Global Plastic Baby Food Packaging Market

Market Size in USD Billion

CAGR :

%

USD

7.82 Billion

USD

12.65 Billion

2024

2032

USD

7.82 Billion

USD

12.65 Billion

2024

2032

| 2025 –2032 | |

| USD 7.82 Billion | |

| USD 12.65 Billion | |

|

|

|

|

Plastic Baby Food Packaging Market Size

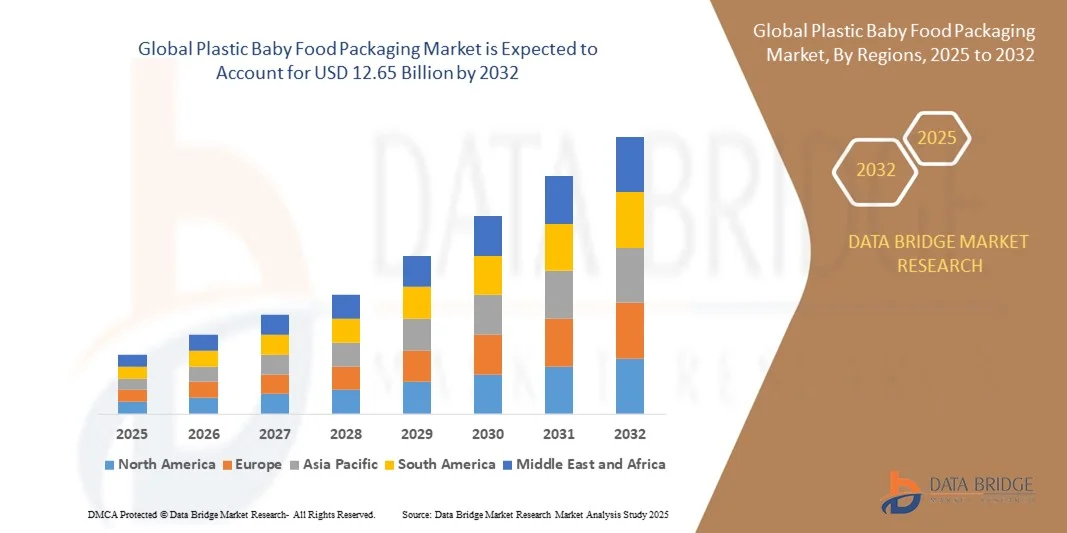

- The global plastic baby food packaging market size was valued at USD 7.82 billion in 2024 and is expected to reach USD 12.65 billion by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is largely fueled by the increasing demand for convenient, safe, and hygienic packaging solutions for infants and toddlers, driven by rising awareness of infant nutrition and safety standards

- Furthermore, the growing preference for ready-to-eat and on-the-go baby food products, along with the need for portion-controlled, leak-proof, and easy-to-use packaging, is establishing plastic packaging as the preferred choice for both manufacturers and consumers. These factors are accelerating the adoption of innovative packaging formats, thereby significantly boosting the industry's growth

Plastic Baby Food Packaging Market Analysis

- Plastic baby food packaging includes bottles, jars, pouches, cartons, and bag-in-box formats designed to store liquid milk formula, prepared foods, powder formula, and baby snacks. These packaging solutions ensure product safety, extended shelf life, and ease of use, catering to both household and commercial applications

- The escalating demand for plastic baby food packaging is primarily driven by the increasing consumption of processed and ready-to-eat baby foods, rising urbanization, busy lifestyles of modern parents, and growing focus on hygiene, convenience, and sustainable packaging solutions

- North America dominated the plastic baby food packaging market with a share of 31.61% in 2024, due to high demand for convenient, safe, and hygienic baby food packaging solutions

- Asia-Pacific is expected to be the fastest growing region in the plastic baby food packaging market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing demand for processed and ready-to-eat baby food products in countries such as China, Japan, and India

- Bottles segment dominated the market with a market share of 42% in 2024, due to their widespread use for liquid milk formula and prepared baby food. Bottles are preferred by parents for their convenience, ease of feeding, and compatibility with sterilizers and feeding accessories. The robust structure of plastic bottles also ensures product safety during transportation and storage, making them a reliable choice for manufacturers and consumers alike. Moreover, the availability of innovative designs, measurement markings, and BPA-free materials enhances their popularity and adoption across global markets

