Global Pharmacy Inventory Management Software Solutions And Cabinets Market

Market Size in USD Billion

CAGR :

%

USD

7.16 Billion

USD

13.85 Billion

2025

2033

USD

7.16 Billion

USD

13.85 Billion

2025

2033

| 2026 –2033 | |

| USD 7.16 Billion | |

| USD 13.85 Billion | |

|

|

|

|

Pharmacy Inventory Management Software Solutions and Cabinets Market Size

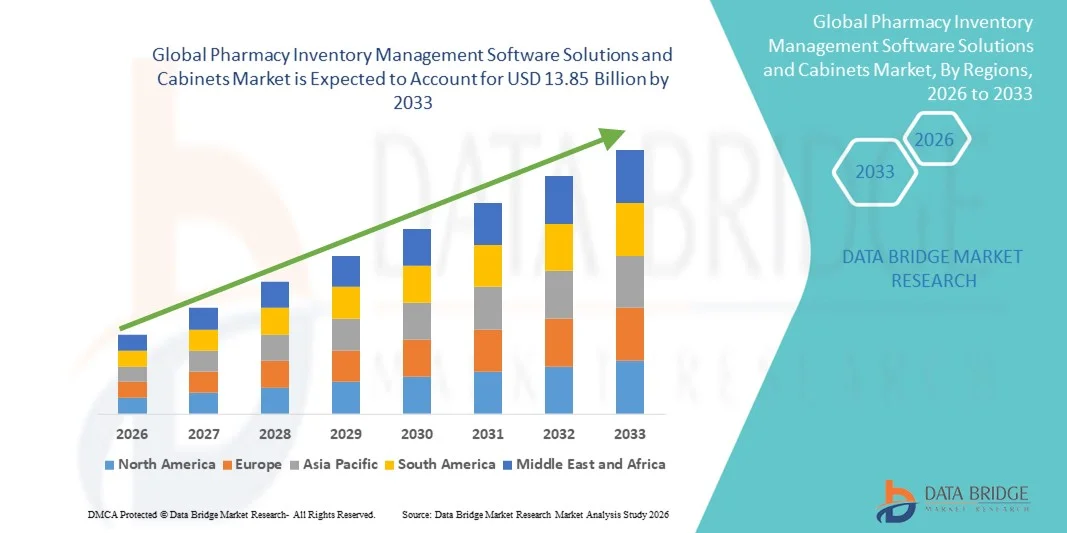

- The global pharmacy inventory management software solutions and cabinets market size was valued at USD 7.16 billion in 2025 and is expected to reach USD 13.85 billion by 2033, at a CAGR of 8.60% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital healthcare technologies, growing demand for efficient inventory management in pharmacies, and the need to minimize medication errors and streamline operational workflows

- Furthermore, rising emphasis on regulatory compliance, cost optimization, and enhanced patient safety is accelerating the uptake of Pharmacy Inventory Management Software Solutions and Cabinets, thereby significantly boosting the industry's growth

Pharmacy Inventory Management Software Solutions and Cabinets Market Analysis

- Pharmacy Inventory Management Software Solutions and Cabinets, offering digital stock tracking, automated dispensing, and electronic inventory control for pharmacies and healthcare facilities, are increasingly vital components of modern medication management systems in both hospital and retail environments due to their enhanced accuracy, real-time monitoring, reduced manual errors, and seamless integration with broader healthcare IT ecosystems

- The escalating demand for Pharmacy Inventory Management Software Solutions and Cabinets is primarily fueled by the rapid digitalization of pharmacies, growing concerns about medication errors, rising regulatory compliance requirements, and a strong industry shift toward automation for improved operational efficiency and cost savings

- North America dominated the pharmacy inventory management software solutions and cabinets market with the largest revenue share of 40 % in 2025, characterized by early digital healthcare adoption, strong regulatory frameworks, high expenditure on pharmaceutical automation, and the robust presence of major technology providers. The U.S. is witnessing significant growth driven by large-scale adoption of automated dispensing cabinets and AI-based inventory software across hospitals, clinics, and retail pharmacy chains

