Global Plant Sensor Market

Market Size in USD Million

CAGR :

%

USD

874.11 Million

USD

2,045.11 Million

2024

2032

USD

874.11 Million

USD

2,045.11 Million

2024

2032

| 2025 –2032 | |

| USD 874.11 Million | |

| USD 2,045.11 Million | |

|

|

|

|

Plant Sensor Market Size

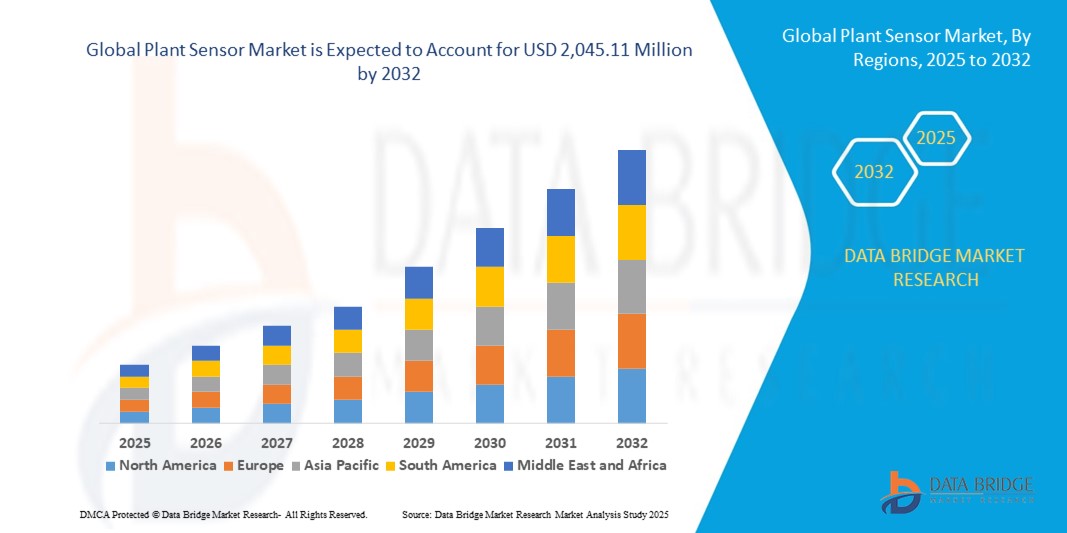

- The global plant sensor market size was valued at USD 874.11 million in 2024 and is expected to reach USD 2,045.11 million by 2032, at a CAGR of 11.21% during the forecast period

- The market growth is largely fuelled by the rising adoption of smart farming technologies, increasing demand for precision agriculture, and growing need for real-time monitoring of crops and soil conditions

- Growing awareness among farmers about data-driven decision-making and its role in enhancing crop yield and profitability is further boosting the demand for plant sensors

Plant Sensor Market Analysis

- The plant sensor market is experiencing strong growth, supported by advancements in IoT and AI-based agricultural solutions that enable farmers to optimize productivity and resource efficiency

- Increasing focus on sustainable farming practices and reducing water and fertilizer wastage is driving the adoption of plant sensors in modern agriculture

- North America dominated the global plant sensor market with the largest revenue share of 38.5% in 2024, driven by the widespread adoption of precision agriculture and smart farming technologies. The region benefits from strong infrastructure, advanced research in agri-tech, and government initiatives promoting sustainable farming practices

- Asia-Pacific region is expected to witness the highest growth rate in the global plant sensor market, driven by expanding agricultural modernization, rising food demand, and large-scale adoption of IoT-based solutions across countries such as China, India, and Japan

- The Low voltage segment accounted for the largest market revenue share in 2024, driven by its widespread adoption across agricultural fields and greenhouses for monitoring soil moisture, temperature, and light intensity. These sensors are cost-effective, energy-efficient, and well-suited for small- to medium-scale farming operations

Report Scope and Plant Sensor Market Segmentation

|

Attributes |

Plant Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration Of IoT And AI Technologies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Plant Sensor Market Trends

Integration of IoT and AI in Plant Sensing

• The integration of IoT and AI technologies is reshaping the plant sensor market by enabling real-time crop monitoring, predictive analytics, and automated decision-making. These innovations allow farmers to make informed decisions quickly, reduce dependency on manual practices, and ensure consistent crop quality. The overall result is higher profitability and reduced risks associated with fluctuating environmental conditions

