Global Pharmaceutical Excipients Market

Market Size in USD Billion

CAGR :

%

USD

8.85 Billion

USD

14.77 Billion

2024

2032

USD

8.85 Billion

USD

14.77 Billion

2024

2032

| 2025 –2032 | |

| USD 8.85 Billion | |

| USD 14.77 Billion | |

|

|

|

|

Pharmaceutical Excipients Market Size

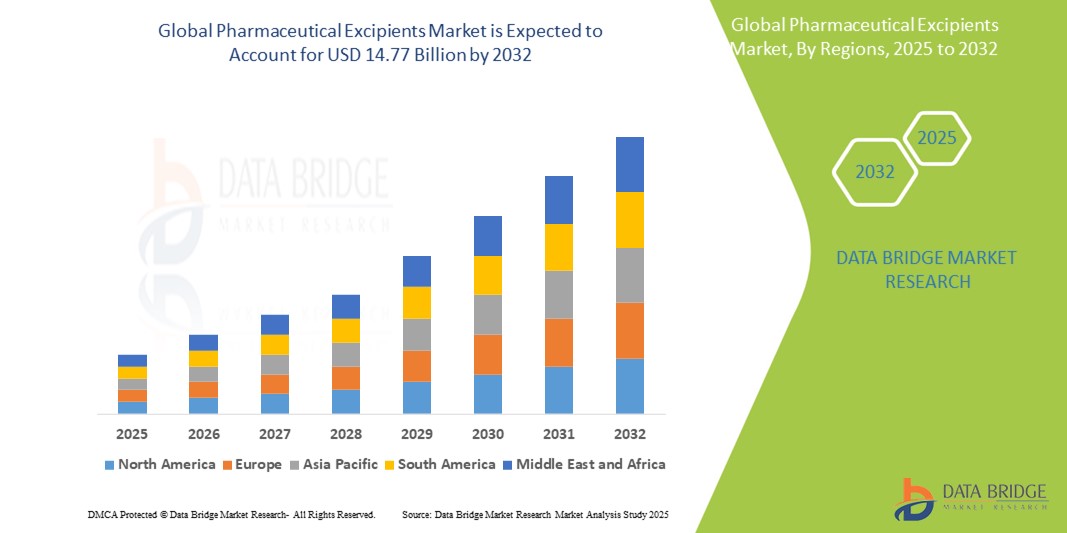

- The global pharmaceutical excipients market size was valued at USD 8.85 billion in 2024 and is expected to reach USD 14.77 billion by 2032, at a CAGR of 6.60% during the forecast period

- This growth is driven by factors such as the expansion of the pharmaceutical industry, rise in generic drug development, and technological advancements in drug delivery systems

Pharmaceutical Excipients Market Analysis

- Pharmaceutical excipients are essential, non-active substances used in drug formulations to improve stability, bioavailability, and patient compliance. They play a crucial role in drug manufacturing, serving as binders, fillers, coatings, and stabilizers

- The demand for pharmaceutical excipients is significantly driven by the rising prevalence of chronic diseases, increasing generic drug production, and advancements in drug delivery technologies

- North America dominates the pharmaceutical excipients market, with share of 39.8% of the global pharmaceutical excipients market driven by its advanced pharmaceutical manufacturing capabilities, high healthcare expenditure, and strong presence of key market players

- Asia pacific market holds a share of 30.4% of the global pharmaceutical excipients market, driven by rapid expansion in pharmaceutical manufacturing, rising healthcare expenditures, and growing demand for cost-effective drug formulations

- Binders and adhesives are expected to dominate the pharmaceutical excipients market with the largest share of 56.72% in 2023, driven by their critical role in tablet and capsule formulations. These excipients provide structural integrity and ensure uniformity in drug content, supporting consistent therapeutic outcomes

Report Scope and Pharmaceutical Excipients Market Segmentation

|

Attributes |

Pharmaceutical Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Excipients Market Trends

“Innovations in Pharmaceutical Excipients for Advanced Drug Delivery”

