Global Plant Based Butter Market

Market Size in USD Billion

CAGR :

%

USD

1.67 Billion

USD

2.53 Billion

2025

2033

USD

1.67 Billion

USD

2.53 Billion

2025

2033

| 2026 –2033 | |

| USD 1.67 Billion | |

| USD 2.53 Billion | |

|

|

|

|

Plant-Based Butter Market Size

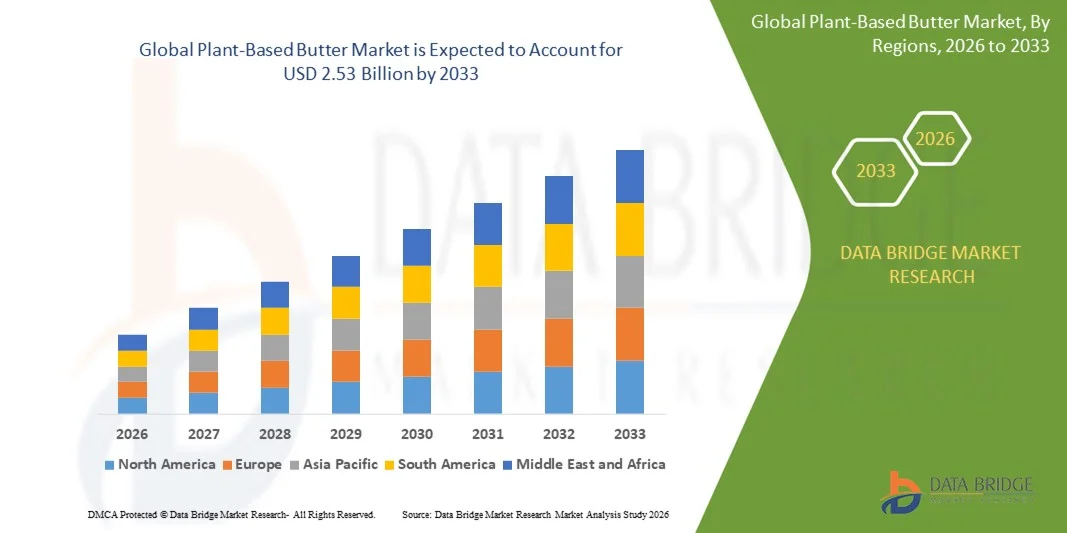

- The global plant-based butter market size was valued at USD 1.67 billion in 2025 and is expected to reach USD 2.53 billion by 2033, at a CAGR of 5.3% during the forecast period

- The market growth is largely driven by the rising shift toward plant-based and dairy-free diets, supported by increasing health awareness and concerns around lactose intolerance and cholesterol consumption

- Furthermore, growing consumer preference for clean-label, sustainable, and ethically sourced food products is positioning plant-based butter as a viable alternative to traditional dairy butter. These combined factors are accelerating product adoption across household, foodservice, and food manufacturing sectors, thereby significantly supporting overall market growth

Plant-Based Butter Market Analysis

- Plant-based butter, formulated using vegetable oils and plant-derived ingredients, has become an essential substitute in modern diets due to its compatibility with cooking, baking, and spreading applications while aligning with vegan and flexitarian preferences

- The expanding demand for plant-based butter is primarily fueled by increasing health consciousness, rising environmental concerns associated with dairy production, and continuous product innovation focused on improving taste, texture, and functional performance

- North America dominated the plant-based butter market with a share of 35.08% in 2025, due to strong adoption of plant-based diets, rising lactose intolerance, and growing awareness of dairy-free alternatives

- Asia-Pacific is expected to be the fastest growing region in the plant-based butter market during the forecast period due to rising urbanization, changing dietary habits, and increasing awareness of plant-based nutrition

- Conventional segment dominated the market with a market share of 85.73% in 2025, due to its wider availability, lower price point, and strong penetration across mass retail and foodservice channels. Manufacturers of conventional plant-based butter benefit from established supply chains and the ability to scale production efficiently, supporting consistent product availability. Consumers seeking dairy-free alternatives for everyday cooking and baking often prefer conventional variants due to affordability and familiar taste profiles. The segment also gains traction from its extensive use in processed foods and bakery applications. Strong brand presence and promotional activities across supermarkets further reinforce its leading position

Report Scope and Plant-Based Butter Market Segmentation

|

Attributes |

Plant-Based Butter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plant-Based Butter Market Trends

Premiumization of Plant-Based Butter Products

- A prominent trend in the plant-based butter market is the growing premiumization of products, driven by consumer demand for superior taste, texture, and clean-label formulations that closely replicate traditional dairy butter. This trend reflects a shift from basic dairy alternatives toward high-quality, performance-driven products suited for both everyday consumption and specialized culinary applications

