Global Pharmaceutical Blister Packaging Market

Market Size in USD Billion

CAGR :

%

USD

7.71 Billion

USD

11.92 Billion

2024

2032

USD

7.71 Billion

USD

11.92 Billion

2024

2032

| 2025 –2032 | |

| USD 7.71 Billion | |

| USD 11.92 Billion | |

|

|

|

|

Pharmaceutical Blister Packaging Market Size

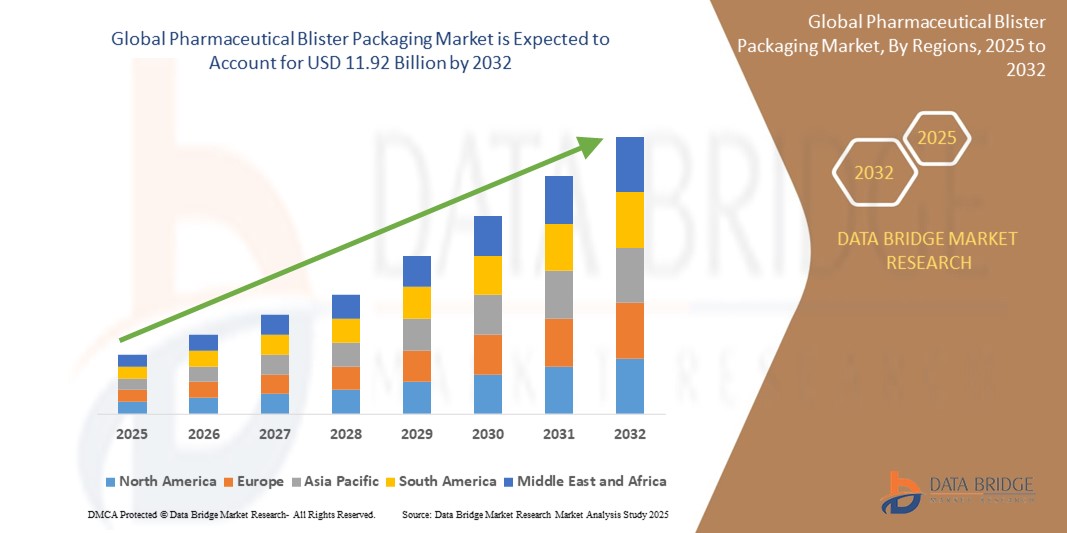

- The global Pharmaceutical Blister Packaging market was valued at USD 7.71 billion in 2024 and is expected to reach USD 11.92 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.60%, primarily driven by the increasing demand for convenient and secure packaging solutions in the pharmaceutical industry

- This growth is driven by factors such as the rising prevalence of chronic diseases, the growing adoption of unit-dose packaging for better dosage control, and the increasing focus on patient safety and drug protection

Pharmaceutical Blister Packaging Market Analysis

- The incorporation of smart technologies such as RFID tags and temperature sensors into blister packaging is improving medication traceability and patient safety

- For Instacnce, WestRock's CerePak blister packs include microprocessors and printed conductive inks to log dosing information, ensuring accurate clinical trial data

- There is a growing emphasis on eco-friendly packaging solutions

- For Instance, In August 2023, Amcor PLC introduced the AmSky blister system, replacing traditional materials with high-density polyethylene, offering a recyclable alternative to polyvinyl chloride and aluminum foil blister packs

- The demand for personalized packaging solutions is increasing. Keystone Folding Box launched the "Push-Pak," a paperboard blister wallet designed for medicine tablets, featuring a straightforward push-through opening system that eliminates the need for complex opening instructions

- Stricter regulations are influencing packaging designs. The U.S. and Europe have enacted laws to curb plastic waste, prompting manufacturers to develop sustainable packaging solutions that comply with these environmental standards

Report Scope and Pharmaceutical Blister Packaging Market Segmentation

|

Attributes |

Pharmaceutical Blister Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Blister Packaging Market Trends

“Integration of Smart Technologies in Blister Packaging”

- Smart blister packs equipped with technologies such as RFID tags, QR codes, and temperature sensors are revolutionizing patient interaction with medications. These features enable real-time tracking, dosage reminders, and authentication, thereby improving patient adherence and safety

- The incorporation of smart technologies allows for seamless monitoring of the product throughout the supply chain. This transparency ensures that medications are stored and transported under optimal conditions, reducing the risk of spoilage or tampering

- With increasing regulatory requirements for drug traceability and anti-counterfeit measures, smart blister packaging provides a solution that meets these standards. The ability to authenticate products and track their journey from manufacturer to end-user helps in complying with stringent regulations

- Consumers are becoming more health-conscious and are seeking products that offer enhanced safety features. Smart blister packs cater to this demand by providing additional layers of security and information, thus building trust and brand loyalty

- The adoption of smart blister packaging is contributing to the overall growth of the pharmaceutical packaging market. As more manufacturers incorporate these technologies, the market is witnessing increased investments and innovations aimed at enhancing product offerings and meeting consumer expectations

Pharmaceutical Blister Packaging Market Dynamics

Driver

“Increasing Demand for Unit-Dose Packaging”

- Unit-dose blister packaging offers individual compartments for each dose, reducing the risk of medication errors and improving patient adherence to prescribed regimens

- Each dose is sealed separately, safeguarding medications from environmental factors such as moisture, light, and air, thereby maintaining their efficacy

- Blister packs are portable and easy to use, making them particularly beneficial for elderly patients or those with chronic conditions who require multiple medications

