Global Phosphate Fertilizers Market

Market Size in USD Billion

CAGR :

%

USD

69.92 Billion

USD

97.92 Billion

2024

2032

USD

69.92 Billion

USD

97.92 Billion

2024

2032

| 2025 –2032 | |

| USD 69.92 Billion | |

| USD 97.92 Billion | |

|

|

|

|

Phosphate Fertilizers Market Size

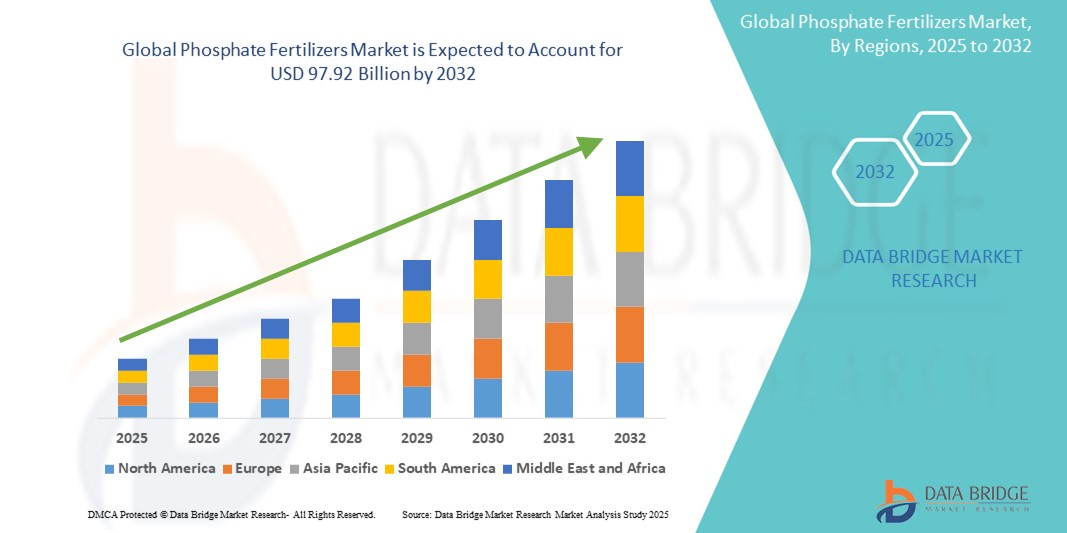

- The global phosphate fertilizers market size was valued at USD 69.92 billion in 2024 and is expected to reach USD 97.92 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by the increasing global demand for food production, spurred by population growth and the need for enhanced agricultural yields, particularly in developing regions

- In addition, the rising adoption of precision agriculture and sustainable farming practices is boosting the demand for efficient phosphate fertilizers, which are critical for improving soil fertility and crop productivity

Phosphate Fertilizers Market Analysis

- Phosphate fertilizers, essential for providing phosphorus to crops, play a vital role in modern agriculture by enhancing root development, crop quality, and yield

- The escalating demand for phosphate fertilizers is driven by the need to address food security challenges, growing awareness of soil nutrient management, and advancements in fertilizer production technologies

- Asia-Pacific dominated the phosphate fertilizers market with the largest revenue share of 45.3% in 2024, fueled by extensive agricultural activities, large-scale crop production, and government initiatives promoting fertilizer use in countries such as China and India

- South America is expected to be the fastest-growing region during the forecast period, driven by expanding agricultural land, increasing adoption of modern farming techniques, and rising demand for high-yield crops

- The monoammonium phosphate (MAP) segment held the largest market revenue share of 38.2% in 2024, driven by its high phosphorus content, cost-effectiveness, and versatility in providing essential nutrients for plant growth across various soil types

Report Scope and Phosphate Fertilizers Market Segmentation

|

Attributes |

Phosphate Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Phosphate Fertilizers Market Trends

“Increasing Integration of Precision Agriculture and Data Analytics”

- The global phosphate fertilizers market is experiencing a notable trend toward the integration of precision agriculture and advanced data analytics

- These technologies enable precise application of phosphate fertilizers, optimizing nutrient delivery based on soil conditions, crop needs, and environmental factors

- Data-driven platforms analyze soil health, weather patterns, and crop growth stages to recommend tailored fertilizer application schedules, improving efficiency and reducing waste

- For instance, companies are developing smart farming solutions that use sensors and IoT devices to monitor phosphorus levels in real-time, enabling farmers to adjust fertilizer use dynamically

- This trend enhances the sustainability of phosphate fertilizer use, making it more appealing to farmers seeking to maximize yields while minimizing environmental impact

- Analytics tools can assess a wide range of data, including soil nutrient profiles, crop yield patterns, and weather forecasts, to provide actionable insights for optimizing fertilizer application

Phosphate Fertilizers Market Dynamics

Driver

“Rising Demand for Food Security and High Crop Yields”

- The increasing global population and growing demand for food production are major drivers for the phosphate fertilizers market

- Phosphate fertilizers, such as Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), and Triple Superphosphate (TSP), enhance soil fertility and promote robust crop growth, critical for meeting food security needs

