Global Phosphorescent Pigments Market

Market Size in USD Million

CAGR :

%

USD

285.08 Million

USD

397.71 Million

2024

2032

USD

285.08 Million

USD

397.71 Million

2024

2032

| 2025 –2032 | |

| USD 285.08 Million | |

| USD 397.71 Million | |

|

|

|

|

Phosphorescent Pigments Market Size

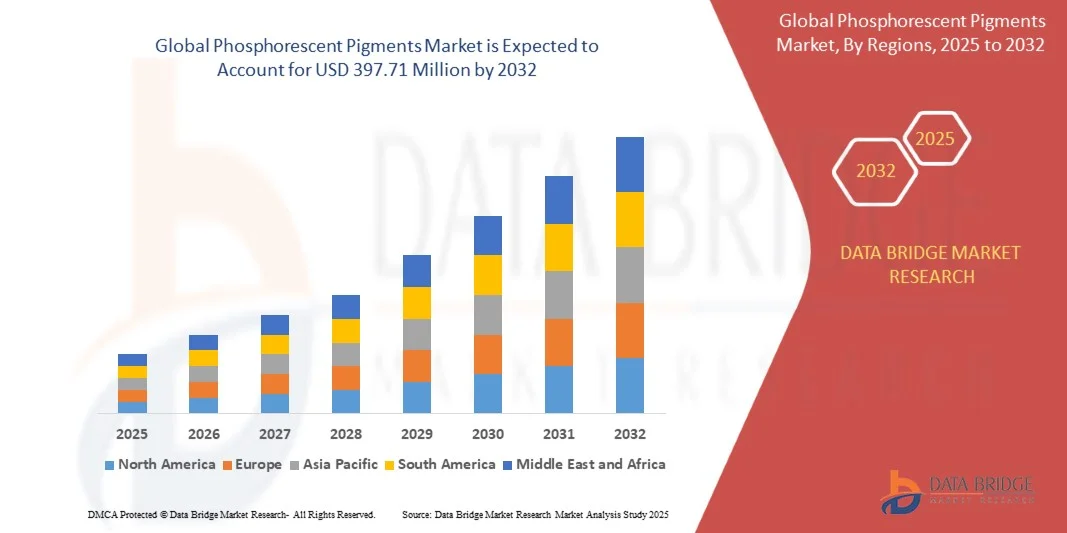

- The global phosphorescent pigments market size was valued at USD 285.08 million in 2024 and is expected to reach USD 397.71 million by 2032, at a CAGR of 4.25% during the forecast period

- The market growth is largely fueled by increasing applications of phosphorescent pigments in safety signage, paints and coatings, plastics, and construction materials, driven by rising awareness of safety standards and decorative applications across industries

- Furthermore, growing demand for long-lasting, high-performance, and eco-friendly glow-in-the-dark materials is encouraging manufacturers to adopt advanced phosphorescent pigment solutions. These factors are accelerating market adoption and significantly boosting industry growth

Phosphorescent Pigments Market Analysis

- Phosphorescent pigments are luminescent materials that absorb light and emit it slowly over time, creating a glow-in-the-dark effect. They are widely used in paints, coatings, plastics, construction materials, and safety signage, providing both functional and decorative benefits

- The escalating demand for phosphorescent pigments is primarily fueled by increasing safety regulations, growing urbanization, rising decorative and novelty applications, and continuous technological innovations that enhance brightness, durability, and afterglow performance

- Asia-Pacific dominated the phosphorescent pigments market in 2024, due to rising demand in paints, coatings, and construction materials, along with expanding manufacturing capabilities in emerging economies

- North America is expected to be the fastest growing region in the phosphorescent pigments market during the forecast period due to rising applications in safety signage, plastics, construction, and decorative coatings

- Inorganic phosphorescent pigment segment dominated the market with a market share of 62.5% in 2024, due to its superior brightness, longer afterglow, and excellent stability under diverse environmental conditions. These pigments are widely preferred in safety and signage applications, where durability and long-lasting luminescence are critical. Their compatibility with multiple mediums such as paints, coatings, plastics, and construction materials further drives their adoption. Inorganic pigments such as strontium aluminate-based powders offer enhanced glow intensity, making them a preferred choice for high-performance applications

