Global Pharmaceutical Glass Packaging Market

Market Size in USD Billion

CAGR :

%

USD

21.18 Billion

USD

37.08 Billion

2024

2032

USD

21.18 Billion

USD

37.08 Billion

2024

2032

| 2025 –2032 | |

| USD 21.18 Billion | |

| USD 37.08 Billion | |

|

|

|

Pharmaceutical Glass Packaging Market Analysis

The pharmaceutical glass packaging market is experiencing significant growth, driven by increasing demand for high-quality and contamination-free drug storage solutions. Glass packaging offers excellent chemical resistance, transparency, and durability, making it a preferred choice for preserving drug stability. Advancements in manufacturing technologies, such as the development of lightweight, high-strength borosilicate glass and enhanced coating techniques, have further improved the performance and safety of pharmaceutical glass containers. Companies are investing in innovations such as smart packaging, digital tracking solutions, and sustainable glass production to meet regulatory standards and environmental concerns. The rising prevalence of chronic diseases, an aging population, and expanding pharmaceutical industries, especially in emerging economies, are fueling market expansion. North America leads the market due to high pharmaceutical investments and increasing demand for generic drugs, while the Asia-Pacific region is witnessing rapid growth due to improved healthcare infrastructure and rising disposable incomes. Collaborations between pharmaceutical companies and packaging manufacturers are enhancing supply chain efficiency and innovation. Overall, the pharmaceutical glass packaging market is poised for substantial growth, driven by technological advancements, regulatory compliance, and evolving industry needs.

Pharmaceutical Glass Packaging Market Size

The pharmaceutical glass packaging market size was valued at USD 21.18 billion in 2024 and is projected to reach USD 37.08 billion by 2032, with a CAGR of 7.25% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Pharmaceutical Glass Packaging Market Trends

“Rising Demand for Sustainable and Eco-Friendly Packaging”

The pharmaceutical glass packaging market is evolving rapidly, with sustainable and eco-friendly packaging emerging as a key trend. With growing environmental concerns and strict regulatory policies, manufacturers are focusing on recyclable glass, lightweight designs, and energy-efficient production methods. Companies such as SGD Pharma have introduced low-carbon glass vials, reducing carbon footprints while maintaining product integrity. In addition, advancements in biodegradable coatings and lightweight borosilicate glass are improving both sustainability and performance. This trend aligns with the pharmaceutical industry's commitment to green packaging solutions, driven by consumer demand and government regulations. The rise of circular economy initiatives is pushing companies toward closed-loop recycling systems, minimizing waste and enhancing material reuse. As sustainability becomes a competitive advantage, leading players such as Gerresheimer AG and SCHOTT AG are investing in eco-friendly pharmaceutical glass packaging, ensuring both drug safety and environmental responsibility. This shift is set to redefine the market, balancing innovation with ecological impact.

Report Scope and Pharmaceutical Glass Packaging Segmentation

|

Attributes |

Pharmaceutical Glass Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Corning Incorporated (U.S.), Nipro Medical Corporation (Japan), SGD Pharma (France), Stoelzle Glass Group (Austria), Bormioli Pharma S.p.A. (Italy), West Pharmaceutical Services, Inc. (U.S.), SCHOTT North America, Inc. (U.S.), Gerresheimer AG (Germany), Beatson Clark (U.K.), Ardagh Group S.A. (Luxembourg), APG Corporate (U.S.), PGP Glass (India), Sisecam Group (Turkey), Shandong Province Medicinal Glass Co., Ltd. (China), Hindusthan National Glass & Industries Limited (India), Acme Vial and Glass Company, LLC. (U.S.), O.Berk Company, LLC. (U.S.), DWK Life Sciences (Germany), BD (Becton, Dickinson and Company) (U.S.), and Amcor plc (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Glass Packaging Market Definition

Pharmaceutical glass packaging refers to the use of specially designed glass containers for storing, protecting, and delivering pharmaceutical products such as liquid medications, injectables, and biological drugs. These packaging solutions, including vials, ampoules, bottles, cartridges, and syringes, ensure drug stability, sterility, and chemical resistance, preventing contamination and degradation.

