Global Pharmaceutical Solvent Market

Market Size in USD Billion

CAGR :

%

USD

6.93 Billion

USD

10.01 Billion

2024

2032

USD

6.93 Billion

USD

10.01 Billion

2024

2032

| 2025 –2032 | |

| USD 6.93 Billion | |

| USD 10.01 Billion | |

|

|

|

|

Pharmaceutical Solvent Market Size

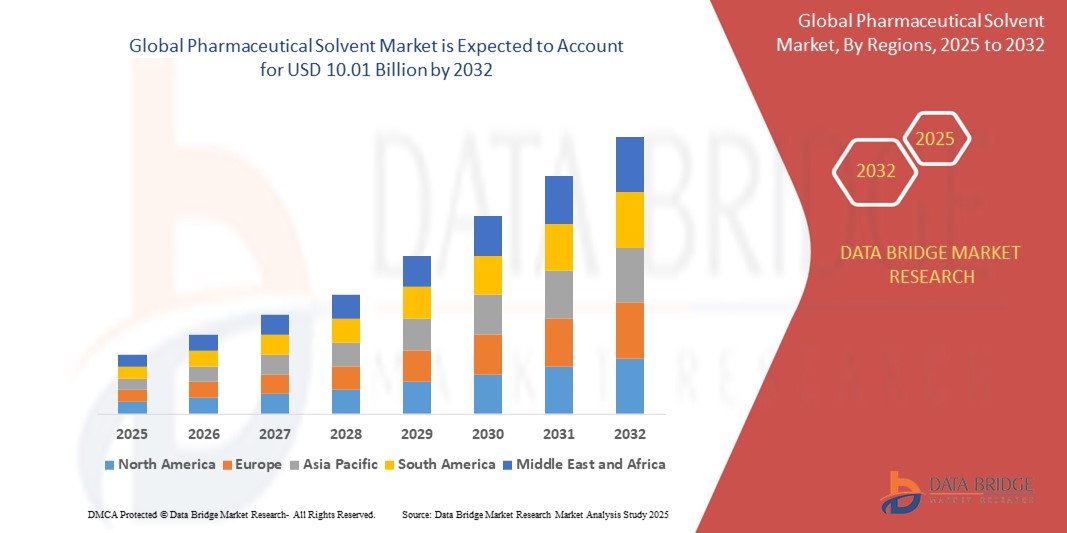

- The global Pharmaceutical Solvent market size was valued at USD 6.93 billion in 2024 and is expected to reach USD 10.01 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is primarily driven by increasing demand for pharmaceutical products, growth in the biopharmaceutical sector, and the rising need for high-quality solvents in drug manufacturing processes

- The growing consumer awareness regarding the need for advanced drug formulations and the expansion of healthcare infrastructure globally are further propelling the demand for pharmaceutical solvents across both OEM and aftermarket channels

Pharmaceutical Solvent Market Analysis

- The pharmaceutical solvent market is experiencing steady growth due to the rising demand for advanced drug manufacturing processes and the increasing focus on biopharmaceuticals and generic drug production

- The growing need for solvents in pharmaceutical applications, such as active pharmaceutical ingredient (API) synthesis and formulation, is encouraging manufacturers to innovate with high-purity, eco-friendly, and bio-based solvent solutions

- Asia-Pacific dominates the pharmaceutical solvent market with the largest revenue share of 43.7% in 2025, driven by the rapid proliferation of the pharmaceutical sector and increasing healthcare expenditure in countries such as China and India

- North America is expected to witness the highest growth rate during the forecast period of 2025 to 2032, fueled by rising demand for solvents in vaccines, medicines, and advanced drug delivery systems, particularly in the U.S.

- The alcohol segment holds the largest market revenue share of 31.8% in 2025, supported by its extensive use in pharmaceutical manufacturing due to its versatility, low toxicity, and ability to dissolve polar compounds. The growing adoption of ethanol and isopropanol in high-quality tablet coatings and disinfectants further drives this segment’s growth

Report Scope and Pharmaceutical Solvent Market Segmentation

|

Attributes |

Pharmaceutical Solvent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Solvent Market Trends

“Rising Preference for Bio-Based and Eco-Friendly Solvents”

- Bio-based solvents, such as ethanol and other alcohol-based solvents, are gaining traction due to their low toxicity, sustainability, and compliance with stringent environmental regulations

- These solvents maintain high solvency power while reducing volatile organic compound (VOC) emissions, making them ideal for pharmaceutical applications

- In regions such as Europe, regulatory pressures to reduce VOC emissions are driving the adoption of green solvents, particularly in drug formulation processes

- Pharmaceutical companies are increasingly opting for bio-based solvents to align with sustainability goals and consumer demand for environmentally friendly products.

