Global Pipes Market

Market Size in USD Billion

CAGR :

%

USD

125.13 Billion

USD

189.15 Billion

2024

2032

USD

125.13 Billion

USD

189.15 Billion

2024

2032

| 2025 –2032 | |

| USD 125.13 Billion | |

| USD 189.15 Billion | |

|

|

|

|

What is the Global Pipes Market Size and Growth Rate?

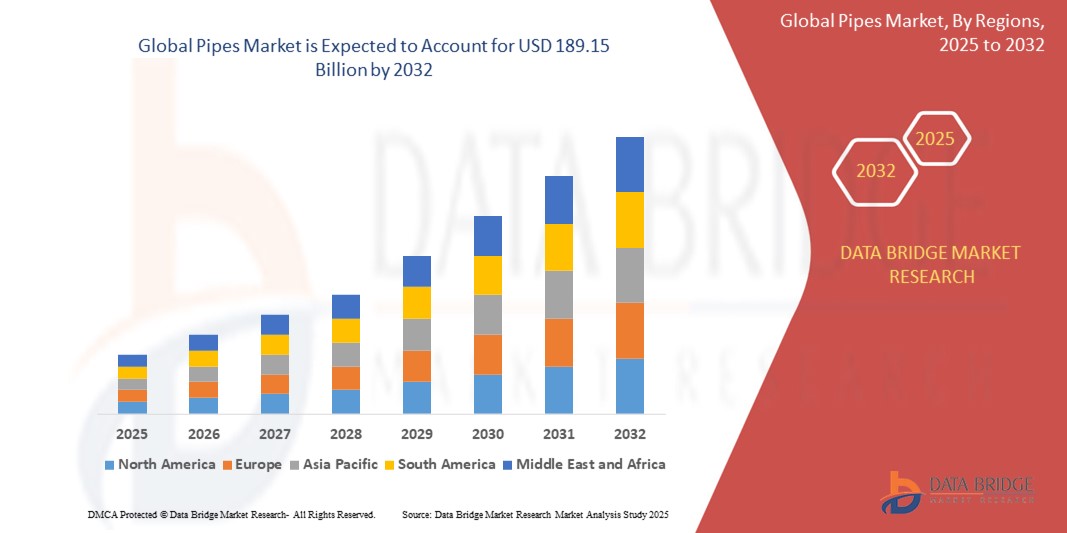

- The global pipes market size was valued at USD 125.13 billion in 2024 and is expected to reach USD 189.15 billion by 2032, at a CAGR of 5.3% during the forecast period

- This growth is primarily driven by infrastructure modernization, urbanization, and the expansion of the construction and industrial sectors, especially in emerging economies

- In addition, the rising demand for durable, corrosion-resistant, and lightweight pipe materials such as plastic and composite pipes continues to shift market dynamics in favor of innovative pipe solutions across water management, oil & gas, and sewage systems

What are the Major Takeaways of Pipes Market?

- Pipes are essential infrastructure components, widely used across water distribution, irrigation, sewage and drainage, oil & gas transportation, and industrial fluid transfer systems

- The market is being bolstered by increasing investments in smart city development, water infrastructure upgrades, and the rising focus on sustainable and energy-efficient materials, such as HDPE, PEX, and composite pipes

- Significant innovations in pipe materials, recyclability, and installation techniques along with the growing need for leak-proof, long-lasting, and maintenance-free pipeline networks are collectively accelerating the growth of the global Pipes market

- North America dominated the global pipes market, accounting for the largest revenue share of 32.89% in 2024, primarily driven by extensive infrastructure development, increasing replacement of aging pipelines, and widespread adoption of advanced piping materials such as HDPE and PEX

- Asia-Pacific pipes market is forecasted to grow at the fastest CAGR of 12.33% from 2025 to 2032, driven by rapid urbanization, industrialization, and increasing investments in infrastructure development across countries such as China, India, and Southeast Asia

- The steel segment dominated the pipes market with the largest market revenue share of 42.5% in 2024, owing to its superior strength, durability, and high-pressure resistance

Report Scope and Pipes Market Segmentation

|

Attributes |

Pipes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pipes Market?

