Global Pharmaceutical Caps And Closures Market

Market Size in USD Billion

CAGR :

%

USD

56.98 Billion

USD

86.53 Billion

2025

2033

USD

56.98 Billion

USD

86.53 Billion

2025

2033

| 2026 –2033 | |

| USD 56.98 Billion | |

| USD 86.53 Billion | |

|

|

|

|

Pharmaceutical Caps and Closures Market Size

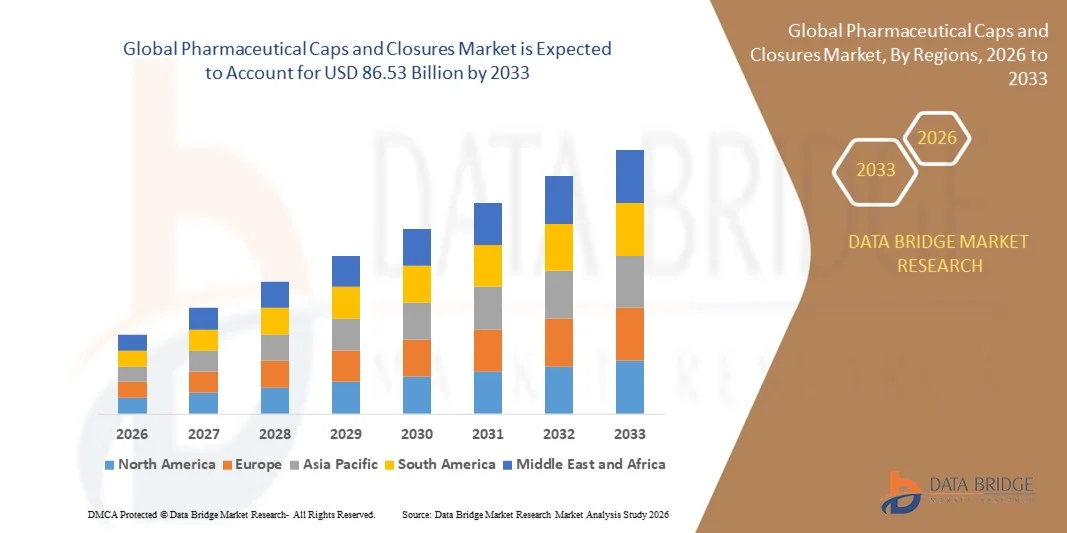

- The global pharmaceutical caps and closures market size was valued at USD 56.98 billion in 2025 and is expected to reach USD 86.53 billion by 2033, at a CAGR of 5.36% during the forecast period

- The market growth is largely fueled by the rising demand for high-quality, contamination-resistant packaging components across global pharmaceutical manufacturing, driven by increasing production of generics, biologics, and injectable formulations. Growing emphasis on patient safety, regulatory compliance, and sterile packaging standards is expanding the adoption of advanced caps and closures in large-scale drug packaging environments

- Furthermore, the increasing need for tamper-evident, child-resistant, and secure closure systems across prescription, OTC, and specialty drug categories is strengthening the transition toward more reliable and durable pharmaceutical closure solutions. These converging factors are accelerating the uptake of pharmaceutical caps and closures, thereby significantly boosting the industry’s growth

Pharmaceutical Caps and Closures Market Analysis

- Pharmaceutical caps and closures, used to seal and protect liquid, solid, and injectable medications, are becoming indispensable components of pharmaceutical packaging due to their role in ensuring sterility, product integrity, and safe patient usage throughout the supply chain. Their widespread adoption across vials, bottles, and containers is driven by the need for reliable sealing performance and compatibility with automated filling systems

- The escalating demand for pharmaceutical caps and closures is primarily fueled by the rapid expansion of drug manufacturing, increasing consumption of healthcare products, and the growing preference for standardized, regulatory-compliant packaging components. Rising adoption of advanced molding technologies and high-performance materials further supports strong market momentum

- Asia-Pacific dominated the pharmaceutical caps and closures market with a share of 42.2% in 2025, due to expanding pharmaceutical manufacturing, rising production of generics, and the presence of large-scale packaging facilities