- For instance, solvay S.A. introduced rhodiasolv IRIS, a biodegradable and non-toxic solvent, to cater to eco-conscious pharmaceutical manufacturers

- Leading manufacturers are investing in green chemical processes, with global investments in green technology reaching USD 750 billion in 2021, boosting the development of sustainable solvent solutions

Pharmaceutical Solvent Market Dynamics

Driver

“Rising Demand for Advanced Drug Formulations and Biopharmaceuticals”

- Growing consumer awareness about the need for high-quality pharmaceuticals and the rising prevalence of chronic diseases are increasing the demand for solvents in drug manufacturing

- Solvents play a critical role in API synthesis, purification, and formulation, enabling the production of tablets, capsules, and injectables with improved efficacy

- The rise of biopharmaceuticals and biosimilars, particularly in North America and Asia-Pacific, is fueling the adoption of high-purity solvents for advanced drug delivery system

- Pharmaceutical companies are partnering with solvent providers to develop specialized solutions for nanotechnology and drug delivery, enhancing market growth

- For instance, Merck KGAA and BASF SE are investing in solvent innovations to support the growing demand for biologics and personalized medicines

- The expansion of healthcare infrastructure and rising pharmaceutical exports, valued at USD 660 billion globally in 2020, further drive the need for solvents in drug production

Restraint/Challenge

“Stringent Regulatory Restrictions on Solvent Use”

- Regulatory restrictions on the use of certain solvents, particularly chlorinated solvents, due to their environmental and health impacts, are limiting market growth

- Different countries have varying regulations on VOC emissions and solvent toxicity, complicating standardization efforts for manufacturers operating globally

- Excessive use of volatile solvents is viewed as an environmental risk, contributing significantly to VOC emissions

- For instance, European regulations are pressuring manufacturers to replace hazardous solvents with eco-friendly alternatives, increasing operational costs

- These strict regulations may deter some manufacturers from using certain solvents, potentially slowing market expansion in regions with stringent environmental policies

Pharmaceutical Solvent Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the pharmaceutical solvent market is segmented into alcohol, amine, esters, ethers, aromatic hydrocarbons, chlorinated solvents, ketones, and others. The alcohol segment holds the largest market revenue share of 31.8% in 2025, supported by its extensive use in pharmaceutical manufacturing due to its versatility, low toxicity, and ability to dissolve polar compounds. The growing adoption of ethanol and isopropanol in high-quality tablet coatings and disinfectants further drives this segment’s growth.

The esters segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its increasing use in pharmaceutical applications for extracting organic solutes and its low toxicity. Esters such as ethyl acetate are favored for their high solvency power and eco-friendly properties, supporting market expansion.

- By Application

On the basis of application, the pharmaceutical solvent market is segmented into pharmaceutical, research laboratories, chemical, and others. The pharmaceutical segment is expected to dominate the market revenue share, owing to the growing pharmaceutical and healthcare industries globally and the indispensable role of solvents in drug formulation, synthesis, purification, and extraction processes.

The research laboratories segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing R&D activities in biotechnology and pharmaceutical research, particularly in North America and Europe, where solvents are critical for drug development and testing.

Pharmaceutical Solvent Market Regional Analysis

- Asia-Pacific dominates the pharmaceutical solvent market with the largest revenue share in 2025, driven by the rapid proliferation of the pharmaceutical sector and increasing healthcare expenditure in countries such as China and India

- Consumers prioritize solvents for their critical role in drug manufacturing, purification, and formulation, especially in regions with large patient pools and expanding healthcare infrastructure

- Growth is supported by advancements in solvent technology, including bio-based and green solvents, alongside rising adoption in both pharmaceutical and research applications

U.S. Pharmaceutical Solvent Market Insight

The U.S. dominates the North America pharmaceutical solvent market with the highest revenue share in 2025, fueled by strong demand for solvents in vaccines, medicines, and advanced drug delivery systems. The trend toward eco-friendly solvents and stringent regulatory standards further boosts market expansion. The presence of major pharmaceutical companies and R&D institutions supports sustained market growth.

Europe Pharmaceutical Solvent Market Insight

The Europe pharmaceutical solvent market is expected to witness significant growth, supported by high R&D expenditures and regulatory emphasis on eco-friendly solvents. Consumers seek solvents that ensure high purity and compliance with environmental standards. Growth is prominent in countries such as Germany and France, driven by advanced pharmaceutical industries and increasing adoption of green chemistry.

U.K. Pharmaceutical Solvent Market Insight

The U.K. market is expected to witness notable growth, driven by demand for solvents in pharmaceutical manufacturing and research. Increased focus on sustainability and VOC reduction encourages the adoption of bio-based solvents. Evolving regulations and rising healthcare expenditure further influence market dynamics, balancing solvent efficacy with environmental compliance.

