Global Planting And Fertilizing Machinery Market

Market Size in USD Billion

CAGR :

%

USD

122.50 Billion

USD

182.37 Billion

2024

2032

USD

122.50 Billion

USD

182.37 Billion

2024

2032

| 2025 –2032 | |

| USD 122.50 Billion | |

| USD 182.37 Billion | |

|

|

|

|

Global Planting and Fertilizing Machinery Market Size

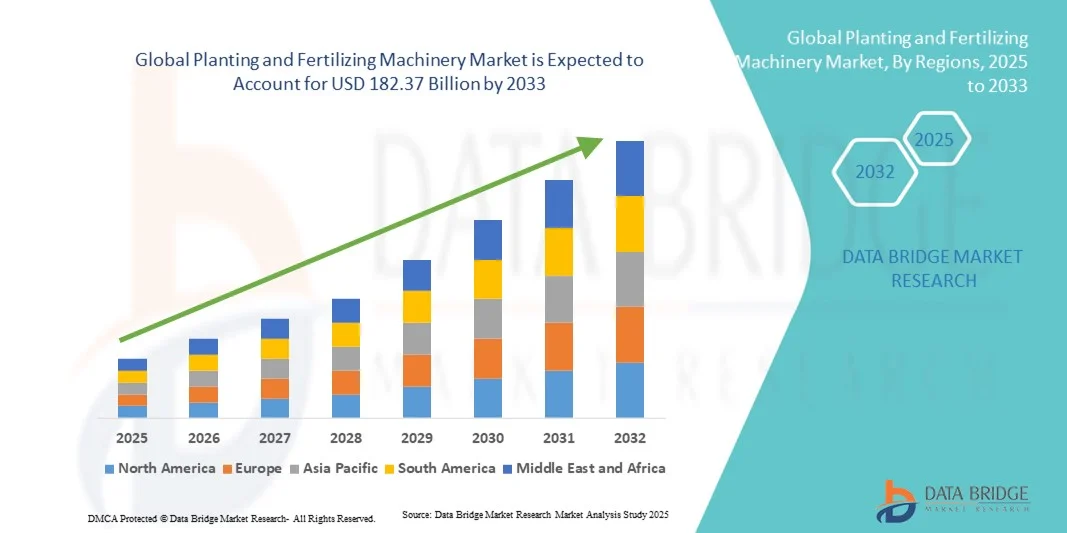

- The global Planting and Fertilizing Machinery Market size was valued at USD 122.50 billion in 2024 and is expected to reach USD 182.37 billion by 2032, at a CAGR of 5.10% during the forecast period.

- The market growth is primarily driven by increasing adoption of advanced agricultural machinery and precision farming technologies, which enhance efficiency and crop yield while reducing labor dependency.

- Additionally, rising demand for sustainable farming practices, coupled with government initiatives promoting mechanization and soil fertility management, is establishing modern planting and fertilizing equipment as essential tools for farmers. These converging factors are accelerating market expansion globally.

Global Planting and Fertilizing Machinery Market Analysis

- Planting and fertilizing machinery, encompassing equipment for sowing seeds and applying fertilizers, is becoming increasingly essential in modern agriculture due to its ability to enhance efficiency, optimize crop yields, and support sustainable farming practices.

- The rising demand for planting and fertilizing machinery is primarily driven by the adoption of precision agriculture technologies, increasing mechanization in farming, and the need to reduce labor dependency while improving productivity.

- North America dominated the Global Planting and Fertilizing Machinery Market with the largest revenue share of 35.1% in 2024, supported by early adoption of advanced agricultural technologies, high investment in mechanized farming, and the presence of major industry players, with the U.S. witnessing significant growth in automated planting and fertilizing equipment adoption, driven by innovations in GPS-guided systems and smart farming solutions.

- Asia-Pacific is expected to be the fastest-growing region in the Global Planting and Fertilizing Machinery Market during the forecast period due to increasing agricultural modernization, rising farm mechanization, and growing demand for high-efficiency equipment.

- The planting machinery segment dominated the market with the largest revenue share of 52.5% in 2024, driven by the increasing adoption of automated seed drills, planters, and precision sowing equipment.