- North America is expected to be the fastest growing region in the pharmaceutical caps and closures market during the forecast period due to strong demand for high-quality pharmaceutical packaging components and increasing investments in automated production lines

- PP segment dominated the market with a market share of 56.73% in 2025, due to its high chemical resistance, lightweight structure, and suitability for sterilization processes used in pharma packaging. Manufacturers adopt PP closures due to their durability and ability to withstand temperature variations without compromising product safety. Its recyclability and sustainability benefits further support widespread adoption. Pharmaceutical liquids, dry formulations, and nutraceutical supplements increasingly use PP closures due to their performance stability. In addition, advancements in medical-grade PP compositions boost long-term dominance

Report Scope and Pharmaceutical Caps and Closures Market Segmentation

|

Attributes |

Pharmaceutical Caps and Closures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Caps and Closures Market Trends

Rising Adoption of Sustainable and Recyclable Closure Solutions

- The pharmaceutical caps and closures market is witnessing a significant shift toward sustainable and recyclable closure technologies as manufacturers and regulators emphasize eco-friendly packaging solutions. Companies are integrating bio-based materials, recyclable polymers, and biodegradable additives into closure systems to align with global sustainability mandates and reduce plastic waste across healthcare packaging

- For instance, West Pharmaceutical Services and Duni Group have developed advanced recyclable and low-PFAS closure ranges in response to consumer preferences for less-plastic alternatives and growing regulatory attention on material safety. Their initiatives are promoting industry-wide innovation by introducing automated molding technologies and smart closures compatible with high-volume pharmaceutical lines

- Sustainability programs driven by industry coalitions and international guidelines are accelerating the uptake of recyclable closure designs. The use of digital technologies for real-time traceability, authentication, and environmental labeling further encourages the adoption of circular economy principles within pharmaceutical packaging

- Expansion in biologics, specialty drugs, and over-the-counter (OTC) products is increasing demand for closures with enhanced barrier properties, ensuring both sterility and recyclability. Companies are incorporating smart packaging elements, senior-friendly formats, and child-resistant features without compromising material recovery and environmental impact

- In addition, regulatory agencies in regions such as Japan and the EU are supporting the transition to eco-friendly packaging through grants, incentives, and updated standards emphasizing patient safety and minimal environmental burden. This is prompting new product development and fast-tracked market entry for sustainable closure solutions

- The overall trend marks a holistic evolution in pharmaceutical packaging, with sustainable and recyclable closures set to redefine industry standards for environmental compliance, patient safety, and material innovation in the next decade

Pharmaceutical Caps and Closures Market Dynamics

Driver

Increasing Demand for Sterile and Tamper-Evident Packaging in Pharmaceuticals

- The escalating demand for sterile and tamper-evident packaging is a major driver supporting the growth of pharmaceutical caps and closures. Ensuring product integrity, patient safety, and regulatory compliance has become integral to the manufacturing and distribution of pharmaceuticals, driving widespread adoption of advanced closure technologies across the value chain

- For instance, companies such as Bharat Rubber Works and Aptar Pharma are introducing a range of tamper-evident, child-resistant, and dosing closures that cater to regulated injectable and oral drug products. Their product portfolios address the rising global need for contamination-free and leakage-proof packaging for high-value medications, specialty injectables, and emerging biopharmaceutical formats

- Heightened focus on anti-counterfeiting and authentication measures is prompting pharmaceutical companies to invest in closures with smart tracking, serialized labeling, and real-time monitoring capabilities. These features enable traceability and deter the proliferation of counterfeit drugs within the supply chain

- In addition, expansion of healthcare infrastructure, growth in prescription and OTC drug markets, and increased self-administered therapies have fueled demand for closures that are both easy to use and meet high clinical safety standards. Senior-friendly and error-minimizing closure designs are particularly important in regions with aging populations