- Asia-Pacific is expected to be the fastest-growing region in the Pharmacy Inventory Management Software Solutions and Cabinets market during the forecast period, supported by rapid healthcare infrastructure expansion, rising pharmacy chains, increasing digitalization efforts, and growing government initiatives for medication safety and automation

- The Centralized Systems segment dominated the largest market revenue share of 58.4% in 2025, driven by expanding digital transformation initiatives across hospital networks and large pharmacy chains

Report Scope and Pharmacy Inventory Management Software Solutions and Cabinets Market Segmentation

|

Attributes |

Pharmacy Inventory Management Software Solutions and Cabinets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Omnicell, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pharmacy Inventory Management Software Solutions and Cabinets Market Trends

Enhanced Efficiency Through Integrated Inventory and Analytics Solutions

- A significant and accelerating trend in the global pharmacy inventory management software solutions and Cabinets market is the increasing adoption of integrated inventory management and analytics platforms. This integration allows pharmacies and healthcare institutions to monitor stock levels, expiration dates, and usage patterns in real time, optimizing procurement and minimizing wastage

- For instance, in March 2024, McKesson Corporation launched an upgraded version of its Pharmacy Automated Inventory Control (PAIC) platform, enabling healthcare facilities to automate stock replenishment and gain predictive insights into inventory trends. This innovation underscores the industry’s focus on efficiency, cost reduction, and improved patient safety

- Integration with electronic health records (EHRs) and hospital management systems is enabling pharmacies to align inventory decisions with prescription patterns, reducing the risk of stockouts and overstocking. Such analytics-driven decision-making enhances operational productivity and improves overall pharmacy performance

- Cloud-based solutions are becoming increasingly prevalent, allowing multi-location pharmacies to centrally monitor inventory and make data-driven decisions. These solutions also facilitate remote access and reporting, ensuring continuity of operations even in decentralized or networked pharmacy chains

- The trend towards centralized dashboards and real-time analytics is driving demand for software solutions that provide actionable insights on inventory turnover, drug utilization, and cost management, supporting both clinical and operational decision-making

- Advanced reporting and predictive analytics are enabling pharmacy managers to identify trends, forecast demand, and adjust procurement strategies proactively, thereby reducing operational costs and improving patient care outcomes

Pharmacy Inventory Management Software Solutions and Cabinets Market Dynamics

Driver

Growing Need for Operational Efficiency and Regulatory Compliance

- The increasing need for operational efficiency and regulatory compliance in pharmacies and healthcare institutions is a key driver for the adoption of advanced inventory management solutions

- For instance, in June 2023, Omnicell, Inc. announced the launch of its Omnicell One Inventory Management Suite, designed to streamline drug dispensing, track expiration dates, and ensure compliance with stringent regulatory standards. Such strategies are expected to accelerate adoption across retail, hospital, and outpatient pharmacies

- As pharmacies manage increasingly complex medication portfolios, software solutions that optimize inventory, track controlled substances, and minimize wastage are becoming critical for operational performance

- Furthermore, growing pressures to reduce operational costs and improve supply chain efficiency are pushing institutions toward automated and software-driven inventory systems, enabling better resource allocation and cost management

- The ability to access real-time stock levels, monitor usage patterns, and generate compliance reports supports pharmacy managers in maintaining adherence to local and international regulations, while ensuring availability of critical medications

- The increasing adoption of cloud-based and scalable inventory management solutions allows pharmacy chains and healthcare networks to maintain consistent oversight, improve procurement decisions, and optimize financial outcomes

Restraint/Challenge

High Implementation Costs and Integration Complexities

- The relatively high implementation costs of advanced pharmacy inventory management software solutions and cabinets can pose a barrier, particularly for smaller pharmacies or facilities in developing regions

