Global Pheromones Based Biopesticides Market

Market Size in USD Million

CAGR :

%

USD

530.36 Million

USD

1,128.64 Million

2025

2033

USD

530.36 Million

USD

1,128.64 Million

2025

2033

| 2026 –2033 | |

| USD 530.36 Million | |

| USD 1,128.64 Million | |

|

|

|

|

Pheromones Based Biopesticides Market Size

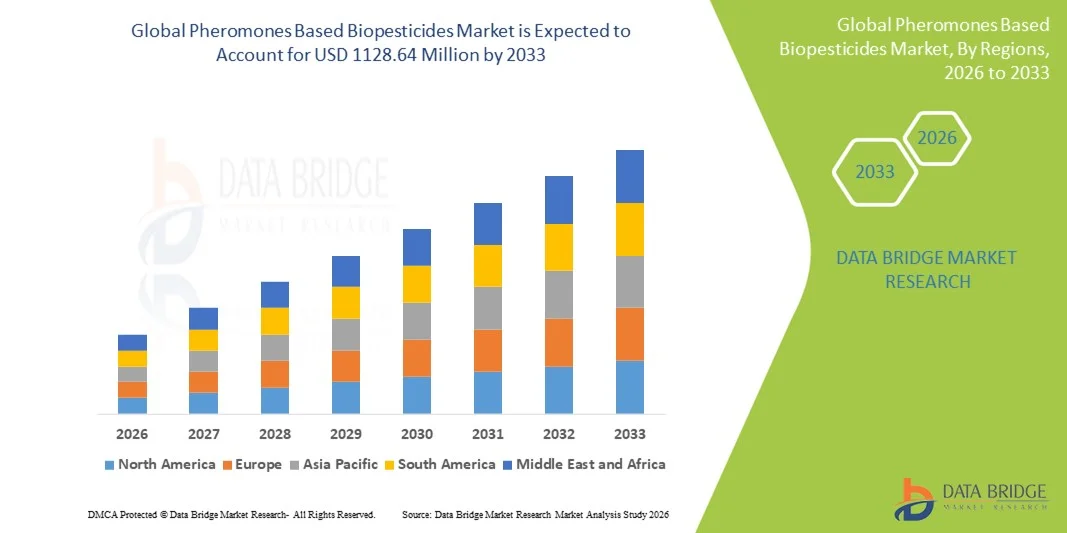

- The global pheromones based biopesticides market size was valued at USD 530.36 million in 2025 and is expected to reach USD 1128.64 million by 2033, at a CAGR of 9.90% during the forecast period

- The market growth is largely driven by the increasing adoption of sustainable agriculture practices and the gradual shift away from chemical pesticides toward environmentally safe crop protection solutions, leading to higher acceptance of pheromones based biopesticides across commercial farming operations

- Furthermore, rising demand for residue-free food, stricter regulatory controls on chemical pesticide usage, and growing awareness among farmers regarding integrated pest management are collectively accelerating the adoption of pheromone-based solutions, thereby significantly supporting overall market growth

Pheromones Based Biopesticides Market Analysis

- Pheromones based biopesticides, which use species-specific chemical signals to disrupt pest behavior, are becoming essential components of modern integrated pest management systems due to their targeted action, environmental safety, and minimal impact on non-target organisms

- The increasing demand for pheromone-based biopesticides is primarily supported by expanding organic and sustainable farming practices, heightened focus on food safety standards, and the need to manage pest resistance while maintaining crop yield and quality

- North America dominated the pheromones based biopesticides market with a share of over 40% in 2025, due to strong adoption of integrated pest management practices and high awareness of sustainable agriculture

- Asia-Pacific is expected to be the fastest growing region in the pheromones based biopesticides market during the forecast period due to expanding agricultural activities, rising awareness of sustainable farming, and increasing export-oriented crop production

- Sex pheromones segment dominated the market with a market share of 58.5% in 2025, due to their widespread effectiveness in pest-specific control and their strong adoption in integrated pest management programs. Farmers and agribusinesses prefer sex pheromones due to their high selectivity, minimal impact on non-target species, and proven success in mating disruption strategies. Their extensive use across high-value crops has further strengthened their dominance, supported by regulatory acceptance and growing awareness of residue-free crop protection

Report Scope and Pheromones Based Biopesticides Market Segmentation

|

Attributes |

Pheromones Based Biopesticides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pheromones Based Biopesticides Market Trends