- International regulatory requirements emphasize advanced closure solutions capable of maintaining sterility, security, and compatibility with sensitive drug formulations. Investment in manufacturing automation and next-generation quality control is supporting broader uptake of precision-engineered pharmaceutical closures across global markets

Restraint/Challenge

High Compliance Requirements and Stringent Regulatory Standards

- Stringent regulatory standards and high compliance requirements present significant operational challenges for pharmaceutical caps and closures manufacturers. The need to meet global pharmacopoeial, FDA, EMA, and ISO specifications for material composition, sterility, tamper evidence, and chemical resistance intensifies production complexity and increases costs

- For instance, companies such as Datwyler Sealing Solutions and Ompi must invest in extensive testing, certification, and documentation processes to ensure closure compatibility with new drug formulations—including specialty biologics and complex injectables. These protocols often result in longer development timelines and higher barriers to market entry

- Constant updates in regional and international packaging safety requirements add further complexities, compelling producers to maintain flexible quality management and adaptive regulatory strategies. Frequent audits, material traceability mandates, and risk-based design controls are standard components of regulatory compliance in the pharmaceutical packaging sector

- Specialized production technologies, such as cleanroom molding and high-precision manufacturing, are required to consistently deliver compliant, defect-free closure solutions for pharmaceutical products. This leads to increased capital expenditure and operating costs, particularly for new entrants or manufacturers scaling innovation pipelines

- Navigating multifaceted compliance regimes while accelerating sustainable innovation will require collaborative dialogue between manufacturers, regulatory authorities, and supply partners. Streamlined regulatory pathways, harmonized quality standards, and proactive compliance investment are essential to sustain growth and competitiveness in the evolving pharmaceutical caps and closures market

Pharmaceutical Caps and Closures Market Scope

The market is segmented on the basis of product, technology, and raw material.

- By Product

On the basis of product, the pharmaceutical caps and closures market is segmented into screw-on caps and dispensing caps. The screw-on caps segment dominated the market due to its high adaptability across bottles, vials, and liquid formulations in regulated pharmaceutical environments. Manufacturers prefer screw-on caps for their strong sealing integrity, which prevents contamination and ensures product stability throughout the supply chain. Their compatibility with automated packaging lines in large-scale production also strengthens their market presence. Rising production of generics and increased demand for OTC liquid medications further support the dominance of screw-on caps. In addition, the availability of tamper-evident designs enhances patient safety and reinforces regulatory compliance.

The dispensing caps segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by increasing demand for precise and hygienic drug administration. Pharmaceutical companies rely on dispensing caps for controlled dispensing of syrups, topical liquids, and pediatric formulations, improving user convenience and dosage accuracy. Growth in home-based therapy adoption accelerates the shift toward dispensing-enabled closure systems. Technological progress in child-resistant and tamper-proof dispensing mechanisms further increases market acceptance. Their expanding adoption in nutraceutical liquids and wellness formulations fuels additional momentum.

- By Technology

On the basis of technology, the market is segmented into injection molding, compression molding, and post-mold TE band. Injection molding dominated the market as it enables high-precision production with strict dimensional accuracy required for medical-grade closures. The process supports mass production of complex designs with consistent quality, benefiting large pharmaceutical packaging manufacturers. Its suitability for producing child-resistant, tamper-evident, and secure closures increases reliance on injection molding. Lower defect rates and strong material performance reinforce its leadership. In addition, continuous improvements in multi-cavity injection systems reduce manufacturing costs and enhance output efficiency.

The compression molding segment is projected to experience the fastest growth from 2026 to 2033, driven by its ability to produce lightweight closures with superior performance in high-stress packaging conditions. The process uses less energy and offers better material distribution, which makes it suitable for high-volume production of uniform caps. Pharmaceutical manufacturers prefer compression molding for its scalability and lower wastage ratio. Rising investments in precision compression lines for high-density polyethylene closures further expand market demand. Its suitability for both standard and child-resistant cap designs supports rapid adoption across diverse packaging formats.