• The demand for data-driven agriculture is fueling the adoption of connected plant sensors that provide instant insights on soil health, moisture levels, and nutrient status. By transmitting accurate field-level data to mobile apps and farm management platforms, farmers gain actionable intelligence for scheduling irrigation and applying inputs. This helps minimize waste, conserve resources, and improve operational efficiency

• The affordability and scalability of IoT-enabled sensors are encouraging adoption among small and mid-sized farmers, making precision farming more accessible than before. These low-cost solutions empower growers to adopt smart farming even in regions where budgets are limited. Efficient use of water and fertilizers becomes particularly valuable in drought-prone and resource-constrained geographies

• For instance, in 2023, several smart farming startups in Europe launched low-cost IoT soil sensors designed for vineyards, helping farmers monitor soil moisture and optimize irrigation schedules. These solutions reduced water consumption, enhanced grape quality, and improved harvest consistency across multiple regions. Such examples highlight how innovation is driving tangible improvements in both yield and sustainability

• While IoT and AI-driven plant sensors are transforming modern agriculture, widespread impact will depend on continuous innovation, farmer training, and supportive infrastructure. Companies must develop localized solutions to address diverse farming conditions. Affordable pricing, easy installation, and robust after-sales support will be essential to accelerate adoption globally

Plant Sensor Market Dynamics

Driver

Rising Demand for Precision Agriculture and Sustainable Farming Practices

• The increasing focus on precision agriculture is driving the adoption of plant sensors as essential tools for monitoring soil, crop, and environmental conditions. These devices provide farmers with accurate data to fine-tune irrigation schedules, fertilizer applications, and pesticide use. By reducing input waste and improving yields, sensors deliver both economic and environmental benefits

• Growing concerns about resource scarcity and climate change are pushing governments and agribusinesses to encourage sustainable practices. Plant sensors play a crucial role in enabling data-based farming strategies that conserve water, minimize fertilizer runoff, and reduce greenhouse gas emissions. This supports not only long-term crop productivity but also global food security objective

• Rising global food demand and consumer preference for quality produce are accelerating the adoption of smart farming technologies, further fueling the growth of the plant sensor market. Consumers increasingly expect transparency in food production, and plant sensors help farmers maintain consistent quality standards. Meeting these expectations strengthens farmer competitiveness in international markets

• For instance, in 2022, large-scale farms across the U.S. Midwest reported higher corn yields after deploying advanced plant sensors connected to AI-powered farm management platforms. These tools enabled precise nutrient scheduling, optimized irrigation planning, and reduced excess resource use. The success encouraged neighboring farms to invest in similar technologies

• While sustainability and yield optimization remain key drivers, broader market growth requires enhanced awareness, cost reduction, and integration of plant sensors into mainstream agricultural practices. Stakeholders must prioritize training programs, subsidies, and demonstration projects. These efforts will help bridge the gap between technology availability and actual farmer adoption

Restraint/Challenge

High Initial Investment and Limited Adoption in Developing Regions

• The high upfront costs of advanced plant sensor systems limit adoption among smallholder farmers, particularly in developing regions. Many solutions require hardware, connectivity infrastructure, and dedicated software platforms, which makes them financially unattainable for cost-sensitive operators. Without subsidies or low-cost models, large-scale adoption remains a challenge

• In rural areas, limited internet connectivity and lack of technical expertise hinder the effective deployment of IoT-enabled sensors. Farmers often face difficulties installing and maintaining these devices without access to training or support services. As a result, underutilization of the technology reduces potential returns, discouraging further investment

• Supply chain limitations and inconsistent availability of affordable sensor devices further restrict adoption in regions where smart farming technologies are most needed. Farmers in remote areas often face delays in accessing spare parts, software updates, or technical assistance. This creates dependency on traditional practices, which are less efficient and resource-intensive

• For instance, in 2023, surveys conducted across Southeast Asia indicated that over 60% of small-scale farmers had no access to plant sensors due to high costs and lack of technical infrastructure. This gap highlighted the digital divide between advanced and emerging markets. Without intervention, precision agriculture adoption risks being uneven globally

• While technology advancements continue to reduce costs, addressing affordability, accessibility, and farmer education remains essential to unlocking the full potential of the global plant sensor market. Policymakers, manufacturers, and agri-tech firms must collaborate to create inclusive solutions. Mobile-based platforms, leasing models, and bundled service packages may help accelerate adoption in underserved regions

Plant Sensor Market Scope

The market is segmented on the basis of voltage level, type, installation type, applications, and technology.

