Global Phenol Derivatives Market

Market Size in USD Billion

CAGR :

%

USD

26.86 Billion

USD

30.57 Billion

2024

2032

USD

26.86 Billion

USD

30.57 Billion

2024

2032

| 2025 –2032 | |

| USD 26.86 Billion | |

| USD 30.57 Billion | |

|

|

|

|

Phenol Derivatives Market Size

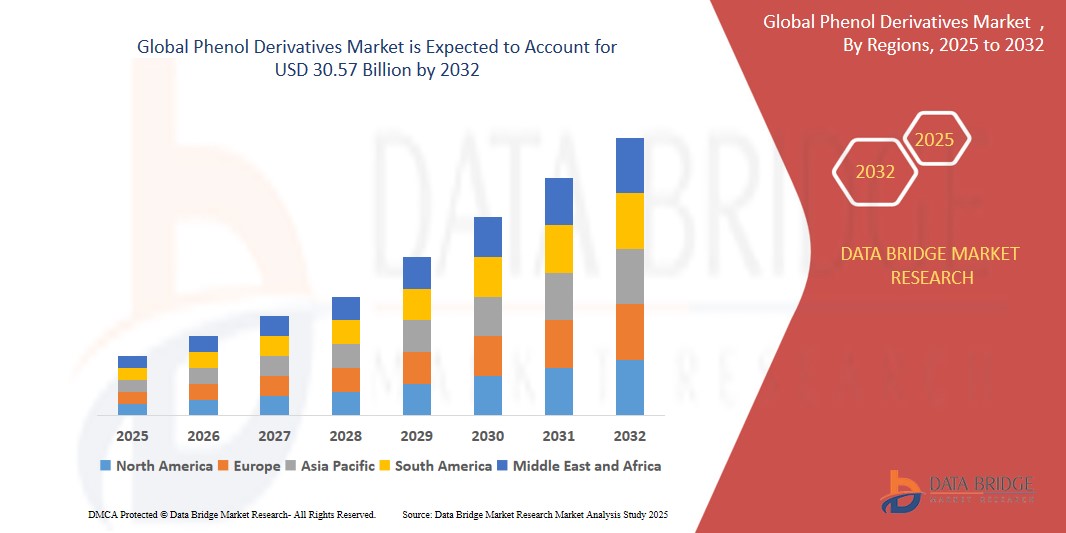

- The Global Phenol Derivatives Market size was valued at USD 26.86 billion in 2024 and is expected to reach USD 30.57 billion by 2032, at a CAGR of 7.30% during the forecast period

- Phenol derivatives like bisphenol A and phenolic resins are widely used in automotive and construction materials. Growing infrastructure projects and vehicle production are significantly boosting global phenol derivative demand.

- Phenol derivatives are essential in manufacturing plastics and laminates used in electronics and packaging. Increased consumer electronics consumption and sustainable packaging trends are fueling consistent market expansion globally.

Phenol Derivatives Market Analysis

- Growing demand for phenol derivatives in the production of epoxy resins and polycarbonates is fueling market expansion. These materials are essential in construction, automotive, and electronics industries for strength, heat resistance, and durability.

- The rising use of phenol derivatives in pharmaceuticals and agrochemicals further supports market growth. Their applications in disinfectants, analgesics, herbicides, and crop protection chemicals continue to expand with global healthcare and food security needs.

- North America dominates the global phenol derivatives market, holding 40.01% share in 2025, due to robust industrial output, established chemical manufacturing infrastructure, and early adoption of advanced material technologies across multiple industries.

- Asia-Pacific is the fastest-growing region, driven by rapid industrialization, urban development, and increasing demand from construction, automotive, and electronics sectors, particularly in China, India, and Southeast Asia.

- Bisphenol-A is the leading segment with a market share of 40.63% due to its extensive use in manufacturing polycarbonates and epoxy resins. These materials are vital in electronics, packaging, automotive components, and building materials, ensuring consistent market dominance.

Report Scope and Phenol Derivatives Market Segmentation

|

Attributes |

Phenol Derivatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phenol Derivatives Market Trends

“growing use of bisphenol-A in the production of polycarbonates and epoxy resins”

- The global phenol derivatives market is witnessing rising demand due to the growing use of bisphenol-A in the production of polycarbonates and epoxy resins, especially in automotive and electronics industries that require durable, lightweight materials.

- Environmental regulations are pushing manufacturers to innovate greener, low-emission phenol derivatives. Sustainable production methods, including bio-based feedstocks, are being adopted to meet environmental standards and consumer expectations for safer, eco-friendly materials.

For instance,

- In April 2024, LG Chem (South Korea) announced expanded production of eco-friendly bisphenol-A for EV battery components. This move supports the growing shift toward sustainable phenol derivative applications, particularly in the Asian electric mobility market, which demands high-performance, low-emission materials across automotive and electronics sectors.

- The pharmaceutical and personal care sectors are also increasingly utilizing phenol derivatives like salicylic acid, driven by demand for pain relievers, antiseptics, and skincare products across emerging economies with rising healthcare expenditures.

