Global Plant Extract Market

Market Size in USD Billion

CAGR :

%

USD

39.35 Billion

USD

67.41 Billion

2024

2032

USD

39.35 Billion

USD

67.41 Billion

2024

2032

| 2025 –2032 | |

| USD 39.35 Billion | |

| USD 67.41 Billion | |

|

|

|

|

What is the Global Plant Extract Market Size and Growth Rate?

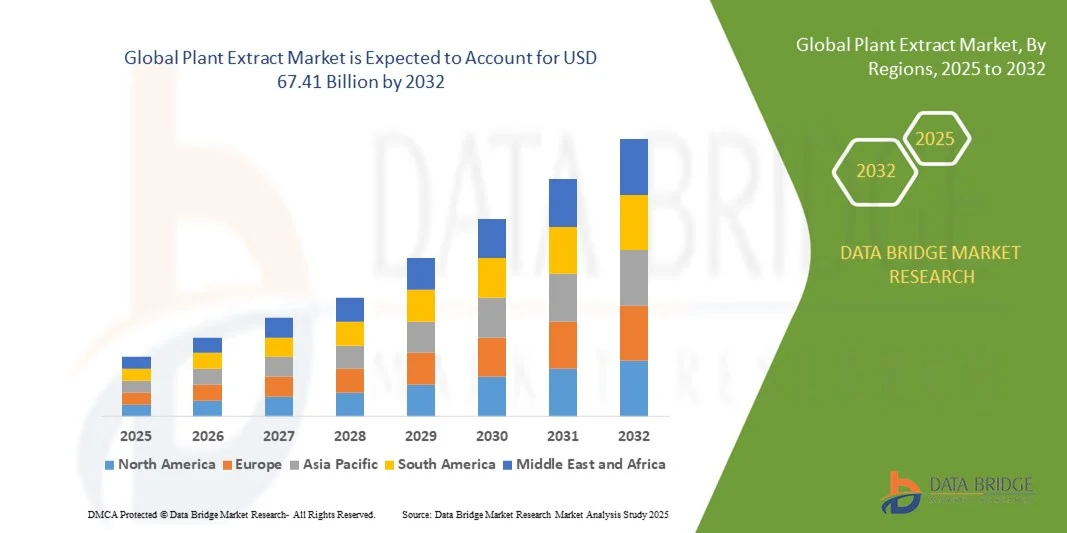

- The global plant extract market size was valued at USD 39.35 billion in 2024 and is expected to reach USD 67.41 billion by 2032, at a CAGR of 6.96% during the forecast period

- The major growing factor towards plant extract market is the rise in the demand for dietary food supplements. Furthermore, the rise in awareness about the benefits of the plant based food and food products and rapid urbanization are also expected to heighten the overall demand for plant extract market

What are the Major Takeaways of Plant Extract Market?

- The various adverse side-effects of synthetic flavors led to an increase in demand for natural favors along with the rise in the trend of veganism and vegetarianism among consumers are also expected to serve as foremost drivers for the plant extract market at a global level. In addition, the rise in the health and wellness trend led to a rise in demand for clean label products are also lifting the growth of the plant extract market

- However, the strict regulations and international quality standards and insufficient supply of raw materials and price fluctuation are projected to act as a restraint towards the growth of plant extract market, whereas the easy availability of substitutes and adulterated products can challenge the growth of the plant extract market

- Asia-Pacific dominated the global plant extract market with the largest revenue share of 42.58% in 2024, reflecting the region’s increasing focus on natural and herbal-based products across pharmaceuticals, cosmeceuticals, nutraceuticals, and functional foods

- North America is anticipated to be the fastest-growing region in the Plant Extract market, with a projected CAGR of 9.54% between 2025 and 2032, driven by rising consumer health consciousness, increasing adoption of natural supplements, and growing demand for clean-label products in food, beverages, and personal care

- The Phytomedicines and Herbal Extracts segment dominated the market with the largest revenue share of 38.5% in 2024, driven by strong demand for natural therapeutics, immunity boosters, and functional supplements

Report Scope and Plant Extract Market Segmentation

|

Attributes |

Plant Extract Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plant Extract Market?

