Global Pharmaceutical Packaging Market

Market Size in USD Billion

CAGR :

%

USD

118.43 Billion

USD

206.52 Billion

2024

2032

USD

118.43 Billion

USD

206.52 Billion

2024

2032

| 2025 –2032 | |

| USD 118.43 Billion | |

| USD 206.52 Billion | |

|

|

|

|

Pharmaceutical Packaging Market Analysis

Outsourcing contract packaging services has become crucial for pharmaceutical companies, enabling them to focus on core competencies while meeting demanding standards. Prespack offers multidimensional partnerships, relieving manufacturers of medicinal products or medical devices from many processes. This trend reflects the growing pharmaceutical outsourcing sector, ultimately contributing to the expansion of the pharmaceutical packaging market.

Pharmaceutical Packaging Market Size

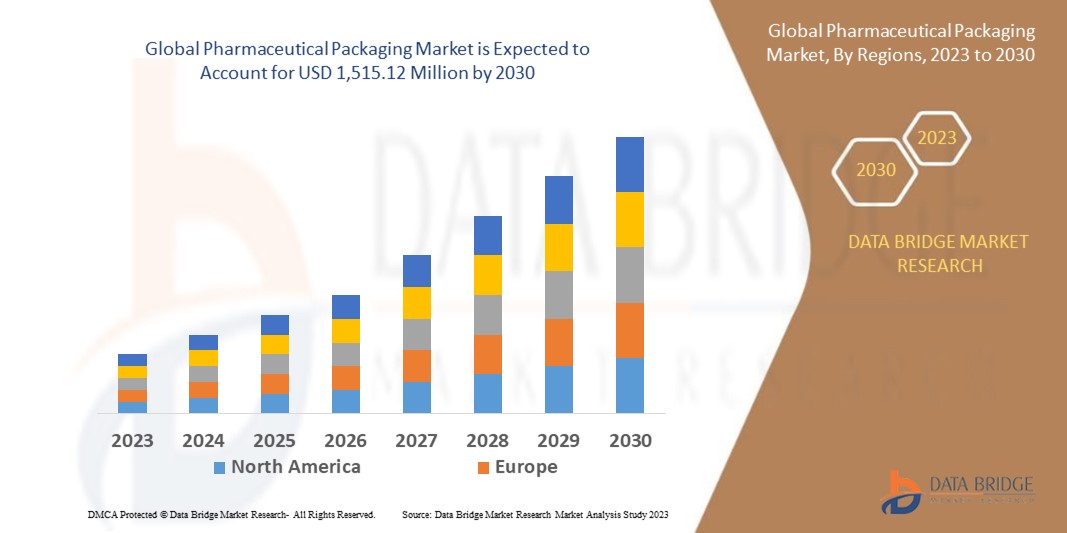

The global pharmaceutical packaging size was valued at USD 118.43 billion in 2024 and is projected to reach USD 206.52 billion by 2032, with a CAGR of 7.20 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Pharmaceutical Packaging Market Segmentation

|

Attributes |

Pharmaceutical Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global , Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar, and Daikyo Seiko Co., Ltd. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pharmaceutical Packaging Market Definition

Pharmaceutical packaging involves the process of enclosing medications and other pharmaceutical products in packaging materials that ensure their protection, identification, and information dissemination. These materials include plastics, glass, aluminum, paper, and cardboard, each chosen for its specific properties and application. These materials are carefully selected based on their compatibility with the pharmaceutical product, their ability to protect against external factors, and regulatory requirements.

Pharmaceutical Packaging Market Dynamics

Drivers

- Rising Pharmaceutical Outsourcing

Pharmaceutical companies are increasingly opting to outsource manufacturing processes to specialized contract packagers. This strategic shift allows these companies to concentrate on their core competencies such as research, development, and marketing, while leaving the complexities of packaging to experts. Contract packagers offer a range of services including packaging design, materials selection, and ensuring compliance with stringent regulatory requirements. This is particularly advantageous for pharmaceutical firms seeking innovative and customized packaging solutions for their products.

- Evolving Role of Pharmaceutical Packaging in Market Differentiation

Packaging has evolved beyond its traditional role of merely containing pharmaceutical products; it is now a key element in differentiating these products in the market. This shift is driven by the intensifying competition in the pharmaceutical industry, where companies are leveraging packaging as a tool to set their products apart from competitors. Packaging serves as a visual and informational platform that communicates vital details about the product, including its quality, safety, and efficacy. Additionally, packaging acts as a marketing medium, helping to attract consumers and influence their purchasing decisions. In response to this trend, there has been a surge in innovative packaging solutions. For example, smart packaging incorporates digital features like RFID tags or QR codes, enabling consumers to access additional product information or track authenticity.

The use of eco-friendly materials in packaging is gaining traction, reflecting consumers' growing environmental consciousness. These innovative approaches not only differentiate products but also contribute to sustainable practices, further enhancing brand reputation.

The focus on product differentiation through packaging is driving significant advancements in the pharmaceutical packaging industry, fostering a market environment ripe for continuous innovation and improvement.

