Global Phosphatases Market

Market Size in USD Million

CAGR :

%

USD

90.13 Million

USD

194.62 Million

2025

2033

USD

90.13 Million

USD

194.62 Million

2025

2033

| 2026 –2033 | |

| USD 90.13 Million | |

| USD 194.62 Million | |

|

|

|

|

What is the Global Phosphatases Market Size and Growth Rate?

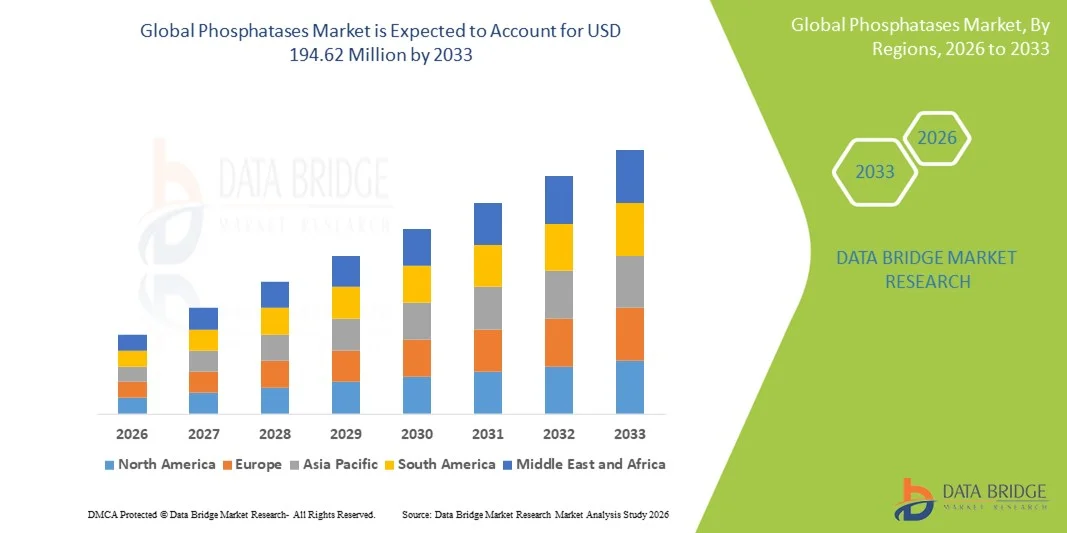

- The global phosphatases market size was valued at USD 90.13 million in 2025 and is expected to reach USD 194.62 million by 2033, at a CAGR of10.10% during the forecast period

- The phosphatases market is expected to gain growth, due to the better crop efficiency and enhance crop growth. Also the rapid increase in population and rise in disposable income are also expected to drive the market for phosphatases

What are the Major Takeaways of Phosphatases Market?

- The rise in usage particularly for the crop fertility and protection against various pests and diseases and rapid increase consumption of organic food is also such asly to lift the growth of the phosphatases market. Also the phosphatase is an indicator of fertility and it also specifies the phosphorus deficiency in the soil which is also the major driving factors leading towards the growth of the phosphatases market

- However, the price fluctuations and strict regulations related to biological products are expected to curb the growth of the phosphatases market in the above mentioned forecast period, whereas the unorganized new entrants with low profit to cost ratio and commercialization of counterfeit of products can challenge the growth of the target market

- North America dominated the phosphatases market with a 43.55% revenue share in 2025, driven by strong investment in life sciences research, clinical diagnostics, biotechnology development, and rapid expansion of enzyme-based testing facilities across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rapid expansion of biotechnology and pharmaceutical industries, growing clinical diagnostics infrastructure, and increasing academic research across China, Japan, India, South Korea, and Southeast Asia

- The Alkaline Phosphatase segment dominated the market with a 55.2% share in 2025, driven by its extensive use in clinical diagnostics, enzyme assays, and molecular biology research

Report Scope and Phosphatases Market Segmentation

|

Attributes |

Phosphatases Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Phosphatases Market?

Increasing Adoption of High-Precision, Multi-Functional, and Automated Phosphatases

- The phosphatases market is witnessing rising adoption of automated, high-throughput, and compact enzyme analyzers designed for biomedical research, drug development, and clinical diagnostics

- Manufacturers are launching multi-mode, high-sensitivity, and software-integrated systems that provide real-time monitoring, advanced assay capabilities, and seamless compatibility with laboratory information management systems (LIMS)

- Growing demand for cost-efficient, user-friendly, and portable assay platforms is driving utilization across research laboratories, pharmaceutical R&D centers, diagnostic labs, and academic institutions

- For instance, companies such as Thermo Fisher Scientific, Merck KGaA, QIAGEN, and Promega have enhanced their enzyme assay systems with higher throughput, miniaturized formats, and cloud-enabled data tracking

- Increasing focus on rapid enzyme activity profiling, high-precision screening, and multi-sample processing is accelerating the shift toward automated, lab-integrated systems

- As research and diagnostics become more complex and high-throughput, Phosphatases remain critical for enzyme kinetics studies, biomarker analysis, and drug discovery

What are the Key Drivers of Phosphatases Market?

