Global Pharmacokinetics Services Market

Market Size in USD Billion

CAGR :

%

USD

1.01 Billion

USD

1.78 Billion

2024

2032

USD

1.01 Billion

USD

1.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.01 Billion | |

| USD 1.78 Billion | |

|

|

|

|

Pharmacokinetics Services Market Size

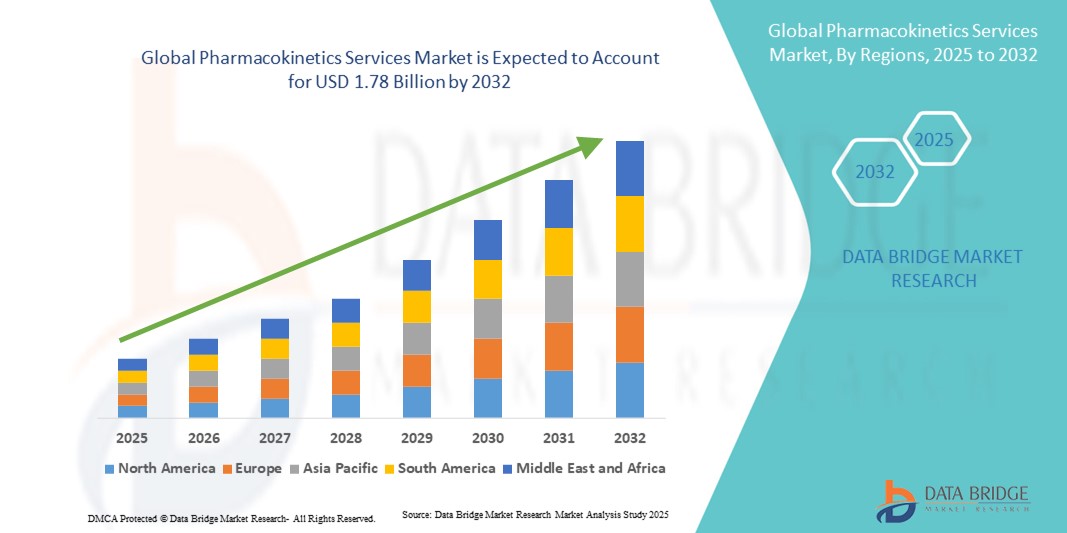

- The global pharmacokinetics services market size was valued at USD 1.01 billion in 2024 and is expected to reach USD 1.78 billion by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the increasing number of drug development programs, rising demand for precise ADME (Absorption, Distribution, Metabolism, and Excretion) profiling, and advancements in computational modeling and bioanalytical technologies supporting clinical trials

- Furthermore, growing investments by pharmaceutical and biotechnology companies in outsourcing pharmacokinetic studies to enhance R&D efficiency and regulatory compliance are driving demand, thereby positioning pharmacokinetics services as a critical enabler in modern drug discovery and development. These converging factors are accelerating adoption and significantly boosting the industry's growth

Pharmacokinetics Services Market Analysis

- Pharmacokinetics services, which analyze the absorption, distribution, metabolism, and excretion (ADME) of drug candidates, are increasingly critical in modern drug discovery and development optimizing dosage, enhancing efficacy, and ensuring regulatory compliance across preclinical and clinical studies

- The escalating demand for pharmacokinetics services is primarily driven by the growing number of clinical trials, rising R&D expenditure by pharmaceutical and biotechnology firms, and the growing trend of outsourcing to specialized CROs for cost efficiency and accelerated drug development timelines

- North America dominated the pharmacokinetics services market, accounting for 37.3% of revenue share in 2024, underpinned by its concentration of leading pharmaceutical companies, advanced research infrastructure, and stringent regulatory standards that prioritize pharmacokinetic profiling

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by surging clinical trial activity, cost-effective outsourcing opportunities, and expanding R&D hubs in countries such as China and India

- The small molecules pharmacokinetics Services segment dominated the pharmacokinetics services market in 2024, with a revenue share of 83.9%, driven by its widespread therapeutic applications, continued innovation in oral drug formulations, and strong demand for pharmacokinetic evaluations to ensure safety and efficacy

Report Scope and Pharmacokinetics Services Market Segmentation

|

Attributes |

Pharmacokinetics Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmacokinetics Services Market Trends

Rising Adoption of AI-Powered Modeling and Simulation

- A significant and accelerating trend in the global pharmacokinetics services market is the growing adoption of artificial intelligence (AI) and advanced computational modeling to improve drug development efficiency and accuracy. This integration enables faster and more reliable predictions of a drug’s absorption, distribution, metabolism, and excretion (ADME) profile