Report Scope and Plastic Baby Food Packaging Market Segmentation

|

Attributes |

Plastic Baby Food Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastic Baby Food Packaging Market Trends

Shift Toward Sustainable and Recyclable Packaging

- The market for plastic baby food packaging is undergoing a fundamental shift driven by sustainability concerns and consumer preference for eco-friendly options. Parents are increasingly aware of the environmental consequences of single-use plastics and are seeking packaging that can be recycled or made from renewable materials

- For instance, Nestlé introduced recyclable pouches for its baby food brand Gerber in 2024, aiming to make all of its baby food packaging 100% recyclable or reusable by 2025. Similarly, Danone has invested in bio-based plastics for infant nutrition products, further boosting momentum in sustainable packaging initiatives

- Advances in packaging technology are enabling the creation of lightweight yet durable plastic packaging that offers reduced environmental impact during production and improved recyclability after use. Such innovations empower brands to align sustainability goals with functionality and safety requirements for baby food packaging

- Consumer perception towards safe, non-toxic, and eco-conscious products is reshaping packaging developments. Parents are more likely to trust brands that provide transparency on sustainable sourcing of raw materials and clear recycling instructions, pushing companies to adapt rapidly to these preferences

- Collaboration across the value chain is intensifying, with packaging manufacturers, retailers, and food brands entering partnerships to create standard recycling systems and promote circular economy models. This collaboration is seen as essential to scale up plastic recycling and lower the footprint of baby food packaging

- The growing demand for eco-friendly packaging solutions is converging with global sustainability targets and regulatory pressures, making recyclability and sustainability principal factors in product design. This trend is expected to dominate future packaging strategies in the baby food sector, leading to a transition away from traditional single-use plastic formats toward sustainable alternatives

Plastic Baby Food Packaging Market Dynamics

Driver

Rising Demand for Convenient Baby Food Formats

- The rise in dual-income households and busier lifestyles among parents is pushing demand for packaging that offers convenience and portability for baby food. Single-serve formats, resealable designs, and easy-to-carry packages are becoming essential features that support on-the-go feeding needs

- For instance, The Kraft Heinz Company expanded its baby food offerings in pouches with spout designs, making feeding easier during travel or outdoor activities. Similarly, Beech-Nut introduced transparent tubs enabling parents to monitor food freshness while offering resealable flexibility

- Growing awareness of the importance of nutritional diversity in early childhood diets has driven demand for portable packaging formats. These solutions allow parents to try different flavors and nutrients in convenient units without compromising quality or freshness

- Technological improvements in packaging materials have enabled the development of innovative features such as tamper-proof lids, spill-resistant spouts, and lightweight plastics. These advancements enhance usability while meeting safety requirements demanded in the baby food industry

- The push for convenient yet safe solutions is now cemented as an important driver, as packaging closely influences purchasing decisions for young parents. As demand continues rising, companies are focusing on delivering functional designs that balance lightweight construction, reusability, and child-safe features

Restraint/Challenge

Stringent Regulations on Plastic Usage

- Governments across regions are enforcing stricter regulations regarding single-use plastics and plastic waste management, posing a restraint for manufacturers of plastic baby food packaging. Such regulations increase compliance costs and limit the flexibility of material choices

- For instance, the European Union’s Single-Use Plastics Directive has forced baby food brands such as HiPP and Holle to redesign packaging formats with recyclable or compostable materials. Similar regulations in countries such as India are accelerating the transition toward alternatives and increasing costs for packaging firms

- Concerns over food safety and health hazards from harmful chemicals in plastics, such as BPA and phthalates, continue to pressure manufacturers to invest heavily in safe, non-toxic plastic alternatives. These requirements raise material and testing costs, slowing innovation flexibility in some regions

- Substitution risk from eco-friendly alternatives such as glass jars, paper-based pouches, and bio-polymers is increasing. While lightweight plastics still dominate for their affordability and durability, sustainable alternatives are gaining regulatory and consumer preference, presenting a challenge to established players

- In conclusion, balancing the use of plastics with regulatory compliance and environmental sustainability expectations remains a complex challenge. The ability of manufacturers to innovate with safe, recyclable plastics while maintaining compliance will directly shape long-term competitiveness in this market

Plastic Baby Food Packaging Market Scope

The market is segmented on the basis of package type and product.