Report Scope and Global Planting and Fertilizing Machinery Market Segmentation

|

Attributes |

Planting and Fertilizing Machinery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• John Deere (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Planting and Fertilizing Machinery Market Trends

Enhanced Efficiency Through AI and IoT Integration

- A significant and accelerating trend in the Global Planting and Fertilizing Machinery Market is the deepening integration with artificial intelligence (AI) and Internet of Things (IoT) technologies. This fusion of technologies is significantly enhancing operational efficiency, precision, and crop yield management.

- For instance, AI-enabled seed drills can automatically adjust seed spacing and depth based on soil conditions, while smart fertilizer spreaders can optimize nutrient distribution in real time. Similarly, IoT-connected tractors provide farmers with remote monitoring and diagnostics capabilities, reducing downtime and maintenance costs.

- AI integration in agricultural machinery enables features such as learning field conditions to optimize planting schedules, predicting fertilizer requirements, and providing actionable insights for crop management. For example, some advanced tractors and planters utilize AI to improve route planning, detect anomalies in soil or crop conditions, and send real-time alerts to farmers.

- The seamless integration of planting and fertilizing machinery with digital farm management platforms facilitates centralized control over various aspects of agricultural operations. Through a single interface, farmers can monitor and manage seeding, fertilization, irrigation, and crop health, creating a fully optimized and data-driven farming environment.

- This trend towards more intelligent, automated, and interconnected agricultural equipment is fundamentally reshaping farmer expectations for operational efficiency. Consequently, companies such as John Deere and Kubota are developing AI-enabled machinery with features like automated planting/fertilizing adjustments, predictive maintenance, and integration with farm management software.

- The demand for smart, AI- and IoT-integrated planting and fertilizing machinery is growing rapidly across both large-scale and smallholder farms, as farmers increasingly prioritize productivity, precision agriculture, and sustainable resource management.

Global Planting and Fertilizing Machinery Market Dynamics

Driver

Growing Need Due to Rising Demand for Agricultural Efficiency and Precision Farming

- The increasing global demand for higher crop yields and efficient resource management, coupled with the accelerating adoption of precision agriculture technologies, is a significant driver for the heightened demand for advanced planting and fertilizing machinery.

- For instance, in 2024, John Deere announced upgrades to its AI-powered planting and fertilizing equipment, integrating IoT sensors and data analytics for optimized crop management. Such initiatives by key companies are expected to drive market growth during the forecast period.

- As farmers face challenges such as labor shortages, rising input costs, and the need for sustainable farming practices, advanced machinery offers features such as automated seeding, variable-rate fertilization, and real-time field monitoring, providing a compelling upgrade over traditional manual methods.

- Furthermore, the growing popularity of smart farming solutions and the desire for data-driven farm management are making AI- and IoT-enabled machinery an integral part of modern agriculture, offering seamless integration with farm management software and other precision farming tools.

- The ability to optimize planting patterns, monitor crop health remotely, and adjust fertilizer application based on soil and weather conditions are key factors propelling the adoption of modern machinery in both large-scale and smallholder farms. The trend towards mechanization and the increasing availability of user-friendly equipment further contribute to market growth.

Restraint/Challenge

High Initial Costs and Technological Complexity

- The relatively high initial cost of advanced planting and fertilizing machinery, coupled with the technical expertise required for operation and maintenance, poses a significant challenge to broader market penetration.

- For instance, the adoption of precision seed drills or AI-enabled fertilizer spreaders may be limited among smallholder farmers due to budget constraints or lack of technical knowledge.

- Addressing these challenges through financing options, farmer training programs, and the development of user-friendly, semi-automated solutions is crucial for increasing adoption. Companies such as Kubota and AGCO offer bundled training and support services to help farmers maximize efficiency while minimizing operational difficulties.

- Additionally, the integration of IoT and AI systems requires reliable connectivity and data management, which can be a barrier in regions with limited infrastructure.

- While prices for basic mechanized equipment are gradually decreasing, the perceived premium for advanced precision farming tools can still hinder adoption, especially for small-scale farms or in developing regions.

- Overcoming these challenges through cost-effective solutions, simplified technology interfaces, and educational initiatives on smart farming practices will be vital for sustained market growth.

Global Planting and Fertilizing Machinery Market Scope

Planting and fertilizing machinery market is segmented on the basis of type and size.

