Global Plasma Feed Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

3.54 Billion

2024

2032

USD

2.20 Billion

USD

3.54 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 3.54 Billion | |

|

|

|

|

Plasma Feed Market Size

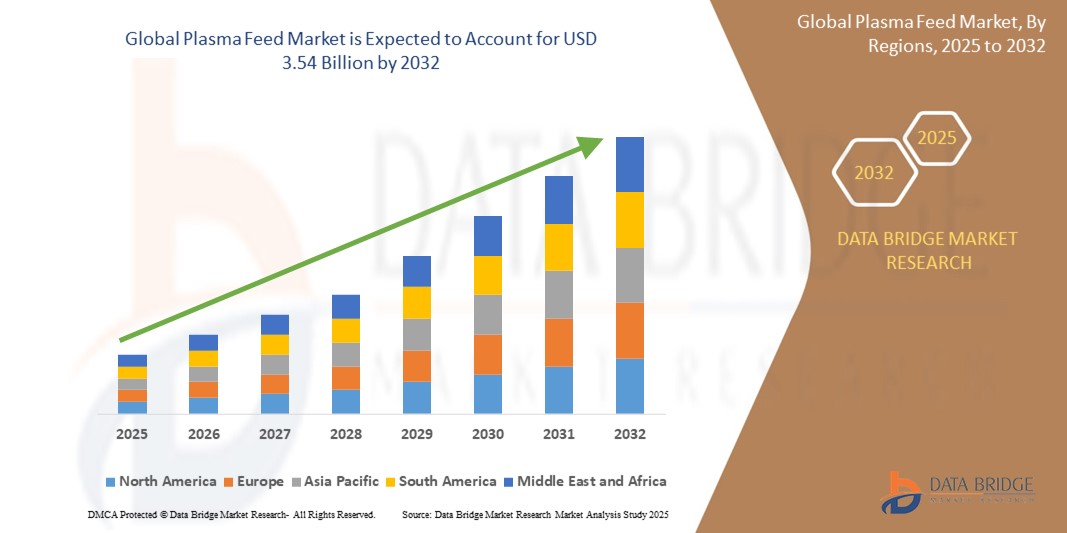

- The global plasma feed market size was valued at USD 2.20 billion in 2024 and is expected to reach USD 3.54 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance, protein-rich animal feed ingredients that enhance growth, immunity, and gut health, particularly in swine, aquaculture, and pet food sectors

- Furthermore, rising concerns over antibiotic resistance and a growing shift toward sustainable, functional feed solutions are positioning plasma proteins as a preferred additive, thereby significantly boosting the industry's growth

Plasma Feed Market Analysis

- Plasma feed, derived from animal blood and rich in functional proteins and bioactive compounds, is increasingly vital in modern animal nutrition across swine, aquaculture, and pet food applications due to its ability to enhance feed intake, improve immunity, and support gut health

- The escalating demand for plasma feed is primarily fueled by the global push for antibiotic-free production, growing focus on livestock efficiency and health, and the rising use of high-quality functional ingredients in commercial feed formulations

- North America dominated the plasma feed market with a share of 37.5% in 2024, due to the established livestock industry, rising demand for high-quality animal protein, and strong adoption of functional feed ingredients

- Asia-Pacific is expected to be the fastest growing region in the plasma feed market during the forecast period due to increasing meat consumption, rapid expansion of aquaculture, and rising demand for high-efficiency feed solutions

- Commercial segment dominated the market with a market share of 67.9% in 2024, due to the broad use of plasma feed in commercial livestock production systems that prioritize high output and animal health. Commercial operations rely heavily on advanced nutritional inputs such as plasma feed to enhance productivity, immune response, and survivability, especially in stress-prone stages such as weaning and transport. This segment benefits from increasing investments in animal nutrition and the need for sustainable, antibiotic-free feed alternatives

Report Scope and Plasma Feed Market Segmentation

|

Attributes |

Plasma Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plasma Feed Market Trends

“Increasing Focus on Animal Health and Nutrition”

- A significant and accelerating trend in the plasma feed market is the growing emphasis on enhancing animal health, immunity, and performance through functional feed ingredients such as plasma proteins, which offer high digestibility and bioactive components that support gut integrity and disease resistance

- For instance, several feed producers are incorporating spray-dried plasma in starter diets for piglets to reduce post-weaning stress and mortality rates. This trend is also expanding into aquafeed and pet food sectors, where plasma improves feed intake and promotes overall wellness

- Plasma feed’s natural ability to support the immune system is becoming increasingly valuable as producers move away from antibiotic growth promoters. As a result, companies are investing in research and innovation to refine plasma formulations for different species and life stages

- The adoption of plasma feed is further supported by advancements in processing technologies that ensure product safety and bioavailability, enhancing its appeal as a high-performance, natural feed additive

- This trend reflects a broader industry shift toward sustainable and science-backed nutrition strategies, prompting companies such as APC and Sonac to expand their product lines with plasma-based solutions tailored for specific animal needs

