Global Picks Disease Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

4.48 Billion

2025

2033

USD

2.92 Billion

USD

4.48 Billion

2025

2033

| 2026 –2033 | |

| USD 2.92 Billion | |

| USD 4.48 Billion | |

|

|

|

|

Pick’s Disease Treatment Market Size

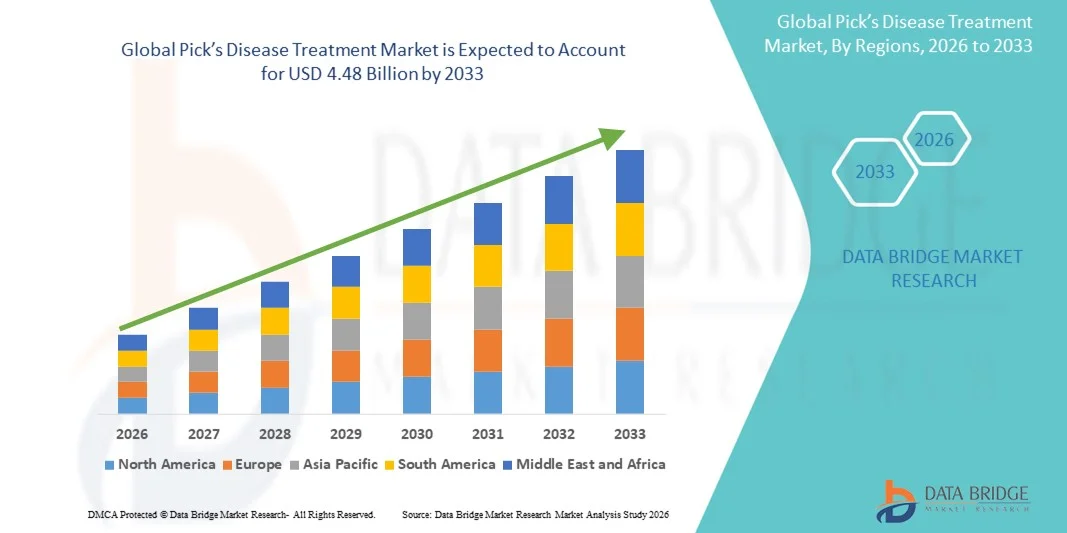

- The global Pick’s disease treatment market size was valued at USD 2.92 billion in 2025 and is expected to reach USD 4.48 billion by 2033, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of Pick’s disease, improvements in diagnostic capabilities, and growing awareness among healthcare providers, which are driving demand for effective treatment and management options

- Furthermore, rising patient demand for symptom‑management therapies and supportive care solutions, along with ongoing research into innovative treatment approaches, is positioning Pick’s disease treatment as a critical segment within neurodegenerative disorder therapeutics, thereby significantly boosting the industry's growth

Pick’s Disease Treatment Market Analysis

- Pick’s disease treatment, offering medications and behavioral therapies for managing neurodegenerative disorders, is increasingly vital in both clinical and home care settings due to its potential to improve patient quality of life and slow disease progression

- The escalating demand for Pick’s disease treatment is primarily fueled by growing prevalence of the disorder, improved diagnostic capabilities, rising awareness among healthcare providers, and a rising preference for effective symptom management strategies

- North America dominated the Pick’s disease treatment with the largest revenue share of 40.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of specialized therapies, and a strong presence of key pharmaceutical and biotech players, with the U.S. experiencing substantial growth in treatment uptake, particularly in hospitals and clinics, driven by innovations in pharmacological and behavioral interventions

- Asia-Pacific is expected to be the fastest growing region in the Pick’s disease treatment during the forecast period due to rising awareness, improving healthcare facilities, and expanding access to therapeutic interventions in emerging economies

- Behavioral Variant segment dominated the Pick’s disease treatment with a market share of 45.2% in 2025, driven by its higher prevalence among Pick’s disease patients and the focus of treatment strategies on managing cognitive and behavioral symptoms

