Global Plant Based Food Packaging Market

Market Size in USD Billion

CAGR :

%

USD

11.68 Billion

USD

34.26 Billion

2024

2032

USD

11.68 Billion

USD

34.26 Billion

2024

2032

| 2025 –2032 | |

| USD 11.68 Billion | |

| USD 34.26 Billion | |

|

|

|

|

What is the Global Plant Based Food Packaging Market Size and Growth Rate?

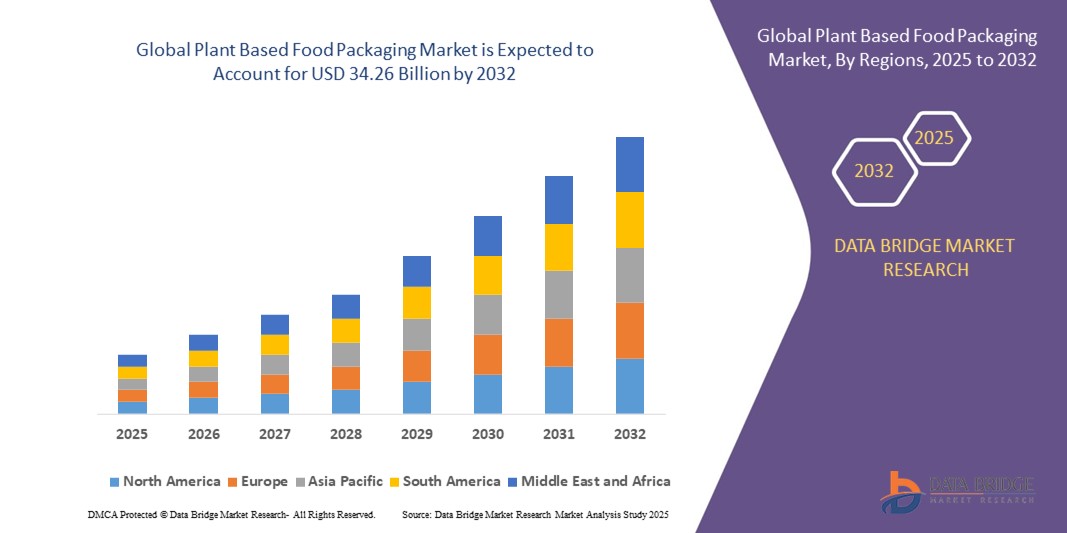

- The global plant-based food packaging market size was valued at USD 11.68 billion in 2024 and is expected to reach USD 34.26 billion by 2032, at a CAGR of 14.40% during the forecast period

- The global plant-based food packaging market is thriving due to increased consumer demand for eco-friendly solutions. This surge is driven by environmental concerns and a preference for healthier lifestyles. Regulations aiming to reduce plastic usage further boost this market

What are the Major Takeaways of Plant Based Food Packaging Market?

- Growing concerns about plastic pollution and environmental sustainability drive the demand for plant-based food packaging. Consumers and businesses are increasingly opting for eco-friendly packaging solutions to reduce their carbon footprint and minimize environmental impact

- Stringent regulations and policies aimed at reducing single-use plastics and promoting sustainable packaging solutions propel the growth of the plant-based food packaging market. Governments worldwide are implementing bans and restrictions on plastic packaging, creating opportunities for plant-based alternatives to gain traction in the market

- Europe dominated the plant-based food packaging market with the largest revenue share of 35.14% in 2024, driven by strong sustainability regulations, consumer preference for eco-friendly materials, and the circular economy push

- Asia-Pacific plant-based food packaging market is expected to grow at the fastest CAGR of 8.88% 2025 to 2032, driven by urbanization, rising disposable incomes, and growing awareness of sustainable consumption

- The Paper and Paperboard segment dominated the market with the largest revenue share of 58.6% in 2024, owing to its wide adoption in sustainable packaging solutions, cost-effectiveness, recyclability, and consumer preference for eco-friendly alternatives

Report Scope and Plant Based Food Packaging Market Segmentation

|

Attributes |

Plant Based Food Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plant Based Food Packaging Market?

Rising Adoption of Biodegradable and Compostable Materials

- A key and accelerating trend in the global plant based food packaging market is the increasing adoption of biodegradable and compostable packaging materials such as polylactic acid (PLA), bagasse, and starch blends, driven by stringent environmental regulations and consumer demand for eco-friendly alternatives

- For instance, Tetra Pak has introduced cartons made with renewable plant-based polymers derived from sugarcane, while Vegware offers fully compostable packaging widely adopted in foodservice industries across Europe and North America

- Plant-based packaging solutions are being positioned as sustainable replacements for single-use plastics, offering biodegradability without compromising food safety and shelf life

- The integration of innovative barrier technologies is enhancing the performance of plant-based packaging, enabling longer preservation and making it suitable for a wider range of food and beverage applications

- This trend is fundamentally reshaping the packaging industry, as sustainability becomes a key differentiator in consumer purchasing decisions

- With governments tightening plastic regulations and consumers actively choosing green alternatives, plant-based food packaging is expected to become a mainstream solution in the global packaging market

What are the Key Drivers of Plant Based Food Packaging Market?