- By Type

On the basis of type, the Global Planting and Fertilizing Machinery Market is segmented into planting machinery and fertilizing machinery. The planting machinery segment dominated the market with the largest revenue share of 52.5% in 2024, driven by the increasing adoption of automated seed drills, planters, and precision sowing equipment. Farmers prefer planting machinery due to its ability to enhance crop yield, reduce manual labor, and optimize planting density. Integration with GPS-guided systems and AI-based monitoring further increases its efficiency and reliability.

The fertilizing machinery segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by rising awareness of soil fertility management and the growing adoption of precision fertilization technologies. Fertilizing machinery, such as spreaders and sprayers, ensures uniform nutrient application, minimizes wastage, and supports sustainable farming practices, driving its growing popularity across commercial and large-scale farms.

- By Size

On the basis of size, the Global Planting and Fertilizing Machinery Market is segmented into large-sized, medium-sized, and small-sized machinery. The large-sized machinery segment dominated the market with a revenue share of 45.3% in 2024, attributed to its suitability for large-scale commercial farms requiring high-capacity equipment for faster operations and greater field coverage. Large-sized machinery often integrates advanced features such as autonomous navigation, AI-enabled monitoring, and IoT connectivity, enhancing productivity and operational efficiency.

The small-sized machinery segment is expected to witness the fastest CAGR of 20.4% from 2025 to 2032, driven by the increasing mechanization of smallholder farms and the need for affordable, compact, and versatile equipment. Small-sized machinery offers flexibility, ease of maintenance, and cost-effectiveness, making it highly suitable for diverse crop types and farms with limited landholding.

Global Planting and Fertilizing Machinery Market Regional Analysis

- North America dominated the Global Planting and Fertilizing Machinery Market with the largest revenue share of 35.1% in 2024, driven by the growing adoption of advanced agricultural machinery and precision farming technologies.

- Farmers and agribusinesses in the region highly value the efficiency, higher crop yield, and labor-saving benefits offered by modern planting and fertilizing equipment, including GPS-guided tractors, automated seed drills, and precision fertilizer spreaders.

- This widespread adoption is further supported by high investment capacity, large-scale commercial farms, and strong government initiatives promoting mechanization and sustainable farming practices, establishing advanced planting and fertilizing machinery as the preferred solution for both large-scale and medium-sized farms in North America.

U.S. Planting and Fertilizing Machinery Market Insight

The U.S. planting and fertilizing machinery market captured the largest revenue share of 78% in 2024 within North America, driven by the rapid adoption of mechanized farming solutions and precision agriculture technologies. Farmers increasingly prioritize advanced machinery for improved crop yields, labor efficiency, and reduced input wastage. The growing trend of smart farming, coupled with integration of GPS-guided tractors, automated seed drills, and precision fertilizer spreaders, further supports market expansion. Additionally, favorable government subsidies and financing options for agricultural mechanization are boosting adoption across both large-scale and medium-sized farms.

Europe Planting and Fertilizing Machinery Market Insight

The Europe planting and fertilizing machinery market is projected to grow at a substantial CAGR during the forecast period, primarily driven by stringent agricultural efficiency regulations and sustainability initiatives. The rise in commercial farming, coupled with increasing mechanization and precision farming adoption, is fostering demand for advanced planting and fertilizing equipment. European farmers are attracted to machinery that optimizes fertilizer usage, reduces manual labor, and integrates with farm management software, supporting growth across smallholder and large-scale agricultural operations.

U.K. Planting and Fertilizing Machinery Market Insight

The U.K. planting and fertilizing machinery market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing mechanization in agriculture and the rising emphasis on sustainable farming practices. Concerns regarding labor shortages, rising input costs, and the need for higher crop yields are driving adoption. The country’s robust agricultural infrastructure, coupled with government incentives for modern equipment, is expected to continue stimulating market growth.

Germany Planting and Fertilizing Machinery Market Insight

The Germany planting and fertilizing machinery market is expected to expand at a considerable CAGR during the forecast period, driven by a strong focus on precision agriculture and sustainable farming. Germany’s well-developed farming sector, technological expertise, and emphasis on innovation promote the adoption of automated planting and fertilizing systems. Integration with IoT-enabled farm management tools and GPS-guided equipment is increasingly prevalent, with farmers seeking high-efficiency solutions for large-scale crop production.

