Global Plasminogen Deficiency Type 1 Market

Market Size in USD Million

CAGR :

%

USD

487.30 Million

USD

719.96 Million

2024

2032

USD

487.30 Million

USD

719.96 Million

2024

2032

| 2025 –2032 | |

| USD 487.30 Million | |

| USD 719.96 Million | |

|

|

|

|

Plasminogen Deficiency Type 1 Market Size

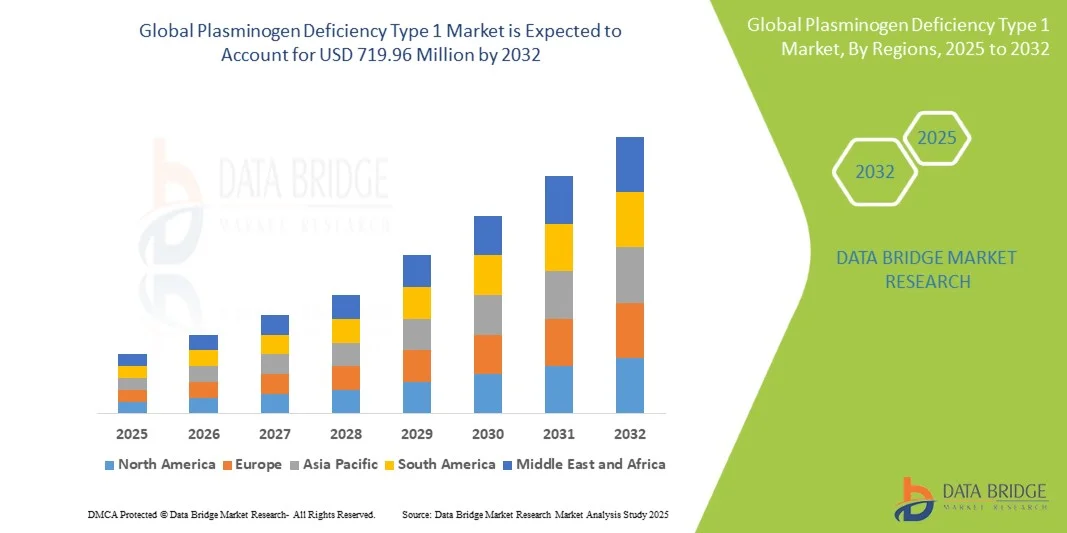

- The global plasminogen deficiency type 1 market size was valued at USD 487.3 million in 2024 and is expected to reach USD 719.96 million by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by increasing awareness of rare bleeding disorders and advances in diagnostic and therapeutic technologies, leading to improved identification and management of Plasminogen Deficiency Type 1 patients

- Furthermore, rising demand for effective and targeted treatment options, including replacement therapies and supportive care, is driving the adoption of Plasminogen Deficiency Type 1 solutions. Enhanced research initiatives, growing investment in rare disease therapeutics, and increasing access to specialized healthcare facilities are significantly boosting the industry’s growth

Plasminogen Deficiency Type 1 Market Analysis

- Plasminogen Deficiency Type 1 is a rare genetic disorder characterized by impaired fibrinolysis, leading to recurrent ligneous lesions in mucous membranes and other complications. The market for its treatment is growing due to increased awareness, advancements in therapeutic options, and rising diagnosis rates

- The escalating demand for effective therapies is primarily fueled by improved diagnostic capabilities, growing awareness among healthcare professionals, and an increasing number of specialized treatment centers

- North America dominated the Plasminogen Deficiency Type 1 market with the largest revenue share of 43.33% in 2024, supported by advanced healthcare infrastructure, early adoption of novel therapies, high healthcare expenditure, and strong presence of key pharmaceutical and medical device players. The U.S. experienced substantial growth in hospital and outpatient treatment centers, driven by innovations in therapy protocols and patient care solutions

- Asia-Pacific is expected to be the fastest-growing region in the plasminogen deficiency type 1 market during the forecast period, with a CAGR fueled by rising healthcare access, increasing disposable incomes, and expansion of specialized treatment centers in countries such as India, China, and Japan

