Global Plain Bearing Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

1.87 Billion

2024

2032

USD

1.16 Billion

USD

1.87 Billion

2024

2032

| 2025 –2032 | |

| USD 1.16 Billion | |

| USD 1.87 Billion | |

|

|

|

|

Plain Bearing Market Size

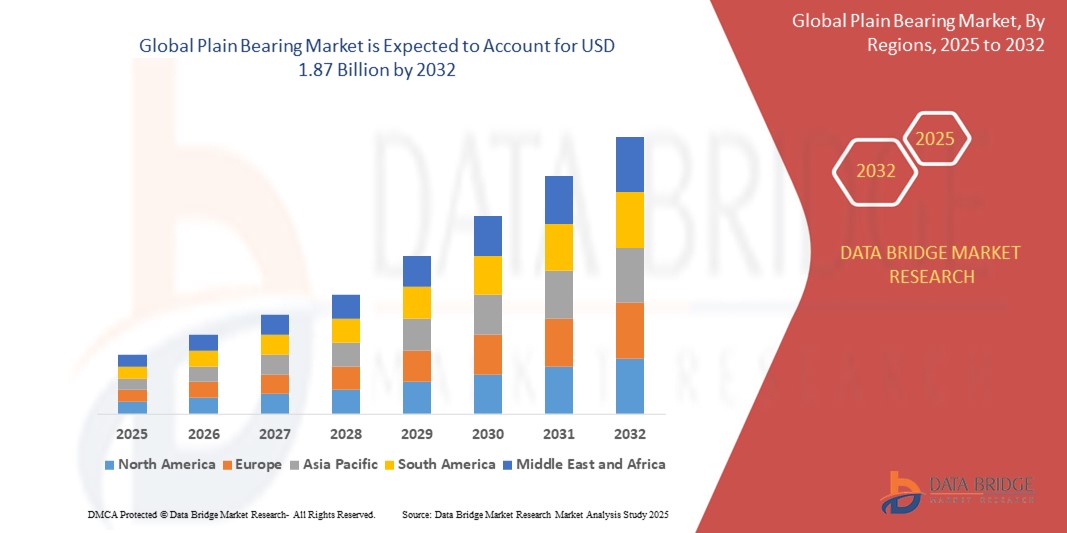

- The global plain bearing market was valued at USD 1.16 billion in 2024 and is expected to reach USD 1.87 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.14%, primarily driven by Increasing industrial automation, rising demand in automotive and aerospace sectors, and cost-effective maintenance.

- This growth is driven by factors such as rising infrastructure projects, demand for durable components, and expanding machinery and automotive industries

Plain Bearing Market Analysis

- Plain Bearings are essential components used across advanced applications in automotive, aerospace, marine, industrial, and energy sectors to reduce friction, support rotational motion, and enhance mechanical efficiency. These components improve machinery lifespan and performance, driving collaboration among metal alloy producers, bearing designers, and OEMs to innovate durable, lightweight, and cost-effective bearing solutions that meet evolving operational standards

- The demand for Plain Bearings is significantly driven by the increasing need for maintenance-free, low-friction components in heavy machinery, electric vehicles, and wind turbines. Emphasis on energy efficiency, reduced emissions, and long service life fuels market growth. Material advancements like composite, bronze, and PTFE-lined bearings enhance load capacity and corrosion resistance, while industrial automation and smart manufacturing boost adoption. Government policies supporting industrialization and clean energy further strengthen demand

- The Asia-Pacific region remains dominant in the global plain bearing market, fueled by rapid industrialization, booming construction, and a strong manufacturing base in countries like China, India, and Japan. The region’s competitive labor costs, large-scale infrastructure projects, and automotive OEM expansion create robust market opportunities

- For instance, China leads in plain bearing production and usage. Its thriving manufacturing sector, focus on domestic machinery innovation, and government-backed "Made in China 2025" initiative drive advanced bearing technology adoption to support sustainable and efficient industrial growth.

- Globally, the plain bearing market is a foundational segment within the mechanical components industry, crucial to minimizing wear and enhancing operational efficiency in various systems. Its pivotal role in enabling high-load operations, reducing maintenance costs, and supporting next-generation equipment cements its importance across both mature and emerging markets

Report Scope and Plain Bearing Market Segmentation

|

Attributes |

Plain Bearing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plain Bearing Market Trends

“Rising Vehicle Production Boosts Global Demand For Plain Bearings”

- One prominent trend in the advancement of Plain Bearings is the rising vehicle production and sales across both passenger and commercial segments, which is directly boosting demand for these components in automotive systems

- Plain Bearings offer key functional benefits such as low friction, wear resistance, and support for high-load applications, making them essential for automotive, aerospace, construction, and energy sectors as industrial demand rises globally

- For instance, with the surge in automotive production in countries like China, India, and Mexico, manufacturers are increasingly using plain bearings in high-speed and heavy-duty applications such as wheel axles, suspension systems, and traction motors to improve efficiency and reduce maintenance costs

- The widespread adoption of these bearings across end-use industries improves equipment reliability, reduces maintenance frequency, and enhances overall operational efficiency—especially in infrastructure, agricultural, and oilfield machinery

- These developments are transforming industrial operations, accelerating the shift toward more durable, energy-efficient mechanical systems, and aligning with global trends such as smart manufacturing, digital integration, and sustainable industrial growth

Plain Bearing Market Dynamics

Driver

“Increasing Demand For Plain Bearings From End-Use Industries”

- The increasing demand from end-use industries such as automotive, aerospace, energy, construction machinery, oilfield machinery, agriculture, gardening equipment, and office products is significantly driving the growth of the Plain Bearing market