Report Scope and Pick’s Disease Treatment Market Segmentation

|

Attributes |

Pick’s Disease Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Pick’s Disease Treatment Market Trends

Emergence of AI-Enabled Early Diagnosis and Monitoring

- A significant and accelerating trend in the Pick’s disease treatment market is the growing use of AI and machine learning for early diagnosis and disease progression monitoring, improving patient outcomes and enabling more targeted interventions

- For instance, AI-based MRI analysis tools can detect early neurodegenerative changes in patients, allowing clinicians to initiate behavioral therapies and pharmacological treatments sooner

- AI integration also enables predictive modeling of symptom progression and treatment response, supporting personalized care plans for patients with Pick’s disease. For instance, software platforms can track behavioral and cognitive changes over time to optimize therapy

- The seamless incorporation of AI-driven diagnostic tools with hospital information systems facilitates centralized patient monitoring and longitudinal care management, creating a more unified approach to treatment

- This trend towards intelligent, data-driven, and personalized management strategies is reshaping clinical expectations for Pick’s disease treatment. Consequently, companies such as Cognito Therapeutics are developing AI-enabled platforms to track cognitive decline and provide actionable insights for care

- The demand for AI-assisted diagnostics and monitoring solutions is growing rapidly across clinical and research settings, as healthcare providers increasingly prioritize precision, early intervention, and optimized therapy selection

- Increasing collaboration between pharmaceutical companies and AI technology providers is accelerating innovation in predictive treatment solutions. For instance, partnerships are being formed to integrate cognitive data analytics with therapeutic interventions

- Telemedicine and remote monitoring technologies are emerging as complementary trends, allowing patients to access treatment guidance and symptom tracking from home. For instance, some clinics now provide AI-assisted virtual consultations to optimize behavioral therapy schedules

Pick’s Disease Treatment Market Dynamics

Driver

Rising Prevalence of Neurodegenerative Disorders and Awareness

- The increasing incidence of Pick’s disease worldwide, coupled with growing awareness among healthcare providers and caregivers, is a significant driver for heightened demand for effective treatments

- For instance, in March 2025, Biogen announced initiatives to improve access to symptomatic therapies and behavioral interventions for neurodegenerative patients in North America, supporting treatment uptake

- As clinicians and caregivers become more aware of disease symptoms, Pick’s Disease Treatment provides options to manage cognitive, behavioral, and psychiatric manifestations, enhancing patient quality of life

- Furthermore, increased investment in healthcare infrastructure and specialized neurology units is making Pick’s Disease Treatment more accessible and integrated into standard care practices

- The convenience of early detection, personalized therapy, and structured management plans, along with the availability of multidisciplinary care approaches, are key factors propelling adoption in both hospitals and clinics

- Expansion of public health initiatives and awareness campaigns is driving early diagnosis and encouraging treatment adoption. For instance, educational programs targeting caregivers have increased referrals for therapy

- Rising government and private funding for neurodegenerative disease research is facilitating faster clinical trials and availability of advanced therapies. For instance, grants have been allocated to explore innovative behavioral and pharmacological treatments

Restraint/Challenge

Limited Treatment Options and High Cost of Therapies

- The scarcity of disease-modifying therapies for Pick’s disease and the reliance on symptomatic management pose significant challenges to broader market growth

- For instance, many patients still rely on antipsychotics or behavioral therapies that only manage symptoms rather than slowing disease progression, limiting long-term efficacy

- Addressing these treatment gaps through R&D, clinical trials, and regulatory approvals is crucial for expanding market adoption. For instance, companies such as Axovant are conducting trials to explore novel therapeutic candidates targeting disease pathways

- In addition, the high cost of specialized medications and therapies can be a barrier for patients, particularly in emerging markets, restricting access and adoption rates

- Overcoming these challenges through innovative therapy development, cost-effective treatment models, and increased awareness among caregivers and clinicians will be vital for sustained market growth

- Limited patient and caregiver knowledge about advanced therapies can hinder adoption rates. For instance, surveys indicate that many families delay seeking treatment until later stages due to lack of information

- Stringent regulatory approvals and long clinical trial timelines slow the introduction of new therapies. For instance, delays in FDA approval processes for novel disease-modifying drugs restrict market expansion

Pick’s Disease Treatment Market Scope

The market is segmented on the basis of type, treatment, diagnosis, dosage, route of administration, symptoms, end-users, and distribution channel.

