Global Pipeline Network Market

Market Size in USD Billion

CAGR :

%

USD

22.17 Billion

USD

41.04 Billion

2024

2032

USD

22.17 Billion

USD

41.04 Billion

2024

2032

| 2025 –2032 | |

| USD 22.17 Billion | |

| USD 41.04 Billion | |

|

|

|

|

Pipeline Network Market Size

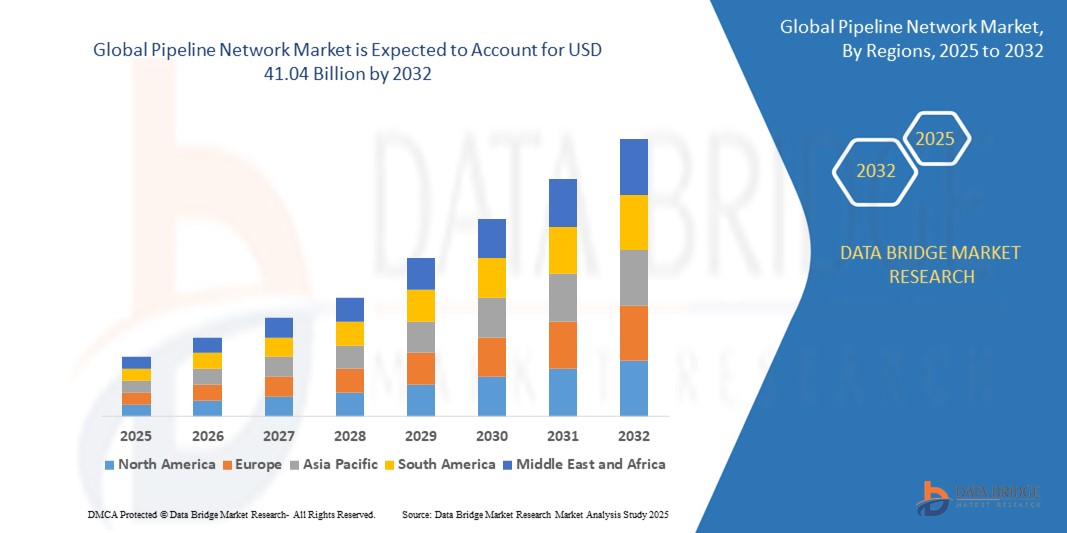

- The global pipeline network market size was valued at USD 22.17 billion in 2024 and is expected to reach USD 41.04 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is primarily driven by the increasing demand for energy and water transportation infrastructure, advancements in pipeline monitoring technologies, and the need for efficient and secure pipeline operations

- In addition, growing investments in oil and gas exploration, coupled with rising urbanization and the need for reliable water and wastewater management systems, are accelerating the adoption of pipeline network solutions, significantly contributing to market expansion

Pipeline Network Market Analysis

- Pipeline networks, essential for transporting oil, gas, water, and other resources, are critical components of global energy and infrastructure systems, offering enhanced efficiency, safety, and real-time monitoring capabilities through advanced technologies

- The rising demand for pipeline networks is fueled by increasing energy consumption, growing environmental concerns, and the need for optimized pipeline operations to reduce losses and ensure safety

- North America dominated the pipeline network market with the largest revenue share of 42.5% in 2024, driven by extensive oil and gas infrastructure, early adoption of advanced monitoring technologies, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing energy demand, and government investments in infrastructure development in countries such as China and India

- The solution segment dominated the largest market revenue share of 62.5% in 2024, driven by the increasing adoption of advanced technologies such as supervisory control and data acquisition (SCADA) systems, pipeline monitoring solutions, and geographic information system (GIS) software.

