Global Pheromones Market

Market Size in USD Billion

CAGR :

%

USD

3.48 Billion

USD

5.97 Billion

2024

2032

USD

3.48 Billion

USD

5.97 Billion

2024

2032

| 2025 –2032 | |

| USD 3.48 Billion | |

| USD 5.97 Billion | |

|

|

|

|

What is the Global Pheromones Market Size and Growth Rate?

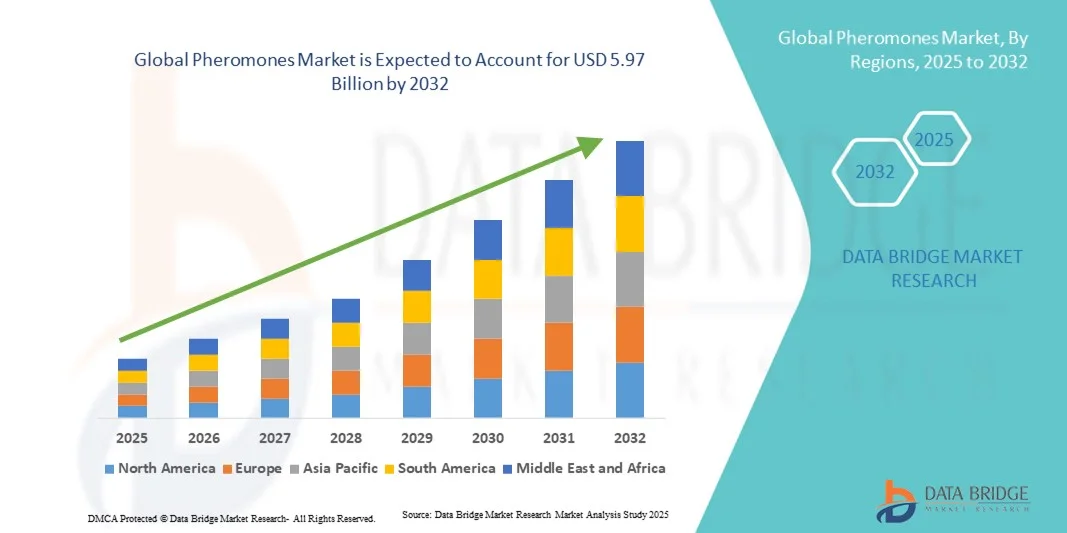

- The global pheromones market size was valued at USD 3.48 billion in 2024 and is expected to reach USD 5.97 billion by 2032, at a CAGR of 7.00% during the forecast period

- Pheromones are a greener and non-toxic method and help in preventing harmful and hazardous environmental conditions which help in driving the market. Strict regulation and environmental laws imposed on the pesticides by the authorities is also a driver for the pheromones market

- Growth in use of the pesticides for pest control, resulting in a higher count of pesticide-resistant organisms is an opportunity for the pheromones market

What are the Major Takeaways of Pheromones Market?

- Escalating demand for efficient pest management leads to less pesticide resistance insect is also an opportunity for the growth of the pheromones market

- Higher production cost of pheromones is the main challenge for the pheromones market. Lowe penetrating power of pheromones in developing and emerging nations is the main restraint for pheromones market

- North America dominated the pheromones market with the largest revenue share of 35.21% in 2024, driven by increasing adoption of sustainable agricultural practices, government incentives for eco-friendly pest control, and the rising awareness of integrated pest management (IPM) solutions

- The Asia-Pacific pheromones market is poised to grow at the fastest CAGR of 9.7% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The Releaser Pheromones segment dominated the Pheromones market with the largest revenue share of 42.5% in 2024, owing to their widespread use in targeting specific pest behaviors such as mating, feeding, and aggregation

Report Scope and Pheromones Market Segmentation

|

Attributes |

Pheromones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pheromones Market?

Adoption of Sustainable and Eco-Friendly Pest Control Solutions

- A major and accelerating trend in the global Pheromones market is the rising focus on environmentally friendly pest management solutions. Farmers, greenhouse operators, and commercial growers are increasingly adopting pheromone-based products as a sustainable alternative to chemical pesticides, reducing the ecological footprint of crop protection

- For instance, mating disruption systems using pheromones are being widely implemented in vineyards, orchards, and vegetable farms, allowing precise pest control without harming beneficial insects or contaminating soil and water

- Pheromone traps and dispensers now integrate with smart agriculture systems, enabling real-time monitoring and automated alerts for pest activity. This ensures targeted interventions, optimizes pesticide use, and minimizes crop losses

- The seamless integration of pheromone solutions with precision farming platforms and IoT devices facilitates centralized monitoring of pest populations, giving growers actionable insights to improve yields

- This shift toward eco-friendly, data-driven pest management is redefining user expectations in agriculture. Consequently, companies such as ISCA Technologies and Koppert Biological Systems are developing advanced pheromone products compatible with digital monitoring systems

- The demand for pheromone-based pest control solutions is rapidly increasing across both commercial agriculture and greenhouse applications, driven by sustainability regulations and consumer preference for pesticide-free produce

What are the Key Drivers of Pheromones Market?