Report Scope and Phosphorescent Pigments Market Segmentation

|

Attributes |

Phosphorescent Pigments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phosphorescent Pigments Market Trends

“Growing Use of Eco-Friendly Phosphorescent Pigments”

- The phosphorescent pigments market is experiencing a significant shift towards eco-friendly and non-toxic pigments as industries seek sustainable solutions with minimal environmental impact. These pigments are increasingly used in consumer goods, decorations, and safety applications due to their reduced toxicity compared to traditional rare-earth or heavy-metal-based alternatives

- For instance, Nemoto & Co., Ltd. has introduced eco-friendly phosphorescent pigments that eliminate hazardous substances and focus on safer formulations, while GloTech International has developed long-lasting non-toxic pigments designed for decorative and functional applications. These initiatives highlight growing industry efforts to replace traditional formulations with safer alternatives

- Eco-friendly phosphorescent pigments are being favored in children’s toys, consumer products, and interior decoration due to their safety and compliance with international regulatory standards. This demand reflects consumer preference for products without harmful chemicals while ensuring high glow performance

- In addition, the construction and architecture sector is increasingly utilizing these pigments in eco-friendly building materials and finishing products. Sustainable glow-in-the-dark paints and coatings are being applied to walls, floors, and pathways to enhance aesthetics while adhering to green building standards

- The adoption of eco-friendly pigments also supports broader sustainability commitments by global manufacturers. Firms are investing in R&D to ensure biodegradable carriers, durable formulations, and compatibility with low-emission production cycles that align with environmental regulations

- The growing use of eco-friendly phosphorescent pigments demonstrates the market’s commitment to sustainability while enhancing product performance. This trend is expected to accelerate as industries move to balance regulatory compliance, safety assurance, and consumer preference for environmentally responsible pigment solutions

Phosphorescent Pigments Market Dynamics

Driver

“Rising Demand in Safety Signage and Glow-in-the-Dark Products”

- The increasing use of phosphorescent pigments in safety signage, emergency lighting, and glow-in-the-dark products is a key driver of market expansion. Their ability to provide long-lasting luminescence without external power makes them indispensable in multiple safety-critical applications

- For instance, companies such as Honeywell have integrated phosphorescent pigments into their safety signage and escape route markers, while ProGlow has developed pigment-infused tapes and paints for industrial safety and public emergency facilities. These applications ensure reliability in evacuation scenarios and compliance with safety standards

- Phosphorescent pigments are used extensively in emergency signage across industries such as construction, transportation, and manufacturing. Their self-illuminating properties ensure visibility during blackouts or hazardous conditions, reducing dependency on electrical lighting in critical moments

- In addition, glow-in-the-dark consumer products ranging from fashion and interior decoration to sporting goods are boosting pigment demand. The durability of glow features enhances product appeal and widens the range of market applications beyond commercial and industrial uses

- The integration of phosphorescent pigments into both functional and decorative applications ensures consistent demand and wider adoption. The combined focus on safety, consumer appeal, and energy efficiency reinforces this driver as a core pillar of long-term growth for the phosphorescent pigments market

Restraint/Challenge

“High Production Costs for Long-Lasting Pigments”

- The production of high-performance phosphorescent pigments, particularly those with long-lasting glow intensity, requires advanced materials and processes that significantly increase costs. This factor presents a challenge for broader adoption across cost-sensitive markets

- For instance, LuminoChem has developed premium phosphorescent pigments offering extended afterglow performance, but the high production expenses related to specialized raw materials and processing technologies restrict their affordability for mass-market applications. Companies face trade-offs between performance and cost efficiency in product design

- The long-lasting glow feature often demands rare-earth-based compounds or advanced formulations, which increases raw material costs. Energy-intensive production processes further contribute to the high operational expenditure associated with these pigments

- In addition, inconsistent availability of rare-earth materials and supply chain complexities create price volatility that amplifies the cost challenge. This affects manufacturers’ ability to maintain competitive pricing in global markets while delivering high-quality pigments

- Addressing high production costs through research in alternative compounds, resource recovery, and economies of scale will be essential to expanding accessibility. Developing more affordable solutions without compromising glow performance will be key for ensuring sustainable growth in the phosphorescent pigments market

Phosphorescent Pigments Market Scope

The market is segmented on the basis of type, product, and end-user.

