Global Plant Based Textile Yarn Market

Market Size in USD Billion

CAGR :

%

USD

12.40 Billion

USD

17.49 Billion

2024

2032

USD

12.40 Billion

USD

17.49 Billion

2024

2032

| 2025 –2032 | |

| USD 12.40 Billion | |

| USD 17.49 Billion | |

|

|

|

|

Plant-Based Textile Yarn Market Size

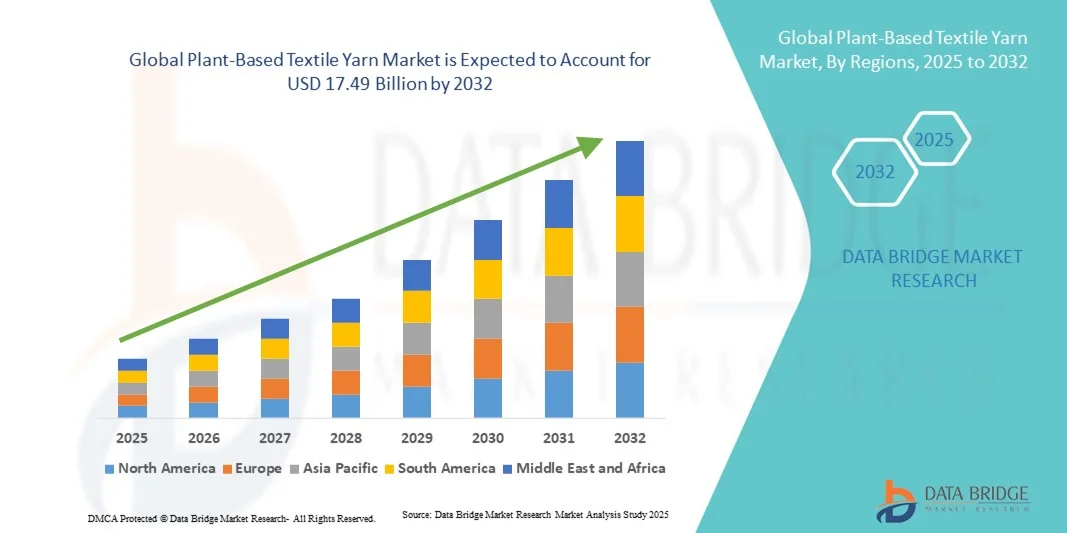

- The global plant-based textile yarn market size was valued at USD 12.4 billion in 2024 and is expected to reach USD 17.49 billion by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely fuelled by the increasing shift toward sustainable and eco-friendly materials, coupled with the rising consumer preference for organic and biodegradable textiles

- Growing environmental concerns and supportive government initiatives promoting green manufacturing practices are further accelerating the market expansion

Plant-Based Textile Yarn Market Analysis

- The plant-based textile yarn market is witnessing steady growth as industries increasingly adopt natural fibers such as cotton, linen, hemp, and bamboo for apparel, home furnishings, and industrial textiles

- The rising demand for sustainable fashion, coupled with advancements in yarn processing technology and bio-based fiber innovation, is enhancing product quality and broadening application areas within the textile sector

- North America dominated the plant-based textile yarn market with the largest revenue share in 2024, driven by a growing preference for sustainable and eco-friendly fabrics and strong demand from the fashion and home textile industries

- Asia-Pacific region is expected to witness the highest growth rate in the global plant-based textile yarn market, driven by rising industrialization, expanding apparel production, and growing investments in eco-friendly textile technologies across China, India, and Southeast Asia

- The natural yarn segment held the largest market revenue share in 2024, driven by the growing preference for eco-friendly and biodegradable materials such as cotton, hemp, jute, and flax. These yarns are widely used in apparel and home textiles due to their softness, breathability, and minimal environmental impact. The increasing adoption of sustainable practices by textile manufacturers and fashion brands further supports the dominance of this segment

Report Scope and Plant-Based Textile Yarn Market Segmentation

|

Attributes |

Plant-Based Textile Yarn Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plant-Based Textile Yarn Market Trends