- Asia-Pacific is witnessing fast growth due to expanding construction and electronics manufacturing in China, India, and Southeast Asia. These regions are becoming major consumption hubs, backed by strong industrial infrastructure and low production costs.

- Digitalization and smart manufacturing are further driving demand for high-performance phenolic resins used in 5G equipment, electric vehicles, and advanced composite materials.

Phenol Derivatives Market Dynamics

Driver

“Rising Demand from the Automotive and Electronics Industries”

- Phenol derivatives are essential in manufacturing high-performance materials used in the automotive and electronics sectors. Bisphenol A (BPA), one of the most significant phenol derivatives, is a key input in polycarbonate plastics and epoxy resins. These materials are highly valued for their thermal stability, strength, and electrical insulation, which are critical in automotive and electronic applications.

- In the automotive industry, the shift toward lightweight, fuel-efficient vehicles has led to a rise in demand for polycarbonate-based components such as headlamp lenses, dashboards, and interior panels. This demand is being further strengthened by the growth of electric vehicles (EVs), which require specialized, high-heat-resistant materials.

- Meanwhile, in electronics, phenolic resins are used in printed circuit boards (PCBs), insulating materials, and chip packaging, as they offer durability, fire resistance, and electrical insulation. The global growth of 5G infrastructure and miniaturized consumer electronics contributes to this upward trend.

For Instance

- In February 2024, Covestro AG announced a 15% expansion in polycarbonate resin production in Shanghai to meet growing demand from Asia-Pacific’s automotive and electronics sectors, highlighting the increased reliance on phenol derivatives in high-performance applications.

Restraint/Challenge

“Volatility in Crude Oil and Benzene Prices”

- Phenol derivatives are primarily synthesized from benzene, which is a petrochemical derivative of crude oil. The volatile nature of crude oil prices directly affects the production cost of benzene and, consequently, phenol and its derivatives. This price fluctuation creates financial uncertainty for manufacturers and disrupts long-term pricing and supply agreements.

- Spikes in crude oil prices can sharply increase the costs of phenol derivative production, pressuring companies to either absorb losses or pass the costs onto consumers. These challenges are more acute for small-to-medium-sized manufacturers that lack the scale or flexibility to hedge against market volatility.

- The global supply chain for petrochemicals is sensitive to geopolitical tensions, environmental regulations, and OPEC+ decisions, which adds another layer of unpredictability. Such factors deter long-term investments in phenol derivative expansion projects.

Phenol Derivatives Market Scope

The market is segmented on the basis of raw material, technology and derivative.

- By Raw Material

On the basis of raw material, the phenol derivatives market is segmented into benzene, propylene, and toluene. Propylene is further sub segmented into optical media, automotive, electrical and electronic appliances. In 2025, the benzene segment dominates with over 60% market share due to its key role in producing bisphenol-A and phenol formaldehyde resins, essential for automotive, electronics, and construction industries worldwide.

In 2025, the propylene automotive segment is the fastest growing, with an estimated CAGR of 7.2%, driven by increasing demand for lightweight, high-performance materials in electric vehicles and advanced electronic appliances.

- By Technology

On the basis of technology, the phenol derivatives market is segmented into cumene peroxidation process, Rasching process, toluene two stage oxidation process, sulphonation process. In 2025, the cumene peroxidation process dominates the phenol derivatives market due to its high efficiency, cost-effectiveness, and widespread industrial adoption for large-scale phenol and acetone production globally.

The toluene two-stage oxidation process is the fastest-growing segment due to its increasing use in producing cresols and other derivatives, driven by rising demand in pharmaceuticals, agrochemicals, and specialty chemicals.

- By Derivative

On the basis of derivative, the phenol derivatives market is segmented into bisphenol-a, phenolic resin, caprolactam, alkylphenol. Bisphenol-a is further sub segmented into polycarbonate, epoxy resin and other derivatives. Propylene is further sub segmented into optical media, automotive, electrical and electronic appliances. Epoxy resin is further sub segmented into marine, can coating and others. Phenolic resin is further sub segmented into Bakelite and others. Bakelite is further sub segmented into coating industry and adhesives. Caprolactam is further sub segmented into nylon fiber. Nylon fiber is further sub segmented into textile or fabric and industrial yarn. Alkylphenol is further sub segmented into detergents, additives. Other derivatives is further sub segmented into aminophenol and cresol. Aminophenol is further sub segmented into dye and pharmaceutical drugs. Cresol is further sub segmented into antioxidants and pesticides. In 2025, bisphenol-A dominates the phenol derivatives market due to its critical role in manufacturing polycarbonates and epoxy resins, widely used in automotive, electronics, construction, and packaging industries globally.

Caprolactam is the fastest-growing segment due to rising demand for nylon-6 in textiles, automotive components, and engineering plastics, supported by expanding industrialization and infrastructure development in emerging economies.

Phenol Derivatives Market Regional Analysis

- North America dominates the global phenol derivatives market, holding 40.01% share in 2025, due to robust industrial output, established chemical manufacturing infrastructure, and early adoption of advanced material technologies across multiple industries

- The well-established industrial base, advanced manufacturing technologies, and high demand across automotive, electronics, and construction sectors, especially in the U.S., which drives large-scale consumption.