Growing Adoption of Pheromone-Based Solutions in Integrated Pest Management

- A major trend in the pheromones based biopesticides market is the growing adoption of pheromone-based solutions within integrated pest management programs, driven by the need to reduce chemical pesticide dependency while maintaining effective pest control. This trend is strengthening the role of pheromones as precise, environmentally safe tools that align with sustainable agriculture practices across diverse crop segments

- For instance, companies such as Suterra and Russell IPM have expanded the deployment of pheromone mating disruption and monitoring products across fruits, nuts, and vegetable crops, supporting large-scale integrated pest management adoption. These solutions help farmers accurately monitor pest populations and implement timely interventions, improving crop protection efficiency

- The use of pheromone-based monitoring systems is increasing as growers seek early detection of pest infestations to optimize control measures. This is enhancing decision-making accuracy and reducing unnecessary pesticide applications across commercial farming operations

- High-value crops are increasingly adopting pheromone technologies to protect yields while meeting stringent residue regulations imposed by export markets. This trend is reinforcing pheromones as essential components of sustainable crop protection strategies

- Agricultural stakeholders are also integrating pheromone solutions with precision agriculture tools to improve field-level pest surveillance. This integration is contributing to more data-driven pest management approaches and long-term farm sustainability

- Overall, the expanding use of pheromone-based solutions in integrated pest management is reinforcing market growth by positioning pheromones as reliable, eco-friendly, and economically viable alternatives to conventional pest control methods

Pheromones Based Biopesticides Market Dynamics

Driver

Rising Demand for Sustainable and Residue-Free Crop Protection

- The rising demand for sustainable and residue-free crop protection is a key driver of the pheromones based biopesticides market, as consumers and regulators increasingly favor environmentally responsible agricultural practices. Pheromone-based solutions address these demands by offering targeted pest control without leaving harmful residues on crops

- For instance, Syngenta Crop Protection and Provivi have commercialized pheromone-based products for large-scale crops such as rice, enabling farmers to control pests while complying with food safety and export quality standards. These initiatives are accelerating adoption in both staple and high-value crops

- Stringent regulatory frameworks limiting chemical pesticide usage are encouraging growers to transition toward biologically derived pest control alternatives. Pheromones support compliance with these regulations while maintaining effective pest suppression

- The expansion of organic and sustainable farming practices is further strengthening this driver, as pheromone-based biopesticides align with certification requirements and environmental stewardship goals. Farmers increasingly rely on pheromones to protect crops without compromising soil health or biodiversity

- Collectively, the growing emphasis on sustainability, food safety, and regulatory compliance is strongly driving the demand for pheromones based biopesticides across global agricultural markets

Restraint/Challenge

Limited Awareness and Technical Expertise Among Small-Scale Farmers

- The pheromones based biopesticides market faces challenges due to limited awareness and technical expertise among small-scale farmers, particularly in developing agricultural regions. Many growers lack sufficient understanding of pheromone deployment techniques and the benefits of long-term pest monitoring strategies

- For instance, organizations such as the Food and Agriculture Organization and national agricultural extension agencies have highlighted the need for farmer training to improve the effective use of pheromone traps and dispensers. Inadequate guidance can lead to improper application and reduced effectiveness

- The successful use of pheromone-based solutions often requires precise timing, correct placement, and consistent monitoring, which can be challenging for farmers without access to technical support. This limits adoption despite proven field performance

- Cost sensitivity among smallholders can also hinder uptake, as the benefits of pheromone-based pest management are often realized over multiple growing seasons. Short-term cost considerations may discourage initial investment

- These challenges collectively slow market penetration among small-scale farmers, emphasizing the need for stronger extension services and education initiatives to fully realize the potential of pheromones based biopesticides

Pheromones Based Biopesticides Market Scope

The market is segmented on the basis of type, crop type, function, and application mode.

- By Type

On the basis of type, the pheromones based biopesticides market is segmented into sex pheromones, aggregation pheromones, and others. The sex pheromones segment dominated the market with the largest revenue share of 58.5% in 2025, driven by their widespread effectiveness in pest-specific control and their strong adoption in integrated pest management programs. Farmers and agribusinesses prefer sex pheromones due to their high selectivity, minimal impact on non-target species, and proven success in mating disruption strategies. Their extensive use across high-value crops has further strengthened their dominance, supported by regulatory acceptance and growing awareness of residue-free crop protection.

