Global Pirimiphos Methyl Market

Market Size in USD Billion

CAGR :

%

USD

10.96 Billion

USD

15.58 Billion

2025

2033

USD

10.96 Billion

USD

15.58 Billion

2025

2033

| 2026 –2033 | |

| USD 10.96 Billion | |

| USD 15.58 Billion | |

|

|

|

|

Pirimiphos-Methyl Market Size

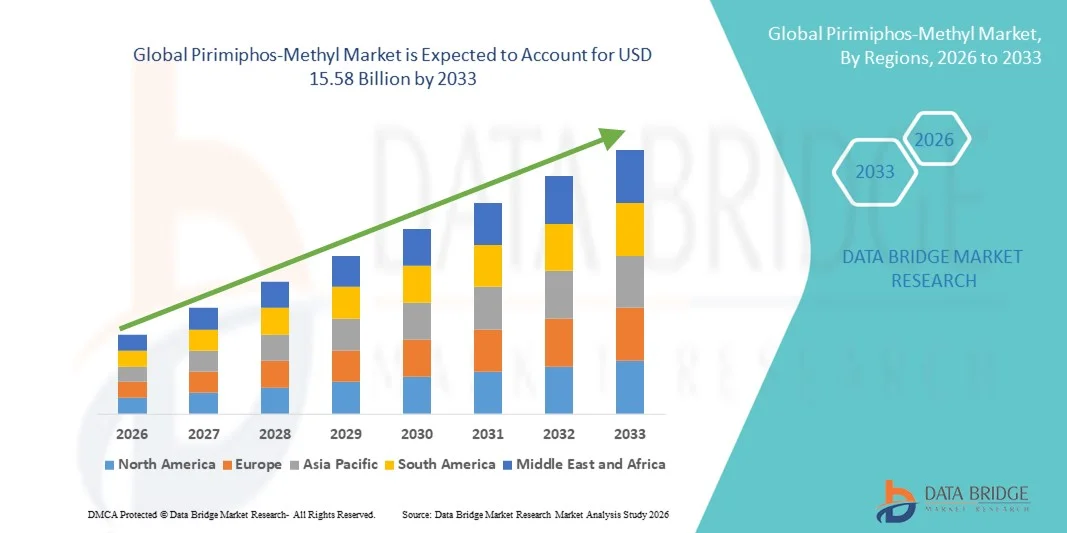

- The global pirimiphos-methyl market size was valued at USD 10.96 billion in 2025 and is expected to reach USD 15.58 billion by 2033, at a CAGR of 4.5% during the forecast period

- The market growth is largely fueled by the increasing need for effective pest management in stored grains, cereals, pulses, and other crops, coupled with the rising emphasis on reducing post-harvest losses and maintaining food quality. Growing awareness among farmers and storage facility operators about the economic impact of pest infestations is driving the adoption of Pirimiphos‑Methyl‑based solutions

- Furthermore, regulatory approvals and extended authorizations in key regions, combined with technological improvements in formulation and application methods, are strengthening market penetration. These factors are accelerating the uptake of Pirimiphos‑Methyl products across commercial storage, agricultural, and household sectors, thereby significantly boosting industry growth

Pirimiphos-Methyl Market Analysis

- Pirimiphos‑Methyl, an organophosphate insecticide used for stored grain protection and crop pest control, is increasingly vital in modern agricultural and storage practices due to its efficacy, versatility, and residual activity against a wide range of pests. The compound’s ability to protect both raw produce and processed commodities enhances its relevance in post-harvest management

- The escalating demand for Pirimiphos‑Methyl is primarily fueled by the expansion of grain storage infrastructure, rising cereal and pulse production, and the growing need for safe, reliable, and cost-effective pest control solutions. In addition, the focus on food security, minimizing economic losses from infestations, and compliance with storage regulations are further contributing to market growth

- Asia-Pacific dominated the pirimiphos-methyl market with a share of 35.3% in 2025, due to extensive agricultural activities, increasing need for post-harvest pest control, and a strong presence of crop storage infrastructure

- North America is expected to be the fastest growing region in the pirimiphos-methyl market during the forecast period due to rising demand for stored-grain protection, expansion of large-scale storage facilities, and increasing focus on food safety and loss prevention