Rising Popularity of Sustainable and Organic Fiber Materials

- The growing consumer preference for environmentally friendly and renewable materials is transforming the textile yarn industry. Plant-based yarns derived from sources such as cotton, hemp, jute, flax, and bamboo are increasingly replacing synthetic fibers due to their biodegradability and lower carbon footprint. This shift aligns with global sustainability goals and circular fashion initiatives. Moreover, the integration of eco-friendly materials into mainstream fashion reflects a major step toward decarbonizing textile supply chains and reducing environmental pollution across manufacturing stages

- The rise of ethical fashion brands and eco-conscious consumers is accelerating the adoption of plant-based textile yarns across apparel, home furnishing, and industrial textile applications. Manufacturers are investing in organic certifications and transparent sourcing to meet consumer expectations for sustainable production. The demand for naturally dyed, non-toxic fabrics is also increasing, pushing producers to enhance traceability and improve environmental performance throughout production

- The trend is further strengthened by government policies and corporate sustainability commitments promoting renewable raw materials and reduced microplastic pollution. This has created a robust demand for bio-based alternatives in global textile supply chains. Incentives for organic cotton cultivation and the reduction of petroleum-based fibers are also encouraging the establishment of new production facilities for sustainable textile yarns across developing economies

- For instance, in 2023, several European fashion houses launched collections using hemp and bamboo yarns to reduce dependency on polyester and nylon. These initiatives not only supported green branding but also improved fabric comfort and durability. Furthermore, the success of such collections has prompted international retailers to collaborate with eco-fiber manufacturers, expanding plant-based yarn distribution in premium and mass-market apparel segments

- While the demand for plant-based textile yarns is expanding rapidly, continued innovation in processing technology and scalability is essential to match the cost and performance of synthetic counterparts. Manufacturers must focus on optimizing fiber yield, quality consistency, and waste reduction to maintain competitiveness. Research and development efforts targeting hybrid blends and bio-engineered fibers are also gaining traction, offering improved elasticity, texture, and longevity for diverse applications

Plant-Based Textile Yarn Market Dynamics

Driver

Increasing Consumer Demand for Sustainable and Eco-Friendly Textiles

- The rising environmental awareness among consumers is a key driver for the plant-based textile yarn market. Shoppers are increasingly prioritizing products that are biodegradable, ethically sourced, and produced with minimal chemical usage. This is encouraging textile producers to transition toward natural and renewable yarn sources. The growing focus on reducing microplastic shedding from synthetic fibers further enhances consumer preference for natural alternatives

- The apparel and fashion industry is undergoing a major transformation, with brands committing to sustainable material sourcing and carbon neutrality targets. The use of plant-based fibers aligns perfectly with these goals, creating a strong market pull from both manufacturers and consumers. Luxury and fast-fashion companies alike are expanding eco-friendly collections to enhance brand image and comply with evolving environmental regulations

- Supportive regulatory frameworks and sustainability certifications such as GOTS (Global Organic Textile Standard) and OEKO-TEX are further promoting the adoption of plant-based yarns. These standards assure transparency and environmental responsibility across the textile value chain. Moreover, increasing retailer demand for certified yarns is motivating suppliers to adopt eco-labeling, fair-trade practices, and digital tracking systems to improve supply chain credibility

- For instance, in 2022, several global fashion brands announced initiatives to source 100% of their textile yarns from renewable and plant-based materials by 2030, driving industry-wide transformation. Such initiatives not only enhance brand sustainability profiles but also support rural economies through the cultivation of natural fiber crops. This long-term transition is expected to reduce dependency on petroleum-based materials, reshaping textile manufacturing worldwide

- While awareness and sustainability mandates are strengthening market adoption, challenges such as high raw material costs and limited large-scale processing capacity remain key areas for improvement. Expanding farmer education programs, improving fiber processing efficiency, and integrating sustainable logistics systems are vital to meeting global demand sustainably. Continuous innovation in low-impact dyeing and chemical-free finishing processes will further reinforce market growth