Rising Adoption of Natural and Functional Ingredients

- A major trend in the global plant extract market is the increasing integration of plant-derived bioactive compounds into dietary supplements, functional foods, and beverages. This trend is being driven by growing consumer awareness of natural health solutions and preventive wellness

- For instance, manufacturers are incorporating plant extracts such as ginseng, turmeric, and green tea into nutraceuticals to improve immune support, enhance energy, and reduce inflammation. Products enriched with standardized extracts are gaining popularity due to their perceived efficacy and scientific validation

- Technological advancements in extraction processes, including supercritical CO₂, ultrasonic, and enzyme-assisted methods, are improving the purity and bioavailability of plant extracts, making them more suitable for use in functional applications

- The rise in demand for clean-label and natural products is prompting companies to focus on sustainable sourcing and eco-friendly extraction methods, aligning with consumer expectations for ethical and environmentally responsible ingredients

- This trend is reshaping product development strategies in the nutraceutical, food, and cosmetic sectors, leading companies such as Givaudan, Indesso, and Synthite to expand their plant extract portfolios with innovative and high-potency solutions

- The growing preference for plant-based functional ingredients is expected to continue driving market growth globally, particularly in health-conscious and aging populations

What are the Key Drivers of Plant Extract Market?

- The increasing consumer preference for natural, plant-based ingredients over synthetic alternatives is a major driver of the plant extract market. People are seeking preventive health solutions, immunity boosters, and functional foods to support overall wellness

- For instance, in 2024, several manufacturers introduced turmeric and kaempferol-based nutraceuticals targeting antioxidant and anti-inflammatory benefits. Such initiatives are expected to propel market expansion

- The rising prevalence of lifestyle-related diseases, such as diabetes, cardiovascular disorders, and obesity, is boosting demand for plant extracts with scientifically proven health benefits

- Furthermore, regulatory support and increasing investment in research for functional ingredients are facilitating innovation in high-quality plant extracts for use in pharmaceuticals, beverages, and food supplements

- Convenience and versatility in formulation, including ready-to-use liquid extracts, powders, and encapsulated forms, are contributing to wider adoption among manufacturers and end-users globally. The growing popularity of clean-label and fortified products further fuels market demand

Which Factor is Challenging the Growth of the Plant Extract Market?

- Quality standardization and consistency remain key challenges in the Plant Extract market, as variations in cultivation, extraction, and storage conditions can impact bioactive concentrations

- For instance, discrepancies in active compound levels have made some consumers and manufacturers cautious about efficacy claims, affecting market adoption

- High costs of premium extracts and advanced processing methods can limit affordability, particularly for small-scale manufacturers and price-sensitive markets. Companies such as Givaudan and Sensient Technologies emphasize quality control and traceability to overcome these concerns

- Counterfeit or adulterated products in certain regions pose additional challenges, as they can undermine consumer trust and affect brand reputation

- Addressing these challenges through robust quality assurance, regulatory compliance, and technological innovation is essential for sustained growth. The development of standardized, cost-effective, and high-potency plant extracts will be critical to meet global demand

How is the Plant Extract Market Segmented?

The market is segmented on the basis of type, source, form, method and application.

- By Type

On the basis of type, the plant extract market is segmented into Phytomedicines and Herbal Extracts, Essential Oils and Natural Extracts, Spices, Phytochemicals, Flavors and Fragrances, and Others. The Phytomedicines and Herbal Extracts segment dominated the market with the largest revenue share of 38.5% in 2024, driven by strong demand for natural therapeutics, immunity boosters, and functional supplements. Consumers and pharmaceutical companies prefer standardized herbal extracts for their proven efficacy and regulatory compliance. The Flavors and Fragrances segment is anticipated to witness the fastest growth at a CAGR of 22.3% from 2025 to 2032, fueled by rising consumer preference for natural ingredients in personal care, cosmetics, and food products. Manufacturers are increasingly formulating natural fragrance blends and flavoring agents, supporting innovation in clean-label and organic products. Overall, the type-based segmentation emphasizes the shift toward multifunctional and natural ingredients across pharmaceutical, food, and cosmetic industries.