- By Voltage Level

On the basis of voltage level, the global plant sensor market is segmented into Low, Medium, and High. The Low voltage segment accounted for the largest market revenue share in 2024, driven by its widespread adoption across agricultural fields and greenhouses for monitoring soil moisture, temperature, and light intensity. These sensors are cost-effective, energy-efficient, and well-suited for small- to medium-scale farming operations.

The Medium voltage segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its expanding use in larger farms and commercial agricultural projects where more robust sensing and monitoring solutions are required. These sensors provide better accuracy and integration with centralized farm management systems, supporting scalability and precision farming initiatives.

- By Type

On the basis of type, the market is segmented into Circuit Breakers, Disconnect Switches, Fuse Units, Switchboards, and Control Panels. The Switchboards segment dominated the market in 2024, supported by their role in integrating multiple plant sensors into a centralized monitoring unit. This allows farmers to collect and analyze data efficiently from various sources to optimize resource utilization.

The Control Panels segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for automated solutions in smart farming. These systems provide seamless control and integration of plant sensors with IoT platforms, enhancing decision-making capabilities and operational efficiency.

- By Installation Type

On the basis of installation type, the plant sensor market is segmented into Indoor and Outdoor. The Outdoor segment captured the largest share in 2024, attributed to its extensive deployment in open agricultural fields for real-time monitoring of soil and crop conditions. Outdoor sensors are designed to withstand environmental variations, ensuring durability and consistent performance.

The Indoor segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of vertical farming, greenhouses, and hydroponic systems. Indoor sensors enable precise environmental control, improving crop quality and yield in controlled-environment agriculture.

- By Applications

On the basis of applications, the market is segmented into Industrial, Commercial, Residential, and Utility. The Industrial segment held the largest market share in 2024, fueled by large-scale agribusinesses leveraging advanced sensor technologies to maximize productivity and efficiency across wide agricultural lands.

The Residential segment is expected to witness the fastest growth rate from 2025 to 2032, as small-scale farmers and individual growers increasingly adopt affordable plant sensors for home gardens and small farms. The growing emphasis on urban farming and smart gardening solutions further accelerates this trend.

- By Technology

On the basis of technology, the global plant sensor market is segmented into Conventional and Smart Switchgear. The Smart Switchgear segment dominated in 2024 due to its advanced features such as real-time monitoring, automated alerts, and seamless integration with cloud-based platforms. Its ability to support predictive analytics and precision farming practices has made it the preferred choice among tech-driven farmers.

The Conventional segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in developing regions. These systems provide basic monitoring capabilities at lower costs, making them suitable for cost-sensitive markets transitioning toward digital agriculture.

Plant Sensor Market Regional Analysis

- North America dominated the global plant sensor market with the largest revenue share of 38.5% in 2024, driven by the widespread adoption of precision agriculture and smart farming technologies. The region benefits from strong infrastructure, advanced research in agri-tech, and government initiatives promoting sustainable farming practices

- Farmers in North America value the efficiency, cost savings, and enhanced yield optimization enabled by plant sensors, which integrate seamlessly with farm management platforms, drones, and irrigation systems

- This strong growth is further supported by a technologically advanced farming community, significant investments in agri-tech startups, and the growing focus on data-driven crop monitoring to reduce resource wastage and increase productivity

U.S. Plant Sensor Market Insight

The U.S. plant sensor market captured the largest revenue share in 2024 within North America, supported by the high penetration of smart farming practices and advanced agri-tech solutions. U.S. farmers are adopting soil moisture sensors, nutrient sensors, and environmental monitoring devices to achieve higher yields and reduce input costs. Precision irrigation, driven by plant sensors, is becoming increasingly common, helping to conserve water resources. Moreover, the integration of IoT-enabled plant sensors with AI-powered platforms is significantly advancing predictive analytics and crop management, fueling long-term market expansion.

Europe Plant Sensor Market Insight

The Europe plant sensor market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising emphasis on sustainable farming and stringent environmental regulations. The European Union’s policies encouraging precision agriculture and efficient water usage are directly boosting plant sensor adoption. Farmers in the region are increasingly leveraging sensors in greenhouses, vertical farms, and open fields to ensure compliance with sustainability goals. In addition, ongoing R&D investments and partnerships between technology providers and agricultural cooperatives are strengthening the market outlook across the region.

U.K. Plant Sensor Market Insight

The U.K. plant sensor market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rapid adoption of digital agriculture solutions and increasing awareness of climate-smart farming. Farmers and agribusinesses in the U.K. are deploying sensors to monitor soil health and optimize resource allocation in response to rising environmental concerns. The government’s support for agri-tech innovation, coupled with a strong push towards sustainable food production, is further driving adoption. Urban farming and greenhouse projects are also gaining traction, enhancing the role of plant sensors in both traditional and modern farming practices.

