Global Plant Growth Regulators Market

Market Size in USD Billion

CAGR :

%

USD

4.50 Billion

USD

11.20 Billion

2024

2032

USD

4.50 Billion

USD

11.20 Billion

2024

2032

| 2025 –2032 | |

| USD 4.50 Billion | |

| USD 11.20 Billion | |

|

|

|

|

Plant Growth Regulators Market Size

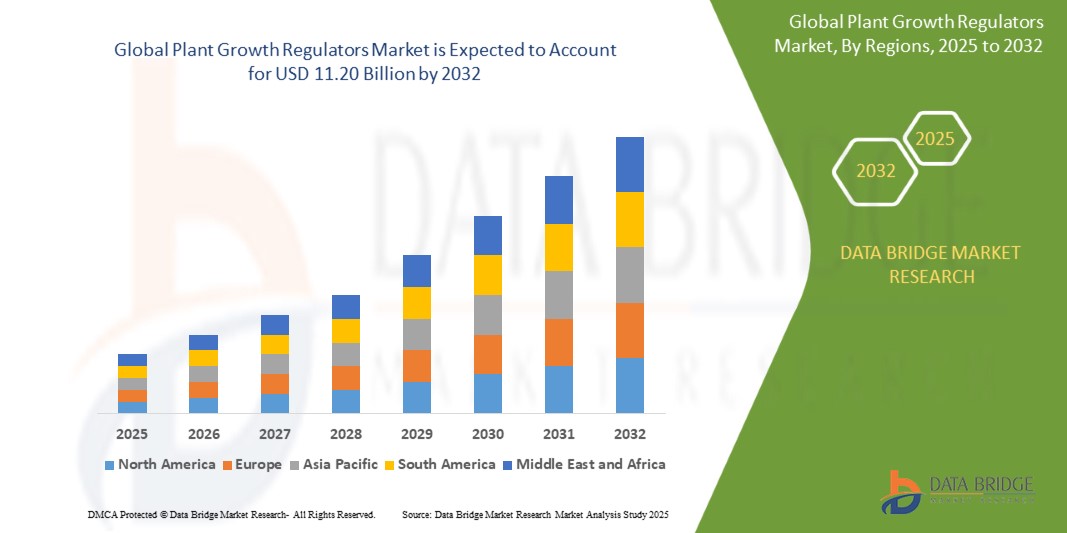

- The Global Plant Growth Regulators Market size was valued at USD 4.50 Billion in 2024 and is expected to reach USD 11.20 Billion by 2032, at a CAGR of 10.9% during the forecast period

- The Plant Growth Regulators Market growth is primarily driven by the increasing global demand for sustainable agriculture practices and higher crop yields, as farmers and agribusinesses seek efficient solutions to enhance plant growth, stress tolerance, and crop quality across both developed and emerging regions.

- Moreover, rising awareness about the environmental impact of synthetic agrochemicals and the growing adoption of eco-friendly and precision farming techniques are accelerating the use of bio-based and novel plant growth regulators. These converging factors are fostering innovation in formulation technologies, expanding applications across various crops, and driving the shift toward more sustainable and productivity-enhancing agricultural inputs, collectively propelling the Plant Growth Regulators Market forward

Plant Growth Regulators Market Analysis

- Plant Growth Regulators (PGRs), crucial for optimizing plant development and crop productivity, are witnessing increased adoption across agriculture and horticulture sectors due to their ability to modulate physiological processes such as flowering, fruiting, and stress resistance

- The growing global focus on sustainable agriculture, coupled with the need to improve crop yields and quality amid climate challenges, is driving demand for effective PGR solutions that enhance plant growth while reducing dependency on chemical fertilizers and pesticides

- North America dominates the Plant Growth Regulators Market with the largest revenue share of 38.01% in 2024, supported by advanced agricultural practices, high adoption rates of innovative crop management technologies, and the presence of leading agrochemical companies investing heavily in R&D. The U.S. leads the region, propelled by increasing demand for high-value crops and sustainable farming solutions