- By Raw Material

On the basis of raw material, the pharmaceutical caps and closures market is segmented into PP, HDPE, and LDPE. PP dominated the market with the largest market share of 56.73%, owing to its high chemical resistance, lightweight structure, and suitability for sterilization processes used in pharma packaging. Manufacturers adopt PP closures due to their durability and ability to withstand temperature variations without compromising product safety. Its recyclability and sustainability benefits further support widespread adoption. Pharmaceutical liquids, dry formulations, and nutraceutical supplements increasingly use PP closures due to their performance stability. In addition, advancements in medical-grade PP compositions boost long-term dominance.

HDPE is expected to witness the fastest growth from 2026 to 2033, supported by its strong barrier properties and suitability for moisture-sensitive drug formulations. Pharmaceutical companies adopt HDPE closures for their rigidity and high stress-cracking resistance, ensuring safety during transportation and storage. Growth in production of OTC health supplements, liquid medicines, and pediatric syrups expands the use of HDPE caps. Its cost-efficiency and compatibility with large-volume production lines further increase adoption. In addition, growing demand for eco-friendly and lightweight packaging materials enhances the future growth prospects of HDPE closures.

Pharmaceutical Caps and Closures Market Regional Analysis

- Asia-Pacific dominated the pharmaceutical caps and closures market with the largest revenue share of 42.2% in 2025, driven by expanding pharmaceutical manufacturing, rising production of generics, and the presence of large-scale packaging facilities

- The region’s cost-effective manufacturing ecosystem, growing investments in sterile packaging capabilities, and increasing consumption of OTC and prescription drugs are accelerating market expansion

- The availability of skilled labor, supportive government initiatives in pharma infrastructure, and rapid industrial growth across developing economies are contributing to higher demand for pharmaceutical caps and closures

China Pharmaceutical Caps and Closures Market Insight

China held the largest share in the Asia-Pacific pharmaceutical caps and closures market in 2025 due to its strong pharmaceutical production capacity and extensive network of packaging manufacturers. Increasing investments in advanced molding technologies and strong export capabilities for finished drugs and formulations support market strength. The country’s rapid shift toward high-quality, compliant packaging solutions enhances demand for caps and closures. Growing consumption of healthcare products and continuous expansion of domestic pharma firms further contribute to market growth.

India Pharmaceutical Caps and Closures Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, supported by its rapidly expanding generic drug industry and growing emphasis on quality-compliant pharmaceutical packaging. Rising investments in manufacturing facilities, driven by the “Make in India” initiative, are strengthening demand for closures used in tablets, syrups, and injectable packaging. Increasing exports of pharmaceuticals to regulated markets and growth in OTC medication consumption are boosting market expansion. In addition, rising adoption of child-resistant and tamper-evident closures is accelerating uptake across drug manufacturers.

Europe Pharmaceutical Caps and Closures Market Insight

The Europe pharmaceutical caps and closures market is expanding steadily, driven by stringent regulatory standards, high demand for safe and compliant drug packaging, and increasing investments in sustainable packaging technologies. The region maintains a strong focus on high-purity materials, quality assurance, and advanced molding solutions to meet pharmaceutical-grade requirements. Growing emphasis on recyclable and eco-friendly closure systems is shaping product development. The use of advanced caps and closures in specialty drugs and high-end formulations is supporting market expansion.

Germany Pharmaceutical Caps and Closures Market Insight

Germany’s market is driven by its leadership in precision pharmaceutical manufacturing and its long-standing expertise in high-quality packaging production. Strong collaboration between pharmaceutical companies, material suppliers, and research institutes enhances innovation in high-performance closure systems. Demand is supported by the country’s focus on sterile packaging, complex dosage forms, and regulatory-compliant components. The presence of well-established pharmaceutical exporters further strengthens the adoption of premium caps and closures.

U.K. Pharmaceutical Caps and Closures Market Insight

The U.K. market is supported by a mature life sciences ecosystem, growing localization of pharmaceutical packaging supply chains, and increasing focus on high-value drug development. Efforts to enhance domestic formulation and packaging capabilities are contributing to higher adoption of specialized closures. Rising investments in R&D centers, academic-industry partnerships, and advanced material testing facilities support growth. The U.K. continues to hold a strong position in supplying precision-made caps and closures for niche and specialty pharmaceuticals.