- The demand for plasma feed as a natural, multifunctional protein source is growing across swine, aquaculture, and pet food segments, as producers increasingly prioritize animal welfare, growth efficiency, and gut health in feed formulation strategies

Plasma Feed Market Dynamics

Driver

“Increasing Demand for High-Quality Animal Feed”

- The rising global demand for high-quality animal protein, combined with the need for more efficient and sustainable livestock and aquaculture production, is driving the adoption of plasma feed as a superior functional ingredient

- For instance, the inclusion of plasma in weaning piglet diets has demonstrated improved feed conversion ratios and reduced mortality rates, making it a valuable tool for producers focused on productivity and profitability

- As consumer preferences shift toward antibiotic-free and ethically raised animal products, the industry is seeking effective alternatives that support animal health without compromising performance. Plasma feed offers a natural, proven solution that aligns with these evolving expectations. Furthermore, the growth of the pet food industry, particularly in the premium and functional segments, is creating additional demand for plasma proteins as pet food manufacturers aim to deliver scientifically supported health benefits

- The versatility of plasma feed across species and life stages, along with increasing regulatory support for sustainable feed ingredients, is further fueling its integration into commercial feed formulations

- Overall, the market is being propelled by the dual need for performance-driven nutrition and responsible feed practices, positioning plasma feed as a key component in modern animal nutrition strategies

Restraint/Challenge

“Risk of Disease Transmission”

- Concerns regarding the potential risk of disease transmission from animal-derived feed ingredients remain a significant challenge to the widespread adoption of plasma feed, particularly in regions with strict biosecurity regulations

- For instance, outbreaks of diseases such as African Swine Fever (ASF) have led to heightened scrutiny and regulatory restrictions on the use of animal blood products in feed, impacting market dynamics and consumer confidence

- Ensuring the microbiological safety of plasma feed through rigorous processing standards—such as high-temperature spray drying and validated pathogen inactivation protocols—is critical to mitigating these risks and maintaining product integrity

- Companies such as Veos Group and Darling Ingredients emphasize their compliance with international safety and traceability standards to build trust among feed manufacturers and regulatory bodies

- Overcoming these concerns requires continued investment in quality control, transparent communication on safety measures, and collaboration with regulatory agencies to ensure the responsible use of plasma-derived ingredients in animal nutrition

Plasma Feed Market Scope

The market is segmented on the basis of source, application, and end use.

• By Source

On the basis of source, the plasma feed market is segmented into bovine, swine, poultry, synthetic, shark, and others. The swine segment dominated the largest market revenue share in 2024, primarily due to its high protein yield, strong amino acid profile, and compatibility with the digestive system of a wide range of animals, particularly young piglets. Swine-derived plasma offers superior palatability and nutritional benefits that help improve feed intake, gut health, and immunity in livestock, which is critical during the early stages of development. The consistency and cost-efficiency of swine plasma products further support their widespread adoption across commercial livestock farms.

The poultry segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for species-specific nutritional solutions and the expanding poultry farming industry globally. Poultry-derived plasma feed is gaining traction for its bioactive components and disease-resistance properties, offering feed formulators a reliable functional ingredient that enhances performance metrics such as growth rate and feed conversion ratio.

• By Application

On the basis of application, the plasma feed market is segmented into industrial and commercial. The commercial segment held the largest market revenue share of 67.9% in 2024, driven by the broad use of plasma feed in commercial livestock production systems that prioritize high output and animal health. Commercial operations rely heavily on advanced nutritional inputs such as plasma feed to enhance productivity, immune response, and survivability, especially in stress-prone stages such as weaning and transport. This segment benefits from increasing investments in animal nutrition and the need for sustainable, antibiotic-free feed alternatives.

The industrial segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by rising interest in scalable, controlled manufacturing of functional proteins and the development of plasma-based ingredients for bio-processing, pharmaceuticals, and specialty pet food production. Technological advancements in plasma fractionation and sterilization techniques are enabling industrial applications to expand beyond conventional livestock usage.

• By End Use

On the basis of end use, the plasma feed market is segmented into swine feed, aquafeed, pet food, and others. The swine feed segment held the largest market revenue share in 2024 due to the critical role plasma proteins play in early-stage swine nutrition, especially during the post-weaning phase. Plasma feed enhances feed intake, nutrient absorption, and immunity in piglets, making it a preferred additive for swine producers aiming to reduce mortality rates and antibiotic dependence. High global pork consumption and the intensification of pig farming continue to drive demand for this segment.

The aquafeed segment is expected to record the fastest CAGR from 2025 to 2032, propelled by the growing aquaculture industry and the need for high-performance, digestible protein sources for fish and shrimp. Plasma feed supports disease resistance and growth in aquatic species while improving water quality by reducing feed waste. As fishmeal alternatives gain popularity, plasma-derived proteins are emerging as a premium, sustainable solution in modern aquafeed formulations.