- The increasing emphasis on sustainable agriculture, coupled with stricter regulations on chemical pesticide use, is a major driver of pheromone adoption

- For instance, in 2024, BASF SE expanded its pheromone product line for fruit and vegetable crops, highlighting the growing regulatory push toward eco-friendly crop protection

- As farmers seek safer and more environmentally responsible solutions, pheromones provide targeted pest control with minimal impact on non-target organisms, soil, and water, making them a compelling alternative to conventional pesticides

- The rising popularity of integrated pest management (IPM) programs and the desire to reduce chemical residues in food products are further fueling pheromone adoption

- In addition, advancements in pheromone formulation and delivery technologies, along with increasing awareness of crop losses caused by pests, are propelling market growth. The availability of user-friendly, efficient dispensers and traps is making pheromone solutions more accessible to growers globally

Which Factor is Challenging the Growth of the Pheromones Market?

- Limited awareness among small-scale farmers and the relatively higher cost of pheromone solutions compared to conventional pesticides pose key challenges for market expansion

- For instance, some regions report slower adoption due to a lack of education on proper deployment techniques or uncertainties about effectiveness against specific pest species

- Ensuring proper formulation stability and effectiveness under varying climatic conditions is another challenge for manufacturers. Companies such as Trécé Inc. and Suterra LLC invest heavily in RandD to optimize product performance

- Moreover, pheromone solutions often target specific pest species, requiring multiple products to cover all potential threats in a crop, which can increase costs and complexity for end users

- Overcoming these challenges through farmer education, government support, subsidies, and cost-efficient, multi-pest pheromone solutions will be crucial to sustaining market growth and wider adoption

How is the Pheromones Market Segmented?

The market is segmented on the basis of type, crop type, pest, function, and mode of application.

- By Type

On the basis of type, the pheromones market is segmented into Releaser Pheromones, Primer Pheromones, Reproduction Pheromones, Signaller Pheromones, and Modulator Pheromones. The Releaser Pheromones segment dominated the Pheromones market with the largest revenue share of 42.5% in 2024, owing to their widespread use in targeting specific pest behaviors such as mating, feeding, and aggregation. Releaser Pheromones are highly effective in integrated pest management (IPM) programs, providing growers with eco-friendly, precise pest control solutions.

The Modulator Pheromones segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by innovations in pest behavior modulation and the growing demand for sustainable, chemical-free crop protection methods.

- By Crop Type

On the basis of crop type, the market is segmented into Field Crops, Fruits and Nuts, and Vegetable Crops. Fruits and Nuts held the largest market revenue share of 45.3% in 2024, due to high-value crops requiring precise and environmentally friendly pest management solutions.

Field Crops are projected to witness the fastest growth rate of 21.8% during 2025–2032, fueled by the increasing adoption of pheromone-based IPM programs in grains, cereals, and oilseeds to reduce chemical pesticide use and ensure crop safety.

- By Pest

On the basis of pest, the Pheromones market is segmented into Beetles, Mites, Fruit Flies, and Moths. The Moths segment dominated the market with a 40.7% share in 2024, as moths cause significant damage across fruit, vegetable, and field crops globally.

The Fruit Flies segment is expected to witness the fastest CAGR of 23.0% from 2025 to 2032, driven by rising infestations in tropical and subtropical regions and the need for precise pest control in high-value fruit crops.

- By Function

On the basis of function, the market is segmented into Mating Disruption, Mass Trapping, and Detection and Monitoring. Mating Disruption held the largest revenue share of 44.1% in 2024, as it provides an environmentally safe method to control pest populations without harming beneficial insects.

Detection and Monitoring is anticipated to grow at the fastest CAGR of 22.5% from 2025 to 2032, fueled by technological advancements in IoT-enabled monitoring devices and the demand for real-time pest activity tracking in precision agriculture.

- By Mode of Application

On the basis of mode of application, the market is segmented into Traps, Dispensers, and Sprays. Dispensers dominated the market with a 41.6% share in 2024, due to their ease of use, uniform release of pheromones, and suitability for large-scale agricultural operations.

Traps are projected to witness the fastest CAGR of 21.9% from 2025 to 2032, as they offer cost-effective and scalable solutions for localized pest monitoring and mass trapping, supporting sustainable pest management practices.

Which Region Holds the Largest Share of the Pheromones Market?

- North America dominated the pheromones market with the largest revenue share of 35.21% in 2024, driven by increasing adoption of sustainable agricultural practices, government incentives for eco-friendly pest control, and the rising awareness of integrated pest management (IPM) solutions

- Farmers and agribusinesses in the region highly value the efficiency, environmental benefits, and targeted pest control offered by Pheromoness compared to conventional chemical pesticides

- This widespread adoption is further supported by advanced agricultural infrastructure, high technological adoption in farming practices, and strong regulatory support for eco-friendly pest management, establishing Pheromoness as a preferred choice for field crops, fruits, nuts, and vegetable farms

U.S. Pheromones Market Insight

The U.S. pheromones market captured the largest revenue share of 71% in 2024 within North America, fueled by early adoption of precision agriculture technologies and increasing investment in sustainable farming solutions. Growers are increasingly prioritizing chemical-free, targeted pest management to enhance crop yield and quality. Moreover, the integration of Pheromoness into modern IPM systems, along with advanced monitoring and delivery mechanisms, is significantly contributing to the market’s growth.