Report Scope and Pipeline Network Market Segmentation

|

Attributes |

Pipeline Network Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Pipeline Network Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global pipeline network market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into pipeline performance, operational efficiency, and predictive maintenance needs

- AI-powered pipeline monitoring solutions facilitate proactive problem-solving, identifying potential issues such as leaks or corrosion before they lead to costly repairs or downtime

- For instance, companies are developing AI-driven platforms that analyze pipeline flow patterns, pressure changes, and environmental conditions to optimize operations and enhance safety measures

- This trend enhances the value proposition of pipeline network systems, making them more appealing to operators in industries such as crude and refined petroleum, water and wastewater, and others

- AI algorithms can analyze vast datasets, including flow rates, pressure anomalies, and maintenance histories, to detect inefficiencies, predict equipment failures, and improve overall pipeline reliability

Pipeline Network Market Dynamics

Driver

“Rising Demand for Efficient Energy and Resource Transportation”

- The increasing global demand for efficient transportation of resources such as crude oil, natural gas, and water is a major driver for the pipeline network market

- Pipeline networks provide a cost-effective and reliable means of transporting large volumes of gas and liquid over long distances, supporting industries such as crude and refined petroleum and water and wastewater management

- Government initiatives and regulations, particularly in North America, which dominates the market, are promoting the adoption of advanced pipeline monitoring and operation optimization systems to enhance safety and environmental compliance

- The proliferation of IoT and advancements in 5G technology are enabling faster data transmission and lower latency, supporting real-time pipeline monitoring and sophisticated operational applications

- Pipeline operators are increasingly integrating advanced solutions, such as Supervisory Control and Data Acquisition (SCADA) systems and Geographic Information System (GIS) software, to meet regulatory requirements and improve operational efficiency

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The significant initial investment required for hardware, software, and integration of pipeline network solutions can be a major barrier to adoption, particularly in emerging markets within the Asia-Pacific region, which is the fastest-growing market

- Retrofitting existing pipeline infrastructure with advanced monitoring and optimization systems can be complex and costly

- Data security and privacy concerns are a significant challenge, as pipeline networks collect and transmit sensitive operational data, raising risks of breaches, cyberattacks, or misuse of information

- Compliance with varying data protection regulations across regions, such as North America and Asia-Pacific, adds complexity for global operators and service providers

- These factors can deter adoption, especially in regions with high cost sensitivity or stringent data privacy regulations, potentially limiting market growth

Pipeline Network market Scope

The market is segmented on the basis of offering, application, content, and end-user industry.

- By Offering

On the basis of offering, the global pipeline network market is segmented into solution and services. The solution segment dominated the largest market revenue share of 62.5% in 2024, driven by the increasing adoption of advanced technologies such as Supervisory Control and Data Acquisition (SCADA) systems, pipeline monitoring solutions, and Geographic Information System (GIS) software. These solutions enhance operational efficiency, safety, and real-time monitoring for pipeline networks.

The services segment is expected to witness the fastest growth rate of 9.2% from 2025 to 2032, fueled by rising demand for consulting, integration, deployment, and training services. The need for ongoing maintenance, regulatory compliance, and system optimization drives the adoption of specialized services across pipeline operations.

- By Application

On the basis of application, the global pipeline network market is segmented into pipeline monitoring and pipeline operation optimization. The pipeline monitoring segment accounted for the largest market revenue share of 58.5% in 2024, driven by the critical need for real-time leak detection, pipeline break detection, and operating condition monitoring to ensure safety and prevent environmental hazards, particularly in crude and refined petroleum pipelines.

The pipeline operation optimization segment is anticipated to experience the fastest growth rate of 8.7% from 2025 to 2032. Advancements in smart pigging, predictive maintenance, and data analytics are enhancing asset utilization, throughput, and operational efficiency, particularly in high-demand regions such as Asia-Pacific.

- By Content

On the basis of content, the global pipeline network market is segmented into gas pipeline and liquid pipeline. The gas pipeline segment dominated the market with a revenue share of 55.5% in 2024, driven by the increasing global demand for natural gas for power generation and industrial applications, especially in North America, where shale gas production has spurred significant pipeline infrastructure investments.