- Sprays segment dominated the market with a market share of 46.1% in 2025, due to its wide applicability for both stored-product protection and field pest control. Sprays offer quick action against a broad spectrum of pests, making them a preferred choice among farmers and storage facility operators. Their ease of application and uniform coverage enhance effectiveness, ensuring minimal crop loss and higher safety standards

Report Scope and Pirimiphos-Methyl Market Segmentation

|

Attributes |

Pirimiphos-Methyl Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pirimiphos-Methyl Market Trends

Rising Adoption of Post-Harvest Pest Management Solutions

- A significant trend in the Pirimiphos‑Methyl market is the rising adoption of post‑harvest pest management solutions as farmers and grain storage operators increasingly seek effective treatments to protect stored cereals, pulses, and oilseeds from insect damage, driven by the critical need to safeguard food quality and reduce economic losses after harvest

- For instance, Syngenta’s Actellic 50 EC, a Pirimiphos‑Methyl‑based insecticide, is widely used globally for controlling stored grain pests such as weevils and moths, offering extended residual protection in bulk storage environments

- The trend reflects expanding integration of Pirimiphos‑Methyl with integrated pest management (IPM) programs where chemical control is combined with sanitation and temperature monitoring to ensure comprehensive storage protection

- Market preference is shifting toward formulations with broad‑spectrum activity that can control multiple pest species in storage facilities, aligning with demand for efficient, single‑solution applications

- Increasing mechanization and modernization of grain storage infrastructure in major agricultural regions are encouraging adoption of chemical protectants such as Pirimiphos‑Methyl‑based products to enhance shelf life and maintain commodity value

- The trend also stems from growing awareness among farmers and agribusinesses of the economic impact of storage pests, prompting investment in proven post‑harvest protection products that ensure food safety and reduce waste

Pirimiphos-Methyl Market Dynamics

Driver

Increasing Need to Reduce Post-Harvest Losses and Protect Stored Grains

- The increasing need to reduce post‑harvest losses and protect stored grains is driving demand for Pirimiphos‑Methyl as an effective insecticidal solution that mitigates infestation by weevils, beetles, and moths in silos and warehouses

- For instance, manufacturers such as Hunan Haili Chemical Industry Co Ltd produce Pirimiphos‑Methyl‑based products such as PIRMECON 55% that are specifically registered for controlling stored product pests such as beetles, weevils, and mites, addressing key storage protection challenges

- Grain growers and commercial storage operators are adopting Pirimiphos‑Methyl treatments to maintain grain quality, minimize weight loss, and uphold commodity market value throughout prolonged storage cycles

- In regions with substantial cereal production, such as the U.S., China, and Brazil, agricultural stakeholders rely on post‑harvest insecticides to support food security goals by ensuring stock remains pest‑free until consumption or processing

- This sustained requirement to protect stored commodities from degradation underpins significant investment in Pirimiphos‑Methyl products, strengthening their role in comprehensive storage pest management practices

Restraint/Challenge

Regulatory Restrictions and Safety Concerns in Key Markets

- The Pirimiphos‑Methyl market faces challenges due to regulatory restrictions and safety concerns in key agricultural markets where stringent assessments of organophosphate pesticides influence product approvals, labeling, and usage requirements

- For instance, in the U.S., the EPA’s interim reregistration eligibility decision imposes risk mitigation measures such as closed‑system mixing, loading requirements, and mandatory personal protective equipment for handlers, which can increase compliance costs and limit application flexibility for producers and applicators

- In the European Union and some individual countries, regulatory frameworks have tightened approvals for organophosphate insecticides, leading to restrictions or non‑renewals of certain Pirimiphos‑Methyl formulations, restraining market expansion in those regions

- Safety concerns related to human and environmental exposure, especially given Pirimiphos‑Methyl’s classification as an organophosphate, prompt rigorous monitoring and handling protocols that can deter smaller operators from adopting these products

- Such regulatory and safety dynamics compel manufacturers and distributors to invest in compliance, stewardship training, and alternative product development, posing ongoing challenges to sustained market growth in certain jurisdictions

Pirimiphos-Methyl Market Scope

The market is segmented on the basis of form, insects, and crop type.

- By Form

On the basis of form, the Pirimiphos-Methyl market is segmented into sprays, baits, and strips. The sprays segment dominated the market with the largest revenue share 46.1% in 2025, driven by its wide applicability for both stored-product protection and field pest control. Sprays offer quick action against a broad spectrum of pests, making them a preferred choice among farmers and storage facility operators. Their ease of application and uniform coverage enhance effectiveness, ensuring minimal crop loss and higher safety standards. The segment also benefits from compatibility with mechanized spraying equipment and integration into pest management programs, reinforcing its strong market presence.