- For instance, Certara’s Simcyp Simulator and Schrödinger’s AI-enabled drug discovery platforms allow researchers to virtually simulate clinical pharmacokinetic outcomes, thereby reducing reliance on time-intensive animal testing and early-stage human trials. Similarly, companies are leveraging machine learning algorithms to optimize dosage strategies and predict adverse drug interactions more effectively

- AI integration in pharmacokinetics enables features such as adaptive modeling, which can learn from large datasets of clinical trial outcomes to refine predictions in real time, improving patient safety and drug efficacy assessments. For instance, Applied BioMath employs AI-driven quantitative systems pharmacology models to support biologics development and reduce trial failures

- The use of in silico pharmacokinetic assessments also enhances regulatory compliance, as agencies such as the FDA and EMA increasingly recognize the value of model-informed drug development (MIDD) approaches in submissions. This fosters faster approvals and reduced development costs

- This trend towards intelligent, simulation-driven pharmacokinetic services is reshaping how pharmaceutical companies approach R&D. Consequently, leading CROs are investing heavily in AI-enabled pharmacokinetics capabilities to differentiate their service offerings and meet growing demand from both large pharma and biotech startups

- The demand for AI-enhanced pharmacokinetics solutions is growing rapidly across preclinical and clinical stages, as drug developers increasingly prioritize predictive accuracy, cost reduction, and faster time-to-market

Pharmacokinetics Services Market Dynamics

Driver

Growing Demand from Expanding Clinical Trials and Biologics Development

- The global increase in clinical trial activity, alongside rising investment in biologics and advanced therapies, is a significant driver of demand for pharmacokinetics services. These studies are critical in ensuring optimal dosing, safety, and regulatory compliance for innovative therapies

- For instance, in March 2024, ICON plc expanded its pharmacokinetics and pharmacodynamics (PK/PD) services with enhanced bioanalytical platforms to support complex biologics and gene therapy trials, strengthening its global CRO offering

- As biopharmaceutical companies continue to face rising R&D costs, outsourcing pharmacokinetics services to specialized providers offers both cost-efficiency and access to advanced expertise. This has led to a surge in strategic collaborations between pharmaceutical firms and CROs worldwide

- Furthermore, increasing regulatory emphasis on pharmacokinetics evaluations as part of new drug approval processes is pushing companies to invest more in PK services to ensure compliance. This, combined with the growing number of first-in-human (FIH) trials, reinforces the role of pharmacokinetics in driving successful drug development outcomes

- The expanding pipeline of small molecules, biologics, and biosimilars is further propelling the uptake of pharmacokinetics services, making them indispensable in both preclinical and clinical drug development stages

Restraint/Challenge

High Costs, Data Complexity, and Regulatory Variability

- One of the major challenges in the pharmacokinetics services market is the high cost and complexity of conducting advanced PK/PD studies, particularly for biologics and personalized therapies. These studies require specialized expertise, advanced bioanalytical instruments, and sophisticated modeling capabilities, creating barriers for smaller biotech firms

- For instance, variability in regulatory guidelines across regions such as the U.S., Europe, and Asia adds complexity, as service providers must tailor PK study designs to meet diverse compliance requirements. This can delay trial timelines and increase operational costs

- In addition, pharmacokinetics generates large volumes of highly complex datasets, which can be difficult to integrate and interpret without advanced computational tools. Smaller CROs with limited digital infrastructure may struggle to compete with larger, AI-enabled players

- Another challenge lies in patient recruitment and retention for clinical pharmacokinetic studies, particularly in rare diseases and pediatric trials, where sample sizes are inherently small. This can impact the statistical power and reliability of PK outcomes

- While outsourcing offers cost benefits, overdependence on external CROs may raise concerns regarding data integrity, intellectual property protection, and long-term quality consistency. Addressing these barriers through cost-effective technologies, harmonized regulatory frameworks, and digital innovation will be vital for sustained industry growth

Pharmacokinetics Services Market Scope

The market is segmented on the basis of type and application

- By Type

On the basis of type, the pharmacokinetics services market is segmented into small molecules pharmacokinetics services and large molecules (biopharmaceuticals) pharmacokinetics services. The small molecules segment dominated the market with the largest revenue share in 2024, accounting for 83.9% of global revenues, owing to their widespread use in therapeutic areas such as oncology, cardiovascular, and infectious diseases. Small molecule drugs have long been the backbone of the pharmaceutical industry, and pharmacokinetics plays a central role in optimizing their absorption, distribution, metabolism, and excretion (ADME) profiles. CROs and pharma companies continue to prioritize PK testing for small molecules due to the large pipeline of generics and novel chemical entities under development. In addition, the relatively straightforward bioanalytical testing methods for small molecules, combined with established regulatory frameworks, make this segment highly scalable and cost-efficient. The robust global demand for oral formulations and the continued investment in novel targeted therapies further support the dominance of this segment in the market.