The liquid pipeline segment is expected to register the fastest growth rate of 8.5% from 2025 to 2032, fueled by rising crude oil exports and the expansion of oil sands production, particularly in North America and the Middle East. Projects such as the Keystone XL pipeline highlight the growing need for efficient liquid pipeline networks.

- By End-User Industry

On the basis of end-user industry, the global pipeline network market is segmented into crude and refined petroleum, water and wastewater, and others. The crude and refined petroleum segment held the largest market revenue share of 65.0% in 2024, driven by the high global consumption of oil and gas and the cost-effectiveness of pipelines for transporting these resources.

The water and wastewater segment is projected to witness the fastest growth rate of 9.0% from 2025 to 2032, driven by increasing instances of water theft and leakage, as well as the need for efficient water transportation systems in urbanizing regions such as Asia-Pacific. The adoption of telematics-driven monitoring solutions is enhancing water pipeline management.

Pipeline Network Market Regional Analysis

- North America dominated the pipeline network market with the largest revenue share of 42.5% in 2024, driven by extensive oil and gas infrastructure, early adoption of advanced monitoring technologies, and the presence of major industry players

- Consumers and industries prioritize pipeline networks for efficient transportation of crude oil, natural gas, and water, with a focus on safety, leak detection, and operational optimization, particularly in regions with high energy demands

- Growth is supported by advancements in smart pipeline technologies, such as real-time monitoring systems and predictive maintenance, alongside rising adoption in both upstream and downstream segments of the energy industry

U.S. Pipeline Network Market Insight

The U.S. pipeline network market captured the largest revenue share of 82.8% in 2024 within North America, fueled by strong demand for oil and gas transportation and increasing investments in shale gas infrastructure. The trend towards digital transformation, including SCADA systems and IoT integration, boosts market expansion. Growing regulatory emphasis on pipeline safety and environmental compliance further drives the adoption of advanced monitoring solutions.

Europe Pipeline Network Market Insight

The Europe pipeline network market is expected to witness significant growth, supported by a focus on energy security and environmental regulations. Consumers and industries seek solutions that enhance pipeline monitoring and optimize operations for both gas and liquid pipelines. Growth is prominent in countries such as Germany and Russia, driven by infrastructure upgrades and the need to transport natural gas efficiently.

U.K. Pipeline Network Market Insight

The U.K. market for pipeline networks is expected to experience notable growth, driven by demand for efficient energy transportation and stringent safety regulations. Increased focus on reducing carbon emissions and integrating renewable energy sources, such as hydrogen pipelines, encourages adoption. The market benefits from both new pipeline projects and retrofitting existing infrastructure with advanced monitoring technologies.

Germany Pipeline Network Market Insight

Germany is expected to witness strong growth in the pipeline network market, attributed to its advanced energy sector and emphasis on operational efficiency. German industries prefer technologically advanced solutions, such as pipeline geographic information systems (GIS) and leak detection technologies, to enhance safety and reduce environmental impact. The integration of these solutions in both gas and liquid pipelines supports sustained market growth.

Asia-Pacific Pipeline Network Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, urbanization, and rising energy demand in countries such as China, India, and Australia. Increasing awareness of pipeline safety and efficiency, coupled with government initiatives promoting energy infrastructure, boosts demand for advanced solutions and services. The region’s focus on expanding natural gas and water pipeline networks further accelerates market growth.

Japan Pipeline Network Market Insight

Japan’s pipeline network market is expected to witness rapid growth due to strong demand for high-quality, technologically advanced solutions that enhance pipeline monitoring and operation optimization. The presence of major energy companies and government support for energy efficiency drives market penetration. Rising investments in gas pipeline infrastructure and aftermarket maintenance services also contribute to growth.