The baits segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in controlled storage environments and households. Baits provide targeted pest control, reducing chemical exposure to non-target organisms and improving safety. For instance, companies such as Syngenta have introduced advanced bait formulations that attract and eliminate beetles and weevils efficiently. Their slow-release mechanism ensures sustained pest management, and the convenience of placement in hard-to-reach areas drives demand across commercial and domestic settings.

- By Insects

On the basis of targeted insects, the Pirimiphos-Methyl market is segmented into beetles, weevils, moths, and others. The beetles segment held the largest market revenue share in 2025 due to their high prevalence in stored cereals and grains and the severe economic losses they cause. Beetles are highly resilient, and Pirimiphos-Methyl sprays and baits effectively control infestations, which makes them the preferred pesticide choice among storage managers. The segment also benefits from ongoing research and development enhancing formulation efficacy and safety, boosting market confidence.

The weevils segment is projected to witness the fastest CAGR from 2026 to 2033, driven by increasing infestations in stored grains and pulses across emerging economies. For instance, BASF’s targeted weevil control products have gained traction due to their efficiency and ease of application. The slow-acting mechanism of Pirimiphos-Methyl formulations allows sustained protection, and growing awareness of grain preservation techniques supports market expansion. In addition, weevil management is increasingly integrated into comprehensive storage management systems, enhancing adoption rates.

- By Crop Type

On the basis of crop type, the Pirimiphos-Methyl market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and other crop types. The cereals and grains segment dominated the market in 2025 with the largest revenue share due to the widespread global cultivation of wheat, rice, and maize, which are highly susceptible to storage pests. Pirimiphos-Methyl formulations provide effective post-harvest protection, ensuring minimal losses and maintaining quality standards. Farmers and storage facility operators prefer these solutions for their proven efficacy and compatibility with existing pest control practices.

The oilseeds and pulses segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising production and the need for enhanced storage protection. For instance, Adama’s Pirimiphos-Methyl-based solutions are increasingly adopted for pulses storage due to their targeted action against beetles and weevils. The segment benefits from regulatory support and growing awareness of post-harvest loss prevention. In addition, the versatility of formulations for application on different oilseeds enhances adoption in both commercial and small-scale operations.

Pirimiphos-Methyl Market Regional Analysis

- Asia-Pacific dominated the pirimiphos-methyl market with the largest revenue share of 35.3% in 2025, driven by extensive agricultural activities, increasing need for post-harvest pest control, and a strong presence of crop storage infrastructure

- The region’s cost-effective labor, government subsidies for pesticide usage, and growing investments in modern storage facilities are accelerating market expansion

- The availability of skilled labor, favorable agricultural policies, and adoption of integrated pest management practices across developing economies are contributing to increased consumption of Pirimiphos-Methyl in cereals, grains, and pulses

China Pirimiphos-Methyl Market Insight

China held the largest share in the Asia-Pacific Pirimiphos-Methyl market in 2025, owing to its status as one of the largest producers and consumers of cereals and grains. Strong government support for post-harvest preservation, growing adoption of advanced storage technologies, and extensive export-oriented grain production are major growth drivers. Demand is also bolstered by ongoing investments in safe and efficient pesticide formulations for both domestic consumption and international trade.

India Pirimiphos-Methyl Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing stored-grain production, rising need for pest management in pulses and oilseeds, and government initiatives promoting agricultural efficiency. For instance, large-scale adoption of Pirimiphos-Methyl sprays and baits in grain silos by companies such as UPL is driving market expansion. In addition, the emphasis on reducing post-harvest losses and improving food security is supporting robust market growth.

Europe Pirimiphos-Methyl Market Insight

The Europe Pirimiphos-Methyl market is expanding steadily, supported by stringent food safety regulations, high demand for pesticide-treated storage solutions, and growing investments in integrated pest management technologies. The region places strong emphasis on quality, efficacy, and environmentally compliant pesticide applications. Increasing use of Pirimiphos-Methyl in stored cereals and pulses for long-term preservation is further enhancing market growth.