The aggregation pheromones segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for advanced pest monitoring and control solutions that target both male and female insects. These pheromones enable more efficient population suppression and are increasingly adopted in large-scale farming operations. Their ability to improve trapping efficiency and reduce reliance on chemical pesticides is accelerating their uptake across diverse agricultural regions.

- By Crop Type

On the basis of crop type, the pheromones based biopesticides market is segmented into fruits and nuts, field crops, vegetable crops, and others. The fruits and nuts segment dominated the market in 2025, driven by the high economic value of these crops and the strict residue regulations associated with their export and consumption. Growers in this segment actively adopt pheromone-based solutions to prevent yield losses while maintaining quality standards. The sensitivity of fruit and nut crops to pest damage further reinforces the preference for targeted and environmentally safe pest control methods.

The vegetable crops segment is anticipated to register the fastest growth rate from 2026 to 2033, supported by increasing global demand for fresh vegetables and the expansion of protected cultivation practices. Pheromone-based biopesticides are gaining traction in this segment due to their suitability for frequent harvesting cycles and their role in reducing chemical residues. This growing emphasis on food safety and sustainable farming is driving rapid adoption.

- By Function

On the basis of function, the pheromones based biopesticides market is segmented into detection and monitoring, and mass trapping and mating disruption. The detection and monitoring segment accounted for the largest market share in 2025, driven by its critical role in early pest identification and informed decision-making. Farmers rely on pheromone-based monitoring systems to optimize pest management timing and minimize unnecessary pesticide applications. This function is widely adopted as a foundational component of integrated pest management strategies across multiple crop types.

The mass trapping and mating disruption segment is projected to grow at the fastest pace from 2026 to 2033, driven by the increasing shift toward preventive and non-chemical pest control approaches. These techniques directly reduce pest populations and interrupt reproduction cycles, leading to long-term control benefits. Growing regulatory pressure to limit chemical pesticide use is further accelerating demand for this functional segment.

- By Application Mode

On the basis of application mode, the pheromones based biopesticides market is segmented into dispensers, traps, and sprays. The dispensers segment dominated the market in 2025, supported by their effectiveness in controlled release and long-lasting pheromone emission for mating disruption applications. Dispensers are widely used in orchards and large agricultural fields where consistent coverage and durability are essential. Their ability to reduce labor requirements and provide season-long pest control contributes to their strong market position.

The traps segment is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption for pest monitoring and mass trapping purposes. Traps offer ease of deployment, cost-effectiveness, and clear visual data on pest populations, making them attractive for small and medium-scale farmers. Their expanding use in precision agriculture and data-driven pest management is supporting rapid growth in this segment.

Pheromones Based Biopesticides Market Regional Analysis

- North America dominated the pheromones based biopesticides market with the largest revenue share of over 40% in 2025, driven by strong adoption of integrated pest management practices and high awareness of sustainable agriculture

- Farmers in the region increasingly prefer pheromone-based solutions due to strict regulations on chemical pesticide residues and growing demand for residue-free fruits and vegetables

- This dominance is further supported by advanced agricultural infrastructure, high adoption of precision farming technologies, and strong presence of biopesticide manufacturers, positioning pheromones as a preferred pest control solution across commercial farming operations

U.S. Pheromones Based Biopesticides Market Insight

The U.S. pheromones based biopesticides market captured the largest revenue share within North America in 2025, supported by widespread implementation of integrated pest management programs across fruits, nuts, and field crops. Growers increasingly adopt pheromone solutions to comply with Environmental Protection Agency regulations and retailer-driven sustainability standards. Strong research support from agricultural universities and active participation of companies specializing in pheromone technologies are further strengthening market growth.

Europe Pheromones Based Biopesticides Market Insight

The Europe pheromones based biopesticides market is expected to expand at a notable CAGR during the forecast period, driven by stringent environmental regulations and strong policy support for sustainable farming. The European Union’s focus on reducing chemical pesticide usage is accelerating the adoption of pheromone-based pest control across multiple crop segments. High consumer demand for organic and residue-free produce is further encouraging farmers to shift toward biologically derived pest management solutions.

U.K. Pheromones Based Biopesticides Market Insight

The U.K. pheromones based biopesticides market is projected to grow steadily during the forecast period, supported by increasing emphasis on environmentally responsible agriculture and integrated pest control strategies. British farmers are increasingly adopting pheromone traps and mating disruption techniques to comply with regulatory guidelines and reduce chemical inputs. Government-backed sustainability initiatives and rising awareness of biodiversity protection are contributing to market expansion.