- By Source

On the basis of source, the plant extract market is segmented into Leaves, Fruits, Flowers and Bulbs, Rhizomes and Roots, Barks and Stems, and Others. The Leaves segment dominated the market with the largest revenue share of 35% in 2024, owing to widespread use in herbal medicines, teas, and nutraceuticals. Leaves such as moringa, green tea, and basil are rich in bioactive compounds, driving adoption in functional applications. The Rhizomes and Roots segment is expected to register the fastest CAGR of 21% from 2025 to 2032, due to the growing demand for turmeric, ginger, and ginseng extracts in pharmaceuticals and dietary supplements. These sources are valued for their high concentration of phytochemicals and therapeutic properties. The segmentation by source highlights the importance of raw material selection in ensuring extract efficacy, quality, and consistency for end-use industries.

- By Form

On the basis of form, the plant extract market is segmented into Powder and Liquid forms. The Powder segment dominated the market with the largest revenue share of 57% in 2024, driven by longer shelf life, ease of handling, and suitability for food, supplement, and cosmetic formulations. Powders allow precise dosing and are compatible with capsules, tablets, and functional food products. The Liquid segment is expected to witness the fastest CAGR of 20% from 2025 to 2032, owing to its higher bioavailability, faster absorption, and convenience in beverage, cosmetic, and nutraceutical applications. The segmentation by form reflects manufacturers’ need to cater to diverse product applications while ensuring potency, stability, and consumer-friendly formats.

- By Method

On the basis of extraction method, the plant extract market is segmented into Maceration, Infusion, Decoction, Percolation, Soxhlet, Ultrasound-Assisted Extraction, Supercritical Fluid Extraction, Phytonics Process, Microwave Assisted Extraction, and Others. The Maceration segment dominated the market with the largest revenue share of 28% in 2024, as it is widely used for its simplicity and cost-effectiveness in extracting bioactive compounds from herbs and spices. The Ultrasound-Assisted Extraction segment is expected to register the fastest CAGR of 23% from 2025 to 2032, driven by higher efficiency, improved yield, and eco-friendly solvent usage. Advancements in modern extraction techniques are supporting the demand for high-purity, standardized plant extracts in pharmaceutical, cosmetic, and food applications, emphasizing innovation in sustainable and scalable processing methods.

- By Application

On the basis of application, the plant extract market is segmented into Pharmaceuticals, Cosmeceuticals, Food and Beverages, and Others. The Pharmaceuticals segment dominated the market with the largest revenue share of 42% in 2024, driven by increasing adoption of herbal medicines, nutraceuticals, and dietary supplements targeting immunity, metabolism, and chronic disease management. The Cosmeceuticals segment is expected to witness the fastest CAGR of 24% from 2025 to 2032, fueled by rising demand for natural and functional ingredients in skincare, haircare, and personal care products. The application-based segmentation underscores the expanding role of plant extracts across multiple industries, highlighting innovation, consumer awareness, and regulatory compliance as key growth enablers.

Which Region Holds the Largest Share of the Plant Extract Market?

- Asia-Pacific dominated the global plant extract market with the largest revenue share of 42.58% in 2024, reflecting the region’s increasing focus on natural and herbal-based products across pharmaceuticals, cosmeceuticals, nutraceuticals, and functional foods. The surge in health-conscious consumers, coupled with rising disposable incomes and urbanization, has significantly boosted demand for plant-based ingredients

- Countries such as China, Japan, and India are leading in production and consumption due to a rich tradition of herbal medicine, well-established agricultural supply chains, and government initiatives promoting natural healthcare solutions. The increasing investment in R&D for high-quality extraction techniques and standardization of plant extracts has further enhanced market growth

- In addition, consumer preference for eco-friendly, safe, and sustainable ingredients, along with the adoption of plant-based wellness products in functional foods and personal care items, is strengthening Asia-Pacific’s position as the dominant region. Local manufacturers are also expanding production capacity to meet both domestic and export demand, driving market expansion

China Plant Extract Market Insight

China’s plant extract market captured the largest revenue share in Asia-Pacific in 2024, primarily due to the rapidly growing middle-class population, increased health awareness, and preference for herbal medicines, dietary supplements, and natural cosmetics. The government has been actively supporting herbal healthcare through standardization initiatives, quality certifications, and investment in technologically advanced extraction facilities, ensuring high-quality, safe, and traceable products. Domestic manufacturers are increasingly adopting innovative extraction techniques to improve efficiency, yield, and bioactive compound retention, meeting global quality standards and export requirements. Rising e-commerce penetration and distribution networks have also made plant extracts more accessible to consumers. The surge in demand for functional foods, nutraceuticals, and cosmeceuticals in urban centers is boosting the commercial use of herbal and plant-based ingredients. Moreover, collaborations between research institutes and manufacturers are fostering product innovation, expanding the range of applications in pharmaceuticals, food and beverages, and personal care products, positioning China as a leading contributor to market growth in Asia-Pacific.