“Increased Demand for Smart and Sustainable Piping Solutions”

- A significant and evolving trend in the global pipes market is the rising demand for eco-friendly, durable, and smart piping systems, driven by urban infrastructure development, smart cities, and environmental regulations

- PVC, HDPE, and PEX pipes are increasingly being adopted due to their corrosion resistance, flexibility, low maintenance, and suitability for water conservation and energy-efficient systems

- For instance, in March 2024, Aliaxis Group launched a line of recyclable plastic piping systems designed for smart water management in Europe and North America

- Integration of IoT-enabled pipe monitoring systems that help detect leaks, pressure fluctuations, and real-time performance is gaining popularity, especially in large-scale infrastructure and industrial applications

- This trend toward smart and sustainable pipes is reshaping infrastructure planning in both developed and emerging economies, offering long-term cost savings and enhanced performance

What are the Key Drivers of the Pipes Market?

- The growth of the construction industry, especially in residential, commercial, and industrial segments, is a major driver of the pipes market. Demand is particularly high in emerging economies undergoing rapid urbanization

- For instance, in April 2024, Tata Pipes reported a surge in sales driven by India's Smart Cities Mission and its emphasis on modern water and gas supply infrastructure

- Government investments in water supply, sewage, and oil & gas pipeline projects, along with stringent regulations promoting sustainable infrastructure, are accelerating pipe installation and replacement cycle

- Expansion of irrigation networks in agriculture, growing adoption of district cooling and heating systems, and retrofitting of old pipelines in developed nations also contribute to market growth

- Furthermore, increasing consumer awareness of safe drinking water systems and efficient wastewater management is boosting the demand for modern piping materials over traditional alternatives such as steel or concrete

Which Factor is challenging the Growth of the Pipes Market?

- A primary challenge in the pipes market is the volatility in raw material prices, especially polymers such as PVC, HDPE, and metals such as copper and steel, which significantly affect production costs and pricing stability

- For instance, in late 2023, global oil price fluctuations impacted the cost of polyethylene and polypropylene, leading to temporary supply chain disruptions for major pipe manufacturers

- Environmental concerns over plastic pipes, especially in regions with stringent regulations on plastic usage, pose an obstacle to market expansion despite the recyclability of some materials

- In developing regions, lack of awareness, limited infrastructure, and budget constraints often hinder the adoption of modern piping systems, favoring traditional or substandard material

- To address these issues, manufacturers are focusing on material innovation, circular economy models, and partnerships with governments to promote affordable and sustainable piping solutions

How is the Pipes Market Segmented?

The market is segmented on the basis of product, pipe size, application, and distribution channel.

• By Product

On the basis of product, the pipes market is segmented into Steel, Plastics, and Concrete Pipe. The Steel segment dominated the Pipes market with the largest market revenue share of 42.5% in 2024, owing to its superior strength, durability, and high-pressure resistance. Steel pipes are extensively used in industrial, oil & gas, and high-stress infrastructure applications. Their long lifecycle and corrosion-resistant variants (such as galvanized or stainless steel) also contribute to their continued dominance.

The Plastic pipes segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in residential plumbing, agricultural irrigation, and water supply systems. Plastics such as PVC, CPVC, and HDPE offer cost-efficiency, ease of installation, and flexibility, making them attractive alternatives across several sectors.

• By Pipe Size

On the basis of pipe size, the market is segmented into Up to ½ Inches, ½ to 1 Inches, 1 to 2 Inches, 2–5 Inches, 5–10 Inches, 10–20 Inches, and Above 20 Inches. The 2–5 Inches segment accounted for the largest market share of 28.6% in 2024, primarily due to its widespread usage in residential and mid-sized commercial applications, including plumbing, HVAC, and drainage systems. This size category strikes an optimal balance between flow rate and pressure handling, making it highly versatile.

The 10–20 Inches segment is projected to register the fastest CAGR from 2025 to 2032, driven by growing demand in infrastructure development projects, such as urban water supply and stormwater management systems, where larger diameter pipes are essential for high-volume flow.