- Government initiatives, particularly in regions such as Asia-Pacific, which dominates the market with over 60% revenue share in 2021, are promoting sustainable agricultural practices and fertilizer use to boost productivity

- The advancement of agricultural technologies and the adoption of high-efficiency fertilizers are further enabling the expansion of phosphate fertilizer applications, supporting higher yields for cereals, grains, oilseeds, and fruits and vegetables

- Agricultural producers are increasingly incorporating phosphate fertilizers as standard inputs to meet consumer demand for diverse and high-quality food products

Restraint/Challenge

“High Production Costs and Environmental Concerns”

- The substantial costs associated with the production and application of phosphate fertilizers, including raw material extraction and manufacturing processes, can be a significant barrier, particularly in emerging markets

- Integrating advanced fertilizer solutions, such as precision application systems, into existing farming practices can be complex and expensive

- In addition, environmental concerns and regulatory challenges pose significant hurdles. Excessive use of phosphate fertilizers can lead to nutrient runoff, causing water pollution and ecosystem damage, raising concerns about sustainability

- The fragmented regulatory landscape across countries regarding fertilizer use, environmental impact, and soil management complicates compliance for manufacturers and farmers

- These factors can deter adoption, particularly in regions such as South America, the fastest-growing market, where cost sensitivity and environmental awareness are increasing

Phosphate Fertilizers market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the global phosphate fertilizers market is segmented into monoammonium phosphate (MAP), diammonium phosphate (DAP), Single Superphosphate (SSP), triple superphosphate (TSP), and others. The monoammonium phosphate (MAP) segment held the largest market revenue share of 38.2% in 2024, driven by its high phosphorus content, cost-effectiveness, and versatility in providing essential nutrients for plant growth across various soil types. Its widespread use in precision farming and as a granular fertilizer for cereals, grains, and other crops further bolsters its dominance.

The triple superphosphate (TSP) segment is expected to witness the fastest growth rate of 9.0% from 2025 to 2032, fueled by its high phosphorus concentration and effectiveness for crops with significant phosphorus requirements, such as leguminous crops. Its high solubility ensures rapid nutrient availability, driving adoption in regions with phosphorus-deficient soils.

- By Application

On the basis of application, the global phosphate fertilizers market is segmented into cereals and grains, oilseeds, fruits and vegetables, and others. The cereals and grains segment dominated the market with a revenue share of 47.0% in 2024, driven by the critical role of phosphate fertilizers in enhancing yields of staple crops such as wheat, rice, and corn to meet global food demand.

The fruits and vegetables segment is anticipated to experience the fastest growth rate of 4.3% from 2025 to 2032. This growth is propelled by shifting consumer preferences toward nutrient-rich diets, increasing demand for high-value crops such as fruits and vegetables. Phosphate fertilizers enhance root development, fruit quality, and yield, making them essential for meeting the rising global demand for fresh produce.

Phosphate Fertilizers Market Regional Analysis

- Asia-Pacific dominated the phosphate fertilizers market with the largest revenue share of 45.3% in 2024, fueled by extensive agricultural activities, large-scale crop production, and government initiatives promoting fertilizer use in countries such as China and India

- Consumers prioritize phosphate fertilizers for improving soil fertility, promoting robust plant growth, and increasing crop yields, particularly in regions with limited arable land and diverse agricultural needs

- Growth is supported by advancements in fertilizer technology, including slow-release and controlled-release formulations, alongside rising adoption in both large-scale farming and smallholder agriculture

Japan Phosphate Fertilizers Market Insight

Japan’s phosphate fertilizers market is expected to witness significant growth due to strong consumer preference for high-quality, nutrient-efficient fertilizers that enhance crop productivity and sustainability. The presence of advanced agricultural practices and integration of phosphate fertilizers in high-value crop production accelerate market penetration. Rising interest in precision farming also contributes to growth.

China Phosphate Fertilizers Market Insight

China holds the largest share of the Asia-Pacific phosphate fertilizers market, propelled by rapid urbanization, rising agricultural output, and increasing demand for food security solutions. The country’s growing population and focus on modern agriculture support the adoption of advanced fertilizers such as DAP and TSP. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Phosphate Fertilizers Market Insight

The U.S. phosphate fertilizers market is expected to witness significant growth, fueled by strong demand for high-yield crops such as corn, soybeans, and wheat, and growing awareness of phosphorus’s role in root development and crop productivity. The trend towards precision agriculture and sustainable farming practices further boosts market expansion. Major producers’ focus on innovative formulations complements both commercial and specialty crop applications, creating a diverse product ecosystem.

Europe Phosphate Fertilizers Market Insight

The Europe phosphate fertilizers market is expected to witness significant growth, supported by regulatory emphasis on sustainable agriculture and soil health. Consumers seek fertilizers that enhance crop quality while minimizing environmental impact. The growth is prominent in both large-scale cereal production and specialized horticulture, with countries such as Germany and France showing significant uptake due to rising food demand and environmental regulations.