- One prominent trend in the pharmaceutical excipients market is the growing focus on multifunctional excipients that support advanced drug delivery systems, including controlled-release, targeted delivery, and orally disintegrating formulations

- These innovative excipients enhance drug stability, bioavailability, and patient compliance, playing a crucial role in the formulation of complex drugs, biologics, and personalized medicines

- For instance, excipients such as cyclodextrins improve solubility and stability for poorly water-soluble drugs, while lipid-based excipients support the delivery of highly lipophilic compounds, facilitating efficient absorption and therapeutic impact

- These advancements are transforming drug development, enabling pharmaceutical companies to overcome formulation challenges, enhance therapeutic outcomes, and drive the demand for novel, high-performance excipients

Pharmaceutical Excipients Market Dynamics

Driver

“Rising Demand for Innovative Drug Delivery Systems”

- The growing focus on patient-centric therapies and personalized medicine is significantly driving the demand for advanced pharmaceutical excipients that support innovative drug delivery systems, such as controlled-release, targeted delivery, and orally disintegrating tablets

- As pharmaceutical companies strive to improve therapeutic outcomes and patient compliance, the need for excipients that can enhance bioavailability, stability, and solubility of active pharmaceutical ingredients (APIs) is rising

- In addition, the trend toward biologics and complex drug formulations, which often require specialized excipients, is further fueling market growth

For instance,

- According to a 2024 report by the Pharmaceutical Research and Manufacturers of America (PhRMA), the number of biologic drugs in development has more than doubled in the past decade, creating a substantial demand for novel excipients that can address the unique challenges of biologic formulations

- As the pharmaceutical industry continues to innovate, the demand for advanced excipients that can support these cutting-edge therapies is expected to grow significantly

Opportunity

“Expansion into Emerging Markets with Rapid Pharmaceutical Growth”

- Emerging economies, particularly in the Asia-Pacific and Latin American regions, present a significant opportunity for pharmaceutical excipient manufacturers, driven by rapid economic growth, increasing healthcare spending, and expanding pharmaceutical manufacturing capabilities

- These regions are experiencing a surge in demand for cost-effective generic drugs, over-the-counter (OTC) medications, and biologics, creating a favorable market for excipients that can support diverse formulation needs

- In addition, favorable government policies, rising health awareness, and growing investments in local pharmaceutical manufacturing are expected to further boost excipient demand

For instance,

- In January 2025, according to a report by the Indian Pharmaceutical Alliance, India is projected to become the world’s third-largest pharmaceutical market by 2030, driven by strong domestic demand and expanding export opportunities. This growth will significantly increase the demand for pharmaceutical excipients required for drug formulation and manufacturing

- As a result, excipient manufacturers that strategically expand into these fast-growing markets stand to benefit from increased sales and market share

Restraint/Challenge

“Stringent Regulatory Requirements and High Compliance Costs”

- The pharmaceutical excipients market faces significant challenges related to stringent regulatory requirements that govern the safety, quality, and performance of excipients used in drug formulations

- These regulations, which vary significantly across regions, often require extensive testing, documentation, and validation, increasing the overall cost and time required for product development and commercialization

- In addition, the need for compliance with Good Manufacturing Practices (GMP), pharmacopoeial standards, and other quality certifications adds to the financial burden for excipient manufacturers

For instance,

- According to a 2024 report by the International Pharmaceutical Excipients Council (IPEC), the cost of regulatory compliance for excipient manufacturers has increased by over 30% in the past five years, as regulatory agencies globally tighten their oversight to ensure patient safety and product efficacy

- These regulatory pressures can limit market entry for smaller players and increase the overall cost of excipient production, impacting profitability and market growth

Pharmaceutical Excipients Market Scope

The market is segmented on the basis of functionality, dosage form, route of administration, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Functionality |

|

|

By Dosage Form |

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the binders and adhesives is projected to dominate the market with a largest share in functionality segment

The binders and adhesives segment is expected to dominate the pharmaceutical excipients market with the largest share of 56.72%, driven by their critical role in tablet and capsule formulations. These excipients provide structural integrity and ensure uniformity in drug content, supporting consistent therapeutic outcomes. Their widespread use is further propelled by the high demand for solid oral dosage forms, which are preferred for their convenience, stability, and patient compliance, reinforcing their market dominance.