• By Application

Based on application, the Pipes market is segmented into Building, Infrastructure, Industrial, and Agriculture. The Infrastructure segment dominated the market with a revenue share of 39.3% in 2024, attributed to rising investments in urban water distribution, sewerage networks, and transportation projects across both developed and emerging regions. Large-scale infrastructure upgrades in countries such as India, China, and the U.S. are particularly driving this segment.

The Industrial segment is projected to witness the highest growth rate from 2025 to 2032, due to expanding applications in oil & gas, chemical processing, manufacturing, and mining sectors. The need for specialized piping systems that handle extreme pressure, temperature, or corrosive materials is boosting the demand for advanced pipe materials in this segment.

• By Distribution Channel

Based on distribution channel, the market is segmented into Direct Selling and Retail Selling. The Direct Selling segment accounted for the largest market revenue share of 61.8% in 2024, driven by bulk procurement in infrastructure and industrial projects, where large volumes and customized pipe specifications are typically managed directly through manufacturer-distributor contracts.

The Retail Selling segment is expected to exhibit the fastest CAGR from 2025 to 2032, supported by the rising demand for pipes in DIY home renovation, small-scale construction, and localized plumbing needs. E-commerce and hardware store expansions are making it easier for consumers and small contractors to access a wider range of pipe products.

Which Region Holds the Largest Share of the Pipes Maret?

- North America dominated the global Pipes market, accounting for the largest revenue share of 32.89% in 2024, primarily driven by extensive infrastructure development, increasing replacement of aging pipelines, and widespread adoption of advanced piping materials such as HDPE and PEX

- The region’s demand is fueled by municipal water management upgrades, oil and gas pipeline expansions, and the growing popularity of sustainable construction practices

- High investment in smart cities, renovation of old pipeline infrastructure, and emphasis on water conservation are also contributing to the region's leadership in the global market

U.S. Pipes Market Insight

The U.S. Pipes market dominated North America's revenue share in 2024, supported by large-scale investments in residential, commercial, and industrial construction projects, as well as in energy transportation infrastructure. Smart water systems, irrigation expansion, and stormwater management projects are further driving demand. In addition, renovation of deteriorating water supply and sewerage pipelines in urban areas, alongside government-backed infrastructure spending, positions the U.S. as a key driver of regional market growth.

Europe Pipes Market Insight

The Europe Pipes market is projected to witness strong growth during the forecast period due to strict environmental regulations, increased demand for eco-friendly pipe materials, and the renovation of aging utility infrastructure. Adoption of plastic pipes for water supply, wastewater management, and HVAC systems is on the rise. EU regulations on carbon emissions and energy efficiency are encouraging the use of thermally efficient and recyclable piping systems across sectors.

U.K. Pipes Market Insight

The U.K. Pipes market is growing steadily, driven by smart building initiatives, urban redevelopment projects, and increased focus on flood control systems. Government funding for housing and green infrastructure is boosting demand for durable and low-maintenance piping systems. The rising popularity of modular construction is also supporting the use of advanced piping technologies.

Germany Pipes Market Insight

The Germany Pipes market is expanding at a notable pace, supported by the country’s strong industrial base and emphasis on sustainable infrastructure. Germany’s push for energy-efficient buildings, replacement of outdated plumbing, and use of recyclable materials positions the market for steady long-term growth. Demand is especially strong in urban construction, district heating, and renewable energy pipeline installations.

Which Region is the Fastest Growing in the Pipes Market?

Asia-Pacific Pipes market is forecasted to grow at the fastest CAGR of 12.33% from 2025 to 2032, driven by rapid urbanization, industrialization, and increasing investments in infrastructure development across countries such as China, India, and Southeast Asia. Government initiatives promoting smart cities, sanitation projects, and affordable housing are contributing significantly to the region’s demand for modern piping systems. The region’s large construction pipeline and emergence as a global manufacturing hub for piping components are making Pipes more accessible and cost-effective for a wider consumer base.

Japan Pipes Market Insight

The Japan Pipes market is growing steadily due to the country’s emphasis on urban renewal, aging infrastructure upgrades, and technological integration. Pipes are being increasingly used in smart water networks, residential plumbing systems, and industrial automation projects. Japan’s focus on disaster-resilient infrastructure also contributes to demand for high-performance piping systems.

