Global Phytosterols Market

Market Size in USD Billion

CAGR :

%

USD

437.73 Billion

USD

850.05 Billion

2024

2032

USD

437.73 Billion

USD

850.05 Billion

2024

2032

| 2025 –2032 | |

| USD 437.73 Billion | |

| USD 850.05 Billion | |

|

|

|

|

Phytosterols Market Size

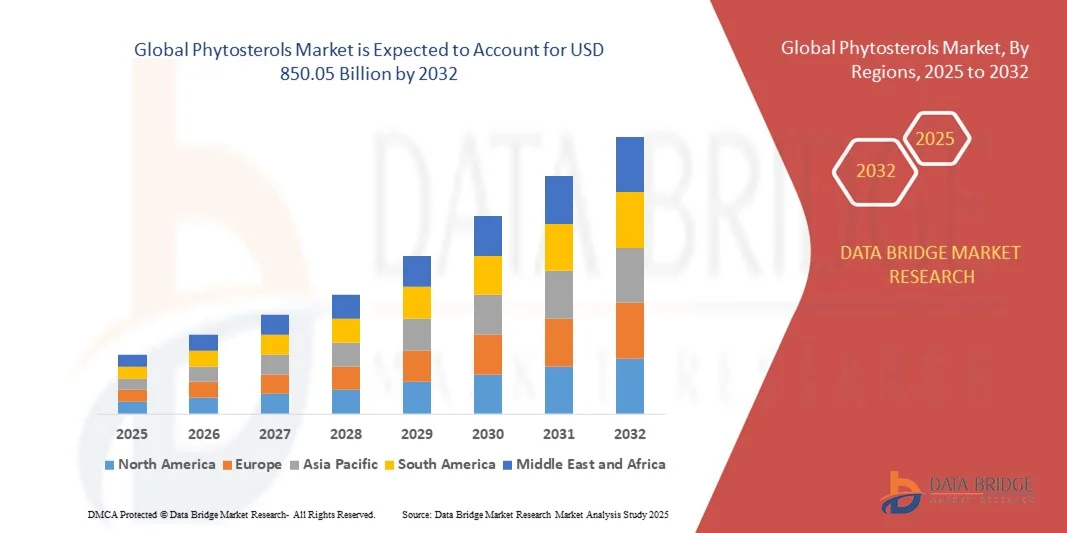

- The global phytosterols market size was valued at USD 437.73 billion in 2024 and is expected to reach USD 850.05 billion by 2032, at a CAGR of 8.65% during the forecast period

- The market growth is largely fuelled by the increasing awareness of heart health, rising demand for cholesterol-lowering food products, and growing adoption of functional foods and dietary supplements

- Growing consumer inclination toward natural and plant-based ingredients, coupled with expanding applications in pharmaceuticals and cosmetics, is further driving market expansion

Phytosterols Market Analysis

- The increasing demand for cholesterol-lowering functional foods and beverages is transforming the phytosterols market, as manufacturers incorporate these compounds to meet consumer health needs

- Rising awareness about cardiovascular health, coupled with government and health organization campaigns, is accelerating the adoption of phytosterols across various regions

- North America dominated the phytosterols market with the largest revenue share of 38.5% in 2024, driven by rising health awareness, growing demand for functional foods, and increasing prevalence of cardiovascular diseases

- Asia-Pacific region is expected to witness the highest growth rate in the global phytosterols market, driven by increasing urbanization, rising disposable incomes, and expanding functional food and nutraceutical industries across countries such as China, Japan, and South Korea

- The Beta-Sitosterol segment held the largest market revenue share in 2024, driven by its widespread use in functional foods, nutraceuticals, and cholesterol-lowering supplements. Its proven efficacy in reducing LDL cholesterol, compatibility with various formulations, and cost-effectiveness make it a preferred choice among manufacturers

Report Scope and Phytosterols Market Segmentation

|

Attributes |

Phytosterols Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.. |

Phytosterols Market Trends

Rising Demand for Phytosterol-Enriched Functional Foods and Beverages

- The growing incorporation of phytosterols into functional foods and beverages is transforming the market by supporting heart health and cholesterol management. Their proven efficacy in reducing LDL cholesterol levels is driving widespread adoption across the food and nutraceutical sectors. This trend contributes to improved consumer health outcomes, product differentiation, and increased brand loyalty among health-conscious consumers

- Increasing demand for fortified snacks, dairy products, and spreads is accelerating market growth, particularly in regions with rising awareness of cardiovascular health. Manufacturers are integrating phytosterols to meet consumer demand for functional and heart-healthy products. In addition, the rise of personalized nutrition trends is further boosting the adoption of phytosterol-enriched offerings