• By Type

On the basis of type, the phosphorescent pigments market is segmented into organic phosphorescent pigments and inorganic phosphorescent pigments. The inorganic phosphorescent pigment segment dominated the largest market revenue share of 62.5% in 2024, owing to its superior brightness, longer afterglow, and excellent stability under diverse environmental conditions. These pigments are widely preferred in safety and signage applications, where durability and long-lasting luminescence are critical. Their compatibility with multiple mediums such as paints, coatings, plastics, and construction materials further drives their adoption. Inorganic pigments such as strontium aluminate-based powders offer enhanced glow intensity, making them a preferred choice for high-performance applications.

The organic phosphorescent pigment segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in decorative and fashion applications. These pigments offer unique color variations and customizable luminescent effects, appealing to designers and manufacturers in specialty markets. Furthermore, advances in organic pigment formulations are improving their stability and glow duration, encouraging adoption in niche applications such as textiles, novelty products, and specialty inks.

• By Product

On the basis of product, the phosphorescent pigments market is segmented into zinc sulfide and strontium aluminate. The strontium aluminate segment dominated the largest market revenue share in 2024, primarily due to its high luminance, long afterglow duration, and superior chemical stability. Strontium aluminate pigments are widely applied in emergency signage, safety markers, and glow-in-the-dark paints, where visibility and durability are crucial. The ability to mix with various binders and coatings without losing luminescence enhances their versatility across multiple industrial applications. In addition, their eco-friendly and non-toxic characteristics further drive market preference.

The zinc sulfide segment is projected to witness the fastest CAGR from 2025 to 2032, owing to its cost-effectiveness and established presence in decorative and novelty applications. Zinc sulfide pigments offer customizable glow colors and moderate afterglow, making them ideal for budget-conscious projects in plastics, inks, and coatings. Continuous product innovations are improving their brightness and stability, which is expected to boost their adoption in emerging markets and DIY applications.

• By End User

On the basis of end user, the phosphorescent pigments market is segmented into paints and coatings, printing inks, plastics, and construction materials. The paints and coatings segment dominated the largest market revenue share in 2024, driven by the extensive use of phosphorescent pigments in decorative, safety, and functional coatings. The segment benefits from the growing trend of glow-in-the-dark wall paints, industrial safety coatings, and protective markings in both residential and commercial spaces. Compatibility with diverse binders, long-lasting luminescence, and enhanced aesthetic appeal further strengthen demand in this segment.

The plastics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in consumer goods, packaging, and specialty products. Incorporation of phosphorescent pigments in plastics enables manufacturers to produce glow-in-the-dark toys, novelty items, and safety equipment with minimal additional processing. Technological advancements in pigment dispersion and improved luminescent intensity are further supporting the growth of this segment across multiple applications.

Phosphorescent Pigments Market Regional Analysis

- Asia-Pacific dominated the phosphorescent pigments market with the largest revenue share in 2024, driven by rising demand in paints, coatings, and construction materials, along with expanding manufacturing capabilities in emerging economies

- The region’s cost-effective production, increasing investments in specialty pigments, and growing exports of luminescent materials are accelerating market growth

- Availability of skilled labor, supportive government policies, and rapid industrialization across countries such as China and India are contributing to higher consumption of phosphorescent pigments in decorative, safety, and industrial applications

China Phosphorescent Pigments Market Insight

China held the largest share in the Asia-Pacific phosphorescent pigments market in 2024, owing to its strong chemical manufacturing base, robust industrial infrastructure, and leadership in specialty pigment production. The country’s investment in research and development, favorable regulatory environment, and extensive export capabilities for phosphorescent materials are key growth drivers. Rising demand from the paints, coatings, plastics, and construction sectors further supports market expansion.

India Phosphorescent Pigments Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing adoption of phosphorescent pigments in safety signage, decorative paints, and construction materials. Government initiatives promoting manufacturing, rising urbanization, and expansion of the paints and coatings industry are driving demand. In addition, growing exports of specialty pigments and investments in R&D for high-performance phosphorescent materials are contributing to strong market growth.

Europe Phosphorescent Pigments Market Insight

The Europe phosphorescent pigments market is expanding steadily, supported by high demand for premium, long-lasting luminescent pigments and strict regulatory standards. The region emphasizes sustainability, quality, and compliance, particularly in paints, coatings, plastics, and construction applications. Investments in advanced formulations and specialty pigment manufacturing are driving market development.

