Global Phytogenic Swine Feed Additives Market

Market Size in USD Billion

CAGR :

%

USD

1.01 Billion

USD

1.81 Billion

2025

2033

USD

1.01 Billion

USD

1.81 Billion

2025

2033

| 2026 –2033 | |

| USD 1.01 Billion | |

| USD 1.81 Billion | |

|

|

|

|

What is the Global Phytogenic Swine Feed Additives Market Size and Growth Rate?

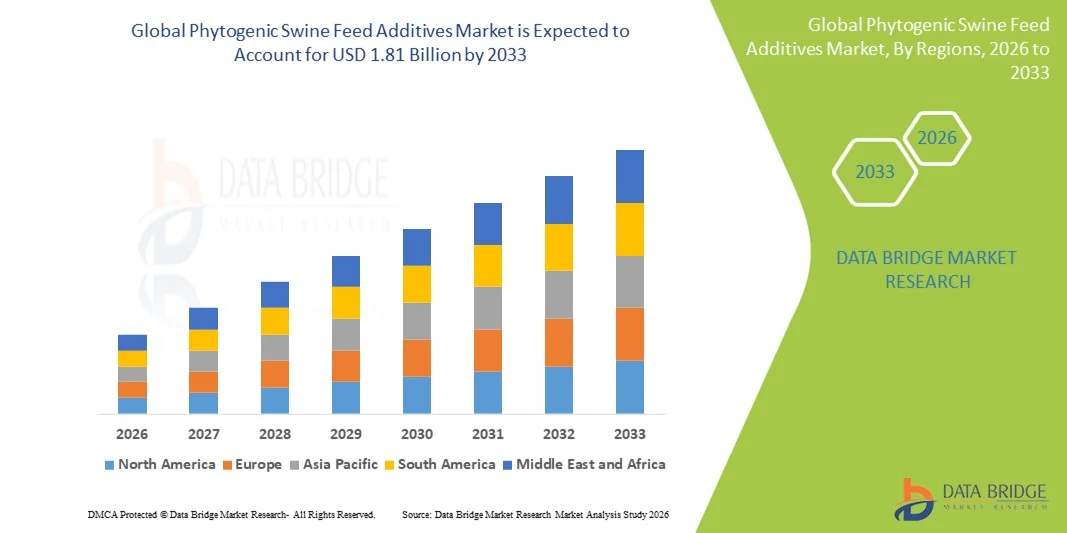

- The global phytogenic swine feed additives market size was valued at USD 1.01 billion in 2025 and is expected to reach USD 1.81 billion by 2033, at a CAGR of 7.50% during the forecast period

- The surge in the production of animal feed across the globe, efficiency and performance and rise in need for superior quality meat and dairy products from health enthusiasts are the major factors driving the phytogenic swine feed additives market

- The increase in popularity of these swine feed additive because of their enhanced efficiency and performance and health-induced benefits of phytogenic in swine, high demand for natural ingredient based animal feed from the livestock producers and growing awareness among livestock rearers for animal nutrition value accelerate the phytogenic swine feed additives market growth

- The high demand for enhanced feed conversion ratio and antibiotic-free additives from an increased number of livestock producers’ increasing the need for the botany-based feed additives, rise in prevalence of diseases in livestock and surging government funding in the feed industry influence the phytogenic swine feed additives market

What are the Major Takeaways of Phytogenic Swine Feed Additives Market?

- Development of animal feed products, the rising importance of animal nutrition, and consumer preference towards healthy lifestyle positively affects the phytogenic swine feed additives market

- Furthermore, research and development activities in animal feed sector, growing restriction on the use of antibiotics as a growth promoter, rise in trend of natural solutions for pet food nutrition and strategic growth initiatives to enter untapped market extend profitable opportunities to the phytogenic swine feed additives market

- Asia-Pacific dominated the phytogenic swine feed additives market with a 37.2% revenue share in 2025, driven by large-scale adoption of vitamin-, protein-, and plant-extract-enriched feed additives across China, India, Japan, and Southeast Asia

- In North America, the market is projected to register the fastest CAGR of 8.1% from 2026 to 2033, driven by rising adoption of essential oils, saponins, and other plant-based feed additives across the U.S. and Canada

- The Essential Oils segment dominated the market with a revenue share of 44.6% in 2025, owing to their multifunctional benefits in improving gut health, immunity, and feed efficiency in swine

Report Scope and Phytogenic Swine Feed Additives Market Segmentation

|

Attributes |

Phytogenic Swine Feed Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Phytogenic Swine Feed Additives Market?