- Asia-Pacific is projected to be the fastest-growing region in the Plant Growth Regulators Market during the forecast period, driven by rapid agricultural modernization, government initiatives promoting crop productivity, and expanding cultivation of fruits, vegetables, and commercial crops in countries such as China, India, and Japan

- Among product types, synthetic plant growth regulators hold a significant market share of 42.5% in 2024, due to their widespread availability, cost-effectiveness, and broad-spectrum applicability across various crop types, while bio-based and natural PGRs are gaining traction for their eco-friendly and sustainable attributes

Report Scope and Plant Growth Regulators Market Segmentation

|

Attributes |

Plant Growth Regulators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plant Growth Regulators Market Trends

“Technological Advancements and Precision Agriculture Integration in Plant Growth Regulators”

- A prominent and growing trend in the Global Plant Growth Regulators Market is the adoption of advanced formulation technologies and precision agriculture tools to enhance crop yield, stress tolerance, and nutrient efficiency. These innovations are driving more targeted, efficient, and environmentally sustainable plant growth solutions

- Leading companies such as BASF and Syngenta are leveraging biotechnology and nano-formulations to develop plant growth regulators that offer improved stability, controlled release, and higher bioavailability, enabling better crop management under diverse climatic conditions

- Integration of digital farming technologies, including drones, IoT sensors, and AI-powered analytics, is facilitating real-time monitoring of crop health and precise application of growth regulators. This data-driven approach reduces chemical use and enhances the effectiveness of plant growth regulators

- Additionally, there is rising demand for bio-based and natural plant growth regulators derived from microbial and plant extracts, aligning with the increasing consumer preference for organic and sustainable agricultural inputs

- The market is also witnessing innovation in combination products that integrate plant growth regulators with fertilizers and crop protection agents, simplifying application processes and improving overall crop performance

- This shift toward technologically advanced, eco-friendly, and precision-enabled plant growth regulators is transforming agricultural practices globally. Companies investing in R&D to develop integrated digital and biological solutions are set to gain a competitive edge in the evolving agri-tech landscape

Plant Growth Regulators Market Dynamics

Driver

“Rising Demand Driven by Precision Agriculture, Sustainable Crop Production, and Technological Innovation”

- The growing global emphasis on sustainable agriculture, increased crop productivity, and environmental stewardship is a major driver propelling the Plant Growth Regulators Market. Farmers and agribusinesses are prioritizing solutions that improve yield, enhance stress tolerance, and reduce chemical inputs, aligning with global food security goals

- For example, in January 2025, Syngenta introduced a new range of bio-based plant growth regulators formulated with enhanced nutrient uptake properties and stress resilience, reflecting the market’s focus on eco-friendly and effective crop management solutions

- Increasing adoption of precision agriculture technologies, such as drone-based spraying and sensor-driven monitoring, is enabling the targeted application of plant growth regulators, reducing wastage and improving efficacy across diverse cropping systems

- The rise in demand for organic and sustainable farming practices is fueling interest in natural and microbial-derived growth regulators, which offer safer alternatives to synthetic chemicals while supporting soil health and biodiversity

- Additionally, advancements in formulation science, including controlled-release and combination products that integrate growth regulators with fertilizers and pesticides, are simplifying agricultural inputs management and improving overall crop performance

- This alignment of environmental sustainability, technological innovation, and enhanced agricultural productivity is accelerating market growth and encouraging continuous product development, particularly in emerging economies with expanding agrarian sectors

Restraint/Challenge

“High Capital Investment and Regulatory Challenges in Key Markets”

- The relatively high capital expenditure required for acquiring advanced plant growth regulator technologies and equipment, particularly those designed for large-scale agricultural and biopharmaceutical applications, poses a significant barrier to market entry and expansion, especially for small and medium-sized enterprises in cost-sensitive regions. These systems often incorporate sophisticated automation, precise formulation controls, and durable materials, contributing to elevated production and maintenance costs

- For example, premium plant growth regulator solutions and delivery systems from leading manufacturers such as Syngenta and Bayer can involve substantial upfront investments, limiting accessibility for smaller agribusinesses and emerging market players who may rely on less advanced or manual alternatives