Japan Plant Extract Market Insight

The Japan plant extract market is experiencing steady growth driven by an aging population, high consumer awareness regarding natural and herbal ingredients, and a strong emphasis on quality and safety. Consumers are increasingly seeking plant-based solutions for healthcare, wellness, and cosmetic purposes, prioritizing efficacy, safety, and sustainability. Japan’s technologically advanced manufacturing infrastructure supports the production of high-quality extracts with precise standardization, ensuring consistency across products. The integration of traditional herbal knowledge with modern extraction technologies enhances product innovation in pharmaceuticals, nutraceuticals, and cosmeceuticals. Rapid urbanization and a growing preference for preventive healthcare are also supporting market expansion. Furthermore, rising exports of Japanese plant extracts to international markets are increasing, aided by strict adherence to regulatory compliance and certifications. The combined effect of domestic demand, aging demographics, and global export opportunities continues to make Japan a key contributor to the Asia-Pacific dominance in the Plant Extract market.

Which Region is the Fastest Growing Region in the Plant Extract Market?

North America is anticipated to be the fastest-growing region in the plant extract market, with a projected CAGR of 9.54% between 2025 and 2032, driven by rising consumer health consciousness, increasing adoption of natural supplements, and growing demand for clean-label products in food, beverages, and personal care. The U.S. leads this growth, fueled by expanding e-commerce platforms, increased accessibility to herbal and functional products, and heightened awareness of preventive healthcare and natural remedies. Consumers are demanding products with verified efficacy, organic certification, and transparency in sourcing, driving innovation and investment in high-quality plant extract formulations. In addition, companies are increasingly leveraging technological advancements in extraction, standardization, and formulation to enhance bioavailability and functional properties. The market is further supported by strong regulatory frameworks ensuring quality, safety, and labeling compliance. Combined with growing interest in alternative medicine and natural cosmetic products, North America represents the fastest-growing region, with substantial opportunities for both domestic and international players to expand their presence.

U.S. Plant Extract Market Insight

The U.S. plant extract market captured the largest revenue share within North America in 2024, fueled by increasing adoption of dietary supplements, herbal remedies, nutraceuticals, and cosmeceutical products. Consumers are actively seeking natural, safe, and effective plant-based solutions to maintain health, boost immunity, and address specific conditions. The rise of e-commerce and direct-to-consumer platforms has further made plant extracts accessible, supporting higher sales volumes. In addition, advancements in extraction technologies, such as supercritical fluid extraction and ultrasound-assisted techniques, are improving yield and preserving bioactive compounds, enhancing product quality. Strong investment in R&D for standardized and high-potency formulations has also stimulated growth. Rising collaborations between international suppliers and domestic manufacturers are expanding the range of plant extracts available in the market. With regulatory oversight ensuring product safety and efficacy, the U.S. market offers a robust environment for innovation, making it a key growth driver for North America’s Plant Extract sector.

Europe Plant Extract Market Insight

The Europe plant extract market is expected to experience moderate growth, supported by stringent regulatory frameworks, rising consumer demand for natural products, and increasing focus on sustainable sourcing practices. Countries such as Germany, France, and the U.K. are driving demand for plant-based ingredients in nutraceuticals, pharmaceuticals, cosmeceuticals, and functional foods. European consumers prioritize transparency, traceability, and quality, leading to the adoption of certified and standardized plant extracts. In addition, innovations in extraction and processing technologies are enabling high-quality, bioactive-rich formulations, which are increasingly used in preventive healthcare and personal care products. The trend toward eco-friendly and clean-label products further propels market adoption. Growing urbanization, health consciousness, and the expansion of retail and e-commerce networks provide additional opportunities for market players. Europe’s strong R&D ecosystem and regulatory focus ensure consistent product standards, supporting sustainable market growth across multiple applications.