Rising Demand for Nutrient-Enriched and Plant-Based Phytogenic Swine Feed Additives

- The Phytogenic Swine Feed Additives market is witnessing a key trend of increasing incorporation of bioactive plant extracts, essential vitamins, minerals, and natural feed enhancers into swine nutrition to improve growth performance, immunity, and gut health. This trend is driven by rising awareness of sustainable and plant-based feed solutions and the growing focus on animal welfare and productivity globally

- For instance, Bluestar Adisseo and Kemin Industries have launched phytogenic premixes and herbal feed additives enriched with antioxidants and digestive enzymes to support swine health and growth efficiency

- Rising concerns over antibiotic alternatives, gut health optimization, and the need for sustainable feed solutions are accelerating adoption of plant-based feed additives

- Feed manufacturers are formulating blends with probiotics, essential oils, and phytonutrients to meet the demand for natural, high-performance swine nutrition

- Increasing R&D on bioavailability, synergistic effects, and digestibility of phytogenic compounds is fostering innovation in additive formulations

- As regulatory and consumer focus on antibiotic-free, plant-based feed grows, phytogenic swine feed additives are expected to remain central to modern swine nutrition strategies

What are the Key Drivers of Phytogenic Swine Feed Additives Market?

- Rising awareness of the health and productivity benefits of phytogenic feed additives, including improved digestion, immunity, antioxidant support, and growth performance, is a major market driver

- For instance, in 2025, Cargill and DuPont expanded production of phytogenic premixes and essential oil-based additives targeting commercial swine farms globally

- The growing preference for natural, antibiotic-free, and sustainable feed ingredients is fueling adoption across North America, Europe, and Asia-Pacific

- Technological advancements in feed formulation, microencapsulation of active compounds, and standardized phytogenic blends are enabling higher efficacy and consistent results

- Increased use of phytogenic additives in preventive health, feed efficiency improvement, and stress management in swine supports widespread market adoption

- With continued investment in R&D, innovation in natural feed compounds, and marketing strategies, the global phytogenic swine feed additives market is projected to maintain strong growth momentum

Which Factor is Challenging the Growth of the Phytogenic Swine Feed Additives Market?

- High production costs of premium plant extracts, essential oils, and fortified blends limit large-scale adoption, particularly in price-sensitive regions

- For instance, during 2024–2025, fluctuations in the availability of essential oils, herbs, and natural feed enhancers impacted production volumes for commercial swine additives

- Regulatory compliance for feed safety, labeling, and regional approval of herbal compounds increases operational complexity and costs

- Limited awareness among small-scale farmers about the benefits of phytogenic additives slows market penetration in emerging markets

- Competition from conventional feed supplements, antibiotics, and synthetic additives creates pricing pressure and adoption barriers

- To overcome these challenges, market participants are investing in sustainable sourcing, formulation optimization, supply chain efficiency, and farmer education to ensure consistent, high-quality, and affordable phytogenic feed solutions globally

How is the Phytogenic Swine Feed Additives Market Segmented?

The market is segmented on the basis of type, form, source and function.

- By Type

On the basis of type, the phytogenic swine feed additives market is segmented into Essential Oils, Flavonoids, Saponins, Oleoresins, and Others. The Essential Oils segment dominated the market with a revenue share of 44.6% in 2025, owing to their multifunctional benefits in improving gut health, immunity, and feed efficiency in swine. Essential oils such as thyme, oregano, and cinnamon are widely incorporated in feed formulations to reduce pathogens and enhance nutrient absorption. Feed manufacturers are leveraging standardized essential oil blends to deliver consistent performance and meet demand for natural, antibiotic-free solutions.

The Oleoresins segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of concentrated plant extracts that provide targeted health benefits, improved flavor, and digestive support in swine diets, particularly in commercial and large-scale farming operations.

- By Form

Based on form, the market is categorized into Dry and Liquid phytogenic feed additives. The Dry segment dominated the market with a revenue share of 51.3% in 2025, attributed to its longer shelf life, ease of storage, and integration into premixes, feed pellets, and compound feed. Dry additives also allow precise dosing and better handling in automated feed systems, making them ideal for large commercial operations.