- The Injection segment dominated the Plasminogen Deficiency Type 1 market with a market revenue share of 60% in 2024, due to intravenous administration being the standard treatment protocol

Report Scope and Plasminogen Deficiency Type 1 Market Segmentation

|

Attributes |

Plasminogen Deficiency Type 1 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plasminogen Deficiency Type 1 Market Trends

“Enhanced Treatment Options and Integration of Care”

- A significant and accelerating trend in the global plasminogen deficiency type 1 market is the development and adoption of advanced therapies, including enzyme replacement therapy and gene-based interventions, which are improving patient outcomes and quality of life across various age groups and disease severities

- For instance, in 2023, several leading hospitals and specialty clinics adopted updated treatment protocols that enable earlier diagnosis, personalized dosing, and more effective management of bleeding episodes, supporting better long-term patient prognosis

- New formulations and delivery methods, such as intravenous therapies and optimized oral medications, have enhanced treatment safety, reduced side effects, and improved patient adherence, allowing for wider utilization in both hospital and outpatient care settings

- The establishment of multidisciplinary care teams—including hematologists, geneticists, and clinical pharmacists—ensures comprehensive patient management, facilitating accurate diagnosis, timely therapy adjustments, and continuous monitoring

- Clinical research and post-market studies are increasingly being conducted to evaluate long-term efficacy, optimize treatment regimens, and expand indications for emerging therapies, providing healthcare providers with evidence-based guidance for decision-making

- This focus on patient-centric care, combined with increasing awareness among healthcare professionals about rare bleeding disorders, is driving the adoption of innovative therapies and specialized treatment programs

- Healthcare providers are investing in training, infrastructure, and patient education initiatives to ensure safe and effective administration of therapies, particularly in regions with limited access to specialized care

- These developments collectively underscore a growing emphasis on improving treatment accessibility, reducing complications, and enhancing overall quality of life for patients with Plasminogen Deficiency Type 1

Plasminogen Deficiency Type 1 Market Dynamics

Driver

“Growing Need Due to Rising Awareness and Expanding Access to Therapies”

- The increasing prevalence of rare bleeding disorders, coupled with growing awareness among healthcare professionals and patients, is a significant driver for the heightened demand for advanced Plasminogen Deficiency Type 1 treatments

- For instance, in April 2024, leading medical centers in the U.S. introduced updated patient management programs, focusing on early diagnosis and tailored therapeutic interventions. Such initiatives by key healthcare providers are expected to drive Plasminogen Deficiency Type 1 industry growth during the forecast period

- As patients and clinicians become more informed about treatment options, advanced therapies such as enzyme replacement therapy, gene therapy, and optimized dosing protocols provide effective disease management and improved patient outcomes

- Furthermore, increasing investment in specialized treatment centers and expansion of outpatient care facilities are enabling wider access to therapies, supporting consistent monitoring, and enhancing long-term patient adherence

- The availability of patient support programs, telemedicine consultations, and educational initiatives on disease management are key factors propelling the adoption of advanced therapies for Plasminogen Deficiency Type 1. Efforts to streamline care pathways and provide guidance for both hospital-based and homecare treatment further contribute to market growth

Restraint/Challenge

“Concerns Regarding High Treatment Costs and Limited Accessibility”

- The relatively high cost of advanced therapies, including enzyme replacement and gene therapy, poses a significant challenge to broader market penetration, particularly in price-sensitive regions. Patients in developing countries often face financial constraints that limit their access to specialized treatments, making affordability a key barrier

- Limited access to specialized healthcare centers, experienced clinicians, and diagnostic facilities in emerging markets can delay early diagnosis and treatment initiation, which may adversely impact patient outcomes. The geographic disparity in healthcare infrastructure creates uneven availability of therapies

- In addition, the logistical challenges of transporting and storing biologics or gene therapies, which often require strict temperature control and handling procedures, further complicate access in less-developed regions

- Even in regions with moderate healthcare infrastructure, the lack of insurance coverage or reimbursement policies for high-cost therapies can discourage patients from pursuing treatment, slowing market adoption

