Global Pharmaceutical Quality Control Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

6.14 Billion

2024

2032

USD

2.81 Billion

USD

6.14 Billion

2024

2032

| 2025 –2032 | |

| USD 2.81 Billion | |

| USD 6.14 Billion | |

|

|

|

|

Pharmaceutical Quality Control Market Size

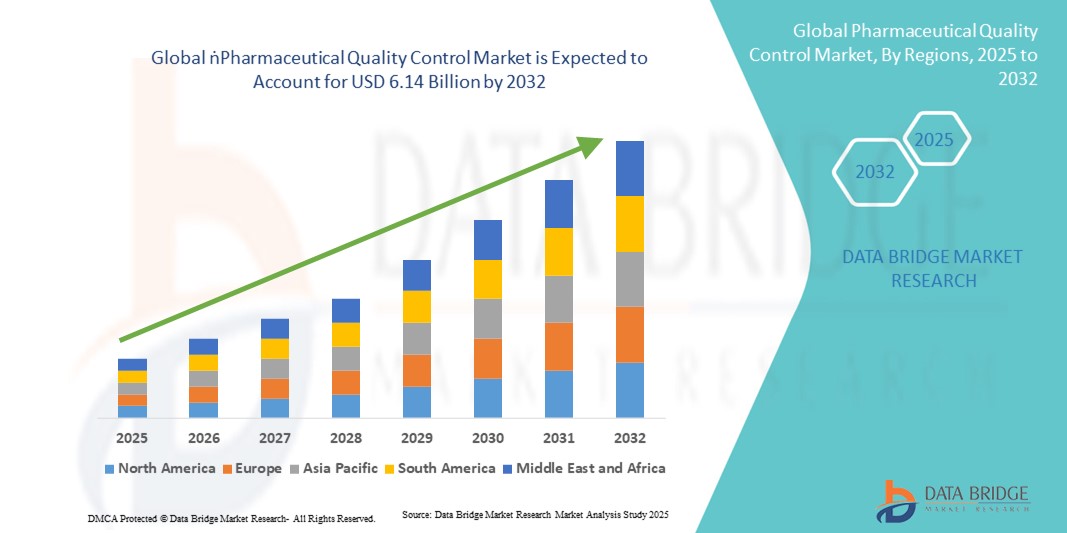

- The global pharmaceutical quality control market size was valued at USD 2.81 billion in 2024 and is expected to reach USD 6.14 billion by 2032, at a CAGR of 10.23% during the forecast period

- The market growth is largely fueled by increasing regulatory compliance requirements and stringent quality standards within the pharmaceutical industry, driving the adoption of advanced quality control solutions

- Furthermore, rising demand for safe, effective, and high-quality pharmaceutical products, coupled with the need for accurate testing and validation throughout the manufacturing process, is accelerating the uptake of pharmaceutical quality control solutions, thereby significantly boosting the industry's growth

Pharmaceutical Quality Control Market Analysis

- Pharmaceutical Quality Control systems, offering advanced analytical and testing solutions for drug manufacturing and research, are increasingly vital components of modern pharmaceutical operations in both production and laboratory settings due to their enhanced accuracy, regulatory compliance capabilities, and seamless integration with automated manufacturing and laboratory information management systems

- The escalating demand for pharmaceutical quality control solutions is primarily fueled by increasing regulatory scrutiny, the need for accurate quality assurance in pharmaceutical manufacturing, and rising adoption of advanced testing technologies. These factors are driving manufacturers to invest in robust and efficient quality control systems

- North America dominated the pharmaceutical quality control market with the largest revenue share of 45.05% in 2024, supported by advanced healthcare infrastructure, strong R&D activities, early adoption of innovative testing technologies, and strict regulatory oversight. The U.S. remains the largest contributor within the region, experiencing substantial growth due to widespread deployment of automated analytical instruments, high-throughput testing platforms, and integrated quality control systems across pharmaceutical manufacturing and research facilities

- Asia-Pacific is expected to be the fastest-growing region in the pharmaceutical quality control market during the forecast period, driven by expanding pharmaceutical production, rising healthcare access, and growing regulatory requirements in emerging economies such as China, India, and Japan. Government initiatives promoting drug safety, increasing investments in laboratory infrastructure, and growing adoption of advanced testing technologies are further accelerating market growth

- The Instruments segment dominated the pharmaceutical quality control market with the largest market revenue share of 46.3% in 2024, driven by the widespread adoption of automated analytical platforms, high-precision testing equipment, and integrated laboratory systems. Instruments such as HPLCs, spectrophotometers, microbial analyzers, and dissolution testers are essential for ensuring accurate, reproducible results and compliance with stringent regulatory standards

Report Scope and Pharmaceutical Quality Control Market Segmentation

|

Attributes |

Pharmaceutical Quality Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Quality Control Market Trends