China Pipes Market Insight

The China Pipes market held the largest revenue share in the Asia-Pacific region in 2024, driven by massive infrastructure investments, expanding real estate development, and the growing adoption of smart and green technologies. Local manufacturers are offering affordable yet advanced solutions, making Pipes highly accessible across urban and rural construction projects. National campaigns such as “Beautiful China” and “Sponge Cities” are fostering the use of efficient piping in drainage, wastewater, and rainwater harvesting systems.

Which are the Top Companies in Pipes Market?

The Pipes industry is primarily led by well-established companies, including:

- Aliaxis Group S.A. (Belgium)

- Pipelife Austria GmbH & Co KG (Austria)

- Sekisui Chemical Co., Ltd. (Japan)

- Wienerberger AG (Austria)

- Plasticos Ferro, S.L.U. (Spain)

- Orbia (Mexico)

- Advanced Drainage Systems (U.S.)

- Supreme.Co.In. (India)

- Agru (Austria)

- Northwest Pipe Company (U.S.)

- CPM Drainage Group (U.K.)

- Xinjiang Guotong Pipeline Co., Ltd (China)

- Thompson Pipe Group (U.S.)

- Finolex Industries Ltd. (India)

- Cemex S.A.B. De C.V. (Mexico)

- Saudi Arabian Amiantit Co. (Saudi Arabia)

- Forterra Inc. (U.S.)

- Old Castle Precast Inc. (U.S.)

- Nucor Tubular Products (U.S.)

What are the Recent Developments in Global Pipes Market?

- In May 2023, Uponor Oyj announced its decision to acquire the remaining 44.7% stake in its subsidiary Uponor Infra Oy from KWH Group, thereby increasing its ownership to 100%. While this transaction does not impact Uponor's turnover or operating results, it is expected to create shareholder value by improving earnings per share, signaling a stronger control over its infrastructure operations

- In October 2021, TechnipFMC completed the acquisition of Magma Global’s technology, combining both companies’ technological strengths to develop disruptive composite pipe solutions for both traditional and emerging energy sectors. This strategic move enhances TechnipFMC’s portfolio with advanced composite pipe systems, improving its competitive edge in next-generation pipeline infrastructure

- In June 2021, Advanced Drainage Systems, Inc. announced the acquisition of Jet Polymer Recycling, a privately held recycling company based in the southeastern region of the U.S. This acquisition supports ADS’s commitment to sustainability and circular economy practices, by strengthening its in-house recycling capabilities and expanding its materials processing infrastructure

- In May 2021, Magma Global delivered one of the world’s first high-pressure composite riser pipes to HWCG at its Gulf Coast storage site, marking the completion of its Offset Flexible Riser (OFR) system. This milestone demonstrates Magma’s ability to supply rapid-deployment, high-performance solutions for emergency and deepwater applications

- In January 2021, Baker Hughes introduced its next-generation Onshore Composite Flexible Pipes, aimed at resolving issues related to corrosion and high maintenance costs associated with conventional steel pipes. The new product line represents a cost-effective, durable alternative for industrial and onshore applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PIPE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PIPE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL PIPE MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.9 4P MATRIX GRID