Germany Pheromones Based Biopesticides Market Insight

The Germany pheromones based biopesticides market is anticipated to witness consistent growth, driven by strong environmental consciousness and advanced agricultural practices. Germany’s emphasis on precision agriculture and eco-friendly crop protection is supporting the use of pheromone-based monitoring and control systems. The market benefits from well-established research institutions and a strong focus on reducing ecological impact while maintaining high crop yields.

Asia-Pacific Pheromones Based Biopesticides Market Insight

The Asia-Pacific pheromones based biopesticides market is expected to grow at the fastest CAGR during the forecast period, driven by expanding agricultural activities, rising awareness of sustainable farming, and increasing export-oriented crop production. Countries such as China, India, and Japan are witnessing growing adoption of pheromone technologies to improve crop quality and meet international residue standards. Government initiatives promoting bio-based agricultural inputs are further accelerating market growth across the region.

Japan Pheromones Based Biopesticides Market Insight

The Japan pheromones based biopesticides market is gaining traction due to the country’s strong focus on food safety, precision agriculture, and technological innovation. Japanese farmers increasingly use pheromone-based monitoring and mating disruption solutions to manage pests in high-value crops. The emphasis on minimizing chemical residues and protecting ecological balance is supporting sustained adoption across the agricultural sector.

China Pheromones Based Biopesticides Market Insight

The China pheromones based biopesticides market accounted for the largest revenue share in Asia Pacific in 2025, driven by large-scale agricultural production and increasing government support for green farming practices. Rising demand for high-quality agricultural exports is encouraging farmers to adopt pheromone-based pest control methods to meet global standards. Strong domestic manufacturing capabilities and growing awareness of sustainable crop protection are key factors driving market expansion in China.

Pheromones Based Biopesticides Market Share

The pheromones based biopesticides industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Novozymes (Denmark)

- Syngenta AG (Switzerland)

- FMC Corporation (U.S.)

- UPL (India)

- Koppert Biological Systems (Netherlands)

- Isagro (Italy)

- Biobest Group NV (Belgium)

- Suterra (U.S.)

- Nufarm (Australia)

- Certis USA L.L.C. (U.S.)

- Russell IPM Ltd. (U.K.)

- ISCA (U.S.)

- AgriLife (U.S.)

- Bioline Agrosciences Ltd. (U.K.)

- Vegalab SA (Spain)

- Valent BioSciences LLC (U.S.)

- Andermatt Biocontrol AG (Switzerland)

- Varsha Bioscience and Technology India Pvt Ltd. (India)

Latest Developments in Global Pheromones Based Biopesticides Market

- In July 2025, Bayer expanded its partnership with M2i Group to globally distribute pheromone-based biological crop protection solutions, significantly strengthening the commercialization of pheromone technologies across North America, Europe, and Asia-Pacific. This expansion enhances market scalability by leveraging Bayer’s established distribution channels and agronomic support network, enabling faster adoption among large-scale farmers seeking alternatives to conventional chemical pesticides while reinforcing pheromones as a mainstream biological input

- In March 2022, Provivi and Syngenta Crop Protection launched Nelvium, a pheromone-based technology designed to control major rice pests, directly impacting the market by extending pheromone applications into staple food crops. This development supports higher-volume adoption beyond specialty crops, improves yield protection in rice cultivation, and accelerates acceptance of pheromones as cost-effective and residue-free solutions for large acreage farming systems

- In June 2022, BASF expanded its collaboration with M2i Group to advance pheromone-based biological crop protection solutions within its sustainable agriculture portfolio. This move strengthened market credibility by aligning pheromone technologies with a global agrochemical leader, encouraging grower confidence and supporting wider integration of pheromones into integrated pest management programs

- In April 2021, Suterra expanded its CheckMate® pheromone mating disruption portfolio for fruits and nuts, enhancing pest control efficiency across orchards and high-value perennial crops. This development positively influenced market growth by improving product longevity and field performance, enabling growers to reduce insecticide applications while maintaining consistent pest suppression

- In March 2021, Natco Pharma Ltd announced plans to launch its first Green Label pheromone product for managing pink bollworm in cotton during the Kharif 2021 season, marking an important milestone for pheromone adoption in India. This initiative strengthened the domestic market by offering farmers an affordable and eco-friendly alternative to chemical insecticides, supporting resistance management and aligning with government-led sustainable agriculture initiatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.