Restraint/Challenge

High Production Costs and Limited Processing Infrastructure

- Despite growing demand, the high cost of plant-based yarn production continues to restrict mass adoption. Factors such as lower fiber yield, complex extraction processes, and limited mechanization contribute to higher operational expenses compared to synthetic alternatives. In addition, producers face fluctuating input prices for organic fertilizers and water-intensive crops, impacting cost predictability and competitiveness in large-scale markets

- The scarcity of large-scale processing facilities for plant-based fibers poses another major constraint. Many regions lack modern infrastructure capable of handling diverse raw materials such as hemp or flax efficiently, leading to higher import dependency and longer lead times. This results in production bottlenecks and limits the scalability of eco-friendly yarn production for global distribution

- In addition, fluctuations in agricultural output due to weather conditions affect the availability and pricing of raw materials, creating supply chain instability. This unpredictability hampers consistent production and scalability for manufacturers targeting global markets. Moreover, dependence on smallholder farms without integrated contract farming systems further complicates material quality control and delivery timelines

- For instance, in 2023, several textile producers in Asia reported a temporary slowdown in hemp yarn output due to fiber shortages and increased raw material costs, impacting overall profitability. Similar disruptions in jute and flax supply chains have highlighted the vulnerability of plant-based textile industries to climatic variations. These challenges underscore the need for diversified sourcing and long-term supply chain resilience strategies

- While technological advancements and automation are gradually addressing these challenges, long-term success depends on improved agricultural practices, fiber processing innovation, and public–private investments in sustainable textile infrastructure. Expanding research into bio-composite processing, sustainable farming inputs, and waste valorization technologies can significantly reduce costs and enhance fiber yield efficiency. Governments and industry stakeholders must also collaborate to establish regional eco-industrial clusters that promote value chain integration and resource optimization

Plant-Based Textile Yarn Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the plant-based textile yarn market is segmented into natural yarn, artificial yarn, and others. The natural yarn segment held the largest market revenue share in 2024, driven by the growing preference for eco-friendly and biodegradable materials such as cotton, hemp, jute, and flax. These yarns are widely used in apparel and home textiles due to their softness, breathability, and minimal environmental impact. The increasing adoption of sustainable practices by textile manufacturers and fashion brands further supports the dominance of this segment.

The artificial yarn segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rising demand for semi-synthetic materials such as bamboo viscose and lyocell. These yarns combine the sustainability of natural sources with the enhanced strength and versatility of engineered fibers. The segment’s growth is also supported by innovations in bio-based polymers and closed-loop production technologies that reduce waste and water usage while maintaining high fabric quality.

- By Application

On the basis of application, the plant-based textile yarn market is segmented into apparel, home textile, industrial, and other applications. The apparel segment held the largest market share in 2024, attributed to the increasing consumer preference for sustainable clothing and the rise of eco-conscious fashion brands. Plant-based yarns are extensively used in producing casual wear, activewear, and luxury fabrics, as they offer comfort, durability, and environmental benefits. The segment’s growth is further enhanced by the global push toward ethical fashion and transparent supply chains.

The industrial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding applications of plant-based yarns in technical textiles, composites, and geotextiles. The shift toward natural reinforcement materials in construction, automotive, and packaging industries is creating new opportunities for bio-based yarn manufacturers. Furthermore, government initiatives promoting sustainable industrial materials and reduced dependency on synthetic fibers are accelerating adoption across multiple sectors.

Plant-Based Textile Yarn Market Regional Analysis

- North America dominated the plant-based textile yarn market with the largest revenue share in 2024, driven by a growing preference for sustainable and eco-friendly fabrics and strong demand from the fashion and home textile industries

- Consumers in the region increasingly favor natural and organic materials such as cotton, hemp, and flax due to their biodegradability and lower environmental impact compared to synthetic alternatives

- This growth is further supported by high consumer awareness, robust retail networks, and the presence of leading sustainable textile brands focusing on circular fashion and ethical sourcing practices

U.S. Plant-Based Textile Yarn Market Insight

The U.S. plant-based textile yarn market captured the largest revenue share in 2024 within North America, fuelled by rising consumer demand for sustainable apparel and government initiatives promoting green manufacturing. The rapid shift toward organic cotton and hemp-based textiles in both fashion and industrial applications has further strengthened the market. Moreover, the presence of major eco-conscious brands and continuous investment in research and development for innovative plant-based fibers are expected to sustain market leadership in the coming years.

