Global Phosphoric Acid Market

Market Size in USD Billion

CAGR :

%

USD

40.47 Billion

USD

56.24 Billion

2024

2032

USD

40.47 Billion

USD

56.24 Billion

2024

2032

| 2025 –2032 | |

| USD 40.47 Billion | |

| USD 56.24 Billion | |

|

|

|

|

Phosphoric Acid Market Size

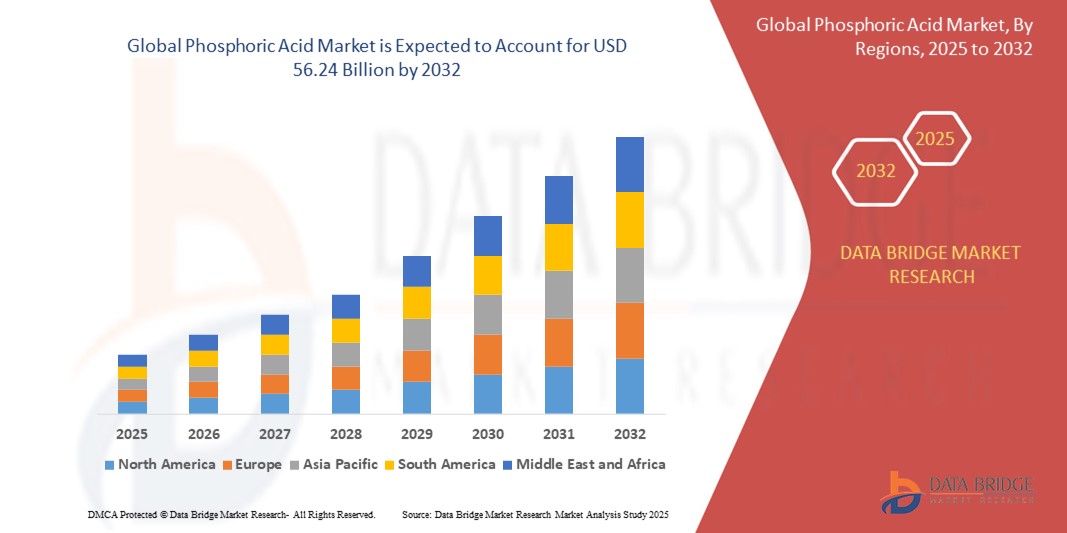

- The global phosphoric acid market size was valued at USD 40.47 billion in 2024 and is expected to reach USD 56.24 billion by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fuelled by the increasing demand from the agriculture sector for fertilizers and rising applications in food additives and industrial chemicals

- Growing adoption of sustainable farming practices and the development of specialty phosphoric acid products for various industrial uses are further supporting market expansion

Phosphoric Acid Market Analysis

- The market is witnessing steady growth as phosphoric acid is increasingly used in the production of fertilizers and food additives, reflecting its critical role in agriculture and food industries

- Manufacturers are focusing on improving production efficiency and developing high-purity phosphoric acid to meet the growing demand across industrial and consumer applications

- Asia-Pacific dominated the phosphoric acid market with the largest revenue share of 45.3% in 2024, driven by the region’s extensive use of phosphoric acid in fertilizer production and growing industrialization

- Europe region is expected to witness the highest growth rate in the global phosphoric acid market, driven by increasing focus on sustainable agriculture, stringent environmental regulations, and growing demand from the food and beverage and pharmaceutical sectors

- The Wet Process segment dominated the market with the largest market revenue share in 2024, attributed to its cost-effectiveness and large-scale applicability in fertilizer production. The wet process is widely adopted by manufacturers for producing industrial-grade phosphoric acid used in downstream applications such as ammonium phosphate fertilizers

Report Scope and Phosphoric Acid Market Segmentation

|

Attributes |

Phosphoric Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phosphoric Acid Market Trends

“Shift Towards Sustainable and Circular Production Methods”

- Phosphoric acid manufacturers are increasingly adopting environmentally friendly production processes to meet regulatory standards and consumer demand for sustainable products

- Companies are investing in technologies that enable the recycling of phosphorus from agricultural and industrial waste streams, promoting a circular economy and reducing environmental impact

- For instance, Mitsui Chemicals focuses on recovering phosphoric acid from underused phosphorus resources and converting it into high-value-added products for reuse in the manufacturing industry

- In addition, advancements in wastewater treatment processes are utilizing phosphoric acid as a coagulant to remove heavy metals and other contaminants, contributing to environmental sustainability

- These trends reflect the industry's commitment to reducing its ecological footprint and aligning with global environmental goals, driving long-term growth and stability in the phosphoric acid market

Phosphoric Acid Market Dynamics

Driver

“Growing Demand for Phosphoric Acid in Fertilizer Production”

