Global Photonic Neuromorphic Chip Market

Market Size in USD Million

CAGR :

%

USD

822.64 Million

USD

5,854.11 Million

2025

2033

USD

822.64 Million

USD

5,854.11 Million

2025

2033

| 2026 –2033 | |

| USD 822.64 Million | |

| USD 5,854.11 Million | |

|

|

|

|

Photonic Neuromorphic Chip Market Size

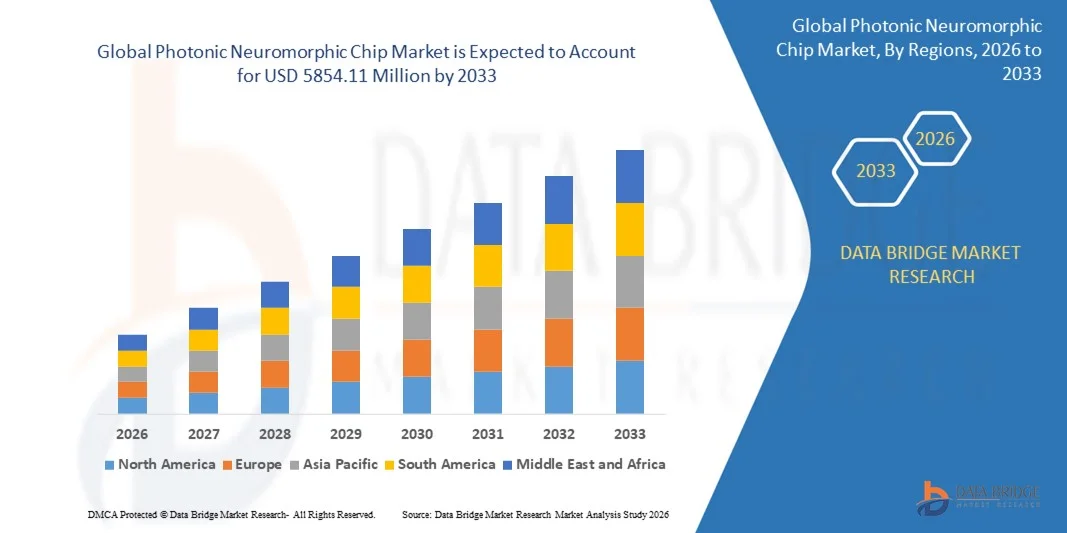

- The global photonic neuromorphic chip market size was valued at USD 822.64 million in 2025 and is expected to reach USD 5854.11 million by 2033, at a CAGR of 27.80% during the forecast period

- The market growth is largely fueled by rapid advancements in photonic computing and neuromorphic architectures, which are enabling ultra-fast, low-latency, and energy-efficient processing for complex AI workloads

- Furthermore, the rising demand for high-performance and power-efficient solutions across data centers, autonomous systems, and advanced AI applications is positioning photonic neuromorphic chips as a critical next-generation computing technology, significantly accelerating overall market growth

Photonic Neuromorphic Chip Market Analysis

- Photonic neuromorphic chips, which leverage light-based signal processing to mimic neural networks, are emerging as transformative components in advanced computing systems due to their ability to deliver parallel processing with significantly reduced energy consumption

- The growing adoption of artificial intelligence, machine learning, and data-intensive applications, coupled with limitations of traditional electronic chips in terms of speed and power efficiency, is a primary factor driving increased interest and investment in photonic neuromorphic chip technologies

- North America dominated the photonic neuromorphic chip market with a share of 37.7% in 2025, due to strong investments in advanced computing, artificial intelligence, and photonic research across both public and private sectors

- Asia-Pacific is expected to be the fastest growing region in the photonic neuromorphic chip market during the forecast period due to rapid technological advancements, expanding semiconductor manufacturing capacity, and rising investments in AI and high-performance computing

- Hardware segment dominated the market with a market share of 64.7% in 2025, due to the increasing demand for high-speed processing and energy-efficient computing in data-intensive applications. Hardware components such as photonic chips, modulators, and integrated optical circuits are critical for achieving ultra-fast parallel processing capabilities, which are increasingly required in AI and machine learning workloads. Companies are investing heavily in advanced photonic hardware to enhance processing speed, reduce latency, and lower energy consumption compared to traditional electronic processors. The compatibility of photonic hardware with neuromorphic computing architectures further strengthens its adoption across research and enterprise sectors

Report Scope and Photonic Neuromorphic Chip Market Segmentation

|

Attributes |

Photonic Neuromorphic Chip Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Photonic Neuromorphic Chip Market Trends