The oral excipients is expected to account for the largest share during the forecast period in route of administration market

In 2025, the oral excipients segment dominated the pharmaceutical excipients market with the largest market share of 55.49%, driven by its widespread use and patient preference for oral drug delivery. These formulations are favoured due to their ease of administration, cost-effectiveness, and high patient compliance. Excipients in this category are essential for enhancing the bioavailability, stability, and taste of oral medications, reinforcing their market dominance.

Pharmaceutical Excipients Market Regional Analysis

“North America Holds the Largest Share in the Pharmaceutical Excipients Market”

- North America dominates the pharmaceutical excipients market, with share of 39.8% of the global pharmaceutical excipients market driven by its advanced pharmaceutical manufacturing capabilities, high healthcare expenditure, and strong presence of key market players

- U.S. holds a significant share of 39% due to its well-established pharmaceutical industry, extensive research and development activities, and growing demand for innovative drug delivery systems, including controlled-release and targeted formulations

- In addition, the presence of major pharmaceutical companies and stringent regulatory standards for drug safety and efficacy further strengthen the market in the region

- The increasing focus on biologics, personalized medicine, and specialty drugs also contributes to the high demand for high-quality excipients, reinforcing North America's leadership in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Pharmaceutical Excipients Market”

- Asia-Pacific is expected to witness the highest growth rate in the pharmaceutical excipients Market with a market share of share of 30.4%, driven by rapid expansion in pharmaceutical manufacturing, rising healthcare expenditures, and growing demand for cost-effective drug formulations

- Countries such as China, India, and Japan are emerging as key markets, supported by favorable government policies, a large patient population, and increasing prevalence of chronic diseases requiring long-term medication

- Japan, known for its cutting-edge pharmaceutical research and advanced drug manufacturing technologies, remains a crucial market for premium excipients that support innovative drug formulations

- India is projected to register the highest growth in market share with CAGR of 5.1%, driven by the rapid growth of its generic drug industry, expanding healthcare infrastructure, and increasing investments in pharmaceutical R&D, making it a key player in the global excipients market

Pharmaceutical Excipients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Kerry Group plc (Ireland)

- DFE Pharma (Germany)

- Cargill, Incorporated (U.S.)

- Pfanstiehl Inc. (U.S.)

- Colorcon Inc. (U.S.)

- MEGGLE Group GmbH (Germany)

- Omya International AG (Switzerland)

- Peter Greven GmbH & Co. KG (Germany)

- Ashland (U.S.)

- Evonik Industries AG (Germany)

- Dow (U.S.)

- Croda International Plc (U.K.)

- Roquette Frères (France)

- The Lubrizol Corporation (U.S.)

- BASF (Germany)

- Avantor, Inc. (U.S.)

- BENEO GmbH (Germany)

- Chemie Trade (India)

Latest Developments in Global Pharmaceutical Excipients Market

- In November 2024, Clariant introduced eight new high-performing pharmaceutical excipients at the CPHI India 2024 trade show. These excipients are designed to support the development of safe and effective medicines, catering to applications such as sensitive APIs, parenteral formulations, and formulations requiring colorless solutions

- In January 2025, Roquette launched three new excipient grades specifically designed for moisture-sensitive active pharmaceutical ingredients (APIs), enhancing stability and efficacy in challenging formulations

- In January 2025, Evonik expanded its portfolio of lipid-based pharmaceutical excipients through strategic acquisitions, supporting the growing demand for novel drug delivery systems and high-quality excipients that improve bioavailability and stability

- In January 2025, Akums Drugs and Pharmaceuticals announced the development of a new facility dedicated to lyophilized and sterile dosage manufacturing, focusing on injectables and biologics, to meet the increasing demand for sterile and biologic drugs

- In September 2024, Glenmark Pharmaceuticals launched a biosimilar variant of the anti-diabetic drug Liraglutide, marking a pioneering endeavor in the Indian pharmaceutical landscape and expanding its biologics portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.