Global Pickup Truck Market

Market Size in USD Billion

CAGR :

%

USD

18.36 Billion

USD

21.69 Billion

2025

2033

USD

18.36 Billion

USD

21.69 Billion

2025

2033

| 2026 –2033 | |

| USD 18.36 Billion | |

| USD 21.69 Billion | |

|

|

|

|

Pickup Truck Market Size

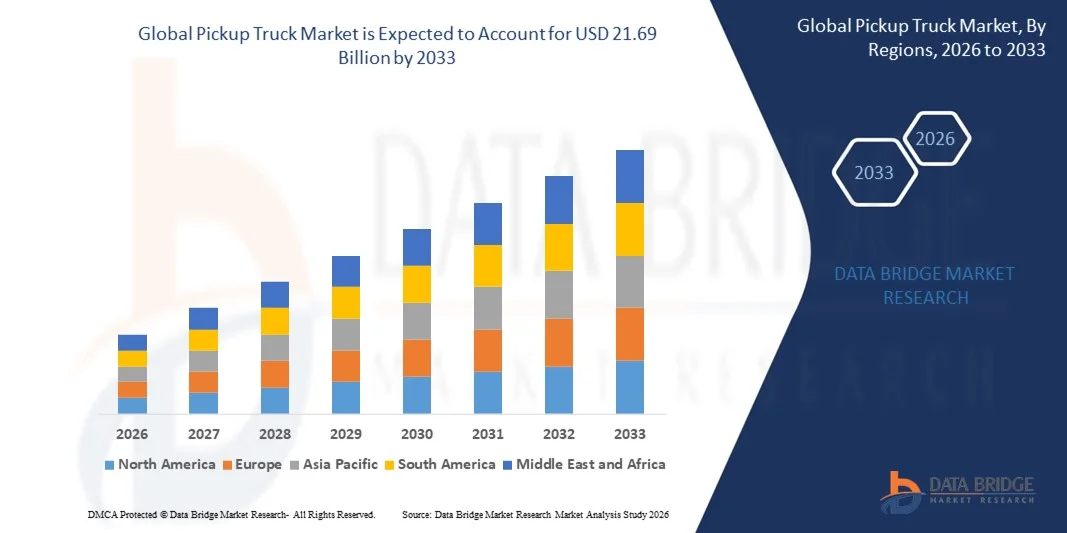

- The global pickup truck market size was valued at USD 18.36 billion in 2025 and is expected to reach USD 21.69 billion by 2033, at a CAGR of 2.10% during the forecast period

- The market growth is largely fuelled by the rising demand for versatile utility vehicles across commercial and personal transportation applications

- The increasing adoption of advanced safety features, improved fuel efficiency technologies, and electrified pickup models is further supporting market expansion

Pickup Truck Market Analysis

- The global pickup truck market is experiencing steady growth due to evolving consumer preferences toward multifunctional and durable vehicles that offer both comfort and performance

- Advancements in powertrain technologies, including hybrid and fully electric pickups, are reshaping competitive dynamics and attracting a wider customer base

- North America dominated the pickup truck market with the largest revenue share of 32.45% in 2025, driven by strong demand for multipurpose vehicles, increasing commercial fleet investments, and rising preference for rugged, off-road capable vehicles

- Asia-Pacific region is expected to witness the highest growth rate in the global pickup truck market, driven by expanding construction and logistics sectors, government incentives for vehicle ownership, and the rising popularity of pickup trucks for both commercial and recreational use

- The full size pickups segment held the largest market revenue share in 2025, driven by their superior towing, hauling, and off-road capabilities, which make them highly preferred for both commercial and personal use. Full size pickups also offer advanced features, higher payload capacity, and robust durability, catering to fleet operators, construction, and logistics applications

Report Scope and Pickup Truck Market Segmentation

|

Attributes |

Pickup Truck Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Pickup Truck Market Trends

Rise of Advanced Powertrain and Connected Features

- The growing adoption of electric pickup trucks is transforming the market by enabling fuel-efficient and environmentally friendly alternatives to conventional diesel and petrol pickups. Advanced battery technologies allow longer driving ranges, lower emissions, and faster charging times, which appeal to environmentally conscious consumers and fleet operators. This trend is supporting a gradual shift toward sustainable transportation and reduced carbon footprints, while encouraging OEMs to invest in green technologies and innovative vehicle platforms

