biopharmaceutical companies accounted for the largest revenue share of 63.4% in 2025, owing to the extensive outsourcing of analytical testing services to meet growing R&D demands, complex drug development pipelines, and regulatory requirements. Large pharmaceutical organizations increasingly rely on CROs for bioanalytical testing, method validation, and finished product analysis, ensuring compliance and accelerating product launch timelines. These companies prioritize quality, speed, and regulatory adherence, making outsourcing a strategic solution. Outsourcing allows pharmaceutical firms to reduce operational costs, access advanced instrumentation, and focus on core drug discovery and development activities. The dominance is also supported by the rising number of clinical trials, regulatory approvals, and global expansion initiatives.

The biotechnology industry segment is expected to register the fastest growth with a CAGR of 23.1% from 2026 to 2033, driven by the increasing development of biologics, biosimilars, and novel therapies requiring specialized analytical testing. Biotech companies, especially startups and small-scale developers, prefer outsourcing to access high-quality analytical expertise without investing in expensive in-house laboratories. Rising global investments in biotech R&D, expansion of clinical trials, and increasing regulatory oversight are further fueling growth. Outsourced analytical testing allows biotech firms to accelerate time-to-market, optimize workflows, and ensure compliance. The trend is particularly strong in emerging biotech hubs in Asia-Pacific and North America.

Pharmaceutical Analytical Testing Outsourcing Market Regional Analysis

- North America dominated the pharmaceutical analytical testing outsourcing market with the largest revenue share of 40% in 2025

- Driven by the high prevalence of pharmaceutical R&D activities, strong regulatory frameworks, advanced laboratory infrastructure, and the presence of key outsourcing service providers

- The region continues to witness robust growth due to expanded clinical trial programs, increasing adoption of automated and high-throughput analytical platforms, and integration of advanced testing technologies in hospitals, clinical laboratories, and contract research organizations

U.S. Pharmaceutical Analytical Testing Outsourcing Market Insight

The U.S. pharmaceutical analytical testing outsourcing market pharmaceutical analytical testing outsourcing market captured the largest revenue share within North America in 2025, fueled by the extensive presence of pharmaceutical and biotechnology companies, large-scale clinical trials, and high investment in analytical testing services. The growing focus on drug safety, method development, and regulatory compliance is further propelling the market. Additionally, increased use of automated analytical platforms and high-throughput testing systems in hospitals and CROs supports accelerated adoption of outsourced testing solutions.

Europe Pharmaceutical Analytical Testing Outsourcing Market Insight

The Europe pharmaceutical analytical testing outsourcing market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulatory frameworks, increasing pharmaceutical and biotechnology research, and the need for accurate, compliant analytical testing. Countries such as Germany, France, and Switzerland are seeing strong growth due to well-established pharmaceutical sectors, the adoption of advanced laboratory automation, and increasing demand for method development, bioanalytical, and stability testing services across hospitals, CROs, and research institutes.

U.K. Pharmaceutical Analytical Testing Outsourcing Market Insight

The U.K. pharmaceutical analytical testing outsourcing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing R&D activities, demand for compliance with stringent EU and MHRA regulations, and rising pharmaceutical outsourcing trends. Hospitals, clinical laboratories, and CROs are increasingly relying on specialized analytical testing providers for method validation, bioanalytical services, and finished product testing to enhance drug quality and regulatory compliance.

Germany Pharmaceutical Analytical Testing Outsourcing Market Insight

The Germany pharmaceutical analytical testing outsourcing market is expected to expand at a considerable CAGR, fueled by the presence of advanced pharmaceutical infrastructure, strong emphasis on quality control, and adoption of automated and semi-automated analytical platforms. Pharmaceutical companies and research institutes in Germany are leveraging outsourcing services to support complex drug development processes, including bioanalytical testing, method development, and stability studies.

Asia-Pacific Pharmaceutical Analytical Testing Outsourcing Market Insight

The Asia-Pacific pharmaceutical analytical testing outsourcing market is expected to be the fastest-growing region during the forecast period, projected to expand at a significant CAGR. Growth is supported by increasing healthcare expenditure, rapid urbanization, and growing pharmaceutical and biotechnology research in China, India, and Southeast Asia. Rising demand for early-stage drug development, method validation, and analytical testing services across hospitals, CROs, and research laboratories is further accelerating the adoption of outsourced analytical solutions.

Japan Pharmaceutical Analytical Testing Outsourcing Market Insight

The Japan pharmaceutical analytical testing outsourcing market is gaining momentum due to the country’s strong pharmaceutical and biotechnology research ecosystem, emphasis on regulatory compliance, and advanced laboratory infrastructure. Hospitals and CROs are increasingly outsourcing analytical testing to ensure accuracy, reproducibility, and compliance with Japanese PMDA regulations. Moreover, the adoption of automated platforms and method development services supports growth in both domestic and multinational pharmaceutical companies.

China Pharmaceutical Analytical Testing Outsourcing Market Insight

The China pharmaceutical analytical testing outsourcing market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to expanding pharmaceutical and biotechnology research, rapid urbanization, and growing investment in hospital and laboratory infrastructure. Hospitals, CROs, and research institutes are increasingly outsourcing analytical testing services to support method development, stability testing, and bioanalytical testing, while domestic and international players continue to drive market growth through advanced analytical platforms and high-throughput testing solutions.

Pharmaceutical Analytical Testing Outsourcing Market Share

The Pharmaceutical Analytical Testing Outsourcing industry is primarily led by well-established companies, including:

- Parexel International (U.S.)

- ICON plc (Ireland)

- Syneos Health (U.S.)

- PPD, Inc. (U.S.)

- Alcami Corporation (U.S.)

- Biomapas (Poland)

- Toxikon (U.S.)

- QPS Holdings (U.S.)

- Frontage Laboratories (U.S.)

- Chemtron (Germany)

- Biotrial (France)

- Viva Biotech (China)

- Pharmaron (China)

- Jubilant Biosys (India)

- Vanta Analytical Services (U.S.)

Latest Developments in Global Pharmaceutical Analytical Testing Outsourcing Market

- In October 2023, Charles River Laboratories completed the acquisition of a biotech-focused analytical testing company. This strategic move strengthened its preclinical and bioanalytical testing capabilities, enabling the company to provide more comprehensive services in early-phase development, from method development to stability testing. The acquisition positions Charles River as a stronger partner for pharmaceutical and biopharmaceutical companies pursuing faster drug development timelines

- In September 2024, Labcorp Drug Development launched an expanded suite of bioanalytical testing services specifically tailored for biologics and gene therapies. This development enhanced its capacity to support advanced therapeutic development, providing high-precision analytical assays and accelerating timelines for early-phase clinical trials. The expansion reflects growing demand from pharmaceutical companies seeking specialized outsourcing solutions for complex molecules

- In May 2025, a European industry report highlighted significant growth driven by R&D investments and strategic collaborations among contract research organizations (CROs). These initiatives have facilitated the expansion of GMP-certified testing services, particularly in bioanalytical testing, method validation, and stability studies, supporting pharmaceutical companies in meeting stringent regulatory requirements while accelerating product development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.