- Addressing these challenges through expanded insurance coverage, government funding, patient assistance programs, telemedicine initiatives, and the development of more cost-effective therapies is crucial for ensuring wider accessibility

- While awareness campaigns are increasing, the perceived complexity, high cost, and limited availability of treatment options may still hinder adoption, particularly among populations with limited healthcare resources

- Overcoming these barriers through patient education, expansion of healthcare infrastructure, partnerships between public and private stakeholders, and development of affordable therapeutic options will be vital for sustained market growth in the Plasminogen Deficiency Type 1 sector

Plasminogen Deficiency Type 1 Market Scope

The market is segmented on the basis of treatment, diagnosis, demographic, dosage, route of administration, end-users, and distribution channel.

• By Treatment

On the basis of treatment, the Plasminogen Deficiency Type 1 market is segmented into Plasminogen, Surgery, and Others. The Plasminogen segment dominated the largest market revenue share of 52% in 2024, driven by its clinically proven ability to prevent thrombotic events and improve patient quality of life. Specialty clinics and hospitals increasingly rely on plasminogen therapy due to its targeted mechanism and established efficacy. Strong regulatory approvals, insurance coverage, and physician awareness programs enhance adoption. Patient assistance initiatives and educational campaigns further boost uptake. Long-term safety data and favorable clinical outcomes reinforce confidence among healthcare providers. The segment benefits from supply chain reliability and increasing availability in both urban and semi-urban areas. Pharmaceutical R&D continues to optimize therapy storage and handling.

The Surgery segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, driven by rising surgical interventions to manage disease complications in underserved regions. Advancements in minimally invasive procedures and improved surgical techniques contribute to adoption. Increased expertise among specialized surgeons and expansion of tertiary care centers support growth. Awareness programs and clinical guidelines emphasizing early intervention encourage patient uptake. Government healthcare initiatives in developing markets facilitate access to surgical solutions. Rising demand for corrective procedures due to delayed diagnosis also fuels growth.

• By Diagnosis

On the basis of diagnosis, the Plasminogen Deficiency Type 1 market is segmented into physical exam, laboratory test, and others. The Laboratory Test segment held the largest market revenue share of 48% in 2024, due to the high accuracy of blood assays and genetic testing in confirming Plasminogen Deficiency Type 1. Early and precise diagnosis enables timely treatment initiation and improved patient outcomes. Hospitals and specialty clinics increasingly integrate laboratory testing into standard workflows. Advanced diagnostic kits with high sensitivity and specificity are expanding adoption. Physician training and awareness programs support accurate interpretation of results. Coverage by insurance and reimbursement policies further drives uptake. Laboratory testing also facilitates monitoring therapy efficacy and disease progression.

The Physical Exam segment is expected to witness the fastest CAGR of 21% from 2025 to 2032, fueled by rising awareness among primary care physicians and pediatricians to detect early symptomatic patients. Telemedicine consultations, checklists, and clinical guidelines contribute to faster adoption. Outreach and screening programs in semi-urban and rural areas enhance diagnosis rates. Collaboration between clinics and specialty centers improves patient follow-up. Physician education and continuous medical training strengthen early detection. Government-backed health initiatives and awareness campaigns are further promoting early screening practices. Integration of AI-based clinical decision support tools is enhancing diagnostic accuracy during routine physical exams.

• By Demographic

On the basis of demographic, the Plasminogen Deficiency Type 1 market is segmented into adult, pediatric, and geriatric populations. The Pediatric segment dominated the largest revenue share of 55% in 2024, as most patients show early-onset symptoms requiring immediate intervention. Pediatric hospitals and specialty clinics emphasize early diagnosis and initiation of therapy, improving long-term prognosis. Government newborn screening programs, awareness campaigns, and clinical guidelines encourage adoption. Access to trained pediatric specialists and infusion centers further reinforces market share. Treatment adherence programs and educational initiatives support ongoing care. Parental awareness and advocacy groups also drive therapy uptake. Research continues to develop pediatric-specific formulations.