Germany Phosphorescent Pigments Market Insight

Germany’s market is driven by its established chemical industry, focus on high-quality pigment production, and strong export-oriented manufacturing model. Demand is particularly robust in industrial coatings, safety applications, and high-performance plastics. Well-developed R&D infrastructure and collaboration between academic and industrial players foster continuous innovation in phosphorescent pigment formulations.

U.K. Phosphorescent Pigments Market Insight

The U.K. market benefits from a mature paints, coatings, and plastics sector, increasing adoption of glow-in-the-dark materials, and investment in sustainable pigment production. Focus on innovation, collaboration between industry and academia, and demand for niche specialty pigments are strengthening the country’s market position.

North America Phosphorescent Pigments Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising applications in safety signage, plastics, construction, and decorative coatings. Increasing investments in specialty pigment R&D, growing adoption in industrial and commercial sectors, and reshoring of chemical manufacturing are boosting market growth.

U.S. Phosphorescent Pigments Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by strong demand from paints, coatings, plastics, and construction industries. A well-established manufacturing base, robust R&D capabilities, and growing focus on high-performance and eco-friendly phosphorescent pigments are driving market expansion. Presence of key players and advanced distribution networks further consolidate the U.S.’s leading position in the region.

Phosphorescent Pigments Market Share

The phosphorescent pigments industry is primarily led by well-established companies, including:

- Thomas Publishing Company (U.S.)

- Nemoto & Co., Ltd (Japan)

- ARALON (U.S.)

- Honeywell International Inc. (U.S.)

- Lightleader Co., Ltd (India)

- NEMOTO PORTUGAL (Portugal)

- Tavco Chemicals, Inc (U.S.)

- RTP Company (U.S.)

- RC Tritec LTD. (Switzerland)

- Allureglow USA (U.S.)

- GloNation Inc. (U.S.)

- GTA LLC (U.S.)

- Glow Inc (U.S.)

- GloTech International (New Zealand)

- LuminoChem (Hungary)

- Radiant Color (U.S.)

- United Mineral and Chemical (U.S.)

- Next Generation B.V. (Netherlands)

- Kremer Pigmente (U.S.)

- Badger Color Concentrates (U.S.)

Latest Developments in Phosphorescent Pigments Market

- In August 2025, Brilliant Group launched the BPM Series Phosphorescent Masterbatch, a high-performance, ready-to-use glow-in-the-dark solution compatible with common thermoplastic carriers such as LDPE, PP, EVA, and PVC. This innovation simplifies the production process for safety signs, emergency exit products, and specialty plastic goods, thereby enhancing manufacturing efficiency and expanding application possibilities in various industries

- In March 2025, Brilliant Group introduced the BPM Series Phosphorescent Masterbatch, a ready-to-use glow-in-the-dark solution compatible with common thermoplastic carriers such as LDPE, PP, EVA, and PVC. This development streamlines the production of safety signs, emergency exit products, and specialty plastic goods, offering manufacturers a convenient and efficient solution for incorporating phosphorescent pigments into their products

- In March 2025, during the in‑Cosmetics Global event, Sun Chemical unveiled a range of new effect pigments under the "Beauty is colorful" campaign, targeting the personal care and cosmetics industries. These pigments offer enhanced color brilliance, shimmer, and luminous effects for use in makeup and skincare formulations, showcasing the versatility and expanding applications of effect pigments in the beauty sector

- In March 2025, DayGlo Color Corp launched the EcoVibe FX series, an environmentally conscious fluorescent pigment line that reflects a growing sustainability trend in colorants. Although not phosphorescent, this innovation contributes to adjacent markets by offering eco-friendly, bright, and weather-resistant pigments, aligning with the increasing demand for sustainable solutions in various industries

- In November 2024, Radiant Color NV expanded its production capacity for high-performance fluorescent pigments at its facility in Belgium. While not strictly phosphorescent, this expansion highlights the company's readiness to meet the growing demand across packaging, textile, and signage industries, indicating a positive outlook for the broader pigment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Phosphorescent Pigments Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Phosphorescent Pigments Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Phosphorescent Pigments Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.