U.K. & Germany Plant Extract Market Insight

In the U.K., rising consumer awareness regarding herbal wellness, dietary supplements, and natural cosmeceuticals is driving market adoption. E-commerce and retail channels are expanding accessibility, making plant extracts more widely available. Germany emphasizes high-quality, eco-conscious production methods and technologically advanced extraction processes, meeting the stringent demands of both domestic and international markets. The focus on traceability, standardization, and sustainability is creating a premium market segment for plant extracts. Together, these markets contribute to Europe’s steady growth while maintaining high standards for safety, efficacy, and environmental responsibility.

Which are the Top Companies in Plant Extract Market?

The plant extract industry is primarily led by well-established companies, including:

- Givaudan (Switzerland)

- Sensient Technologies Corporation (U.S.)

- Kangcare (China)

- Indesso (India)

- haldin (India)

- VIDYA HERBS (India)

- TOKIWA PHYTOCHEMICAL CO. LTD. (Japan)

- Native Extracts Pty Ltd. (Australia)

- Shaanxi Jiahe Phytochem Co., Ltd. (China)

- Synthite Industries Ltd. (India)

- Döhler (Germany)

- International Flavors & Fragrances, Inc. (U.S.)

- Martin Bauer Group (Germany)

- Arjuna Natural Pvt Ltd (India)

- Plant Extracts International Inc. (Canada)

- Network Nutrition (India)

- Lehmann&Voss&Co. (Germany)

- Alkaloids Corporation (India)

- Phyto Life Sciences P. Ltd. (India)

- Kuber Impex Ltd (India)

What are the Recent Developments in Global Plant Extract Market?

- In July 2022, Symrise launched Maison Lautier 1795, a naturals fragrance brand featuring its first three product lines, focusing on artisan, sustainably grown Mediterranean flowers and plants, expanding the company’s scent product portfolio and reinforcing its commitment to sustainability and premium natural ingredients

- In December 2021, ADM acquired Flavor Infusion International, S.A. (FISA), a leading provider of flavors and specialty ingredients in Latin America and the Caribbean, offering ADM new growth opportunities and enabling expansion of its market reach across the region, strengthening its global flavor and ingredient presence

- In November 2021, Sensient introduced Boundless, a line of chili-based extracts including Ancho Chili, Chipotle Chili, Green Jalapeno, Habanero Chili, and Red Jalapeno, enhancing the company’s flavors & extracts portfolio and addressing the rising demand for diverse and innovative flavor profiles worldwide

- In February 2021, International Flavors & Fragrances Inc. (IFF) completed the merger with DuPont’s N&B, a supplier of binders, plant-based proteins, and texturants, significantly expanding IFF’s revenue base and customer reach, while strengthening its capabilities for sustainable growth and diversified offerings

- In February 2021, Givaudan Taste & Wellbeing launched Advanced Tools for Modelling (ATOM), an AI-driven platform that optimizes food and flavor formulations, investigates ingredient synergies, and identifies key flavor drivers, supporting the company’s digitalization strategy and accelerating innovation to shorten time-to-market for new products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PLANT EXTRACT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL PLANT EXTRACT MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PLANT EXTRACT MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 IMPORT-EXPORT ANALYSIS