- Increasing demand for connected vehicle features such as telematics, infotainment, and driver-assist technologies is accelerating adoption across commercial and personal pickup segments. These smart features enhance safety, convenience, and fleet management efficiency, particularly for logistics, construction, and utility applications. In addition, integration with IoT platforms and predictive maintenance solutions is helping businesses optimize operations and reduce downtime

- The versatility and utility of modern pickups, including towing, hauling, and off-road capabilities, continue to attract consumers. Automakers are introducing rugged designs with advanced suspension systems, reinforced chassis, and modular cargo solutions, improving both functionality and driving experience. This is fueling stronger sales in regions with high demand for multipurpose vehicles and supporting new applications in agriculture, mining, and emergency services

- For instance, in 2023, several North American pickup manufacturers reported higher fleet adoption after integrating telematics and EV options, improving operational efficiency, reducing fuel costs, and lowering carbon emissions for commercial users. The trend is driving innovation, product diversification, and investment in both electrification and smart features, positioning pickups as central to sustainable mobility

- While electrification and connectivity are accelerating market growth, adoption depends on battery infrastructure, regulatory support, and consumer awareness. OEMs must focus on cost reduction, charging accessibility, feature integration, and aftermarket services to fully capitalize on this evolving pickup truck market

Pickup Truck Market Dynamics

Driver

Rising Demand for Utility, Performance, and Electrification

- The increasing need for versatile vehicles for commercial, recreational, and industrial purposes is driving growth in the pickup truck market. Consumers and businesses value towing, hauling, off-road capabilities, and cargo adaptability, which pickups provide alongside enhanced durability, reinforced safety features, and reliable performance under extreme conditions. These factors support adoption in construction, logistics, and outdoor recreation

- Adoption of electric and hybrid pickup trucks is rising, driven by government incentives, emission regulations, corporate sustainability targets, and rising environmental consciousness among consumers. OEMs are investing in advanced battery technologies, modular electric drivetrains, and lightweight materials to meet emission norms, reduce energy consumption, and deliver comparable performance to conventional pickups

- The integration of connected and smart vehicle technologies, including telematics, fleet management systems, driver-assist features, and AI-powered monitoring, is strengthening market demand. These innovations improve safety, operational efficiency, predictive maintenance, and convenience for both personal and commercial users, while also enabling fleet operators to optimize routes and reduce operational costs

- For instance, in 2022, several U.S. and European fleet operators began transitioning to electric pickups with telematics integration, resulting in lower operating costs, enhanced route management, improved safety compliance, and increased uptime. The move also encouraged OEMs to expand production capacity and develop next-generation electric pickups

- While utility, performance, and electrification are key growth drivers, challenges remain in infrastructure availability, purchase cost, consumer familiarity, and public perception of EV capabilities. Manufacturers and governments must collaborate on expanding charging networks, awareness campaigns, and financial incentives to accelerate adoption

Restraint/Challenge

High Vehicle Cost and Limited Charging Infrastructure

- Pickup trucks, particularly electric and premium models, often carry higher purchase prices compared to conventional trucks, limiting adoption among budget-conscious consumers, small businesses, and emerging market buyers. High initial investment remains a barrier to mass-market penetration, despite potential long-term savings on fuel and maintenance

- In many regions, limited public charging stations, inconsistent grid availability, and inadequate fast-charging infrastructure constrain the practicality of electric pickups for long-distance travel, fleet operations, and remote applications. This reduces consumer confidence, increases range anxiety, and slows adoption rates

- Market penetration is further challenged by fluctuating fuel prices, high maintenance costs for advanced systems, regional regulatory variations, and limited technical support in certain geographies. These factors can delay fleet modernization, restrict aftermarket services, and limit access to EV pickups in emerging markets

- For instance, in 2023, several emerging markets in Africa, Southeast Asia, and Latin America reported slow uptake of electric pickups due to limited charging infrastructure, high upfront costs, and insufficient consumer awareness, constraining market growth and adoption of smart features

- While pickup truck technologies continue to evolve with electrification, connected features, and improved durability, addressing cost, infrastructure, consumer awareness, and policy support is essential for unlocking the market's full potential and ensuring global scalability

Pickup Truck Market Scope

The pickup truck market is segmented on the basis of truck type, propulsion type, and end user.