- In mature markets such as North America and Europe, stringent regulatory frameworks and complex approval processes increase the time and expense involved in product registration and commercialization, thereby slowing new market penetration and upgrades. Compliance with agencies like the EPA, EFSA, and other local regulatory bodies demands rigorous testing, documentation, and process consistency, which can deter rapid adoption

- Furthermore, market saturation in these developed regions—with well-established players and advanced technology penetration—restricts growth opportunities, forcing companies to compete heavily on innovation and pricing strategies, which can compress profit margins

- Addressing these challenges requires innovation in cost-effective, modular application technologies, enhanced regulatory support services, and strategic partnerships that lower entry barriers for emerging businesses while expanding adoption in developing markets with growing agricultural modernization and sustainability initiatives

Plant Growth Regulators Market Scope

The market is segmented on the basis of type, process, mode of operation, material type and Material type.

- By Type

On the basis of product type, the Plant Growth Regulators Market is segmented into Auxins, Cytokinins, Gibberellins, Ethylene, and Others.

The Auxins segment dominates the market with the largest revenue share of 31.2% in 2024, driven by its extensive application in stimulating root growth, enhancing fruit development, and regulating plant growth cycles across various crops. Auxins are widely preferred due to their effectiveness in improving crop yield and quality, making them essential in both commercial agriculture and horticulture

- By Crop Type

On the basis of crop type, the Plant Growth Regulators Market is segmented into Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Turf and Ornamentals

The Cereals and Grains segment dominates the market with the largest revenue share of 34.5% in 2024, driven by the high global demand for staple crops like wheat, rice, and maize. Plant growth regulators are extensively used in this segment to enhance crop yield, improve stress tolerance, and regulate growth cycles, making them vital for ensuring food security and supporting large-scale agricultural production

- By Formulation

On the basis of formulation, the Plant Growth Regulators Market is segmented into Water-Dispersible and Water-Soluble Granules, Wettable Powders, and Solutions

The Water-Dispersible and Water-Soluble Granules segment dominates the market with the largest revenue share of 31.2% in 2024, attributed to their ease of handling, efficient dispersion in water, and enhanced bioavailability. These formulations are widely preferred by farmers and manufacturers for their effective application, improved stability, and compatibility with modern spraying equipment, making them ideal for large-scale agricultural practices

- By Function

On the basis of function, the Plant Growth Regulators Market is segmented into Promoters and Inhibitors

The Promoters segment dominates the market with the largest revenue share of 65.4% in 2024, driven by their extensive application in enhancing crop growth, increasing yield, and improving resistance to environmental stresses. Promoters are widely adopted across various agricultural sectors due to their ability to stimulate vital physiological processes such as cell division, elongation, and flowering, making them essential for maximizing productivity and crop quality

Plant Growth Regulators Market Regional Analysis

- North America dominates the Plant Growth Regulators Market with the largest revenue share of 39.01% in 2024, driven by increasing demand for precision biomanufacturing, high-value biologics, and fermented food and beverage products. The region benefits from well-established biotech and pharmaceutical sectors, extensive R&D investments, and a high concentration of major market players with advanced fermentation infrastructure

- Manufacturers in North America are focusing on automation, scale-up capabilities, and compliance with regulatory standards such as FDA and cGMP, which strengthens their competitive edge. The rise in health-conscious consumers, coupled with growing innovation in plant-based and probiotic-rich foods, further boosts fermenter deployment across the region

U.S. Plant Growth Regulators Market Insight

The U.S. Plant Growth Regulators Market captured the largest revenue share of 80% in North America in 2024, driven by expanding applications in biopharmaceuticals, personalized medicine, and functional foods. Increasing government and private sector investment in biotech innovation, alongside a growing demand for clean-label and organic food products, are key growth drivers

Europe Plant Growth Regulators Market Insight

The Europe Plant Growth Regulators Market is projected to expand at a substantial CAGR throughout the forecast period, supported by growing demand for sustainable food production, precision fermentation, and industrial biotech applications. Rising consumer preference for fermented dairy alternatives, meat substitutes, and health supplements is fostering rapid adoption