5.2 RAW MATERIAL PRICING ANALYSIS

5.3 PRODUCTION AND CONSUMPTION PATTERN

5.4 MARKETING STRATEGIES

5.5 BRAND ANALYSIS

5.6 COMPARITIVE ANALYSIS WITH PARENT MARKET

5.7 LIST OF SUBSTITUTES IN THE MARKET

5.8 DETAILS OF PLANT BASED EXTRACT MANUFACTURERS, BY TYPE OF EXTRACTION TECHNIQUE

6 REGULATORY FRAMEWORK & GUIDELINES

7 GLOBAL PLANT EXTRACT MARKET , BY TYPE

7.1 OVERVIEW

7.2 HERB EXTRACTS

7.2.1 HERB EXTRACTS, BY TYPE

7.2.1.1. GYMNEMA SYLVESTRE

7.2.1.2. BHUMI AMLA

7.2.1.3. GURMAR

7.2.1.4. BRAHMI

7.2.1.5. LICORICE

7.2.1.6. BASIL

7.2.1.7. SALACIA

7.2.1.8. FENUGREEK

7.2.1.9. RENNET

7.2.1.10. OTHERS

7.3 FRUIT EXTRACTS

7.3.1 FRUIT EXTRACT, BY TYPE

7.3.1.1. BERRIES

7.3.1.1.1. ACAI BERRY

7.3.1.1.2. STRAWBERRY

7.3.1.1.3. BLACKBERRY

7.3.1.1.4. OTHERS

7.3.1.2. ACEROLA

7.3.1.3. PLUM

7.3.1.4. PEACH

7.3.1.5. AVOCADO

7.3.1.6. EGGPLANT

7.3.1.7. OTHERS

7.4 EXOTIC EXTRACTS

7.4.1 EXOTIC EXTRACTS, BY TYPE

7.4.1.1. CAMU-CAMU

7.4.1.2. CUPUACU

7.4.1.3. WASAI

7.4.1.4. BURUTI

7.4.1.5. LAPACHO

7.4.1.6. SHAPUMVILLA

7.4.1.7. CANELLILA

7.4.1.8. OTHERS

7.5 SPICES

7.5.1 SPICES, BY TYPE

7.5.1.1. TURMERIC

7.5.1.2. BLACK PEPPER

7.5.1.3. SALVIA (SAGE)

7.5.1.4. GARLIC

7.5.1.5. CINNAMON

7.5.1.6. CARDAMOM

7.5.1.7. CURRY LEAF

7.5.1.8. MYROBALAN

7.5.1.9. GAMBIR

7.5.1.10. CORIANDER

7.5.1.11. OTHERS

7.6 FLOWER EXTRACTS

7.6.1 FLOWER EXTRACTS, BY TYPE

7.6.1.1. ROSEMARY

7.6.1.2. ORANGE BLOSSOMS

7.6.1.3. JASMINE

7.6.1.4. MALLOW

7.6.1.5. LAVENDER

7.6.1.6. BANABA

7.6.1.7. OTHERS

8 GLOBAL PLANT EXTRACT MARKET , BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

8.4 LEAF EXTRACT

8.5 CONCENTRATES

9 GLOBAL PLANT EXTRACT MARKET , BY EXTRACTION TECHNIQUE

9.1 OVERVIEW

9.2 SOLVENT EXTRACTION

9.3 SUBLIMATION

9.4 DISTILLATIONT

9.5 OTHERS

10 GLOBAL PLANT EXTRACT MARKET , BY APPLICATION

10.1 OVERVIEW

10.2 COLORANTS

10.3 FUNCTIONAL FOOD

10.4 ARTIFICAL SWEETNERS

10.5 NUTRACEUTICALS/MEDICAL APPLICATIONS

10.6 FLAVORS AND FRAGRANCES

10.7 PRESERVING AGENTS

10.8 EDIBLE/NON‐EDIBLE OILS

10.9 OTHERS

11 GLOBAL PLANT EXTRACT MARKET , BY END USER

11.1 OVERVIEW

11.2 FOOD & BEVERAGE INDUSTRY

11.2.1 FOOD & BEVERAGE INDUSTRY

11.2.1.1. BAKERY & CONFECTIONERY PRODUCTS

11.2.1.1.1. CHOCOLATES

11.2.1.1.2. BREAD

11.2.1.1.3. CAKE MIXES

11.2.1.1.4. BISCUITS & COOKIES