The Liquid segment is expected to register the fastest CAGR during 2026–2033, fueled by rising demand for water-soluble extracts, functional liquid supplements, and feed top-coating applications. Liquid formulations support rapid absorption, higher bioavailability, and targeted health effects such as improved digestion, immunity, and palatability, making them increasingly preferred in modern swine nutrition practices.

- By Source

On the basis of source, the Phytogenic Swine Feed Additives market is segmented into Herbs and Spices, Flowers, and Fruits and Vegetables. The Herbs and Spices segment dominated the market with a revenue share of 47.5% in 2025, driven by the widespread use of oregano, thyme, garlic, and cinnamon for antimicrobial, antioxidant, and digestive benefits. These plant-derived ingredients are recognized for their natural bioactive compounds that improve feed conversion efficiency and animal health.

The Flowers segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing adoption of marigold, chamomile, and hibiscus extracts for gut health, immunity, and stress reduction. Growing interest in exotic, plant-based feed components and continuous research on bioactive profiles of floral extracts further drives market expansion.

- By Function

Based on function, the market is segmented into Performance Enhancers, Antimicrobial Properties, Palatability Enhancers, and Others. The Performance Enhancers segment dominated the market with a revenue share of 45.9% in 2025, owing to their ability to improve feed efficiency, growth rate, and overall swine productivity. Ingredients such as essential oils, flavonoids, and saponins are widely formulated to enhance nutrient absorption and reduce metabolic stress in pigs.

The Antimicrobial Properties segment is expected to grow at the fastest CAGR during 2026–2033, driven by increasing demand for natural alternatives to antibiotics, regulatory pressure to reduce synthetic growth promoters, and rising adoption of phytogenic solutions that prevent infections while maintaining gut health. Continuous R&D and innovation in functional additive blends are expected to further accelerate growth across this segment globally.

Which Region Holds the Largest Share of the Phytogenic Swine Feed Additives Market?

- In 2025, Asia-Pacific dominated the phytogenic swine feed additives market with a 37.2% revenue share, driven by large-scale adoption of vitamin-, protein-, and plant-extract-enriched feed additives across China, India, Japan, and Southeast Asia

- Strong livestock farming infrastructure, increasing urbanization, and rising health-conscious consumer behavior support regional leadership. Key players are investing in R&D, product innovation, and supply chain expansion to meet growing demand

- Increasing government support for preventive health and animal nutrition further strengthens market dominance

China Phytogenic Swine Feed Additives Market Insight

In China, the market is led by widespread use of phytogenic feed additives for gut health, immunity, and performance enhancement. Rising livestock production, urbanization, and demand for high-quality pork and poultry products drive growth. Companies are innovating with natural extracts, essential oils, and fortified feed blends. Extensive distribution networks across commercial farms and feed mills enable large-scale adoption. Government programs promoting animal health and feed quality continue to support the country’s leadership in Asia-Pacific.

India Phytogenic Swine Feed Additives Market Insight

In India, market growth is driven by rising awareness of phytogenic feed benefits, increasing livestock production, and adoption of fortified and plant-based feed solutions. The expansion of commercial farms, e-commerce platforms for feed distribution, and government initiatives supporting animal nutrition strengthen adoption. Companies are developing affordable, clean-label, and eco-friendly feed additives. Urbanization, rising disposable incomes, and preventive health trends among farmers continue to fuel long-term market growth in India.

North America Phytogenic Swine Feed Additives Market Insight

In North America, the market is projected to register the fastest CAGR of 8.1% from 2026 to 2033, driven by rising adoption of essential oils, saponins, and other plant-based feed additives across the U.S. and Canada. Large-scale commercial farms focus on improving growth performance, immunity, and feed efficiency. Advanced R&D in feed fortification, clean-label solutions, and natural extract formulation accelerates innovation. Government support for sustainable livestock practices and preventive nutrition further boosts regional growth.

U.S. Phytogenic Swine Feed Additives Market Insight

In the U.S., the market is led by widespread use of vitamin-, protein-, and plant-based feed additives to enhance growth, immunity, and gut health. Large commercial farms adopt essential oils, flavonoids, and saponins for improved feed conversion and reduced antibiotic use. Manufacturers are innovating with clean-label, eco-friendly, and high-bioavailability products. Strong distribution networks through feed suppliers and e-commerce platforms ensure widespread adoption. Government programs promoting animal health and sustainable livestock practices further support market expansion.