- By Type

On the basis of type, the Pick’s disease treatment market is segmented into behavioural variant and primary progressive aphasia (PPA). The Behavioural Variant segment dominated the market with the largest share of 42.5% in 2025, driven by its higher prevalence among patients diagnosed with Pick’s disease. Treatment strategies for this type focus on managing cognitive and behavioral symptoms such as apathy, aggressiveness, and impulsivity, which require ongoing clinical attention. Healthcare providers often prioritize interventions for the behavioural variant due to its profound impact on patient quality of life and caregiver burden. The availability of pharmacological therapies combined with behavioral therapy contributes to the dominance of this segment. In addition, awareness programs and specialized neurology clinics focusing on behavioral symptoms further enhance adoption rates for treatment solutions.

The Primary Progressive Aphasia (PPA) segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing awareness of language-related cognitive impairments and advancements in speech-focused behavioral therapies. PPA treatments often require multi-disciplinary approaches, combining pharmacological support with speech and cognitive therapies. Growing investment in early diagnosis and therapeutic interventions is expanding the patient pool for PPA. Furthermore, adoption is being supported by the development of targeted care plans and home-based therapy solutions. Telemedicine initiatives and AI-assisted language assessment tools also contribute to faster uptake in this segment.

- By Treatment

On the basis of treatment, the Pick’s disease treatment market is segmented into analgesics, antipsychotic drugs, antidepressants, behavioral therapy, and others. The Antipsychotic Drugs segment dominated the market in 2025 due to its widespread use in controlling aggression, agitation, and severe behavioral symptoms associated with Pick’s disease. Clinicians prefer antipsychotics to manage challenging patient behaviors in both hospital and home care settings, improving caregiver support and patient safety. The availability of multiple approved antipsychotic medications and their inclusion in standard treatment protocols contribute to dominance. Furthermore, antipsychotic therapies are often combined with behavioral interventions to enhance efficacy. Consistent clinical guidance and insurance coverage for these drugs also help maintain a large patient base.

The Behavioral Therapy segment is expected to witness the fastest growth from 2026 to 2033, driven by increased adoption of non-pharmacological interventions aimed at improving patient cognition and managing emotional symptoms. Growing evidence supporting behavioral therapy effectiveness is encouraging caregivers and healthcare providers to integrate these solutions into treatment plans. Home-based therapy programs, cognitive training apps, and structured behavioral routines are contributing to adoption. Furthermore, rising awareness of the limitations of pharmacological treatments for symptom management supports growth in this segment. Insurance reimbursement and government support programs for therapy services are also accelerating uptake.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Blood Tests, MRI, CT scan, PET scan, biopsy, and others. The MRI segment dominated the market in 2025, owing to its high accuracy in detecting neurodegenerative changes and widespread availability in hospitals and clinics. MRI enables clinicians to identify early structural and functional brain changes in Pick’s disease patients, facilitating timely therapeutic interventions. Its non-invasive nature and compatibility with other diagnostic techniques enhance adoption. MRI-based diagnosis is often coupled with symptom assessment and cognitive testing, making it a preferred choice for routine clinical evaluation. In addition, technological advancements in imaging resolution and AI-based analysis tools are further strengthening MRI’s dominance.

The PET scan segment is expected to witness the fastest growth from 2026 to 2033, driven by its ability to detect metabolic and molecular brain changes before structural symptoms appear. PET imaging supports early diagnosis and helps in monitoring disease progression and response to therapy. Increasing investment in PET infrastructure and rising clinical awareness of its utility in neurodegenerative disorders are key growth drivers. The integration of PET scans with AI-assisted imaging analytics enhances precision and adoption. Clinical studies highlighting PET’s effectiveness in guiding treatment decisions also promote its rapid uptake.