- By Truck Type

On the basis of truck type, the market is segmented into small size pickups, medium size pickups, and full size pickups. The full size pickups segment held the largest market revenue share in 2025, driven by their superior towing, hauling, and off-road capabilities, which make them highly preferred for both commercial and personal use. Full size pickups also offer advanced features, higher payload capacity, and robust durability, catering to fleet operators, construction, and logistics applications.

The small size pickups segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their affordability, fuel efficiency, and ease of maneuverability in urban and semi-urban regions. These pickups are increasingly adopted for last-mile deliveries, light commercial operations, and personal utility purposes.

- By Propulsion Type

On the basis of propulsion type, the market is segmented into diesel, petrol, hybrid, and electric. The diesel segment held the largest revenue share in 2025, owing to its high torque, long driving range, and cost-effectiveness for heavy-duty and long-distance applications. Diesel pickups are widely preferred by fleet operators, construction companies, and logistics services for reliable performance.

The electric segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising environmental concerns, government incentives, and growing adoption of EV technologies. Electric pickups offer lower emissions, reduced fuel costs, and integration with smart vehicle features, attracting both commercial and eco-conscious personal users.

- By End User

On the basis of end user, the market is segmented into luxury medium commercial vehicles, heavy duty commercial vehicles, and light duty commercial vehicles. The heavy duty commercial vehicles segment held the largest market revenue share in 2025 due to its extensive use in logistics, construction, and industrial sectors requiring high payload and durability.

The luxury medium commercial vehicles segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer preference for premium features, connected technologies, and comfort in medium-sized pickups. These vehicles are gaining traction among urban professionals, corporate fleets, and recreational users.

Pickup Truck Market Regional Analysis

- North America dominated the pickup truck market with the largest revenue share of 32.45% in 2025, driven by strong demand for multipurpose vehicles, increasing commercial fleet investments, and rising preference for rugged, off-road capable vehicles

- Consumers in the region highly value towing, hauling, and utility features, along with the integration of advanced safety and telematics systems in pickups

- This widespread adoption is further supported by high disposable incomes, robust infrastructure for commercial operations, and growing interest in electrified pickups, establishing pickups as a preferred choice for both personal and business use

U.S. Pickup Truck Market Insight

The U.S. pickup truck market captured the largest revenue share in 2025 within North America, fueled by rising adoption of electric and hybrid pickups alongside conventional diesel and petrol variants. Consumers increasingly prioritize performance, fuel efficiency, and connected vehicle features such as telematics, infotainment, and advanced driver-assist systems. The growing fleet modernization trend, supported by government incentives and corporate sustainability goals, further drives the market. In addition, strong manufacturing capabilities and infrastructure for EV deployment are contributing to sustained growth.

Europe Pickup Truck Market Insight

The Europe pickup truck market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent emission regulations, increasing preference for electric and hybrid pickups, and the need for fuel-efficient commercial vehicles. Rising urbanization and demand for last-mile logistics vehicles are fostering adoption across both personal and commercial segments. European consumers also value connected and smart features, contributing to enhanced safety and operational efficiency. The market is expanding across fleet operators, construction, and logistics applications.

U.K. Pickup Truck Market Insight

The U.K. pickup truck market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption of electric pickups, government incentives, and a growing emphasis on environmental sustainability. In addition, the increasing use of pickups in commercial and logistics applications is encouraging both small businesses and large enterprises to invest in versatile vehicles. The country’s strong automotive infrastructure and support for smart vehicle technologies are expected to continue boosting market growth.

Germany Pickup Truck Market Insight

The Germany pickup truck market is expected to witness significant growth from 2026 to 2033, fueled by rising consumer awareness of electrification, energy-efficient propulsion systems, and connected vehicle technologies. Germany’s focus on innovation, sustainability, and advanced automotive engineering promotes adoption across both commercial fleets and personal pickups. Integration of smart features, telematics, and advanced safety systems is increasing, aligning with local consumer expectations for high-performance, eco-conscious vehicles.