U.K. Plant Growth Regulators Market Insight

The U.K. Plant Growth Regulators Market is anticipated to grow at a noteworthy CAGR, driven by the increasing development of bio-based products and next-generation pharmaceuticals. Supportive regulatory frameworks and academic-industry collaborations are stimulating innovation in fermentation technology

Germany Plant Growth Regulators Market Insight

The Germany Plant Growth Regulators Market is expected to expand at a considerable CAGR, fueled by a strong manufacturing sector, innovation in green technologies, and a robust demand for pharmaceutical and nutritional products

Asia-Pacific Plant Growth Regulators Market Insight

The Asia-Pacific Plant Growth Regulators Market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, increasing health awareness, and a surge in demand for plant-based and probiotic foods across countries like China, India, Japan, and Australia.

Rising biotech investments, government incentives for pharmaceutical manufacturing, and strong growth in fermented beverage consumption are major factors propelling the market. Local manufacturers are increasingly developing cost-effective and modular fermenters to meet regional production demands

Japan Plant Growth Regulators Market Insight

The Japan Plant Growth Regulators Market is gaining momentum due to the country’s leadership in high-tech manufacturing and growing interest in clean-label, fermented health foods. Japan’s aging population is creating demand for functional, gut-health-focused products, while its advanced pharma sector drives the use of precision fermentation

China Plant Growth Regulators Market Insight

The China Plant Growth Regulators Market accounted for the largest revenue share in Asia-Pacific in 2024, supported by large-scale investments in biopharma, nutraceuticals, and alternative proteins. Rapid industrialization, strong government support for domestic biotech, and a growing middle-class consumer base fuel demand

Plant Growth Regulators Market Share

The smart lock industry is primarily led by well-established companies, including:

- Syngenta AG (Switzerland)

- BASF SE (Germany)

- Valent BioSciences Corporation (U.S.)

- Arysta LifeScience Corporation (Japan)

- UPL Limited (India)

- Adama Agricultural Solutions Ltd. (Israel)

- Helena Agri-Enterprises, LLC (U.S.)

- Corteva Agriscience (U.S.)

- Nufarm Limited (Australia)

- Kingenta Ecological Engineering Group Co., Ltd. (China)

- De Sangosse (France)

- ICL Group Ltd. (Israel)

- Biostadt India Limited (India)

- Sharda Cropchem Ltd. (India)

- Valagro S.p.A. (Italy)

- Clariant AG (Switzerland)

- Kemira Oyj (Finland)

- Acadian Seaplants Limited (Canada)

- Plant Health Care, Inc. (U.S.)

Latest Developments in Global Plant Growth Regulators Market

- In April 2025, BASF SE, a global leader in agricultural solutions, launched a new line of bio-based Plant Growth Regulators (PGRs) designed to enhance crop resilience and yield under climate stress conditions. The innovative formulations leverage natural plant extracts and biostimulants to promote sustainable farming practices, reflecting growing demand for eco-friendly crop management products

- In March 2025, Syngenta AG announced the commercial release of its next-generation synthetic auxin PGRs featuring improved efficacy and environmental safety profiles. This launch targets major cereal and grain producers across North America and Asia-Pacific, aiming to optimize crop growth cycles and improve harvest quality

- In February 2025, UPL Limited expanded its portfolio with the introduction of a water-soluble gibberellin formulation designed for precision foliar application. The product caters to high-value fruit and vegetable growers seeking enhanced fruit size and uniformity while reducing chemical usage, aligning with sustainable agriculture trends

- In January 2025, Corteva Agriscience entered a strategic partnership with several research institutions in Europe to develop next-generation cytokinin-based PGRs with enhanced stress tolerance traits. This collaboration aims to accelerate innovation and meet rising demand for climate-resilient crop inputs in the region

- In January 2025, Adama Agricultural Solutions launched a comprehensive range of wettable powder PGR formulations tailored for oilseeds and pulses, improving ease of application and compatibility with integrated pest management programs. This product line expansion supports Adama’s goal to increase market share in emerging agricultural economies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.