Global Pigment Wetting Agent Market

Market Size in USD Billion

CAGR :

%

USD

4.82 Billion

USD

6.69 Billion

2024

2032

USD

4.82 Billion

USD

6.69 Billion

2024

2032

| 2025 –2032 | |

| USD 4.82 Billion | |

| USD 6.69 Billion | |

|

|

|

|

Pigment Wetting Agent Market Size

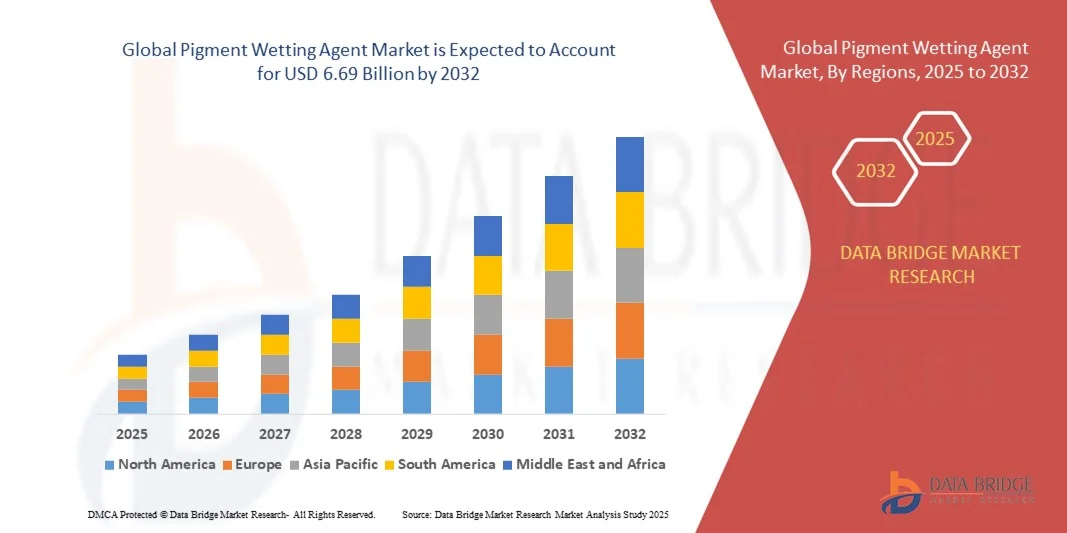

- The global pigment wetting agent market size was valued at USD 4.82 billion in 2024 and is expected to reach USD 6.69 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by the increasing demand for high-quality, stable, and visually appealing pigment formulations across personal care, coatings, paints, and printing industries, driving the adoption of advanced wetting agents and dispersants

- Furthermore, rising consumer preference for eco-friendly, sustainable, and high-performance products is prompting manufacturers to develop innovative pigment wetting solutions that enhance formulation efficiency, improve color uniformity, and reduce environmental impact, thereby accelerating market growth

Pigment Wetting Agent Market Analysis

- Pigment wetting agents, which improve the dispersion and stability of pigments in liquid formulations, are becoming essential in modern applications across cosmetics, coatings, and industrial printing due to their ability to enhance product aesthetics and performance

- The increasing use of water-based and bio-based formulations, coupled with regulatory pressure to reduce volatile organic compounds (VOCs), is further boosting the adoption of advanced pigment wetting agents in various industries

- Asia-Pacific dominated the pigment wetting agent market in 2024, due to expanding automotive and industrial coatings production, rapid urbanization, and a strong presence of chemical manufacturing hubs

- North America is expected to be the fastest growing region in the pigment wetting agent market during the forecast period due to robust demand for high-performance coatings in automotive, aerospace, and industrial applications

- Anionic segment dominated the market with a market share of 43% in 2024, due to its effective dispersion properties and compatibility with a wide range of pigment types. Anionic wetting agents are preferred in water-based coatings and paints, as they improve pigment stability and prevent aggregation, ensuring uniform color distribution and enhanced coating performance. Their widespread adoption is also supported by ease of formulation, cost-effectiveness, and strong performance across various industrial applications. Manufacturers and end-users often favor anionic types due to their consistent quality and ability to enhance the aesthetic and functional properties of finished products

Report Scope and Pigment Wetting Agent Market Segmentation

|

Attributes |

Pigment Wetting Agent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pigment Wetting Agent Market Trends

