Global Phorate Fertilizers Market

Market Size in USD Million

CAGR :

%

USD

829.70 Million

USD

1,207.28 Million

2024

2032

USD

829.70 Million

USD

1,207.28 Million

2024

2032

| 2025 –2032 | |

| USD 829.70 Million | |

| USD 1,207.28 Million | |

|

|

|

|

Phorate Fertilizers Market Size

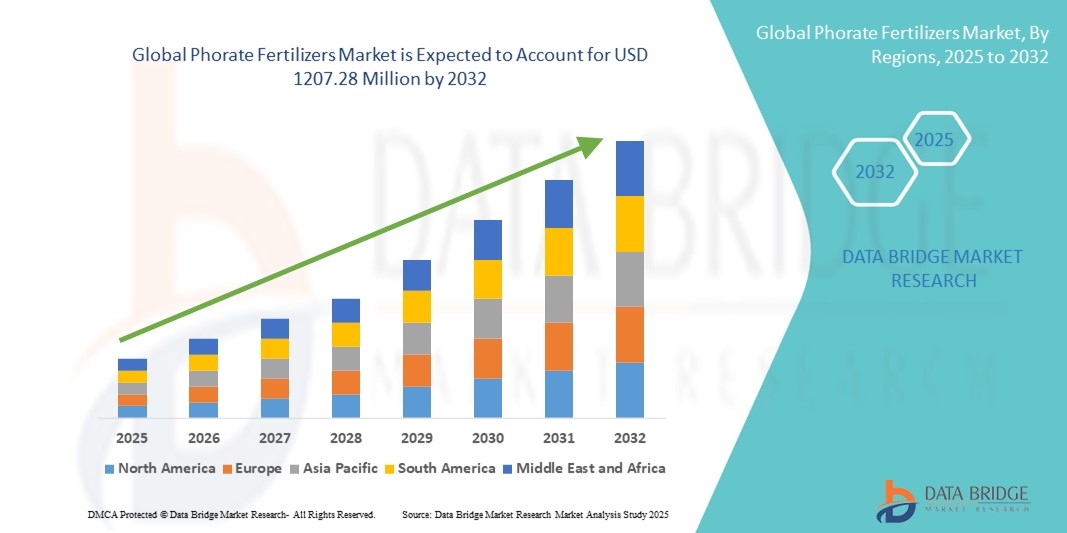

- The global phorate fertilizers market size was valued at USD 829.7 million in 2024 and is expected to reach USD 1207.28 million by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by the extensive use of chemical pest control methods in high-risk crop cultivation, particularly across developing agricultural economies with limited access to biological alternatives. Phorate fertilizers remain a preferred choice due to their effectiveness against soil-borne pests and affordability for smallholder farmers, which continues to support their widespread adoption across cotton, sugarcane, and cereal farms

- Furthermore, the rising need to improve crop yields in pest-prone regions, coupled with favorable government initiatives promoting integrated pest management practices, is driving consistent demand for phorate-based formulations. These converging factors are reinforcing the role of phorate fertilizers in global agricultural systems, thereby significantly boosting market expansion

Phorate Fertilizers Market Analysis

- Phorate fertilizers are systemic organophosphate insecticides commonly used in granular, powder, and emulsion forms to protect crops from rootworms, aphids, and other pests. Once applied to the soil, phorate is absorbed by plant roots, offering internal pest resistance and prolonged protection, especially in crops such as cotton, sugarcane, beet, and sorghum

- The increasing reliance on soil-applied systemic insecticides in tropical and subtropical regions is a key driver of the phorate market, supported by expanding cultivation areas and persistent pest threats. Regulatory support for controlled use and improved formulation technologies are further strengthening market dynamics across both emerging and developed economies

- Asia-Pacific dominated the phorate fertilizers market with a share of 44% in 2024, due to the region’s vast agricultural base, rising pest incidence, and high dependency on chemical crop protection

