Global Pharmaceutical Logistics Market

Market Size in USD Million

CAGR :

%

USD

269.25 Million

USD

528.67 Million

2024

2032

USD

269.25 Million

USD

528.67 Million

2024

2032

| 2025 –2032 | |

| USD 269.25 Million | |

| USD 528.67 Million | |

|

|

|

|

Pharmaceutical Logistics Market Size

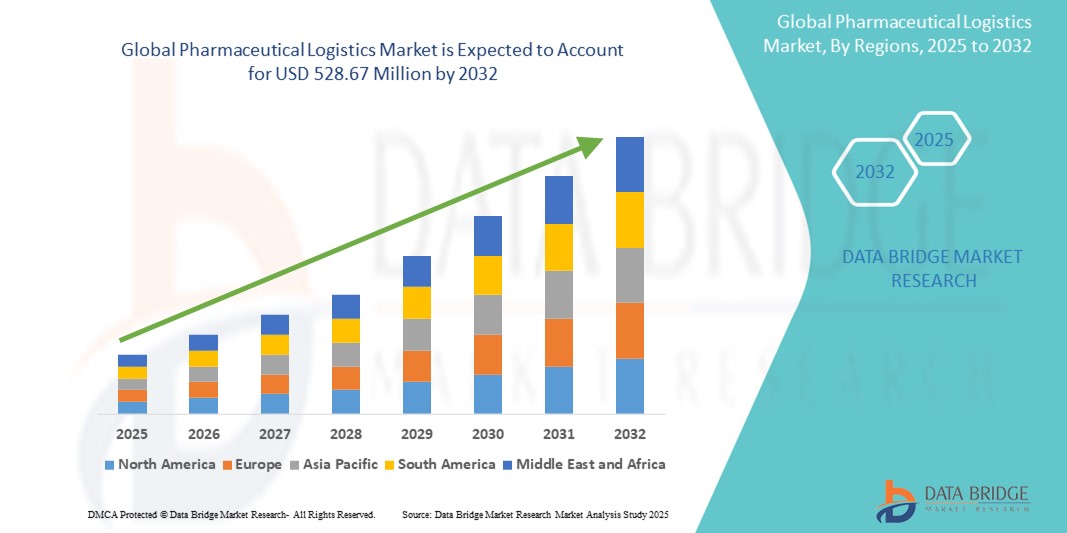

- The global Pharmaceutical Logistics market was valued at USD 269.25 million in 2024 and is expected to reach USD 528.67 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.80%, primarily driven by the increased demand for temperature-sensitive pharmaceutical products

- This growth is driven by factors such as the expansion of the biopharmaceutical industry, advancements in cold chain logistics, and the rising need for global distribution of vaccines and biologics

Pharmaceutical Logistics Market Analysis

- The factors such as the increasing demand for temperature-sensitive products such as vaccines and biologics, the expansion of global healthcare systems, and advancements in logistics infrastructure, particularly cold chain logistics

- The market is heavily driven by cold chain logistics, a segment that continues to experience rapid growth due to the increased need for temperature-controlled transportation and storage solutions.

- Cold chain logistics is crucial for ensuring the safe transport of vaccines and biologics. Storage also plays a vital role in maintaining the integrity of pharmaceutical products in compliance with regulatory standards, especially in regions such as North America and Europe.

- Technological advancements such as real-time monitoring systems for temperature, humidity, and other conditions during transportation are key to ensuring product safety and compliance with regulations.

- Major logistics providers such as UPS and DHL have adopted IoT sensors and data analytics to enhance visibility and efficiency in cold chain logistics, ensuring the safe delivery of sensitive pharmaceuticals across global markets

- For Instance, companies such as UPS and DHL have adapted to the increasing demands of pharmaceutical logistics by investing in dedicated hubs for temperature-sensitive goods and expanding their air freight capabilities

- These logistics giants have played a crucial role in meeting the urgent needs of pharmaceutical companies during the pandemic, offering faster and more reliable delivery services for life-saving medications and vaccines

Report Scope and Pharmaceutical Logistics Market Segmentation

|

Attributes |

Pharmaceutical Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pharmaceutical Logistics Market Trends

“Growth in Outsourced Logistics Services”

- Pharmaceutical companies are increasingly outsourcing logistics operations to specialized third-party providers to streamline their supply chains and reduce costs

- Outsourcing allows companies to focus on their core competencies while benefiting from the specialized expertise and infrastructure of logistics service providers

- This trend is expected to continue as pharmaceutical companies seek to optimize their supply chain operations and meet the increasing demand for efficient and reliable logistics service

- Outsourcing provides access to specialized skills and advanced technologies that may not be available in-house

- This is particularly important for complex processes such as biologics manufacturing, where expertise and advanced facilities are crucial

Pharmaceutical Logistics Market Dynamics

Driver

“Surge in Cold Chain Demand”

- The increasing prevalence of biologics, vaccines, and temperature-sensitive drugs necessitates robust cold chain logistics to maintain product efficacy and safety

- Companies are investing in specialized transportation equipment, temperature monitoring devices, and cold storage warehouses to effectively manage cold chain operations

- Government regulations mandate strict adherence to cold chain protocols for temperature-sensitive drugs, further driving the demand for cold chain logistics services