- Additionally, strict environmental regulations promote the adoption of high-performance, low-emission materials. Significant investments in R&D and the presence of key players further reinforce North America's leading position in the global phenol derivatives market.

U.S. Phenol Derivatives Market Insight

In 2025, the U.S. holds approximately 22.32% of the global phenol derivatives market share. Growth is driven by strong demand in automotive, electronics, and construction sectors. Technological advancements, domestic production strength, and regulatory support for sustainable materials further position the U.S. as a leading consumer and innovator in this market.

Europe Phenol Derivatives Market Insight

Europe's phenol derivatives market thrives on stringent environmental policies and a high demand for advanced materials in automotive, construction, and healthcare. Innovation in bio-based phenol alternatives and sustainable resins supports market evolution. Major players in Germany, Belgium, and France anchor regional growth, ensuring stable supply and technological advancements.

U.K. Phenol Derivatives Market Insight

The U.K. market benefits from increasing demand for phenol-based resins in aerospace, electronics, and sustainable packaging. Post-Brexit industrial adaptation and investment in green chemistry strengthen its position. Government initiatives supporting clean manufacturing and the circular economy further encourage adoption of phenol derivatives in both legacy and emerging applications.

Germany Phenol Derivatives Market Insight

Germany is a key player in Europe’s phenol derivatives market, driven by its dominant automotive and chemical industries. High R&D capabilities, strict environmental regulations, and a strong push toward sustainable and high-performance materials contribute to growth. Major producers and end-user industries ensure steady domestic consumption and export potential.

Asia-Pacific Phenol Derivatives Market Insight

Asia-Pacific leads the global phenol derivatives market, driven by rapid industrialization, expanding automotive and electronics sectors, and growing construction activities. In 2025, the region is projected to grow at a CAGR of 6.8%, fueled by strong demand from China and India, increasing urbanization, and rising investments in manufacturing and infrastructure across Southeast Asia and emerging economies..

Japan Phenol Derivatives Market Insight

Japan's phenol derivatives market is driven by its advanced electronics, automotive, and chemical manufacturing sectors. High-quality standards and innovation in specialty phenolic resins support steady demand. The country focuses on sustainable and high-performance materials, with increasing investment in research and eco-friendly alternatives, positioning Japan as a key player in premium phenol-based product development and applications.

China Phenol Derivatives Market Insight

China dominates the Asia-Pacific phenol derivatives market due to its massive industrial base, growing domestic consumption, and strong presence in construction, automotive, and electronics sectors. Government initiatives promoting manufacturing and infrastructure, coupled with rising demand for polycarbonate and epoxy resins, drive market expansion. China's cost-effective production capabilities also make it a global hub for phenol derivative exports.

Phenol Derivatives Market Share

The Phenol Derivatives industry is primarily led by well-established companies, including:

- Dow (U.S.)

- SABIC (Saudi Arabia)

- Mitsui Chemicals, Inc. (Japan)

- INEOS Group Ltd (U.K.)

- Cepsa (Spain)

- Honeywell International Inc. (U.S.)

- LG Chem (South Korea)

- Royal Dutch Shell plc (U.K./Netherlands)

- KUMHO PETROCHEMICAL (South Korea)

- PTT Global Chemical Public Company Limited (Thailand)

- Solvay (Belgium)

- Chang Chun Group (Taiwan)

- Versalis S.p.A. (Italy)

- Taiwan Prosperity Chemical Corporation (Taiwan)

- Altivia (U.S.)

- Department of Automatic Control - Lund University (Sweden)

- Hexion (U.S.)

- Domo Chemicals (Germany)

- Novapex Technologies Inc. (Canada)

- ALLNEX GMBH (Germany)

- IMEXBB (China)

- The Axiall Corporation (U.S.)

- Borealis AG (Austria)

Latest Developments in Global Phenol Derivatives Market

- In November 2023, INEOS Phenol acquired Mitsui Phenol Singapore for $330 million. This strategic move enables INEOS to expand its presence in Asia, supporting global customer growth and introducing bisphenol A to new markets, thereby enhancing its position in the phenol derivatives industry.

- In November 2024, Haldia Petrochemicals Ltd. signed a license agreement with Lummus Technology to increase its phenol production capacity from 300 KTPA to 345 KTPA at its West Bengal plant. This expansion aims to meet the rising demand for phenol in India.

- As of January 2025, the European phenol market is experiencing headwinds due to weak demand and global oversupply. Major producers are adjusting production capacities, with some facilities closing, in response to declining profitability and market saturation.

- In March 2025, US phenol prices increased by 3% due to supply tightness and rising benzene costs. Despite steady demand, market volatility persists, influenced by potential tariffs and uncertainties in the construction and automotive sectors.

- In June 2024, Dow introduced its REVOLOOP Reusable Polymers Resins group, focusing on converting waste into sustainable materials. This initiative underscores Dow's commitment to promoting sustainable development within the phenol derivatives market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Phenol Derivatives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Phenol Derivatives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Phenol Derivatives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.