Plasma Feed Market Regional Analysis

- North America dominated the plasma feed market with the largest revenue share of 37.5% in 2024, driven by the established livestock industry, rising demand for high-quality animal protein, and strong adoption of functional feed ingredients

- The region benefits from advanced animal nutrition practices, well-developed feed production infrastructure, and regulatory support for alternatives to antibiotics in animal diets

- Growing concerns over animal health, increasing investments in pet food innovation, and the use of plasma proteins in specialized diets support market expansion across swine, aquafeed, and companion animal sectors

U.S. Plasma Feed Market Insight

The U.S. plasma feed market captured the largest revenue share in 2024 within North America, driven by the country’s large-scale swine and pet food industries. Continuous advancements in animal health research, combined with a strong emphasis on feed efficiency and gut health, are encouraging the integration of plasma-based proteins in feed formulations. The growing awareness of sustainable feed options and reduced antibiotic usage further supports demand from livestock producers and premium pet food brands.

Europe Plasma Feed Market Insight

The Europe plasma feed market is projected to grow at a steady CAGR throughout the forecast period, supported by increasing focus on biosecurity, animal welfare, and antibiotic-free feeding strategies. The region is seeing rising adoption of functional proteins in swine and aquaculture sectors due to strict regulatory frameworks and shifting consumer preferences toward responsibly sourced animal products. Plasma feed is also gaining traction in the pet food segment, with manufacturers seeking high-digestibility ingredients that promote immunity and health.

U.K. Plasma Feed Market Insight

The U.K. plasma feed market is anticipated to grow at a notable CAGR during the forecast period, fueled by the growing importance of livestock productivity, especially in swine and poultry. The shift toward non-antibiotic growth promoters and enhanced animal care practices is driving demand for natural feed solutions such as plasma proteins. The U.K.'s advanced animal nutrition research and premium pet care industry are also contributing to broader market growth.

Germany Plasma Feed Market Insight

The Germany plasma feed market is expected to grow steadily, underpinned by the country’s robust livestock industry and emphasis on sustainable agriculture. German feed manufacturers are increasingly incorporating functional ingredients that support immune function and feed efficiency, aligning with EU guidelines on responsible feeding. The strong demand for traceable and scientifically backed feed components is supporting the uptake of plasma proteins, particularly in high-performance swine and aquafeed sectors.

Asia-Pacific Plasma Feed Market Insight

The Asia-Pacific plasma feed market is expected to grow at the fastest CAGR from 2025 to 2032, driven by increasing meat consumption, rapid expansion of aquaculture, and rising demand for high-efficiency feed solutions. The region’s growing livestock populations and greater awareness of animal health management are accelerating adoption of plasma feed. Supportive government policies, especially in China and India, promoting feed quality improvement are further driving market growth.

Japan Plasma Feed Market Insight

The Japan plasma feed market is expanding steadily, supported by its advanced pet food industry and growing demand for functional animal nutrition. The use of plasma feed is gaining popularity in premium pet diets and specialty livestock segments, where digestibility and immune support are prioritized. Japan’s focus on food safety and product innovation is encouraging the adoption of high-value feed additives such as plasma proteins.

China Plasma Feed Market Insight

The China plasma feed market held the largest revenue share in Asia-Pacific in 2024, driven by the country’s extensive swine production industry and fast-growing aquaculture sector. The need for feed efficiency, disease resistance, and alternatives to antibiotics is propelling the use of plasma proteins in commercial feed formulations. The presence of major local feed manufacturers, coupled with strong government initiatives promoting sustainable agriculture, continues to boost the market in China.

Plasma Feed Market Share

The plasma feed industry is primarily led by well-established companies, including:

- Daka Denmark A/S (Denmark)

- Darling Ingredients Inc. (U.S.)

- APC, Inc. (U.S.)

- Sera Scandia A/S (Denmark)

- Sonac (Netherlands)

- Ew-Nutrition (Germany)

- Darling Ingredients Inc. (U.S.)

- Lauridsen Group Inc. (U.S.)

- Veos Group (Belgium)

- SARIA Group (Germany)

Latest Developments in Global Plasma Feed Market

- In June 2023, Solid Gold launched its Nutrient Boost dog food line, enhancing several existing recipes with a proprietary blend of superfoods, antioxidants, and plasma to improve nutrient absorption, gut health, and immunity. This launch is expected to boost the plasma feed market by increasing awareness and demand for plasma-enriched pet food products that support overall animal wellness.

- In March 2023, Sonac introduced a new ovine plasma powder for the pet food industry, derived from the blood of free-range lambs and sheep. Positioned as a high-quality protein source for limited-ingredient wet foods, treats, and snacks, this innovation is anticipated to strengthen the market by expanding the application of plasma ingredients in premium and specialty pet nutrition

- May 2021, Solid Gold launched NutrientBoost, a new range of dog and cat food formulas and meal toppers designed to enhance gut health with a distinctive ingredient. The formulas feature plasma, a natural liquid ingredient that supports immune system function and gut health. Despite being 92% water, this ingredient provides essential proteins such as albumin, globulin, and fibrinogen, along with minerals, antibodies, and amino acids

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.