The Adult segment is expected to witness the fastest CAGR of 20% from 2025 to 2032, driven by late-diagnosed cases, growing recognition of complications, and increased healthcare access. Patient education, telemedicine follow-ups, and homecare therapy options enhance convenience. Specialty clinics in urban and semi-urban areas are expanding treatment access. Adult-focused clinical guidelines and patient advocacy initiatives support market growth. Delayed diagnosis and increasing awareness of therapeutic benefits boost adoption. Expanding insurance coverage and reimbursement for adult rare disease therapies further facilitate uptake. Advances in biomarker-based diagnostics are improving early detection and targeted treatment strategies in adults.

• By Dosage

On the basis of dosage, the Plasminogen Deficiency Type 1 market is segmented into tablet, injection, and others. The injection segment held the largest market revenue share of 60% in 2024, due to intravenous administration being the standard treatment protocol. IV administration provides precise dosing, rapid bioavailability, and monitoring for acute events. Hospitals and specialty clinics prefer injection therapy for clinical control and patient safety. Patient support programs and therapy monitoring systems further enhance adoption. Clinical guidelines and hospital infrastructure reinforce its dominance. Long-term safety and efficacy data increase confidence among providers. Widespread hospital availability supports market stability. Robust cold-chain logistics, trained infusion nurses, and dedicated infusion centers ensure consistent delivery and adherence, further entrenching injections as the primary mode of therapy.

The Tablet segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, fueled by research into oral formulations that improve convenience, adherence, and patient quality of life. Home-based treatment options and patient preference drive growth. Clinical trials, regulatory approvals, and technological advances in drug delivery contribute to faster adoption. Simplified dosing and reduced need for hospital visits make oral therapy appealing. Telehealth and remote monitoring support safe administration. Development of pediatric-friendly and age-appropriate oral formulations expands the eligible patient base. Oral therapies reduce healthcare system burden and improve long-term adherence through simplified regimens. Increasing interest from payers and inclusion in reimbursement frameworks further accelerates market uptake.

• By Route of Administration

On the basis of route of administration, the Plasminogen Deficiency Type 1 market is segmented into oral, intravenous, and others. The Intravenous segment dominated the largest market revenue share of 58% in 2024, supported by hospital and specialty clinic infrastructure for infusion therapy. IV administration ensures rapid therapeutic effect, clinical monitoring, and precise dosing. Hospitals prefer IV due to established protocols, trained staff, and insurance coverage. Patient support programs and infusion monitoring reinforce its dominance. The segment benefits from high therapy reliability and long-term patient outcomes. Regulatory guidelines and treatment standardization further support adoption. Centralized infusion centers and multidisciplinary care teams enable comprehensive management of complex cases. Cold-chain logistics and established supply chains ensure consistent therapy availability across regions, while ongoing clinical evidence and hospital-led registries continue to strengthen clinician confidence in IV delivery.

The Oral segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, driven by ongoing research into oral enzyme therapies and patient preference for home-based treatment. Improved patient convenience, adherence, and quality of life fuel growth. Clinical trials, telehealth support, and technology-enabled monitoring enhance adoption. Rising awareness of oral therapy benefits encourages uptake. Oral formulations reduce the need for infusion infrastructure, lowering treatment costs for healthcare systems. Development of sustained-release oral technologies and pediatric-friendly formulations broadens applicability. Online pharmacies and home-delivery models simplify access and support adherence programs. Favorable regulatory pathways and growing payer interest in cost-effective home therapies further accelerate market penetration.

• By End-Users

On the basis of end-users, the Plasminogen Deficiency Type 1 market is segmented into clinic, hospital, and others. Hospitals accounted for the largest revenue share of 65% in 2024, driven by the presence of advanced infrastructure, specialized care units, and highly trained healthcare professionals. Hospitals are the primary centers for diagnosis, administration of enzyme replacement therapy (ERT), and long-term monitoring of patients with plasminogen deficiency. The availability of multidisciplinary teams including geneticists, hematologists, and rare disease specialists further reinforces their dominance. Strong collaboration between hospitals and pharmaceutical companies ensures consistent drug supply and adoption of clinical guidelines. Favorable reimbursement structures and government support programs make hospitals accessible to a wider patient base. Moreover, patient assistance initiatives and counseling services integrated into hospital networks improve adherence and outcomes. The centralized system of patient management and safety monitoring makes hospitals the most preferred setting for treatment. Continuous investments in rare disease centers of excellence and hospital-based research studies further strengthen this segment’s leading position.