- By Package Type

On the basis of package type, the plastic baby food packaging market is segmented into bottles, cartons, jars, pouches, and bag-in-box. The bottles segment dominated the largest market revenue share of 42% in 2024, driven by their widespread use for liquid milk formula and prepared baby food. Bottles are preferred by parents for their convenience, ease of feeding, and compatibility with sterilizers and feeding accessories. The robust structure of plastic bottles also ensures product safety during transportation and storage, making them a reliable choice for manufacturers and consumers alike. Moreover, the availability of innovative designs, measurement markings, and BPA-free materials enhances their popularity and adoption across global markets.

The pouches segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer preference for on-the-go feeding solutions and single-serve packaging. Pouches offer lightweight, flexible packaging that reduces storage space and packaging waste, appealing to environmentally conscious parents. Their ease of use, resealability, and compatibility with squeezable dispensers make them particularly suitable for toddlers and infants. In addition, pouches support a wide range of baby food products, including purees and snacks, enabling brands to offer diverse product formats without compromising freshness and quality.

- By Product

On the basis of product, the plastic baby food packaging market is segmented into liquid milk formula, dried baby food, powder milk formula, prepared baby food, and baby snacks. The liquid milk formula segment held the largest market revenue share in 2024, driven by the high demand for infant nutrition products in both developed and emerging markets. Plastic packaging ensures hygiene, extended shelf life, and easy handling, which are critical for liquid formulations. Parents and caregivers prefer plastic containers for their leak-proof design, lightweight nature, and compatibility with sterilization processes. Moreover, liquid milk formula packaging often incorporates features such as measurement indicators and tamper-evident seals, enhancing trust and convenience for consumers.

The prepared baby food segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the growing adoption of ready-to-eat meals for infants and toddlers. Prepared baby food packaging offers convenience, portion control, and freshness preservation, addressing the busy lifestyles of modern parents. Flexible plastic containers, pouches, and single-serve cups make feeding simpler, reduce wastage, and improve product accessibility during travel or outdoor activities. The segment’s growth is further boosted by increasing awareness of nutrition, organic ingredients, and fortified formulations that require protective and safe packaging solutions.

Plastic Baby Food Packaging Market Regional Analysis

- North America dominated the plastic baby food packaging market with the largest revenue share of 31.61% in 2024, driven by high demand for convenient, safe, and hygienic baby food packaging solutions

- Consumers in the region highly value durable, easy-to-use plastic bottles, pouches, and jars that ensure product safety, extended shelf life, and portability

- This widespread adoption is further supported by rising awareness of infant nutrition, strong regulatory standards for child-safe packaging, and a technologically inclined manufacturing base, establishing plastic packaging as a preferred solution for both liquid and prepared baby food products

U.S. Plastic Baby Food Packaging Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by high consumption of liquid milk formula and ready-to-eat baby foods. Parents are increasingly prioritizing convenient, lightweight, and safe packaging for feeding infants, while manufacturers focus on innovative designs, resealable pouches, and BPA-free materials. The growing trend of organic and fortified baby foods is also driving demand for specialized plastic packaging that preserves nutrition and freshness.

Europe Plastic Baby Food Packaging Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing demand for high-quality, hygienic, and sustainable packaging solutions. Stringent regulations on child-safe materials and rising urbanization are fostering adoption. European consumers are drawn to innovative packaging formats such as pouches and jars, which provide convenience, portion control, and minimal wastage. Growth spans residential, retail, and e-commerce channels, with manufacturers emphasizing eco-friendly and recyclable plastic solutions.

U.K. Plastic Baby Food Packaging Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of ready-to-eat baby food and liquid milk formula consumption. Parents are increasingly seeking packaging that is portable, resealable, and safe for infants. The country’s strong retail and e-commerce infrastructure supports widespread availability of packaged baby foods, further stimulating market growth.