The large molecules (biopharmaceuticals) segment is anticipated to witness the fastest growth from 2025 to 2032, expanding at a CAGR above the overall market average. This growth is driven by the rising adoption of biologics, biosimilars, monoclonal antibodies, and advanced therapies such as cell and gene therapies. Unsuch as small molecules, large molecules are structurally complex and require sophisticated PK analysis to determine bioavailability, immunogenicity, and therapeutic window. The surge in global approvals of biologics and biosimilars by the FDA and EMA is further propelling demand for advanced pharmacokinetics services tailored to biologics. Service providers are increasingly investing in high-sensitivity bioanalytical platforms, ligand-binding assays, and advanced modeling to meet these needs. As biologics gain prominence in treating chronic diseases, this segment presents a significant growth opportunity for CROs and pharma companies seeking specialized PK expertise.

- By Application

On the basis of application, the pharmacokinetics services market is segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment dominated the market with the largest revenue share in 2024, benefiting from the presence of multinational pharmaceutical companies with extensive drug pipelines and high R&D expenditure. Large pharma companies conduct multiple preclinical and clinical trials simultaneously, creating consistent demand for pharmacokinetics services to optimize trial design and ensure regulatory compliance. Their ability to invest heavily in advanced PK/PD modeling tools, bioanalytical technologies, and strategic outsourcing partnerships also drives this dominance. Moreover, large enterprises often collaborate with leading CROs globally to accelerate timelines and expand into biologics and precision medicine, reinforcing their strong position in the market.

The small and medium enterprises (SMEs) segment is expected to grow at the fastest CAGR during the forecast period, fueled by the increasing participation of biotech startups and emerging pharma companies in novel drug discovery. Many SMEs are focused on niche therapeutic areas such as rare diseases, immuno-oncology, and personalized medicine, where pharmacokinetics services are vital for regulatory submissions and clinical validation. Since SMEs often face resource constraints, they tend to outsource pharmacokinetics studies extensively to specialized CROs, enabling cost-effective access to advanced expertise and infrastructure. The growing availability of AI-powered modeling and cloud-based bioanalytical platforms is also making PK services more accessible for SMEs. As venture capital funding in biotech continues to rise, SMEs will play a crucial role in driving innovation, making this segment the fastest-growing contributor to the pharmacokinetics services market.

Pharmacokinetics Services Market Regional Analysis

- North America dominated the pharmacokinetics services market, accounting for 37.3% of revenue share in 2024, underpinned by its concentration of leading pharmaceutical companies, advanced research infrastructure, and stringent regulatory standards that prioritize pharmacokinetic profiling

- Companies in the region place high value on accurate PK/PD assessments, advanced bioanalytical technologies, and AI-driven modeling, which streamline trial timelines and support successful regulatory submissions to agencies such as the FDA

- This widespread adoption is further supported by high R&D expenditure, a robust clinical trial ecosystem, and the growing emphasis on biologics and personalized medicine, establishing pharmacokinetics services as an indispensable component of preclinical and clinical drug development in North America

U.S. Pharmacokinetics Services Market Insight

The U.S. pharmacokinetics services market captured the largest revenue share of 81% in North America in 2024, fueled by the strong presence of pharmaceutical and biotech giants and the rapid expansion of clinical trials. Companies are increasingly prioritizing advanced PK/PD modeling and bioanalytical services to optimize drug development efficiency and secure FDA approvals. The growing emphasis on biologics, gene therapies, and precision medicine further propels market growth, with U.S. CROs offering cutting-edge AI-driven PK solutions. Moreover, the country’s mature regulatory framework and extensive R&D investment are cementing its dominance in the global pharmacokinetics landscape.

Europe Pharmacokinetics Services Market Insight

The Europe pharmacokinetics services market is projected to expand at a substantial CAGR throughout the forecast period, driven by the region’s stringent EMA guidelines and emphasis on patient safety. Growing demand for advanced pharmacokinetic evaluations in oncology, rare diseases, and biologics development is fostering market adoption. European biopharma firms are increasingly outsourcing to specialized CROs, supported by robust university–industry collaborations and government-backed R&D initiatives. The rise in multi-country clinical trials across Germany, France, and the U.K. further strengthens Europe’s role in the global pharmacokinetics services market.

U.K. Pharmacokinetics Services Market Insight

The U.K. pharmacokinetics services market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s thriving biotech sector and increasing adoption of model-informed drug development (MIDD). Rising concerns around drug safety and efficacy are driving demand for precise PK/PD analysis, especially in oncology and immunotherapy trials. With strong government funding for life sciences and advanced academic research hubs, the U.K. is emerging as a hub for innovative pharmacokinetics solutions.