- For instance, Miyoko’s Creamery has positioned its European-style plant-based butter as a premium offering by emphasizing cultured formulations and artisanal production methods that appeal to health-conscious and gourmet consumers. Such products are strengthening consumer confidence in plant-based butter as a direct substitute for dairy butter in baking and cooking

- The premium segment is also expanding through the use of advanced ingredients and processes that enhance functionality, including improved melting behavior and spreadability. Companies are focusing on elevating sensory attributes to meet expectations of both household consumers and professional chefs

- Foodservice and bakery sectors are increasingly adopting premium plant-based butter to maintain product quality while addressing vegan and flexitarian demand. This is contributing to wider acceptance of plant-based butter in high-end restaurants and specialty baked goods

- Retailers are supporting this trend by expanding shelf space for premium plant-based butter and promoting them as lifestyle and wellness products rather than niche alternatives. This positioning is reinforcing premium perception and driving higher value sales

- Overall, the premiumization trend is reshaping competitive dynamics by encouraging innovation, differentiation, and higher-margin product development, strengthening the long-term growth outlook of the plant-based butter market

Plant-Based Butter Market Dynamics

Driver

Rising Adoption of Plant-Based and Dairy-Free Diets

- The increasing adoption of plant-based and dairy-free diets is a primary driver of growth in the plant-based butter market, supported by rising awareness of health, environmental, and ethical concerns associated with animal-derived products. Consumers are actively seeking alternatives that align with vegan, flexitarian, and lactose-free dietary preferences

- For instance, Upfield has expanded its Flora Plant Butter portfolio across multiple regions to address growing demand from consumers transitioning away from dairy. The company’s focus on dairy-free formulations has helped accelerate mainstream adoption of plant-based butter

- Health considerations such as cholesterol reduction and improved heart health are further motivating consumers to replace conventional butter with plant-based alternatives. These products are increasingly perceived as better-for-you options suitable for regular consumption

- Environmental sustainability is also reinforcing this driver, as plant-based butter production is associated with lower carbon emissions and reduced resource use compared to dairy butter. This resonates strongly with environmentally conscious consumers

- As plant-based diets gain wider cultural acceptance, this driver is expected to remain a core force sustaining long-term expansion of the plant-based butter market

Restraint/Challenge

Taste and Texture Parity with Traditional Dairy Butter

- Achieving consistent taste and texture parity with traditional dairy butter remains a key challenge for the plant-based butter market, particularly for consumers accustomed to the sensory characteristics of conventional butter. Differences in mouthfeel, melting behavior, and flavor can limit repeat purchases

- For instance, early plant-based butter formulations faced criticism for poor performance in baking compared to dairy butter, prompting companies such as Bunge to invest in advanced fat structuring and formulation techniques through products such as Beleaf PlantBetter. These efforts highlight the complexity of matching dairy butter functionality

- Maintaining stability across varied applications such as lamination, frying, and spreading requires precise ingredient balance, which increases formulation difficulty. Variability in plant oil sources further complicates consistency

- Consumer expectations are especially high in regions with strong baking and culinary traditions, where minor performance gaps can influence brand perception. This places pressure on manufacturers to continuously refine product quality

- This challenge continues to influence competitive positioning within the market, making product innovation and sensory optimization critical to sustaining consumer trust and driving wider adoption

Plant-Based Butter Market Scope

The market is segmented on the basis of nature, source, application, and distribution channel.

- By Nature

On the basis of nature, the plant-based butter market is segmented into organic and conventional. The conventional segment dominated the market with the largest share of 85.73% in 2025, driven by its wider availability, lower price point, and strong penetration across mass retail and foodservice channels. Manufacturers of conventional plant-based butter benefit from established supply chains and the ability to scale production efficiently, supporting consistent product availability. Consumers seeking dairy-free alternatives for everyday cooking and baking often prefer conventional variants due to affordability and familiar taste profiles. The segment also gains traction from its extensive use in processed foods and bakery applications. Strong brand presence and promotional activities across supermarkets further reinforce its leading position.

The organic segment is expected to witness the fastest growth from 2026 to 2033, supported by rising consumer focus on clean-label, non-GMO, and pesticide-free food products. Increasing awareness around sustainability, health, and environmental impact is encouraging consumers to shift toward organic plant-based butter. Premium positioning and transparent sourcing practices enhance consumer trust in this segment. Growing demand from health-conscious households and specialty food retailers is accelerating adoption. Expansion of organic-certified production capacities is also supporting market growth.