5.1 3 C'S GRID

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 STRATEGY OUTLOOK

8.1 MARKET ENTRY

8.2 MARKETING AND DISTRIBUTION

8.3 ALLIANCE FORMATION

8.4 NEW PRODUCT LAUNCHES

8.5 PRODUCTION EXPANSION

8.6 MERGERS AND ACQUISITION

9 GLOBAL PIPE MARKET, BY MATERIAL, (2022-2031), (USD MILLION) (TONS)

9.1 OVERVIEW

9.2 METALLIC PIPES

9.2.1 FERROUS MATERIALS PIPE

9.2.1.1. FERROUS MATERIALS PIPE, BY TYPE

9.2.1.1.1. STEEL PIPE

9.2.1.1.1.1 STEEL PIPE, BY TYPE

9.2.1.1.1.1.1. CARBON STEEL PIPES

9.2.1.1.1.1.2. STAINLESS STEEL PIPES

9.2.1.1.1.1.3. ALLOY STEEL PIPES

9.2.1.1.1.1.4. DUPLEX STAINLESS STEEL

9.2.1.1.1.1.5. GALVANIZED STEEL PIPES

9.2.1.1.2. IRON PIPE

9.2.1.1.2.1 IRON PIPE, BY TYPE

9.2.1.1.2.1.1. DUCTILE IRON PIPES

9.2.1.1.2.1.2. CAST IRON PIPES

9.2.2 NON-FERROUS MATERIALS PIPE

9.2.2.1. NON-FERROUS MATERIALS PIPE, BY TYPE

9.2.2.1.1. ALUMINUM ALLOY PIPES

9.2.2.1.2. COPPER ALLOY PIPES

9.2.2.1.3. NICKEL ALLOY PIPES

9.2.2.1.4. TITANIUM ALLOY PIPES

9.2.2.1.5. ZIRCONIUM ALLOY PIPES

9.3 NON-METALLIC PIPES

9.3.1 NON-METALLIC PIPES, BY TYPE

9.3.1.1. PLASTICS

9.3.1.1.1. PLASTICS, BY TYPE

9.3.1.1.1.1 POLYVINYL CHLORIDE (PVC)

9.3.1.1.1.1.1. POLYVINYL CHLORIDE (PVC), BY TYPE

9.3.1.1.1.1.2. RIGID POLYVINYL CHLORIDE (RPVC)

9.3.1.1.1.1.3. CHLORINATED POLYVINYL CHLORIDE (CPVC)

9.3.1.1.1.2 POLYETHYLENE (PE)

9.3.1.1.1.2.1. POLYETHYLENE (PE), BY TYPE

9.3.1.1.1.2.2. HDPE

A. HDPE, BY GRADE

I. PE 100

II. PE 80

III. PE63

IV. PE 40

V. PE 32

9.3.1.1.1.2.3. PERT (POLYETHYLENE OF RAISED TEMPERATURE RESISTANCE)

9.3.1.1.1.2.4. PEX (CROSS LINK POLYETHYLENE)

9.3.1.1.1.2.5. LDPE

9.3.1.1.1.2.6. LLDPE

9.3.1.1.1.2.7. MDPE (MEDIUM DENSITY POLYETHYLENE)

9.3.1.1.1.3 POLYPROPYLENE (PP)

9.3.1.1.1.4 ACRYLONITRILE BUTADIENE STYRENE (ABS) PIPES

9.3.1.2. CONCRETE

9.3.1.2.1. CONCRETE, BY TYPE

9.3.1.2.1.1 PRE-STRESSED CONCRETE CYLINDER PIPES

9.3.1.2.1.2 PRE-STRESSED REINFORCED CONCRETE PIPES

9.3.1.2.1.3 REINFORCED CONCRETE PIPES

9.3.1.2.1.4 BAR-WRAPPED CONCRETE PIPES

9.3.1.2.1.5 OTHERS

9.3.1.3. OTHERS

10 GLOBAL PIPE MARKET, BY MANUFACTURING PROCESS, (2022-2031), (USD MILLION)

10.1 OVERVIEW

10.2 SEAMLESS PIPE MANUFACTURING

10.3 ELECTRIC RESISTANCE WELDING (ERW) PIPE MANUFACTURING

10.4 SUBMERGED ARC WELDING (SAW) PIPE MANUFACTURING

10.5 DOUBLE SUBMERGED ARC WELDING (DSAW) PIPE MANUFACTURING

10.6 SEAMLESS AND WELDED PIPE MANUFACTURING PROCESS SEAMLESS AND WELDED PIPE MANUFACTURING

11 GLOBAL PIPE MARKET, BY CATEGORY, (2022-2031), (USD MILLION)

11.1 OVERVIEW

11.2 PRESSURE PIPES

11.3 NON-PRESSURE PIPES

12 GLOBAL PIPES MARKET, BY SIZE, (2022-2031) (USD MILLION)

12.1 OVERVIEW

12.2 UPTO 1/2''

12.3 1/2-1''

12.4 1-2''

12.5 2-5''

12.6 5-10''

12.7 10-20''