Pharmaceutical Glass Packaging Market Dynamics

Drivers

- Increasing Pharmaceutical Production

The pharmaceutical industry is witnessing rapid expansion, driven by rising global healthcare needs, increasing R&D investments, and growing demand for medicines, vaccines, and biologics. As pharmaceutical companies scale up production, the demand for high-quality, contamination-free glass packaging is surging. Glass vials, ampoules, and syringes play a critical role in preserving drug integrity, preventing contamination, and ensuring long shelf life. The COVID-19 pandemic, for instance, highlighted the importance of glass vial manufacturing, as vaccine production skyrocketed worldwide. Companies such as SCHOTT AG, Gerresheimer AG, and Corning Incorporated ramped up their vial production capacities to meet the massive global vaccine demand. Similarly, the growing use of biologics and biosimilars is further driving the adoption of chemically resistant borosilicate glass containers. As pharmaceutical manufacturing continues to expand, the need for reliable, advanced, and scalable glass packaging solutions remains a key market driver.

- Growing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, cancer, cardiovascular disorders, and autoimmune conditions is significantly impacting the demand for pharmaceutical glass packaging. Many chronic diseases require long-term medication management, often involving injectable drugs stored in glass vials, syringes, and cartridges to maintain drug efficacy and sterility. For instance, the increasing number of diabetes patients has fueled the demand for insulin pens and prefilled glass cartridges, ensuring precise and safe medication delivery. Similarly, cancer treatments involving chemotherapy drugs, monoclonal antibodies, and immunotherapies require high-quality, break-resistant glass containers to prevent contamination and degradation. With chronic diseases becoming a global health burden, pharmaceutical companies are expanding the production of injectables and biologics, directly boosting the demand for sterile and advanced glass packaging. This trend serves as a major market driver, pushing glass packaging manufacturers to innovate and meet the increasing healthcare requirements.

Opportunities

- Rising Demand for Biologics and Injectable Drugs

The growing adoption of biologics, biosimilars, and specialty drugs is creating a strong demand for high-quality pharmaceutical glass packaging. Biologic drugs, derived from living organisms, are highly sensitive and require sterile, chemically resistant, and inert glass containers to maintain stability and efficacy. Unlike traditional small-molecule drugs, biologics must be stored in specialized glass vials, syringes, and cartridges to prevent contamination and degradation. For instance, monoclonal antibodies (mAbs) used in cancer treatment, such as Keytruda (pembrolizumab) and Herceptin (trastuzumab), require borosilicate glass packaging to ensure long-term stability. In addition, with the rise of biosimilars, pharmaceutical companies are increasing their focus on secure and break-resistant glass solutions. This trend presents a significant market opportunity for manufacturers to develop advanced glass packaging technologies that cater to the expanding injectable drug segment.

- Increasing Technological Advancements in Glass Manufacturing

Innovations in glass manufacturing are transforming the pharmaceutical packaging industry by enhancing durability, efficiency, and drug safety. The introduction of lightweight borosilicate glass helps reduce transportation costs while maintaining high chemical resistance. Companies such as Corning Incorporated have pioneered Valor® Glass, a breakthrough in glass packaging that offers superior strength, chemical durability, and reduced breakage risks. In addition, anti-fragmentation coatings are being developed to minimize contamination risks in case of accidental vial breakage. Another emerging trend is smart glass packaging, which integrates digital tracking and temperature sensors to ensure optimal storage conditions throughout the supply chain. For instance, Gerresheimer AG has been investing in RFID-enabled smart vials that provide real-time data on drug storage conditions. These technological advancements present a significant market opportunity, as pharmaceutical companies seek innovative, high-performance packaging solutions to meet regulatory standards and enhance drug stability.