- The ease of formulation and stability in a variety of food matrices makes phytosterols attractive for routine industrial applications, providing cost-effective enrichment of products. Phytosterols can be incorporated into dairy, bakery, and beverage products without affecting taste or texture, allowing manufacturers to maintain product quality and consistency across batches

- For instance, in 2023, several food companies in Europe and North America reported increased consumer adoption of phytosterol-fortified spreads and dairy products, highlighting market potential and driving further innovation. Companies also leveraged marketing campaigns emphasizing heart health benefits to strengthen consumer engagement

- While phytosterol adoption is growing across the food and nutraceutical industries, its impact depends on continued product innovation, regulatory approvals, and cost-effective sourcing. Companies must focus on high-purity formulations, efficient distribution, and collaborative partnerships with ingredient suppliers to fully capitalize on market demand

Phytosterols Market Dynamics

Driver

Increasing Consumer Awareness About Heart Health and Functional Ingredients

- Rising concerns over cardiovascular diseases are pushing both consumers and manufacturers to prioritize functional foods enriched with phytosterols. This has accelerated investment in product development, fortified offerings, and R&D for improved efficacy. Consumer education initiatives highlighting LDL reduction and cholesterol management are also driving adoption

- Governments and health organizations promoting heart-healthy diets are supporting market growth through awareness campaigns, nutrition guidelines, and fortification programs. These initiatives encourage manufacturers to incorporate phytosterols into daily consumables, and policy incentives further accelerate adoption in commercial products

- The global trend toward preventive healthcare and lifestyle-related wellness is pushing food and beverage manufacturers to integrate phytosterols into functional formulations, increasing overall market adoption. Emerging markets with rising disposable incomes and expanding health-conscious populations are particularly attractive for growth

- For instance, in 2022, several North American and European dairy and bakery companies expanded their product lines with phytosterol-fortified options, significantly boosting market uptake and consumer engagement. Strategic partnerships with retail chains further helped in increasing product visibility and availability

- While health awareness and functional food trends are driving growth, supply chain consistency and formulation stability must be addressed to ensure long-term market expansion. Companies need to invest in ingredient sourcing, processing technology, and quality assurance to meet rising global demand

Restraint/Challenge

High Cost of Phytosterol Ingredients and Regulatory Barriers

- The high production cost of high-purity phytosterols, especially for functional foods and nutraceuticals, limits adoption among small manufacturers and in emerging markets. Premium pricing can restrict widespread use, particularly in cost-sensitive regions. Companies must balance formulation costs with consumer affordability to sustain growth

- Regulatory restrictions on maximum allowable phytosterol content in foods in certain regions can pose challenges for manufacturers seeking global market penetration. Compliance requires reformulation, testing, and label adjustments, which can delay product launches and increase operational costs

- Supply chain constraints, including raw material sourcing and transportation, can affect consistent availability, leading to fluctuations in market prices and potential production delays. Volatility in raw material markets, geopolitical factors, and import/export restrictions further exacerbate supply challenges

- For instance, in 2023, several functional food manufacturers in Asia-Pacific reported delays in product launches due to limited access to high-quality phytosterol concentrates, impacting timelines and market performance. Manufacturers also faced increased logistics costs and storage issues for sensitive ingredients

- While technological advancements in extraction and formulation continue, addressing cost, regulatory compliance, and supply chain challenges remains critical. Companies must focus on scalable production, optimized sourcing, improved packaging solutions, and regional regulatory alignment to unlock long-term market potential

Phytosterols Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the phytosterols market is segmented into Beta-Sitosterol, Campesterol, Stigmasterol, Phytosterol, and Others. The Beta-Sitosterol segment held the largest market revenue share in 2024, driven by its widespread use in functional foods, nutraceuticals, and cholesterol-lowering supplements. Its proven efficacy in reducing LDL cholesterol, compatibility with various formulations, and cost-effectiveness make it a preferred choice among manufacturers.

The Campesterol segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its increasing adoption in dietary supplements and fortified food products. Campesterol is particularly valued for its antioxidant properties and contribution to heart health, making it popular in both pharmaceutical and food applications.

- By Application

On the basis of application, the phytosterols market is segmented into Food, Pharmaceuticals, Cosmetics, and Feed Industry. The Food segment held the largest market revenue share in 2024, driven by growing consumer demand for heart-healthy and functional food products. Phytosterol-enriched spreads, dairy, and bakery products are gaining popularity due to increased awareness of cholesterol management and preventive healthcare.

The Pharmaceuticals segment is expected to witness the fastest growth from 2025 to 2032, attributed to rising incorporation of phytosterols in dietary supplements, cholesterol-lowering formulations, and functional nutraceutical products. Their clinical efficacy and consumer trust in natural cholesterol-reducing ingredients are key factors driving market adoption in the pharmaceutical sector.