Clinics are expected to witness the fastest CAGR of 21% from 2025 to 2032, supported by the rising availability of outpatient and specialty clinics offering faster and more convenient treatment. Clinics are becoming popular in both urban and semi-urban areas as they reduce travel time and waiting periods for patients. With advancements in telemedicine and remote consultation, clinics provide flexible access to genetic counseling and follow-up care. Expansion of specialty infusion clinics capable of handling ERT is further boosting their importance. Patient education programs and awareness drives conducted by clinics are increasing treatment initiation at earlier stages. Outpatient centers also provide cost-effective alternatives to hospitals while maintaining high-quality care. Clinics play a vital role in bridging the gap between hospitals and homecare, particularly in developing regions. As healthcare decentralizes, clinics are expected to play an increasingly prominent role in providing accessible and patient-friendly treatment environments.

• By Distribution Channel

On the basis of distribution channel, the Plasminogen Deficiency Type 1 market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacies dominated the largest market revenue share of 55% in 2024, owing to their integration with treatment centers where most patients receive ERT under direct supervision. These pharmacies ensure reliable supply of plasminogen therapies through robust cold chain logistics and inventory systems. They play a key role in monitoring dosing schedules and offering patient counseling alongside physicians. The presence of trained pharmacists specializing in rare disease medication management enhances adherence and reduces therapy-related risks. Hospital pharmacies also benefit from strong insurance coverage and reimbursement support, making them the first choice for patients undergoing regular infusions. Their close collaboration with doctors and healthcare teams ensures that therapy protocols are consistently followed. Centralized procurement systems at hospitals contribute to lower costs and reliable access for patients. Moreover, the established infrastructure and trust factor make hospital pharmacies the backbone of drug distribution in this market.

Online Pharmacies are expected to witness the fastest CAGR of 25% from 2025 to 2032, propelled by rapid digital transformation and the growing acceptance of e-commerce in healthcare. Online platforms provide patients with the convenience of home delivery, particularly important for those in rural and semi-urban regions with limited physical access to specialty centers. Integration with telehealth services enables patients to order prescribed medications easily after remote consultations. Online pharmacies also support better adherence through subscription models, automated refills, and doorstep counseling services. The increasing adoption of secure payment systems and temperature-controlled delivery logistics ensures product integrity and boosts patient trust. Favorable regulatory frameworks in several countries are encouraging the growth of digital healthcare distribution. Rising smartphone penetration and patient familiarity with digital platforms further enhance adoption. This segment is becoming critical in expanding reach to underserved populations and making treatments more patient-centric.

Plasminogen Deficiency Type 1 Market Regional Analysis

- North America dominated the Plasminogen Deficiency Type 1 market with the largest revenue share of 43.33% in 2024, supported by advanced healthcare infrastructure, early adoption of novel therapies, high healthcare expenditure, and strong presence of key pharmaceutical and medical device players

- Increased diagnostic rates due to greater awareness of rare diseases, combined with proactive regulatory approvals and incentives for orphan drugs, positioned North America as the leading market

- The market experienced substantial growth in hospital and outpatient treatment centers, driven by innovations in therapy protocols, patient care solutions, and increased awareness of rare bleeding disorders

U.S. Plasminogen Deficiency Type 1 Market Insight

The U.S. plasminogen deficiency type 1 market captured the largest revenue share in North America in 2024, fueled by the rapid adoption of advanced therapeutic options, including enzyme replacement therapy, targeted medications, and novel treatment protocols. Growing investment in specialized clinics, increasing patient awareness, and the expansion of diagnostic and monitoring facilities further support market growth. The focus on personalized patient care and optimized treatment outcomes continues to propel the industry forward.