Restraints/Challenges

- High Manufacturing and Processing Costs

Pharmaceutical glass packaging requires precise manufacturing processes to meet stringent industry standards. The production involves melting high-purity silica at extremely high temperatures (above 1700°C), which is energy-intensive and costly. In addition, specialized coatings, such as aluminosilicate layers, are often applied to enhance durability and chemical resistance, further driving up costs. For instance, borosilicate glass, a preferred material for injectable drugs due to its superior chemical stability, is significantly more expensive to produce than standard soda-lime glass. The rising energy costs worldwide add further financial strain on manufacturers, making glass packaging less competitive compared to cheaper alternatives such as plastics. These high costs trickle down to pharmaceutical companies, leading to higher drug prices or forcing companies to explore alternative materials, affecting the demand for glass packaging.

- Stringent Regulatory Requirements

Pharmaceutical glass packaging must comply with strict global regulations to ensure drug safety and stability. Regulatory agencies such as the U.S. FDA, European Medicines Agency (EMA), and China’s NMPA impose rigorous standards on glass vials, ampoules, and bottles. These regulations cover aspects such as chemical leachability, sterility, and mechanical strength, requiring manufacturers to conduct extensive testing before approval. For instance, in 2020, the FDA issued warnings regarding glass delamination, where tiny glass flakes were found in injectable drugs, leading to product recalls. To prevent such risks, manufacturers must invest in advanced quality control systems and high-purity glass compositions, increasing production costs and time-to-market. In addition, compliance with evolving Good Manufacturing Practices (GMP) forces companies to continuously upgrade facilities and testing protocols, adding further financial and operational burdens.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Pharmaceutical Glass Packaging Market Scope

The market is segmented on the basis of product type, application, and drug type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Vials