- By Dosage

On the basis of dosage, the market is segmented into tablet, injection, and others. The Tablet segment dominated the market in 2025, owing to its ease of administration, patient compliance, and suitability for long-term symptom management. Tablets allow flexible dosing schedules and can be administered at home, reducing the need for frequent hospital visits. Clinicians often prefer oral tablets for their practicality and ability to combine multiple medications in one regimen. The dominance is further supported by the high availability of approved oral medications in developed markets. Patient familiarity and caregiver comfort with oral tablets also drive widespread adoption.

The Injection segment is expected to witness the fastest growth from 2026 to 2033, fueled by the introduction of new injectable therapies targeting specific disease pathways. Injectable formulations often offer higher bioavailability and faster therapeutic effects. Hospitals and specialized clinics are increasingly adopting injectable treatments for patients with advanced symptoms. Research advancements and clinical trial approvals of new injectable drugs are encouraging uptake. In addition, caregiver support programs and in-clinic administration models facilitate adoption in both developed and emerging markets.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, intramuscular, and others. The Oral segment dominated in 2025 due to its convenience, non-invasiveness, and compatibility with home-based care. Patients and caregivers often prefer oral administration to reduce hospital dependency and simplify long-term management. Oral medications are available in multiple therapeutic classes, enhancing their applicability across diverse patient profiles. The dominance is reinforced by insurance coverage, ease of monitoring, and high patient adherence. Oral therapies are often combined with behavioral interventions for comprehensive management.

The Intravenous segment is expected to witness the fastest growth from 2026 to 2033, driven by the development of advanced biologic therapies and disease-modifying drugs that require IV delivery. Hospitals and specialized care centers are increasingly equipped to administer IV treatments, ensuring effective dosing. Rising clinical evidence supporting IV therapy efficacy is boosting adoption. In addition, integration of IV treatments with patient monitoring technologies accelerates uptake. Pharmaceutical innovations and streamlined administration protocols contribute to rapid growth in this segment.

- By Symptoms

On the basis of symptoms, the market is segmented into apathy, depression, aggressiveness, loss of inhibition, paranoia, impatience, restlessness, impulsive behavior, childsuch as behavior, speech problems, poor attention, and others. The Apathy segment dominated in 2025, driven by the high prevalence of apathy among Pick’s disease patients and the clinical focus on improving motivation and engagement. Apathy significantly impacts caregiver burden and patient quality of life, increasing demand for targeted therapies. Pharmacological and behavioral interventions addressing apathy are widely adopted in clinical practice. Training programs for caregivers and clinical guidelines emphasize apathy management, further supporting dominance. The prevalence of apathy across both Behavioral Variant and PPA patients reinforces its market share.

The Speech Problems segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing awareness and development of speech-focused behavioral therapies, especially for PPA patients. Tele-rehabilitation tools and AI-assisted speech therapy applications are supporting home-based treatment. Early diagnosis and intervention programs targeting speech impairments are expanding the patient base. In addition, government initiatives and insurance coverage for speech therapy contribute to rapid adoption. Clinical studies highlighting therapy effectiveness enhance growth prospects.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The Hospitals segment dominated in 2025 due to their comprehensive care infrastructure, specialized neurology departments, and ability to provide integrated pharmacological and behavioral therapies. Hospitals often serve as referral centers for diagnosis, treatment, and monitoring of Pick’s disease. Institutional adoption of treatment protocols, advanced diagnostic tools, and multidisciplinary care teams reinforces hospital dominance. Hospitals also facilitate clinical trials and research initiatives that drive awareness and adoption.