Germany Plant Sensor Market Insight

The Germany plant sensor market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong R&D capabilities and the country’s focus on innovative, eco-friendly agricultural solutions. Germany’s emphasis on sustainable food production and efficient resource use aligns with the adoption of plant sensors across various crops. Advanced greenhouse technologies and automation systems are integrating plant sensors for real-time monitoring, ensuring high productivity and quality. Growing demand for data-driven decision-making in agriculture, coupled with government-backed sustainability initiatives, is further accelerating adoption in the country.

Asia-Pacific Plant Sensor Market Insight

The Asia-Pacific plant sensor market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing food demand, and technological advancements in countries such as China, India, and Japan. Rising investments in smart farming and government initiatives supporting digital agriculture are fueling adoption. As APAC becomes a hub for agricultural innovation and affordable sensor manufacturing, accessibility is improving for small and medium farmers. The region is witnessing significant growth in vertical farming and greenhouse projects, further expanding market opportunities.

Japan Plant Sensor Market Insight

The Japan plant sensor market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced technological landscape, focus on automation, and rising demand for high-quality crops. Japanese farmers are leveraging plant sensors in smart greenhouses, hydroponic systems, and vertical farms to achieve precise environmental control. Integration with robotics, AI, and IoT platforms is enhancing efficiency and reducing labor dependency. Furthermore, Japan’s aging farming population is driving demand for automated, easy-to-use sensor solutions, making technology adoption critical for long-term agricultural sustainability.

China Plant Sensor Market Insight

The China plant sensor market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by its rapidly growing agricultural technology sector, urbanization, and government-backed smart farming initiatives. China is emerging as one of the largest consumers and manufacturers of plant sensors, offering affordable solutions for a wide farming base. Adoption is strong across large-scale agricultural enterprises, greenhouses, and smallholder farms, supported by the nation’s push towards smart cities and digital farming. With increasing investment in AI-driven platforms and IoT infrastructure, China is set to remain a major growth engine for the global plant sensor market.

Plant Sensor Market Share

The Plant Sensor industry is primarily led by well-established companies, including:

- Parrot SA (France)

- Spectrum Technologies (U.S.)

- Decagon Devices (U.S.)

- CropX (Israrel)

- Arable Labs (U.S.)

- Sentek (Australia)

- Delta-T Devices (U.K.)

- Vegetronix (U.S.)

- Soil Scout (Finland)

- The Toro Company (U.S.)

- Teralytic (U.S.)

- AgriWebb (Australia)

- GreenSight (U.S.)

- HydroPoint (U.S.)

Latest Developments in Global Plant Sensor Market

- In March 2023, Arable introduced the Mark 3, an advanced all-in-one weather and crop sensor aimed at delivering real-time insights into environmental conditions and crop health. The device is designed to improve agricultural decision-making and operational efficiency while supporting sustainable farming practices. By integrating cutting-edge sensing technologies, the Mark 3 enables farmers to adopt data-driven strategies that enhance productivity. This launch strengthens Arable’s position in the plant sensor market and accelerates the adoption of precision farming solutions globally

- In August 2023, Valley Irrigation launched its new wireless soil moisture sensors that seamlessly integrate with irrigation systems. These sensors provide accurate, real-time soil moisture data, helping farmers optimize irrigation schedules and minimize water waste. By significantly improving water efficiency, the innovation supports sustainable farming and enhances crop yields. This development positions Valley Irrigation as a leader in smart water management solutions within the precision agriculture industry

- In April 2023, CropX Technologies completed a USD 30 million Series C funding round led by Aliaxis, with plans to expand its digital farm management solutions and pursue strategic acquisitions. The funding supports the company’s mission to strengthen sustainable agriculture practices and optimize water management. CropX had already acquired Tule Technologies, showcasing its growth-oriented strategy. This investment round highlights investor confidence and is expected to accelerate the company’s global expansion in the plant sensor market

- In December 2021, AgriWebb enhanced its digital platform by integrating AI-driven insights from plant sensors into its farm management system. The upgrade enabled farmers to access valuable real-time data for better decision-making and operational planning. By offering advanced analytical tools, AgriWebb improved its service offerings in precision agriculture. This development increased the company’s competitive edge and contributed to wider adoption of smart farming technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plant Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plant Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plant Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.