Europe Pheromones Market Insight

The Europe pheromones market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent agricultural regulations and the growing preference for environmentally safe pest control solutions. Rising demand for organic crops, coupled with increasing investments in smart farming and IPM technologies, is fostering adoption. European growers are also motivated by the benefits of reducing pesticide residues, promoting sustainability, and enhancing consumer trust.

U.K. Pheromones Market Insight

The U.K. pheromones market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the demand for eco-friendly crop protection and organic farming practices. In addition, awareness campaigns promoting integrated pest management are encouraging both large-scale farms and smallholders to adopt pheromone-based solutions. The U.K.’s advanced agricultural infrastructure, alongside strong government support for sustainable farming, is expected to continue to stimulate market growth.

Germany Pheromones Market Insight

The Germany pheromones market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of sustainable agriculture, technological adoption in farming, and strict environmental regulations. Germany’s focus on innovation, research-driven agriculture, and organic crop production promotes the adoption of Pheromoness, particularly in high-value crops such as fruits, vegetables, and nuts. The integration of pheromone-based pest management with precision farming systems is becoming increasingly prevalent, aligning with local consumer and regulatory expectations.

Which Region is the Fastest Growing Region in the Pheromones Market?

The Asia-Pacific pheromones market is poised to grow at the fastest CAGR of 9.7% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. Government initiatives promoting sustainable agriculture, coupled with the region’s high pest infestation rates and growing focus on reducing chemical pesticide use, are accelerating pheromone adoption.

Japan Pheromones Market Insight

The Japan pheromones market is gaining momentum due to the country’s high focus on precision farming, rapid adoption of smart agriculture technologies, and demand for eco-friendly crop protection solutions. The integration of Pheromoness with automated crop monitoring systems and IoT-enabled farming devices is fueling growth. Moreover, Japan’s aging farmer population is driving the adoption of user-friendly, automated pest management solutions to improve efficiency and yield.

China Pheromones Market Insight

The China pheromones market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding agricultural sector, growing middle-class demand for safe and organic food, and high adoption of modern farming practices. China is one of the largest markets for pheromone-based pest control, with increasing use across fruits, vegetables, and field crops. Strong domestic manufacturing capabilities and government support for sustainable agriculture are key factors propelling market growth in China.

Which are the Top Companies in Pheromones Market?

The pheromones industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Koppert Biological Systems (Netherlands)

- Shin Etsu Chemical Co., Ltd. (Japan)

- ISCA Technologies, Inc. (U.S.)

- Novagrica (Greece)

- International Pheromone Systems Ltd (U.K.)

- Biobest Group NV (Belgium)

- Isagro Group (Italy)

- Russell IPM LTD (U.K.)

- Suterra LLC (U.S.)

- Pherobank B.V. (Netherlands)

- ATGC Biotech Pvt. Ltd. (India)

- Trécé Inc. (U.S.)

- SEDQ Healthy Crops S.L (Spain)

- Rentokil – PCI Pvt Ltd (India)

- Laboratorios Agrochem, S.L. (Spain)

- Bio Controle (France)

- SUMI AGRO France S.A.S. (France)

- Bedoukian Research, Inc. (U.S.)

- Certis Europe BV (Netherlands)

- Hercon Environmental (U.S.)

- Pacific Biocontrol Corporation (U.S.)

- Fuji Flavor Co., Ltd (Japan)

What are the Recent Developments in Global Pheromones Market?

- In June 2025, V8 Energy, a brand under Campbell’s, launched a new drink mix designed for on-the-go convenience, featuring fruit-based energy blends with natural caffeine for busy consumers seeking portable, health-oriented beverage options, and this launch is expected to strengthen the brand’s position in the health and energy beverage segment

- In April 2025, Tropicana introduced its Fresh + Light reduced-sugar juice range in the U.K., offering fruit juices with 40% less sugar, no artificial sweeteners, and a refreshing taste for health-conscious consumers, and this product line aims to capture the growing demand for healthier beverage alternatives

- In February 2025, Agro Tech Foods completed the acquisition of Del Monte’s India business, leveraging Del Monte’s brand equity, distribution network, and portfolio of fruit-based products to expand its presence in the packaged food and beverage sector in India, thereby accelerating market growth and portfolio diversification

- In December 2024, Spindrift Beverage, known for its actual fruit-infused sparkling waters, entered discussions to be acquired by Gryphon Investors for over USD 650 million, reflecting the growing investor interest in premium and natural beverage brands, and this deal is expected to enhance Spindrift’s market expansion opportunities

- In January 2024, Hint, Inc. announced the successful completion of its USD 25 million Series D fundraising, aimed at supporting product innovation, expanding distribution channels, and scaling operations, thereby strengthening the company’s competitive position in the fruit beverage market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.