Integration of Photonic Neuromorphic Architectures with AI Accelerators

- A prominent trend in the photonic neuromorphic chip market is the increasing integration of photonic neuromorphic architectures with AI accelerators to overcome performance and energy limitations of conventional electronic processors. This integration is enabling faster parallel computation, reduced latency, and significantly lower power consumption for complex AI and machine learning workloads across data-intensive environments

- For instance, Lightmatter has developed its Passage platform, which combines photonic computing with AI acceleration to enhance data movement and processing efficiency in large-scale AI systems. Such advancements are strengthening the role of photonic neuromorphic chips as complementary technologies to GPUs and other accelerators in high-performance computing architectures

- The trend is gaining traction in data centers where AI accelerators are required to process massive volumes of data in real time while managing power and thermal constraints. Photonic neuromorphic integration supports higher bandwidth and faster interconnects, improving overall system throughput and scalability

- Research institutions and technology firms are increasingly focusing on co-design approaches where photonic hardware and AI models are optimized together. This is enabling more efficient deployment of neural networks and accelerating the transition of photonic neuromorphic chips from experimental stages to practical AI applications

- Telecommunications and defense sectors are also adopting integrated photonic neuromorphic solutions to support signal processing and decision-making tasks that demand ultra-fast response times. This growing cross-industry adoption is reinforcing the trend toward tighter integration between photonics and AI acceleration technologies

- Overall, the integration of photonic neuromorphic architectures with AI accelerators is shaping a new generation of computing platforms that prioritize speed, efficiency, and scalability. This trend is positioning photonic neuromorphic chips as critical enablers of next-generation AI infrastructure

Photonic Neuromorphic Chip Market Dynamics

Driver

Rising Demand for Ultra-Fast and Energy-Efficient AI Computing

- The growing demand for ultra-fast and energy-efficient AI computing is a major driver of the photonic neuromorphic chip market, as traditional electronic processors face increasing limitations related to power consumption and heat dissipation. AI applications in data centers, autonomous systems, and scientific research require rapid processing of large datasets while maintaining operational efficiency

- For instance, IBM has been actively advancing photonic and neuromorphic computing research to address data movement bottlenecks and energy challenges in AI systems. These efforts highlight how photonic neuromorphic technologies can support faster computation with reduced energy requirements, aligning with the needs of modern AI workloads

- The expansion of cloud computing and hyperscale data centers is intensifying the requirement for processors that can deliver high throughput without escalating power costs. Photonic neuromorphic chips offer advantages through optical signal transmission, which enables parallel processing at higher speeds compared to electronic counterparts

- Industries such as automotive and aerospace are adopting AI-driven systems for real-time decision-making, further increasing demand for computing solutions that can operate efficiently under strict performance constraints. Photonic neuromorphic chips support these requirements by enabling rapid neural processing with minimal latency

- Collectively, the need for faster, scalable, and power-efficient AI computing solutions is driving strong interest in photonic neuromorphic chips. This driver is positioning the technology as a key solution to the evolving performance demands of next-generation AI systems

Restraint/Challenge

High Development Complexity and Limited Commercial Scalability

- The photonic neuromorphic chip market faces significant challenges due to the high complexity involved in designing, fabricating, and integrating photonic components with neuromorphic architectures. Developing reliable optical circuits at scale requires advanced materials, precision manufacturing processes, and specialized expertise, which increases technical barriers

- For instance, companies such as Intel and Ayar Labs are heavily investing in silicon photonics research to address integration and scalability challenges, highlighting the complexity and long development cycles associated with commercial deployment. These efforts demonstrate that while progress is being made, large-scale adoption remains technically demanding

- Manufacturing photonic neuromorphic chips involves stringent alignment and fabrication tolerances to ensure accurate light-based signal processing. These requirements elevate production costs and limit the ability to scale manufacturing volumes rapidly compared to conventional semiconductor chips

- The lack of standardized design frameworks and manufacturing processes further constrains scalability and interoperability across platforms. This creates challenges for system integration and slows down widespread commercial adoption across industries

- As a result, high development complexity and limited commercial scalability continue to restrain the market’s near-term growth. Overcoming these challenges will be essential for enabling broader adoption and unlocking the full potential of photonic neuromorphic chip technologies

Photonic Neuromorphic Chip Market Scope

The market is segmented on the basis of component, application, and end-use.

- By Component

On the basis of component, the photonic neuromorphic chip market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share of 64.7% in 2025, driven by the increasing demand for high-speed processing and energy-efficient computing in data-intensive applications. Hardware components such as photonic chips, modulators, and integrated optical circuits are critical for achieving ultra-fast parallel processing capabilities, which are increasingly required in AI and machine learning workloads. Companies are investing heavily in advanced photonic hardware to enhance processing speed, reduce latency, and lower energy consumption compared to traditional electronic processors. The compatibility of photonic hardware with neuromorphic computing architectures further strengthens its adoption across research and enterprise sectors.