- For instance, initial software licensing, hardware setup, and training for personnel may require substantial investment, limiting adoption among budget-conscious organizations

- Furthermore, integration complexities with existing hospital management systems, EHRs, and legacy pharmacy platforms may result in operational disruption or require additional IT support, creating resistance among healthcare administrators

- Addressing these challenges requires cost-effective deployment strategies, vendor support for system integration, and user training to ensure seamless adoption and maximize return on investment

- While cloud-based and modular solutions are helping reduce some cost and integration barriers, perceived complexity and initial expenses continue to influence decision-making, particularly in smaller-scale or resource-constrained facilities

- Overcoming these challenges through scalable, user-friendly solutions and effective implementation support will be vital for sustained growth in the Pharmacy Inventory Management Software Solutions and Cabinets market

Pharmacy Inventory Management Software Solutions and Cabinets Market Scope

The market is segmented on the basis of mode of operation outlook and end-user outlook.

- By Mode of Operation Outlook

On the basis of mode of operation, the Pharmacy Inventory Management Software Solutions and Cabinets market is segmented into Centralized Systems and Decentralized Systems. The Centralized Systems segment dominated the largest market revenue share of 58.4% in 2025, driven by expanding digital transformation initiatives across hospital networks and large pharmacy chains. Centralized systems enable unified drug tracking, automated replenishment, and improved regulatory compliance. Hospitals prefer centralized inventory control to minimize wastage and reduce medication dispensing errors. Integration with EHR systems and automated dispensing cabinets further strengthens adoption. Centralized systems improve visibility across multiple branches, supporting efficient procurement and inventory forecasting. Growing pressure to reduce drug diversion and ensure controlled substance compliance boosts usage. Increased government mandates for accurate medication tracking also fuel adoption. Their scalability and ability to support enterprise-level decision-making reinforce strong market penetration across developed regions.

The Decentralized Systems segment is expected to witness the fastest CAGR of 14.6% from 2026 to 2033, driven by growing adoption in community pharmacies, ambulatory centers, and long-term care facilities. Decentralized setups allow real-time inventory management at the point of care, reducing dispensing delays. Smaller facilities prefer decentralized systems due to lower upfront costs and ease of deployment. Increasing demand for rapid medication access in emergency and outpatient settings accelerates adoption. Integration with mobile inventory tools enhances operational efficiency. Telepharmacy expansion contributes to higher decentralized usage. Rural and semi-urban pharmacies are rapidly shifting toward decentralized software to manage stock more effectively. Their flexibility and low maintenance requirements appeal to facilities lacking large IT infrastructure.

- By End User Outlook

On the basis of end user, the Pharmacy Inventory Management Software Solutions and Cabinets market is segmented into Independent Pharmacies, Hospital Pharmacies, and Long-term Care Centers. The Hospital Pharmacies segment dominated the largest market revenue share of 49.3% in 2025, supported by high prescription volumes, increasing medication complexity, and the need for strict regulatory compliance. Hospitals rely on advanced inventory software to track controlled substances, manage automated dispensing cabinets, and prevent stockouts. Integration with clinical decision-support systems enhances accuracy and reduces medication errors. Rising admissions, surgical procedures, and chronic disease cases increase dependency on efficient inventory systems. Hospitals prioritize solutions that provide analytics for procurement, budgeting, and drug utilization review. Investments in modernizing pharmacy infrastructure further elevate segment dominance. Compliance with accreditation standards such as JCI and NABH drives the adoption of advanced inventory controls. Complex hospital supply chains also require centralized monitoring to ensure uninterrupted medication availability.