Europe Plasminogen Deficiency Type 1 Market Insight

The Europe plasminogen deficiency type 1 market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of rare bleeding disorders, rising healthcare expenditure, and the expansion of specialized treatment facilities. Countries such as Germany, the U.K., and France are witnessing growing adoption of advanced treatment protocols and improved patient management strategies, which are strengthening the region’s market.

U.K. Plasminogen Deficiency Type 1 Market Insight

The U.K. plasminogen deficiency type 1 market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of rare bleeding disorders, development of specialized clinics, and improvements in healthcare infrastructure. Enhanced patient support programs and advanced therapeutic options are further boosting adoption across hospitals and specialty centers.

Germany Plasminogen Deficiency Type 1 Market Insight

The Germany plasminogen deficiency type 1 market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of novel treatment protocols, increasing healthcare investments, and the availability of specialized care centers. A growing focus on early diagnosis and patient-centric therapy is contributing to market expansion.

Asia Pacific Plasminogen Deficiency Type 1 Market Insight

The Asia-Pacific plasminogen deficiency type 1 market is expected to be the fastest-growing region in the plasminogen deficiency type 1 market during the forecast period, with a CAGR fueled by rising healthcare access, increasing disposable incomes, and the expansion of specialized treatment centers in countries such as India, China, and Japan.

Japan Plasminogen Deficiency Type 1 Market Insight

The Japan plasminogen deficiency type 1 market is gaining momentum due to rising awareness of rare bleeding disorders, rapid expansion of healthcare infrastructure, and the growing availability of advanced treatment options. Increasing government initiatives supporting rare disease management are also boosting market growth.

China Plasminogen Deficiency Type 1 Market Insight

The China plasminogen deficiency type 1 market accounted for a significant revenue share in Asia-Pacific in 2024, attributed to rising healthcare access, an expanding middle class, and increased awareness of rare bleeding disorders. The expansion of specialized treatment centers and improved diagnostic capabilities are key factors driving market adoption in China.

India Plasminogen Deficiency Type 1 Market Insight

The India plasminogen deficiency type 1 market is witnessing substantial growth due to rising healthcare awareness, growing investment in specialized clinics, and the increasing adoption of advanced therapies. Efforts to enhance early diagnosis and expand patient access are supporting continued market expansion across both urban and semi-urban regions.

Plasminogen Deficiency Type 1 Market Share

The Plasminogen Deficiency Type 1 industry is primarily led by well-established companies, including:

- Grifols S.A. (Spain)

- Kedrion (Italy)

- Soleo Health (U.S.)

- Liminal BioSciences Inc. (Canada)

Latest Developments in Plasminogen Deficiency Type 1 Market

- In May 2025, Kedrion Biopharma spotlighted Plasminogen Deficiency Type 1 (PLGD-1) through a series of virtual, digital, and in-person events taking place on May 5. PLGD-1 is an ultra-rare genetic disorder, affecting roughly 1.6 individuals per 1 million worldwide. The condition is characterized by the development of abnormal fibrin-rich lesions on mucosal surfaces, which, if left undiagnosed or untreated, can result in serious complications such as vision and hearing loss, airway obstruction, and infertility

- In May 2024, Soleo Health, a leading national provider of complex specialty pharmacy services for rare and ultra-rare diseases, announced that it has been selected as a limited distribution specialty pharmacy partner for RYPLAZIM (plasminogen, human-tvmh), manufactured by Kedrion Biopharma

- In June 2021, the U.S. Food and Drug Administration (FDA) approved Ryplazim (plasminogen, human-tmvh), the first-ever treatment for patients with type 1 plasminogen deficiency, also known as hypoplasminogenemia. This approval marked a significant milestone in addressing an unmet medical need for individuals affected by this rare genetic disorder

- In October 2023, a clinical study published in Blood highlighted the long-term safety and efficacy of intravenous human plasminogen replacement therapy for treating type 1 plasminogen deficiency. The study demonstrated that patients receiving this therapy experienced significant improvements in lesion resolution and overall clinical outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.