- As industrial activities expand and equipment performance requirements become more demanding, manufacturers are increasingly focusing on developing durable, low-maintenance plain bearing solutions that enhance operational efficiency across sectors

- Plain Bearings are extensively used in automotive engines, aircraft components, construction and agricultural machinery, and office equipment due to their ability to reduce friction, support high-load capacities, and perform reliably under harsh working conditions

- These bearings not only extend machinery lifespan and reduce maintenance costs but also contribute to greater energy efficiency and productivity across critical industrial applications

- As rapid urbanization, infrastructure development, and rising middle-class income levels in Asia Pacific drive growth in sectors like automotive, agriculture, and construction, the demand for high-performance plain bearings is poised to rise, supporting the evolution of more efficient and resilient industrial ecosystems

For instance,

- In China and India, rapid growth in the construction and automotive sectors—fueled by expanding urban populations and rising disposable incomes—is increasing the demand for heavy-duty machinery and vehicles equipped with reliable bearing systems

- In Japan, technological advancements in office automation and industrial robotics are boosting the adoption of precision-engineered plain bearings that ensure high operational stability and reduced downtime

Opportunity

“Rising Demand in Electric Vehicles (EVs)”

- The growing demand for lightweight, low-friction, and maintenance-free plain bearings is driven by their ability to improve mechanical efficiency and performance in electric vehicles (EVs)

- These advanced bearings reduce energy losses caused by friction, enhance battery life, and support the overall efficiency of EV powertrains and drivetrain systems

- Additionally, the adoption of such bearings aligns with the automotive industry's shift toward lightweight, energy-efficient, and low-maintenance vehicle designs, reinforcing the transition to sustainable e-mobility solutions

For instance,

- High-performance polymer and composite plain bearings are increasingly used in electric power steering, suspension systems, and thermal management units in EVs to reduce weight, eliminate lubrication needs, and extend vehicle lifespan—helping manufacturers meet both performance and environmental goals

Restraint/Challenge

“Volatility in raw material prices”

- While there is growing demand for durable and high-performance plain bearings, the price volatility of raw materials remains a significant challenge for consistent market growth

- These bearings rely on materials such as steel, tin-based alloys, chrome steel, and engineering plastics, which are subject to extreme price fluctuations in the global market

- This raw material cost instability impacts production expenses and can deter manufacturers from scaling operations, ultimately limiting broader market expansion, especially in price-sensitive regions

Plain Bearing Market Scope

The market is segmented on the basis of product, and end-use.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By End-Use |

|

Plain Bearing Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Plain Bearing Market”

- Asia-Pacific dominates the global Plain Bearing market, driven by rapid industrialization, expanding automotive production, and growing infrastructure development in emerging economies

- China, India, and Japan hold significant shares in the market due to their large-scale automotive, agricultural, and construction industries, coupled with rising middle-class demand and rapid urbanization

- The region’s well-established manufacturing base, coupled with increased demand for durable, energy-efficient components across industries, creates a favorable environment for the growth of the Plain Bearing market

- Furthermore, the presence of major automotive and industrial machinery manufacturers, strong government initiatives supporting infrastructure and industrial development, and rising demand for high-performance bearings continue to drive the expansion of the Plain Bearing market across Asia-Pacific

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Plain Bearing market, driven by rapid industrialization, increasing automotive production, and expanding infrastructure development

- Countries such as China, India, and Vietnam are emerging as key markets, propelled by growing industrial and automotive sectors, which require durable, low-friction, and energy-efficient bearings

- China, with its advanced manufacturing capabilities, large automotive sector, and focus on innovation, remains a pivotal market for high-performance plain bearings. The country continues to lead in adopting next-generation machinery and automotive technologies

- India, with its fast-growing automotive production, infrastructure development, and rising demand for machinery components, is experiencing increased investments in bearing solutions. The growing focus on energy efficiency and sustainability further accelerates market growth in the region

Plain Bearing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Altra Industrial Motion Corp. (U.S.)

- GGB (Germany)

- Igus (Germany)

- Minebea Intec GmbH (Germany)

- NSK Ltd. (Japan)

- NTN Corporation (Japan)

- PBC Linear (U.S.)

- RBC Bearings Incorporated (U.S.)

- SGL Group (Germany)

- SKF (Sweden)

- Schaeffler AG (Germany)

- THK CO., LTD. (Japan)

- Thomson Industries, Inc. (U.S.)

- Kashima Bearings, Inc. (Japan)

- THE TIMKEN COMPANY (U.S.)

- ZOLLERN GmbH & Co. KG (Germany)

Latest Developments in Global Plain Bearing Market

- In 2022, Schaeffler introduced an asymmetric spherical roller plain bearing for wind turbines at the WindEnergy Hamburg Show.

- In March 2021, SKF Group invested USD 44.3 million to expand and modernize its manufacturing facility in Airasca, Italy. This investment aims to enhance the production of super-precision bearings for industrial applications at the Group's largest manufacturing site in Italy.

- In December 2020, Timken Company acquired the assets of Aurora Bearing Company, a manufacturer of rod ends and spherical plain bearings. These bearings cater to a wide array of industrial sectors, including aerospace and defense, racing, off-highway equipment, and packaging.

- In August 2020, NTN Corporation began its first overseas mass production of precision bearings for machine tools at NTN Mettmann (Deutschland) GmbH, a subsidiary of NTN Kugellagerfabrik (Deutschland) GmbH, located in Germany.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plain Bearing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plain Bearing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plain Bearing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.