China Pipeline Network Market Insight

China holds the largest share of the Asia-Pacific pipeline network market, propelled by rapid urbanization, increasing energy consumption, and extensive pipeline infrastructure development. The country’s growing focus on natural gas and water transportation, supported by strong domestic manufacturing capabilities, enhances market accessibility. Competitive pricing and government-backed energy projects further drive the adoption of advanced pipeline solutions.

Pipeline Network Market Share

The pipeline network industry is primarily led by well-established companies, including:

- Huawei Technologies Co., Ltd. (China)

- ABB (Switzerland)

- Siemens Energy (Germany)

- Hitachi, Ltd. (Japan)

- Schneider Electric (France)

- GE Grid Solutions, LLC (U.S.)

- Wipro (India)

- Emerson Electric Co. (U.S.)

- Rockwell Automation (U.S.)

- Moxa Inc. (Taiwan)

- ORBCOMM (U.S.)

- Luna Innovations Incorporated (U.K.)

- Xylem (Canada)

- Necon Group (Qatar)

- Open Access Technology International, Inc. (U.S.)

- KROHNE Messtechnik GmbH (Germany)

What are the Recent Developments in Global Pipeline Network Market?

- In January 2025, India’s Ministry of Petroleum & Natural Gas reported a major milestone in its Year End Review 2024: the total length of operational natural gas pipelines in the country increased from 15,340 kilometers in 2014 to 24,945 kilometers in 2024, marking a 62.6% expansion. This growth significantly strengthens the national gas grid, enhancing connectivity between major demand and supply centers across India. The expansion supports the government’s vision of “One Nation, One Grid, One Tariff”, promoting cleaner energy, regional equity, and economic development through improved access to natural gas

- In July 2024, Engie partnered with Macquarie Asset Management to expand the Mayakan natural gas pipeline in Mexico, a strategic move aimed at doubling the region’s natural gas transportation capacity. As part of the agreement, Macquarie acquired a 50% stake in the project for USD 360 million. The expanded pipeline will span approximately 700 kilometers, crossing the states of Chiapas, Tabasco, Campeche, and Yucatán, and will support the energy needs of CFE’s combined-cycle power plants. This collaboration aligns with Mexico’s energy transition goals and is expected to reduce carbon emissions by up to 7.4 million tons of CO₂ annually

- In May 2024, Nesma & Partners formed a strategic joint venture with Italian engineering firm SICIM to execute two major Master Gas System (MGS) Phase III projects for Saudi Aramco. This collaboration involves the construction of nearly 500 kilometers of pipelines across Saudi Arabia, including a 56-inch pipeline spanning 310 km and another 212 km of varying diameters in the Shoaiba region. The joint venture will deliver engineering, procurement, and construction (EPC) services, supporting the expansion of Saudi Arabia’s gas infrastructure. This initiative aligns with Saudi Vision 2030, promoting energy diversification and industrial growth

- In November 2023, ExxonMobil completed its Denbury Inc., a U.S.-based carbon solutions provider. This all-stock transaction positions ExxonMobil as the largest owner and operator of CO₂ pipelines in the United States, adding over 1,300 miles of pipeline, including nearly 925 miles in Louisiana, Texas, and Mississippi. The acquisition significantly enhances ExxonMobil’s capabilities in carbon capture, utilization, and storage (CCUS), providing access to more than 15 onshore CO₂ storage sites. This strategic move supports the company’s Low Carbon Solutions business and strengthens its role in industrial decarbonization efforts

- In August 2023, Automation Technology, Inc. (ATI) introduced its Zero Emission Electro-Hydraulic Actuator, a breakthrough solution aimed at eliminating the carbon footprint of pipeline operations. Unlike traditional actuators that rely on pipeline gas as a power source—often vented into the atmosphere—ATI’s system is self-contained, using an electro-hydraulic power unit that can be powered by solar energy in remote locations. Available in spring-return or double-acting configurations, the actuator integrates components such as pumps, motors, solenoids, and positioners into a compact suite. This innovation aligns with growing environmental sustainability goals and evolving regulatory standards in the oil and gas industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.