Asia-Pacific Planting and Fertilizing Machinery Market Insight

The Asia-Pacific planting and fertilizing machinery market is poised to grow at the fastest CAGR of 21% from 2025 to 2032, driven by rapid urbanization, increasing farm mechanization, and rising disposable incomes in countries such as China, India, and Japan. The growing need for higher crop productivity, supported by government initiatives promoting smart agriculture and mechanization, is fueling adoption. Furthermore, APAC’s emergence as a manufacturing hub for agricultural machinery enhances affordability and accessibility, enabling wider adoption across small, medium, and large farms.

Japan Planting and Fertilizing Machinery Market Insight

The Japan planting and fertilizing machinery market is gaining momentum due to the country’s high-tech agricultural culture, aging farming population, and demand for labor-saving solutions. Japanese farmers increasingly rely on automated planting and fertilizing machinery integrated with IoT devices for crop monitoring and efficiency optimization. The trend toward precision farming and smart agriculture solutions is driving adoption in both small and large farms, with an emphasis on minimizing labor requirements and maximizing yield.

China Planting and Fertilizing Machinery Market Insight

The China planting and fertilizing machinery market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, rising farm mechanization, and high agricultural technology adoption. China represents one of the largest markets for mechanized planting and fertilizing equipment, driven by large-scale farming, government incentives, and the push toward smart agriculture. The increasing availability of affordable, high-capacity machinery from domestic manufacturers, along with growing precision farming initiatives, is propelling market growth across both commercial and smallholder farms.

Global Planting and Fertilizing Machinery Market Share

The Planting and Fertilizing Machinery industry is primarily led by well-established companies, including:

• John Deere (U.S.)

• AGCO Corporation (U.S.)

• Kubota Corporation (Japan)

• CNH Industrial (U.S.)

• CLAAS Group (Germany)

• Mahindra & Mahindra (India)

• Yanmar Co., Ltd. (Japan)

• Great Plains Manufacturing (U.S.)

• Amazone GmbH & Co. KG (Germany)

• Kverneland Group (Norway)

• Vaderstad AB (Sweden)

• Horsch Maschinen GmbH (Germany)

• Jacto (Brazil)

• Seed Hawk (Canada)

• Precision Planting LLC (U.S.)

• Semeato (Brazil)

• Fendt (Germany)

• Argo Tractors (Italy)

• Kinze Manufacturing (U.S.)

• Maschio Gaspardo (Italy)

What are the Recent Developments in Global Planting and Fertilizing Machinery Market?

- In April 2023, John Deere, a global leader in agricultural machinery, launched a new line of autonomous planting and fertilizing equipment in Brazil, aimed at improving efficiency and crop yield for large-scale farms. This initiative demonstrates the company’s commitment to providing advanced, precision-driven machinery that addresses the specific needs of regional agriculture while reinforcing its leadership position in the global planting and fertilizing machinery market.

- In March 2023, AGCO Corporation, a U.S.-based agricultural technology firm, introduced the latest version of its smart fertilizer spreader, designed for high-accuracy nutrient application on commercial farms. The system features real-time monitoring and automated adjustment capabilities, reflecting AGCO’s dedication to enhancing sustainability and operational efficiency in modern agriculture.

- In March 2023, Kubota Corporation successfully deployed its precision planting and fertilizing solutions as part of the “Smart Farm Initiative” in Japan, aimed at optimizing crop production and resource utilization. This project highlights Kubota’s focus on integrating technology and automation into agriculture to improve farm productivity and reduce environmental impact.

- In February 2023, CLAAS Group, a leading manufacturer of agricultural equipment in Europe, announced a strategic collaboration with regional agricultural cooperatives in Germany to implement AI-driven planting and fertilizing machinery across cooperative-owned farms. This partnership is designed to improve efficiency, precision, and overall crop output, emphasizing CLAAS’s commitment to innovation and sustainable farming practices.

- In January 2023, CNH Industrial unveiled its latest automated planting tractor at Agritechnica 2023 in Germany. Equipped with GPS-guided navigation and smart fertilization systems, the tractor allows farmers to remotely monitor and manage field operations. This launch underscores CNH Industrial’s focus on integrating advanced technology into agricultural machinery, providing growers with enhanced productivity, accuracy, and operational control.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.