- By Source

On the basis of source, the plant-based butter market is segmented into oat milk, rice milk, corn milk, soy milk, pea milk, almond milk, coconut milk, cashew milk, flax milk, hemp milk, and others. The coconut milk segment dominated the market in 2025 due to its high fat content, which closely mimics the texture and mouthfeel of traditional dairy butter. Coconut-based formulations offer superior spreadability and stability, making them suitable for cooking, baking, and frying applications. Their neutral-to-mild flavor profile supports wide culinary usage across cuisines. Strong consumer familiarity with coconut-derived products further strengthens demand. Foodservice operators also prefer coconut milk sources for consistent performance at high temperatures.

The oat milk segment is projected to grow at the fastest rate during the forecast period, driven by its sustainability credentials and rising popularity of oat-based dairy alternatives. Oat milk-based butter appeals to consumers seeking allergen-friendly options with lower environmental impact. Its smooth texture and mild taste enhance acceptance in both household and foodservice applications. Increasing innovation in oat processing technology is improving fat functionality and product quality. Rapid expansion of oat-based product portfolios by manufacturers is further accelerating growth.

- By Application

On the basis of application, the plant-based butter market is segmented into the food and beverage industry, foodservice industry, and household or retail. The household or retail segment accounted for the largest market share in 2025, supported by growing adoption of plant-based diets at the consumer level. Rising lactose intolerance and vegan lifestyle trends are encouraging regular household use of plant-based butter as a dairy substitute. Easy availability across supermarkets and online retail platforms supports frequent purchases. Product innovations in flavor, packaging, and fortified variants are also boosting retail demand. Marketing campaigns highlighting health and ethical benefits further strengthen this segment.

The foodservice industry segment is anticipated to register the fastest growth from 2026 to 2033, driven by increasing inclusion of plant-based options in restaurant and café menus. Foodservice operators are adopting plant-based butter to cater to vegan and flexitarian customers. Consistent performance in cooking and baking makes these products suitable for large-scale food preparation. Rising demand from quick-service restaurants and bakery chains supports volume growth. Expansion of plant-based menus across global foodservice brands is accelerating adoption.

- By Distribution Channel

On the basis of distribution channel, the plant-based butter market is segmented into business to business and business to consumer. The business to consumer segment dominated the market in 2025 due to strong sales through supermarkets, hypermarkets, specialty stores, and e-commerce platforms. Direct access to end consumers allows brands to build visibility and brand loyalty. Increasing preference for home cooking and baking with plant-based ingredients supports retail demand. Promotional strategies and private-label offerings further enhance consumer reach. Online platforms play a key role in expanding product accessibility across regions.

The business to business segment is expected to grow at the fastest pace during the forecast period, driven by rising demand from food manufacturers, bakeries, and foodservice operators. Bulk purchasing and long-term supply contracts support steady volume growth in this channel. Manufacturers increasingly partner with plant-based butter suppliers to reformulate products and meet clean-label requirements. Growing institutional adoption in hotels, restaurants, and catering services is accelerating demand. Expansion of commercial plant-based food production further supports this segment’s growth trajectory.

Plant-Based Butter Market Regional Analysis

- North America dominated the plant-based butter market with the largest revenue share of 35.08% in 2025, driven by strong adoption of plant-based diets, rising lactose intolerance, and growing awareness of dairy-free alternatives

- Consumers in the region actively seek clean-label, non-GMO, and cholesterol-free spreads, supporting sustained demand across household and foodservice applications

- This dominance is further reinforced by high disposable incomes, strong retail penetration, and continuous product innovation by leading plant-based food brands, positioning plant-based butter as a mainstream alternative

U.S. Plant-Based Butter Market Insight

The U.S. plant-based butter market accounted for the largest revenue share within North America in 2025, supported by widespread acceptance of vegan and flexitarian lifestyles. Consumers increasingly prefer plant-based butter for everyday cooking and baking due to health, ethical, and environmental considerations. Strong presence of established brands, extensive supermarket distribution, and rapid growth of private-label offerings continue to fuel market expansion. The rise of plant-based product launches and foodservice adoption further strengthens demand across the country.

Europe Plant-Based Butter Market Insight

The Europe plant-based butter market is projected to expand at a notable CAGR during the forecast period, driven by rising demand for sustainable and animal-free food products. Growing environmental awareness and supportive regulatory frameworks for plant-based foods are accelerating adoption. European consumers show strong preference for organic and clean-label formulations, supporting premium product sales. The market is witnessing steady growth across retail and foodservice sectors, particularly in bakery and spreads applications.

U.K. Plant-Based Butter Market Insight

The U.K. plant-based butter market is expected to grow at a significant CAGR over the forecast period, driven by increasing vegan population and strong consumer focus on sustainability. Rising dairy-free product availability across supermarkets and foodservice outlets is supporting market growth. Consumers are increasingly adopting plant-based butter as a direct replacement for traditional butter in daily consumption. The country’s well-developed retail infrastructure and strong plant-based brand presence further contribute to market expansion.