Demand for Sustainable Pigment Wetting Agents

- The pigment wetting agent market is undergoing a substantial transition toward sustainable and environmentally compatible solutions due to rising regulatory pressure and increasing awareness of eco-safe chemical usage. Manufacturers are focusing on bio-based, low-VOC, and solvent-free formulations that meet performance requirements while minimizing environmental impact and worker exposure risks

- For instance, BASF SE has introduced eco-friendly wetting and dispersing agents under its Dispex and Efka product lines that comply with stringent global environmental guidelines. These innovations are widely utilized in coatings and printing applications where reduced emissions and improved dispersion efficiency are critical for sustainable production

- The shift toward sustainability is encouraging R&D advancements emphasizing non-toxic, renewable raw material sources that maintain pigment stability and coloration quality across industrial coatings and inks. This change supports the broader sustainability agendas of end-use industries seeking low-carbon and compliant material inputs

- In addition, increasing demand for energy-efficient coatings in automotive, construction, and industrial sectors is promoting the adoption of waterborne and solvent-free pigment systems. This move aligns with global climate targets by reducing greenhouse gas output from conventional organic solvents used in pigment dispersion

- Collaboration between chemical producers and end-user industries is accelerating innovation in biodegradable pigment wetting agents, ensuring compatibility with next-generation paints, plastics, and digital printing systems. Such partnerships are becoming crucial for establishing standardized sustainability benchmarks throughout the pigment supply chain

- Overall, the preference for sustainable pigment wetting agents underscores a pivotal market shift where environmental performance, product efficiency, and regulatory compliance merge to redefine growth strategies across industrial coating and pigment applications

Pigment Wetting Agent Market Dynamics

Driver

Adoption of High-Performance Pigments in Key Industries

- Growing utilization of high-performance pigments in sectors such as automotive, construction, plastics, and packaging is driving the adoption of advanced wetting agents that ensure optimal dispersion and long-term color stability. These pigments offer superior resistance to heat, light, and chemicals, demanding wetting agents that can enhance their uniform distribution and surface adhesion

- For instance, Clariant AG provides high-performance pigment dispersants developed under its Hostaphat and Genamin ranges, designed to stabilize complex organic pigments in industrial coatings and polymer applications. These innovations contribute to more consistent film quality, improved gloss, and enhanced durability across high-demand end-use environments

- The increasing complexity of pigment formulations used for high-gloss paints and UV-curable coatings requires sophisticated wetting agents that balance surface tension, viscosity, and pigment-particle interaction. Optimized wetting performance ensures improved paste flow and reduced flocculation during production processes

- In addition, the expansion of architectural and automotive coating applications is propelling demand for enhanced wetting efficiency to achieve uniform color tone and mechanical strength. These performance-driven products also play a vital role in ensuring adherence to product life-cycle standards specified by industrial customers

- The growing emphasis on aesthetic quality, high opacity, and superior dispersion uniformity is reinforcing the market for advanced wetting technologies. This continuous integration of functional additives with pigment systems is expected to sustain momentum for next-generation pigment wetting agents across key industries

Restraint/Challenge

Regulatory Restrictions on Chemical Dispersants

- Stringent regulations surrounding the use of certain chemical dispersants in pigment wetting agent formulations are significantly affecting manufacturing processes and permissible product compositions. Environmental and health safety organizations are enforcing strict restrictions governing volatile organic compounds, solvent emissions, and bioaccumulative substances used in pigment processing

- For instance, the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have implemented regulations under REACH and TSCA frameworks that limit or prohibit certain solvent-based surfactants. Companies such as Evonik Industries are being compelled to modify formulations and invest in R&D to introduce eco-friendly dispersants that meet compliance while maintaining performance efficiency

- Frequent reformulation to address newly emerging chemical restrictions increases production costs and delays time-to-market, particularly for multinational manufacturers operating under varying global regulatory frameworks. These limitations create obstacles for innovation, particularly in balancing functional performance with eco-compliance requirements

- In addition, stringent waste disposal standards and the necessity for safety certification further elevate operational complexity, making it challenging to maintain scalability and consistent supply to high-volume consumers such as paint and ink producers. This regulatory landscape demands continuous adaptation through transparent documentation, testing, and third-party verification

- Overcoming these challenges will rely on the industry’s commitment to developing safer alternative chemistries such as water-based surfactant systems and hybrid polymeric dispersants. Long-term success will depend on proactive sustainability strategies and collaboration with regulators to ensure innovation continues within environmentally safe parameters for pigment wetting agent manufacturing

Pigment Wetting Agent Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the pigment wetting agent market is segmented into anionic, cationic, amphoteric, and non-ionic. The anionic segment dominated the market with the largest revenue share of 43% in 2024, owing to its effective dispersion properties and compatibility with a wide range of pigment types. Anionic wetting agents are preferred in water-based coatings and paints, as they improve pigment stability and prevent aggregation, ensuring uniform color distribution and enhanced coating performance. Their widespread adoption is also supported by ease of formulation, cost-effectiveness, and strong performance across various industrial applications. Manufacturers and end-users often favor anionic types due to their consistent quality and ability to enhance the aesthetic and functional properties of finished products.