Phytosterols Market Regional Analysis

- North America dominated the phytosterols market with the largest revenue share of 38.5% in 2024, driven by rising health awareness, growing demand for functional foods, and increasing prevalence of cardiovascular diseases

- Consumers in the region are increasingly prioritizing heart-healthy diets and cholesterol management, boosting the adoption of phytosterol-enriched products across food, nutraceuticals, and dietary supplements

- This widespread adoption is further supported by advanced food processing infrastructure, high disposable incomes, and strong distribution networks, establishing phytosterols as a preferred ingredient for functional food formulations

U.S. Phytosterols Market Insight

The U.S. phytosterols market captured the largest revenue share in 2024 within North America, fueled by growing consumer awareness about cholesterol management and heart health. The increasing incorporation of phytosterols in spreads, dairy, and bakery products is driving market expansion. Moreover, favorable regulatory frameworks, functional food trends, and the rising popularity of nutraceuticals are significantly contributing to market growth in the country.

Europe Phytosterols Market Insight

The Europe phytosterols market is expected to witness the fastest growth from 2025 to 2032, primarily driven by strict dietary guidelines, proactive public health initiatives, and rising cardiovascular disease awareness. Increasing demand for fortified foods, dietary supplements, and functional beverages is fostering market adoption. European consumers are also drawn to natural and preventive health solutions, further supporting growth in the region.

U.K. Phytosterols Market Insight

The U.K. phytosterols market is expected to witness the fastest growth from 2025 to 2032, driven by increased health consciousness and the growing preference for functional food and nutraceutical products. Rising government initiatives on cholesterol management and preventive healthcare are further stimulating adoption. The country’s robust retail and e-commerce infrastructure enables wide distribution of phytosterol-enriched foods and supplements.

Germany Phytosterols Market Insight

The Germany phytosterols market is expected to witness the fastest growth from 2025 to 2032, fueled by strong consumer awareness regarding heart health and lifestyle-related disorders. Germany’s emphasis on preventive healthcare, coupled with well-established food processing and nutraceutical industries, promotes the use of phytosterols in functional food formulations. The integration of phytosterols into dairy, bakery, and beverage products is becoming increasingly prevalent across the region.

Asia-Pacific Phytosterols Market Insight

The Asia-Pacific phytosterols market is expected to witness the fastest growth from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing health awareness in countries such as China, India, and Japan. The region's rising incidence of cardiovascular diseases, coupled with a shift toward functional foods and dietary supplements, is driving phytosterol adoption. Moreover, APAC is emerging as a manufacturing hub for phytosterol concentrates, improving affordability and accessibility for both local and international markets.

Japan Phytosterols Market Insight

The Japan phytosterols market is expected to witness the fastest growth from 2025 to 2032 due to the country’s health-conscious population, aging demographic, and strong preference for preventive healthcare solutions. Phytosterol-enriched foods and nutraceuticals are increasingly adopted to manage cholesterol and support cardiovascular health. Integration of phytosterols into daily consumables, along with consumer education and government initiatives, is driving sustained market growth in both residential and commercial segments.

China Phytosterols Market Insight

The China phytosterols market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing health awareness, and increasing adoption of functional foods and dietary supplements. Rising incidence of cardiovascular diseases and strong government promotion of heart-healthy diets are encouraging manufacturers to integrate phytosterols into a wide range of food products. The availability of domestic phytosterol production facilities and cost-effective solutions is further propelling market expansion in China.

Phytosterols Market Share

The Phytosterols industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bunge Limited (U.S.)

- Archer Daniels Midland Company (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Cargill, Incorporated (U.S.)

- Arboris, LLC (U.S.)

- Matrix Fine Sciences Pvt. Ltd. (India)

- Parmentier & Co. Deutsche Lanolin Handels GmbH & Co. KG (Germany)

- Ashland (U.S.)

- The Lubrizol Corporation (U.S.)

- Merck KGaA (Germany)

- Les Derives Resiniques Et Terpeniques SA (France)

- ConnOils LLC (U.S.)

- Vitae Caps S.A. (France)

Latest Developments in Global Phytosterols Market

- In September 2023, Nutrartis launched a new product, Cardiosmile, in the U.S. market, marking its entry into the functional supplements segment. The product, a plant sterol-based formulation, is designed to help lower LDL cholesterol and triglyceride levels, supporting cardiovascular health. By leveraging the proven benefits of phytosterols, Cardiosmile aims to meet the rising consumer demand for heart-healthy supplements. The launch is expected to enhance Nutrartis’ presence in the U.S. nutraceutical market, drive product differentiation, and encourage adoption of phytosterol-enriched functional foods and supplements.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Phytosterols Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Phytosterols Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Phytosterols Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.