The software segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for specialized algorithms, simulation tools, and software platforms that optimize the performance of photonic neuromorphic systems. For instance, companies such as Lightmatter are developing software frameworks to efficiently map neural network models onto photonic hardware, enhancing computational efficiency. Software solutions also provide flexibility in designing and testing neuromorphic architectures for various AI applications, contributing to their growing adoption. The increasing need for end-to-end photonic computing solutions, which integrate both hardware and software, supports the rapid growth of this segment.

- By Application

On the basis of application, the photonic neuromorphic chip market is segmented into data processing, image recognition / computer vision, signal processing, natural language processing (NLP), and sensor fusion. The data processing segment dominated the market with the largest revenue share in 2025, driven by the need for high-throughput, low-latency processing in AI and machine learning applications. Photonic neuromorphic chips offer unparalleled parallel processing capabilities, enabling faster computation of complex datasets and real-time analytics in enterprise and research environments. Organizations increasingly rely on these chips to accelerate workloads in cloud computing, data centers, and scientific simulations. Their energy efficiency and speed make them particularly attractive for large-scale data processing tasks, reinforcing their market dominance.

The image recognition / computer vision segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rapid adoption of AI-enabled vision systems across industries such as automotive, healthcare, and robotics. For instance, companies such as Lightelligence are leveraging photonic neuromorphic chips to enhance computer vision algorithms for autonomous vehicles and smart surveillance systems. These applications require high-speed parallel processing to handle massive image and video datasets efficiently, making photonic solutions ideal. The growing demand for edge AI and low-power vision processing further contributes to the rapid expansion of this segment.

- By End-Use

On the basis of end-use, the photonic neuromorphic chip market is segmented into data centers, telecommunications, automotive, healthcare, aerospace & defense, and others. The data centers segment dominated the market with the largest revenue share in 2025, driven by the escalating demand for AI-driven services and cloud computing solutions that require ultra-fast, energy-efficient processing. Photonic neuromorphic chips enable data centers to perform large-scale computations while significantly reducing power consumption and heat generation compared to traditional electronic processors. Leading cloud service providers are increasingly exploring photonic computing technologies to enhance performance and meet growing data processing demands, reinforcing the dominance of this segment.

The automotive segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies that rely on real-time processing of sensor and vision data. For instance, companies such as Lightmatter are collaborating with automotive tech developers to implement photonic neuromorphic chips for high-speed sensor fusion and object recognition in autonomous vehicles. The ability to process complex neural network models rapidly and with low energy consumption positions photonic chips as a critical technology in the next generation of smart vehicles. Increasing investments in autonomous mobility and intelligent transportation solutions drive the rapid growth of this segment.

Photonic Neuromorphic Chip Market Regional Analysis

- North America dominated the photonic neuromorphic chip market with the largest revenue share of 37.7% in 2025, driven by strong investments in advanced computing, artificial intelligence, and photonic research across both public and private sectors

- The region benefits from a mature semiconductor ecosystem, early adoption of next-generation computing architectures, and a strong presence of research institutions and technology companies actively developing neuromorphic and photonic solutions

- This leadership is further supported by high R&D spending, robust funding for AI and defense applications, and growing demand for energy-efficient, high-speed computing technologies in data centers and enterprise environments, positioning North America as a key innovation hub

U.S. Photonic Neuromorphic Chip Market Insight

The U.S. photonic neuromorphic chip market captured the largest revenue share within North America in 2025, fueled by rapid advancements in AI hardware, cloud computing, and high-performance computing infrastructure. The country’s strong focus on next-generation semiconductor innovation, supported by government funding and defense-related research initiatives, accelerates adoption. Increasing demand for low-latency and energy-efficient computing solutions in data centers and autonomous systems continues to drive market growth. Moreover, the presence of leading photonic and AI chip developers strengthens the U.S. position in this emerging market.

Europe Photonic Neuromorphic Chip Market Insight

The Europe photonic neuromorphic chip market is projected to expand at a substantial CAGR during the forecast period, driven by rising emphasis on sustainable computing, digital transformation, and advanced semiconductor research. Strong regulatory support for energy-efficient technologies and growing investments in AI and photonics research are encouraging adoption. European industries are increasingly exploring neuromorphic computing to improve processing efficiency in telecommunications, healthcare, and industrial automation. The region’s collaborative research ecosystem further supports steady market expansion.

U.K. Photonic Neuromorphic Chip Market Insight

The U.K. photonic neuromorphic chip market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing government initiatives in AI research and advanced computing. The country’s strong academic base and focus on innovation in photonics and neuromorphic architectures are key growth drivers. Rising demand for high-speed data processing in telecommunications and defense applications is accelerating adoption. The U.K.’s push toward becoming a global AI innovation center continues to stimulate market development.