Enhanced Efficiency and Accuracy in Testing Processes

- A significant and accelerating trend in the global pharmaceutical quality control market is the increasing adoption of advanced automated testing systems and high-throughput analytical platforms. These technologies are significantly enhancing the accuracy, efficiency, and reliability of pharmaceutical testing processes

- For instance, state-of-the-art chromatographic and spectroscopic instruments, integrated with laboratory information management systems (LIMS), allow manufacturers to streamline quality control operations and ensure consistent compliance with regulatory standards

- Automation in testing processes enables features such as real-time monitoring of production batches, predictive maintenance of equipment, and faster detection of deviations, improving overall operational efficiency and reducing errors

- The integration of advanced software with quality control instruments facilitates centralized management of testing workflows, enabling laboratories to maintain detailed audit trails and ensure traceability across multiple production sites

- This trend toward more sophisticated, interconnected, and standardized quality control systems is fundamentally reshaping industry expectations for drug safety and regulatory compliance. Consequently, companies such as Thermo Fisher Scientific, Agilent Technologies, and Shimadzu are developing cutting-edge analytical instruments and solutions tailored to meet evolving quality standards

- The demand for efficient, accurate, and compliant Pharmaceutical Quality Control systems is growing rapidly across both large-scale pharmaceutical manufacturers and smaller contract research organizations, as stakeholders increasingly prioritize product safety, regulatory adherence, and operational efficiency

Pharmaceutical Quality Control Market Dynamics

Driver

Growing Need Due to Rising Regulatory Standards and Quality Assurance Demands

- The increasing stringency of regulatory standards among pharmaceutical manufacturers, coupled with the rising focus on ensuring product safety and efficacy, is a significant driver for the heightened demand for advanced Pharmaceutical Quality Control solutions

- For instance, in April 2024, Thermo Fisher Scientific introduced an upgraded high-throughput analytical system designed to enhance quality assurance workflows in drug manufacturing. Such innovations by key companies are expected to drive the Pharmaceutical Quality Control industry growth in the forecast period

- As manufacturers become more aware of potential risks related to product contamination, formulation inconsistencies, and regulatory non-compliance, PQC solutions offer advanced features such as real-time monitoring, automated reporting, and predictive analytics, providing a compelling upgrade over traditional quality control methods

- Furthermore, the growing adoption of automated laboratories and digitalized manufacturing processes is making PQC systems an integral component of these operations, offering seamless integration with Laboratory Information Management Systems (LIMS) and other digital platforms

- The convenience of streamlined testing, rapid validation of batch quality, and the ability to manage compliance data efficiently are key factors propelling the adoption of Pharmaceutical Quality Control systems in both small-scale and large-scale production facilities. The trend towards advanced, automated QC solutions and the increasing availability of user-friendly systems further contribute to market growth

Restraint/Challenge

Concerns Regarding High Implementation Costs and Operational Complexity

- Concerns surrounding the high initial investment and operational complexity of advanced PQC systems pose a significant challenge to broader market penetration. As PQC solutions often require sophisticated instrumentation, software, and skilled personnel, manufacturers may hesitate to adopt these systems due to budgetary constraints or resource limitations

- For instance, high-profile reports of costly instrument failures or software glitches have made some pharmaceutical companies cautious about implementing new quality control technologies

- Addressing these concerns through cost-effective solutions, user-friendly interfaces, and comprehensive training programs is crucial for building manufacturer confidence. Companies such as Agilent Technologies and Waters Corporation emphasize their robust support services and scalable system designs in their marketing to reassure potential buyers

- In addition, the relatively high upfront costs of some advanced PQC systems compared to conventional testing methods can be a barrier to adoption for small or mid-sized manufacturers. While entry-level PQC solutions are gradually becoming more affordable, premium systems with features such as multi-parameter analysis, automation, or advanced data analytics often come with a higher price tag

- While costs are slowly decreasing due to technological advancements and competitive pricing, the perceived premium for sophisticated PQC solutions can still hinder widespread adoption, especially among cost-sensitive manufacturers or in emerging markets

- Overcoming these challenges through more accessible pricing models, enhanced training programs, and ongoing technical support will be vital for sustained Pharmaceutical Quality Control market growth

Pharmaceutical Quality Control Market Scope

The market is segmented on the basis of product, analysis type, and products tested.

- By Product

On the basis of product, the pharmaceutical quality control market is segmented into consumables, instruments, and services. The instruments segment dominated the largest market revenue share of 46.3% in 2024, driven by the widespread adoption of automated analytical platforms, high-precision testing equipment, and integrated laboratory systems. Instruments such as HPLCs, spectrophotometers, microbial analyzers, and dissolution testers are essential for ensuring accurate, reproducible results and compliance with stringent regulatory standards. Their growing use in both in-house and contract testing laboratories supports the high revenue share, as pharmaceutical manufacturers prioritize efficiency and quality in production workflows. The robust growth of R&D activities, expansion of pharmaceutical manufacturing, and demand for real-time monitoring also strengthen the dominance of instruments in the market.