- North America is expected to be the fastest growing region in the phorate fertilizers market during the forecast period due to selective use of phorate in crops such as sorghum, corn, and beet

- Particles segment dominated the market with a market share of 49.1% in 2024, due to its ease of application, longer shelf life, and enhanced soil retention properties that enable gradual release of the active ingredient. Farmers prefer particle-based phorate fertilizers for their consistent distribution and compatibility with standard agricultural spreading equipment. Their efficiency in targeting soil-borne pests and minimizing volatilization further strengthens their market position in both commercial and subsistence farming systems

Report Scope and Phorate Fertilizers Market Segmentation

|

Attributes |

Phorate Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phorate Fertilizers Market Trends

“Rising Focus on Sustainable Agriculture”

- The phorate fertilizers market is shaped by an increasing global emphasis on sustainable agriculture, as producers and regulators seek to balance effective crop protection with reduced ecological impact

- For instance, leading suppliers are optimizing phorate application protocols in high-value crops—such as sugarcane and potatoes—to maximize pest control while minimizing soil and water contamination, thereby aligning product usage with sustainability certification standards and regional regulations

- Growing adoption of integrated pest management (IPM) encourages the judicious use of systemic insecticides such as phorate in combination with biological controls, reducing overall chemical input and promoting soil health

- Technological advancements in microgranule and controlled-release formulations are helping to lower the risk of phorate leaching and runoff, supporting environmental compliance and product stewardship goals

- Regulatory pressure, especially in major agricultural economies, is prompting the transition toward best management practices and traceability systems for phorate use, safeguarding both yield and long-term land productivity

- Educational initiatives by industry groups and government agencies are raising farmer awareness of proper phorate handling, storage, and application to ensure safety and meet emerging sustainability standards

Phorate Fertilizers Market Dynamics

Driver

“Rising Pest Infestation in High-Value Crops”

- Persistent and emerging pest infestations, particularly in crops such as corn, cotton, potatoes, and sugarcane, are a major driver behind the sustained demand for phorate as a potent soil and systemic pesticide

- For instance, in regions experiencing increased white grub and nematode outbreaks, manufacturers such as ADAMA and Coromandel have documented increased sales and recommended targeted phorate interventions to protect yield and crop quality

- Resistance development to older chemicals and climatic changes leading to new pest pressures are boosting the adoption of powerful organophosphates such as phorate, especially in markets where pest management options are limited

- Expansion of commercial agriculture and intensive monoculture practices amplify pest population cycles, reinforcing the need for robust solutions such as phorate in pest control programs

- Government extension services and dealers often advocate for seasonal phorate use in areas with high-value crops or export-oriented agriculture facing stricter quality requirements

Restraint/Challenge

“Health and Environmental Concerns Associated with Phorate Toxicity”

- The high acute toxicity and persistence of phorate pose significant human health and environmental risks, limiting its adoption and subjecting it to rigorous regulatory scrutiny in many countries

- For instance, cases in India and the US have led to periodic restrictions and implementation of strict safety protocols as accidental exposure and misuse resulted in worker illness, bird kills, honeybee mortality, and contamination of water sources

- Regulatory bodies such as the EPA have flagged phorate for cholinesterase inhibition in humans and ecological toxicity impacting birds, fish, aquatic organisms, and beneficial insects, prompting the development of risk mitigation measures and eventual phase-outs in certain applications

- Rising consumer awareness and demand for residue-free, eco-safe produce pressure manufacturers and growers to seek alternatives, favoring biologicals or less toxic chemistries where feasible

- The implementation of stricter maximum residue limits (MRLs), continued monitoring, and education on safe handling are impacting how and where phorate can be marketed and used, adding compliance complexity and cost for suppliers and large-scale users

Phorate Fertilizers Market Scope

The market is segmented on the basis of type and application

- By Type

On the basis of type, the Phorate fertilizers market is segmented into emulsion, particles, and powder. The particles segment dominated the largest market revenue share of 49.1% in 2024, primarily due to its ease of application, longer shelf life, and enhanced soil retention properties that enable gradual release of the active ingredient. Farmers prefer particle-based phorate fertilizers for their consistent distribution and compatibility with standard agricultural spreading equipment. Their efficiency in targeting soil-borne pests and minimizing volatilization further strengthens their market position in both commercial and subsistence farming systems.