Germany Pharmacokinetics Services Market Insight

The Germany pharmacokinetics services market is expected to expand at a considerable CAGR, fueled by its leadership in pharmaceutical manufacturing and bioanalytical innovation. The country’s emphasis on high-quality, eco-conscious, and data-secure solutions aligns with the rising adoption of advanced PK technologies. Germany’s well-developed clinical research infrastructure, coupled with strong collaborations between pharma companies, CROs, and academic institutes, promotes widespread use of pharmacokinetics in drug development. The demand for PK services in biosimilars and biologics is particularly accelerating growth.

Asia-Pacific Pharmacokinetics Services Market Insight

The Asia-Pacific pharmacokinetics services market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, driven by expanding clinical trial activity, rapid urbanization, and cost advantages in outsourcing. Countries such as China, India, and Japan are becoming global hubs for pharmacokinetics studies due to large patient populations and supportive government policies for biotech and drug development. Rising investment from multinational pharma firms in APAC R&D centers, along with growing expertise in biologics and biosimilars, is propelling strong adoption of pharmacokinetics services in the region.

Japan Pharmacokinetics Services Market Insight

The Japan pharmacokinetics services market is gaining momentum due to the country’s advanced healthcare infrastructure, high focus on precision medicine, and rapid adoption of digital health technologies. Strong demand for pharmacokinetics studies in oncology and regenerative medicine is driving market expansion. The integration of AI and modeling platforms in PK evaluations, combined with government initiatives supporting clinical research, positions Japan as a leading player in Asia. Moreover, the country’s aging population is spurring demand for tailored pharmacokinetic services to ensure safe and effective drug dosing.

India Pharmacokinetics Services Market Insight

The India pharmacokinetics services market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its growing biotech ecosystem, expanding clinical trial base, and cost-competitive CRO services. India is emerging as one of the most attractive destinations for outsourcing pharmacokinetics studies, supported by its skilled workforce and government-backed “Make in India” and smart city initiatives. Domestic CROs are increasingly partnering with global pharmaceutical firms, while local startups drive innovation in bioanalytical technologies. The rising middle class and surge in chronic disease prevalence are further fueling demand for pharmacokinetics services in India.

Pharmacokinetics Services Market Share

The pharmacokinetics services industry is primarily led by well-established companies, including

- Antibody Solutions (U.S.)

- Pharmaron (China)

- Charles River Laboratories. (U.S.)

- IBT Bioservices (U.S.)

- Allucent (U.S.)

- Resolian Inc. (Australia)

- QPS Holdings. (U.S.)

- Abzena (U.K.)

- Scantox. (Austria)

- ICON plc (Ireland)

- Parexel International (MA) Corporation. (U.S.)

- IQVIA (U.S.)

- Syneos Health (U.S.)

- Medpace (U.S.)

- Quanticate (U.K.)

- FGK Clinical Research GmbH (Germany)

- Ergomed Group (U.K.)

- Dr. Vince Clinical Research (U.S.)

What are the Recent Developments in Global Pharmacokinetics Services Market?

- In April 2025, Worldwide Clinical Trials added a new AI capability aimed at patient-centric trial optimization that supports improved trial design and operational efficiency — the AI tool helps segment patient populations and predict those most such asly to drive positive outcomes, which can reduce required sample sizes and shorten timelines; importantly for PK services, improved cohort selection and model-informed trial design can increase the efficiency and interpretability of PK/PD studies

- In February 2025, Veloxity Labs announced a strategic partnership with Aplos Analytics to accelerate and transform pharmacokinetic (PK) and toxicokinetic (TK) analysis the collaboration pairs Veloxity’s bioanalytical CRO services with Aplos’s analytics engine to deliver near-real-time PK/TK results, dramatically reducing turnaround time for assays and enabling faster decision-making during preclinical and clinical development

- In December 2024, CareDx announced a partnership with TC BioPharm to support the ACHIEVE clinical trial by providing pharmacokinetic monitoring assays for allogeneic cell-therapy patients the collaboration adds specialized PK/PD and monitoring capabilities tailored to cell therapies, reflecting increased demand for PK approaches adapted to advanced biologic modalities and the growing role of specialized diagnostics firms in PK support for cell and gene therapy trials

- In September 2024, Thermo Fisher Scientific (PPD clinical research business) announced an expansion of its bioanalytical laboratory services in Gothenburg, Sweden this facility expansion increases capacity for bioanalytical testing that supports pharmacokinetics, immunogenicity, and biomarker assays for clinical programs in Europe, reducing sample transit times and improving turnaround for PK analyses in multi-center trials

- In July 2022, Worldwide Clinical Trials launched a dedicated Large Molecule Services offering establishing a bioanalytical center of excellence focused on large-molecule bioanalysis, PK/PD, biomarker assays, and immunogenicity testing to better support biologics development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.