Germany Photonic Neuromorphic Chip Market Insight

The Germany photonic neuromorphic chip market is expected to expand at a considerable CAGR, driven by the country’s strong engineering capabilities and emphasis on Industry 4.0 initiatives. Germany’s leadership in automotive, industrial automation, and advanced manufacturing is increasing demand for efficient, real-time data processing solutions. Growing interest in energy-efficient and sustainable computing technologies further supports adoption. The integration of photonic neuromorphic chips into research and industrial applications aligns well with Germany’s innovation-driven economy.

Asia-Pacific Photonic Neuromorphic Chip Market Insight

The Asia-Pacific photonic neuromorphic chip market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid technological advancements, expanding semiconductor manufacturing capacity, and rising investments in AI and high-performance computing. Governments across the region are actively supporting digital transformation and next-generation chip development. Increasing demand for advanced computing in data centers, telecommunications, and autonomous systems is accelerating adoption. The region’s growing role as a global semiconductor manufacturing hub further strengthens market growth.

Japan Photonic Neuromorphic Chip Market Insight

The Japan photonic neuromorphic chip market is gaining momentum due to the country’s strong focus on robotics, AI, and advanced electronics. Japan’s emphasis on precision technology and energy-efficient computing supports the adoption of photonic neuromorphic architectures. Growing applications in autonomous systems, smart manufacturing, and high-speed data processing are key contributors. The integration of photonic computing with existing advanced electronics infrastructure continues to fuel market expansion.

China Photonic Neuromorphic Chip Market Insight

The China photonic neuromorphic chip market accounted for the largest revenue share in Asia-Pacific in 2025, driven by massive investments in semiconductor self-sufficiency and AI development. Rapid expansion of data centers, telecommunications infrastructure, and smart city initiatives is boosting demand for high-speed, energy-efficient computing solutions. Strong government support and the presence of large domestic semiconductor manufacturers further accelerate adoption. China’s focus on scaling next-generation computing technologies positions it as a major growth engine for the photonic neuromorphic chip market.

Photonic Neuromorphic Chip Market Share

The photonic neuromorphic chip industry is primarily led by well-established companies, including:

- Advanced Micro Devices, Inc. (U.S.)

- Ayar Labs, Inc. (U.S.)

- Baidu, Inc. (China)

- Furukawa Electric Co., Ltd. (Japan)

- Google LLC (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- Lightelligence Pte. Ltd. (Singapore)

- Lightmatter, Inc. (U.S.)

- Micron Technology, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Ocean Optics, Inc. (U.S.)

- PsiQuantum Corp. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Xanadu Quantum Technologies Inc. (Canada)

Latest Developments in Global Photonic Neuromorphic Chip Market

- In January 2025, IBM announced a new photonic neuromorphic research program focused on scaling optical neural networks on silicon, marking a significant step toward commercializing energy-efficient, high-speed AI computing. This initiative strengthens the market by accelerating the transition from laboratory-scale photonic neuromorphic concepts to scalable silicon-based platforms, addressing performance bottlenecks in data-intensive AI workloads and reinforcing industry confidence in long-term adoption

- In December 2024, Lightmatter, a U.S.-based silicon-photonics hardware company, joined the UALink Consortium to support the development of standardized, high-speed photonic interconnects for large-scale AI systems using its 3D-stacked Passage platform. This development is impactful for the market as it promotes interoperability and scalability of photonic neuromorphic architectures, enabling faster accelerator-to-accelerator communication and improving the efficiency of AI clusters and high-performance computing environments

- In June 2024, NVIDIA announced a collaboration with Intel to explore integrated photonic neuromorphic processing for AI workloads, highlighting growing industry alignment toward next-generation computing paradigms. This collaboration is expected to accelerate market growth by combining semiconductor leadership with photonic innovation, supporting the development of low-latency, high-bandwidth AI processors that can outperform conventional electronic chips in advanced AI and machine learning applications

- In January 2024, IBM Corp introduced a new chip designed to enhance data flow efficiency, reinforcing its broader push toward advanced computing technologies. This advancement contributes to the photonic neuromorphic chip market by addressing critical data movement challenges in AI systems, supporting faster computation and reduced energy consumption, which are key adoption drivers across data centers and enterprise AI platforms

- In June 2023, Florida-based BrainChip Holdings unveiled a new chip aimed at making AI systems smarter while significantly reducing power consumption. This development positively impacts the market by demonstrating the commercial viability of neuromorphic approaches for low-power edge and embedded applications, expanding the addressable market into niche segments such as IoT, edge AI, and intelligent sensing solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.