The emulsion segment is projected to register the fastest growth rate from 2025 to 2032, driven by its superior penetration ability and quicker action against pests. Emulsion-based phorate formulations offer better solubility and mixing uniformity in irrigation systems, making them suitable for precision agriculture practices. Their rising adoption is particularly evident in regions where water-efficient application methods such as drip irrigation are prevalent, highlighting their role in sustainable farming practices.

- By Application

On the basis of application, the Phorate fertilizers market is segmented into cotton, wheat, sorghum, and beet. The cotton segment held the largest market share in 2024, driven by the crop's high susceptibility to pests such as aphids, thrips, and bollworms, which phorate effectively targets. The growing cultivation of genetically modified cotton varieties, which often require targeted pest management solutions, has further supported demand. In major cotton-producing countries, phorate remains a key input in integrated pest management strategies aimed at maintaining yield and quality.

The sorghum segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by its expanding cultivation in semi-arid and tropical regions where pest pressure is significant. Sorghum's rising significance as a bioenergy crop and food grain is increasing its economic value, encouraging farmers to adopt protective agrochemicals such as phorate. The product’s efficacy against rootworms and shoot flies, common in sorghum fields, makes it a preferred choice in pest-intensive environments.

Phorate Fertilizers Market Regional Analysis

- Asia-Pacific dominated the phorate fertilizers market with the largest revenue share of 44% in 2024, driven by the region’s vast agricultural base, rising pest incidence, and high dependency on chemical crop protection

- Government support for increasing crop yields, combined with expanding cultivation of pest-susceptible crops such as cotton and sorghum, is significantly fueling market demand

- In addition, limited access to alternative pest control solutions and the affordability of phorate products continue to make them a preferred choice among smallholder farmers across the region

India Phorate Fertilizers Market Insight

The India market leads in Asia-Pacific due to extensive usage of phorate in cotton and sugarcane cultivation. Rising pest resistance and the need for yield optimization in high-risk crops have increased reliance on granular formulations. Government-backed pest management programs and the availability of phorate through local distribution channels contribute to its dominant presence in the Indian agrochemical sector.

China Phorate Fertilizers Market Insight

China holds a significant share in the regional market, supported by large-scale cereal and vegetable farming and a strong focus on pest control efficiency. With growing mechanization and the shift toward intensive agriculture, demand for systemic insecticides such as phorate remains robust. The country's investment in improving agrochemical infrastructure and farmer training also boosts product penetration.

Europe Phorate Fertilizers Market Insight

The Europe phorate fertilizers market is expected to grow at a moderate pace due to stringent regulations on hazardous agrochemicals. However, in Eastern Europe, phorate use persists in regions where alternative pest control options are limited. Focus on crop productivity, especially in wheat and beet production, continues to sustain localized demand. Regulatory harmonization and integrated pest management frameworks will shape the region’s future adoption.

Russia Phorate Fertilizers Market Insight

Russia represents a key market in Eastern Europe, where phorate continues to be used in grain and industrial crop farming. Limited availability of biological pest control and the prevalence of pests such as wireworms and aphids support continued use. Efforts to boost agricultural self-reliance and expansion of cultivable land are reinforcing phorate application in large-scale farming operations.

North America Phorate Fertilizers Market Insight

North America is projected to witness fastest growth from 2025 to 2032, led by selective use of phorate in crops such as sorghum, corn, and beet. While regulatory constraints limit widespread usage, certain states in the U.S. still permit controlled application. Rising pest pressure and the need for targeted soil treatments in dryland farming systems are factors contributing to sustained demand.