- Increasing environmental concerns and government regulations on single-use plastics are accelerating the shift towards sustainable, plant-based alternatives

- For instance, in May 2024, Amcor launched a new range of recyclable and bio-based food packaging solutions made from renewable resources to support global decarbonization goals

- Growing consumer awareness of eco-friendly packaging and willingness to pay a premium for sustainable products is driving adoption across foodservice chains, supermarkets, and FMCG companies

- The rapid expansion of the ready-to-eat and takeaway food industry, particularly in urban markets, is boosting the demand for disposable, compostable plant-based packaging

- Technological advancements in biopolymer processing are enabling the production of durable and flexible plant-based packaging that rivals petroleum-based plastics in performance

- Collectively, these drivers are propelling the demand for plant-based packaging, making it an integral part of sustainability strategies for global food and beverage brands

Which Factor is Challenging the Growth of the Plant Based Food Packaging Market?

- Concerns surrounding the cybersecurity vulnerabilities of connected devices, including Plant One of the most significant challenges for the market is the higher production cost of plant-based packaging compared to conventional plastics, limiting affordability for small businesses and cost-sensitive consumers

- For instance, Vegware has faced criticism from foodservice operators about the higher cost of compostable packaging compared to standard plastic containers

- In addition, the lack of widespread industrial composting infrastructure in many regions creates difficulties in ensuring that plant-based packaging is disposed of correctly, undermining its environmental benefits

- Performance limitations, such as lower moisture and heat resistance, can also restrict plant-based packaging use in certain food applications, making innovation critical

- While large brands are increasingly adopting it to meet sustainability targets, small players often struggle with cost and supply chain accessibility

- Overcoming these barriers through scaling production, improving composting systems, and developing more durable bio-based materials will be crucial for wider market penetration

How is the Plant Based Food Packaging Market Segmented?

The market is segmented on the basis of material, application, and type.

- By Material

On the basis of material, the plant based food packaging market is segmented into Paper and Paperboard, Metal, and Glass. The Paper and Paperboard segment dominated the market with the largest revenue share of 58.6% in 2024, owing to its wide adoption in sustainable packaging solutions, cost-effectiveness, recyclability, and consumer preference for eco-friendly alternatives. The lightweight nature of paper packaging, coupled with regulatory restrictions on single-use plastics, has accelerated its demand in both retail and foodservice sectors.

The Glass segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its premium appeal, excellent barrier properties, and infinite recyclability without loss of quality. The rising demand for glass jars and bottles in premium beverages and specialty food categories further enhances growth. Overall, the material shift toward recyclable and biodegradable options underlines the market’s transition toward environmentally responsible packaging solutions.

- By Application

On the basis of application, the plant based food packaging market is segmented into Food and Beverages. The Food segment dominated the market with a revenue share of 64.1% in 2024, supported by the growing demand for sustainable packaging for ready-to-eat meals, bakery products, snacks, and fresh produce. The increasing adoption of compostable and biodegradable packaging by restaurants, quick-service chains, and online food delivery platforms has further accelerated growth in this segment. Consumers are increasingly associating eco-friendly packaging with healthier and safer food choices, boosting adoption.

The Beverage segment is projected to record the fastest CAGR from 2025 to 2032, owing to the rising shift toward recyclable cartons, biodegradable bottles, and reusable glass containers. The surge in plant-based beverages, including dairy alternatives and functional drinks, is also driving demand for innovative, eco-conscious pacSkaging. Beverage brands are focusing on reducing plastic footprints, thus creating strong growth prospects for sustainable packaging in the sector.

- By Type

On the basis of type, the plant based food packaging market is segmented into Recycled Content Packaging, Degradable Packaging, and Reusable Packaging. The Recycled Content Packaging segment dominated the market with the largest share of 46.7% in 2024, driven by strong government mandates promoting recycled materials, corporate sustainability goals, and consumer acceptance of recycled cartons, trays, and containers. The cost-effectiveness and ease of scaling recycled packaging across mass-market products further reinforce its dominance.

The Reusable Packaging segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the circular economy movement and innovations in refillable containers, returnable packaging models, and packaging-as-a-service initiatives. Growing adoption in urban areas, where consumers are more environmentally conscious and supportive of zero-waste lifestyles, contributes to growth. This trend reflects a broader industry shift from linear consumption models toward circular, resource-efficient solutions that reduce waste and carbon emissions.

Which Region Holds the Largest Share of the Plant Based Food Packaging Market?