The cationic segment is anticipated to witness the fastest growth from 2025 to 2032, driven by its increasing use in specialty coatings and printing inks. Cationic wetting agents are especially valued for their ability to modify surface interactions, improve adhesion on challenging substrates, and enhance pigment dispersion in high-performance applications. Growing demand in sectors requiring precise color consistency and superior coating performance, such as automotive refinishes and advanced industrial coatings, is fueling the rapid adoption of cationic types. Their compatibility with new resin systems and improved formulation flexibility also contributes to their projected high growth rate.

- By Application

On the basis of application, the pigment wetting agent market is segmented into automotive and transportation, building and infrastructure, marine and defence, textile, and others. The automotive and transportation segment dominated the market in 2024, accounting for the largest revenue share, driven by the high demand for high-performance coatings and paints in vehicle manufacturing and refinishing. Pigment wetting agents play a critical role in achieving uniform color, gloss, and durability in automotive coatings, making them essential in OEM and aftermarket applications. The segment benefits from stringent quality standards, growing vehicle production, and the rising focus on aesthetics and corrosion resistance in automotive coatings.

The building and infrastructure segment is expected to witness the fastest growth from 2025 to 2032, supported by increasing construction activities and the rising adoption of advanced coating technologies. Wetting agents in this sector improve pigment dispersion in architectural paints, protective coatings, and cementitious products, enhancing coverage, color uniformity, and longevity. Demand is particularly strong in emerging markets with rapid urbanization, where high-performance coatings are needed for durability and visual appeal. The growing focus on sustainable and low-VOC paints also drives the adoption of wetting agents in this segment.

Pigment Wetting Agent Market Regional Analysis

- Asia-Pacific dominated the pigment wetting agent market with the largest revenue share in 2024, driven by expanding automotive and industrial coatings production, rapid urbanization, and a strong presence of chemical manufacturing hubs

- The region’s cost-effective manufacturing landscape, growing investments in specialty chemical production, and rising exports of coatings and paints are accelerating market expansion

- Availability of skilled labor, favorable government policies, and increasing adoption of advanced pigment dispersion technologies across developing economies are contributing to higher consumption of wetting agents

China Pigment Wetting Agent Market Insight

China held the largest share in the Asia-Pacific pigment wetting agent market in 2024, owing to its leadership in coatings, paints, and automotive manufacturing. The country’s extensive chemical production base, supportive industrial policies, and strong export capabilities for specialty chemicals are major growth drivers. Demand is further supported by rising investments in research and development of advanced coatings, water-based paints, and high-performance pigment formulations for both domestic and international markets.

India Pigment Wetting Agent Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding automotive and infrastructure sector and increasing industrial coatings production. Initiatives promoting local chemical manufacturing, along with growing demand for high-quality, cost-effective pigments in paints and coatings, are strengthening market growth. The surge in construction, rising exports of decorative and protective coatings, and increasing adoption of advanced dispersion technologies are further accelerating demand.

Europe Pigment Wetting Agent Market Insight

The Europe pigment wetting agent market is growing steadily, driven by stringent quality and environmental regulations, high demand for premium coatings, and investments in sustainable chemical production. The region emphasizes performance, safety, and eco-friendly formulations, particularly in automotive, industrial, and architectural coatings. Increasing use of specialty wetting agents in high-performance and water-based coatings is further supporting market expansion.

Germany Pigment Wetting Agent Market Insight

Germany’s market is led by its strong automotive and industrial coatings sector, well-established chemical manufacturing infrastructure, and focus on high-precision formulations. Extensive R&D networks and collaboration between academic institutions and chemical producers drive innovation in pigment dispersion and wetting technologies. Demand is particularly strong for applications requiring high color consistency, durability, and environmentally compliant coatings.