U.S. Phorate Fertilizers Market Insight

The U.S. market accounted for the largest share in North America in 2024, primarily due to phorate’s effectiveness in managing soil insects in beet and sorghum farming. Despite regulatory scrutiny, the product remains in demand among large-scale operations with pest-prone acreage. The emphasis on crop protection and yield preservation in high-value crops continues to support its controlled use under federal and state guidelines.

Phorate Fertilizers Market Share

The phorate fertilizers industry is primarily led by well-established companies, including:

- Kalyani Industries Private Limited (India)

- A.S. Joshi & Company (India)

- Canary Agro Chemicals Pvt. Ltd. (India)

- Jayalakshmi Fertilisers (India)

- Anmol Agrotech Industries (India)

- Chromservis s.r.o. (Czech Republic)

- Ram Shree Chemicals (India)

- Hindustan Mint & Agro Products Ltd. (India)

- Sikko Industries Ltd. (India)

- Piramyd Pesticides Pvt. Ltd. (India)

- Meghmani Organics Ltd. (India)

- Bharat Rasayan Ltd. (India)

- Tagros Chemicals India Pvt. Ltd. (India)

- Excel Crop Care (Sumitomo Chemical India Ltd.) (India)

- Aimco Pesticides Ltd. (India)

- Coromandel International Ltd. (India)

- Rallis India Ltd. (India)

Latest Developments in Global Phorate Fertilizers Market

- In 2024, Tagros Chemicals India Pvt. Ltd. entered into a partnership with agro-input distributors across sub-Saharan Africa to expand the availability of phorate-based products tailored to regional pest challenges. The collaboration aimed to address the growing need for effective soil-applied insecticides in cotton and maize farming. Through joint field demonstrations, training programs, and localized formulation strategies, Tagros positioned itself to strengthen its presence in African markets facing high pest burdens and limited access to advanced pest control alternatives

- In 2024, regulatory bodies in Indonesia and the Philippines revised their agrochemical approval frameworks, allowing the controlled re-registration of certain organophosphate insecticides, including phorate. These revisions introduced stricter application guidelines, improved safety labeling, and mandatory farmer training programs. The regulatory shift created new opportunities for international manufacturers, especially from India and China, to re-enter these markets under compliance-driven product positioning. It also triggered renewed interest among local agricultural input suppliers in sourcing high-quality phorate formulations to meet national food security goals

- In 2023, Excel Crop Care, now operating under Sumitomo Chemical India, expanded its presence in Southeast Asia through new partnerships with regional agrochemical distributors in Vietnam, Thailand, and the Philippines. This initiative included the rollout of customized phorate formulations adapted to local cropping patterns and pest profiles. By strengthening on-ground technical support and logistics, the company aimed to capture a larger share of the regional phorate market, particularly in rice and sugarcane cultivation areas that suffer from persistent soil pest infestations

- In 2022, Meghmani Organics Ltd. inaugurated a new agrochemical manufacturing facility in Gujarat, India, with dedicated lines for the production of organophosphate compounds, including phorate. The investment aimed to address surging demand from Southeast Asia, Latin America, and parts of Africa, where phorate remains a key component in pest control programs. The facility was equipped with automated systems for precise formulation and quality control, allowing Meghmani to meet evolving regulatory and environmental standards while scaling up output for granular and powder-based phorate products

- In 2021, Bharat Rasayan Ltd., a prominent Indian agrochemical manufacturer, expanded its technical production facilities to increase the output of key organophosphate insecticides, including phorate. This move was part of its broader strategy to cater to rising demand in both domestic and international markets, particularly in Asia-Pacific and Africa. The expansion enabled the company to secure larger contracts with agricultural distributors and enhance its footprint in pest-intensive farming regions. The increased capacity also positioned Bharat Rasayan to offer cost-competitive phorate formulations amid tightening supply chains globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.