North America Pharmaceutical Caps and Closures Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for high-quality pharmaceutical packaging components and increasing investments in automated production lines. The region’s advanced drug development landscape, strict regulatory compliance standards, and rising adoption of innovative closure technologies support rapid expansion. Growth in biologics, injectables, and OTC medications also contributes to increased closure demand. In addition, reshoring of pharmaceutical manufacturing strengthens the supply chain for caps and closures.

U.S. Pharmaceutical Caps and Closures Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its extensive pharmaceutical manufacturing base and strong preference for premium, compliant closure solutions. High investment in R&D, continuous innovation in molded packaging components, and stringent FDA requirements drive adoption of high-performance caps and closures. The presence of major pharma companies and a robust distribution network further reinforces the country’s leading position. Growing production of advanced therapies and injectable drugs continues to strengthen market demand.

Pharmaceutical Caps and Closures Market Share

The pharmaceutical caps and closures industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Berry Global Inc. (U.S.)

- Caps & Closures Pty Ltd (Australia)

- Closure Systems International (U.S.)

- O.Berk (U.S.)

- Röchling (Germany)

- SABIC (Saudi Arabia)

- Silgan Holdings Inc. (U.S.)

- Tecnocap S.p.A (Italy)

- Crown (U.S.)

- Bericap (Germany)

- AptarGroup, Inc. (U.S.)

- Coral Products (U.K.)

- Guala Closures S.p.A (Italy)

- UNITED CAPS (Luxembourg)

- Caprite Australia (Australia)

- Pano Cap (Canada)

- Plastic Closures (U.K.)

- TriMas (U.S.)

- COMAR, LLC (U.S.)

- J.L. CLARK (U.S.)

- MJS Packaging (U.S.)

Latest Developments in Global Pharmaceutical Caps and Closures Market

- In May 2025, AptarGroup entered a strategic partnership with a leading pharmaceutical company to co-develop smart, connected closure systems featuring capabilities such as serialization, traceability, and digital dose monitoring. This collaboration accelerates the integration of intelligent technologies in sterile drug packaging and supports the rising focus on patient safety and regulatory compliance. The initiative positions Aptar at the forefront of next-generation digital pharmaceutical packaging solutions

- In January 2025, West Pharmaceutical Services introduced its Daikyo PLASCAP Ready-to-Use Validated (RUV) closures in a nested configuration, enabling faster, cleaner, and more efficient fill-finish operations for advanced therapeutics. This launch strengthens the availability of sterile, high-precision closure systems tailored for biologics, cell therapies, and high-value injectables. The development enhances production reliability for pharma manufacturers and reinforces West’s competitive position in the rapidly expanding injectable packaging segment

- In June 2023, Aptar Pharma launched a new elastomeric closure engineered specifically for high-potency and sensitive drug formulations, improving contamination control and product integrity. This innovation directly addresses the rising demand for secure packaging components suitable for potent APIs and biologics. It enhances patient safety, strengthens quality assurance, and elevates Aptar’s presence in the premium elastomeric closure market

- In May 2023, West Pharmaceutical expanded its North American manufacturing capacity to meet the growing need for pre-sterilized and ready-to-use closures across injectable drug platforms. This expansion improves supply chain resilience for pharmaceutical companies and ensures consistent availability of critical components required for aseptic filling. The increased production capability also reinforces West’s role as a dependable supplier to regulated pharma markets

- In April 2023, Datwyler entered a strategic partnership focused on advancing sustainable packaging solutions for biologics by incorporating eco-efficient materials and improved manufacturing processes. The collaboration strengthens industry efforts toward greener pharmaceutical packaging without compromising sterility or performance. It positions Datwyler as a key contributor to sustainability-driven innovation in the caps and closures ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pharmaceutical Caps And Closures Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pharmaceutical Caps And Closures Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pharmaceutical Caps And Closures Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.