Opportunities

- Innovations in Smart Packaging

Innovations in smart packaging, such as temperature-sensitive labels and RFID tracking, are revolutionizing the global pharmaceutical packaging market. These advancements offer a myriad of benefits, starting with enhanced visibility across the supply chain. Temperature-sensitive labels, for instance, provide real-time monitoring, ensuring medications are stored and transported under optimal conditions. This capability is particularly crucial for pharmaceuticals, as maintaining the right temperature is critical for preserving their efficacy and safety. Moreover, RFID tracking enables companies to track individual product units, ensuring authenticity and preventing tampering. This level of traceability not only helps in compliance with regulatory standards but also boosts consumer trust. Additionally, smart packaging facilitates efficient recall processes, as companies can quickly identify and retrieve affected products.

Restraints/Challenges

- Counterfeiting and Product Security

Counterfeiting in the pharmaceutical sector poses a multifaceted challenge despite the advancements in packaging technologies. The proliferation of counterfeit drugs not only jeopardizes patient health but also erodes trust in pharmaceutical products and the industry. These illicit activities often involve sophisticated tactics, including the replication of packaging and labeling to mimic genuine products. As counterfeiters continually evolve their methods to evade detection, pharmaceutical companies must remain vigilant and adapt their packaging strategies to stay ahead of these threats. This ongoing battle against counterfeit drugs underscores the critical importance of innovative packaging solutions and collaborative efforts within the industry and regulatory bodies to ensure the safety and integrity of pharmaceutical products.

- Cost Constraints for Implementing Advanced Packaging Technologies

The development and implementation of advanced packaging technologies, such as smart packaging and anti-counterfeiting measures, often require substantial investment in research, development, and technology infrastructure. For smaller companies with limited resources, these costs can be prohibitive, preventing them from adopting innovative packaging solutions. As a result, these companies may be at a disadvantage compared to larger competitors who can afford to invest in advanced packaging technologies. This constraint hinder the overall growth and innovation potential of the pharmaceutical packaging market, limiting the availability of advanced packaging solutions and potentially hindering market competitiveness.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Pharmaceutical Packaging Market Scope

The market is segmented on the basis of product, material, drug delivery mode, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Primary Packaging

- Secondary and Tertiary Packaging

Material

- Plastics and Polymers

- Paper and Paperboards

- Glass

- Metals

- Others

Drug Delivery Mode

- Oral Drug Delivery Packaging

- Parenteral Drug Delivery Packaging

- Topical Drug Delivery Packaging

- Inhalation Drug Delivery Packaging

- Nasal Drug Delivery Packaging

- Ocular Drug Delivery Packaging

- Other Drugs Delivery Packaging

End User

- Pharma Manufacturing Companies

- Contract Packaging Companies

- Pharmacies

- Others

Pharmaceutical Packaging Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, material, drug delivery mode, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the global pharmaceutical packaging market due to its advanced healthcare infrastructure, robust regulatory framework, and significant investment in research and development. U.S. is expected to dominate the North America due to its advanced healthcare infrastructure, large pharmaceutical industry, and high demand for innovative packaging solutions. China is expected to dominate in the Asia-Pacific region due to its rapidly expanding pharmaceutical industry, large consumer base, and increasing investments in healthcare infrastructure and packaging technologies. Germany is expected to dominate in the Europe region due to its robust pharmaceutical manufacturing sector, strong regulatory environment, and emphasis on high-quality packaging standards.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Pharmaceutical Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Pharmaceutical Packaging Market Leaders Operating in the Market Are:

- WestRock Company

- Amcor plc

- BD

- AptarGroup, Inc.

- West Pharmaceutical Services, Inc.

- Berry Global, Inc.

- CCL Industries

- Gerresheimer AG

- Schott AG

- UFlex Limited

- SGD Pharma

- EPL Limited

- Drug Plastics Group

- Comar

- Daikyo Seiko Co., Ltd.

Latest Developments in Pharmaceutical Packaging Market

- In September 2023, WestRock Company WRK and Smurfit Kappa Group Plc SMFKY have agreed to merge and create Smurfit WestRock, which is expected to be one of the world’s largest paper and packaging company with a worth of around $20 billion

- In July 2023, Constantia Flexibles has announced its latest pharmaceutical packaging solution, the coldform foil REGULA CIRC, a cutting-edge technology that sets a new standard for sustainability in blister packaging. Designed with circularity in mind, REGULA CIRC complies with future regulations and legislation, offering a total barrier solution that meets the highest sustainable packaging standards

- In June 2022, Berlin Packaging, a one of world's largest hybrid packaging supplier, announced the acquisition of Andler Packaging Group, a value-added distributor of plastic, glass, and metal containers and closures

- In December 2021, Comar, a premier supplier of custom medical devices and assemblies and specialty packaging solutions, announced today it has acquired Omega Packaging, a manufacturer of injection and blow molded products serving the pharmaceutical, nutraceutical, sports nutrition, and skin care markets

- In April 2022, Amcor, a leader in the design and production of ethical packaging solutions, recently revealed the addition of a new, more environment-friendly High Shield laminate to its line of pharmaceutical packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.