Europe Plant-Based Textile Yarn Market Insight

The Europe plant-based textile yarn market is expected to witness strong growth from 2025 to 2032, primarily driven by strict sustainability regulations and growing consumer awareness about ethical production. The region’s established textile industry is transitioning toward renewable materials such as linen, jute, and bamboo yarns to comply with environmental directives. Furthermore, initiatives promoting circular fashion, waste reduction, and organic certification are accelerating the adoption of plant-based textile yarns across apparel and home furnishing sectors.

U.K. Plant-Based Textile Yarn Market Insight

The U.K. plant-based textile yarn market is expected to witness significant growth from 2025 to 2032, driven by increasing awareness of sustainable fashion and eco-friendly material sourcing. British textile manufacturers are actively investing in bio-based fibers and recycled plant materials to align with national carbon reduction goals. In addition, rising consumer preference for locally produced, ethically sourced clothing and home textiles is further propelling market expansion in the country.

Germany Plant-Based Textile Yarn Market Insight

The Germany plant-based textile yarn market is projected to register one of the fastest growth rates from 2025 to 2032, fuelled by strong innovation in green materials and advanced textile technology. Germany’s commitment to sustainability and resource efficiency is encouraging the widespread use of organic and recycled fibers in both industrial and fashion segments. The country’s robust textile manufacturing infrastructure, combined with increasing adoption of automation and eco-certification, is strengthening its position as a key hub for sustainable yarn production in Europe.

Asia-Pacific Plant-Based Textile Yarn Market Insight

The Asia-Pacific plant-based textile yarn market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing textile production, growing awareness of eco-friendly fabrics, and supportive government policies promoting sustainability. Countries such as China, India, and Japan are emerging as major producers and consumers of plant-based yarns, supported by expanding domestic textile industries and export-oriented growth strategies. The availability of raw materials, coupled with rising investment in green manufacturing facilities, is further enhancing regional market prospects.

Japan Plant-Based Textile Yarn Market Insight

The Japan plant-based textile yarn market is expected to witness steady growth from 2025 to 2032 due to the nation’s strong emphasis on innovation, quality, and sustainability. Japanese manufacturers are focusing on advanced processing technologies to produce high-performance natural and regenerated yarns with superior texture and durability. Moreover, rising consumer demand for eco-conscious fashion and home textiles, along with government initiatives promoting resource recycling and reduced waste, is driving the expansion of plant-based yarn applications in the country.

China Plant-Based Textile Yarn Market Insight

The China plant-based textile yarn market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by abundant raw material availability, large-scale textile production, and strong government support for sustainable development. China’s growing domestic fashion industry and rapid expansion of export-oriented textile manufacturing have accelerated the demand for cotton, bamboo, and hemp-based yarns. The rise of eco-friendly textile clusters and increasing international collaborations are further enhancing China’s dominance in the global plant-based textile yarn market.

Plant-Based Textile Yarn Market Share

The Plant-Based Textile Yarn industry is primarily led by well-established companies, including:

• Parkdale Mills, Inc. (U.S.)

• Vardhman Group (India)

• Huvis (South Korea)

• Grasim Industries Limited (India)

• Raymond Limited (India)

• Weiqiao Textile Company Limited (China)

• Toray Industries, Inc. (Japan)

• Bonar Yarns & Fabrics Ltd (U.K.)

• Thai Rayon Public Company Limited (Thailand)

• Aksa (Turkey)

• Asahi Kasei Corporation (Japan)

• Barnhardt Natural Fibers (U.S.)

• Celanese Corporation (U.S.)

• Far Eastern New Century Corporation (Taiwan)

• Formosa Taffeta Co., Ltd. (Taiwan)

• Indorama Ventures Public Company Limited (Thailand)

• FiberVisions, L.P. (U.S.)

• Kuraray Co., Ltd. (Japan)

• PT Polychem Indonesia Tbk (Indonesia)

• Reliance Industries Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.