- Rising demand for high-accuracy, automated enzyme assay platforms to support pharmaceutical R&D, diagnostics, and molecular biology applications

- For instance, in 2025, leading companies such as Thermo Fisher Scientific, Illumina, and Agilent Technologies expanded their assay portfolio with automated Phosphatases detection systems, enhanced sensitivity, and multi-sample processing capabilities

- Growing adoption of biotechnology, personalized medicine, proteomics, and high-throughput screening is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in miniaturized assays, multiplexing, software integration, and microplate formats have improved efficiency, reproducibility, and scalability

- Rising use of enzyme assays in drug discovery, biomarker identification, and molecular diagnostics is creating demand for robust, multi-functional platforms

- Supported by steady investments in life sciences R&D, clinical diagnostics, and laboratory automation, the Phosphatases market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Phosphatases Market?

- High costs associated with automated, high-throughput, and multi-functional enzyme analyzers restrict adoption among small research labs and emerging markets

- For instance, during 2024–2025, fluctuations in raw materials, reagent availability, and specialized component prices increased overall system costs for global vendors

- Complexity in handling high-throughput assays, multiplexed formats, and software integration increases the need for skilled personnel and training

- Limited awareness in emerging regions regarding enzyme assay platforms, automation benefits, and lab integration slows adoption

- Competition from manual assay kits, microplate readers, and multi-enzyme detection platforms creates pricing pressure and limits differentiation

- To address these challenges, companies are focusing on cost-effective designs, training programs, cloud-enabled analytics, and fully integrated laboratory solutions to increase global adoption of Phosphatases

How is the Phosphatases Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the phosphatases market is segmented into Alkaline Phosphatase and Acid Phosphatase. The Alkaline Phosphatase segment dominated the market with a 55.2% share in 2025, driven by its extensive use in clinical diagnostics, enzyme assays, and molecular biology research. Its robust stability, wide pH range, and suitability for high-throughput screening make it the preferred choice in hospitals, diagnostic labs, and research institutions. The growing demand for enzyme-based testing in disease detection, biomarker identification, and therapeutic research further supports adoption

The Acid Phosphatase segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing applications in cancer diagnostics, prostate health monitoring, and pharmaceutical research. Rising focus on novel assay development, biomarker studies, and precision medicine is accelerating demand for Acid Phosphatase-based analytical and diagnostic solutions. Technological advancements and automated platforms are expected to strengthen growth for both segments globally.

- By Application

On the basis of application, the phosphatases market is segmented into Academic and Research Institutes, Hospitals and Diagnostic Centers, Pharmaceutical and Biotechnology Companies, and Others. The Academic and Research Institutes segment dominated the market with a 38.7% share in 2025, supported by extensive use in enzyme kinetics studies, molecular biology experiments, and drug discovery programs. Rising investment in life sciences R&D, biotechnology programs, and educational laboratory setups drives strong adoption

The Pharmaceutical and Biotechnology Companies segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by increasing utilization of Phosphatases in drug development, high-throughput screening, and biomarker discovery. Growing demand for precision enzyme assays, high-sensitivity detection, and automated platforms in pharmaceutical R&D accelerates market penetration. Hospitals and diagnostic centers continue to rely on both alkaline and acid phosphatase tests for clinical diagnostics, while emerging applications in biotechnology support steady adoption in the other segment.

Which Region Holds the Largest Share of the Phosphatases Market?

- North America dominated the phosphatases market with a 43.55% revenue share in 2025, driven by strong investment in life sciences research, clinical diagnostics, biotechnology development, and rapid expansion of enzyme-based testing facilities across the U.S. and Canada. High adoption of advanced assay technologies, automated laboratory platforms, and high-throughput screening continues to fuel demand for Phosphatases in research labs, hospitals, diagnostic centers, and pharmaceutical R&D

- Leading companies in North America are developing innovative enzyme formulations, high-purity reagents, and automated assay kits, strengthening the region’s technological edge. Continuous investment in biotechnology, clinical trials, and molecular diagnostics drives long-term market expansion

- Concentration of skilled biotechnologists, robust innovation ecosystems, and strong regulatory support further reinforce regional leadership

U.S. Phosphatases Market Insight

The U.S. is the largest contributor in North America, supported by extensive life sciences R&D, widespread clinical diagnostics adoption, and growing pharmaceutical and biotech activity. Rising focus on disease biomarker detection, drug development, and academic research intensifies demand for high-performance Phosphatases. Presence of major biotech companies, research institutes, and government-supported innovation hubs further drives market growth.