- Blister packaging reduces waste by providing precise doses, which can lead to cost savings for both manufacturers and consumers

- Regulatory bodies in various regions are increasingly mandating unit-dose packaging for certain medications to enhance safety and traceability

Opportunity

“Adoption of Sustainable Packaging Materials”

- The pharmaceutical industry is under pressure to reduce its environmental footprint, leading to a shift towards eco-friendly packaging solutions

- Companies are exploring biodegradable and recyclable materials, such as paperboard and bio-based plastics, to replace traditional non-biodegradable options

- Governments are offering incentives for adopting sustainable practices, encouraging manufacturers to invest in eco-friendly packaging

- There is a growing consumer preference for products with minimal environmental impact, prompting companies to align their packaging strategies accordingly

- Adopting sustainable packaging can serve as a competitive differentiator, enhancing brand image and attracting environmentally conscious consumers

Restraint/Challenge

“High Production Costs of Advanced Packaging Solutions”

- Implementing advanced blister packaging technologies requires significant capital expenditure, which can be a barrier for smaller manufacturers

- The maintenance and operation of sophisticated packaging machinery incur ongoing costs, impacting profitability

- Rapid advancements in packaging technology necessitate frequent upgrades, leading to additional financial burdens

- There is a lack of skilled personnel to operate and maintain advanced packaging equipment, leading to increased training costs

- Meeting stringent regulatory requirements for packaging materials and processes adds complexity and cost to production

Pharmaceutical Blister Packaging Market Scope

The market is segmented on the basis product type, technology type, material, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology Type |

|

|

By Material |

|

|

By Application |

|

Pharmaceutical Blister Packaging Market Regional Analysis

“North America is the Dominant Region in the Pharmaceutical Blister Packaging Market”

- North America continues to lead the global pharmaceutical blister packaging market, attributed to its advanced healthcare systems and significant pharmaceutical industry presence

- Stringent regulations and a focus on product safety have bolstered the demand for high-quality packaging solutions

- The region holds a substantial market share, with major pharmaceutical companies and packaging manufacturers operating within its borders.

- There is a growing consumer preference for convenient and tamper-evident packaging, further driving market growth

- The presence of leading packaging companies in North America contributes to its dominant position in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is experiencing rapid economic development, leading to increased demand for pharmaceutical products and, consequently, blister packaging solutions

- For Instance, countries such as China and India are witnessing significant growth in their healthcare sectors, necessitating advanced packaging solutions

- The region's large and aging population is driving the need for efficient and safe medication packaging

- Government initiatives aimed at improving healthcare infrastructure are positively impacting the pharmaceutical packaging market

- Asia-Pacific is projected to exhibit the highest compound annual growth rate during the forecast period, reflecting its burgeoning market potential

Pharmaceutical Blister Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Schott (Germany)

- Amcor plc (Switzerland)

- Dow (U.S.)

- AptarGroup, Inc. (U.S.)

- Klöckner Pentaplast (U.K.)

- West Pharmaceutical Services, Inc. (U.S.)

- Berry Global Inc. (U.S.)

- Honeywell International, Inc. (U.S.)

- ACG (India)

- Nipro (Japan)

- Gerresheimer AG (Germany)

- Catalent Inc. (U.S.)

- WestRock Company (U.S.)

Latest Developments in Global Pharmaceutical Blister Packaging Market

- In May 2024, TerraCycle, a company dedicated to global recycling initiatives, introduced TerraCycle BlisterBack in the U.K. This innovative solution targets the health industry, aiming to minimize the incineration of blister packs and prevent them from reaching landfills. Medicine blister packs, composed of a challenging blend of materials such as plastic and aluminum foil, are designed to safeguard medications

- In November 2023, Schreiner MediPharm, in collaboration with packaging specialist Keystone Folding Box Co., expanded its portfolio of smart blister packs tailored for clinical trials. Keystone, renowned for its expertise in the pharmaceutical sector, has introduced a unique, child-resistant, and senior-friendly solution. By incorporating integrated electronics, these blister packs now function as a real-time e-diary, effectively capturing dosing history data

- In January 2024, TekniPlex Healthcare, partnered with Alpek Polyester to introduce a pharmaceutical-grade polyethylene terephthalate (PET) blister film. This innovative film incorporates 30% post-consumer recycled (PCR) monomers. According to the company, when this blister film is paired with its Teknilid Push polyester lidding, the resulting film-plus-lidding blister system can be fully recycled within the polyester recycling stream, provided the necessary infrastructure is in place

- In July 2023, Constantia Flexibles revealed REGULA CIRC, its 'total barrier,' designed-for-recycling cold-form foil solution for sustainable pharmaceutical blister packaging applications. A polyethylene sealing layer is set to replace traditional PVC solutions; a transition is seeking to simplify the sorting process, improve the pack's recyclability, and, in turn, improve material recoverys

- In October 2023, WINPAK Films, Inc., a division of WINPAK LTD, acquired approximately 44 acres of land adjacent to its current facility in Senoia, with the intention of potential future expansion. The property was purchased from the Senoia Development Authority for a sum of USD 890,000. This strategic decision reflects WINPAK's objective of broadening its geographical footprint in North America, positioning the company for future growth and enhanced operations in the region

- In July 2023, Constantia Flexibles introduced a new pharmaceutical packaging solution called REGULA CIRC, which utilizes coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in a reduction in plastic content while increasing the proportion of aluminum. This optimization not only enhances the sustainability of the packaging but also improves material recovery during recycling processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pharmaceutical Blister Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pharmaceutical Blister Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pharmaceutical Blister Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.