Germany Plastic Baby Food Packaging Market Insight

The Germany market is anticipated to expand at a considerable CAGR, fueled by growing awareness of infant nutrition and demand for high-quality, sustainable packaging. Germany’s well-developed manufacturing base, combined with a focus on innovation and eco-conscious products, promotes the adoption of plastic packaging for both liquid and prepared baby foods. The integration of advanced packaging technologies that enhance convenience and safety is also becoming increasingly prevalent.

Asia-Pacific Plastic Baby Food Packaging Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing demand for processed and ready-to-eat baby food products in countries such as China, Japan, and India. Government initiatives promoting infant health and safety, along with growing awareness of nutrition, are driving the adoption of convenient plastic packaging solutions.

Japan Plastic Baby Food Packaging Market Insight

The Japan market is gaining momentum due to the country’s high consumption of liquid milk formula and prepared baby foods. Convenience, safety, and portion-controlled packaging are critical factors driving growth. The integration of packaging with user-friendly features, such as resealable pouches and ergonomic bottles, is supporting widespread adoption among caregivers.

China Plastic Baby Food Packaging Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to a growing middle class, urbanization, and high demand for convenient, safe, and hygienic baby food packaging. China is a key manufacturing hub for plastic packaging solutions, and the availability of affordable, innovative products is expanding market reach. Rising awareness of infant nutrition and strong domestic production capabilities are further propelling growth.

Plastic Baby Food Packaging Market Share

The plastic baby food packaging industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Ardagh Group, Inc. (Luxembourg)

- Mondi (U.K.)

- Rexam plc (U.K.)

- RPC Group plc (U.K.)

- WINPAK LTD (Canada)

- BERICAP (Germany)

- Hindustan National Glass & Industries Limited (India)

- Tata Tinplate (India)

- Cascades Inc. (Canada)

- Flexible Packaging Corp. (U.S.)

- Hood Packaging Corporation (U.S.)

- AptarGroup Inc. (U.S.)

- Bemis Company, Inc. (U.S.)

- Tetra Pak International S.A. (Switzerland)

- Celplast Metallized Products (India)

Latest Developments in Global Plastic Baby Food Packaging Market

- In December 2024, Tetra Pak received the ‘Resource Efficiency’ Award at the Sustainable Packaging News Awards, recognizing its innovative paper-based barrier technology in aseptic cartons. This development significantly reduces the carbon footprint of packaging by up to one-third while increasing the paperboard content to 80%. The innovation strengthens Tetra Pak’s position in sustainable baby food packaging, catering to a growing market demand for environmentally friendly and resource-efficient solutions, and sets a benchmark for competitors to adopt greener packaging practices

- In November 2023, Chadwicks launched a spoon-in-lid solution for infant formula packaging in Australia, New Zealand, and East Asia, developed in collaboration with plastic engineering specialist Tekplas. This innovation addresses a key market challenge where traditional scoops often become submerged in the product, causing inconvenience and contamination risk. By integrating the scoop into the lid, Chadwicks enhanced user convenience and hygiene, positioning itself as a leader in functional and user-friendly infant food packaging

- In November 2022, Plum Organics rolled out a full redesign of its baby food pouches and snack packaging, emphasizing ingredient transparency and clear communication to parents. This initiative strengthens consumer trust and brand loyalty by enabling caregivers to make informed decisions about infant nutrition. The updated packaging supports market growth by aligning with increasing consumer preference for products that highlight natural ingredients, nutritional value, and safety in baby food packaging

- In April 2022, Little Spoon undertook a comprehensive packaging redesign to create a cohesive and impactful appearance across its product range, tailored for direct-to-consumer (D2C) distribution. Alongside the packaging revamp, Little Spoon expanded its offerings to include toddler and kids’ meals, vitamin boosters, remedies, and smoothies. This strategic move enhances brand visibility, appeals to health-conscious parents, and strengthens market share in the growing premium and D2C baby food segment

- In January 2022, LactaLogic and Scholle IPN jointly developed aseptic packaging solutions for human milk, including pouches and cartons designed for premature infants and NICU use. This innovation provides shelf-stable, ready-to-serve human milk and fortifiers, significantly improving accessibility and convenience for hospitals and caregivers. The development addresses a critical need in the neonatal nutrition market, positioning the companies as key players in specialized, high-value infant food packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Baby Food Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Baby Food Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Baby Food Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.