11.2.1.1.5. CANDIES

11.2.1.1.6. CHEW GUMS

11.2.1.1.7. OTHERS

11.2.1.2. DAIRY PRODUCTS

11.2.1.2.1. ICE-CREAM

11.2.1.2.2. MILK POWDER

11.2.1.2.3. CREAM POWDER

11.2.1.2.4. GRATED CHEESE

11.2.1.2.5. CHEESE CURD

11.2.1.2.6. OTHERS

11.2.1.3. SEASONING & SAUCES

11.2.1.4. SPORTS NUTRITION

11.2.1.5. INFANT FORMULA

11.2.1.6. BEVERAGES

11.2.1.6.1. FRUIT JUICES

11.2.1.6.2. FLAVOURED DRINKS

11.2.1.6.2.1 CHOCOLATE

11.2.1.6.2.2 VANILA

11.2.1.6.2.3 STRAWBERRY

11.2.1.6.2.4 MANGO

11.2.1.6.2.5 OTHERS

11.2.1.6.3. OTHERS

11.2.1.6.4. PROCESSED FOODS

11.2.1.6.5. COFFEE

11.2.1.6.6. COCOA

11.2.1.6.7. INSTANT SOUP POWDERS

11.2.1.7. OTHERS

11.3 OTHERS

11.4 ORAL CARE

11.5 PHARMACEUTICAL INDUSRTY

11.5.1 CARDIOVASCULAR DISEASES

11.5.2 WEIGHT MANAGEMENT

11.5.3 DIABETES

11.5.4 JOIN PAIN

11.5.5 METABOLIC ACTIVITY

11.5.6 OTHERS

11.6 NUTRACEUTICAL INDUSRTY

11.6.1 POWDER

11.6.2 TABLETS

11.6.3 LIQUID

11.7 COSMETICS & PERSONAL CARE

11.7.1 SKINCARE

11.7.1.1. SKIN CARE OIL

11.7.1.2. SERUM

11.7.1.3. LOTION & CREAM

11.7.1.4. OTHERS

11.7.2 HAIRCARE

11.7.2.1. SHAMPOO

11.7.2.2. CONDITIONER

11.7.2.3. HAIR OIL

11.7.2.4. HAIR SERUM

11.7.2.5. OTHERS

11.7.3 OTHERS

11.8 AROMA THERAPY

11.9 OTHERS

12 GLOBAL PLANT EXTRACT MARKET , BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

12.4 STORE-BASED RETAILING

12.4.1 CONVENIENCE STORES

12.4.2 SUPERMARKETS/HYPERMARKETS

12.4.3 SPECIALTY STORES

12.4.4 GROCERY STORES

12.4.5 WHOLESALERS

12.4.6 OTHERS

12.5 ONLINE RETAILING

13 GLOBAL PLANT EXTRACT MARKET , BY GEOGRAPHY

13.1 GLOBAL PLANT EXTRACT MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 ITALY

13.3.4 FRANCE

13.3.5 SPAIN

13.3.6 SWITZERLAND

13.3.7 NETHERLANDS

13.3.8 BELGIUM

13.3.9 RUSSIA

13.3.10 DENMARK

13.3.11 SWEDEN

13.3.12 POLAND

13.3.13 TURKEY

13.3.14 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 AUSTRALIA

13.4.6 SINGAPORE

13.4.7 THAILAND

13.4.8 INDONESIA

13.4.9 MALAYSIA

13.4.10 PHILIPPINES

13.4.11 NEW ZEALAND

13.4.12 VIETNAM

13.4.13 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 UAE

13.6.3 SAUDI ARABIA

13.6.4 OMAN

13.6.5 QATAR

13.6.6 KUWAIT

13.6.7 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL PLANT EXTRACT MARKET , COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14.6 MERGERS & ACQUISITIONS