- Europe dominated the plant based food packaging market with the largest revenue share of 35.14% in 2024, driven by strong sustainability regulations, consumer preference for eco-friendly materials, and the circular economy push

- Consumers in the region highly value biodegradable, recyclable, and compostable packaging solutions, especially in the food and beverage sector where sustainable choices are becoming a purchasing priority

- This widespread adoption is further supported by stringent government policies, high awareness of plastic pollution, and commitments from major brands to adopt plant-based packaging, positioning Europe as the global leader in this market

U.K. Plant Based Food Packaging Market Insight

The U.K. market is expanding rapidly, driven by government initiatives such as the Plastic Packaging Tax, which promotes the use of recycled and plant-based alternatives. Rising consumer concern over plastic pollution and strong demand for sustainable packaging in e-commerce and quick-service restaurants (QSRs) are key drivers. Moreover, collaborations between packaging innovators and food brands are accelerating the adoption of compostable films, bioplastics, and fiber-based solutions.

Germany Plant Based Food Packaging Market Insight

The Germany market is experiencing strong growth, supported by its eco-conscious consumers, robust recycling infrastructure, and advanced R&D in bio-based materials. Germany is a leader in innovation, with several companies pioneering plant-based plastics, molded fiber, and paper packaging solutions. The market is also supported by strict government targets for reducing single-use plastics and the preference of retailers and manufacturers for eco-label-certified packaging, further strengthening demand.

Which Region is the Fastest Growing Region in the Plant Based Food Packaging Market?

Asia-Pacific Plant Based Food Packaging market is expected to grow at the fastest CAGR of 8.88% 2025 to 2032, driven by urbanization, rising disposable incomes, and growing awareness of sustainable consumption. Government support for eco-friendly packaging solutions and bans on single-use plastics are further boosting adoption. As APAC is home to large-scale manufacturing hubs and biopolymer producers, affordability and availability are making plant-based packaging accessible to both local and international brands.

Japan Plant Based Food Packaging Market Insight

The Japan market is growing steadily, driven by the country’s technological innovation, high environmental standards, and demand for convenience in food packaging. Plant-based packaging adoption is gaining traction in the ready-to-eat meals, beverages, and retail food sectors. Japan’s aging population is also influencing demand for easy-to-handle, lightweight, and sustainable packaging, further supporting growth.

China Plant Based Food Packaging Market Insight

The China market accounted for the largest share in Asia-Pacific in 2024, fueled by its large middle class, rapid e-commerce expansion, and government bans on plastic packaging. Domestic companies are scaling up production of bioplastics, compostable films, and molded fiber packaging, making sustainable options cost-competitive. With growing investments in smart cities and green supply chains, China is emerging as a global leader in scalable plant-based packaging solutions.

Which are the Top Companies in Plant Based Food Packaging Market?

The plant based food packaging industry is primarily led by well-established companies, including:

- Tetra Pak (Switzerland)

- Vegware (U.K.)

- Plantic Technologies (Australia)

- TIPA Corp (Israel)

- Uflex Ltd (India)

- DuPont (U.S.)

- Innovia Films (U.K.)

- Huhtamaki Group (Finland)

- Amcor (Australia)

- Mondi Group (Austria)

- Be Green Packaging, Inc. (U.S.)

- Biopak Pty Ltd (Australia)

- Biomass Packaging (U.S.)

- Eco-Products, Inc. (U.S.)

- Daio Paper Construction (Japan)

- Gascogne Papier (France)

- Glatfelter Corporation (U.S.)

- Genpak LLC (U.S.)

- Green Pack (Australia)

- Nordic Paper AB (Sweden)

- PacknWood (France)

- Stora Enso Oyj (Finland)

- Sulapac Ltd (Finland)

What are the Recent Developments in Global Plant Based Food Packaging Market?

- In June 2024, Mondi partnered with traceless to adopt a plant-based coating and upscale its application within the paper industry, aiming to significantly reduce unnecessary plastic packaging waste. This initiative marks a major step toward sustainable packaging transformation across the global paper sector

- In June 2024, Xampla supplied its plant-based Morro Coating to Huhtamaki for takeaway packaging, under a multi-year supply deal involving Huhtamaki and 2M Group of Companies. This collaboration highlights a strong industry shift toward recyclable, compostable, and renewable packaging solutions

- In November 2023, Xampla collaborated with 2M Group of Companies to scale up production and distribution of its fully biodegradable plant-based Morro materials at the Milton Keynes site. This move is expected to accelerate the commercialization of eco-friendly packaging at a larger scale

- In August 2023, Clement Packaging introduced a patent-pending, sustainable packaging material that is free from additives such as plasticizers and hardeners, while being compatible with water, oils, and emulsions without requiring an inner lining. This innovation reinforces the shift toward clean and versatile packaging alternatives

- In March 2023, Tetra Pak launched an aseptic beverage carton featuring a paper-based barrier developed in collaboration with Lactogal, with 90% renewable content and a one-third lower carbon footprint. This carton, certified as Carbon Neutral by the Carbon Trust, is part of a 25 million package trial in Portugal, aiming for industrial-scale rollout by 2025

- In January 2023, Cascades Inc. unveiled a new closed basket made of recycled and recyclable corrugated cardboard for fresh produce packaging. This product strengthens Cascades’ commitment to sustainable packaging solutions in the food industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.