U.K. Pigment Wetting Agent Market Insight

The U.K. market is supported by its mature coatings and construction industries, increasing focus on sustainable formulations, and growth in specialty and decorative coatings. R&D investments, collaboration between industry and research institutions, and rising adoption of high-performance wetting agents in industrial and architectural applications are bolstering market growth.

North America Pigment Wetting Agent Market Insight

North America is expected to grow at the fastest CAGR from 2025 to 2032, driven by robust demand for high-performance coatings in automotive, aerospace, and industrial applications. Advancements in material science, increasing adoption of water-based and eco-friendly coatings, and rising reshoring of chemical manufacturing are boosting demand. Collaboration between specialty chemical companies and end-user industries is further supporting market expansion.

U.S. Pigment Wetting Agent Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its advanced coatings and automotive industries, strong R&D infrastructure, and significant investments in specialty chemicals. Focus on innovation, regulatory compliance, and high-performance pigment formulations is encouraging widespread use of wetting agents in industrial, automotive, and architectural applications. Presence of major players and a mature distribution network further strengthens the U.S.’s leading position in the region.

Pigment Wetting Agent Market Share

The pigment wetting agent industry is primarily led by well-established companies, including:

- Croda International Plc (U.K.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- BYK Additives & Instruments (Germany)

- Akzo Nobel N.V. (Netherlands)

- Clariant (Switzerland)

- Dalian CIM Co. Ltd (China)

- Wilbur-Ellis Holdings, Inc. (U.S.)

- BrettYoung (Canada)

- Seasol (Australia)

- MD Biocoals Pvt. Ltd. (India)

- ADS Agrotech Private Limited (India)

- Milliken (U.S.)

- Elementis PLC (U.K.)

- Dow (U.S.)

- Shamrock (U.S.)

- Harima Chemicals Group, Inc. (Japan)

- Solvay (Belgium)

- ADDAPT Chemicals B.V. (Netherlands)

- DuPont de Nemours, Inc. (U.S.)

Latest Developments in Global Pigment Wetting Agent Market

- In April 2025, BASF introduced three new natural-based ingredients—Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA aimed at enhancing sustainable personal care formulations. These ingredients are designed to offer high performance while supporting eco-friendly product development. Verdessence Maize provides plant-derived emollience, Lamesoft OP Plus serves as a mild surfactant, and Dehyton PK45 GA/RA acts as a bio-based conditioning agent. This expansion strengthens BASF’s portfolio in natural and sustainable cosmetic solutions, catering to the rising consumer demand for products with clean, environmentally responsible ingredients

- In April 2025, Croda Beauty launched several innovative ingredients, including Natrine CR8, NatraFusion SL HA, and Sphingo’HAIR Drypure, targeting sustainable and performance-driven personal care products. Natrine CR8 is a PEG-free phosphate emulsifier promoting cleaner formulations, NatraFusion SL HA is a bio-based surfactant supporting skin-friendly properties, and Sphingo’HAIR Drypure is a ceramide produced via biofermentation to improve scalp and hair health. This launch expands Croda’s solutions for brands seeking natural, functional, and environmentally responsible ingredients, addressing the growing consumer preference for efficacy combined with sustainability

- In April 2025, Solvay expanded its rare earth processing facility in La Rochelle, France, significantly enhancing its production capacity and technological capabilities. The expansion allows for the increased manufacture of high-purity rare earth compounds, which are critical for specialty chemicals and emerging applications in personal care formulations. This development strengthens Solvay’s competitive position in the global market, enabling suppliers and cosmetic manufacturers to access advanced, high-quality ingredients for premium and high-performance products

- In March 2025, Evonik unveiled its new range of bio-based surfactants tailored for high-performance skin and hair care formulations. These surfactants support sustainability goals by providing natural alternatives to conventional chemicals without compromising efficacy. By enabling cosmetic manufacturers to develop cleaner, eco-friendly products, this initiative addresses the growing consumer demand for natural, safe, and effective personal care ingredients, reinforcing Evonik’s position as a leader in sustainable formulation solutions

- In February 2025, Clariant launched a set of advanced pigment dispersants and wetting agents optimized for personal care applications, enhancing the stability, texture, and aesthetic appeal of cosmetic formulations. These ingredients are specifically designed to improve performance while aligning with sustainability trends, enabling brands to offer visually appealing, high-quality products. The launch reinforces Clariant’s presence in the expanding market for natural, safe, and functional cosmetic ingredients, meeting both regulatory requirements and rising consumer expectations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pigment Wetting Agent Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pigment Wetting Agent Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pigment Wetting Agent Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.