14.7 NEW PRODUCT DEVELOPMENT & APPROVALS

14.8 EXPANSIONS & PARTNERSHIP

14.9 REGULATORY CHANGES

15 GLOBAL PLANT EXTRACT MARKET , SWOT & DBMR ANALYSIS

16 GLOBAL PLANT EXTRACT MARKET , COMPANY PROFILE

16.1 ADM WILD EUROPE GMBH & CO.KG

16.1.1 COMPANY OVERVIEW

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 GEOGRAPHIC PRESENCE

16.1.5 RECENT DEVELOPMENTS

16.2 IFF

16.2.1 COMPANY OVERVIEW

16.2.2 PRODUCT PORTFOLIO

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 RECENT DEVELOPMENTS

16.3 KALSEC INC

16.3.1 COMPANY OVERVIEW

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 GEOGRAPHIC PRESENCE

16.3.5 RECENT DEVELOPMENTS

16.4 DÖHLER GMBH

16.4.1 COMPANY OVERVIEW

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 GEOGRAPHIC PRESENCE

16.4.5 RECENT DEVELOPMENTS

16.5 NEXIRA

16.5.1 COMPANY OVERVIEW

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 GEOGRAPHIC PRESENCE

16.5.5 RECENT DEVELOPMENTS

16.6 HALDIN NATURAL

16.6.1 COMPANY OVERVIEW

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 GEOGRAPHIC PRESENCE

16.6.5 RECENT DEVELOPMENTS

16.7 SYNTHITE INDUSTRIES

16.7.1 COMPANY OVERVIEW

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 GEOGRAPHIC PRESENCE

16.7.5 RECENT DEVELOPMENTS

16.8 MB-HOLDING GMBH & CO. KG

16.8.1 COMPANY OVERVIEW

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 GEOGRAPHIC PRESENCE

16.8.5 RECENT DEVELOPMENTS

16.9 SYNERGY FLAVORS

16.9.1 COMPANY OVERVIEW

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 GEOGRAPHIC PRESENCE

16.9.5 RECENT DEVELOPMENTS

16.1 BLUE SKY BOTANICS

16.10.1 COMPANY OVERVIEW

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 GEOGRAPHIC PRESENCE

16.10.5 RECENT DEVELOPMENTS

16.11 FYTOSAN

16.11.1 COMPANY OVERVIEW

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 GEOGRAPHIC PRESENCE

16.11.5 RECENT DEVELOPMENTS

16.12 BI NUTRACEUTICALS

16.12.1 COMPANY OVERVIEW

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 GEOGRAPHIC PRESENCE

16.12.5 RECENT DEVELOPMENTS

16.13 PROVITAL GROUP

16.13.1 COMPANY OVERVIEW

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 GEOGRAPHIC PRESENCE

16.13.5 RECENT DEVELOPMENTS

16.14 INGREDION INCORPORATED

16.14.1 COMPANY OVERVIEW

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 GEOGRAPHIC PRESENCE

16.14.5 RECENT DEVELOPMENTS

16.15 TATE & LYLE

16.15.1 COMPANY OVERVIEW

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 GEOGRAPHIC PRESENCE

16.15.5 RECENT DEVELOPMENTS

16.16 BIO BOTANICA, INC..

16.16.1 COMPANY OVERVIEW

16.16.2 PRODUCT PORTFOLIO

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 RECENT DEVELOPMENTS

16.17 BIO-GEN EXTRACTS PRIVATE LIMITED

16.17.1 COMPANY OVERVIEW

16.17.2 PRODUCT PORTFOLIO

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 RECENT DEVELOPMENTS

16.18 PHYTONEERING EXTRACT SOLUTIONS

16.18.1 COMPANY OVERVIEW

16.18.2 PRODUCT PORTFOLIO

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 RECENT DEVELOPMENTS

16.19 PLANTNAT NATURAL INGREDIENTS INC

16.19.1 COMPANY OVERVIEW

16.19.2 PRODUCT PORTFOLIO

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 RECENT DEVELOPMENTS

16.2 BIO-MED INGREDIENTS

16.20.1 COMPANY OVERVIEW

16.20.2 PRODUCT PORTFOLIO

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 RECENT DEVELOPMENTS

16.21 SENSIENT TECHNOLOGIES

16.21.1 COMPANY OVERVIEW

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 GEOGRAPHIC PRESENCE

16.21.5 RECENT DEVELOPMENTS

16.22 GIVAUDAN.

16.22.1 COMPANY OVERVIEW

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 GEOGRAPHIC PRESENCE

16.22.5 RECENT DEVELOPMENTS

16.23 NATIVE EXTRACTS PTY. LTD.

16.23.1 COMPANY OVERVIEW

16.23.2 PRODUCT PORTFOLIO

16.23.3 GEOGRAPHIC PRESENCE

16.23.4 RECENT DEVELOPMENTS

16.24 SYMRISE AG

16.24.1 COMPANY OVERVIEW

16.24.2 PRODUCT PORTFOLIO

16.24.3 GEOGRAPHIC PRESENCE

16.24.4 RECENT DEVELOPMENTS

16.25 KANGCARE BIOINDUSTRY CO., LTD.

16.25.1 COMPANY OVERVIEW

16.25.2 PRODUCT PORTFOLIO

16.25.3 GEOGRAPHIC PRESENCE

16.25.4 RECENT DEVELOPMENTS

NOTE: THE LIST OF COMPANIES IS A TENTATIVE AND THIS CAN BE MODIFIED ACCORDING TO THE CLIENT’S REQUEST AND SUGGESTION.

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Plant Extract Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plant Extract Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plant Extract Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.