The consumables segment is expected to witness the fastest CAGR of 19.2% from 2025 to 2032, driven by the recurring need for reagents, testing kits, culture media, filters, and other disposable items essential for daily quality control processes. Consumables are critical for maintaining accuracy, sterility, and repeatability across various testing applications. The rising number of pharmaceutical production facilities, contract testing laboratories, and outsourcing of QC processes fuels this growth. In addition, increasing regulatory scrutiny and continuous quality assurance requirements amplify the demand for reliable consumables. Consumables provide a cost-effective, efficient, and scalable solution to meet high testing volumes, making them a crucial segment in the Pharmaceutical Quality Control market.

- By Analysis Type

On the basis of analysis type, the pharmaceutical quality control market is segmented into sterility testing, bioburden testing, endotoxin testing, stability testing, extractable and leachable testing, and raw material testing. The Sterility Testing segment held the largest market revenue share of 38.5% in 2024, driven by regulatory mandates for injectable drugs, vaccines, and biologics. Sterility testing ensures patient safety by preventing microbial contamination, and the adoption of automated sterility test systems increases throughput and reliability. Pharmaceutical companies are increasingly investing in advanced sterility testing equipment to maintain compliance with FDA, EMA, and ICH guidelines. The growth is supported by the expansion of biologics, vaccine production, and high-value drug formulations requiring rigorous sterility assessment.

The stability testing segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, fueled by growing emphasis on shelf-life determination, storage condition monitoring, and long-term stability analysis of drug formulations and biologics. Stability testing is critical for assessing potency, safety, and efficacy over the product’s lifecycle. Increasing regulatory pressure, the rise of personalized medicines, and the rapid growth of biopharmaceuticals drive this demand. Advanced stability chambers, automated sampling systems, and analytical techniques contribute to faster, more accurate testing, supporting adoption across contract and in-house laboratories. Pharmaceutical manufacturers are also leveraging stability data to optimize packaging, transportation, and storage protocols, further expanding this segment.

- By Products Tested

On the basis of products tested, the pharmaceutical quality control market is segmented into vaccines, plasma products, and drugs. The drugs segment accounted for the largest market revenue share of 44.7% in 2024, driven by mass production of generics, branded drugs, and increasing global demand for quality-assured medications. Drug testing involves multiple analytical methods, including sterility, potency, endotoxin, and stability testing, ensuring adherence to regulatory standards. The expansion of pharmaceutical R&D, contract testing organizations, and manufacturing facilities reinforces the dominance of the drugs segment. Its high market share reflects the scale and complexity of pharmaceutical production requiring rigorous quality control measures.

The vaccines segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, propelled by global immunization programs, increasing biologics production, and stringent regulatory requirements for vaccine quality and safety. Vaccine testing demands precise sterility, potency, and stability evaluations, often facilitated by advanced automated instruments. Government initiatives supporting pandemic preparedness, vaccination drives, and public health campaigns further accelerate market adoption. The increasing number of biotechnology companies and contract research organizations engaged in vaccine production also boosts demand. Moreover, the critical need for high-quality vaccines in emerging markets is driving investments in specialized QC infrastructure, making this segment a key growth driver.

Pharmaceutical Quality Control Market Regional Analysis

- North America dominated the pharmaceutical quality control market with the largest revenue share of 45.05% in 2024, supported by advanced healthcare infrastructure, strong R&D activities, early adoption of innovative testing technologies, and strict regulatory oversight

- The region, experiencing substantial growth due to widespread deployment of automated analytical instruments, high-throughput testing platforms, and integrated quality control systems across pharmaceutical manufacturing and research facilities

- The demand for PQC solutions is further driven by the need for precise, real-time monitoring, adherence to regulatory standards, and the adoption of digitalized laboratory workflows

U.S. Pharmaceutical Quality Control Market Insight

The U.S. pharmaceutical quality control market captured the largest share within North America in 2024, driven by widespread deployment of advanced PQC systems, sophisticated laboratory automation, and strong compliance with FDA regulations. The growth is fueled by increasing demand for precise, real-time quality monitoring, adoption of integrated quality control solutions in both research and production facilities, and the presence of leading pharmaceutical and biotech companies. High R&D investment, technological innovation, and early adoption of automated and high-throughput testing platforms further reinforce the U.S. as a key contributor to the regional market.