12.8 ABOVE 20''

13 GLOBAL POLYETHYLENE (PE) PIPES MARKET, BY INDUSTRY, (2022-2031) (USD MILLION)

13.1 OVERVIEW

13.2 WATER INFRASTRUCTURE

13.2.1 WATER INFRASTRUCTURE, BY APPLICATION

13.2.1.1. AGRICULTURE

13.2.1.1.1. AGRICULTURE, BY APPLICATION

13.2.1.1.1.1 FLOOD IRRIGATION

13.2.1.1.1.2 SPRINKLER IRRIGATION

13.2.1.1.1.3 DRIP IRRIGATION

13.2.1.1.1.4 OTHERS

13.2.1.2. SEWAGE

13.2.1.2.1. SEWAGE, BY APPLICATION

13.2.1.2.1.1 DOMESTIC SEWAGE SYSTEM

13.2.1.2.1.2 SANITARY SYSTEM

13.2.1.2.1.3 PETROCHEMICAL INDUSTRY

13.2.1.2.1.4 FERTILIZER INDUSTRY

13.2.1.2.1.5 OTHERS

13.2.2 WATER INFRASTRUCTURE, BY MATERIAL

13.2.2.1. METALLIC PIPES

13.2.2.2. NON-METALLIC PIPES

13.3 OIL AND GAS INFRASTRUCTURE

13.3.1 OIL AND GAS, BY APPLICATION

13.3.1.1. OIL PRODUCTION PIPILINES

13.3.1.2. REFINERY PIPES

13.3.1.3. FUEL HANDLING AND STORAGE

13.3.1.4. LNG (LIQUEFIED NATURAL GAS)

13.3.1.5. OTHERS

13.3.2 OIL AND GAS, BY MATERIAL

13.3.2.1.1. METALLIC PIPES

13.3.2.1.2. NON-METTALIC PIPES

13.4 INDUSTRIAL INFRASTRUCTURE

13.4.1 INDUSTRIAL INFRASTRUCTURE, BY APPLICATION

13.4.1.1. CHEMICALS

13.4.1.2. HEALTHCARE

13.4.1.3. MINING

13.4.1.4. PAPER AND PULP

13.4.1.5. OTHERS

13.4.2 INDUSTRIAL INFRASTRUCTURE, BY MATERIAL

13.4.2.1. METALLIC PIPES

13.4.2.2. NON-METALLIC PIPES

13.5 BUILDING INFRASTRUCTURE

13.5.1 BUILDING INFRASTRUCTURE, BY APPLICATION

13.5.1.1. HOSPITALITY (HOTELS & RESORTS)

13.5.1.2. GOVERNMENT BUILDING

13.5.1.3. COMMERCIAL BUIILDING

13.5.1.4. RESIDENTIAL BUIILDING

13.5.1.5. OTHERS

13.5.2 BUILDING INFRASTRUCTURE, BY MATERIAL

13.5.2.1. METALLIC PIPES

13.5.2.2. NON-METALLIC PIPES

14 GLOBAL PIPE MARKET, BY DISTRIBUTION CHANNEL, (2022-2031) (USD MILLION)

14.1 OVERVIEW

14.2 DIRECT SELLING

14.3 RETAIL SELLING

15 GLOBAL PIPE MARKET, BY REGION, (2022-2031), (USD MILLION)

15.1 GLOBAL PIPE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 U.K.

15.3.2 ITALY

15.3.3 FRANCE

15.3.4 SPAIN

15.3.5 RUSSIA

15.3.6 SWITZERLAND

15.3.7 TURKEY

15.3.8 BELGIUM

15.3.9 NETHERLANDS

15.3.10 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 SINGAPORE

15.4.6 THAILAND

15.4.7 INDONESIA

15.4.8 MALAYSIA

15.4.9 PHILIPPINES

15.4.10 AUSTRALIA & NEW ZEALAND

15.4.11 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 UNITED ARAB EMIRATES

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL PIPE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18 GLOBAL PIPE MARKET - COMPANY PROFILES