The Independent Pharmacies segment is expected to witness the fastest CAGR of 15.1% from 2026 to 2033, fueled by increasing competition, rising demand for automated stock management, and growing OTC product volumes. Independent pharmacies are rapidly adopting cloud-based inventory software to improve profitability and reduce manual workload. Digital tools help streamline purchase orders, prevent overstocking, and enhance customer service. Expansion of telepharmacy and home delivery services further accelerates adoption. Small pharmacies increasingly rely on real-time stock tracking to remain competitive against organized retail chains. Cloud subscriptions with low upfront cost make adoption easier for small-to-medium pharmacy owners. Growing consumer expectations for faster service and accurate prescription handling also promote system adoption. Independent pharmacies benefit from software-driven insights for sales forecasting, expiry management, and reimbursement processing.

Pharmacy Inventory Management Software Solutions and Cabinets Market Regional Analysis

- North America dominated the pharmacy inventory management software solutions and cabinets market with the largest revenue share of 40% in 2025, driven by early adoption of digital healthcare technologies, strong regulatory standards for medication safety, and increasing demand for automated inventory systems in hospitals and retail pharmacies

- The region benefits from high healthcare expenditure, rapid integration of AI- and analytics-based platforms, and widespread implementation of automated dispensing cabinets (ADCs) to reduce medication errors and optimize stock control

- Major hospitals, long-term care centers, and pharmacy chains are prioritizing centralized and decentralized automated systems to improve workflow efficiency, ensure compliance, and reduce wastage

U.S. Pharmacy Inventory Management Software Solutions and Cabinets Market Insight

The U.S. pharmacy inventory management software solutions and cabinets market captured the largest revenue share of the North American market in 2025, fueled by the large-scale deployment of automated dispensing cabinets, barcode-enabled tracking systems, and AI-driven pharmacy management platforms. The demand is further propelled by rising labor shortages in healthcare, increasing pressure to reduce medication errors, and strong adoption of cloud-based and interoperable systems across hospitals, retail pharmacies, and specialty clinics. Robust digital healthcare infrastructure and active investments in automation by major pharmacy chains significantly accelerate market growth in the U.S.

Europe Pharmacy Inventory Management Software Solutions and Cabinets Market Insight

The Europe pharmacy inventory management software solutions and cabinets market is projected to grow at a substantial CAGR during the forecast period, supported by strict regulatory policies for medication storage, increasing healthcare digitalization, and rising demand for automated medication distribution in hospitals and outpatient settings. Growing adoption of smart medication cabinets, RFID-enabled tracking solutions, and cloud-based inventory platforms across Germany, the U.K., France, Italy, and the Nordics is fueling market expansion. Additionally, the shift toward minimizing manual errors and strengthening audit trails across pharmaceutical environments is boosting system installations.

U.K. Pharmacy Inventory Management Software Solutions and Cabinets Market Insight

The U.K. pharmacy inventory management software solutions and cabinets market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing deployment of automated dispensing cabinets, pharmacy robotics, and digital inventory platforms across NHS hospitals and private healthcare institutions. Rising concerns around medication safety, staff shortages, and the need for real-time stock-level visibility are pushing pharmacies and hospitals to upgrade to automated, software-driven systems. Government support for digital transformation in the healthcare sector further contributes to rapid adoption.

Germany Pharmacy Inventory Management Software Solutions and Cabinets Market Insight

The Germany market is anticipated to expand at a considerable CAGR, supported by the country’s advanced pharmacy inventory management software solutions and cabinets market infrastructure, strong emphasis on safety and compliance, and increased focus on efficient medication handling. Hospitals and pharmacies are adopting RFID-enabled systems, automated cabinets, and AI-based tracking tools to optimize stock levels, prevent drug shortages, and maintain strict quality control. Germany’s growing investment in digital health and smart hospital initiatives continues to fuel system deployments.