Germany Pirimiphos-Methyl Market Insight

Germany’s Pirimiphos-Methyl market is driven by its advanced agricultural practices, strong regulatory oversight, and focus on sustainable pest control solutions. The country has well-established research networks and partnerships promoting safe pesticide usage, fostering continuous innovation in formulation and application techniques. Demand is particularly strong for use in stored grains, oilseeds, and pulses due to strict food quality standards.

U.K. Pirimiphos-Methyl Market Insight

The U.K. market is supported by a mature agricultural sector, growing need for post-harvest pest management, and adoption of modern storage technologies. With rising emphasis on safe and effective pesticide solutions, academic-industry collaborations and investments in R&D for pesticide efficacy and sustainability continue to drive demand. The market is increasingly leveraging Pirimiphos-Methyl formulations for both commercial storage and small-scale farming operations.

North America Pirimiphos-Methyl Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for stored-grain protection, expansion of large-scale storage facilities, and increasing focus on food safety and loss prevention. Advanced pest management practices, integration of chemical treatments with monitoring technologies, and government support for post-harvest management are boosting demand. In addition, increasing adoption of efficient Pirimiphos-Methyl formulations for cereals, pulses, and oilseeds is supporting market expansion.

U.S. Pirimiphos-Methyl Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by extensive grain storage infrastructure, strong regulatory oversight, and significant investment in agricultural efficiency. The country’s focus on reducing post-harvest losses, adoption of advanced pest control technologies, and use of high-efficacy Pirimiphos-Methyl formulations are encouraging market growth. Presence of key agricultural players and a well-established distribution network further solidify the U.S.’s leading position in the region.

Pirimiphos-Methyl Market Share

The pirimiphos-methyl industry is primarily led by well-established companies, including:

- Crop I.Q. Technology (U.S.)

- T. STANES & COMPANY LIMITED (India)

- DuPont (U.S.)

- Makhteshim Agan Industries (Israel)

- Valent BioSciences L.L.C. (U.S.)

- Isagro S.p.A (Italy)

- Bayer AG (Germany)

- Syngenta AG (Switzerland)

- Corteva (U.S.)

- BASF SE (Germany)

- ADAMA India Private Limited (India)

- F.M.C. Corporation (U.S.)

- Nufarm (Australia)

- U.P.L. (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- Cheminova A/S (Denmark)

- American Vanguard Corporation (U.S.)

Latest Developments in Global Pirimiphos-Methyl Market

- In February 2026, Lodi UK became the sole distributor of the Actellic insecticide range, including products containing Pirimiphos‑Methyl, after Envu completed the portfolio acquisition from Syngenta. This expanded distribution strengthens grain storage pest protection offerings in the U.K. market, enabling growers and grain traders to access comprehensive solutions that combine the Actellic portfolio with existing storage protection products, improving grain quality and broadening the reach of Pirimiphos‑Methyl‑based applications in post‑harvest protection

- In September 2025, Envu completed its acquisition of Actellic products from Syngenta for the stored grain segment, consolidating the portfolio under one global provider. This strategic completion gives Envu full rights to leverage Actellic formulations that include Pirimiphos‑Methyl for broader pest control in grain storage, enhancing product integration and market penetration across Latin America, Europe, Africa, and other regions

- In August 2025, India’s Central Insecticides Board & Registration Committee (CIBRC) approved a fresh wave of technical and formulation registrations under Section 9(3), spanning various crop protection solutions. Although not specific only to Pirimiphos‑Methyl, this regulatory activity reflects a broader strengthening of pesticide availability, supporting an improved market environment for defined pest control tools including stored‑grain insecticides, which may indirectly enhance adoption and portfolio growth in India

- In May 2025, the European Commission extended the approval period of Pirimiphos‑Methyl as an active substance under Commission Implementing Regulation, ensuring that authorisation remains valid while renewal evaluations proceed. This regulatory extension stabilises the market in the EU by preventing lapses in legal use, allowing manufacturers and distributors to continue providing Pirimiphos‑Methyl‑based products for crop protection without disruption

- In February–June 2025, the Bureau of Indian Standards (BIS) released a draft revision of the Indian standard specification for technical Pirimiphos‑Methyl, aiming to update quality benchmarks for the active ingredient. The move to revise technical standards can improve product consistency and quality assurance, fostering greater confidence among manufacturers, formulators, and end‑users regarding Pirimiphos‑Methyl’s technical performance in crop protection and stored product pest management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.