Canada Phytogenic Swine Feed Additives Market Insight

In Canada, steady market growth is driven by increasing adoption of phytogenic feed additives to improve swine health, performance, and feed efficiency. Commercial pig farms are increasingly using essential oils, oleoresins, and botanical extracts to replace antibiotics and enhance productivity. Companies are investing in R&D and natural extract formulations. Retail and online distribution channels support accessibility. Government initiatives promoting preventive livestock nutrition, sustainable farming, and feed quality continue to strengthen Canada’s market position within North America.

Europe Phytogenic Swine Feed Additives Market Insight

In Europe, the market holds a significant share, driven by high adoption of fortified and plant-based feed additives in Germany, the U.K., France, and the Netherlands. Essential oils, saponins, and flavonoids are increasingly integrated into swine feed to improve gut health, immunity, and performance. Clean-label, eco-friendly, and sustainable livestock practices drive adoption. Manufacturers are innovating with natural extracts and high-bioavailability formulations. Urbanization, preventive animal health awareness, and government regulations supporting antibiotic-free farming strengthen Europe’s position as a mature and high-value market.

Germany Phytogenic Swine Feed Additives Market Insight

In Germany, market growth is led by strong demand for phytogenic feed additives to improve swine performance, immunity, and gut health. Essential oils, flavonoids, and saponins are widely adopted across commercial farms. Companies are investing in R&D, natural extract innovation, and sustainable production practices. Distribution through feed suppliers, agricultural cooperatives, and online channels supports widespread accessibility. Government support for antibiotic-free livestock production, preventive nutrition, and animal welfare strengthens Germany’s leadership in the European market.

U.K. Phytogenic Swine Feed Additives Market Insight

In the U.K., the market is expanding steadily, driven by rising awareness of plant-based and fortified feed additives in swine nutrition. Farmers are increasingly adopting essential oils, flavonoids, and saponins to improve feed efficiency, gut health, and overall productivity. Manufacturers are innovating with natural, clean-label, and eco-friendly formulations. Distribution through agricultural cooperatives, retail feed stores, and online platforms supports accessibility. Preventive livestock health initiatives, government regulations, and increasing adoption of antibiotic-free practices continue to drive long-term market growth.

Which are the Top Companies in Phytogenic Swine Feed Additives Market?

The phytogenic swine feed additives industry is primarily led by well-established companies, including:

- Bluestar Adisseo (France)

- DuPont (U.S.)

- Synthite Industries Ltd. (India)

- ABT International (U.K.)

- British Horse Feeds (U.K.)

- MIAVIT GmbH (Germany)

- Tolsa SA (Spain)

- Kemin Industries (U.S.)

- Cargill, Incorporated (U.S.)

- Delacon Biotechnik GmbH (Austria)

- BIOMIN Holding GmbH (Austria)

- Growell India (India)

- Phytobiotics Futterzusatzstoffe GmbH (Germany)

- Ayurvet Limited (India)

What are the Recent Developments in Global Phytogenic Swine Feed Additives Market?

- In January 2025, EW Nutrition, aiming to strengthen its global expertise in animal nutrition, appointed Nadia Yacoubi and Marie Galissot at its headquarters in Germany to lead the Phytogenic Products and Feed Quality Solutions departments, respectively. This strategic move is expected to enhance the company’s product innovation and operational capabilities in phytogenic feed additives

- In February 2024, Cargill’s Animal Nutrition & Health (ANH) business unit introduced Micronutrition and Health Solutions (MHS), a specialized division focused on providing innovative feeding solutions for livestock. The launch is anticipated to expand Cargill’s portfolio of advanced animal nutrition products globally

- In April 2023, Kemin AquaScience, a division of Kemin Industries Inc., launched a novel natural phytogenic feed additive named Pathorol, designed to improve shrimp health, and rolled it out across multiple Asian markets. This innovation is expected to support sustainable aquaculture and enhance overall animal performance

- In June 2022, Cargill (U.S.) acquired Delacon (Austria) after five years of collaboration, combining Delacon’s expertise in phytogenic feed additives with Cargill’s animal health technologies. This acquisition is projected to boost global animal productivity and advance sustainable livestock production

- In November 2021, the Neolac research program was launched with GBP 2.5 million funding in collaboration with Biodevas Labs, INRAE, and SODIAAL, aiming to reduce antibiotic use on dairy farms using innovative phytogenic treatments tested on 100 farms in Brittany, France over four years. The program’s experimental phase is underway, highlighting the potential of plant-based solutions for preventive animal health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.