Asia-Pacific Pharmacy Inventory Management Software Solutions and Cabinets Market Insight

The Asia-Pacific pharmacy inventory management software solutions and cabinets market is poised to grow at the fastest CAGR during 2026–2033, driven by rapid healthcare infrastructure development, expansion of pharmacy chains, rising medical spending, and increasing adoption of healthcare automation in China, India, Japan, South Korea, and Southeast Asia. Government initiatives supporting digital health records, e-pharmacy growth, and medication safety protocols are accelerating the adoption of automated inventory systems and smart dispensing cabinets. APAC’s strengthening manufacturing ecosystem also enables cost-efficient procurement of advanced pharmacy management solutions.

Japan Pharmacy Inventory Management Software Solutions and Cabinets Market Insight

Japan’s pharmacy inventory management software solutions and cabinets market is gaining momentum due to its technologically advanced healthcare environment, rapid aging population, and high need for accurate medication management. Hospitals and pharmacies increasingly rely on automated dispensing cabinets, robotics, barcode verification systems, and integrated software platforms to ensure safe, fast, and error-free medication workflows. Japan’s strong culture of precision and digital innovation fosters high adoption rates.

China Pharmacy Inventory Management Software Solutions and Cabinets Market Insight

China pharmacy inventory management software solutions and cabinets market accounted for the largest share of the APAC market in 2025, supported by massive expansion of hospitals and pharmacy chains, growth of digital health platforms, and strong government backing for healthcare automation. Rapid urbanization, rising chronic disease burden, and increasing adoption of AI-driven pharmaceutical supply chain solutions are driving widespread deployment of automated storage cabinets and advanced pharmacy management systems. The presence of major domestic manufacturers enhances accessibility and affordability.

Pharmacy Inventory Management Software Solutions and Cabinets Market Share

The Pharmacy Inventory Management Software Solutions and Cabinets industry is primarily led by well-established companies, including:

• Omnicell, Inc. (U.S.)

• BD (U.S.)

• Swisslog Healthcare (Switzerland)

• Capsa Healthcare (U.S.)

• ScriptPro LLC (U.S.)

• McKesson Corporation (U.S.)

• Talyst Systems, LLC (U.S.)

• ARxIUM (U.S.)

• Cerner Corporation (U.S.)

• Oracle Health (U.S.)

• Yuyama Co., Ltd. (Japan)

• TouchPoint Medical (U.S.)

• Aethon (U.S.)

• NewIcon Oy (Finland)

• OmniCell Technologies Ltd. (U.K.)

• Medacist Solutions Group (U.S.)

• Pyxis MedStation (U.S.)

• ExactCare Pharmacy Solutions (U.S.)

• Talyst Autopack (U.S.)

• CareFusion (U.S.)

Latest Developments in Global Pharmacy Inventory Management Software Solutions and Cabinets Market

- In July 2021, Omnicell announced the agreement to acquire FDS Amplicare, a pharmacy software solutions provider focused on patient engagement and analytics, expanding Omnicell’s software footprint for retail and specialty pharmacy operations and strengthening its capabilities in medication adherence and data-driven pharmacy services

- In January 2022, Omnicell completed the acquisition of MarkeTouch Media, adding patient-engagement and multi-channel communication capabilities to its EnlivenHealth suite — a strategic move to integrate pharmacy software, adherence tools, and digital engagement for retailers and health plans

- In June 2022, Becton, Dickinson and Company (BD) announced a definitive agreement to acquire Parata Systems — a major player in pharmacy automation (robotic dispensing, packaging and perpetual inventory management) — signaling consolidation in the pharmacy automation and cabinet space to deliver end-to-end dispensing and inventory solutions

- In July 2022, BD completed the acquisition of Parata Systems, officially integrating Parata’s automation and perpetual inventory capabilities into BD’s medication management portfolio and accelerating BD’s offerings for retail, hospital, and centralized fill operations

- In April 2024, McKesson launched Project Oasis, an initiative to address “pharmacy deserts” and improve access to pharmacy services in underserved communities; Project Oasis includes operational and technology support that can influence deployment of pharmacy software, inventory management and cabinet solutions in targeted geographies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.