- Phosphoric acid plays a vital role in agriculture as a key component in phosphate fertilizers, essential for improving soil health and increasing crop yields

- Rising global food demand is pushing the adoption of efficient farming practices, where phosphoric acid-based fertilizers are widely used to boost productivity

- The substance is also utilized in food additives, beverages, and industrial applications, which expands its overall market reach and demand

- For instance, companies in India are increasing production capacity of fertilizers using phosphoric acid to support growing agricultural needs in rural regions

- Technological improvements in manufacturing are enhancing phosphoric acid quality and lowering production costs, further supporting its adoption across various industries

Restraint/Challenge

“Environmental Concerns and Regulatory Challenges in Production”

- The production of phosphoric acid depends on phosphate rock, a limited natural resource, who’s mining often causes environmental issues such as habitat loss and water contamination

- Strict environmental regulations on emissions and waste disposal increase compliance costs, making manufacturing more complex and expensive

- The corrosive nature of phosphoric acid requires specialized handling and transport systems, adding to operational and logistical expenses

- For instance, some fertilizer producers in Europe have faced increased costs due to updated safety and environmental compliance laws regarding acid transport

- Price and supply fluctuations of phosphate rock create instability in raw material availability, while concerns over fertilizer runoff raise environmental alarms, leading to demand for reduced usage alternatives

Phosphoric Acid Market Scope

The market is segmented on the basis of process type, form, grade, and applications.

- By Process Type

On the basis of process type, the phosphoric acid market is segmented into wet process and thermal process. The Wet Process segment dominated the market with the largest market revenue share in 2024, attributed to its cost-effectiveness and large-scale applicability in fertilizer production. The wet process is widely adopted by manufacturers for producing industrial-grade phosphoric acid used in downstream applications such as ammonium phosphate fertilizers.

The Thermal Process segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-purity phosphoric acid in food, pharmaceuticals, and electronics. The thermal process yields acid with minimal impurities, making it suitable for sectors requiring stringent quality standards.

- By Form

On the basis of form, the phosphoric acid market is segmented into solid and liquid. The Liquid segment held the largest market revenue share in 2024 due to its ease of handling and extensive usage in agriculture and industrial manufacturing. Liquid phosphoric acid is preferred for fertilizer blending, water treatment, and as an additive in food-grade applications.

The Solid segment is expected to witness the fastest growth rate from 2025 to 2032, as demand rises in regions with transportation and storage constraints. Solid forms, including crystalline and granular variants, are gaining traction for their longer shelf life and ease of incorporation in feed and chemical manufacturing.

- By Grade

On the basis of grade, the phosphoric acid market is segmented into technical grade, food grade, and feed grade. The Technical Grade segment accounted for the highest revenue share in 2024, primarily driven by its widespread use in fertilizer production, metal treatment, and chemical synthesis. Its versatility and availability make it the most commercially utilized grade.

The Food Grade segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising usage in carbonated beverages, preservatives, and acidity regulators. Increasing consumer demand for processed food and beverages across emerging economies is fuelling growth in this segment.

- By Applications

On the basis of applications, the phosphoric acid market is segmented into food and beverages, animal feed, personal care, chemical manufacturing, leather and textile, cleaning agents, ceramics and refractories, agricultural fertilizers, metallurgy, water treatment, construction, mining, semiconductors, oral and dental care, pharmaceuticals, and others. The Agricultural Fertilizers segment dominated the market in 2024, supported by the extensive use of phosphoric acid in the production of phosphate-based fertilizers such as DAP and MAP, which are essential for crop productivity.

The Semiconductors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of phosphoric acid in etching and surface treatment processes. As the electronics industry continues to expand, the demand for ultra-pure acids suitable for semiconductor fabrication is expected to surge significantly.

Phosphoric Acid Market Regional Analysis

- Asia-Pacific dominated the phosphoric acid market with the largest revenue share of 45.3% in 2024, driven by the region’s extensive use of phosphoric acid in fertilizer production and growing industrialization

- Rapid expansion of the agriculture sector in countries such as China and India is boosting demand, especially for DAP (Diammonium Phosphate) and MAP (Monoammonium Phosphate) fertilizers, which are key applications of phosphoric acid

- The presence of major producers and strong demand from food processing, water treatment, and metal industries also support market growth, while favorable government policies and expanding chemical manufacturing sectors reinforce Asia-Pacific’s leadership position

China Phosphoric Acid Market Insight

The China phosphoric acid market held the largest revenue share within Asia-Pacific in 2024, supported by its position as a global leader in phosphate rock mining and fertilizer manufacturing. The country’s growing demand for high-yield agricultural practices and increasing food production needs drive consumption. China’s rapid industrialization and environmental initiatives also encourage phosphoric acid usage in water treatment and industrial cleaning applications. In addition, domestic manufacturers benefit from integrated supply chains and strong export potential.