U.K. Phosphate Fertilizers Market Insight

The U.K. market for phosphate fertilizers is expected to witness notable growth, driven by demand for improved crop yields and soil fertility in intensive farming systems. Increased interest in sustainable agriculture and rising awareness of phosphorus’s benefits for crop development encourage adoption. Evolving environmental regulations influence consumer choices, balancing nutrient efficiency with compliance.

Germany Phosphate Fertilizers Market Insight

Germany is expected to witness significant growth in phosphate fertilizers, attributed to its advanced agricultural sector and high consumer focus on crop productivity and sustainability. German farmers prefer technologically advanced fertilizers such as Diammonium Phosphate (DAP) and Monoammonium Phosphate (MAP) that enhance nutrient uptake and contribute to efficient land use. The integration of these fertilizers in high-value crops and sustainable farming practices supports sustained market growth.

South America Phosphate Fertilizers Market Insight

South America is the fastest-growing region in the global phosphate fertilizers market, driven by expanding agricultural activities and increasing demand for high-yield crops such as soybeans and corn in countries such as Brazil. The region’s focus on boosting export-oriented agriculture and adopting modern farming techniques fuels market growth. Government support for agricultural development and rising awareness of phosphorus’s role in crop health further accelerate adoption.

Phosphate Fertilizers Market Share

The phosphate fertilizers industry is primarily led by well-established companies, including:

- ICL (Israel)

- CF Industries Holdings, Inc. (U.S.)

- Coromandel International Ltd. (India)

- Nutrien Ltd. (Canada)

- PhosAgro Group(Russia)

- Yara International ASA (Norway)

- EuroChem Group (Switzerland)

- Mosaic (U.S.)

- OCP (Morocco)

- Ma'aden (Saudi Arabia)

- California Organic Fertilizers Inc (U.S.)

- Hubei Xingfa Chemicals Group Co., Ltd. (China)

- QAFCO | QATAR FERTILISER COMPANY (Qatar)

- Kazphosphate LLP (Kazakhstan)

- Jordan Phosphate Mines Company (Jordan)

- Haifa Group (Israel)

- J.R. Simplot Company (U.S.)

- Itafos (U.S.)

What are the Recent Developments in Global Phosphate Fertilizers Market?

- In September 2024, Coromandel International, a leading agri-solutions provider in India, increased its equity stake in Baobab Mining and Chemicals Corporation (BMCC), a Senegal-based rock phosphate miner, from 45% to 53.8%. The acquisition was made through Coromandel’s wholly owned subsidiary, Coromandel Chemicals Ltd, with an investment along with loan infusion to support BMCC’s expansion and working capital needs. This strategic move strengthens Coromandel’s backward integration and secures a stable supply of rock phosphate, a key raw material for phosphatic fertilizer production, reinforcing India’s fertilizer supply chain resilience

- In February 2024, India initiated discussions to sign a long-term agreement with Mauritania for the import of rock phosphate, a critical raw material used in the production of fertilizers such as DAP (Di-ammonium Phosphate) and NPK (Nitrogen, Phosphorus, Potassium). The proposed deal includes the formation of a joint venture involving both public and private Indian entities to oversee mining, production, and transportation of fertilizers from Mauritania to India. This move is part of India’s broader strategy to diversify its fertilizer supply sources, reduce dependency on a few countries, and ensure fertilizer security amid global disruptions such as the Ukraine war and Red Sea crisis

- In November 2023, Comatam, a subsidiary of Morocco’s OCP Group, set a new world record by loading 100,000 tons of fertilizer onto a single bulk carrier at the Port of Jorf Lasfar. The operation, completed on October 24 and involving the vessel Patricia Oldendorff, surpassed the previous record of 75,000 tons set in Brazil. This achievement highlights OCP’s commitment to operational efficiency, digitization, and adherence to international safety and quality standards in fertilizer logistics. It also reinforces OCP’s global leadership in phosphate-based fertilizer distribution and its role in strengthening global food security

- In July 2023, Norge Mining announced the discovery of a massive phosphate deposit in southwestern Norway, estimated at up to 70 billion tonnes—a volume nearly equal to the world’s known phosphate reserves. This discovery, located in the Bjerkreim-Sokndal intrusion, positions Norway as a potential global leader in the supply of phosphorus, a critical raw material used in fertilizers, solar panels, and lithium iron phosphate (LFP) batteries. The find is especially significant for Europe, which currently relies heavily on phosphate imports, and aligns with the EU’s Critical Raw Materials Act to secure strategic resources domestically

- In May 2023, EuroChem Group launched its Croplex® fertilizer in Brazil, marking a strategic expansion into one of the world’s most important agricultural markets. Croplex is a balanced nitrogen-phosphate starter fertilizer enriched with sulfur, zinc, and boron, designed to support early crop growth and improve nutrient uptake. Its homogeneous granule composition ensures even distribution and reduces nutrient segregation, making it ideal for direct application. This product launch reflects EuroChem’s commitment to enhancing crop yields and sustainable farming practices, while also strengthening its presence in Latin America’s competitive fertilizer sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.