Germany Plant-Based Butter Market Insight

The Germany plant-based butter market is anticipated to witness considerable growth during the forecast period, supported by high consumer awareness of health and environmental benefits. Germany’s strong organic food culture and preference for sustainably sourced products favor plant-based butter adoption. Increasing demand from bakery and food manufacturing sectors is further driving growth. The market benefits from innovation focused on taste, texture, and natural ingredients aligned with local consumer expectations.

Asia-Pacific Plant-Based Butter Market Insight

The Asia-Pacific plant-based butter market is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising urbanization, changing dietary habits, and increasing awareness of plant-based nutrition. Growing middle-class populations and expanding retail networks are improving product accessibility across the region. Demand is increasing from both household consumption and foodservice sectors, particularly in metropolitan areas. Rapid growth of plant-based food startups is further accelerating market penetration.

Japan Plant-Based Butter Market Insight

The Japan plant-based butter market is gaining traction due to rising health consciousness and demand for low-cholesterol food alternatives. Consumers are increasingly incorporating plant-based spreads into traditional and Western-style diets. The market is supported by innovation in flavor and texture tailored to local preferences. Growing interest in sustainable food choices and convenience-oriented products is contributing to steady market growth.

China Plant-Based Butter Market Insight

The China plant-based butter market held the largest revenue share within Asia Pacific in 2025, driven by rapid urbanization and increasing adoption of plant-based foods. Rising awareness of lactose intolerance and health benefits is encouraging consumers to shift toward dairy-free alternatives. Expanding modern retail formats and e-commerce platforms are improving product availability. Strong domestic food manufacturers and increasing experimentation with Western-style baking further support market expansion.

Plant-Based Butter Market Share

The plant-based butter industry is primarily led by well-established companies, including:

- Conagra Foodservice, Inc. (U.S.)

- Upfield (Netherlands)

- Pure Blends (U.S.)

- Nutiva (U.S.)

- Jem Organics (U.S.)

- Yumbutter (U.S.)

- NOW Foods (U.S.)

- Prosperity Organic Foods, Inc. (U.S.)

- ForA Foods Co. (U.S.)

- Miyoko’s Creamery (U.S.)

- Wayfare (U.S.)

- Califia Farms, LLC (U.S.)

- Premier Organics (U.S.)

- Alpino Health Foods (India)

- Dhatuorganics.com (India)

- Halenda's Fine Foods Ltd (Canada)

- Daisya Fine Food (Japan)

- Ceres Organics (New Zealand)

- Kitchen Garden (India)

- Homecrop (India)

Latest Developments in Global Plant-Based Butter Market

- In May 2025, Dr. Foods Co. is expected to expand the distribution of its Vegan Truffle Butter across specialty gourmet stores in key European markets, strengthening the premium segment of the plant-based butter market. This move reflects rising consumer willingness to pay for high-end, flavor-forward plant-based alternatives and supports market diversification beyond mass retail. The expansion is likely to enhance brand visibility among affluent and niche consumer groups while reinforcing plant-based butter’s positioning in gourmet and specialty food categories

- In August 2024, Arla Foods launched its Lurpak Plant Based spread in the U.K. and Denmark, marking a significant step in mainstreaming plant-based butter through a well-established dairy brand. The launch leverages strong brand trust and existing distribution networks to accelerate consumer adoption of plant-based spreads. This development is expected to intensify competition and drive wider acceptance of plant-based butter among traditional dairy consumers

- In June 2024, Bunge introduced Beleaf PlantBetter in North America, targeting food manufacturers and professional bakers with a cost-stable, high-performance plant-based butter alternative. By closely matching the functional and sensory properties of premium dairy butter, the product addresses key barriers to adoption in commercial baking and food processing. Its cost savings and reduced price volatility are expected to support large-scale industrial adoption, strengthening plant-based butter penetration in B2B applications

- In October 2023, Wesson launched Wesson Plant Butter variants in select northeastern U.S. retailers, expanding its portfolio beyond cooking oils into plant-based dairy alternatives. The strong positive response from blind taste tests highlights growing consumer acceptance of plant-based butter in everyday household use. This launch supports market growth by attracting health-conscious consumers seeking familiar, trusted brands offering cholesterol-free and trans-fat-free alternatives

- In September 2023, Willicroft introduced a plant-based fermented butter developed using precision fermentation, signaling innovation-driven growth in the European plant-based butter market. By replicating the taste and functionality of high-end dairy butter with lower saturated fat content, the product raises quality benchmarks within the segment. This development is expected to encourage further R&D investments and accelerate the shift toward advanced fermentation-based plant-based butter solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plant Based Butter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plant Based Butter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plant Based Butter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.