Europe Pharmaceutical Quality Control Market Insight

The Europe pharmaceutical quality control market is projected to expand at a notable CAGR throughout the forecast period, driven by stringent regulatory requirements, increasing demand for quality assurance in drug production, and rising investments in laboratory automation. Countries such as Germany, France, and the U.K. are witnessing adoption of advanced PQC systems for both large-scale pharmaceutical manufacturers and research institutions. Germany’s focus on innovation and sustainability, coupled with robust infrastructure, promotes the integration of high-throughput analytical instruments and automated QC platforms, enhancing efficiency and accuracy in pharmaceutical operations.

U.K. Pharmaceutical Quality Control Market Insight

The U.K. pharmaceutical quality control market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing adoption of automated laboratory systems and advanced analytical instruments. The country’s emphasis on regulatory compliance, drug safety, and precision in quality testing drives demand for integrated PQC solutions. Furthermore, the U.K.’s strong research ecosystem, robust pharmaceutical manufacturing sector, and growing digitalization of laboratory operations contribute to market growth.

Germany Pharmaceutical Quality Control Market Insight

The Germany pharmaceutical quality control market is expected to expand steadily during the forecast period, supported by strong pharmaceutical R&D initiatives, adoption of high-precision analytical instruments, and growing focus on laboratory automation. Increasing awareness of regulatory compliance and the integration of PQC solutions with manufacturing and research workflows enhance operational efficiency, making Germany one of the key markets in Europe.

Asia-Pacific Pharmaceutical Quality Control Market Insight

The Asia-Pacific pharmaceutical quality control market is expected to be the fastest-growing region during the forecast period, driven by expanding pharmaceutical production, rising healthcare access, and growing regulatory requirements in emerging economies such as China, India, and Japan. Government initiatives promoting drug safety, increasing investments in laboratory infrastructure, and growing adoption of advanced testing technologies are further accelerating market growth. Rapid urbanization, technological advancements, and the presence of major pharmaceutical manufacturing hubs in the region are also contributing to the adoption of high-throughput PQC systems and automated analytical platforms.

Japan Pharmaceutical Quality Control Market Insight

The Japan pharmaceutical quality control market is gaining momentum due to the country’s advanced pharmaceutical research environment, strong regulatory framework, and increasing adoption of automated analytical instruments. The demand for precise and efficient quality control processes, coupled with integration of digital and high-throughput laboratory systems, is driving growth in both pharmaceutical manufacturing and research facilities.

China Pharmaceutical Quality Control Market Insight

The China pharmaceutical quality control market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid pharmaceutical production growth, expanding healthcare infrastructure, and strong regulatory enforcement. The country’s increasing focus on drug safety, coupled with investments in laboratory automation and adoption of advanced testing technologies, is propelling demand for high-performance PQC systems across both commercial and research segments.

Pharmaceutical Quality Control Market Share

The pharmaceutical quality control industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- BIOMÉRIEUX (France)

- Charles River Laboratories International, Inc. (U.S.)

- Sartorius AG (Germany)

- WuXi AppTec (China)

- Thermo Fisher Scientific, Inc. (U.S.)

- SGS Société Générale de Surveillance SA (Switzerland)

- Eurofins Scientific (Luxembourg)

- Toxikon Corporation (U.S.)

- McKinsey & Company (U.S.)

- Esco Micro Pte. Ltd (Singapore)

- Lucideon Limited (U.K.)

- PerkinElmer (U.S.)

- SOLVIAS AG (Switzerland)

- Shimadzu Scientific Instruments (Japan)

- METTLER TOLEDO (Switzerland)

- REMI GROUP (India)

- BRAM-COR SPA (Italy)

- Panomex Inc. (India)

- Waters Corporation (U.S.)

- Danaher Corporation (U.S.)

Latest Developments in Global Pharmaceutical Quality Control Market

- In August 2025, Thermo Fisher Scientific inaugurated a new 375,000-square-foot carbon-neutral manufacturing facility in Mebane, North Carolina. This state-of-the-art site is designed to produce at least 40 million laboratory pipette tips per week, supporting the growing demand for high-quality laboratory consumables essential in pharmaceutical testing and research. The facility aims to strengthen the U.S. supply chain for life-saving medicines and therapies

- In July 2025, SGS announced the acquisition of Applied Technical Services (ATS), a leading U.S.-based provider of testing, inspection, and calibration services. This strategic move is part of SGS's "Strategy 27" initiative to enhance its pharmaceutical testing services, particularly in Latin America. The acquisition is expected to bolster SGS's capabilities in drug testing and clinical research, aligning with the industry's growing emphasis on quality control and compliance

- In August 2025, Eurofins BioPharma Product Testing expanded its service offerings by launching Viral Clearance Services at its Milan site. This addition enhances Eurofins's global footprint in viral safety services, addressing the increasing need for comprehensive testing solutions in the pharmaceutical industry. The new service aims to support the development and manufacturing of biologics by ensuring the safety and efficacy of products through rigorous viral clearance testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.