Japan Phosphoric Acid Market Insight

The Japan phosphoric acid market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand across agriculture and electronics sectors. Japan is one of the leading producers of high-purity phosphoric acid in Asia-Pacific, catering to both domestic and export markets. The growth is primarily fuelled by the use of phosphoric acid in fertilizers, semiconductors, water treatment, and industrial cleaning applications. Japan’s strong focus on technological innovation and quality standards supports the production of premium-grade phosphoric acid, especially for use in high-end manufacturing and precision industries. In addition, Japan’s aging population and limited arable land are encouraging efficient agricultural practices, thereby increasing the demand for phosphate-based fertilizers.

North America Phosphoric Acid Market Insight

The North America phosphoric acid market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong demand in food-grade and industrial applications. The region’s well-established agricultural infrastructure and high meat production rates boost feed-grade phosphoric acid use. In addition, increasing adoption in water treatment, metal finishing, and semiconductor manufacturing supports the market. Regulatory support for environmentally sustainable chemicals and technological advancements in processing also stimulate growth.

U.S. Phosphoric Acid Market Insight

The U.S. phosphoric acid market accounted for the majority share in North America in 2024, fuelled by a diversified application base spanning agriculture, personal care, and pharmaceuticals. Rising concerns regarding water pollution and demand for efficient treatment chemicals drive usage. Technological innovation and strong R&D capabilities among major chemical manufacturers further position the U.S. as a key player in global phosphoric acid production and innovation.

Europe Phosphoric Acid Market Insight

The Europe phosphoric acid market is expected to witness the fastest growth rate from 2025 to 2032, supported by demand from food processing, cleaning agents, and industrial applications. Stringent environmental regulations and sustainability goals encourage the use of phosphate-based products in controlled applications. European countries also benefit from advanced manufacturing capabilities and steady demand from the pharmaceutical and oral care sectors, especially in countries such as Germany and France.

Germany Phosphoric Acid Market Insight

The Germany phosphoric acid market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's focus on industrial efficiency and innovation. The chemical and manufacturing sectors rely on phosphoric acid for surface treatment, cleaning, and formulation. In addition, Germany’s emphasis on high-quality food processing and increasing demand for functional beverages contribute to steady consumption. Sustainability-driven product development and recycling initiatives are also shaping market trends.

U.K. Phosphoric Acid Market Insight

The U.K. phosphoric acid market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand from the food and beverage, pharmaceutical, and water treatment sectors. Increasing consumer preference for processed and convenience foods is boosting the use of food-grade phosphoric acid as an acidity regulator. In addition, the country’s stringent water quality regulations are encouraging the adoption of phosphate-based treatment chemicals. Growth in oral care products and ongoing investment in industrial cleaning solutions further support market expansion across the U.K.

Phosphoric Acid Market Share

The Phosphoric Acid industry is primarily led by well-established companies, including:

- Nutrien Ltd (Canada)

- OCP (Morocco)

- J.R. Simplot Company (U.S.)

- Brenntag North America, Inc. (U.S.)

- Arkema (France)

- ICL (Israel)

- Innophos (U.S.)

- Spectrum Chemical (U.S.)

- Solvay (Belgium)

- Merck KGaA (Germany)

- Prayon (Belgium)

- CLARIANT (Switzerland)

- Jordan Phosphate Mines Company (PLC) (Jordan)

- Quadra Chemicals Ltd. (Canada)

- Chemische Fabrik Budenheim KG (Germany)

- Grupa Azoty (Poland)

- EuroChem Group (Switzerland)

Latest Developments in Global Phosphoric Acid Market

- In July 2022, Ineos Group Ltd signed three major agreements with SINOPEC, totaling USD 7 billion, to expand its chemical production footprint. This move strengthens Ineos' global position in the chemicals industry and enhances its capabilities in diversified chemical manufacturing. The expansion may influence the phosphoric acid market by supporting integrated production chains and improving supply efficiency. The partnership also reflects the strategic alignment of Western and Asian chemical sectors for long-term growth

- In January 2022, SABIC completed its transformation by launching a standalone agri-nutrients company focused on sustainable agricultural development. This strategic shift is expected to increase the company's involvement in phosphoric acid production to meet the growing demand for advanced fertilizer solutions. By offering end-to-end agricultural services, SABIC aims to strengthen its competitive edge in both domestic and international markets. This move also underscores the trend toward specialization and vertical integration in the sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Phosphoric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Phosphoric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Phosphoric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.