Canada Phosphatases Market Insight

Canada contributes significantly to regional growth, driven by expanding biotechnology clusters, rising adoption of enzyme-based assays, and growing investment in pharmaceutical and diagnostic research. Academic institutions and hospitals increasingly utilize Phosphatases for clinical and research applications. Government initiatives supporting biotech innovation, skilled workforce availability, and interest in molecular diagnostics strengthen market adoption.

Asia-Pacific Phosphatases Market

Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rapid expansion of biotechnology and pharmaceutical industries, growing clinical diagnostics infrastructure, and increasing academic research across China, Japan, India, South Korea, and Southeast Asia. Rising production of recombinant enzymes, diagnostic kits, and laboratory reagents is boosting demand for Phosphatases. Growth in precision medicine, molecular diagnostics, and industrial biotechnology continues to accelerate adoption across research, healthcare, and pharmaceutical applications.

China Phosphatases Market Insight

China is the largest contributor to Asia-Pacific due to massive investments in biotechnology, expanding pharmaceutical manufacturing, and strong government support for innovation. Growing research on disease biomarkers, enzyme-based assays, and high-throughput screening drives demand for high-purity and versatile Phosphatases. Local manufacturing capabilities and competitive pricing further expand domestic and export adoption.

Japan Phosphatases Market Insight

Japan shows steady growth supported by advanced healthcare infrastructure, precision biotechnology manufacturing, and continuous modernization of clinical and research labs. High focus on quality, enzyme reliability, and assay sensitivity drives adoption of premium Phosphatases. Increasing applications in diagnostics, molecular biology, and industrial research reinforce long-term expansion.

India Phosphatases Market Insight

India is emerging as a key growth hub, driven by expanding biotechnology research centers, rising startup activity, and government-backed initiatives in pharmaceutical and diagnostics sectors. Growing demand for high-quality reagents, enzyme assays, and molecular diagnostics fuels Phosphatases adoption. Increasing R&D investments and laboratory infrastructure expansion further accelerate market penetration.

South Korea Phosphatases Market Insight

South Korea contributes significantly due to strong demand for advanced pharmaceuticals, diagnostics, and industrial biotechnology applications. Rapid development of enzyme-based research, clinical testing, and high-performance biotechnology solutions drives adoption of Phosphatases. Technological innovation, growing manufacturing capacity, and expanding biotech ecosystems support sustained market growth.

Which are the Top Companies in Phosphatases Market?

The phosphatases industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- New England Biolabs (U.S.)

- Promega Corporation (U.S.)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Takara Bio Inc. (Japan)

- QIAGEN (Netherlands)

- BD (U.S.)

- Novozymes (Denmark)

- Creative Enzyme (China)

- TCI Chemicals (India) Pvt. Ltd. (India)

- Advansta Inc. (U.S.)

What are the Recent Developments in Global Phosphatases Market?

- In October 2024, Sudeep Pharma India introduced its new subsidiary, Sudeep Advanced Materials, marking its entry into the battery materials sector with a focus on green iron phosphate for EV energy storage. The initiative leverages over three decades of expertise in green chemistry to deliver sustainable solutions for the expanding electric vehicle market, reinforcing the company’s long-term diversification strategy.

- In September 2024, OCP Group announced a USD 33 million investment in Weir Technology to enhance phosphate production capabilities in Morocco, particularly targeting a threefold expansion in output at the Benguerir project. The collaboration focuses on energy-efficient technologies that support sustainable operations, underscoring OCP’s commitment to environmentally responsible growth.

- In July 2024, Arianne Phosphate reported promising results from its prefeasibility study for a purified phosphoric acid facility in Quebec, designed to produce 350,000 tonnes annually for lithium-iron-phosphate battery applications. Company President Brian Ostroff highlighted strong economic potential with a pre-tax NPV surpassing USD 4.5 billion, emphasizing the project’s long-term strategic value

- In May 2024, Ma’aden revealed its acquisition of Mosaic’s 25% stake in the joint venture Ma’aden Wa’ad Al Shamal Phosphate Company (MWSPC) for USD 1.5 billion, increasing its ownership from 60% to 85%. The transaction, pending regulatory and shareholder approvals, is expected to strengthen Ma’aden’s position in the global phosphate industry and expand its production capabilities

- In March 2024, EuroChem inaugurated a new phosphate fertilizer production facility in Serra do Salitre, Brazil, following an investment nearing USD 1 billion to support domestic agricultural needs. The plant is set to produce 1 million tonnes of advanced fertilizers annually with low water usage and clean energy systems, reinforcing EuroChem’s commitment to sustainable agricultural solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.