Germany Pharmaceutical Solvent Market Insight

Germany is expected to witness a high growth rate, attributed to its advanced pharmaceutical manufacturing sector and focus on sustainable solvent solutions. German manufacturers prefer high-purity solvents that support biologics and personalized medicines. The integration of green solvents in drug production supports sustained market growth.

Asia-Pacific Pharmaceutical Solvent Market Insight

The Asia-Pacific region is expected to maintain its dominance, driven by expanding pharmaceutical production, rising disposable incomes, and increasing healthcare awareness in countries such as China, India, and Japan. Government initiatives promoting life sciences and low-cost manufacturing environments further encourage solvent use.

Japan Pharmaceutical Solvent Market Insight

Japan’s pharmaceutical solvent market is expected to witness significant growth due to strong consumer preference for high-purity solvents and advanced drug manufacturing processes. The presence of major pharmaceutical companies and integration of solvents in biologics production accelerate market penetration. Rising R&D activities also contribute to growth.

China Pharmaceutical Solvent Market Insight

China holds the largest share of the Asia-Pacific pharmaceutical solvent market, propelled by rapid urbanization, a growing middle class, and increasing demand for pharmaceuticals. The country’s robust industrial sector and government support for life sciences enhance market accessibility. Competitive pricing and domestic manufacturing capabilities further drive growth.

Pharmaceutical Solvent Market Share

The pharmaceutical solvent industry is primarily led by well-established companies, including:

- Royal Dutch Shell Plc (U.K.)

- BASF (Germany)

- Brenntag SE (Germany)

- Merck KGaA (Germany)

- Dow (U.S.)

- DuPont (U.S.)

- LyondellBasell Industries Holdings B.V (Netherlands)

- Exxon Mobil Corporation (U.S.)

- Clariant AG (Switzerland)

- Mitsui Chemicals (Japan)

- Santa Cruz Biotechnology Inc. (U.S.)

- LabChem Inc. (U.S.)

- Fisher Scientific Inc. (U.S.)

- MP Biomedicals Inc(U.S.)

- Bayer Group (Germany)

Latest Developments in Global Pharmaceutical Solvent Market

- In April 2025, AustinPx introduced the KinetiLease™ program, enabling pharmaceutical companies to lease its KinetiSol™ research-scale equipment for bioavailability enhancement in R&D labs. This initiative grants direct access to cutting-edge amorphous dispersion technology, supporting drug development for poorly soluble molecules. The program includes comprehensive training, installation, and maintenance, ensuring seamless integration into research workflows. By offering flexible leasing options, AustinPx empowers biotech firms to accelerate innovation and optimize formulation strategies

- In May 2025, Epson launched the SureColor S8160 eco-solvent printer, a next-generation solution for high-quality printing. Designed for large-format signage, it features PrecisionCore MicroTFP printhead technology, ensuring exceptional image quality, reliability, and efficiency. The printer supports eco-friendly solvent technologies, reflecting a broader industry shift toward sustainable solutions. With low-VOC, GreenGuard Gold-certified inks, it minimizes environmental impact while delivering vibrant colors and sharp details. This innovation aligns with growing demand for greener printing technologies, influencing research and development in pharmaceutical solvents as well

- In June 2024, Aurorium launched Haelium Pharmaceutical Solutions, a new brand dedicated to high-purity pharmaceutical ingredients. Inspired by the Old English word “hælan”, meaning “to cure”, Haelium offers high-purity buffers, reagents, solvents, extended-release coatings, and immunostimulants for therapeutic applications such as peptide and oligonucleotide production, biologics, vaccines, and oral solid dosage forms. With four cGMP manufacturing sites in North America, Aurorium reinforces its commitment to innovation and patient outcomes. This strategic expansion strengthens its global leadership in pharmaceutical solutions

- In August 2024, Eastman introduced Eastman electronic grade isopropyl alcohol (IPA), a high-purity solvent designed for semiconductor manufacturing. As part of the EastaPure electronic chemicals line, this domestically produced IPA ensures superior quality, reliability, and contamination control. It serves as an effective wet-clean solvent in wafer fabrication and semiconductor production, supporting front-end, middle-end, and back-end processes. This launch strengthens Eastman’s presence in the high-purity solvent market, addressing growing industry demands for precision and performance in semiconductor applications