The Clinics segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing availability of specialized neurology and behavioral therapy clinics offering personalized treatment programs. Outpatient clinics allow greater accessibility for patients and caregivers. Telemedicine integration and home-based therapy coordination further boost adoption. Private clinics in urban areas are expanding their services, catering to early-stage diagnosis and intervention. In addition, growing awareness campaigns and patient referrals accelerate clinic-based uptake.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The Hospital Pharmacy segment dominated in 2025 due to direct availability of prescription medications, integration with hospital care, and ease of access for inpatients. Hospitals often provide bundled therapy options, combining pharmacological and behavioral care. Institutional trust and clinician recommendations drive the dominance of hospital pharmacies. Availability of high-cost medications and support programs in hospitals further reinforces adoption.

The Online Pharmacy segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing e-commerce adoption, home delivery of medications, and telemedicine integration. Patients and caregivers prefer online channels for convenience, recurring orders, and access to specialty medications. Digital platforms offering prescription management, counseling, and remote monitoring are supporting growth. Awareness of online pharmacy reliability and expanding internet penetration contribute to rapid adoption.

Pick’s Disease Treatment Market Regional Analysis

- North America dominated the Pick’s disease treatment with the largest revenue share of 40.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of specialized therapies, and a strong presence of key pharmaceutical and biotech players

- Patients and clinicians in the region highly value the availability of advanced pharmacological therapies, behavioral interventions, and early diagnostic tools, enabling better management of cognitive and behavioral symptoms associated with Pick’s disease

- This widespread adoption is further supported by advanced healthcare infrastructure, high investment in specialized neurology clinics, and increasing access to multidisciplinary care programs, establishing Pick’s disease treatment as a preferred solution in both hospitals and clinics.

U.S. Pick’s Disease Treatment Market Insight

The U.S. Pick’s disease treatment market captured the largest revenue share of 81% in 2025 within North America, fueled by the increasing prevalence of neurodegenerative disorders and growing awareness among healthcare providers and caregivers. Patients and clinicians are prioritizing early diagnosis and effective management of cognitive and behavioral symptoms through pharmacological and behavioral therapies. The expanding adoption of specialized neurology clinics, coupled with telemedicine and home-based care programs, further propels market growth. Moreover, the integration of advanced diagnostic tools such as MRI and PET scans with personalized treatment plans is significantly contributing to the market's expansion.

Europe Pick’s Disease Treatment Market Insight

The Europe Pick’s disease treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of neurodegenerative disorders and the increasing demand for structured care solutions. The growth in specialized healthcare infrastructure, alongside the adoption of advanced pharmacological and behavioral therapies, is fostering market expansion. European patients and caregivers are also drawn to early diagnostic and therapy options that improve quality of life. The region is experiencing significant growth across hospitals, clinics, and rehabilitation centers, with treatments being incorporated into both new care protocols and updated management strategies.

U.K. Pick’s Disease Treatment Market Insight

The U.K. Pick’s disease treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of cognitive and behavioral symptoms associated with Pick’s disease. In addition, increasing government initiatives and caregiver education programs are encouraging early diagnosis and adoption of treatment strategies. The U.K.’s robust healthcare system, combined with a growing network of specialized neurology clinics, is expected to continue to stimulate market growth. Early intervention programs and personalized therapy plans are becoming increasingly prevalent, supporting both pharmacological and behavioral therapy uptake.

Germany Pick’s Disease Treatment Market Insight

The Germany Pick’s disease treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing healthcare infrastructure, research investment, and focus on innovative treatment approaches. Patients and caregivers in Germany emphasize early diagnosis, integrated care plans, and access to specialized therapies, which is promoting adoption. Germany’s strong healthcare system and emphasis on clinical innovation support the use of advanced diagnostic tools and novel therapy options. Hospitals and specialized clinics are increasingly adopting multidisciplinary approaches to manage Pick’s disease, ensuring both pharmacological and behavioral interventions are effectively implemented.

Asia-Pacific Pick’s Disease Treatment Market Insight

The Asia-Pacific Pick’s disease treatment market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rising awareness, improving healthcare infrastructure, and increasing availability of specialized treatment options in countries such as China, Japan, and India. The region's growing inclination towards early diagnosis, coupled with telemedicine adoption and AI-assisted monitoring tools, is driving treatment uptake. Furthermore, government initiatives promoting neurodegenerative disease management and increasing access to healthcare facilities are expanding the patient base. Affordability of medications and therapy programs, alongside growing clinical trial participation, further supports market growth.