- The COVID-19 pandemic highlighted the critical role of cold chain logistics in the distribution of vaccines and other temperature-sensitive medical supplies

- For instance, UPS's acquisition of Frigo-Trans and BPL in Germany aims to enhance its temperature-controlled logistics capabilities, anticipating a significant increase in healthcare logistics revenue

Opportunity

“Technological Integration”

- The adoption of technologies such as IoT, AI, and blockchain is optimizing supply chain visibility, transparency, and efficiency

- These innovations enable real-time monitoring of shipments, ensuring better tracking of pharmaceutical products throughout the logistics process

- Companies are utilizing automation, artificial intelligence, and data analytics to optimize routes, reduce costs, and improve service delivery

- The integration of cloud computing and IoT allows monitoring of dosage, temperature deviations, and ingredient types, ensuring product integrity

- For Instance, DHL's acquisition of CryoPDP strengthens its supply chain services for the life sciences and healthcare industry, enhancing its capabilities in temperature-controlled logistics

Restraint/Challenge

“Regulatory Complexity”

- Pharmaceutical logistics is heavily regulated due to safety and quality requirements, covering all aspects of the supply chain from good distribution practices to storage conditions

- Compliance with multi-jurisdictional regulations increases operational expenses and requires significant investments of time and resources

- The lack of harmonization across regions regarding coding, packaging, and labeling standards further compounds regulatory issues

- Even minor non-compliance can lead to financial and legal consequences such as regulatory actions, delays in clearance, or returns

- For instance, the European Federation of Pharmaceutical Industries and Associations has warned that U.S. policy shifts could divert pharmaceutical R&D and manufacturing away from Europe unless quick and radical policy actions are taken

Pharmaceutical Logistics Market Scope

The market is segmented on the basis type, product, component, procedure, and application

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product |

|

|

By Component |

|

|

By Procedure |

|

|

By Application |

|

Pharmaceutical Logistics Market Regional Analysis

“Europe is the Dominant Region in the Pharmaceutical Logistics Market”

- Europe’s robust healthcare infrastructure, stringent regulatory standards, and high demand for temperature-sensitive drugs and vaccines contribute to its leading position

- Countries such as Germany, the U.K., and France are central to Europe's pharmaceutical logistics, facilitating substantial intra-regional trade and exports

- The increasing need for cold chain logistics, new drugs in the research and development pipeline requiring temperature-controlled storage and transport, is enhancing Europe's market share

- The adoption of advanced technologies such as IoT and blockchain is improving the efficiency and transparency of pharmaceutical supply chains in Europe

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific countries are becoming key manufacturing hubs for Active Pharmaceutical Ingredients (APIs), facilitating regional supply networks within Asia and with other parts of the world

- Rapid economic growth in developing countries such as China and India is expanding their healthcare sectors, thereby increasing the demand for pharmaceutical logistics services

- The focus on improving cold chain logistics and enhancing supply chain visibility is further driving the growth of the pharmaceutical logistics market in the Asia-Pacific region

Pharmaceutical Logistics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AmerisourceBergen Corporation (U.S.)

- CAVALIER LOGISITICS (U.S.)

- Continental Carbon Company (U.S.)

- DHL International GmbH (Germany)

- FedEx (U.S.)

- Kuehne+Nagel (Switzerland)

- Deutsche Post AG (Germany)

- LifeConEx (U.S.)

- American Airlines Inc. (U.S.)

- Air Charter Service (India)

- Agility (Kuwait)

- VersaCold Logistics Services (Canada)

- Delhivery Limited (India)

- YUSEN LOGISTICS CO., LTD. (India)

- V-Xpress (India)

- FulfillmentHubUSA (U.S.)

- Prompt Brazil Logistics (Brazil)

Latest Developments in Global Pharmaceutical Logistics Market

- In October 2023, UPS Healthcare launched a healthcare logistics service in Europe, marking a strategic move towards leadership in the sector. The launch of UPS Pickup Point locations across the U.K., Germany, Italy, France, and Spain enhances its offering, particularly for health laboratory customers, by providing a new reverse logistics service

- In March 2023, Dentons advised GEODIS to acquire trans-o-flex, a specialized provider of temperature-controlled transport for pharmaceutical and high-tech products. With this acquisition, GEODIS aims to strengthen its integrated freight network in Germany, advancing its position in the logistics industry and bolstering its capabilities in serving these critical sectors

- In February 2021, Agility launched an express road freight network in the GCC region, facilitating efficient connections for consumers and businesses. Offering both full truckload (FTL) and less-than-truckload (LTL) options, the service enhances agility and responsiveness in meeting the diverse transportation needs of its customers across the region

- In December 2020, Agility's 5,000 SQM warehouse project in Abidjan is chosen by Maersk as a storage, deconsolidation, and distribution facility. Positioned to meet the requirements of Maersk customers across various industries, this strategic partnership underscores Agility's commitment to providing efficient and reliable logistics solutions in key markets

- In May 2020, United Parcel Service of America, Inc. expanded its healthcare capabilities with the launch of UPS Premier. Leveraging next-generation sensor technology and monitoring, UPS Premier enhances service reliability and visibility for healthcare packages, meeting the evolving needs of the healthcare industry for secure and efficient transportation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.