- Bottles

- Cartridges and Syringes

- Ampoules

Application

- Oral

- Injectable

- Nasal

- Others

Drug Type

- Generic

- Branded

- Biologic

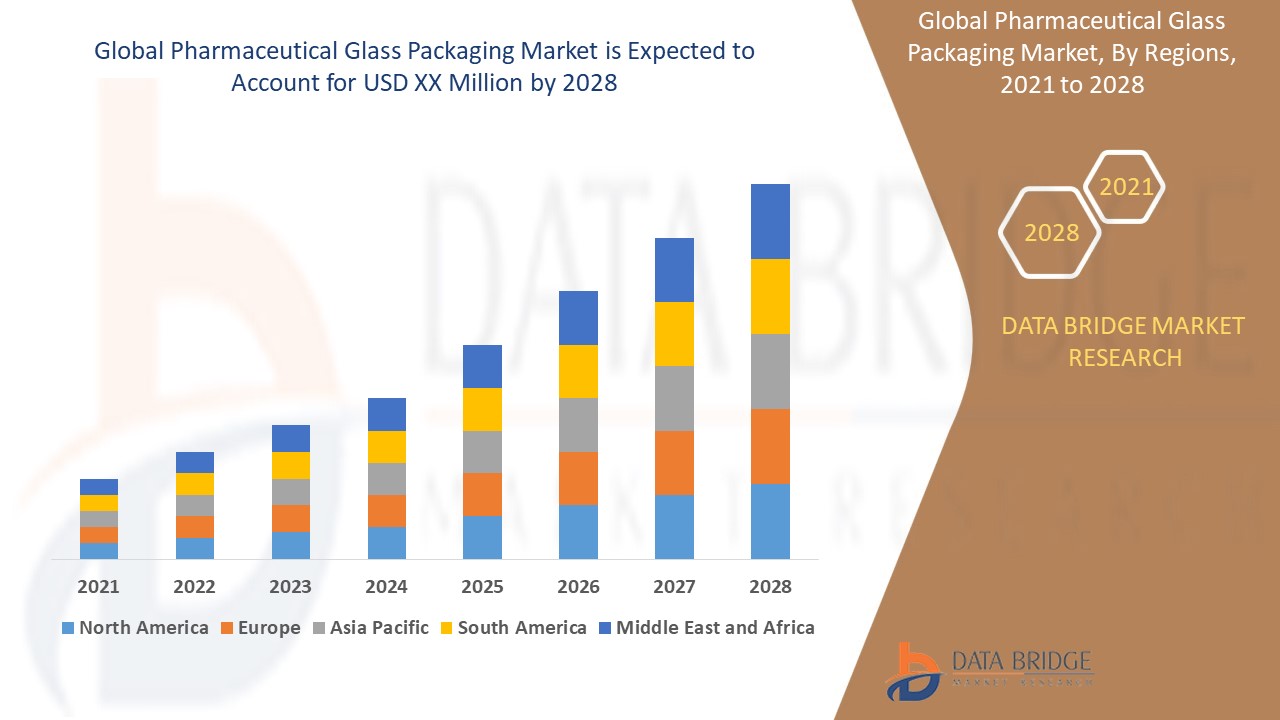

Pharmaceutical Glass Packaging Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, application, and drug type as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

North America dominates the pharmaceutical glass packaging market due to significant growth in pharmaceutical industry investments. The region has witnessed a rapid increase in healthcare spending, driving demand for high-quality packaging solutions. In addition, the rising production and adoption of generic drugs have further boosted market expansion. This strong industry growth has led to increased innovation and advancements in pharmaceutical glass packaging.

The Asia-Pacific pharmaceutical glass packaging market is projected to experience fastest growth from 2025 to 2032. This expansion is driven by a rising prevalence of chronic diseases, which has increased the demand for effective drug packaging solutions. In addition, growing healthcare awareness among the population has led to higher adoption of advanced medical treatments. Furthermore, increasing income levels across the region have improved access to quality healthcare, further fueling market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Pharmaceutical Glass Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Pharmaceutical Glass Packaging Market Leaders Operating in the Market Are:

- Corning Incorporated (U.S.)

- Nipro Medical Corporation (Japan)

- SGD Pharma (France)

- Stoelzle Glass Group (Austria)

- Bormioli Pharma S.p.A. (Italy)

- West Pharmaceutical Services, Inc. (U.S.)

- SCHOTT North America, Inc. (U.S.)

- Gerresheimer AG (Germany)

- Beatson Clark (U.K.)

- Ardagh Group S.A. (Luxembourg)

- APG Corporate (U.S.)

- PGP Glass (India)

- Sisecam Group (Turkey)

- Shandong Province Medicinal Glass Co., Ltd. (China)

- Hindusthan National Glass & Industries Limited (India)

- Acme Vial and Glass Company, LLC. (U.S.)

- O.Berk Company, LLC. (U.S.)

- DWK Life Sciences (Germany)

- BD (Becton, Dickinson and Company) (U.S.)

- Amcor plc (Switzerland)

Latest Developments in Pharmaceutical Glass Packaging Market

- In June 2023, SDG SA announced its collaboration with Corning Incorporated to set up a glass tubing facility in Telangana, India. This partnership leveraged SDG’s industry expertise and Corning’s advanced glass coating technology to enhance fine-line productivity, supporting the expansion of pharmaceutical manufacturing

- In May 2023, Bormioli Pharma S.p.A extended its collaboration with Desall.com to drive innovation in pharmaceutical packaging. The partnership focused on integrating augmented reality solutions for drug delivery and developing biometric recognition systems to enhance child-resistant closure mechanisms

- In March 2023, Schott AG commenced the production of FIOLAX® amber pharma glass in India to meet the growing demand in the Asian market. This initiative aimed to improve the reliability, planning, availability, and cost-efficiency of pharmaceutical converters

- In October 2022, Gerresheimer AG partnered with Merck to introduce a digitalized twin solution to enhance trust and traceability in the pharmaceutical supply chain. This innovation created a digital representation of packaging for syringes and vials, ensuring greater transparency and security

- In January 2022, West Pharmaceutical Services Inc. collaborated with Corning to advance drug delivery and containment solutions by developing innovative pharmaceutical packaging technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pharmaceutical Glass Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pharmaceutical Glass Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pharmaceutical Glass Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.