Japan Pick’s Disease Treatment Market Insight

The Japan Pick’s disease treatment market is gaining momentum due to the country’s high healthcare standards, increasing aging population, and rising focus on early detection of neurodegenerative disorders. Adoption is driven by specialized clinics offering advanced diagnostic tools, such as MRI and PET scans, and home-based behavioral therapy programs. Patients and caregivers are increasingly utilizing telemedicine and AI-assisted monitoring solutions to track disease progression. Integration of personalized care plans with hospital and outpatient services is fueling growth. Moreover, Japan’s emphasis on patient-centered care and technological adoption is such asly to spur demand for comprehensive Pick’s disease management solutions in both residential and clinical settings.

India Pick’s Disease Treatment Market Insight

The India Pick’s disease treatment market accounted for the largest revenue share in Asia Pacific in 2025, attributed to growing awareness, expanding healthcare infrastructure, and increasing access to specialized neurology services. India has witnessed a rise in dedicated clinics, hospitals, and telemedicine platforms offering pharmacological and behavioral interventions. Patients and caregivers are increasingly adopting early diagnostic solutions, such as MRI and PET scans, to enable timely treatment. Government programs promoting neurological healthcare and growing private healthcare investment are key factors propelling market growth. Furthermore, the availability of affordable medications and therapy services is facilitating wider adoption across urban and semi-urban regions.

Pick’s Disease Treatment Market Share

The Pick’s Disease Treatment industry is primarily led by well-established companies, including:

- H. Lundbeck A/S (Denmark)

- Otsuka Pharmaceutical (U.S.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Azafaros B.V. (Netherlands)

- Cyclo Therapeutics, Inc. (U.S.)

- ZevraDenmark (Denmark)

- Genzyme (U.S.)

- IntraBio Inc (U.S.)

- Mandos Health (U.S.)

- Orphazyme ApS (Denmark)

- CTD Holdings Inc (U.S.)

- Neurotrope Inc (U.S.)

- Okklo Life Sciences BV (Netherlands)

- Centogene AG Rostock (Germany)

- Actelion Pharmaceuticals Ltd (Switzerland)

- Mallinckrodt Pharmaceuticals (U.S.)

- Merck & Co., Inc. (U.S.)

- Alexion Pharmaceuticals (U.S.)

- Aldagen Inc (U.S.)

- Johnson & Johnson Services, Inc. (India)

What are the Recent Developments in Global Pick’s Disease Treatment Market?

- In September 2025, a landmark genetic‑association study published in The Lancet Neurology found that a specific variant (haplotype H2) of the MAPT gene is associated with a significantly increased risk of Pick’s disease the first time such a large‑scale genetic risk factor has been identified for this rare tauopathy

- In June 2025, researchers reported a proteomics‑based discovery that brain‑derived extracellular vesicles (BD‑EVs) in patients with tauopathies including Pick’s disease show distinct protein “fingerprints,” particularly enriched in astrocytic and mitochondrial proteins; this suggests BD‑EVs could become non‑invasive biomarkers to monitor tau pathology and disease progression without needing post‑mortem tissue

- In May 2025, researchers announced the formation of an international collaborative effort Pick's Disease International Consortium which reported novel gene‑expression changes in brain tissue from Pick’s disease patients, offering new potential biomarkers and therapeutic targets

- In May 2024, results from the consortium study were broadly covered, highlighting that the MAPT H2 variant might drive disease risk which opens up possibilities for genetically‑based diagnostics or future disease-modifying therapies targeting tau pathology

- In June 2023, a study published in Acta Neuropathologica identified a novel mutation ∆K281 in the MAPT gene as a cause of Pick’s disease, providing direct genetic evidence linking a specific MAPT mutation to disease pathology and offering a clear target for future genetic testing and therapeutic research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.