18.1 FURUKAWA ELECTRIC CO., LTD

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 REVENUE ANALYSIS

18.1.4 RECENT UPDATES

18.2 OASIS IRIGATION EQUIPMENT CO.LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 REVENUE ANALYSIS

18.2.4 RECENT UPDATES

18.3 KOREA PETROCHEMICAL IND. CO., LTD.

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 REVENUE ANALYSIS

18.3.4 RECENT UPDATES

18.4 SHANGHAI METAL CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 REVENUE ANALYSIS

18.4.4 RECENT UPDATES

18.5 NEWAGE INDUSTRIES

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 REVENUE ANALYSIS

18.5.4 RECENT UPDATES

18.6 ADVANCED DRAINAGE SYSTEMS

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 REVENUE ANALYSIS

18.6.4 RECENT UPDATES

18.7 APL APOLLO TUBES LIMITED

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 REVENUE ANALYSIS

18.7.4 RECENT UPDATES

18.8 ASTRAL PIPES

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 REVENUE ANALYSIS

18.8.4 RECENT UPDATES

18.9 BLUE DIAMOND INDUSTRIES (HEXATRONIC GROUP)

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 REVENUE ANALYSIS

18.9.4 RECENT UPDATES

18.1 CHEVRON PHILLIPS CHEMICAL COMPANY LLC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 REVENUE ANALYSIS

18.10.4 RECENT UPDATES

18.11 CHINA LESSO

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 REVENUE ANALYSIS

18.11.4 RECENT UPDATES

18.12 JAIN IRRIGATION SYSTEMS LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 REVENUE ANALYSIS

18.12.4 RECENT UPDATES

18.13 JM EAGLE, INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 REVENUE ANALYSIS

18.13.4 RECENT UPDATES

18.14 LANE ENTERPRISES, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 REVENUE ANALYSIS

18.14.4 RECENT UPDATES

18.15 PRINSCO, INC

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 REVENUE ANALYSIS

18.15.4 RECENT UPDATES

18.16 SUPREME.CO.IN.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 REVENUE ANALYSIS

18.16.4 RECENT UPDATES

18.17 UPONOR CORPORATION (PART OF ASKO CORPORATION)

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 REVENUE ANALYSIS

18.17.4 RECENT UPDATES

18.18 WL PLASTICS (PART OF INEOS)

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 REVENUE ANALYSIS

18.18.4 RECENT UPDATES

18.19 WAVIN (PART OF ORBIA)

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 REVENUE ANALYSIS

18.19.4 RECENT UPDATES

18.2 NAN YA PLASTICS CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 REVENUE ANALYSIS

18.20.4 RECENT UPDATES

18.21 JSW GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 REVENUE ANALYSIS

18.21.4 RECENT UPDATES

18.22 ARCELORMITTAL

18.22.1 ISTW COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 REVENUE ANALYSIS

18.22.4 RECENT UPDATES

18.23 STEEL PIPE INDUSTRY INDONESIA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 REVENUE ANALYSIS

18.23.4 RECENT UPDATES

18.24 INDONESIA NIPPON STEEL PIPE

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 REVENUE ANALYSIS

18.24.4 RECENT UPDATES

18.25 ARAYA STEEL TUBE INDONESIA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 REVENUE ANALYSIS

18.25.4 RECENT UPDATES

18.26 KARINDO ABADI MAKMUR

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 REVENUE ANALYSIS

18.26.4 RECENT UPDATES

18.27 ESC STEEL INDONESIA

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 REVENUE ANALYSIS

18.27.4 RECENT UPDATES

18.28 JINDALSTAINLESS

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 REVENUE ANALYSIS

18.28.4 RECENT UPDATES

18.29 TATA STEEL

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 REVENUE ANALYSIS

18.29.4 RECENT UPDATES

18.3 SEAMLESS STEEL PIPE

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 REVENUE ANALYSIS

18.30.4 RECENT UPDATES

18.31 BAKRIE PIPE INDUSTRIES

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 REVENUE ANALYSIS

18.31.4 RECENT UPDATES

18.32 NAVNIDHI FERROMET PVT. LTD

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 REVENUE ANALYSIS

18.32.4 RECENT UPDATES

18.33 FINOLEX INDUSTRIES LTD.

18.33.1 COMPANY SNAPSHOT

18.33.2 PRODUCT PORTFOLIO

18.33.3 REVENUE ANALYSIS

18.33.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 QUESTIONNAIRE

21 CONCLUSION

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Pipes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pipes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pipes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.