- In December 2024, Veolia Water Technologies launched its mobile water services for the pharmaceutical, cosmetics, and life sciences sectors across Europe. This rental-based offering provides continuous, sustainable solutions for manufacturing, cleaning, and complex liquid waste management. The service includes purified water systems, pure steam generation, and advanced waste treatment technologies, ensuring compliance with European and U.S. Pharmacopeia, FDA, cGMP, and GAMP standards. Veolia’s performance-based approach optimizes water quality and resource recovery, minimizing environmental impact while supporting industry growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PHARMACEUTICAL SOLVENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PHARMACEUTICAL SOLVENT MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL PHARMACEUTICAL SOLVENT MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 IMPORT-EXPORT ANALYSIS

5.3 PRODUCTION CONSUMPTION ANALYSIS

5.4 PORTER’S FIVE FORCES

5.5 VENDOR SELECTION CRITERIA

5.6 PESTEL ANALYSIS

5.7 REGULATION COVERAGE

5.7.1 PRODUCT CODES

5.7.2 CERTIFIED STANDARDS

5.7.3 SAFETY STANDARDS

5.7.3.1. MATERIAL HANDLING & STORAGE

5.7.3.2. TRANSPORT & PRECAUTIONS

5.7.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

10 GLOBAL PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2022-2031 (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 ALCOHOL

10.2.1 1-BUTANOL

10.2.2 2-BUTANOL

10.2.3 ETHANOL

10.2.4 METHANOL

10.2.5 2-METHOXYETHANOL

10.2.6 3-METHYL-1-BUTANOL

10.2.7 2-METHYL-1-PROPANOL

10.2.8 1-PENTANOL

10.2.9 1-PROPANOL

10.2.10 2-PROPANOL

10.2.11 ISOPROPANOL

10.2.12 PROPYLENE GLYCOL

10.2.13 OTHERS

10.3 AMINE

10.3.1 MONOETHANOLAMINE (MEA)

10.3.2 DIETHANOLAMINE (DEA)

10.3.3 METHYLDIETHANOLAMINE (MDEA)

10.3.4 ANILINE

10.3.5 TRIMETHYLAMINE

10.3.6 OTHERS

10.4 ESTERS

10.4.1 ACETYL ACETATE

10.4.2 ETHYL ACETATE

10.4.3 BUTYL ACETATE

10.4.4 OTHERS

10.5 ETHERS

10.5.1 DIETHYL ETHER

10.5.2 METHOXYETHANE

10.5.3 TETRAHYDROFURAN

10.5.4 METHYL TERT-BUTYL ETHER

10.5.5 DI-N-PROPYL ETHER

10.5.6 ANISOLE

10.5.7 POLYETHYLENE GLYCOL

10.5.8 OTHERS

10.6 AROMATIC HYDROCARBONS

10.6.1 TOLUENE

10.6.2 XYLENE

10.6.3 ETHYLBENZENE

10.6.4 OTHERS

10.7 CHLORINATED SOLVENTS

10.7.1 TRICHLOROETHYLENE (TCE)

10.7.2 PERCHLOROETHYLENE (PCE)

10.7.3 1,1,1-TRICHLOROETHANE (TCA)

10.7.4 CARBON TETRACHLORIDE

10.7.5 DICHLOROMETHANE

10.7.6 OTHERS

10.8 KETONES

10.8.1 CYCLOHEXANONE

10.8.2 METHYL ETHER KETONE

10.8.3 METHYL ETHYL KETONE

10.8.4 METHYL ISOBUTYL KETONE

10.8.5 OTHERS

10.9 OTHERS

11 GLOBAL PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 PHARMACEUTICAL

11.3 RESEARCH LABORATORIES

11.4 CHEMICAL

11.5 OTHERS

12 GLOBAL PHARMACEUTICAL SOLVENT MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (KILO TONS)

GLOBAL PHARMACEUTICAL SOLVENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 SWITZERLAND

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 LUXEMBURG

12.2.12 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 SINGAPORE

12.3.6 THAILAND

12.3.7 INDONESIA

12.3.8 MALAYSIA

12.3.9 PHILIPPINES

12.3.10 AUSTRALIA

12.3.11 NEW ZEALAND

12.3.12 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL PHARMACEUTICAL SOLVENT MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL PHARMACEUTICAL SOLVENT MARKET - COMPANY PROFILES

15.1 SHELL PLC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 SK GLOBAL CHEMICAL CO., LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 EXXONMOBIL CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 MERCK KGAA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 BASF SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 BAYER GROUP

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 AKZONOBEL N.V

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 DOW

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 DUPONT

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 MITSUI CHEMICALS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 BRASKEM SA

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 PPG INDUSTRIES

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 EASTMAN CHEMICAL COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 FINAR LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 NOURYON

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 MITSUBISHI CHEMICAL CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 CLARIANT AG

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 YIP’S CHEMICAL HOLDINGS LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 PON PURE CHEMICALS

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Pharmaceutical Solvent Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pharmaceutical Solvent Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pharmaceutical Solvent Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.