Asia-Pacific Pickup Truck Market Insight

The Asia-Pacific pickup truck market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, growing infrastructure development, and increasing adoption of commercial fleets in countries such as China, India, and Japan. The region’s demand for versatile, fuel-efficient, and electrified pickups is growing, supported by government policies promoting electric mobility. In addition, the expansion of local manufacturing hubs is improving affordability and availability of pickups across emerging economies.

Japan Pickup Truck Market Insight

The Japan pickup truck market is expected to witness strong growth from 2026 to 2033, due to high technological adoption, rapid urbanization, and increasing interest in electric and hybrid pickups. Japanese consumers value compact yet high-performing pickups with advanced safety and connectivity features. The growing number of smart city initiatives and corporate fleet modernization programs is further driving demand in both personal and commercial sectors.

China Pickup Truck Market Insight

The China pickup truck market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing infrastructure projects, and rising demand for versatile commercial vehicles. The market is further propelled by government incentives for electric pickups, growing consumer interest in high-performance utility vehicles, and strong domestic production capabilities. The trend towards electrification and connected vehicle features is expanding the market across both urban and rural areas.

Pickup Truck Market Share

The Pickup Truck industry is primarily led by well-established companies, including:

- Ford Motor Company (U.S.)

- Fiat Chrysler Automobiles (U.S.)

- Chevrolet (U.S.)

- Great Wall Motors (China)

- American Honda Motor Co., Inc. (U.S.)

- ISUZU MOTORS INDIA (India)

- Mahindra & Mahindra Ltd. (India)

- Mercedes-Benz India Pvt. Ltd. (India)

- Mitsubishi Motors Corporation (Japan)

- SSANGYONG MOTOR COMPANY (South Korea)

- GMC Canyon (U.S.)

- Mack Trucks (U.S.)

- The Nissan Motor Company, Ltd. (Japan)

- Tata Motors Limited (India)

- Piaggio & C. SpA. (Italy)

- Force Motors Limited (India)

- ASHOK LEYLAND (India)

- MARUTI SUZUKI INDIA LIMITED (India)

- TOYOTA MOTOR CORPORATION (Japan)

- Volkswagen Commercial Vehicles (Germany)

Latest Developments in Global Pickup Truck Market

- In January 2025, Isuzu, Electric Pickup Launch, unveiled its first electric pickup truck, the D-Max BEV, featuring a 66.9 kWh battery and dual electric motors delivering 174 bhp and 325 Nm of torque. Initially launching in select European markets including Norway, and later in the UK, Australia, and Thailand, the vehicle aims to promote electrification in the pickup segment and enhance Isuzu’s presence in sustainable commercial vehicles, positively influencing the global pickup truck market

- In January 2025, Isuzu Motors India, Concept Vehicle Showcase, presented the D-MAX BEV prototype at the Bharat Mobility Expo 2025. The concept includes a full-time 4WD system and newly developed e-Axles at both front and rear, highlighting the company’s technological advancements and readiness for electric pickup adoption in emerging markets, supporting market growth and innovation

- In March 2025, Mahindra & Mahindra, Strategic Acquisition, entered negotiations to acquire Sumitomo Corp’s 44% stake in SML Isuzu, valuing the company at approximately 20.26 billion rupees ($236 million). This move strengthens Mahindra’s stake in the heavy vehicle and pickup segment, expanding production capabilities and competitive positioning in India and international markets

- In January 2025, Honda, Award Recognition, the Honda Civic Hybrid won Car of the Year at the North American Car, Truck, and Utility Vehicle Awards. The recognition enhances Honda’s brand credibility in hybrid and electric vehicle technology, boosting consumer confidence and potentially increasing sales in the hybrid and pickup segments

- In November 2024, Honda, Product Risk Update, reports indicated that the Honda Ridgeline pickup faced potential discontinuation due to declining sales against competitors such as the Ford Maverick. This situation highlights market pressures in the mid-size pickup segment and emphasizes the need for product differentiation and innovation to maintain market share

- In March 2025, Mercedes-Benz, Cost-Cutting Strategy, Daimler Truck announced plans to implement over one billion euros in cost reductions for its Mercedes-Benz Trucks unit in Europe by 2030. The initiative responds to declining earnings from weakened European demand, aiming to improve operational efficiency, maintain profitability, and sustain market competitiveness in the global pickup truck sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.